Market Analysis and Insights

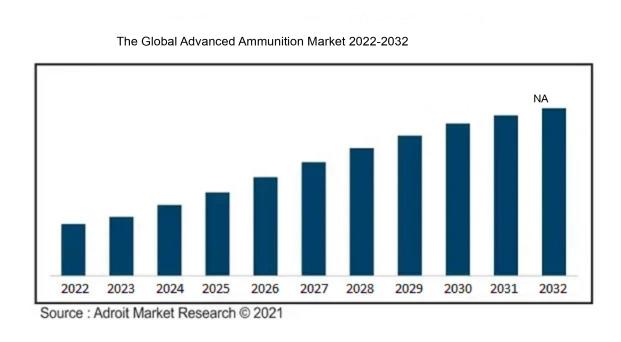

At a compound annual growth rate (CAGR) of XX%, the global market for advanced ammunition is projected to reach USD XX billion by 2031 from USD XX billion in 2022.

The need for precise ammunition is expanding, smart governments worldwide are spending more on defence, and the industry is being pushed by the increasing uptake of advanced ammunition technology. Furthermore, the introduction of new enterprises and the ongoing advancement of technology are expected to benefit market participants. However, the global market for sophisticated ammunition is developing, owing to escalating civil unrest, an increased need for precise targeting, and technical advances in bullet design.

Advanced Ammunition Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | NA |

| Growth Rate | CAGR of NA during 2022-2031 |

| Segment Covered | by Caliber,by Type, by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nexter Group SA, Remington Outdoor Company, Rheinmetall AG, Orbital ATK Inc., BAE Systems PLC, General Dynamics Corporation, Heckler & Koch GmbH, Northrop Grumman Corporation, Alliant Techsystems Inc., and FN Herstal SA. |

Market Definition

The global advanced ammunition market refers to the industry that produces and supplies technologically advanced and specialized ammunition for military and defense purposes. The purpose of these advanced ammunitions is to improve the lethality, precision, and efficacy of different weaponry, such as missile launchers, artillery, and guns. They incorporate cutting-edge materials, designs, and technologies to improve range, precision, penetration, and overall performance, meeting the evolving needs of modern armed forces.

This market encompasses a wide range of ammunition types, including small arms ammunition, artillery shells, guided munitions, and smart munitions, catering to defense and security agencies worldwide. Rising defense expenditures, geopolitical tensions, and the persistent quest for military dominance are driving the expansion of this industry, resulting in continued research, development, and innovation in sophisticated ammunition systems.

Key Market Segmentation

Insights on Caliber

The Small-Caliber Segment is Estimated to Account for the Majority Share.This is due to its numerous uses in the military, law enforcement, and civilian sectors. Small-caliber ammunition is typically defined as ammunition with a caliber of 5.56mm or less. It is the most widely used type of ammunition in the world and is used in a variety of military, law enforcement, and civilian applications.

Increasing demand from military services for enhanced medium-caliber ammunition for use in urban combat and other specialized tasks is expected to create significant expansion in the medium-caliber sector throughout the projected period. Medium-caliber ammunition is typically defined as ammunition with a caliber between 5.56mm and 20mm. It is employed in a wide range of military applications, including infantry rifles, machine guns, and sniper rifles.

The large-caliber and very-large-caliber segments are expected to witness slower growth but will remain important segments of the overall market. Large-caliber ammunition is typically defined as ammunition with a caliber between 20mm and 30mm. It is used in a variety of AI in military applications, including artillery, tanks, and armored vehicles.

Very large-caliber ammunition is typically defined as ammunition with a caliber of 30mm or more. It is used in a limited number of specialized applications, such as naval and air defense systems. The very large-caliber segment is expected to witness slower growth during the forecast period but will remain an important segment of the overall market.

Insight on Type

The Kinetic Energy Ammunition Segment is Likely to Account for the Largest Share Kinetic energy ammunition uses the kinetic energy of a projectile to penetrate and damage targets. It is typically used in anti-tank and anti-armor applications. Kinetic energy ammunition is becoming increasingly popular due to its ability to defeat advanced armor systems.

Chemical energy ammunition launches a projectile using the chemical energy of propulsion. It is the most common type of ammunition used in firearms and artillery. Chemical energy ammunition is available in a wide range of calibers and types, making it suitable for a variety of applications.

Explosives are utilized to generate explosions that can be employed to harm or destroy things. Explosives are used in a variety of military applications, including bombs, missiles, and grenades. Due to the rising consumption of precision-guided munitions, the explosives segment is likely to expand considerably throughout the time frame being forecasted.

Incendiaries are used to start fires. They are typically used to destroy targets or create smoke screens. Incendiaries are used in a variety of military applications, including bombs, missiles, and artillery shells. During the projected time frame, the incendiaries segment is predicted to increase at a modest rate.

Insights on Application

During the forecast duration, the military usage segment is likely to account for the greatest share of the overall marketplace.

The military use segment is driven by the rising demand for advanced ammunition from armed forces to enhance their combat capabilities. Advanced ammunition offers several advantages over conventional ammunition, such as increased accuracy, lethality, and range. This makes them ideal for modern warfare, which is increasingly characterized by long-range precision strikes and urban combat.

The law enforcement use segment is driven by the need for law enforcement agencies to stay ahead of criminals and terrorists. Advanced ammunition can provide law enforcement officers with the firepower they need to neutralize threats quickly and effectively while minimizing the risk of harm to innocent bystanders.

The civil use segment is driven by the growing popularity of shooting sports and hunting. Advanced ammunition can provide shooters with the accuracy and performance they need to improve their skills and compete at a higher level.

Insights on Region

North America is expected to remain the largest market for advanced ammunition throughout the forecast period.

The US military is the largest spender on advanced ammunition in the world. The region is also home to some of the leading manufacturers of advanced ammunition, such as Raytheon, Lockheed Martin, and General Dynamics.

Europe is the second-largest consumer of advanced ammunition, with a substantial increase projected in the next few years. This is due to the increasing military spending of European countries in response to the rising geopolitical tensions in the region.

The most quickly growing market for advanced munitions is Asia-Pacific. Rising regional tensions, more defence spending, and military modernization are some of the factors contributing to this development. Three of the biggest military investors in the world are China, India, and Japan.

Although the Middle East and Africa are currently small markets for advanced weapons, they are anticipated to expand significantly over the next years. This is due to governments in these areas boosting military spending in response to escalating security challenges.

Key Company Profiles

The key players in the global advanced ammunition market are focusing on several strategies to grow their market share. They are diversifying their product lines to encompass a broader range of modern ammunition. This is in response to the increasing need for precision-guided munitions and other modern ammunition technology. The key players are entering new markets as well, particularly in the Asia-Pacific region.

Some key players in the global market are Nexter Group SA, Remington Outdoor Company, Rheinmetall AG, Orbital ATK Inc., BAE Systems PLC, General Dynamics Corporation, Heckler & Koch GmbH, Northrop Grumman Corporation, Alliant Techsystems Inc., and FN Herstal SA.

COVID-19 Impact and Market Status

In 2020 alone, the global advanced ammunition industry was significantly impacted by the COVID-19 catastrophe. Supply chain disruptions, country-specific shutdowns, and lower production levels all contributed to a decline in demand for advanced ammunition. Additionally, many governments around the world prioritized aid programs for citizens over increasing their defense budgets, further hindering the market's growth.

However, on the one hand, it caused disruptions to supply chains and manufacturing operations, leading to delays and shortages in the production and distribution of ammunition. This was due to lockdowns, reduced capacity, and social distancing measures that slowed production and transportation. Additionally, some governments diverted funding away from defense spending to focus on the pandemic response.

On the other hand, the pandemic also led to increased demand for ammunition from both military and civilian users. Military demand was driven by increased geopolitical tensions and the ongoing conflicts in the Middle East and North Africa. Civilian demand was driven by a surge in gun purchases, as many people felt the need to stock up on ammunition for self-defense in the uncertain environment created by the pandemic.

As a result of these opposing forces, the overall impact of the pandemic on the global advanced ammunition market was relatively muted, though quite negative. The market fell somewhat in 2020, but it recovered in 2021 and is predicted to rise more in the next few years.

Latest Trends

1. Increasing demand for precision-guided munitions: Precision-guided munitions are becoming increasingly popular due to their ability to accurately target and destroy enemy targets with minimal collateral damage. This is leading to an increase in the demand for precision-guided munitions.

2. Growing demand for small arms ammunition: Small arms ammunition is the most widely used type of ammunition in the world. The increased usage of small guns by military and law enforcement organizations worldwide is the cause of the rising demand for small arms ammunition.

3. Increasing R&D investment: Market participants are investing extensively in R&D to produce new and more sophisticated ammunition. This is leading to the development of new advanced ammunition with improved performance and capabilities.

Recent Developments in the Global Advanced Ammunition Market: A Snapshot

? The Indian government ordered 670,000 AK-203 Kalashnikov assault weapons from Russia in December 2021 for INR 5,124 crore (USD 681.85 million). The AK-203 is an advanced assault rifle that is equipped with a variety of features, including a Picatinny rail for mounting accessories, a folding stock, and a new magazine release.

? In January 2022, the US Army awarded a contract to Northrop Grumman to develop a new type of precision-guided artillery round. The new round, known as the XM1156, is a 155mm projectile that is guided using GPS and INS technology. The XM1156 is expected to enter service in 2025.

? Saab, a Swedish military manufacturer, stated in March 2022 that it has produced a new form of caseless ammunition. Caseless ammo is ammunition that does not have a cartridge casing. This makes caseless ammunition lighter and more efficient than traditional ammunition. Saab's new caseless ammunition is designed for use in small arms, such as assault rifles and machine guns.

Significant Growth Factors

Geopolitical tensions and wars: The growing number of geopolitical tensions and conflicts throughout the world is increasing military demand for sophisticated weaponry. Advanced ammunition provides increased precision, range, and lethality, which can provide militaries with a substantial tactical edge.

Boosting defense expenditure: In reaction to geopolitical tensions and wars, governments throughout the world are boosting defense spending. This increased spending is being used to purchase new weapons and equipment, including advanced ammunition.

Technological breakthroughs are resulting in the production of new and more sophisticated forms of ammunition. Smart ammunition, for example, has electrical components that may be programmed to regulate the bullet's flight path and impact. This makes smart ammunition much more precise and effective than traditional ammunition.

Growing demand from law enforcement and civilian markets: Law enforcement agencies and civilians are also increasingly demanding advanced ammunition. Law enforcement agencies use advanced ammunition to reduce collateral damage and improve the safety of their officers. Advanced ammunition is used by civilians for several objectives, including hunting, self-defense, and competitive shooting.

Precision-guided munitions (PGMs) are weapons that employ guidance systems to hit their targets with pinpoint accuracy. PGMs are extremely successful in reducing collateral damage and civilian fatalities.

Smart ammunition has electrical components that may be programmed to manipulate the bullet's flight path and impact. Smart ammunition is much more precise and effective than traditional ammunition.

Kinetic energy penetrators: Kinetic energy penetrators (KEPs) are munitions that use their kinetic energy to penetrate enemy armor. KEPs are very effective against heavily armored vehicles and fortifications.

Non-lethal ammunition: Non-lethal ammunition is designed to incapacitate targets without killing them. Non-lethal ammunition is often used by law enforcement agencies for crowd control and riot suppression.

Restraining Factors

Stringent government regulations: The development and sale of advanced ammunition are subject to stringent government regulations in many countries. These regulations are designed to ensure the safety and security of ammunition, but they can also add time and cost to the development and commercialization processes.

High cost of development and production: Advanced ammunition is typically more expensive to develop and produce than traditional ammunition. This is due to the use of more sophisticated materials and manufacturing processes. The high cost of advanced ammunition can limit its adoption by militaries and other security forces.

Limited availability of raw materials: Some of the key raw materials used in the production of advanced ammunition, such as tungsten and molybdenum, are in limited supply. This can cause price volatility and supply interruptions, affecting the manufacture and cost of sophisticated munitions.

In addition to the above factors, the global advanced ammunition market is also facing increasing competition from emerging market players. These players can produce advanced ammunition at a lower cost than traditional Western manufacturers, which makes them more competitive in the global market.

Key Segments of the Global Advanced Ammunitions Market

Caliber Overview

• Small Caliber

• Medium Caliber

• Large Caliber

• Very Large Caliber

Type Overview

• Kinetic energy ammunition

• Chemical energy ammunition

• Explosives

• Incendiaries

Application Mode Overview

• Military Use

• Law Enforcement

• Civil Use

Regional Overview

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• France

• U.K.

• Spain

• Italy

• Russia

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• South Korea

• ASEAN

• Australia

• Rest of Asia Pacific

Middle East & Africa

• Saudi Arabia

• UAE

• South Africa

• Egypt

• Ghana

• Rest of MEA

Latin America

• Brazil

• Argentina

• Colombia

• Rest of Latin America