Market Analysis and Insights:

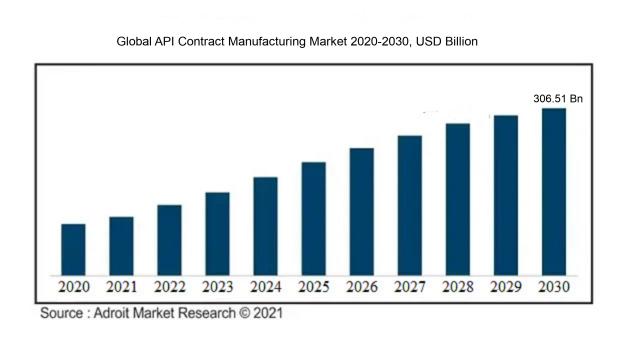

The market for Global API Contract Manufacturing was estimated to be worth USD 168.31 billion in 2021, and from 2022 to 2030, it is anticipated to grow at a CAGR of 7.11%, with an expected value of USD 306.51 billion in 2030.

The API contract manufacturing sector is being shaped by a multitude of influential factors. Primarily, the spike in demand for pharmaceutical goods and the growing intricacy of drug development processes have prompted a surge in outsourcing endeavors. Pharmaceutical firms are increasingly looking to outsource non-core functions in order to concentrate on their primary capabilities. This trend has opened up significant growth prospects for API contract manufacturers, renowned for their adeptness in intricate manufacturing processes and adherence to regulatory standards. Moreover, the impetus of cost cutting and operational effectiveness is another driving force in this arena. Contract manufacturing empowers pharmaceutical companies to reduce expenditure on infrastructure, labor, and equipment, fostering financial efficiency. Furthermore, the market is steered by the imperative for rapid time-to-market, with contract manufacturing facilitating companies in expediting their drug development timelines by leveraging the specialized knowledge and resources of contract manufacturers. The escalating incidence of chronic diseases, along with a burgeoning elderly populace, has augmented the requirement for pharmaceutical products, consequently propelling the growth of the API contract manufacturing sector. Additionally, emerging markets like Asia-Pacific and Latin America are contributing to market expansion owing to their conducive regulatory frameworks and economical manufacturing expenses. In essence, these influential factors are currently propelling the growth trajectory of the API contract manufacturing sector, presenting lucrative prospects for both pharmaceutical enterprises and contract manufacturers.

Api Contract Manufacturing Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 306.51 billion |

| Growth Rate | CAGR of 7.11% during 2022-2030 |

| Segment Covered | By Type, By Volume ,By Form,By End User,By Distribution channel ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Lonza Group Ltd., WuXi AppTec, Catalent, Inc., Patheon N.V. (Thermo Fisher Scientific Inc.), Cambrex Corporation, Jubilant Life Sciences Limited, Dishman Group, Pharmaceutical Product Development, LLC (PPD), Dr. Reddy's Laboratories Ltd., and Aurobindo Pharma Ltd. |

Market Definition

API contract manufacturing involves the external sourcing of Active Pharmaceutical Ingredient (API) production to third-party manufacturers through formal agreements. This enables pharmaceutical firms to allocate their attention to other facets of drug development, leveraging the specialized knowledge and capabilities of API manufacturers.

The collaboration with API contract manufacturers holds immense significance for pharmaceutical companies since it provides them with the opportunity to outsource the manufacturing of active pharmaceutical ingredients (APIs) to specialized entities. By engaging in such partnerships, pharmaceutical firms can allocate their resources towards their core strengths, such as research and development, quality assurance, and marketing strategies, while entrusting the production of high-quality APIs to contract manufacturers equipped with the necessary expertise, technology, and regulatory adherence. This strategic alliance not only reduces the financial burden on pharmaceutical companies but also grants them access to a broader spectrum of manufacturing capabilities and capacities. Ultimately, API contract manufacturing plays a pivotal role in enhancing operational efficiency, cost-effectiveness, and scalability within the pharmaceutical sector, enabling companies to fulfill market requirements and introduce innovative pharmaceutical solutions to patients.

Key Market Segmentation:

Insights On Key Type

Organic

Among the parts of the By Type category, the Organic part is expected to dominate the Global API Contract Manufacturing market. The rising inclination towards organic components in pharmaceutical merchandise and the escalating need for eco-friendly and sustainable medications are propelling the expansion of this sector. Organic APIs are produced from natural sources and offer numerous benefits such as reduced toxicity and enhanced therapeutic effects. These factors, along with the rising adoption of green manufacturing practices, are contributing to the dominance of the Organic part in the Global API Contract Manufacturing market.

Inorganic

The Inorganic part of the By Type category is another significant in the Global API Contract Manufacturing market. Inorganic APIs are manufactured using mineral or chemical sources and find extensive application in various pharmaceutical formulations. Factors such as the availability of a wide range of inorganic compounds for API production, cost-effectiveness, and stability of inorganic APIs contribute to the growth of this part. Additionally, the increasing prevalence of chronic diseases and the development of new drug compounds are fueling the demand for inorganic APIs, further strengthening the position of the Inorganic part in the market.

Others

The Others part of the By Type category encompasses various types of APIs that do not fall under the Organic or Inorganic categories. This part includes APIs derived from unconventional sources, such as biologics or synthetic compounds. Although the Others part holds potential in the Global API Contract Manufacturing market, it may not dominate the industry as compared to the Organic and Inorganic parts. The dominance of Organic APIs due to their natural and sustainable attributes and the widespread use of Inorganic APIs in pharmaceutical formulations limit the market share of the Others part. However, it continues to play a vital role in catering to specific drug requirements and niche markets within the API Contract Manufacturing industry.

Insights On Key Volume

Large

The significant segment is poised to lead the Global API Contract Manufacturing market. This is chiefly attributed to the ened requirement for generic medications and biologics, alongside pharmaceutical firms' outsourcing of manufacturing tasks. Substantial production volumes facilitate economies of scale, resulting in cost-effectiveness and competitive pricing. Additionally, large scale manufacturers often have established infrastructure and resources to meet the stringent regulatory requirements for API contract manufacturing.

Medium

The medium volume part of the Global API Contract Manufacturing market is likely to hold a significant market share. This trend is steered by the escalating desire for specialized medications and distinctive APIs. Pharmaceutical enterprises are progressively forming alliances with contract manufacturers to harness their proficiency and capacities in manufacturing medium volume APIs. These manufacturers offer flexible production capacities and tailored solutions to meet the specific requirements of medium volume API manufacturing.

Low

Although the low volume part of the Global API Contract Manufacturing market may have a smaller market share compared to large and medium volume parts, it plays a crucial role in catering to the needs of drug development and early-stage clinical trials. Contract manufacturers specializing in low volume APIs offer rapid prototyping, process development, and small-scale production services. The demand for low volume APIs is driven by advancements in personalized medicine, orphan drugs, and early-stage biotechnology research.

Others

The Others part within the By Volume category of the Global API Contract Manufacturing market includes any volume range not explicitly mentioned within the low, medium, or large parts. This part may comprise niche or specialized API manufacturing requirements that may not fit into the defined volume categories. The "Others" part could have varying market shares, depending on factors such as unique product specifications, targeted therapeutic areas, or emerging technologies in drug development.

Insights On Key Form

Solid

The solid form is expected to dominate the Global API Contract Manufacturing market. This surge is chiefly attributed to the rising need for solid dosage formats like tablets and capsules, extensively utilized in the pharmaceutical sector. Solid dosage forms offer various advantages such as ease of administration, longer shelf life, and precise dosing, which are driving their popularity in the market.

Liquid

The liquid category is another significant segment of the Global API Contract Manufacturing market. Liquid APIs are widely used in pharmaceutical formulations such as syrups, suspensions, and injectables. Liquid APIs are in high demand due to their ease of administration and faster absorption rates when compared to solid dose forms. Furthermore, the rising prevalence of chronic illnesses and the need for parenteral drug delivery drive up demand for liquid APIs.

Semi-solids

The semi-solids form is a notable part in the Global API Contract Manufacturing market. Semi-solid APIs are used in the production of creams, ointments, gels, and lotions, which find applications in diverse therapeutic areas such as dermatology, pain management, and wound care. The increasing incidence of skin-related disorders, along with the growing demand for topical drug delivery systems, is fueling the demand for semi-solid APIs.

Others

The Others part includes forms that are not categorized as solid, liquid, or semi-solids. This part comprises niche parts such as gases, powders, and suppositories. While these forms have specific applications in the pharmaceutical industry, they are expected to have a relatively smaller market share than the dominant solid, liquid, and semi-solid forms. The market demand for these other parts is driven by specific therapeutic requirements and formulations.

Insights On Key End-Users

Pharmaceutical industries:

Pharmaceutical industries are expected to dominate the Global API Contract Manufacturing market. With the increasing demand for drugs and pharmaceutical products, pharmaceutical industries rely heavily on API contract manufacturing for the production of active pharmaceutical ingredients. The outsourcing of API manufacturing allows pharmaceutical companies to focus on their core competencies and reduce production costs. Additionally, the expanding pharmaceutical market in emerging economies, advancements in technology, and the need for specialized manufacturing capabilities further contribute to the dominance of pharmaceutical industries in the API contract manufacturing market.

Research organization:

Research organizations play a significant role in the Global API Contract Manufacturing market. These organizations often engage in drug discovery and development programs that require a reliable supply of high-quality APIs. By outsourcing API manufacturing to contract manufacturing organizations, research organizations can ensure a seamless supply chain, optimize costs, and focus on their core research activities. The demand for innovative and effective drugs drives the collaboration between research organizations and API contract manufacturers, making this part a crucial player in the market.

Others:

While pharmaceutical industries and research organizations dominate the API contract manufacturing market, the others category represents various s that also contribute to market growth. These s could include biotechnology companies, contract research organizations, medical device manufacturers, and nutraceutical companies, among others. Although the impact may not be as significant as pharmaceutical industries or research organizations, these industries still play a vital role by leveraging API contract manufacturing to meet their specific manufacturing needs. The diverse range of sectors falling under the others category ensures market opportunities across multiple industries and strengthens the overall growth of the API contract manufacturing market.

Insights On Key Distribution channel

Retailers

The retail segment is expected to dominate the global API contract manufacturing market. This can be attributed to the increasing demand for APIs from various end-use industries, including pharmaceuticals, biotechnology, and healthcare. Retailers play a crucial role in distributing API products to the end consumers, making it a significant channel for API contract manufacturing companies to reach a wider customer base. Additionally, the growing trend of e-commerce platforms has further boosted the sales of API products through retailers, further strengthening their dominance in the market.

Direct Tender

While the retailer part dominates the API contract manufacturing market, the direct tender part also holds significant market share. Direct tender involves companies or organizations directly approaching API contract manufacturers for their specific requirements. This part is favored by large pharmaceutical companies and research institutions that opt for a direct procurement approach to ensure quality and customization of APIs. The direct tender part continues to thrive as it enables a direct and streamlined channel for companies to source APIs, ensuring a seamless supply chain process.

Others

The others part in the API contract manufacturing market comprises various distribution channels that are not classified under direct tender or retailers. This may include wholesalers, distributors, and third-party procurement agencies involved in the supply chain process of APIs. Although this part may not dominate the market compared to retailers or direct tender, it plays a significant role in catering to specific market niches and catering to regional or niche demands. The "others" part is diverse and encompasses various distribution channels that complement the overall API contract manufacturing market, further contributing to its growth and expansion.

Insights on Regional Analysis:

North America

North America is set to dominate the global API contract manufacturing market. The region is characterized by favorable regulatory policies, sophisticated healthcare infrastructure, and a high focus on research and development. Furthermore, the presence of major pharmaceutical companies and funding for innovative drug development add to the region's dominance in the market. North American contract manufacturers offer advanced capabilities, quality compliance, and streamlined supply chains, attracting both domestic and international clients.

Latin America

Latin America holds significant potential in the global API contract manufacturing market. The region's pharmaceutical industry is witnessing substantial growth due to the expanding population, increasing healthcare expenditure, and rising demand for generic drugs. Moreover, numerous Latin American countries have enacted policies aimed at attracting foreign investments in the pharmaceutical domain, thereby bolstering the API contract manufacturing market. With improving manufacturing capabilities, cost advantages, and a favorable business environment, Latin America is emerging as a lucrative destination for API contract manufacturing.

Asia Pacific

Asia Pacific is rapidly growing in the global API contract manufacturing market. The region's dominance can be attributed to factors such as low labor costs, abundant raw material availability, favorable regulations, and a skilled workforce. Additionally, countries like India and China have established themselves as major players in the pharmaceutical industry, providing cost-effective and high-quality API contract manufacturing services. The increasing demand for pharmaceutical products in Asia Pacific, coupled with a supportive business environment, make the region a thriving hub for API contract manufacturing.

Europe

Europe plays a significant role in the global API contract manufacturing market, although it is overshadowed by North America and Asia Pacific. The region benefits from its advanced healthcare systems, strong pharmaceutical industry, and stringent quality standards. European contract manufacturers focus on delivering high-quality API manufacturing services and adhere to strict regulatory requirements. While facing competition from other regions, Europe maintains its position by leveraging its technological advancements, research capabilities, and emphasis on innovation. The European API contract manufacturing market continues to attract clients seeking reliable and high-quality manufacturing partners.

Middle East & Africa

The Middle East & Africa region is a growing player in the global API contract manufacturing market. Factors such as increased healthcare spending, rising chronic diseases, and the implementation of favorable regulatory policies contribute to the region's growth. Countries like UAE, Saudi Arabia, and South Africa are witnessing significant investments in the pharmaceutical sector, fostering the development of contract manufacturing services. Although still in the nascent stage, the Middle East & Africa region shows potential due to its increasing focus on pharmaceutical manufacturing capabilities and efforts to attract international clients for API contract manufacturing.

Company Profiles:

Significant contributors within the Global API Contract Manufacturing industry play a vital role in offering top-tier Active Pharmaceutical Ingredients (APIs) to pharmaceutical firms through effective contract manufacturing solutions. These entities are instrumental in advancing, creating, and delivering APIs, thereby facilitating the seamless operation of the pharmaceutical value chain on a worldwide scale.

Prominent entities in the API contract manufacturing sector encompass Lonza Group Ltd., WuXi AppTec, Catalent, Inc., Patheon N.V. (Thermo Fisher Scientific Inc.), Cambrex Corporation, Jubilant Life Sciences Limited, Dishman Group, Pharmaceutical Product Development, LLC (PPD), Dr. Reddy's Laboratories Ltd., and Aurobindo Pharma Ltd. These organizations hold a key position in the international API contract manufacturing arena through their diverse service offerings spanning process development, manufacturing, formulation, and regulatory assistance. Their adeptness and resources in API contract manufacturing assist pharmaceutical firms in streamlining expenses, enhancing operational efficacy, and hastening drug development schedules. Furthermore, they contribute to the amplification of the global API contract manufacturing sphere by addressing the surging need for top-quality and cost-efficient APIs across numerous therapeutic s.

COVID-19 Impact and Market Status:

The Global API Contract Manufacturing market has been profoundly affected by the Covid-19 pandemic, resulting in disturbances in supply chains and setbacks in project schedules.

The global API contract manufacturing market experienced notable effects from the COVID-19 pandemic. There were disruptions in supply chains and manufacturing operations of pharmaceutical companies, resulting in a ened demand for APIs necessary for crucial drugs and treatments.

Lockdowns and travel restrictions worldwide posed challenges for API manufacturers, such as sourcing raw materials, experiencing labor shortages, and facing logistical obstacles. Some companies had to temporarily halt or reduce production as a consequence. On a positive note, the increased emphasis on healthcare and the urgent requirement for medicines created opportunities for API contract manufacturers to enhance their capabilities and facilities to meet the escalating demand. Furthermore, the pandemic underscored the significance of supply chain durability and diversification, leading companies to reconsider their API procurement strategies, potentially favoring local or regional suppliers. Despite the substantial challenges posed by the pandemic, it also brought forth growth possibilities for API contract manufacturers as the pharmaceutical sector continues to prioritize drug development and supply chain robustness. By adapting appropriately and making informed decisions, the API contract manufacturing market can navigate and recover from the impact of COVID-19.

Latest Trends and Innovation:

- In March 2021, Lonza Group announced its acquisition of Capsugel, a leading global provider of capsule-based drug delivery technologies, for approximately $5.5 billion.

- In October 2020, Catalent, Inc. acquired MaSTherCell Global, a leading cell and gene therapy CDMO, to enhance Catalent's capabilities in advanced therapeutic development and manufacturing.

- In March 2019, Thermo Fisher Scientific Inc. finalized its acquisition of Brammer Bio, a contract development and manufacturing organization (CDMO) specializing in viral vectors. This acquisition broadened Thermo Fisher's expertise in gene therapy and viral vector manufacturing.

- WuXi Biologics, a leading global open-access biologics technology platform company, announced the completion of its acquisition of CMAB Biopharma in April 2021, aiming to enhance its end-to-end CDMO offerings.

- In February 2021, Samsung Biologics signed a manufacturing partnership agreement with Eli Lilly and Company to provide drug substance manufacturing for Lilly's COVID-19 therapeutic antibodies.

- In June 2020, Alcami Corporation, a leading global provider of pharmaceutical and biotechnology services, was acquired by Madison Dearborn Partners, a leading private equity firm, to support Alcami's future growth.

- Novartis announced the expansion of its strategic alliance with Lonza in May 2021, establishing the Cell and Gene Manufacturing Innovation Center for the production of innovative cell and gene therapies.

- In August 2020, Fujifilm Diosynth Biotechnologies signed a long-term manufacturing agreement with VLP Therapeutics for the production of VLP's COVID-19 vaccine candidate.

Significant Growth Factors:

The growth drivers of the API Contract Manufacturing Market encompass a rising need for generic medications, a growing emphasis on cost-efficiency, and technological advancements.

The market for Active Pharmaceutical Ingredient (API) Contract Manufacturing is witnessing notable growth propelled by a variety of factors. Primarily, the surge in demand for generic drugs is a key driver as the expiration of patents for numerous branded drugs presents opportunities for API contract manufacturing. Outsourcing API production enables pharmaceutical firms to intensify their concentration on research and development initiatives, facilitating the introduction of groundbreaking medications to the market.

Additionally, the escalating prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders is amplifying the demand for APIs and contract manufacturing services. An essential growth catalyst is the cost-effectiveness offered by contract manufacturing services, allowing for economies of scale utilization, utilization of advanced technologies, and optimization of production expenses, ultimately decreasing the overall drug manufacturing costs. Additionally, the expansion of the biopharmaceutical domain, particularly in the realm of biologics and biosimilars, is fostering the growth of the API contract manufacturing sector. The intricate manufacturing processes and specialized facilities mandatory for biologic drugs make outsourcing an attractive choice for pharmaceutical companies. Lastly, the growing emphasis on regulatory compliance and quality standards is propelling the need for dependable and proficient contract manufacturers capable of ensuring conformity with stringent guidelines. In essence, the API contract manufacturing market is poised for substantial growth in the forthcoming years due to ened demand for generic drugs, surging prevalence of chronic diseases, cost effectiveness, burgeoning biopharmaceutical sector, and escalating regulatory compliance requisites.

Restraining Factors:

Constraints in the API contract manufacturing sector stem from the scarcity of proficient workforce and the substantial expenses linked to the integration of cutting-edge manufacturing technologies.

The market for API contract manufacturing has experienced notable expansion recently due to rising demand for pharmaceutical products and the trend of outsourcing manufacturing operations. However, various factors are impeding the market's growth. Stringent regulatory mandates set by governing bodies present challenges for API contract manufacturers, necessitating compliance with intricate standards to maintain quality. Limited availability of skilled labor in certain areas may constrain manufacturers' capabilities to meet escalating API demands. Fluctuations in raw material costs can impact the profitability of API contract manufacturing firms, making it difficult to sustain competitive pricing. Additionally, concerns persist regarding intellectual property infringements, as involvement in producing patented drugs may lead to legal repercussions. The market has also encountered uncertainty due to disruptions in the global supply chain caused by the COVID-19 pandemic.

Despite these obstacles, the API contract manufacturing sector is anticipated to rebound and expand in the future, powered by technological progress, ened investments in pharmaceutical research, and the rising preference for generic drugs. Players in the market can leverage opportunities in emerging economies and strategic partnerships to surmount these challenges and achieve enduring growth.

Key Segments of the API Contract Manufacturing Market

Contract Type Overview

- Organic

- Inorganic

- Other

Volume Overview

- Low

- Medium

- Large

- Other

Form Overview

- Solid

- Liquid

- Semi-solids

- Other

End-User Overview

- Pharmaceutical Industries

- Research Organizations

- Others

Distribution Channel Overview

- Direct Tender

- Retailers

- Other

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America