Market Analysis and Insights:

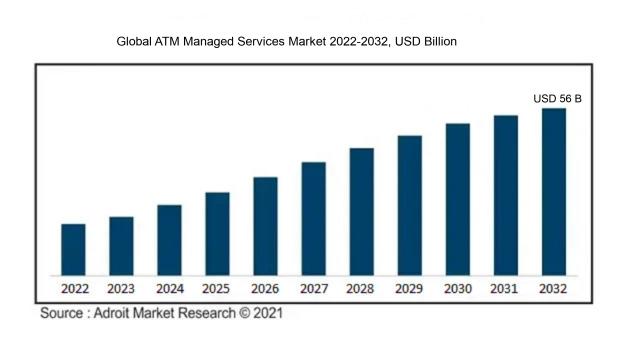

The market for Global ATM Managed Services was estimated to be worth USD 31 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6.5%, with an expected value of USD 56 billion in 2032.

The growth of the ATM Managed Services Market is significantly influenced by a ened focus on cost efficiency and operational effectiveness within financial institutions. By outsourcing ATM management, banks can concentrate on their primary operations while simultaneously lowering maintenance and operational expenses. Furthermore, there is an escalating demand for improved customer experiences through enhanced ATM features, such as sophisticated security measures and streamlined transaction processes, contributing to the market's expansion. Innovations in technology, particularly the incorporation of artificial intelligence and big data analytics for transaction oversight, play a crucial role in facilitating superior decision-making and preventing fraud. Additionally, the increasing number of ATMs globally, particularly in developing regions, along with the necessity to adhere to regulatory compliance, further drives the need for managed services. Lastly, the movement towards self-service banking and the rise in cashless transactions are prompting banks to embrace managed services to keep their ATM networks both competitive and secure.

ATM Managed Services Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 56 billion |

| Growth Rate | CAGR of 6.5% during 2024-2032 |

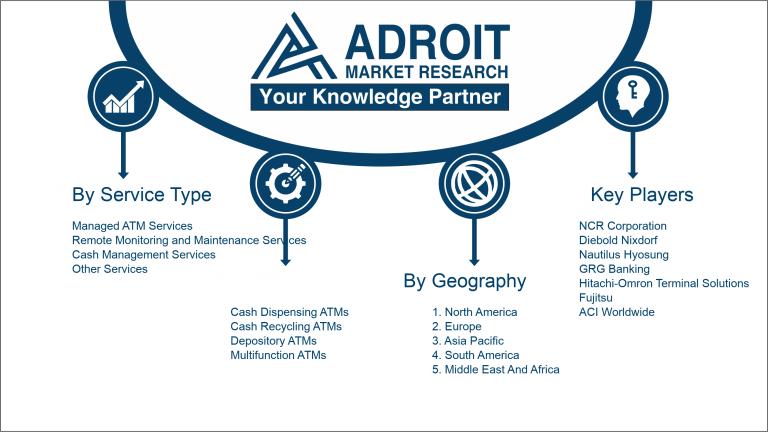

| Segment Covered | By Service Type, By ATM Equipment, By Application, By Deployment Model, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | NCR Corporation, Diebold Nixdorf, Nautilus Hyosung, GRG Banking, Hitachi-Omron Terminal Solutions, Fujitsu, ACI Worldwide, Core Data, Cardtronics, and TNS, Inc. Other important contributors include Verifone, Antlabs, and Currencies Direct. |

Market Definition

ATM Managed Services encompass a range of holistic solutions offered by external providers to oversee the functioning, upkeep, and administration of Automated Teller Machines (ATMs). These offerings generally consist of cash replenishment, system monitoring, software maintenance, and technical assistance, all intended to maximize ATM efficiency and improve user satisfaction.

ATM Managed Services play a vital role in the operations of financial entities and enterprises by boosting efficiency and minimizing expenses related to the upkeep and governance of ATMs. Through the delegation of these services, organizations can concentrate on their primary functions while guaranteeing that their ATMs are maintained adequately, stocked appropriately, and safeguarded effectively. Such services typically encompass oversight, cash replenishment, technical support, and compliance management, all of which reduce operational interruptions and enhance cash flow coordination. Additionally, these services can utilize cutting-edge technology and data analytics to elevate performance and enhance user experience, ultimately leading to increased transaction rates and improved customer contentment in a rapidly evolving market.

Key Market Segmentation:

Insights On Key Service Type

Cash Management Services

Cash Management Services is anticipated to dominate the Global ATM Managed Services Market. This is primarily due to the growing need for effective cash handling and optimization in financial institutions. Organizations are increasingly recognizing the importance of efficiently managing cash flow to reduce operational costs and improve liquidity. Additionally, the rise in transaction volumes across ATMs necessitates robust cash management strategies to minimize downtime and enhance service reliability. Furthermore, as cash transactions remain a staple in many economies, the demand for advanced cash management solutions tailored for ATMs is expected to surge, solidifying this 's leading position in the market.

Managed ATM Services

Managed ATM Services provides financial institutions with comprehensive solutions that streamline ATM operations. This service encompasses installing, monitoring, and maintaining ATMs, allowing banks to focus on core activities while ensuring that their ATM networks operate efficiently. The continued evolution of technology in ATM management aims to enhance user experience and reduce the operational burden on banks. However, despite its benefits, the growth of this service has been somewhat tempered by the increasing preference for cashless transactions.

Remote Monitoring and Maintenance Services

Remote Monitoring and Maintenance Services are essential in providing real-time oversight of ATM systems to predict and prevent potential failures. These services allow banks to respond quickly to issues, thereby ensuring maximum uptime and customer satisfaction. The rise of digital banking solutions has prompted the need for more proactive measures in ATM maintenance; however, this market is growing at a slightly slower pace compared to cash management solutions, given the ongoing preferential shift towards innovative banking technologies.

Other Services

The Other Services category includes a variety of specialized offerings, such as fraud detection and compliance solutions, insurance services for ATMs, and customer support services. While these services play a crucial role in enhancing ATM operations, they are not as widely demanded as the aforementioned services. The focus remains largely on core functionalities that directly impact operational efficiency, thus limiting the growth potential of this service category compared to cash management, managed services, or remote monitoring options.

Insights On Key ATM Equipment

Cash Recycling ATMs

Cash Recycling ATMs are expected to dominate the Global ATM Managed Services Market due to their growing adoption by financial institutions seeking to optimize cash management operations. These machines not only dispense cash but also accept deposits, allowing banks to efficiently manage their cash flow while reducing the risk of cash shortages and operational costs. Their ability to recycle cash enhances efficiency by eliminating the need for frequent cash replenishments and significantly decreasing the amount of cash handling required by personnel. With the rising emphasis on operational efficiency and cost-effectiveness, financial institutions prefer cash recycling solutions, which are seen as a forward-thinking technological advancement.

Cash Dispensing ATMs

Cash Dispensing ATMs continue to be a fundamental component in the ATM landscape, predominantly serving the essential function of cash withdrawal. While they constitute a significant portion of the market, their growth rate is being outpaced by more advanced technologies such as cash recycling ATMs. They remain prevalent in regions where traditional banking practices dominate, and their reliability for simple transactions keeps them in demand. However, as customer expectations evolve toward integrated services, cash dispensing ATMs may struggle to maintain their market position amidst the growing preference for multifunctional equipment.

Depository ATMs

Depository ATMs are becoming increasingly important as they offer customers the ability to deposit cash and checks directly into the ATM without a physical bank visit. This convenience aligns with the growing trend of self-service banking solutions. Nevertheless, they face competition from cash recycling ATMs, which provide more comprehensive functions by allowing both deposits and withdrawals. The growth of digital banking also poses challenges to the depository ATM, as more consumers opt for electronic payments and online transactions instead of cash handling.

Multifunction ATMs

Multifunction ATMs are gaining traction as they provide multiple services beyond standard cash transactions, including bill payments, funds transfers, and mobile top-ups. This integration caters to the modern consumer's demand for diverse banking services in one platform. Despite their versatility, multifunction ATMs are relatively less adopted compared to cash recycling ATMs, which streamline cash management processes. The challenge lies in keeping pace with technological advancements, as consumers increasingly lean towards digital banking channels for convenience and efficiency.

Insights On Key Application

Financial Institutions

The Financial Institutions sector is anticipated to dominate the Global ATM Managed Services Market due to the increasing reliance on cash and digital transactions. Financial institutions such as banks and credit unions are expanding their ATM networks to meet customer demands for accessibility and convenience. Moreover, the need for high security, compliance, and efficiency in cash management drives these institutions to seek third-party managed services that can provide cost-effective solutions and innovative technologies. Enhanced operational efficiency and reduced downtime through managed services are critical for financial institutions aiming to maintain competitiveness in a rapidly evolving financial landscape.

Retail Stores

Retail stores represent a significant application area within the ATM Managed Services Market, driven largely by the need for streamlined cash handling and customer convenience. With the rise in customer footfall, retailers are increasingly integrating ATMs to offer on-site cash withdrawals, enhancing the shopping experience and minimizing checkout disruptions. As consumers continue to value the ease of access to cash, retail establishments are looking to partner with managed service providers to efficiently handle ATM operations, maintenance, and security, ensuring that they can meet customer needs while optimizing operational costs.

Government Agencies

Government agencies are crucial players in the ATM Managed Services Market, utilizing ATMs to facilitate the distribution of welfare payments, tax refunds, and other public services. These agencies require a reliable and secure method to deliver cash to citizens, especially in underserved areas. Managed services play a vital role in ensuring that ATMs are operational, well-maintained, and secure, which is essential for public trust and service delivery. The ability to quickly respond to outages or security threats makes managed services an attractive option for government entities aiming to provide seamless financial access.

Hospitals and Healthcare Facilities

Hospitals and healthcare facilities are increasingly recognizing the importance of having ATMs on-site for patient convenience and operational efficiency. These facilities face unique challenges, such as the need for quick access to cash for patients and families during emergencies. By utilizing managed services, hospitals can ensure that their ATMs are stocked, functioning correctly, and secure, minimizing wait times and enhancing the patient experience. Furthermore, the integration of ATMs into healthcare facilities allows for better cash flow management, enabling hospitals to focus on delivering quality care rather than being burdened with cash handling logistics.

Transportation Hubs

Transportation hubs, including airports and train stations, are pivotal for the ATM Managed Services Market due to the high volume of travelers requiring access to cash. These locations are often busy and dynamic, necessitating ATMs that are reliable and continuously operational. The presence of ATMs in these hubs not only aids in providing convenience to passengers but also serves businesses within the vicinity. Managed services can enhance the customer experience by ensuring that machines are well-maintained and replenished, ultimately supporting a smoother travel experience.

Insights On Key Deployment Model

Cloud-Based

The Cloud-Based option is anticipated to dominate the Global ATM Managed Services Market due to its scalability, flexibility, and cost-effectiveness. As financial institutions increasingly embrace digital transformation, the cloud model provides them with the ability to rapidly deploy new services and expand their operational capabilities without the heavy infrastructure investments associated with on-premise solutions. Furthermore, cloud-based services allow for real-time data management and enhanced security protocols, catering to the growing demand for seamless and secure banking experiences. With the acceleration toward online and mobile banking, institutions are likely to prefer cloud services that offer robust management capabilities and a quick response to changing market demands.

On-Premise

The On-Premise model continues to appeal to financial institutions that prioritize data privacy and control. Many organizations believe that maintaining ATM systems on-site allows them to retain greater oversight regarding security and operational processes. This is particularly pertinent in regions where regulatory compliance mandates strict data handling guarantees. However, while this model offers advantages in control, it often requires substantial upfront investment and ongoing maintenance costs, which may hinder its wider adoption compared to more modern alternatives.

Hybrid

The Hybrid approach is gaining traction as it combines the strengths of both on-premise and cloud-based models. This strategy allows institutions to maintain sensitive operations on-site while leveraging cloud services for additional scalability and flexibility. The Hybrid model caters to organizations seeking to mitigate risks associated with data breaches while still benefiting from the advanced technological capabilities of the cloud. Nevertheless, the complexity of managing such a system can be a potential drawback for some institutions, as they need to ensure seamless integration between the two environments.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global ATM Managed Services market due to several pivotal factors. The region boasts a well-established banking infrastructure that is increasing its focus on improving customer experience through technology. Major players in the market, including both global and regional service providers, have significantly invested in ATM managed services, driven by a strong demand for innovation and security. The proliferation of contactless payment solutions and advanced fraud protection measures has further propelled the demand in this. Additionally, government regulations and increased consumer expectations for service reliability position North America as a leader in ATM managed services.

Latin America

Latin America is witnessing growth in the ATM managed services sector, albeit at a slower pace than North America. The region is focusing on modernization and expansion of its financial services, particularly in the unbanked and underbanked s. However, challenges such as political instability and economic fluctuations can hinder rapid growth. The rise of fintech companies is also transforming the landscape, creating opportunities for collaboration and innovation in ATM technologies.

Asia Pacific

The Asia Pacific region shows promising potential in the ATM managed services market, driven by increasing urbanization and a burgeoning middle class. Countries like India and China are investing heavily in their banking infrastructure, pushing for improved ATM networks and services. However, the market remains fragmented, with varying degrees of technology adoption across different nations. Despite these challenges, the ongoing digitization and growing preference for cashless transactions are expected to enhance the growth trajectory.

Europe

Europe continues to have a stable presence in the ATM managed services market, supported by strong banking regulations and a push for security in financial transactions. Established players have a significant market share due to the presence of advanced technologies and customer demand for enhanced service. However, intense competition and market saturation in certain areas may limit further growth. The focus on sustainability and efficiency may offer new avenues for innovation in ATM managed services.

Middle East & Africa

The Middle East & Africa region has an emerging ATM managed services market, primarily driven by increasing banking penetration and mobile payment adoption. Although it is still in its nascent stage compared to other regions, the growth potential is significant due to substantial investments in technology and infrastructure. Challenges such as varying regulatory environments and economic disparities, however, pose obstacles to expansive growth. The focus on enhancing financial inclusion is expected to stimulate the demand for ATM managed services across the region.

Company Profiles:

The primary stakeholders in the global ATM Managed Services market consist of service providers responsible for the setup, upkeep, and management of ATMs. Their role is critical in guaranteeing efficient performance and security measures. Additionally, they enable transaction processing and improve the customer experience by utilizing advanced technological solutions and offering extensive support.

The major entities operating within the ATM Managed Services Market encompass NCR Corporation, Diebold Nixdorf, Nautilus Hyosung, GRG Banking, Hitachi-Omron Terminal Solutions, Fujitsu, ACI Worldwide, Core Data, Cardtronics, and TNS, Inc. Other important contributors include Verifone, Antlabs, and Currencies Direct. Moreover, ACI Worldwide and Giesecke+Devrient also play substantial roles in the industry. These organizations are well-regarded for their knowledge and specialization in ATM management, maintenance, and comprehensive solutions tailored for the global financial sector.

COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly accelerated the uptake of digital financial services, resulting in an increased need for ATM management solutions as financial institutions aimed to improve the remote oversight and security of cash distribution.

The COVID-19 pandemic had a profound impact on the market for ATM managed services, primarily driven by changes in consumer patterns and the operational difficulties encountered by financial institutions. As public health concerns grew, the need for contactless transaction methods surged, prompting banks to upgrade their ATMs to support these technologies. Concurrently, the economic decline compelled financial institutions to reduce operational expenses, leading many to outsource their ATM management to specialized providers. This shift has allowed banks to concentrate on their primary business activities while maintaining effective ATM operation and upkeep. The pandemic also accelerated the adoption of innovative technologies, such as remote monitoring and management systems, which enhanced operational performance. Moreover, with the reopening of public spaces, there has been an increased emphasis on safety protocols, further underscoring the significance of hygiene practices and reducing cash handling. In summary, the pandemic acted as a catalyst for change within the ATM managed services sector, driving innovation and transforming service delivery frameworks.

Latest Trends and Innovation:

- In October 2022, NCR Corporation announced its acquisition of Cardtronics, a leading provider of ATM and payment solutions, for approximately $2.5 billion. This merger aimed to enhance NCR's capabilities in the ATM managed services market and expand its customer base.

- In March 2023, Diebold Nixdorf showcased its DN Vynamic software at the ATM & Cyber Security conference, emphasizing its continuous innovations in cash management solutions. This technology aims to improve the efficiency and security of ATM operations, highlighting the importance of advanced software in managed services.

- In June 2023, Fiserv announced the launch of its "ATM Advanced Management" suite, which integrates AI-driven analytics to optimize cash management and minimize operational downtime for ATMs. This technological innovation represents a significant shift towards data-driven management in the ATM services sector.

- In September 2023, Cardtronics rebranded to "Allpoint" and expanded its partnership with several major banks to enhance the accessibility of ATMs across the United States. This strategic move aims to bolster its managed services by increasing the number of fee-free ATMs for customers.

- In August 2023, Global Payments completed its acquisition of EVO Payments, which included the expansion of their ATM processing capabilities. This acquisition is expected to allow Global Payments to provide enhanced ATM management services and integrated payment solutions.

- In April 2023, the fintech company, Genmega, announced a strategic partnership with Ziosk, aiming to integrate self-service technology, including ATMs, into dining environments. This partnership underlines the push towards innovative service delivery within the ATM managed services market.

- In July 2023, the Allpoint ATM network reported a 20% increase in its footprint, indicating a successful expansion strategy. This growth enhances their managed services offerings and reflects the increasing demand for ATMs in various locations.

- In May 2023, PayRange launched its new ATM management platform, which allows operators to manage ATMs remotely and offers real-time data analytics for better decision-making. This product aims to streamline operations and enhance service efficiency in the market.

Significant Growth Factors:

The ATM Managed Services Market is experiencing significant growth driven by several key factors, including the escalating preference for cashless payment methods, improved operational efficiencies, and a ened demand for sophisticated security measures within the financial sector.

The ATM Managed Services Market is witnessing notable expansion, fueled by a variety of critical influences. Firstly, the surging appetite for automated banking solutions and the pursuit of elevated customer experience are encouraging financial organizations to delegate ATM management, aiming for greater operational effectiveness. Moreover, technological innovations, especially in remote monitoring and maintenance capabilities, facilitate cost-efficient ATM oversight, enticing banks to embrace these services.

The escalating trend toward digital banking has resulted in an increase in ATM installations, which in turn demands improved management and support frameworks. In addition, the pressure of stringent regulatory compliance and the imperative for data protection in financial operations are driving banks to seek managed services that provide specialized knowledge in compliance and security standards.

The growth of contactless payment technologies, along with the integration of ATMs with mobile applications, also contributes to the expansion of the market, as these advancements necessitate advanced management systems to accommodate various transactions. Finally, the shift towards enhanced safety measures in the wake of the pandemic has prompted financial institutions to adopt managed services that ensure ATM operations comply with health regulations, thereby further stimulating demand in this field. Together, these elements are promoting significant growth within the ATM Managed Services Market.

Restraining Factors:

The ATM Managed Services Market faces significant limitations due to regulatory hurdles, security issues surrounding cybersecurity, and substantial upfront capital requirements for service providers.

The ATM Managed Services sector is currently contending with numerous obstacles that may hinder its growth potential. A primary concern is the substantial upfront capital required to set up and sustain a comprehensive ATM infrastructure, which can discourage smaller banking institutions from engaging with managed services. Additionally, the rapid pace of technological evolution necessitates regular updates and improvements, resulting in escalated operational expenses. Compliance with regulatory frameworks also presents a challenge, as institutions must manage intricate legal requirements, which can consume significant resources. The risk of cybersecurity incidents adds another layer of complexity, as service providers are compelled to implement stringent measures against data breaches and fraudulent activities, thereby increasing overall service expenditures. Furthermore, the rising trend toward digital banking solutions may result in decreased ATM utilization, leading to a potential downturn in the demand for managed services. Nonetheless, it is crucial to note that the market is evolving; technological advancements and novel service approaches are fostering the development of more effective solutions. As stakeholders in the ATM Managed Services sector enhance their offerings and strengthen security measures, they are poised to uncover new avenues for growth, enabling the market to thrive within an ever-changing financial environment.

Key Segments of the ATM Managed Services Market

By Service Type

• Managed ATM Services

• Remote Monitoring and Maintenance Services

• Cash Management Services

• Other Services

By ATM Equipment

• Cash Dispensing ATMs

• Cash Recycling ATMs

• Depository ATMs

• Multifunction ATMs

By Application

• Financial Institutions

• Retail Stores

• Government Agencies

• Hospitals and Healthcare Facilities

• Transportation Hubs

By Deployment Model

• On-Premise

• Cloud-Based

• Hybrid

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America