Spices And Seasonings Market Analysis and Insights:

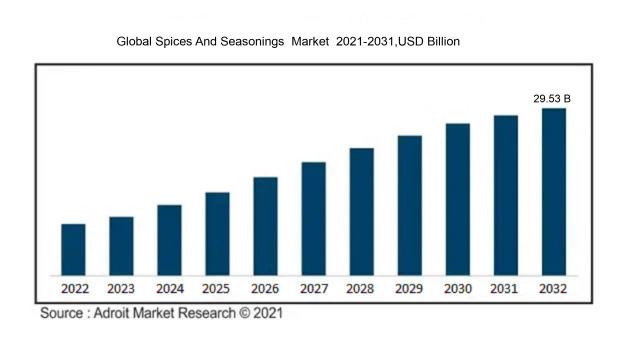

In 2023, the size of the worldwide Spices and Seasonings market was US$ 19.24 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4.79% from 2024 to 2032, reaching US$ 29.53 billion.

The market for spices and seasonings is primarily fueled by an escalating consumer appetite for rich and varied culinary experiences, a trend bolstered by globalization and the emergence of diverse international cuisines. Growing awareness of the health advantages linked to numerous spices, including their anti-inflammatory and antioxidant effects, is a significant factor contributing to market expansion, especially among health-conscious consumers who are increasingly opting for natural over synthetic additives. Additionally, the organized food industry is expanding, and the popularity of gourmet cooking at home is augmenting the demand for high-quality and specialty spices. The rise of e-commerce has also been vital, offering consumers access to a wider array of products. Moreover, innovations in food, characterized by the introduction of new spice blends and convenient packaging options, further enhance consumer interest. Consumer preferences are additionally being shaped by sustainability concerns and trends towards organic certification, leading to a growing inclination for ethically sourced and environmentally sustainable choices in the spices and seasonings market.

Spices And Seasonings Market Definition

Spices are fragrant substances obtained from plants, primarily utilized to enhance the flavor, color, or preservation of food. Seasonings represent a wider classification that not only includes spices but also herbs and other additives designed to elevate the taste of culinary creations.

Herbs and seasonings are vital for elevating the taste, scent, and intrinsic charm of dishes, turning them into delightful and unforgettable experiences. Beyond enhancing flavors, they embody cultural history and traditions, showcasing the unique culinary practices of different regions. Furthermore, a number of these ingredients offer health advantages, such as reducing inflammation and providing antioxidants, which promote well-being. Their capacity to convert basic ingredients into colorful, appetizing meals inspires culinary creativity and deepens our appreciation for various food traditions worldwide. In essence, herbs and seasonings significantly enrich our gastronomic journey, establishing their importance in the culinary landscape across cultures.

Spices And Seasonings Market Segmental Analysis:

Insights On Key Type

Pepper

Pepper is expected to dominate the Global Spices and Seasonings Market due to its widespread use in both culinary applications and food processing. It is one of the most sought-after spices globally, valued for its flavor-enhancing properties and versatility across various cuisines. The growing trend towards flavor customization in food products, along with increasing urbanization and a rise in the food service industry, supports the demand for pepper. Its stabilizing and health benefits further contribute to its prominence, ensuring that it remains a preferred choice among consumers and manufacturers alike.

Chili

Chili has gained significant popularity in recent years, particularly due to its diverse range of flavors and heat levels that cater to different culinary styles. With the rising trend of spicy food among consumers, especially in regions like Asia and Latin America, the appeal of chili has surged. Moreover, its application in processed foods, sauces, and condiments has expanded its market reach. The growing awareness of the health benefits associated with capsaicin, found in chili, also contributes to its appeal, making it a prominent choice in both domestic and commercial kitchens.

Ginger

Ginger's rise in popularity can be attributed to its health benefits, including its anti-inflammatory and antioxidant properties. It is widely used not only in cooking but also in the production of beverages, including teas and health drinks. The growing preference for natural ingredients and health-oriented products has further augmented ginger's demand in the food sector. With its integration into various cuisines globally, ginger remains a staple spice that appeals to health-conscious consumers, ensuring its steady presence in the global market for spices and seasonings.

Cinnamon

Cinnamon is favored for its aromatic and sweet flavor, making it a popular choice in both sweet and savory dishes. Its versatility extends beyond cooking, as it is increasingly used in baked goods, specialty coffees, and festive products. The rising trend of using spices in healthy diets, particularly with cinnamon's reputation for potential health benefits such as blood sugar regulation, propels its demand. As consumers seek warmth and comfort in their food choices, cinnamon effectively satisfies this trend, securing its position in the spice market.

Nutmeg and Mace

Nutmeg and mace, often considered together, bring unique flavors to various culinary applications. While they appeal to niche markets, their demand is marked by their use in traditional dishes and baking. Nutmeg is commonly associated with holiday recipes, while mace is often used in international cuisine. The growing trend of gourmet cooking has also helped to maintain interest in these spices. Their aromatic properties and traditional usage continue to resonate with consumers looking for authentic culinary experiences, thus sustaining their presence in the spice market.

Cumin

Cumin is renowned for its earthy, warm flavor and is a staple in many global cuisines, particularly in Indian, Middle Eastern, and Mexican cooking. Its growing popularity can be attributed to the increasing acceptance of diverse culinary traditions among consumers. The rise of health-focused eating has also bolstered cumin's status due to its potential digestive benefits. Additionally, its frequent use in spice blends and seasonings reflects its integral role in both home cooking and the food industry, making it a vital part of the spice market.

Turmeric

Turmeric has become exceedingly popular due to its vibrant color and recognized health benefits, particularly its anti-inflammatory properties linked to curcumin. It has found applications not just in culinary uses but also in health supplements and functional foods. The wellness trend has intensified consumer interest in turmeric, contributing to its increased presence in a variety of products, from drinks to supplements. As consumers continue to search for natural health solutions, turmeric's significance in the market is only set to grow, reinforcing its presence in the spice industry.

Cardamom

Cardamom is often considered the "queen of spices," prized for its unique flavor and aroma. It finds extensive use in various cuisines, particularly in Indian and Middle Eastern dishes. Its popularity has been bolstered by its applications in aromatic teas and desserts. The spice is also gaining traction for its potential health benefits, including digestive support. Furthermore, the increasing interest in exotic flavors among consumers has helped cardamom carve out a distinctive niche in both home cooking and gourmet food production, solidifying its position in the spice market.

Cloves

Cloves are valued for their strong, warm flavor and are widely used in both sweet and savory dishes. They hold a traditional place in numerous cultural cuisines, especially in spice blends. Though more niche than some other spices, cloves have seen a rise in demand due to their application in baking and holiday dishes. Additionally, cloves are recognized for their medicinal properties, which adds to their appeal. As consumers look for robust flavors and traditional ingredients, cloves will continue to be a relevant part of the spice landscape.

Others

The "Others" category encompasses a broad range of spices that may not be as mainstream but still offer unique flavors and uses. Emerging spices like za'atar, sumac, and fenugreek are gaining traction among consumers seeking to diversify their culinary experiences. The increasing popularity of global cuisines has paved the way for these lesser-known spices, driving their market growth. While they may not dominate like traditional spices, their distinct characteristics allow them to find a dedicated consumer base, contributing to the overall diversity in the spices and seasonings market.

Insights On Key Application

Meat and Poultry

The Meat and Poultry category is expected to dominate the Global Spices and Seasonings market due to the rising consumer demand for flavored and seasoned meat products. With the increasing popularity of barbecues, grilling, and ready-to-cook items, consumers are looking for unique flavors that spices and seasonings can provide. Additionally, the growing trend of meat consumption in various cuisines globally contributes significantly to the expansion of this. Health-conscious individuals are also leaning towards processed meat that is seasoned with natural and organic spices, further propelling the opportunities in this category.

Bakery and Confectionary

The Bakery and Confectionery category holds a significant position in the Global Spices and Seasonings market but is expected to have slower growth compared to meat and poultry. This incorporates various spices to enhance flavors and aromas in products like breads, pastries, and cookies. The increasing consumer inclination towards artisanal and gourmet baked goods is driving demand for high-quality spices. Furthermore, there is a rise in the popularity of ethnic baked goods, creating room for diverse spice applications within this category.

Frozen Food

The Frozen Food category encompasses a wide array of ready-to-eat meals where spices and seasonings play a crucial role in taste enhancement. While this enjoys steady growth due to rising convenience and busy lifestyles, it faces intensified competition from fresh and chilled alternatives. Nonetheless, the introduction of new, innovative flavors in frozen meals is helping retain consumer interest. The continuous investment in flavor development is allowing this to maintain relevance against other more dominant categories.

Snacks and Convenience Food

Snacks and Convenience Food represent a burgeoning area within the Global Spices and Seasonings market. The increasing market penetration of on-the-go snacking solutions has prompted food manufacturers to incorporate a diverse range of seasonings to appeal to changing consumer preferences. However, while this category is broad and evolving, it does face challenges due to health trends promoting natural and organic ingredients. The demand for unique flavors, such as spicy and sweet combinations, could lead to growth but remains secondary to the dominant meat and poultry.

Others

The Others category encompasses a varied assortment of applications where spices and seasonings are utilized, such as in sauces, dressings, and ready-to-eat meals. Although it serves as a catch-all, this is often overshadowed by stronger market contenders. Its growth is contingent upon culinary innovation and emerging trends in global cuisine but lacks the robust sales figures associated with more dominant applications. As consumers increasingly seek flavor variety, this may experience incremental growth, yet it remains marginal in comparison to meat and poultry applications.

Global Spices And Seasonings Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Spices and Seasonings market due to its rich culinary heritage and the high demand for diverse flavors in various cuisines. Countries such as India, China, and Vietnam are major producers and consumers of spices, offering a wide variety of regional spices and unique seasoning blends. The growing population, rapid urbanization, and increase in disposable incomes have contributed to a surge in demand for processed and value-added spices. Additionally, the rising trend of international cuisine and increased awareness regarding the health benefits of spices are anticipated to further boost the growth of this sector in the Asia Pacific region.

North America

North America is witnessing continuous growth in the spices and seasonings market propelled by a rise in consumer inclination towards convenient cooking solutions and gourmet products. With a strong emphasis on organic and natural ingredients, consumers are increasingly turning to spices to enhance flavor while maintaining health consciousness. Retail platforms and e-commerce are becoming pivotal, allowing for greater access to a variety of spices. As the culinary landscape in North America continues to evolve, diverse flavor profiles and specialty spices are also gaining traction, contributing to market expansion.

Latin America

Latin America is experiencing growth in the spices and seasonings market, driven by a combination of cultural culinary traditions and rising health awareness among consumers. Local cuisines heavily feature spices, which are integral to regional dishes. Additionally, as lifestyles change, there is an increasing inclination towards exotic flavors and ethnic foods, which further fuels demand for spices. The region also has the potential to emerge as a key supplier, given its agricultural resources, while local brands are expanding their portfolios to include various unique seasoning blends.

Europe

In Europe, the spices and seasonings market is characterized by a demand for quality and authenticity, with consumers exhibiting keen interest in traditional and exotic flavors. The increasing popularity of Mediterranean and Asian cuisines has driven growth in spice consumption, supported by the trend towards home cooking and culinary experimentation. Moreover, health and wellness trends have pushed consumers to seek natural and organic spice options. As restaurants and chefs prioritize innovative uses of spices in their offerings, the market is likely to benefit from growing gastronomic enthusiasm across the continent.

Middle East & Africa

The Middle East and Africa region showcases a diverse culinary landscape that traditionally emphasizes spices in cooking. The demand for spices is further amplified by the popularity of street food and local delicacies. In recent years, the middle class is expanding, leading to a growing preference for processed spices, as well as fresh formats for convenience. Moreover, with the increasing interest in health benefits associated with various spices, the region is becoming more appreciative of herbs and seasonings. Increased investment in agricultural practices is also expected to support local spice production in the future.

Spices And Seasonings Competitive Landscape:

Influential participants in the worldwide market for spices and seasonings, such as producers, vendors, and distributors, propel advancements and maintain high standards by focusing on product innovation and forming strategic alliances. They also adapt to consumer preferences for natural and organic alternatives. Their involvement is vital for maintaining a consistent supply chain and expanding market presence through targeted marketing initiatives.

Prominent figures in the spices and seasonings sector encompass McCormick & Company, Olam International, A. M. Todd Company, Ajinomoto Co., Kraft Heinz Company, Badia Spices, Schwartz (a division of McCormick & Company), DS Group, The Spice Hunter, and Associated British Foods plc (Allied Mills). Other noteworthy entities include Kerry Group, Kancor Ingredients Limited, Everest Spices, Spice World, Inc., and Hengshun Group. Additionally, significant contributions come from B & G Foods, Inc., Rivoira Spices, and YAMO, along with various regional and specialized market players that enrich the complexity of the industry.

Global Spices And Seasonings COVID-19 Impact and Market Status:

The COVID-19 pandemic profoundly impacted the worldwide market for spices and seasonings by transforming supply chain dynamics, prompting a notable increase in home cooking preferences among consumers, and driving a surge in online sales.

The COVID-19 pandemic profoundly influenced the market for spices and seasonings, leading to significant changes in consumer behavior and supply chain operations. As lockdowns took effect and residents stayed home, there was a marked increase in cooking at home, prompting a rise in the demand for spices and seasonings as individuals aimed to recreate dining experiences akin to those found in restaurants. This shift notably boosted sales, especially through online retail platforms. Nonetheless, the pandemic caused widespread disruptions in global supply chains, which included delays in transportation and ened costs for raw materials, posing challenges for both manufacturers and suppliers. Furthermore, ened health awareness among consumers led to a greater interest in functional spices, such as turmeric and ginger, recognized for their health advantages. As economic activities resumed and food service establishments reopened, the market began to show signs of recovery, with consumers increasingly favoring convenience products and organic selections, indicative of their evolving priorities regarding quality and sustainability in their culinary choices.

Latest Trends and Innovation in The Global Spices And Seasonings Market:

- In June 2023, McCormick & Company acquired the popular hot sauce brand Frank's RedHot from The French's Food Company, expanding their portfolio in the condiment sector and enhancing their footprint in the spicy flavor market.

- In March 2023, Spice World, a leading garlic and specialty vegetable supplier, announced a partnership with a tech company to develop an innovative AI-driven platform for optimizing supply chain logistics, aiming to enhance freshness and reduce waste in their spice distribution processes.

- In October 2022, Olam Food Ingredients acquired the spices business of the Indian group, the Kissan Foods, allowing Olam to fortify its presence in the Indian market and expand its capabilities in spice sourcing and processing.

- In January 2022, the US-based company, Badia Spices, introduced a new line of organic spices and seasonings, responding to the growing consumer demand for clean and sustainable food products.

- In August 2021, the global spice supplier, Döhler, invested significantly in building a new spice extraction plant in India, aimed at increasing their capacity to produce high-quality extracts and flavors for the global market.

- In February 2021, the European spice company, E ink and Company, launched a range of innovative spice blends developed through a collaborative effort with local growers, emphasizing sustainability and organic farming practices.

- In September 2020, Ajinomoto Co. Inc. acquired the remaining shares of its subsidiary, Ajinomoto Frozen Foods, thus fully integrating their seasonings and spices division to streamline operations and improve market competitiveness.

Spices And Seasonings Market Growth Factors:

Significant drivers of expansion in the spices and seasonings industry encompass a ened consumer appetite for vibrant culinary experiences, the growing popularity of international cuisines, and a ened emphasis on health and well-being.

The Spices and Seasonings sector is witnessing significant expansion, propelled by a variety of influential factors. A primary driver is the ened consumer interest in flavorful and diverse culinary experiences, which has been amplified by globalization and the exchange of cultural practices. This trend is reflected in increased utilization of an array of spices and seasonings in both domestic kitchens and food service operations. Moreover, there is a rising consciousness regarding the health advantages linked to spices, including their anti-inflammatory and antioxidant qualities, which enhances their appeal as natural food preservatives and flavor enhancers.

In addition, the growth of the food and beverage industry, especially in developing regions, is markedly elevating the demand for spice and seasoning products. The proliferation of e-commerce and enhanced distribution networks further contribute to the accessibility of these items, promoting market growth. Furthermore, the consumer shift towards organic and clean-label options is shaping buying habits, compelling manufacturers to prioritize the provision of high-quality, sustainably sourced spices and seasonings.

Lastly, the surge in home cooking, particularly due to the COVID-19 pandemic, perpetuates interest in a variety of spices and seasonings, emphasizing the market's strong growth potential amid evolving consumer habits. Together, these factors highlight the vibrant elements driving the Spices and Seasonings market forward.

Spices And Seasonings Market Restaining Factors:

The market for spices and seasonings encounters obstacles, including fluctuating costs of raw materials, strict food safety standards, and rivalry from synthetic flavoring substitutes.

The market for spices and seasonings is confronted with several impediments that may limit its growth potential. A primary concern is the instability in raw material pricing, influenced by climatic conditions, farming methods, and fluctuations in market demand, which can escalate manufacturing costs. Furthermore, the existence of stringent regulatory requirements for food safety and quality certifications can pose significant barriers to entry for newcomers and present challenges for established entities. The increasing awareness among consumers regarding health has sparked a demand for alternatives that are low in sodium or fat, thereby potentially diminishing the interest in conventional spice and seasoning products. Additionally, the issue of counterfeit spices and a lack of transparency in sourcing can erode consumer confidence, negatively affecting buying behavior. Disruptions in supply chains, ened by global crises such as the COVID-19 pandemic, further complicate the constant availability of products. Nonetheless, despite these challenges, the rising popularity of ethnic cuisines, the trend towards plant-based diets, and the growing appetite for organic and natural ingredients offer promising avenues for innovation and growth within the spices and seasonings market. This evolving scenario indicates that with carefully devised strategies, industry participants can effectively address challenges and seize new opportunities.

Key Segments of the Spices and Seasonings Market

By Type:

• Pepper

• Chili

• Ginger

• Cinnamon

• Nutmeg and Mace

• Cumin

• Turmeric

• Cardamom

• Cloves

• Others

By Application:

• Meat and Poultry

• Bakery and Confectionery

• Frozen Food

• Snacks and Convenience Food

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America