Automotive 3D Printing Market Analysis and Insights:

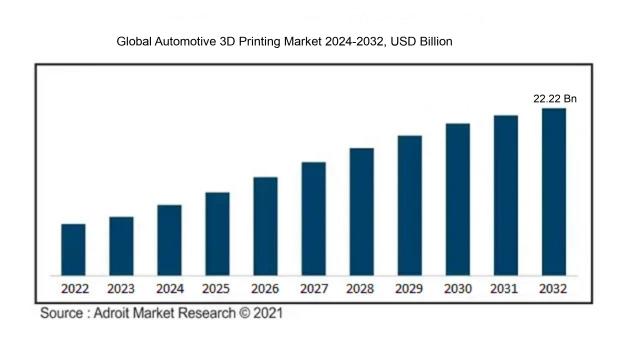

The global automotive 3D printing market was valued at USD 3.45 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.50% to reach USD 22.22 billion by 2032.

The growth of the Automotive 3D Printing Market can be attributed to several pivotal factors. To begin with, the rising need for lightweight materials aimed at improving fuel efficiency and minimizing emissions is encouraging manufacturers to adopt additive manufacturing methods. Furthermore, the swift prototyping abilities offered by 3D printing enable quicker design modifications, thereby significantly shortening the time required to bring new vehicles and components to market. The increasing trend toward customization in automotive design is also driving the market forward, as 3D printing supports the creation of personalized parts that cater to distinct consumer demands. In addition, ongoing advancements in 3D printing technologies, which include enhanced material characteristics and faster production rates, are making additive manufacturing more viable for producing end-use components. Lastly, ened investments and partnerships between automotive firms and tech providers are stimulating innovation and broadening the scope of 3D printing applications across various s of the automotive industry, encompassing tooling, production components, and aftermarket offerings.

Automotive 3D Printing Market Definition

Automotive 3D printing involves the application of additive manufacturing techniques to create parts, prototypes, and tools tailored for the automotive sector. This approach offers enhanced design versatility, minimizes material waste, and accelerates production timelines when contrasted with conventional manufacturing processes.

The role of 3D printing in the automotive sector is vital, as it offers significant advantages in design adaptability, facilitates swift prototyping, and lowers production costs. This innovative technology enables the fabrication of intricate shapes and lightweight parts that conventional manufacturing techniques struggle to produce, thus enhancing vehicle efficiency and performance. Moreover, it allows for the tailored production of components, addressing unique customer demands and driving innovation. The capacity for rapid design iteration and reduced lead times means that automotive 3D printing speeds up the entire development cycle, helping manufacturers remain competitive in a rapidly changing marketplace, all while contributing to sustainability efforts by reducing material waste.

Automotive 3D Printing Market Segmental Analysis:

Insights On Technology

Selective Laser Sintering (SLS)

Among the various technologies, Selective Laser Sintering (SLS) is poised to dominate the Global Automotive 3D Printing Market. This dominance can be attributed to its ability to produce complex geometries with excellent mechanical properties, making it ideal for custom or lightweight parts. SLS also supports a wide range of materials, including polymers and metals, allowing manufacturers to create functional prototypes and end-use parts efficiently. This versatility enhances production capabilities, reduces lead times, and aligns well with the automotive industry's demand for rapid prototyping and customization, leading to its forecasted leadership in the market.

Stereo Lithography (SLA)

Stereo Lithography (SLA) is known for its high resolution and smooth surface finish, making it particularly suitable for producing intricate details in prototypes. The technology excels in creating visual representations and cosmetic prototypes that require precise detailing. While SLA may not be as widely adopted for functional parts compared to SLS, its ability to manufacture high-quality models quickly makes it a valuable tool in the initial design and testing phases of automotive development.

Digital Light Processing (DLP)

Digital Light Processing (DLP) shares similarities with SLA but utilizes digital light to cure resin materials, offering faster print speeds due to its ability to expose entire layers simultaneously. This technology can produce high-quality parts with a smooth finish, although it is often limited to specific materials. DLP caters to niche applications where precision and speed are paramount, making it a complementary technology in the automotive industry for certain prototype requirements.

Electronic Beam Melting (EBM)

Electronic Beam Melting (EBM) is increasingly used in aerospace and biomedical sectors but also finds a niche in automotive applications, especially for creating high-strength metal parts. EBM employs an electron beam to melt and fuse metal powder, producing dense and durable components. Its ability to process titanium and other high-performance materials makes it valuable for parts that need exceptional mechanical properties. However, the technology's slower build rates and higher costs limit its broader adoption in the automotive sector.

Selective Laser Melting (SLM)

Selective Laser Melting (SLM) is particularly effective in producing functional metal parts, thanks to its capability of melting powder materials layer by layer. SLM is particularly suited for creating highly complex geometries that demand high strength and precision, making it an attractive option for automotive applications that prioritize performance and material properties. Although SLM is rapidly advancing, the initial costs and material limitations may slow its widespread adoption in comparison to SLS, primarily for prototyping and low-volume production.

Fused Deposition Modeling (FDM)

Fused Deposition Modeling (FDM) is one of the most accessible 3D printing technologies, widely used for prototyping and manufacturing in various industries. In the automotive sector, FDM is often utilized for creating functional prototypes that require durability and affordability. While FDM holds a strong position in the market for its ease of use and cost-effectiveness, it primarily focuses on plastic parts. The resolution and material properties may not match those of technologies like SLS or SLM, limiting its usage for specialized automotive applications.

Insights On Application

Production

The Production application is expected to dominate the Global Automotive 3D Printing Market due to the increasing demand for more efficient and cost-effective manufacturing processes in the automotive industry. Manufacturers are increasingly adopting 3D printing technologies to create end-use parts directly, which lead to reduced lead times and cost savings. Additionally, as the automotive sector shifts towards customization and the manufacturing of lightweight components, 3D printing serves an essential role in meeting these trends. Benefits like material waste reduction, the ability to produce complex geometries, and lower tooling costs further enhance the attractiveness of using 3D printing in production environments, solidifying its leading position.

Prototyping/R&D

Prototyping and R&D represent a critical aspect of the automotive sector, particularly for developing new models and testing concepts. This application provides manufacturers with the flexibility to rapidly produce prototypes without the significant costs associated with traditional manufacturing methods. Prototyping enables car manufacturers to iterate designs quickly, test functionalities, and refine performance, which is vital in today's fast-paced automotive market. Although it won’t lead the market, its importance in the innovation cycle serves to enhance the overall product development process and lay the groundwork for future production applications.

Insights On Component

Service

Service is expected to dominate the Global Automotive 3D Printing Market due to its critical role in enhancing operations and maintenance within the automotive industry. With the increasing complexity of automotive designs and the necessity for custom parts, companies require ongoing support and expertise to maximize their 3D printing capabilities. As car manufacturers continue to adopt 3D printing technologies for rapid prototyping and production, the demand for maintenance, installation, and consulting services is rising. This need for technical assistance ensures that service offerings will see significant uptake, driving growth and prominence in the overall automotive 3D printing market.

Hardware

Hardware plays a significant role in the automotive 3D printing landscape, representing the foundational technology required for executing printing processes. Although it will not lead the market, advancements in 3D printers, such as enhanced printing speed, improved material compatibility, and increased printing volume, are essential for manufacturers. The growth in hardware capabilities allows automotive companies to streamline production and reduce costs, leading to a larger installed base of printers. However, the capital-intensive nature of hardware investments can lead to a more cautious adoption pace compared to other components focused on service.

Software

Software is critical for the automotive 3D printing market, serving as the backbone for the design, production, and management of 3D-printed components. Offering solutions for CAD modeling, simulation, and workflow management, software enhances the efficiency and precision of the printing process. However, while software is imperative for operational success, the market is expected to see slower growth as businesses primarily focus on the tangible returns from services and hardware investments. The dynamic nature of software updates may complement the other components but is less likely to outpace service offerings in terms of overall market dominance.

Insights On Material

Polymer

Polymer is expected to dominate the Global Automotive 3D Printing Market due to its versatility and cost-effectiveness. With advancements in material technology, polymers are capable of producing lightweight parts that are crucial for improving fuel efficiency and performance in vehicles. They offer excellent design freedom and are suitable for creating complex geometries that add significant value in prototyping and end-use applications. The growing demand for rapid prototyping and customization in the automotive sector further strengthens the position of polymers, as they can be quickly manipulated to meet diverse manufacturing needs. This adaptability makes polymers an essential choice for automotive manufacturers seeking to innovate and streamline production processes.

Metal

Metal presents a compelling choice in the automotive 3D printing market, especially for applications requiring high strength and durability. Its ability to produce functional parts that can endure extreme conditions is a significant advantage, making it ideal for critical components like engine parts and structural elements. Technologies such as Direct Metal Laser Sintering (DMLS) enhance the appeal of metal printing by enabling intricate designs that traditional manufacturing cannot achieve. The automotive industry's ongoing transition toward electrification and lightweight materials creates additional opportunities for metal applications, as manufacturers explore hybrid solutions and require robust components to support advanced technologies.

Ceramic

Ceramic is gaining traction in the automotive 3D printing market, primarily due to its excellent thermal and chemical resistance, which is advantageous when designing engine components and exhaust systems. Although ceramic materials are less common than metals or polymers, their unique properties are essential for specific applications requiring heat resistance and thermal insulation. The growth in the automotive industry toward adopting lightweight, high-performance materials makes ceramics increasingly relevant, especially in electric vehicles, where weight reduction and heat management are critical. However, challenges in manufacturing processes and scalability still limit widespread adoption compared to the more established materials.

Global Automotive 3D Printing Market Regional Insights:

Asia Pacific

The Asia Pacific region is poised to dominate the Global Automotive 3D Printing market due to a rapid surge in automotive manufacturing and increasing investments in innovative technologies such as 3D printing. Countries like China, Japan, and India are leading the charge with strong government support, a booming automotive sector, and a high rate of adoption of advanced manufacturing technologies. The presence of major automotive manufacturers and a growing ecosystem of 3D printing service providers further solidifies the region's leadership. Additionally, the increasing demand for lightweight components, customization, and cost-effective production solutions contributes to the region's significant growth potential in the automotive 3D printing landscape.

North America

North America holds a substantial share of the Global Automotive 3D Printing market, driven by advances in technology and a strong automotive industry presence. The United States, in particular, has been at the forefront of 3D printing innovations, with numerous companies investing heavily in additive manufacturing for prototypes and end-use parts. The region benefits from a strong infrastructure, collaboration between automotive manufacturers and tech firms, and a growing emphasis on sustainability, which supports the trend toward additive manufacturing methods.

Europe

Europe is recognized as a key player in the Global Automotive 3D Printing market, benefiting from a well-established automotive sector characterized by a focus on research and development. Countries like Germany, France, and the UK are leveraging 3D printing technology to improve production efficiency and reduce time-to-market for automotive components. The European Union's commitment to innovation and sustainability also provides a favorable regulatory environment for the 3D printing industry, with various initiatives promoting the use of this technology in automotive applications.

Latin America

Latin America is gradually emerging in the Global Automotive 3D Printing market, although it currently lags behind North America, Europe, and Asia Pacific. The region is witnessing a growing interest in 3D printing technologies due to rising demand for locally manufactured automotive parts and increasing collaboration among local startups and established companies. Key players are beginning to invest in research and user education, which may accelerate adoption rates in the near future, although more substantial growth is needed to compete with leading regions.

Middle East & Africa

The Middle East & Africa region represents a nascent in the Global Automotive 3D Printing market. Though there is considerable growth potential, particularly in countries like South Africa, the region faces challenges like limited infrastructure and lower levels of investment in advanced manufacturing technologies. However, increased government interest in diversifying economies away from oil dependency and fostering technological advancements may lead to future growth in the adoption of 3D printing within the automotive sector.

Automotive 3D Printing Competitive Landscape:

The principal actors within the global automotive 3D printing sector are pivotal in propelling technological progress and innovation, concentrating on the enhancement of manufacturing techniques and material quality. Additionally, they promote partnerships to advance product development and broaden their market presence, securing a competitive edge.

Prominent participants in the Automotive 3D Printing sector comprise Stratasys Ltd., 3D Systems Corporation, HP, Inc., Siemens AG, EOS GmbH, Materialise NV, Autodesk, Inc., GE Additive, Volkswagen AG, Ford Motor Company, BMW AG, Nissan Motor Corporation, BASF SE, ExOne Company, Renishaw plc, SLM Solutions Group AG, Formlabs, Arkema S.A., and Zortrax.

Global Automotive 3D Printing COVID-19 Impact and Market Status:

The Covid-19 pandemic catalyzed a swift increase in the use of 3D printing technologies within the worldwide automotive sector, bolstering supply chain robustness and facilitating rapid prototyping in response to production interruptions.

The automotive 3D printing sector experienced substantial changes due to the COVID-19 pandemic, which led to significant supply chain interruptions, production stoppages, and a downturn in vehicle sales. As manufacturers confronted these unprecedented operational obstacles, 3D printing emerged as an essential tool for rapid prototyping and parts production. The imposed lockdowns hastened the shift towards additive manufacturing, enabling companies to swiftly produce components and minimize inventory expenses. Furthermore, organizations began to investigate decentralized manufacturing methods to better prepare for potential future disruptions, which in turn spurred investments in 3D printing technologies. The crisis also underscored the benefits of customization in production, resulting in an increased demand for tailored automotive components. As the industry gradually rebounds, it's anticipated that the automotive field will incorporate 3D printing in a more strategic manner, enhancing innovation, sustainability, and operational efficiency. Consequently, while the pandemic posed considerable challenges, it simultaneously acted as a catalyst for progress and transformation in the automotive 3D printing arena, paving the way for future development.

Latest Trends and Innovation in The Global Automotive 3D Printing Market:

- In April 2023, General Motors announced a partnership with Desktop Metal to enhance their additive manufacturing capabilities, aiming to accelerate the production of lightweight automotive components using metal 3D printing technology.

- In March 2023, Ford Motor Company revealed its investment in additive manufacturing startup Xometry, facilitating a collaboration to leverage 3D printing for rapid prototyping and production of custom parts.

- In January 2023, Volkswagen and HP Inc. expanded their collaboration to integrate 3D printing technologies into Volkswagen's manufacturing processes, focusing on producing complex vehicle parts and tooling to improve efficiency.

- In September 2022, BMW Group unveiled its plans to establish a new 3D printing facility in Germany, designed to produce high-performance polymer parts, enhancing their production flexibility and reducing manufacturing time.

- In July 2022, Mercedes-Benz initiated a strategic acquisition of the startup Lavoisier, a company specializing in advanced 3D printing materials, to support its sustainability goals and reduce material waste in automotive manufacturing.

- In June 2022, Tesla announced the successful implementation of new 3D printing methods at its Gigafactory in Austin, Texas, which enabled them to reduce lead times for producing certain structural components by over 50%.

- In May 2022, the Italian company, Materialise, launched a new software suite specifically designed for automotive manufacturers to optimize the design and production of 3D printed components, aiming to streamline workflows and reduce costs.

- In February 2022, Renault disclosed a collaboration with the 3D printing firm, Sculpteo, to develop a range of custom parts through 3D printing technologies in an effort to enhance the personalization of their vehicle offerings.

- In January 2022, Stratasys announced a collaboration with the University of Michigan to research and develop advanced materials for 3D printing applications in the automotive sector.

- In December 2021, Honda announced the acquisition of an equity stake in the 3D printing firm, Anisoprint, to explore new possibilities for producing composite materials in vehicle manufacturing.

Automotive 3D Printing Market Growth Factors:

The expansion of the Automotive 3D Printing Market is fueled by innovations in additive manufacturing processes, a rising need for lightweight parts, and the demand for swift prototyping solutions.

The Automotive 3D Printing Market is witnessing remarkable expansion, influenced by several pivotal trends. Innovations in additive manufacturing technology have improved the accuracy and effectiveness of crafting intricate automotive parts, leading to increased uptake among producers. There is also a rising demand for lightweight, high-performance materials that enhance fuel efficiency and overall vehicle capabilities, further fueling market advancement. Additionally, the movement towards customization and rapid prototyping allows automotive manufacturers to shorten production cycles and reduce costs related to conventional manufacturing methods. The surge in electric vehicle (EV) production presents another vital aspect, as these vehicles often necessitate cutting-edge designs that 3D printing can facilitate effortlessly. A ened focus on sustainability is prompting manufacturers to embrace 3D printing practices that decrease waste and incorporate environmentally friendly materials. As global supply chains continue to grow in complexity, automotive companies are turning to 3D printing to localize their production efforts and boost supply chain durability. Lastly, partnerships between automotive original equipment manufacturers (OEMs) and 3D printing companies inspire innovation and create customized solutions addressing specific challenges within the industry. Collectively, these elements pave the way for a strong growth trajectory for the Automotive 3D Printing Market in the upcoming years, propelled by technological advancements and shifting consumer demands.

Automotive 3D Printing Market Restaining Factors:

Factors like elevated material expenses, restricted production rates, and regulatory obstacles pose considerable limitations that affect the expansion of the Automotive 3D Printing Market.

The Automotive 3D Printing Market encounters numerous challenges that may hinder its expansion. A primary obstacle is the substantial initial investment needed for sophisticated 3D printing technologies, which particularly affects smaller and medium-sized businesses. Furthermore, doubts regarding the durability and structural integrity of 3D-printed materials, compared to those produced through traditional manufacturing methods, restrict their use in essential automotive applications. Regulatory hurdles and the absence of uniform standards for 3D-printed automotive components contribute to uncertainty among manufacturers, potentially stalling progress and the assimilation of these technologies into established production systems. Moreover, the existing automotive supply chain's reluctance to evolve, alongside the necessity for specialized training to prepare the workforce, complicates the shift toward additive manufacturing. Challenges related to sourcing materials and high costs associated with specific 3D printing methods add further constraints to market growth. Nonetheless, ongoing innovations in material science and technology are set to enhance the reliability and scalability of 3D printing solutions. As educational programs expand and successful case studies become more evident, automotive manufacturers are expected to progressively adopt additive manufacturing, thereby stimulating growth in this vibrant sector and promoting a more sustainable and efficient production landscape.

Key Segments of the Automotive 3D Printing Market

By Technology

- Selective Laser Sintering (SLS)

- Stereo Lithography (SLA)

- Digital Light Processing (DLP)

- Electronic Beam Melting (EBM)

- Selective Laser Melting (SLM)

- Fused Deposition Modeling (FDM)

By Application

- Production

- Prototyping/R&D

By Component

- Hardware

- Software

- Service

By Material

- Metal

- Polymer

- Ceramic

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America