Artificial Insemination Market Analysis and Insights:

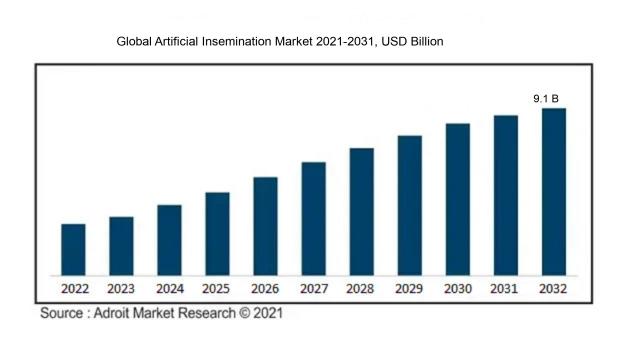

In 2023, the size of the worldwide Artificial Insemination market was US$ 2.7 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2032, reaching US$ 9.1 billion.

The artificial insemination sector is influenced by multiple significant factors. A notable contributor is the rising incidence of infertility and reproductive health challenges faced by couples, which amplifies the need for assisted reproductive technologies. Moreover, progress in medical innovations and techniques, such as intracytoplasmic sperm injection (ICSI) and preimplantation genetic diagnosis (PGD), has improved success rates for artificial insemination, making it more attractive for potential parents.

The increasing recognition and acceptance of artificial reproductive technologies across various cultures, alongside ened investments in healthcare infrastructure, further stimulate the growth of this market. Additionally, the increasing prevalence of same-sex couples and single parents seeking fertility options also plays a role in the market's expansion. Furthermore, the presence of sperm banks and donor programs has broadened choices for patients, creating a competitive environment that encourages both innovation and cost-effectiveness in the services provided.

Artificial Insemination Market Definition

The artificial insemination sector pertains to the field that focuses on various methodologies for achieving ovum fertilization with sperm outside of traditional mating. This sector includes a range of products, services, and technologies designed to enhance reproductive capabilities in both agricultural animals and human fertility interventions.

The market for artificial insemination holds significant importance due to its contributions to livestock efficiency and genetic enhancement. This method facilitates the selective breeding of animals, allowing for the preservation of advantageous characteristics and reducing the risk of disease transmission. In the realm of human health, it addresses infertility issues and presents alternatives for those seeking to start a family. Moreover, it fosters innovations in reproductive technologies, playing a key role in ensuring food security and promoting sustainability in agriculture. As the global population continues to grow, the necessity for efficient and ethical breeding methods escalates, underscoring the market's essential role in contemporary agriculture and healthcare.

Artificial Insemination Market Segmentation:

Insights On Key Type

Intrauterine Insemination

Intrauterine Insemination (IUI) is expected to dominate the Global Artificial Insemination Market due to its widespread acceptance, higher success rates compared to other methods, and lower invasiveness. IUI is preferred by many healthcare providers and patients as it allows for the direct placement of sperm into the uterus, which enhances the likelihood of fertilization without the need for complex procedures. Additionally, the method is often less costly than other assisted reproductive technologies, making it accessible to a broader demographic. Its increasing use in combination with ovarian stimulation therapies further augments its market presence, solidifying its leading status.

Intracervical Insemination

Intracervical Insemination (ICI) involves placing sperm directly into the cervix. While it is less frequently chosen than IUI, it serves as an alternative for couples who may wish to bypass more invasive procedures. ICI is often performed in home settings, using at-home insemination kits, which adds a level of convenience for couples trying to conceive. The lower costs and simplicity of the procedure cater to those with limited access to fertility clinics, but the success rates typically do not match those of IUI, limiting wider adoption.

Intratubal Insemination

Intratubal Insemination (ITI) is a method where sperm is placed directly into the fallopian tubes. This technique can increase the chances of natural conception since sperm can meet the egg much sooner. However, ITI is generally more invasive, requiring surgical intervention, which leads to higher costs and complexity compared to other methods. Its use is primarily confined to specific medical scenarios where traditional methods have failed, thus keeping its market share smaller. Its relatively low adoption rate indicates that it remains secondary to more patient-friendly techniques like IUI.

Intravaginal Insemination

Intravaginal Insemination (IVI) involves depositing sperm directly into the vagina. While it is seen as a more accessible option to couples, it lacks the precision of IUI and may lead to lower success rates. The procedure is often performed using at-home kits, catering to those who prefer privacy and convenience. Despite its user-friendliness, the effectiveness of IVI is questioned when compared to the more scientifically founded methods like IUI, which diminishes its dominance in the market. As a result, IVI remains a less preferred option for couples facing fertility challenges.

Insights On Key By Product

Insemination Kits

Insemination kits are expected to dominate the Global Artificial Insemination Market due to their comprehensive nature and high demand among households and fertility clinics. They offer a complete set of tools necessary for artificial insemination, making them user-friendly for both practitioners and couples seeking home insemination solutions. The rising awareness regarding fertility issues, along with the trend toward at-home conception options, supports the preference for these kits. Additionally, the increasing investments in fertility treatments and advancements in technology further enhance the kit's appeal, leading to a growing market presence expected to establish them as market leaders.

Home Conception Devices

Home conception devices, while not leading the market, play a significant role in catering to couples seeking privacy and convenience in their fertility journey. These devices, which typically include ovulation tracking kits and cervical mucus monitors, enable individuals to take control of their reproductive health in the comfort of their home. The rising trend towards self-care and empowerment in health services significantly boosts the growth of this. Increasing access to information about personal fertility encourages more couples to invest in these devices, fostering a gradual yet consistent expansion in this vertical.

Accessories

Accessories, including various tools and supplementary items for artificial insemination procedures, are essential for enhancing the overall user experience and procedure effectiveness. While they do not represent the largest share of the market, their relevance cannot be overlooked as they provide additional support and convenience for both medical professionals and individuals. As the awareness around fertility issues grows, the demand for these items is expected to increase as part of a holistic approach to artificial insemination. Accessories play a necessary role in ensuring that the process is as seamless and efficient as possible for all parties involved.

Other

The 'Other' category encompasses a diverse range of products and services related to artificial insemination that do not fall into the aforementioned classifications. This may include emerging technologies, personalized fertility solutions, and specialized consultation services that cater to unique needs. Although this category is not expected to lead in market share, it shows potential for innovative growth as the industry evolves. With increasing focus on personalized medicine and tailored fertility treatments, there is room for unique offerings to emerge from this and capture the interest of consumers seeking non-traditional solutions.

Insights On Key End Use

Fertility centers

Fertility centers are expected to dominate the Global Artificial Insemination Market. This is primarily due to their specialization in reproductive technologies, offering enhanced services tailored to fertility issues. These centers often have advanced equipment, skilled professionals, and a wide range of treatment options that appeal to individuals seeking reproductive assistance. Additionally, fertility centers usually provide comprehensive care that encompasses various aspects of reproductive health, making them a popular choice for those undergoing artificial insemination procedures. The rising rates of infertility globally and the increasing public awareness of fertility treatments further bolster the significance and growth of this sector.

Hospitals and Clinics

Hospitals and clinics play a substantial role in the Global Artificial Insemination Market, providing essential reproductive health services alongside various other medical treatments. Often equipped with the necessary technology, they can initiate basic artificial insemination procedures. However, the competitive advantage lies in the integration of other healthcare services provided to patients. While they cater to broader healthcare needs, their limited focus on fertility compared to specialized fertility centers may affect the volume of artificial insemination procedures performed.

Home

Home-based artificial insemination is a growing trend but does not dominate the market due to a few limitations. The convenience of self-administered procedures appeals to some couples seeking privacy and comfort, but the lack of professional oversight can raise concerns about effectiveness and safety. Additionally, home methods often require access to specific kits and education on the process, which might not be feasible for all potential users. Hence, while it is an attractive option for some, it remains a niche rather than a dominant player.

Others

The 'Others' category in the Global Artificial Insemination Market encompasses a variety of less traditional settings and approaches, such as non-medical clinics and online fertility services. While these alternatives may cater to unique demographics or preferences, their impact on the overall market is relatively minimal. Factors such as limited recognition, varying standards of care, and regulatory challenges hinder their growth compared to hospitals and fertility centers, making them less influential in shaping the market dynamics of artificial insemination.

Insights On Key By Source

AIH-Husband

The AIH-Husband is poised to dominate the Global Artificial Insemination Market. This preference can be attributed to cultural and familial factors where couples prefer the use of the husband's sperm for insemination, contributing to an emotional connection and trust. Traditional and religious beliefs often play a significant role in choosing AIH over AID, providing couples with reassurance. Additionally, the rise in awareness surrounding fertility treatments has reinforced confidence in AIH, as it is often viewed as a more natural approach compared to sperm donation. Moreover, the advancements in technology and techniques enhance the success rates of AIH, making it the preferred choice for many couples seeking to conceive.

AID-Donor

The AID-Donor category, while less dominant, still holds significance in the market, largely driven by single women and same-sex couples. This approach allows individuals or partners without male partners to consider assisted reproductive technologies for family planning. The growing acceptance of diverse family structures further bolsters the demand for donor sperm, and the notion of inclusivity is increasingly influencing potential customers. Despite its smaller share, the AID benefits from advancements in donor screening processes and the availability of anonymous donation, enhancing trust and confidence among prospective parents.

Insights on Regional Analysis for Artificial Insemination Market:

North America

North America is expected to dominate the Global Artificial Insemination Market due to advanced healthcare infrastructure, high disposable incomes, and substantial investments in animal husbandry technologies. The region houses several key players in the industry, including companies that focus on innovation and research to enhance artificial insemination techniques. Moreover, increasing demand for high-quality livestock and genetic improvements in animals contribute to its market growth. The regulatory framework also supports the development of advanced reproductive technologies, making North America a leader in the artificial insemination sector.

Latin America

Latin America shows potential for growth in the artificial insemination market, driven by improving agricultural practices and an increasing focus on livestock productivity. Countries like Brazil and Argentina are significant leaders in beef and dairy production, investing in reproductive technologies to enhance yields. However, the region faces challenges such as varying regulation standards and infrastructural limitations which may hinder its growth compared to North America.

Asia Pacific

Asia Pacific is a rapidly growing region in the artificial insemination market with countries like India and China showing increased adoption due to rising meat and dairy consumption. However, variations in technological adaptation and investment levels amongst countries in the region limit its dominance compared to the North American market. Continued government support for modern agriculture may drive future growth in this area.

Europe

Europe is a strong competitor in the artificial insemination market, particularly driven by high standards in animal husbandry and consumer demand for quality products. The focus on sustainable farming practices is pushing innovations in reproductive technologies. However, strict regulations and cost issues may limit expansive growth compared to North America.

Middle East & Africa

The Middle East and Africa (MEA) region is gradually tapping into the artificial insemination market primarily driven by improving agricultural practices and government initiatives to support livestock production. However, the market is still in a nascent stage, facing challenges like resource limitations, lack of technology, and varying regulatory frameworks that could hinder its competitive edge globally.

Artificial Insemination Market Company Profiles:

Leading entities in the worldwide artificial insemination sector, such as biotech companies and veterinary service providers, spearhead advancements and uphold product standards via sophisticated reproductive technologies. Their efforts include broadening market presence and forming strategic alliances to improve breeding techniques and satisfy the increasing demand within the agricultural and livestock sectors.

Prominent participants in the artificial insemination sector comprise Vitrolife AB, Medtronic, Bayer AG, Genea Limited, Pride Angel, Zoetis Inc., Genus PLC, Rocket Medical, Neogen Corporation, Syngenta AG, Hendrix Genetics, and CRV Holding B.V. Furthermore, notable contributors to this industry include Allflex Livestock Intelligence, Semex, GIVET, and The Semen Company. Additional key organizations in this field are Genex Cooperative, Inc., Select Sires Inc., Cogent Breeding Ltd., and Rinovum Women’s Health. Finally, the impact of firms such as Alta Genetics, Genetricks, and Trans Ova Genetics is significant, as these companies are essential in the development and enhancement of artificial insemination technologies and services within the agricultural and veterinary sectors.

COVID-19 Impact and Artificial Insemination Market Status:

The Covid-19 pandemic has profoundly affected the Global Artificial Insemination Market, leading to postponements in veterinary services, a slowdown in livestock breeding efforts, and disruptions in the supply chain related to reproductive technologies.

The COVID-19 pandemic had a profound impact on the artificial insemination sector, as measures to limit non-essential healthcare led to a notable downturn in fertility treatments. Medical facilities shifted their focus to COVID-19 management, resulting in disruptions in artificial insemination services for both humans and animals. Furthermore, interruptions in supply chains affected the availability of essential reproductive technologies like semen thawing devices and hormone therapies. Conversely, the pandemic spurred an increased awareness of reproductive health issues and family planning, contributing to a surge in demand for fertility services in the wake of lockdowns. The incorporation of telemedicine also enhanced accessibility for consultations. As the market begins to rebound, advancements in reproductive technology alongside evolving societal perceptions of infertility are poised to propel growth. With couples returning to their family planning initiatives after pandemic-induced hold-ups, the market value is anticipated to rise. In summary, although the initial repercussions were detrimental, the long-term prospects are favorable as demand stabilizes and transforms.

Artificial Insemination Market Latest Trends and Innovation:

- In April 2023, Genus plc acquired the artificial insemination business of Axiom Animal Health, enhancing their global market position and expanding their product portfolio in livestock genetic services.

- In March 2023, CRV Holding BV launched an innovative breeding program using genomic selection to improve dairy cattle genetics, reflecting the growing trend toward precision breeding techniques in the artificial insemination market.

- In January 2023, Zoetis announced a partnership with World Wildlife Fund (WWF) to support sustainable farming practices, which includes promoting the use of artificial insemination techniques for livestock, aiming for more efficient breeding.

- In November 2022, Neogen Corporation introduced a new line of semen extenders that improve the viability and motility of sperm during the freezing and thawing process, showcasing advancements in technology for artificial insemination protocols.

- In October 2022, Merck Animal Health acquired the reproductive technologies division of Synlogic, allowing Merck to expand its offerings in the equine artificial insemination sector and enhance reproductive services for horse breeders.

- In June 2022, Select Sires Inc. announced a breakthrough in sexed semen technology that has shown to improve conception rates by 15%, marking a significant innovation in the artificial insemination market for cattle producers.

- In February 2022, the American Duroc Association launched a new genetic benchmarking initiative using data analytics tools, aiming to enhance the efficiency of artificial insemination in swine breeding.

- In December 2021, GENCOR partnered with Biogenetics, focusing on the development of next-generation animal genetic evaluation tools that integrate artificial insemination practices to enhance productivity in livestock farming.

Artificial Insemination Market Significant Growth Factors:

The expansion of the artificial insemination sector is fueled by innovations in reproductive technology, ened awareness surrounding fertility solutions, and a growing need for enhanced efficiency in livestock breeding practices.

The artificial insemination market is witnessing significant growth due to several factors, notably the evolution of reproductive technologies, ened awareness of agricultural efficiency, and an increasing desire for superior livestock. Innovative methods, such as the integration of artificial insemination with in vitro fertilization, are bolstering breeding success, making these options more attractive to farmers and breeders alike. Moreover, the rising focus on sustainable agricultural practices is encouraging the use of artificial insemination to improve genetic diversity while minimizing the necessity of maintaining numerous breeding animals.

The global population increase creates a pressing demand for greater food production, which in turn drives investments aimed at enhancing livestock productivity through artificial insemination. Additionally, government efforts aimed at fostering livestock breeding play a vital role in facilitating market growth. The advent of e-commerce and telemedicine in veterinary care further simplifies access to artificial insemination services and products. Consequently, both the agricultural and veterinary fields are exhibiting greater interest, which fuels ongoing innovation and creates a competitive market environment. The revival of traditional breeding methods, when paired with contemporary scientific advancements, significantly bolsters production potential, ensuring a positive outlook for the artificial insemination market in the years ahead.

Artificial Insemination Market Restraining Factors:

Critical challenges in the artificial insemination sector encompass elevated expenses, regulatory hurdles, and differing degrees of societal acceptance among various cultures.

The market for artificial insemination is hindered by several factors that can impede its expansion and acceptance. One major challenge is the significant expense linked to advanced reproductive technologies, which might restrict accessibility for numerous potential users. Furthermore, strict regulatory environments and varying cultural perspectives on artificial insemination practices can create obstacles, limiting broader implementation. Ethical dilemmas related to genetic manipulation and concerns about animal welfare in livestock insemination add another layer of complexity to the situation. Additionally, insufficient awareness and education among consumers and healthcare professionals may result in the underuse of these services. Consequently, these issues can foster reluctance towards adoption and potentially decelerate market growth. Nonetheless, continuous advancements in technology, along with a rising understanding of the advantages of artificial insemination, are swiftly reshaping the industry. As these challenges are tackled through enhanced education and better regulatory support, there exists a considerable opportunity for growth in both human and veterinary sectors, ultimately broadening reproductive choices for a diverse array of clients and healthcare practitioners.

Key Segments of the Artificial Insemination Market

By Type

- Intrauterine Insemination

- Intracervical Insemination

- Intratubal Insemination

- Intravaginal Insemination

By Product

- Insemination Kits

- Home Conception Devices

- Accessories

- Other

By End Use

- Hospitals and Clinics

- Fertility Centers

- Home

- Others

- By Source

- AIH-Husband

- AID-Donor

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America