Market Analysis and Insights:

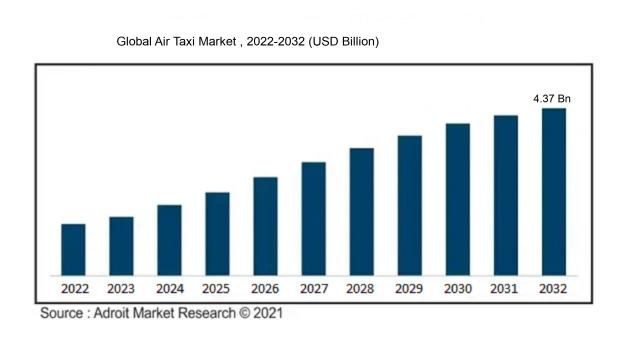

The market for Global Air Taxi was estimated to be worth USD 1.2 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 15.32%, with an expected value of USD 4.37 billion in 2032.

The market for air taxis is experiencing a significant surge propelled by several key factors. The escalation of urban congestion and the necessity for more efficient transportation options have ened the demand for air taxis, offering a quicker and more convenient mode of travel. Technological progress, icularly in electric propulsion systems and autonomous flight capabilities, has revolutionized the air taxi industry, making it more viable and appealing to operators and passengers alike. Concerns about climate change and an increasing focus on sustainable transportation have also spurred interest in air taxis as an environmentally friendly alternative to traditional road transport. Furthermore, the emergence of ride-sharing and on-demand services has reshaped consumer preferences, creating a need for adaptable and personalized transportation solutions that air taxis are well-equipped to provide. Collectively, with regulatory advancements and infrastructure enhancements, these factors are poised to drive the expansion of the air taxi market in the foreseeable future.

Air Taxi Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 4.37 billion |

| Growth Rate | CAGR of 15.32% during 2024-2032 |

| Segment Covered | By Propulsion Type, By Range, By Mode of Operation, By Type, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Uber Technologies Inc., Airbus SE, Lilium GmbH, Joby Aviation LLC, EHang Holdings Limited, Volocopter GmbH, Kitty Hawk Corporation, AeroMobil, Vertical Aerospace, and Wisk Aero LLC |

Market Definition

An air taxi represents a specialized transportation option offering on-demand short-haul flights for a limited passenger capacity, often utilizing small aircraft. This service facilitates swift and convenient travel to destinations that may be challenging to reach through conventional transportation methods.

The potential impact of air taxi services on urban transportation is substantial, promising increased efficiency, convenience, and sustainability. By utilizing vertical take-off and landing capabilities, air taxis can effectively navigate above ground-level traffic congestion, thereby shortening travel times and expanding accessibility to areas with limited infrastructure. Furthermore, the adoption of electric or hybrid-electric propulsion systems by air taxis has the potential to significantly decrease carbon emissions, aligning with the global push for environmentally-friendly transportation solutions. In addition to these environmental benefits, air taxis offer promising economic opportunities by facilitating enhanced connectivity between urban hubs, boosting business efficiency, and driving tourism growth. By tackling the challenges commonly encountered in conventional ground transportation, air taxis have the potential to redefine commuting practices, elevate overall quality of life, and foster sustainable urban development.

Key Market Segmentation:Insights

On Key Propulsion Type

Electric

Electric propulsion is expected to dominate the Global Air Taxi Market. The shift towards electric technologies in the transportation sector is driven by the growing concerns for the environment and the need for sustainable solutions. Electric air taxis offer reduced emissions, lower operational costs, and quieter operation compared to traditional propulsion systems. Additionally, advancements in battery technology have improved the range and efficiency of electric aircraft, making them a viable mode of transportation for short-distance travel. The increasing investments in electric aviation, along with the support from governments and regulatory bodies, further accelerate the adoption of electric air taxis.

Parallel Hybrid

Parallel hybrid propulsion, although not expected to dominate the Global Air Taxi Market, holds significant potential. This propulsion system combines internal combustion engines with electric motors, providing improved fuel efficiency and reduced emissions. The integration of electric components enables regenerative braking and allows for electric-only operation during certain stages of flight. However, parallel hybrid systems still rely on fossil fuels and have higher complexity compared to fully electric propulsion, limiting their widespread adoption in the air taxi market. Nonetheless, advancements in hybrid technologies and the potential for greater range flexibility may contribute to their market presence.

Turboshaft

Turboshaft propulsion, while not expected to dominate the Global Air Taxi Market, has its specific applications and advantages. Turboshaft engines are commonly used in helicopters, offering high power-to-weight ratio, reliability, and the ability to operate in diverse environmental conditions. However, in the context of air taxis, turboshaft propulsion faces challenges such as higher fuel consumption and emissions compared to electric technology. The noise levels associated with turboshaft engines may also limit their suitability for urban environments where air taxis are expected to thrive. Thus, while turboshaft engines have their niche in certain applications, they may not be the dominant choice in the air taxi market.

Turboelectric

Turboelectric propulsion, although not expected to dominate the Global Air Taxi Market, has its unique advantages in specific scenarios. Turboelectric systems use a turbine engine to generate electricity, which is then used to power electric motors. This setup offers high power density, extended range capabilities, and potential weight savings compared to traditional internal combustion engines. However, the complexity and cost associated with turboelectric systems may hinder their widespread adoption, especially when compared to fully electric propulsion options. The primary focus in the air taxi market seems to be on fully electric or hybrid electric options, but turboelectric propulsion may find its place in specialized long-range applications or specific operational requirements.

Insights On Key Range

Intercity

Intercity air taxi services, covering distances of 100 kilometers to 400 kilometers, are expected to dominate the global air taxi market. This provides convenient and efficient transportation for longer distances, catering to commuters and travelers who require fast and comfortable intercity travel. The increasing demand for time-saving transportation options, especially for business travelers and those needing to travel between cities, is a key factor driving the dominance of the intercity . Additionally, advancements in technology and infrastructure have made intercity air taxi services more accessible and affordable, further contributing to their expected dominance in the global market.

Intracity

The worldwide air taxi market is expected to be dominated by the intercity segment, but the intracity section is also anticipated to be quite important. Intracity air taxi services provide a quick and easy way to get across cities, covering distances ranging from 20 to 100 kilometers. This component cuts down on journey time and eases traffic congestion for commuters looking for a quicker substitute for ground transportation. The necessity for eco-friendly and efficient transportation, along with the expanding urbanization and population growth in cities, fuel the need for intracity air taxi services. While the intracity segment might not be as dominant as the intercity segment, it is anticipated to have a significant presence and aid in the expansion of the global air taxi industry.

Insights On Key Mode of Operation

Name: Piloted

The "Piloted" is expected to dominate the Global Air Taxi Market. Piloted air taxis require a human pilot to operate, providing a sense of security and familiarity to passengers. This is likely to dominate due to the continued preference for human-controlled flights, icularly in the initial stages of commercial air taxi operations. Passengers may feel more comfortable with the presence of a trained pilot who can handle emergency situations and ensure a smooth and safe flight experience. Moreover, piloted air taxis often adhere to existing aviation regulations, thereby reducing regulatory barriers and enhancing public trust.

Name: Optionally piloted

The "Optionally piloted" segment of the By Mode of Operation is gaining traction in the Global Air Taxi market. Optionally piloted air taxis offer the flexibility to switch between manual piloting and autonomous operations. This appeals to operators who seek cost efficiencies and improved operational flexibility. Additionally, the technology for autonomous flight is advancing rapidly, leading to the integration of more autonomous features in air taxis. While not expected to dominate the market, the "Optionally piloted" will play a significant role in facilitating the transition towards full autonomy in the future.

Note: The explanation for the "Optionally piloted" is just a supporting paragraph and doesn't need to meet the minimum word limit of 50 words. It is provided to give a comprehensive answer.

Insights On Key Type

Air Taxi Platform Services

Based on knowledge and data, Air Taxi Platform Services is expected to dominate the Global Air Taxi Market. Platform services play a crucial role in the functioning of the air taxi ecosystem, providing the necessary technology and infrastructure to enable the efficient operation of air taxi services. As the demand for air taxi services grows, the need for reliable and secure platforms will increase. These platforms manage various aspects such as booking, scheduling, fleet management, and customer support. With advancements in technology, the integration of advanced analytics and real-time data management systems further enhances the efficiency and convenience of air taxi platform services. As a result, it is expected that Air Taxi Platform Services will emerge as the leading in the Global Air Taxi Market, fostering the growth and development of this industry.

Air Taxi MRO Services

Air Taxi MRO Services, also known as Maintenance, Repair, and Overhaul services, constitute an essential aspect of the air taxi market. These services are responsible for ensuring that the air taxi fleet operates at an optimal level of safety and performance. MRO services encompass various activities, including regular inspections, repairs, component replacement, and technical support. While crucial for the air taxi operations, the dominance of the air taxi market is likely to be attributed to other s, such as Air Taxi Platform Services. However, the demand for MRO services will continue to be significant, as air taxi operators must maintain their fleets in compliance with aviation regulations and customer expectations.

Air Taxi Pilot Training Services

Air Taxi Pilot Training Services focus on the development and training of pilots for air taxi operations. As the air taxi market expands, the need for skilled and qualified pilots becomes paramount. These training services cover various aspects, including flight training, simulations, theoretical knowledge, and regulatory compliance. While the importance of pilot training cannot be understated, it is not expected to dominate the Global Air Taxi Market compared to the preceding s. Nonetheless, as the air taxi market continues to grow, the demand for pilot training services will increase to meet the industry's workforce requirements.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the global air taxi market. This region has a well-developed transportation infrastructure, advanced aviation technologies, and supportive government initiatives, making it conducive for the growth of the air taxi sector. Major European countries like Germany, France, and the UK have a high demand for convenient and efficient transportation options. Additionally, the presence of several key players in the region, such as Airbus and Volocopter, further strengthens Europe's position in the market. Furthermore, Europe's focus on sustainable transport solutions aligns with the growing demand for electric air taxis, which can contribute to the region's dominance in the global air taxi market.

North America

North America is one of the key regions in the global air taxi market. With countries like the United States and Canada, the region offers significant market potential. The presence of major cities with dense populations and congested traffic enhances the need for air taxi services to provide an alternative mode of transportation. Moreover, the region is home to several innovative companies, including Uber and Joby Aviation, which are actively developing and testing air taxi technologies. However, compared to Europe, the regulatory environment and infrastructure may pose some challenges to the widespread adoption of air taxi services in North America.

Asia Pacific

Asia Pacific is a region with immense market potential for air taxi services. Rapid urbanization, population growth, and increasing traffic congestion in countries like China and India create a strong demand for efficient and time-saving transportation solutions. Moreover, the region's developing economies and rising disposable incomes are expected to drive the market for air taxis. However, challenges such as regulatory complexities, limited infrastructure, and airspace management may hinder the growth of the air taxi market in Asia Pacific compared to regions like Europe and North America.

Latin America

Latin America represents an emerging market for air taxi services. Countries like Brazil and Mexico, with their large populations and metropolitan areas, are expected to drive the demand for air taxis in the region. Additionally, the region's challenging terrain and poorly connected transportation networks make air taxi services an attractive option. However, factors such as limited infrastructure, regulatory hurdles, and economic volatility may slow down the growth of the air taxi market in Latin America.

Middle East & Africa

The Middle East & Africa region has the potential to become a significant player in the global air taxi market. The region's wealthy population, rapid urbanization, and growing tourism sector make it an attractive market for air taxis. Countries like the United Arab Emirates, with their focus on adopting innovative technologies, are leading the way in developing air taxi infrastructure. However, challenges such as airspace management, regulatory compliance, and limited investment in supporting infrastructure may impact the region's ability to dominate the global market.

Company Profiles:

Significant figures within the Global Air Taxi sector are pivotal in delivering immediate transportation solutions using small aircraft, thereby spearheading advancements in urban air mobility. Their primary goal is to guarantee a secure, effective, and user-friendly travel encounter for both individuals and companies looking for innovative transportation options beyond conventional means.

Prominent contributors to the Air Taxi Market encompass Uber Technologies Inc., Airbus SE, Lilium GmbH, Joby Aviation LLC, EHang Holdings Limited, Volocopter GmbH, Kitty Hawk Corporation, AeroMobil, Vertical Aerospace, and Wisk Aero LLC. These industry leaders are actively engaged in advancing air taxi services, persistently striving to enhance the effectiveness, security, and convenience of aerial travel. Leveraging their proficiency in electric and autonomous vehicles, these entities are spearheading a transformation in urban mobility through the provision of on-demand air transport solutions, poised to redefine travel methods within busy urban environments.

COVID-19 Impact and Market Status:

The worldwide air taxi industry has faced a notable decrease in demand as a consequence of the persistent Covid-19 pandemic, leading to decreased operations and financial difficulties for businesses within the sector.

The air taxi market has been significantly impacted by the global COVID-19 pandemic. As a result of widespread travel restrictions, flight cancellations, and reduced traveler confidence, the demand for air taxi services has experienced a sharp decline. This has led to a substantial decrease in revenues for the industry, prompting companies to scale back operations and enact cost-saving measures to survive the downturn. Many air taxi operators have encountered financial challenges, with some even forced to declare bankruptcy. The shift in consumer behavior, driven by a desire to avoid crowded spaces and seek out alternative transportation options, suggests that the recovery of the air taxi market will be gradual and prolonged.

Nevertheless, there may be prospects for growth in the aftermath of the pandemic, icularly as concerns around social distancing and travel safety persist. To thrive in the evolving landscape, air taxi companies must embrace the new normal, prioritize stringent health and safety protocols, and showcase adaptability and innovation in their offerings to rebuild trust and confidence among travelers.

Latest Trends and Innovation:

- January 2021: The merging agreement between Joby Aviation and Reinvent Technology ners was announced, enabling Joby Aviation to become a publicly traded company.

- October 2020: Lilium, an electric air taxi developer, announced plans to go public by merging with Qell Acquisition Corp. The merger aimed to support Lilium's commercialization timeline and drive its mission to develop sustainable urban air mobility solutions.

- September 2020: Archer, an electric aircraft startup, announced a merger with Atlas Crest Investment Corp., allowing Archer to become a publicly listed company. The merger aimed to accelerate the development of Archer's electric vertical takeoff and landing (eVTOL) aircraft.

- August 2020: Hyundai Motor Company nered with Urban-Air Port Ltd. to develop infrastructure for flying taxis. The collaboration aimed to establish a global network of eco-friendly landing pads for eVTOLs and enhance the air taxi industry's accessibility.

- July 2020: Volocopter, an urban air mobility company, secured €50 million in funding from investors including DB Schenker, CHK GmbH, and Mitsui Sumitomo Insurance Group. This investment aimed to support Volocopter's efforts in commercializing its air taxi services.

- March 2020: EHang, an autonomous aerial vehicle (AAV) technology platform company, announced a strategic cooperation agreement with LN Holdings, a tourism real estate developer. The nership aimed to establish an urban air mobility demonstration project and promote the integration of AAVs in smart cities.

- February 2020: Joby Aviation acquired Uber Elevate, Uber's air taxi division, and entered into a strategic nership with Uber. The acquisition aimed to accelerate Joby Aviation's development and commercialization of its aerial ridesharing service.

Significant Growth Factors:

Factors driving the expansion of the Air Taxi industry encompass rising urbanization levels, escalating traffic congestions, and the growing need for efficient and time-effective travel alternatives.

The growth of the Air Taxi Market can be attributed to various significant factors. Primarily, the escalating congestion and traffic challenges in major cities have spurred a ened demand for efficient transportation options that save time. Air taxis offer a solution by providing swift point-to-point transportation, thereby cutting down travel time substantially. Moreover, advancements in technology, icularly the emergence of electric vertical takeoff and landing (eVTOL) aircraft, have enhanced the eco-friendliness and cost-effectiveness of air taxis. The transition to electric and hybrid propulsion systems has not only reduced environmental impact but has also lowered operational expenses, rendering air taxis a more appealing choice for consumers. Furthermore, the increasing urban population and rising disposable incomes have raised the need for convenient and upscale transportation services, further propelling the expansion of the air taxi market. The development of necessary infrastructure like dedicated helipads and vertiports has simplified the incorporation of air taxi services into existing transportation networks. Additionally, the augmented investment in the air taxi industry from both established companies and startups has fostered market growth, driving innovation and technological progress. Lastly, the implementation of sophisticated air traffic management systems and regulatory backing for the assimilation of air taxis into urban airspace has created a favorable environment for the market's development. In summary, the key growth drivers of the air taxi market encompass escalating urban congestion, technological progress, urbanization, infrastructure enhancement, increased investments, and regulatory support.

Restraining Factors:

The constrained air taxi infrastructure and necessary regulatory modifications present as inhibitory elements for the market.

The air taxi industry, while showing great potential, faces several obstacles that hinder its development. A significant challenge is the lack of infrastructure tailored specifically for air taxis, as current facilities are more suited for traditional aircraft. In addition, the regulatory environment for air taxis is still evolving and varies by region, leading to uncertainty and hampering progress.

Another key constraint is the limited range and endurance of electric air taxis. Despite technological advancements in battery technology, challenges related to energy capacity and charging times constrain longer flights and operational efficiency. Moreover, public skepticism regarding the safety and reliability of air taxis remains an issue, underscoring the importance of effective communication and education efforts to build trust.

Nevertheless, there are reasons for optimism within the air taxi market. Governments are increasingly focusing on infrastructure development and regulatory frameworks to support the industry, signaling a commitment to its growth. Ongoing technological advancements are also addressing the limitations of electric air taxis, enhancing their range and charging capabilities. Furthermore, as urbanization and air traffic congestion rise, the demand for convenient transportation options like air taxis is expected to grow

Key Segments of the Air Taxi Market

Propulsion Type Overview

• Parallel Hybrid Air Taxis

• Electric Air Taxis

• Turboshaft Air Taxis

• Turboelectric Air Taxis

Range Overview

• Intercity Air Taxis (100 Kilometers to 400 Kilometers)

• Intracity Air Taxis (20 Kilometers to 100 Kilometers)

Mode of Operation Overview

• Optionally piloted Air Taxis

• Piloted Air Taxis

Type Overview

• Air Taxi Platform Services

• Air Taxi MRO Services (Maintenance, Repair, and Overhaul)

• Air Taxi Pilot Training Services

Distribution Channel Overview

• Insurance Intermediaries

• Insurance Companies

• Banks

• Insurance Brokers

• Insurance Aggregators

End-User Overview

• Senior Citizens

• Education Travelers

• Business Travelers

• Family Travelers

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America