Market Analysis and Insights:

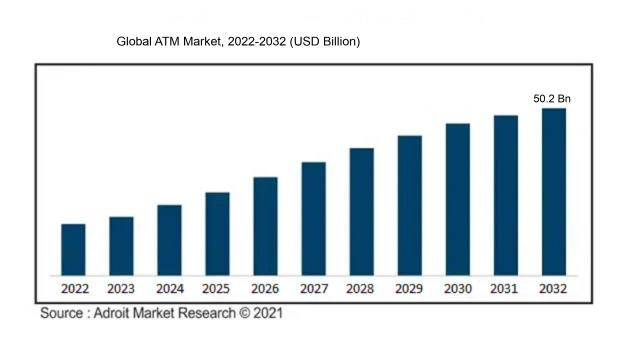

The market for ATMs was estimated to be worth USD 22.7 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 8.62%, with an expected value of USD 50.2 billion in 2032.

The ATM industry is shaped by a variety of key factors. Primarily, the rise in popularity of digital banking services plays a vital role. With more customers transitioning to online and mobile banking, the demand for ATMs offering self-service features like cash withdrawals and deposits becomes essential. Secondly, the expansion of e-commerce and the necessity for secure payment methods have contributed to the increased use of ATMs. These machines provide a convenient and dependable cash withdrawal option for those shopping online. Furthermore, the growing number of unbanked and underbanked individuals in developing areas presents an opportunity for growth in the ATM market. Efforts to promote financial inclusion by providing banking services to these populations drive the demand for ATMs. Additionally, ongoing technological advancements and the incorporation of features such as biometric authentication, contactless transactions, as well as enhanced security measures are driving growth in the market. The ATM industry is also impacted by governmental policies and regulations that oversee the banking sector. These regulations ensure the safety and compliance of ATMs, prompting the need for regular updates and replacements. In conclusion, the increasing digitization, e-commerce expansion, financial inclusion initiatives, technological progress, and regulatory landscape are the primary drivers behind the growth of the ATM market.

ATM Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 50.2 billion. |

| Growth Rate | CAGR of 8.62% during 2023-2032 |

| Segment Covered | By Type, By Solution, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | NCR Corporation, Diebold Nixdorf, Inc., GRG Banking Equipment Co., Ltd., Hitachi-Omron Terminal Solutions Corporation, Fuji Electric Co., Ltd., Nautilus Hyosung Corporation, HESS Cash Systems GmbH & Co. KG, Euronet Worldwide, Inc., Triton Systems of Delaware, LLC, and Perto S.A. |

Market Definition

The term ATM stands for Automated Teller Machine, a self-service banking terminal that enables individuals to conduct a range of financial transactions independently without requiring assistance from a teller.

Automated teller machines (ATMs) are indispensable in contemporary society due to their pivotal role. These machines offer unparalleled convenience to individuals by enabling them to perform a myriad of banking transactions, such as withdrawing cash and making deposits, without needing to physically visit a bank branch. This perpetual availability and flexibility afford customers the autonomy to manage their financial affairs at any hour. Additionally, ATMs have transformed financial practices by reducing the dependence on physical currency and advocating for electronic payment methods. As digital currencies and contactless transactions gain popularity, ATMs function as a conduit for embracing and integrating cutting-edge financial technologies. Moreover, underserved areas and rural communities derive immense benefits from ATM services, bridging the gap by providing access to financial resources where traditional banking infrastructure may be lacking. In essence, the significance of ATMs stems from their convenience, accessibility, adaptability to evolving financial landscapes, solidifying their position as an essential component of modern banking practices and daily routines.

Key Market Segmentation:

Insights On Key Type

White Label

White Label ATMs are expected to dominate the Global ATM Market. White Label ATMs are owned and operated by non-bank entities, allowing them to reach underserved areas and provide convenient banking services. These ATMs are typically deployed in retail locations, shopping centers, and other high-traffic areas. Their dominance can be attributed to factors such as high scalability, cost-effectiveness, and the ability to cater to a wide range of banking needs. Additionally, the increasing demand for financial inclusion and the rise of independent ATM deployers contribute to the growth of the White Label ATM .

Brown Label

Brown Label ATMs, are not expected to dominate. Brown Label ATMs are operated by non-bank entities but are owned and maintained by a sponsor bank. This offers a nership between the sponsor bank and the non-banking entity, allowing for wider ATM network coverage. However, the dominance of White Label ATMs in terms of scalability, flexibility, and operational efficiency outweighs the growth potential of Brown Label ATMs. Furthermore, technological advancements and changing consumer preferences towards self-service banking further contribute to the lesser dominance of Brown Label ATMs in the Global ATM Market.

Insights On Key Solution

Managed Services

Managed Services is expected to dominate the global ATM market. With the increasing complexity and security requirements of ATMs, many financial institutions are opting for managed services to ensure smooth operations and efficient management of their ATM networks. Managed services offer a range of benefits, including proactive monitoring, maintenance, software updates, and security enhancements. This also provides remote troubleshooting and quick response to any issues, minimizing downtime and improving customer satisfaction. The demand for managed services is expected to grow as financial institutions seek cost-effective solutions that allow them to focus on their core business while ensuring the reliability and security of their ATMs.

Deployment

Deployment may not dominate the market like Managed Services, Deployment is still a significant aspect. This involves the physical installation and setup of ATMs at various locations. Deployment encompasses the installation of hardware, software configuration, network connectivity, and testing. Financial institutions and ATM deployers rely on this to expand their ATM networks geographically, reach new customer bases, and enhance accessibility. The demand for Deployment services will continue to be driven by the need for ATM infrastructure expansion, especially in emerging markets and areas with limited banking facilities.

Insights On Key Application

Commercial

The Commercial is expected to dominate the Global ATM market. Commercial businesses, such as retail stores, restaurants, and shopping malls, heavily rely on ATMs for customer convenience and cash management. With the increasing demand for self-service banking options, commercial establishments are incorporating ATMs to provide quick and secure access to cash. Additionally, the rise of e-commerce has led to the need for cash-driven customers to withdraw funds for their purchases. As a result, the Commercial is anticipated to dominate the Global ATM market due to the steady growth of businesses and their reliance on ATMs for seamless financial transactions.

Government

Government segment is not expected to dominate the Global ATM market. While government agencies and institutions do utilize ATMs for various transactions such as tax refunds or social benefit disbursements, their overall demand for ATMs is relatively lower compared to commercial businesses. Government entities tend to have fewer ATM requirements and often rely on a limited number of ATMs located in specific government buildings or facilities. Therefore, while the Government holds significance in terms of providing financial services to citizens, it is not anticipated to dominate the Global ATM market due to its lower demand compared to the Commercial .

Insights on Regional Analysis:

North America:

North America is expected to dominate the global ATM market. The region has witnessed a high adoption of ATMs due to the well-established banking infrastructure and the presence of leading ATM manufacturers. Moreover, the technological advancements in ATMs such as advanced security features and mobile integration have further fueled the demand in the region. Additionally, the growing need for convenient banking services and the preference for self-service options have contributed to the dominance of North America in the global ATM market.

Latin America:

Latin America has shown significant growth in the ATM market in recent years. The region has witnessed a rise in the number of banking facilities and an increase in the demand for convenient banking services. However, despite the growth, Latin America is still catching up with other regions in terms of ATM penetration and technological advancements. Factors such as the lack of robust banking infrastructure in certain areas and concerns regarding security may pose challenges to the overall dominance of Latin America in the global ATM market.

Asia Pacific:

Asia Pacific has emerged as a leading market for ATMs, primarily driven by countries like China and India. The region has witnessed rapid urbanization and a growing middle class, leading to an increased demand for banking services and advanced ATMs. Additionally, technological innovations such as biometric authentication, contactless payments, and interactive user interfaces have further propelled the growth of the ATM market in Asia Pacific. While the region shows immense potential, factors like varying regulations and security concerns may impact its overall dominance in the global market.

Europe:

Europe has a mature market for ATMs, with a high penetration rate in most countries. The region has witnessed the adoption of advanced technologies such as cash recycling and intelligent deposit systems in ATMs. Additionally, the increasing focus on enhancing customer experience and the rise in mobile banking services have contributed to the dominance of Europe in the global ATM market. However, factors such as economic uncertainties and regulatory changes may affect the growth trajectory of the European ATM market.

Middle East & Africa:

The Middle East & Africa region has witnessed steady growth in the ATM market. The rise in population, increasing urbanization, and the expansion of banking networks are key factors driving the demand for ATMs in the region. However, challenges such as security concerns, limited banking infrastructure in certain areas, and economic uncertainties may hinder the overall dominance of the Middle East & Africa in the global ATM market. Despite these challenges, the region presents substantial opportunities for ATM manufacturers and service providers to expand their presence and cater to the growing needs of the population.

Company Profiles:

Prominent contributors to the worldwide ATM sector encompass Diebold Nixdorf, NCR Corporation, and GRG Banking Equipment. Diebold Nixdorf stands out as a top supplier of automated teller machines and software solutions, while NCR Corporation is acclaimed for its cutting-edge ATM technology. GRG Banking Equipment holds a noteworthy position in the industry, providing a diverse array of self-service banking solutions.

Prominent entities in the ATM industry consist of NCR Corporation, Diebold Nixdorf, Inc., GRG Banking Equipment Co., Ltd., Hitachi-Omron Terminal Solutions Corporation, Fuji Electric Co., Ltd., Nautilus Hyosung Corporation, HESS Cash Systems GmbH & Co. KG, Euronet Worldwide, Inc., Triton Systems of Delaware, LLC, and Perto S.A.

COVID-19 Impact and Market Status:

The ATM market on a global scale has faced a decrease in expansion as a result of the decrease in cash utilization and the move towards digital transactions during the Covid-19 crisis.

The global ATM market has been significantly influenced by the COVID-19 pandemic, as lockdowns and social distancing measures have prompted a surge in the use of cashless payment methods, reducing the reliance on cash withdrawals from ATMs. This change in consumer behavior has resulted in a decrease in cash transactions, leading to a corresponding downturn in ATM usage. Moreover, the closure of businesses and limited access to public spaces have further dampened foot traffic, diminishing the necessity for ATMs. Consequently, ATM operators have encountered profitability challenges, prompting considerations of shutting down unprofitable ATM locations. Nevertheless, it is worth highlighting that despite these obstacles, there remains a need for ATMs in specific regions and among certain demographics, including older adults who tend to depend more on cash transactions. Hence, albeit the COVID-19 pandemic has had a notable impact on the ATM market, it is anticipated that as economic activities revive and consumer habits return to normalcy, the demand for cash withdrawals and, consequently, ATM utilization is likely to recover gradually.

Latest Trends and Innovation:

- Diebold Nixdorf, an American multinational company, announced its merger with Wincor Nixdorf AG on August 15, 2016.

- NCR Corporation, an American enterprise company, acquired JetPay Corporation on October 8, 2018, integrating their payment processing technology into their ATM systems.

- Triton Systems, a leading manufacturer of ATMs, introduced their newest model, the ARGO 15e, in February 2020. The ARGO 15e incorporates advanced security features and a modern design.

- Hyosung TNS, a division of Hyosung Corporation, launched their MX8300 compact cash recycling ATM in November 2019. The MX8300 combines ATM functionalities with cash recycling capabilities, providing increased efficiency for financial institutions.

- GRGBanking, a Chinese ATM manufacturer, unveiled their groundbreaking H68N series ATM featuring facial recognition technology on January 9, 2020. The facial recognition technology enhances security and offers a more convenient user experience.

- Hitachi-Omron Terminal Solutions (HOTS), a joint venture between Hitachi and Omron, introduced their HT-K216 model in March 2019. The HT-K216 offers improved security and enhanced user interface.

- Nautilus Hyosung America, a subsidiary of Hyosung Corporation, nered with Elan Financial Services to provide enhanced ATM functionality, including cardless cash withdrawals, in July 2018. This nership aims to improve the customer experience and increase ATM efficiency.

Significant Growth Factors:

The rising inclination towards convenient, electronic payments and the expanding global network of bank branches are stimulating the expansion of the ATM industry.

The ATM market is observing significant growth propelled by various key factors. The escalating demand for convenient and easily accessible cash transactions has been a primary driver behind the global expansion of ATM networks. This trend persists as economies evolve, icularly in emerging markets where access to traditional banking services may be limited, ening the necessity for financial services like cash withdrawals. Despite the rise of digital banking solutions, physical cash remains indispensable, and ATMs function as a vital link by providing a secure and dependable channel for individuals to manage their funds. Technological progressions have revolutionized conventional ATMs into multifunctional self-service terminals, broadening the spectrum of services offered to include bill payments, fund transfers, and account inquiries, thus appealing to a broader customer base and uplifting the ATM market growth. Collaboration between ATM providers and financial institutions has yielded enhanced security protocols like biometric verification and real-time fraud detection, ensuring customers a secure and seamless transaction experience. Moreover, ened government endeavors to achieve financial inclusivity, especially in developing regions, have spurred the placement of ATMs in rural areas, thereby extending the reach of banking services and fostering economic development. In essence, the buoyant ATM market owes its success to the increasing need for cash transactions, the convenience afforded by self-service terminals, technological advancements, ened security features, and governmental initiatives to advance financial inclusivity.

Restraining Factors:

Certain inhibiting elements within the ATM industry could stem from the rising trend towards utilizing mobile payment technologies and the expanding inclination towards online banking solutions.

The market for automated teller machines (ATMs) has experienced notable expansion in recent years; however, certain inhibiting factors must be acknowledged. Primarily, the rise in popularity of digital payment solutions such as mobile banking and online payment platforms has resulted in a decrease in cash transactions, impacting the demand for ATMs. Furthermore, the COVID-19 pandemic has hastened the transition to digital payments, further diminishing the necessity for physical cash and ATMs. Additionally, the substantial costs associated with installing and maintaining ATMs pose challenges for businesses and financial institutions, icularly in areas with inadequate infrastructure or low population density. Moreover, the growing instances of ATM fraud and security breaches have instilled apprehension in consumers, causing a decrease in confidence in using ATMs. Lastly, the regulatory landscape governing ATMs, encompassing compliance mandates and accessibility standards, can impede market expansion.

Nevertheless, it is crucial to recognize that the ATM market retains substantial potential. The persistent demand for cash withdrawals, icularly in emerging economies, coupled with advancements in ATM technology such as biometric authentication and contactless transactions, present growth opportunities. Moreover, the convenience and accessibility afforded by ATMs in remote or underserved areas continue to be essential for financial inclusion. As the market progresses and responds to evolving consumer requirements, targeted investments in innovative ATM solutions and nerships with financial technology companies can help surmount these limiting factors and foster an optimistic outlook for the ATM market.

Key Segmentation:

Key Segments of the Electric Scooters Market

Product Type Overview

• Standard Electric Scooters

• Folding Electric Scooters

• Self-Balancing Electric Scooters

• Maxi Electric Scooters

• Three-Wheeled Electric Scooters

Battery Type Overview

• Lithium-Ion Battery Electric Scooters

• Nickel Metal Hydride (NiMH) Battery Electric Scooters

• Lead-Based Battery Electric Scooters

Technology Overview

• Plug-In Electric Scooters

• Battery Electric Scooters

Voltage Overview

• 24V Electric Scooters

• 36V Electric Scooters

• 48V Electric Scooters

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America