Agricultural Biologicals Market Analysis and Insights:

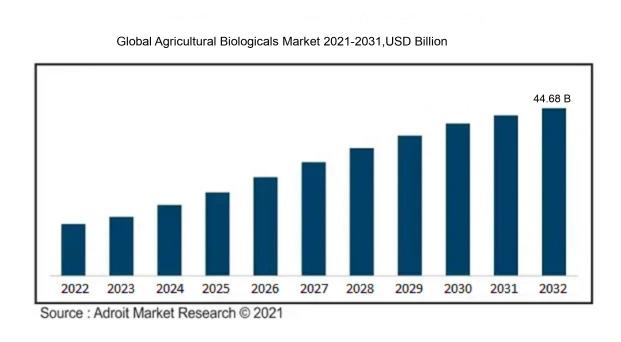

In 2023, the size of the worldwide Agricultural Biologicals market was US$ 13.34 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 14.33% from 2024 to 2032, reaching US$ 44.68 billion.

The Agricultural Biologicals Market is largely influenced by a growing consumer preference for organic and sustainable farming methods, which focus on minimizing the use of synthetic chemicals. Rising environmental awareness and stricter regulations concerning pesticide applications are accelerating the shift towards biological alternatives like biopesticides and biofertilizers. Moreover, progress in biotechnology and ongoing research are improving the effectiveness and usability of these solutions, promoting their incorporation into conventional farming practices. The increasing occurrence of pests and diseases, alongside the demand for higher crop yields and quality, intensifies interest in these biological methods. Government support and initiatives aimed at advancing sustainable agriculture further fuel market expansion, as industry players seek innovative strategies to boost productivity while lessening environmental impact. Additionally, partnerships between agricultural entities and biotechnology companies are driving the creation of new biological products, thereby broadening the market's overall scope.

Agricultural Biologicals Market Definition

Agricultural biologicals encompass natural organisms and biotechnological innovations aimed at improving crop yields and safeguarding plants from pests and pathogens. This category includes biofertilizers, biopesticides, and various eco-friendly alternatives that support sustainable farming practices.

Agricultural biologicals are essential for promoting sustainable farming by offering eco-friendly approaches to crop management and improvement. This category includes products like biopesticides, biofertilizers, and biostimulants, all sourced from natural organisms and materials, which in turn support soil vitality and biodiversity. Their importance is underscored by their ability to decrease reliance on synthetic pesticides, thus lessening environmental repercussions and safeguarding human health. Furthermore, these biological solutions bolster crops' defenses against diseases, pests, and changing climate conditions, ultimately strengthening food security. In light of the increasing global food demand, these advanced methods play a vital role in achieving sustainable agricultural practices, ensuring a harmonious relationship between productivity and environmental stewardship.

Agricultural Biologicals Market Segmental Analysis:

Insights On Key Type

Biopesticides

Biopesticides are projected to dominate the Global Agricultural Biologicals Market due to their environmentally friendly nature and increasing consumer preference for sustainable farming practices. This 's growth is fueled by stringent regulations against synthetic pesticides, coupled with a rising awareness of health hazards linked to chemical inputs in agriculture. Farmers are increasingly adopting biopesticides as they provide effective pest management solutions while minimizing harm to beneficial organisms and the ecosystem. Furthermore, advancements in biopesticide formulations and the development of innovative products are expected to accelerate market demand, positioning this sector as a frontrunner in the agricultural biologicals landscape.

Biostimulants

Biostimulants represent a promising in the Global Agricultural Biologicals Market that enhances plant growth and resilience, particularly under adverse conditions. They are gaining attention for their ability to stimulate biological processes in plants, leading to increased nutrient uptake, improved stress tolerance, and higher yields. Farmers are progressively incorporating biostimulants to optimize crop performance and sustain soil health, resulting in a noteworthy uptick in demand. Enhanced formulation technologies and research into diverse natural compounds are also driving innovations within this category, making biostimulants an essential tool for modern agriculture.

Biofertilizers

The Biofertilizers plays a vital role in sustainable agriculture by fostering soil fertility through natural processes. These products contribute to nutrient recycling, improving soil health by enhancing the bioavailability of essential nutrients to crops. Market growth for biofertilizers is driven by rising awareness of the negative environmental impact of chemical fertilizers and a push for organic farming practices. As agricultural stakeholders pursue eco-friendly alternatives to synthetic fertilizers, biofertilizers are becoming an increasingly valuable option for promoting sustainable farming practices and ensuring long-term soil productivity.

Insights On Key Source

Microbial

Microbial sources are expected to dominate the Global Agricultural Biologicals Market due to their increasing application in sustainable agriculture practices. The growing awareness among farmers about the environmental benefits of using microbial products, which enhance soil health and improve crop yields, is driving their popularity. Additionally, microbial solutions are often more targeted and effective in pest management compared to traditional chemical approaches. The expansion of organic farming and the demand for non-toxic agricultural inputs also fuel the growth of microbial-based products, making them a preferred choice among farmers looking to minimize chemical residues in food production.

Biochemicals

Biochemical sources are significant players within the agricultural biologicals arena, leveraging natural compounds derived from plant and animal materials to produce effective solutions. These products often appeal to farmers due to their ability to enhance crop health and boost productivity while also being compliant with organic farming standards. They provide crucial benefits, such as improved nutrient availability and increased resistance to environmental stresses, making them a useful addition to the agricultural toolkit. However, their adoption faces challenges such as higher production costs and limited awareness compared to microbial products.

Insights On Key Application Method

Foliar Spray

Foliar spray is expected to dominate the Global Agricultural Biologicals Market due to its efficiency in delivering beneficial microorganisms and nutrients directly to plant leaves. This method leads to rapid absorption and utilization, resulting in improved crop yield and health. As farmers increasingly seek sustainable practices to enhance productivity, foliar application stands out as a favored choice because it minimizes soil-borne diseases and allows precise targeting of nutrients. Furthermore, advancements in formulations and technologies that improve spray efficiency bolster the growth of this application method. Consequently, foliar spray’s effectiveness, combined with its growing acceptance among farmers, positions it as the leading application method in this market.

Soil Treatment

Soil treatment is also a pivotal application method in the agricultural biologicals market. It focuses on enhancing the overall soil health by introducing beneficial organisms that improve nutrient availability and promote a balanced ecosystem. This method helps in addressing issues like soil degradation and contamination, which have become more prevalent due to conventional farming practices. Additionally, the increasing awareness of soil management among farmers drives the demand for soil treatment solutions. As the industry moves toward sustainability, soil treatment is gaining traction as it directly impacts crop production through better soil conditioning.

Seed Treatment

Seed treatment is another essential application method in the agricultural biologicals market that aims to protect seeds from pests and diseases before planting. The early application of biological agents enhances seed germination and root development, leading to healthier plants. The growing emphasis on improved seed performance and protection against biotic and abiotic stresses is driving the adoption of this method. As farmers seek ways to maximize yield potential while minimizing chemical inputs, seed treatment is becoming increasingly relevant, particularly in crop varieties that are vulnerable to certain pests and diseases.

Others

The category labeled "Others" encompasses various alternative application methods that are used depending on specific agricultural needs or innovations. Although these methods may involve techniques such as trunk injections or biological soil amendments, they occupy a smaller market share compared to the more traditional approaches. Nevertheless, as growers continuously explore diverse solutions in sustainable agriculture, these alternative methods may gain popularity. They are particularly attractive in specific niche markets or for specialty crops where traditional application methods may not be as effective, reflecting a dynamic landscape in agricultural practices.

Insights On Key Crop

Fruits and Vegetables

Fruits and vegetables are expected to dominate the Global Agricultural Biologicals Market due to the increasing consumer demand for organic produce and sustainable farming practices. With rising health consciousness among consumers, there is a notable trend towards organic food, pushing farmers to adopt agricultural biologicals that enhance crop yield while minimizing chemical residues. This category of crops also benefits from significant research and development investments aimed at improving pest resistance and addressing climate change challenges. Furthermore, countries with advanced agricultural technologies are leaning towards biotechnology solutions for fruits and vegetables, making this sector a critical player in the agricultural biologicals market.

Row Crops

Row crops, such as corn, soybeans, and wheat, play a crucial role in global agriculture but are presently less dominant in the agricultural biologicals market compared to fruits and vegetables. These crops typically rely more on traditional chemical inputs, which can limit the uptake of biological alternatives. However, recent trends indicate a gradual acceptance of biological solutions as farmers seek ways to reduce costs and environmental impact. Ongoing innovation in crop-specific bio-products could stimulate growth in this area, but currently, row crops hold a secondary position in the biologicals market compared to the more agile fruits and vegetables sector.

Others

The "others" category, encompassing crops like oilseeds and various specialty crops, currently holds a minimal share in the agricultural biologicals market compared to the leading areas of fruits and vegetables. While there is potential for growth, this faces challenges such as market fragmentation and varying agricultural practices across regions. Additionally, farmers growing oilseeds may not prioritize biologicals due to established conventional agricultural practices. Nonetheless, as sustainability becomes increasingly critical, there is hope for a gradual shift toward biological solutions in this category, although it remains sidelined compared to more dominant crop types.

Global Agricultural Biologicals Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Agricultural Biologicals market due to several key factors. First, the region has witnessed a significant increase in the demand for organic and sustainable farming practices driven by growing consumer awareness towards food safety and environmental concerns. Additionally, countries like China and India have large agricultural sectors that are increasingly adopting biotechnological advancements and agricultural biologicals to enhance crop yield and resistance. The supportive government policies promoting organic farming, along with increasing investments from both domestic and international companies in research and development, further position Asia Pacific as the leading market. The region's high biodiversity also allows for a plethora of biological products, ensuring the market's potential for growth remains robust.

North America

In North America, the agricultural biologicals market is gaining momentum driven largely by the United States and Canada. With advanced agricultural technologies and a strong focus on sustainable practices, farmers are increasingly looking towards biological solutions to mitigate the adverse effects of chemical inputs. The region has also seen a surge in regulatory support that encourages the use of biopesticides and biofertilizers. As consumer preferences shift towards organic produce, the demand for agricultural biologicals continues to grow, making North America an important player in the global market, albeit not as dominant as the Asia Pacific region.

Europe

Europe is witnessing steady growth in its agricultural biologicals market, supported by stringent regulations on chemical pesticides and fertilizers. European consumers are increasingly advocating for eco-friendly and organic products, thereby fueling demand for biological solutions. Furthermore, the European Union has implemented policies that incentivize sustainable agriculture, leading to increased investments in research and innovation within this sector. Despite its significant market size and focus on sustainability, Europe is still overshadowed by Asia Pacific's aggressive market expansion and adoption rates for agricultural biologicals.

Latin America

Latin America has a developing agricultural biologicals market, characterized by its rich biodiversity and strengths in agricultural production. Countries such as Brazil and Argentina are major agricultural producers and are gradually adopting biological alternatives to combat pests and diseases. The increasing trend towards sustainable agriculture in these nations, driven by both regulatory support and consumer demand, presents a growing market for agricultural biologicals. However, while Latin America shows potential for growth, it remains behind the Asia Pacific region, which benefits from larger investments and advancements in agricultural biotechnology.

Middle East & Africa

The Middle East and Africa region represents a nascent of the agricultural biologicals market, primarily constrained by challenges such as limited agricultural infrastructure and varying levels of awareness regarding biological solutions. However, there is a growing recognition of organic farming and the need for sustainable practices due to water scarcity and soil degradation issues. Some nations, particularly in Africa, are gradually investing in agricultural improvements, but the region is still in the early stages compared to the more advanced markets in the Asia Pacific. The potential exists, but it lags significantly behind the dominant regions.

Agricultural Biologicals Competitive Landscape:

Major participants in the Global Agricultural Biologicals sector are dedicated to creating groundbreaking biopesticides and biofungicides aimed at boosting crop productivity while supporting sustainable agricultural methods. Additionally, they pursue strategic partnerships and investments to broaden their product offerings and extend their market presence.

Prominent entities in the Agricultural Biologicals sector encompass Bayer AG, BASF SE, Syngenta AG, Corteva Agriscience, UPL Limited, Novozymes A/S, FMC Corporation, Marrone Bio Innovations, BioWorks, and AgraQuest, Inc. Among other significant participants are Valagro S.p.A., Koppert Biological Systems, the Australian Biotechnology Company, Ginkgo BioWorks, INRAE, and Arcadia Biosciences. Furthermore, organizations such as Certis USA, ATGC Biotech, Rizobacter Argentina S.A., and Summit Agro International play crucial roles in the industry. Additional contributors include Biolchim S.p.A., Agrinos, along with various startups and emerging companies dedicated to providing innovative biological solutions addressing agricultural challenges.

Global Agricultural Biologicals COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Agricultural Biologicals sector, leading to disruptions in supply chains and altering consumer preferences in favor of more sustainable farming methods.

The agricultural biologicals sector experienced a notable transformation due to the COVID-19 pandemic, presenting a mixture of hurdles and prospects. Initially, interruptions to supply chains, workforce shortages, and transportation limitations hindered production and distribution efforts, leading to postponed product launches and ened expenses. Nonetheless, the crisis prompted farmers to adopt more sustainable agricultural methods, aiming to build resilience against future disruptions. This increased emphasis on food security, alongside rising consumer interest in organic and eco-friendly options, spurred demand for biopesticides and biofertilizers. Furthermore, enhanced funding for research and development paved the way for advancements in biological alternatives. As the agricultural industry adjusts to the new normal following the pandemic, the agricultural biologicals market is predicted to rebound and grow, driven by a focus on sustainable practices and integrated pest management strategies that support global sustainability efforts.

Latest Trends and Innovation in The Global Agricultural Biologicals Market:

- In August 2023, BASF announced its acquisition of the bio-based solutions company, Sarv Agricultural Technologies, to enhance its sustainable agriculture portfolio and expand its biologicals offerings.

- In July 2023, Syngenta launched its new range of biocontrol agents under the brand name "SYN-VITAL". This innovation focuses on improving crop health while reducing the reliance on synthetic pesticides.

- In April 2023, Bayer partnered with the biotech company, Ginkgo Bioworks, to harness precision fermentation technology for developing innovative biological crop protection products.

- In March 2023, Corteva Agriscience expanded its biologicals pipeline by acquiring the startup, Symborg, which specializes in microbial solutions for agriculture, significantly strengthening its biologicals division.

- In January 2023, FMC Corporation announced the successful commercialization of its new bio-based insecticide, resulting from a collaboration with the agricultural biotech firm, Novozymes, aimed at increasing crop productivity sustainably.

- In December 2022, Valagro, a part of the Syngenta Group, received EU approval for its innovative microbial-based biostimulant, reinforcing its commitment to sustainable agronomy and plant nutrition.

- In October 2022, Novozymes extended its partnership with the environmental agriculture company, Indigo Ag, focusing on developing microbial solutions that enhance soil health and crop resilience against climate variability.

- In September 2022, Arysta LifeScience, acquired by UPL, introduced a new line of biopesticides derived from natural plant extracts, aimed at promoting environmentally friendly pest management practices.

- In August 2022, biologic inputs leader, AgBiome, secured a series C funding round to further enhance its platform for product discovery and development in agricultural biologicals, with a focus on beneficial soil microbes.

- In June 2022, the agrochemical company, Adama, launched a new innovative biological fungicide that utilizes advanced fermentation technology, improving disease management in crops while promoting sustainable agriculture practices.

Agricultural Biologicals Market Growth Factors:

The Agricultural Biologicals Market is primarily driven by a growing demand for eco-friendly farming methods, ened awareness regarding the safety of chemical pesticides, and significant progress in biotechnological advancements.

The expansion of the Agricultural Biologicals Market is influenced by various crucial elements. To begin with, there is a notable increase in the demand for environmentally sustainable farming practices, alongside a growing awareness regarding eco-friendly agricultural products. This trend is fueling interest in biological solutions like biopesticides and biofertilizers, which not only improve soil quality but also minimize chemical residues—appealing to consumers who prefer organic and sustainably sourced food options.

Moreover, supportive government policies that encourage the adoption of sustainable agricultural methods and the gradual elimination of harmful chemical inputs are motivating farmers to transition towards biological alternatives. The rise in pest and disease occurrences that are resistant to traditional pesticides underscores the urgent need for innovative solutions, further promoting the development and utilization of biological control methods.

In addition, advancements in biotechnology and ened investments in research and development aimed at creating new biological agents are improving both product performance and agricultural yield, thus propelling market growth. The advent of precision agriculture technologies, coupled with the integration of biological solutions into these innovative farming systems, is also easing their implementation. Finally, the effects of globalization in trade, combined with evolving regulatory standards that favor biological products, are broadening the market landscape and access, thereby strengthening the growth trajectory of the agricultural biologicals sector. Together, these elements illustrate a promising outlook for continued advancement in this industry.

Agricultural Biologicals Market Restaining Factors:

The Agricultural Biologicals Market faces significant challenges due to regulatory obstacles and a general lack of consumer knowledge regarding biological products in contrast to conventional chemical alternatives.

The Agricultural Biologicals Market encounters various obstacles that may hinder its expansion. A primary issue is the limited recognition and comprehension among farmers regarding the advantages and uses of biological products in comparison to conventional chemical inputs. This insufficient awareness can foster doubts about the efficacy of agricultural biologicals. Additionally, regulatory challenges can postpone the introduction of new products, as the process of securing essential approvals can be both lengthy and financially burdensome. The supply of raw materials needed for crafting biological solutions may also be unreliable, disrupting supply chains and product accessibility. Established chemical agriculture products further complicate the landscape, leveraging robust marketing strategies and long-standing customer loyalty. Furthermore, biological products' effectiveness can fluctuate significantly based on environmental conditions, contributing to uncertainty for users. Nonetheless, the rising shift towards sustainable farming practices and the escalating demand for environmentally friendly options create substantial opportunities for growth in the agricultural biologicals sector. As awareness of ecological impacts increases among farmers, the drive for alternatives to synthetic chemicals enhances the potential for innovation and advancement in this industry.

Key Segments of the Agricultural Biologicals Market

By Type

• Biopesticides

• Biostimulants

• Biofertilizers

By Source

• Microbial

• Biochemicals

By Application Method

• Foliar spray

• Soil treatment

• Seed treatment

• Others

By Crop

• Row crops

• Fruits and vegetables

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America