Advance Search

Opportunities And Threats To Facebook’s Mega Acquisition Of Whatsapp

By Pooja Jain | Feb 2019

Mergers & Acquisitions offer numerous benefits in different ways such as increased value for the shareholders, improved overall efficiency and access to newer markets. They are a significant aspect of corporate financing and strategic management. The process involves selling, buying, combining different entities of an organization to accelerate its growth and sales. This study is based on acquisition of WhatsApp by Facebook. Facebook has a track record of 76 successful acquisitions. The most remarkable one is WhatsApp, as it is a messaging service with 400 million users across the world. This study also deals with the positive impact of acquisition on profitability of the company.

Mergers & Acquisitions offer numerous benefits in different ways such as increased value for the shareholders, improved overall efficiency and access to newer markets. They are a significant aspect of corporate financing and strategic management. The process involves selling, buying, combining different entities of an organization to accelerate its growth and sales. This study is based on acquisition of WhatsApp by Facebook. Facebook has a track record of 76 successful acquisitions. The most remarkable one is WhatsApp, as it is a messaging service with 400 million users across the world. This study also deals with the positive impact of acquisition on profitability of the company.

and acquisitions (M&A) is carried out to consolidate the companies financially and improve company’s performance. However, some businesses adopt it to protect themselves from the drastic downfall. Most of the time, M&A led to winning way by combining to alike business and create more value in the market compared to be on individual stand. With a motive of wealth maximization, businesses keep exploring different opportunities through the route of merger or acquisition. Differentiating the two terms, Merger is a case where the two companies combine to form one whereas in acquisition, one company is taken over by the other. However, M&A phenomena certainly leave a strong impact on its stakeholders; negative or positive. In acquisition case, the stakeholders of acquired company may feel the off-putting or uneasy impact at the initial phase of M&A.

Objectives of study

- To find out need of Facebook to acquire WhatsApp.

- To find out whether Facebook took the right step by acquiring WhatsApp.

- To find out the impact of acquisition on stakeholders.

- To highlight post-acquisition impacts that Facebook will have.

Research methodology

Source of Data

The source of data for accomplished data is secondary. The data is extracted from published press releases of Facebook and WhatsApp acquisition, various websites, journals and magazines have also been used as sources of data.

Period of Study

The study covers a period of five years from 20xx – 20xx.

Scope of the Study

Present paper covers two social media platforms ‘Facebook’ and ‘WhatsApp’ only.

Interpretation and analysis

About Facebook

is an American online social media platform, headquartered in Menlo Park, California. This is the biggest social media network on the Internet, in terms of both total users as well as name recognition. According to the latest data recorded, as of September 2018, there are 1.49 billion daily and 2.27 billion monthly active users on Facebook. Facebook is accredited with acquisitions of 76 companies as of by 2018. Facebook acquired WhatsApp in 2014 and by far it’s the largest acquisition by Facebook worth $ 19 Billion. This mega acquisition was an effort to accelerate the company’s ability to bring connectivity and utility to the world by delivering core internet services affordably and efficiently. These kind of amalgamation will promote growth and user engagement across both (WhatsApp and FB) companies. As seventy percent of WhatsApp users are active daily, compared to Facebook’s 62%. WhatsApp users send 500 million pictures back and forth per day, about 150 million more than Facebook users. WhatsApp is anticipated to fuel Facebook growth in developing markets where internet connectivity is limited still WhatsApp is tremendously used. This will come as support for Facebook as it will gain access to these mobile user bases. Ability to connect these WhatsApp users in these particular areas will also assist Facebook’s Internet.org initiative, offering internet access to the two-thirds of the world not yet online by Facebook CEO Mark Zuckerberg. The present paper deals with the future growth prospects of Facebook as the company believes it will profit from WhatsApp down the line as phone calls become obsolete and mobile messages reign.

About Whatsapp

is an ad-free text messaging app that is cross-platform, freeware and Voice over IP (VoIP). It is based in Mountain View, California. The mobile messaging app has more than 1.5 billion active users in over 180 countries. Whatsapp is labelled as low-cost alternative to carrier-billed text messaging via SMS. In the United States, the WhatsApp audience amounted to 18.8 million users in 2016 and is set to grow to 25.6 million users 2021. In 2014, Whatsapp joined Facebook but maintained separate app that has a laser focus on enhancing this messaging service that works even faster and anywhere in the world.

Profitability and Returns of Facebook over last Ten Years

Profitability and Returns of Facebook over last Ten Years

Facebook Reports Fourth Quarter and Full Year 2014 Results (Pre-acquisition and Post-acquistion)

|

|

Three Months Ended December 31, |

Year Ended December 31, |

||

|

In millions, except percentages and per share amounts |

2014 (Post-acquisition) |

2013 (Pre-acquisition) |

2014 (Post-acquisition) |

2013 (Pre-acquisition) |

|

Revenue |

$ 3,851 |

$ 2,585 |

$ 12,466 |

$ 7,872 |

|

Income From Operations |

|

|||

|

GAAP |

$ 1,133 |

$ 1,133 |

$ 4,994 |

$ 2,804 |

|

Non-GAAP* |

$ 2,219 |

$ 1,498 |

$ 7,207 |

$ 3,948 |

|

Operating Margin |

|

|||

|

GAAP |

29% |

44% |

40% |

36% |

|

Non-GAAP* |

58% |

58% |

58% |

50% |

|

Net Income |

|

|||

|

GAAP |

$ 701 |

$ 523 |

$ 2,940 |

$ 1,500 |

|

Non-GAAP* |

$ 1,518 |

$ 814 |

$ 4,713 |

$ 2,334 |

|

Diluted Earnings per Share (EPS) |

|

|

|

|

|

GAAP |

$ 0.25 |

$ 0.20 |

$ 1.10 |

$ 0.60 |

|

Non-GAAP* |

$ 0.54 |

$ 0.32 |

$ 1.77 |

$ 0.93 |

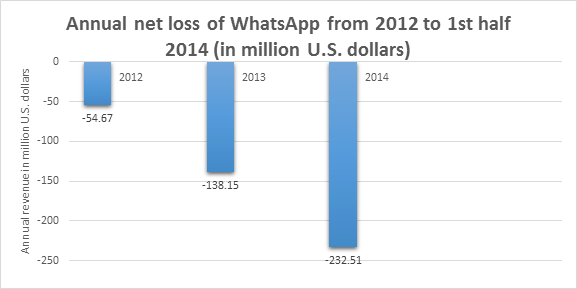

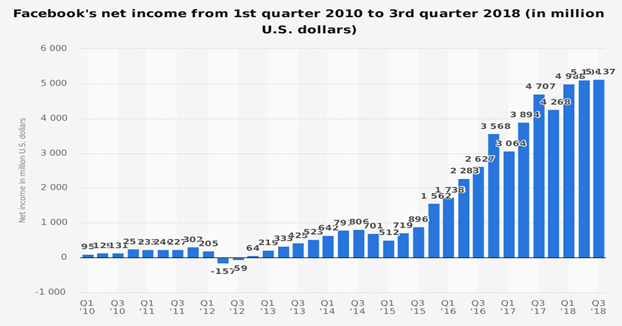

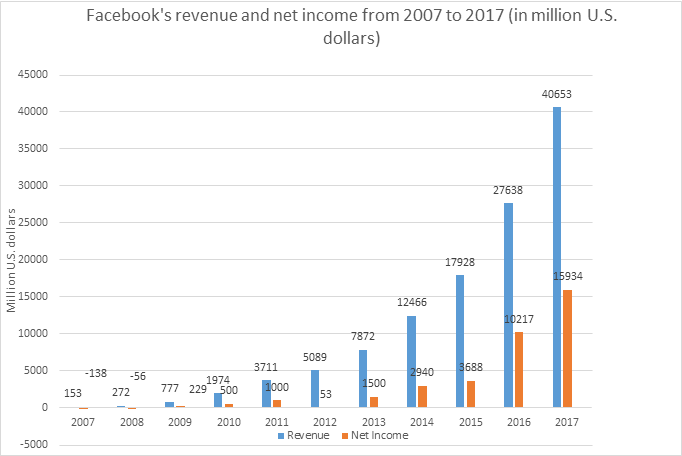

Facebook pre acquisition reported an Annual Revenue of $ 7,872 in FY 2013, while post WhatsApp acquisition Annual Revenue has gone up to $ 12,466 in FY 2014 which exhibits synergy benefit after successful acquisition. Net Income (GAAP) also increased from $ 1,500 to $ 2,940. Similarly, Income from Operations (GAAP) also spurted from $ 2,804 to $ 4,994. No doubt the balance sheet of the company shows strengthened position after mega acquisition almost at every parameter.

of last five years indicates Facebook has benefited to have acquired market share of WhatsApp in many ways, particularly revenue and net income have grown significantly after acquisition of WhatsApp. However, the income from operations based on fourth quarter of 2013 and 2014 remained similar yet post acquisition, the net income from operations has soared.

Emphasizing on overall percentage from fourth quarter of 2013 to 2014, most of the entities have registered an increment. Revenue for the fourth quarter from 2013 to 2014 has increased to 49%. Whereas discussing the costs and expenses, GAAP acknowledged an increase of 87% whereas non-GAAP increment was approx. 50%. The increased percentage of non-GAAP income from operations is 48%. When pointing GAAP operating margin, there is increment of 29% whereas non-GAAP operating margin has escalated to 58%. Focusing on GAAP net income and EPS has increased up to 34% and 25% respectively, while non-GAAP net income and EPS, the values has augmented to 86% and 69% respectively.

Findings and recommendations

Though merger and acquisition offers synergy to both the participating companies but sometimes it may have negative impact on any company. The company should consider every issue in a special way and try to overcome those challenges. Some of the major issues include integrating the already existing individual corporate cultures of respective companies. Along with that, there are concerns over the privacy of the users. The consumers demanded to know if Facebook will be offered opportunity to make unnecessary changes to the data packaging policy. However, findings revealed that there would be no interference by Facebook. After the acquisition, Facebook should emphasize on linking or integrating these two autonomous systems in way that the users of both platforms are able to reach each other on the internet. This will be an opportunity for WhatsApp and Facebook user to interact with each other but without sharing their personal details. Facebook will be able to capture a larger user base as before acquisition, it lacked the basic information of the WhatsApp user such as phone numbers. WhatsApp gained more popularity due to its cost-effectiveness while accessing a message or attending a call. Similarly, Facebook should reduce the cost to access its content to engage more customers with help of WhatsApp.

Conclusion

Facebook has always exhibited interest in mobile, location and payment services as target. Though acquiring WhatsApp wasn’t easy as it had stiff competition from other investors as well. But, Facebook emerged victorious in the deal and was able to acquire deeper comprehension of the inner strategies and upcoming plans of WhatsApp. This has remained a great source of benefit to Facebook. This mega acquisition was demand of the time. As Facebook has acquired 77 companies till 2018 successfully, it can be concluded that the company moved in right direction.