Market Analysis and Insights:

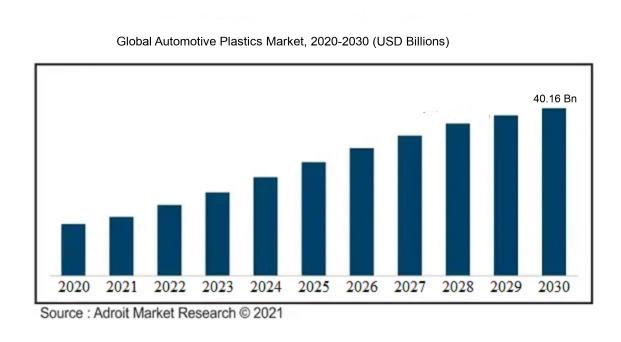

The market for Global Automotive Plastics was estimated to be worth USD 27.87 billion in 2022, and from 2023 to 2030, it is anticipated to grow at a CAGR of 4.31%, with an expected value of USD 40.16 billion in 2030.

The growth and demand of the automotive plastics market are fueled by various factors. One significant catalyst is the increasing preference for lightweight materials within the automotive sector. Plastics serve as a lightweight substitute for conventional materials like metals, aiding in enhancing fuel efficiency and lowering carbon emissions. The rising popularity of electric and hybrid vehicles further underscores the need for lightweight materials to enhance performance and range. Another influential driver lies in the ened emphasis on vehicle safety and crash durability. Plastics boast exceptional impact resistance, rendering them suitable for various safety components including airbags, seat belts, and bumpers. Moreover, the surging demand for luxury and premium vehicles is creating avenues for enhanced design flexibility and customization offered by plastics. Additionally, strict government regulations and emission standards worldwide aimed at curbing greenhouse gas emissions and promoting sustainability are triggering a surge in demand for automotive plastics. In essence, the automotive plastics market is poised for growth in the foreseeable future due to escalating demand for lightweight, safe, sustainable, and visually appealing automotive solutions.

Automotive Plastics Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 40.16 billion |

| Growth Rate | CAGR of 4.31% during 2023-2030 |

| Segment Covered | By Product, By Process, By Application, By Vehicle Type ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF SE, DowDuPont Inc., LyondellBasell Industries Holdings B.V., Covestro AG, Grupo Antolin-Irausa S.A., Lear Corporation, Magna International Inc., Adient plc, Evonik Industries AG, and Sabic. |

Market Definition

Automotive plastics encompass synthetic compounds utilized in the production of automobiles, providing lightweight, resilient, and adaptable alternatives for a range of automotive uses. These substances contribute to the advancement of fuel efficiency, emission reduction, and the overall enhancement of safety and performance in the automotive sector.

Automotive plastics have become increasingly important in the automotive sector due to their multitude of advantageous characteristics. These materials, known for their lightweight nature, contribute to improved fuel efficiency and reduced emissions, ultimately promoting environmentally-friendly vehicles.

Moreover, the exceptional durability, impact resistance, and corrosion resistance of automotive plastics ensure the longevity and safety of various car components. The flexibility and intricate design possibilities offered by plastics in manufacturing processes allow for more cost-effective production and the creation of innovative vehicle designs. Additionally, automotive plastics help enhance the overall driving experience by reducing noise, vibration, and harshness levels within the vehicle, while their thermal insulation properties aid in regulating cabin temperature. In conclusion, the integration of automotive plastics into vehicle manufacturing is a key factor in enhancing performance, safety, efficiency, and sustainability in the automotive industry.

Key Market Segmentation:

Insights On Key Product

Polypropylene (PP)

Polypropylene (PP) is expected to dominate the Global Automotive Plastics Market. PP is widely used for automotive applications due to its excellent properties such as lightweight, high chemical resistance, and good impact strength. It is commonly used in various automotive components including bumpers, interior trims, and under-the-hood applications. The increasing demand for lightweight materials in the automotive industry, along with the stringent regulations for reducing emissions, is driving the adoption of PP. Additionally, its cost-effectiveness and ease of processing make it a preferred choice for manufacturers in the automotive sector. PP's dominance is further reinforced by its versatility and ability to be blended with other materials to enhance its performance for specific applications.

Acrylonitrile butadiene styrene (ABS)

ABS is another significant product in the Global Automotive Plastics Market. It offers excellent impact resistance, high strength, and good dimensional stability, which makes it suitable for various automotive applications. ABS is commonly used in interior trims, consoles, instrument panels, and door panels due to its aesthetic appeal and ease of customization. The increasing demand for advanced safety features in vehicles, as well as the growing preference for stylish and visually appealing interiors, is driving the demand for ABS in the automotive industry.

Polyurethane (PU)

Polyurethane (PU) is a product that holds a prominent position in the Global Automotive Plastics Market. PU is known for its excellent flexibility, durability, and resistance to abrasion, making it suitable for automotive seating, steering wheels, and foam applications. The growing emphasis on comfort and luxury in automobiles, along with the increasing demand for lightweight materials, is contributing to the dominance of PU in the automotive sector. Its ability to provide superior comfort and noise reduction further reinforces its position in the market.

Polyvinyl Chloride (PVC)

Polyvinyl Chloride (PVC) is another product with significant presence in the Global Automotive Plastics Market. PVC offers excellent chemical resistance, weatherability, and electrical insulation properties, making it suitable for automotive wire coatings, upholstery, and interior trims. The demand for PVC in the automotive industry is driven by factors such as its affordability, ease of processing, and versatility. Additionally, the increasing focus on sustainability and recyclability is further propelling the adoption of PVC in the automotive sector.

Polyethylene (PE)

Polyethylene (PE) is a product that plays a significant role in the Global Automotive Plastics Market. PE is widely used for automotive applications due to its excellent impact strength, chemical resistance, and low coefficient of friction. It is commonly used in fuel systems, electrical components, and under-the-hood applications. The increasing demand for electric and hybrid vehicles, along with the need for lighter and more fuel-efficient vehicles, is driving the adoption of PE in the automotive industry.

Polybutylene Terephthalate (PBT)

Polybutylene Terephthalate (PBT) is a product that holds a considerable share in the Global Automotive Plastics Market. PBT offers excellent dimensional stability, high heat resistance, and good electrical properties, making it suitable for automotive connectors, housings, and electrical components. The increasing adoption of electric vehicles, as well as the growing demand for lightweight and durable materials, is driving the demand for PBT in the automotive industry.

Polycarbonate (PC)

Polycarbonate (PC) is a product that has a significant presence in the Global Automotive Plastics Market. PC offers excellent impact resistance, high transparency, and good heat resistance, making it suitable for automotive applications such as headlamps, interior trims, and instrument panels. The increasing focus on safety, as well as the demand for lightweight materials, is driving the adoption of PC in the automotive industry. Additionally, its ability to be molded into complex shapes and its aesthetic appeal contribute to its dominance in the market.

Polymethyl methacrylate (PMMA)

Polymethyl methacrylate (PMMA) is a product that plays a role in the Global Automotive Plastics Market. PMMA offers excellent optical clarity, scratch resistance, and weatherability, making it suitable for automotive applications such as headlamp covers, indicator lenses, and instrument clusters. The growing emphasis on advanced lighting systems and the demand for aesthetically appealing exteriors contribute to the adoption of PMMA in the automotive sector.

Polyamide (Nylon 6, Nylon 66)

Polyamide (Nylon 6, Nylon 66) is a product that holds a certain share in the Global Automotive Plastics Market. Polyamide offers excellent mechanical properties, high heat resistance, and good chemical resistance, making it suitable for automotive applications such as engine components, fuel systems, and electrical connectors. The increasing demand for lightweight materials and the growing focus on reducing vehicle emissions are driving the adoption of polyamide in the automotive industry.

Others

The Others category in the Global Automotive Plastics Market represents various other plastic materials that have a smaller market share compared to the dominant parts. This may include specialty plastics such as polyetheretherketone (PEEK), polyphenylene sulfide (PPS), and thermoplastic elastomers (TPE), among others. These materials find application in specific automotive components where their unique properties are required. Although the market share of "Others" is relatively smaller, it contributes to the overall diversity and innovation in the automotive plastics industry.

Insights On Key Process

Thermoforming

Thermoforming is expected to dominate the Global Automotive Plastics Market. The thermoforming process offers several advantages, such as cost-effectiveness, design flexibility, and high production efficiency, making it a preferred choice in automotive plastic manufacturing. With thermoforming, complex shapes can be easily achieved, allowing automakers to create innovative designs for various interior and exterior components. Moreover, the process enables efficient mass production, contributing to lower costs and increased profitability. Given its numerous advantages and growing demand for lightweight and sustainable automotive materials, thermoforming is anticipated to dominate the global market.

Injection Molding

Injection molding is another significant process within the Global Automotive Plastics Market. This process involves injecting molten plastic into a mold, allowing for the production of intricate and precise automotive parts. Injection molding offers exceptional design freedom, consistent part quality, and faster production cycles, making it appealing for a wide range of applications. While it may not be the dominating part, injection molding still plays a crucial role in meeting the automotive industry's requirements for efficiency, durability, and cost-effectiveness.

Blow Molding

Blow molding is a process in which plastic is inflated into a mold to produce hollow shapes. Although blow molding is commonly used for the production of containers and bottles, it also finds application in the automotive sector. Blow molding can produce various automotive parts, including fuel tanks, air ducts, and fluid reservoirs. While it may not be the dominating part, blow molding contributes to the overall market by providing cost-effective and lightweight solutions for specific automotive plastic components.

Others

The Others category encompasses various additional plastic processing methods, such as compression molding, rotational molding, and extrusion. While these processes play a role in the automotive plastics market, they are not expected to dominate the industry. These methods may be used for specific applications, custom production, or specialized parts, but in terms of overall market share, their contribution is relatively smaller compared to other parts like thermoforming, injection molding, and blow molding.

Insights On Key Application

Interior

The interior application is expected to dominate the Global Automotive Plastics Market. This is due to the increasing demand for lightweight materials in automotive interiors, as they help improve fuel efficiency and reduce emissions. Automotive plastics provide excellent design flexibility, allowing for the production of aesthetically appealing and comfortable interiors. Additionally, the use of plastics in interior components helps in reducing noise, vibration, and harshness (NVH) levels, thereby enhancing the overall driving experience. The interior part encompasses various components such as seats, dashboard, door panels, and trim, which collectively contribute to its dominance in the market.

Exterior

The exterior application focuses on the use of automotive plastics in exterior components such as bumpers, body panels, and grills. While the exterior plays a crucial role in the vehicle's aesthetics and impact resistance, the interior part is expected to dominate the market due to its greater influence on overall consumer experience and regulatory requirements.

Under the hood

The under the hood application involves the use of automotive plastics in engine covers, air intake manifolds, and other components located under the hood. While this part is essential for improving thermal management and reducing vehicle weight, it is not expected to dominate the market as the interior part holds greater significance for consumers and manufacturers.

Powertrain

The powertrain application focuses on the use of automotive plastics in transmission components, engine mounts, and other powertrain systems. Despite its importance in enhancing vehicle performance and efficiency, it is not anticipated to dominate the market as the interior part holds greater consumer demand and market value.

Drivetrain

The drivetrain application involves the use of automotive plastics in drivetrain components such as axles, differentials, and transfer cases. Although the drivetrain is crucial for vehicle functionality, the interior part is expected to dominate the market as consumers prioritize comfort and aesthetics over drivetrain components.

Instrument Panel

The instruments panel application refers to the use of automotive plastics in the dashboard, instrument cluster, and control panels. While this part contributes to the overall interior experience, it is not expected to dominate the market as the interior part encompasses a broader range of components that have a more significant impact on consumer preferences.

Electronics

The electronics application involves the use of automotive plastics in electronic components such as wiring harnesses, connectors, and multimedia systems. Although electronics play a crucial role in modern vehicles, the interior part is anticipated to dominate the market due to its wider range of components and greater impact on consumer satisfaction.

Others

The others category encompasses various automotive plastics applications not mentioned in the above parts, such as fuel systems, suspension components, and safety systems. Although these applications are essential for vehicle performance and safety, the dominance in the market is expected to lie with the interior part, which is of higher consumer interest and value.

Insights On Key Vehicle Type

Passenger Cars

Passenger Cars are expected to dominate the Global Automotive Plastics Market. With the growing demand for fuel-efficient and lightweight vehicles, automotive manufacturers are increasingly adopting plastics as a substitute for traditional materials. Passenger cars constitute a significant portion of the global automotive market, and their use of plastics in various applications such as interior, exterior, and under the hood components further reinforces their dominance in the Automotive Plastics Market. Moreover, the rising consumer preference for advanced features, comfort, and aesthetics in passenger cars is driving the demand for innovative plastic solutions in the industry.

Light Commercial Vehicles

While not expected to dominate the Global Automotive Plastics Market, Light Commercial Vehicles (LCVs) hold a considerable share in the market. LCVs are primarily used for transportation purposes by small businesses and individuals. Although they have a lower demand for plastics compared to passenger cars, LCV manufacturers are gradually incorporating plastics in their vehicles to enhance fuel efficiency and reduce overall weight. The utilization of plastics in interior parts, body panels, and structural components makes LCVs a significant part in the Automotive Plastics Market.

Medium & Heavy Commercial Vehicles

Medium & Heavy Commercial Vehicles (MHCVs) are likely to have the lowest dominance in the Global Automotive Plastics Market. MHCVs include trucks, buses, and other heavy-duty vehicles used for commercial purposes. The demand for plastics in MHCVs is relatively lower compared to passenger cars and LCVs due to their focus on durability, strength, and safety. However, advancements in plastic technologies and the need for weight reduction to achieve better fuel efficiency might result in a gradual adoption of plastics in MHCVs, increasing their presence in the market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Automotive Plastics market. This region has gained significant traction in the automotive industry due to the growing population, increasing disposable income, and rapid urbanization. Moreover, the rising demand for passenger and commercial vehicles in countries like China, India, and Japan has further fueled the market growth. The presence of prominent automotive manufacturers and a robust supply chain network in the region has also contributed to the dominance of Asia Pacific in the Global Automotive Plastics market. Additionally, favorable government policies and initiatives promoting the use of lightweight materials in automobiles to enhance fuel efficiency and reduce emissions have further propelled the demand for automotive plastics in this region.

North America

North America is one of the major regions in the Global Automotive Plastics market. The region is characterized by the presence of technologically advanced automotive industries, high disposable income, and a strong demand for premium and luxury vehicles. Moreover, stringent regulations and environmental norms emphasizing fuel efficiency and lightweight vehicles have fueled the adoption of automotive plastics in the region. The North American market is also driven by the increasing focus on electric and hybrid vehicles, where lightweight materials, including automotive plastics, play a crucial role. With the presence of key automotive manufacturers and a well-established infrastructure, North America holds a significant share in the Global Automotive Plastics market.

Europe

Europe is a prominent player in the Global Automotive Plastics market. The region is known for its strong automotive manufacturing industry, technological advancements, and stringent regulatory standards. The emphasis on reducing greenhouse gas emissions and improving fuel efficiency has led to the increased adoption of automotive plastics in Europe. The demand for lightweight materials, including plastics, is driven by the growing popularity of electric and hybrid vehicles. Additionally, the presence of major automotive OEMs and suppliers in countries like Germany, France, and Italy further boosts the market growth of automotive plastics in Europe.

Latin America

Latin America is an emerging market in the Global Automotive Plastics industry. The region's growth can be attributed to the increasing automotive production and sales, improving economic conditions, and rising disposable income. The demand for automotive plastics in Latin America is driven by factors such as the growing middle-class population, urbanization, and expanding transportation infrastructure. Moreover, the adoption of fuel-efficient vehicles and the implementation of stringent emission regulations have further propelled the market growth of automotive plastics in this region. However, the market in Latin America is still relatively smaller compared to other regions like Asia Pacific and Europe.

Middle East & Africa

Middle East & Africa is a developing market in the Global Automotive Plastics industry. The region's market growth is driven by factors such as the increasing population, rapid urbanization, and rising disposable income. The demand for automotive plastics in the Middle East & Africa is primarily fueled by the growth of the automotive sector, the expansion of transportation infrastructure, and a shift towards lightweight materials in vehicles. However, challenges such as the limited manufacturing facilities and infrastructure in certain countries and the dominance of traditional automotive materials like steel pose limitations to the market growth in this region. Overall, the Middle East & Africa region holds a smaller share in the Global Automotive Plastics market compared to regions like Asia Pacific, Europe, and North America.

Company Profiles:

Prominent entities within the worldwide Automotive Plastics sector are actively shaping innovation and delivering advanced plastic solutions that meet the increasing need for lightweight, resilient, and economical materials within the automotive field. Their objective is to boost fuel efficiency, lower emissions, and elevate safety measures, thereby fostering the market's expansion and long-term viability.

Leading companies in the automotive plastics sector consist of BASF SE, DowDuPont Inc., LyondellBasell Industries Holdings B.V., Covestro AG, Grupo Antolin-Irausa S.A., Lear Corporation, Magna International Inc., Adient plc, Evonik Industries AG, and Sabic. These firms are actively engaged in the manufacturing and distribution of automotive plastics to meet the growing requirements of the automotive sector. Their product offerings encompass a diverse array of materials, including polypropylene, polyurethane, polyvinyl chloride, and acrylonitrile butadiene styrene, utilized in a wide range of automotive applications such as interiors, exteriors, under-the-hood components, and powertrains. These key industry players prioritize research and development efforts to introduce innovative products and strengthen their market positions. Moreover, they employ various strategies like mergers, acquisitions, collaborations, and partnerships to broaden their product portfolios and extend their global reach within the automotive plastics market.

COVID-19 Impact and Market Status:

The global market for automotive plastics has been profoundly influenced by the Covid-19 pandemic, resulting in decreased demand and supply chain disturbances.

The global automotive plastics market has been significantly influenced by the COVID-19 pandemic. Lockdowns and travel restrictions imposed by various countries have led to a notable decline in vehicle sales and production within the automotive industry. This decline has directly impacted the demand for automotive plastics given their essential role in vehicle manufacturing.

Moreover, disruptions in supply chains, including limited availability of raw materials and logistical challenges, have further impeded the production and distribution of automotive plastics. The closure of manufacturing plants and temporary shutdowns of automotive production facilities have also contributed to the reduced demand for automotive plastics. Despite these challenges, there is a potential silver lining. The increased focus on hygiene and safety standards as a result of the pandemic may fuel a ened requirement for plastics in the automotive sector, as they feature surfaces that are easy to clean and resistant to germs. As the automotive industry gradually recovers from the impacts of the COVID-19 crisis, there is an anticipation for a gradual rebound in the demand for automotive plastics, although reaching pre-pandemic levels may take some time.

Latest Trends and Innovation:

- In September 2020, Teijin Limited announced the acquisition of Renegade Materials Corporation, a North American manufacturer of highly heat-resistant thermoset prepreg.

- In June 2020, BASF SE introduced a new grade of Ultramid® polyamide with high flowability and improved flame retardancy for automotive applications.

- In March 2020, LyondellBasell Industries N.V. and Sasol Limited completed their joint venture, forming Louisiana Integrated PolyEthylene JV LLC (LIPE).

- In January 2020, Solvay SA launched AVANCO™, a range of high-performance polyamides for the automotive industry, designed to help manufacturers meet lightweighting and sustainability targets.

- In October 2019, Covestro AG inaugurated a new production plant for high-performance plastics in Caojing, Shanghai, China, to meet the rising demand for lightweight materials in the automotive industry.

- In July 2019, Evonik Industries AG announced the acquisition of PeroxyChem LLC, a leading manufacturer of hydrogen peroxide and peracetic acid in the U.S., to strengthen its position in the attractive hydrogen peroxide market.

- In March 2019, Saudi Basic Industries Corporation (SABIC) introduced a new lightweight material called Noryl GTX™ resin for automotive applications requiring exceptional dimensional stability and low-temperature ductility.

- In February 2019, DSM Engineering Plastics entered into a partnership with Toyota Motorsport GmbH (TMG) to develop high-performance thermoplastic composite parts for the automotive industry.

- In November 2018, DuPont de Nemours, Inc. completed the merger with The Dow Chemical Company, forming a new company called DowDuPont Inc., which subsequently split into three independent publicly traded companies.

- In September 2018, Evonik Industries AG inaugurated a new production line for high-performance polymers at its site in Shanghai, China, to meet the increasing demand for lightweight materials in the automotive industry.

Significant Growth Factors:

Factors contributing to the expansion of the Automotive Plastics Market involve the rising need for vehicles that are both lightweight and fuel-efficient, continuous progress in plastic technology, and the increasing prevalence of electric vehicles.

The Automotive Plastics industry is poised for substantial expansion in the foreseeable future, propelled by various critical factors. Foremost among these is the escalating requirement for lightweight substances within the automotive sector, serving as a primary catalyst for growth. Automotive plastics present a remarkable strength-to-weight ratio, effectively lessening the overall vehicle weight and enhancing fuel efficiency. Additionally, the increasing embrace of electric and hybrid vehicles is further amplifying the call for automotive plastics, given the necessity for lightweight constituents to optimize battery functionality. Furthermore, the implementation of rigorous governmental mandates concerning fuel efficiency and emission management is propelling the demand for advanced materials like automotive plastics. Employing these plastics aids automobile manufacturers in adhering to stringent emission regulations while offering enhanced design adaptability and functionality.

Moreover, the upward trajectory of vehicle personalization preferences and the evolution of technology such as 3D printing and injection molding are anticipated to nurture market growth. These technological innovations facilitate the manufacturing of intricate and personalized plastic elements, elevating the overall aesthetics and utility of automobiles. In summary, the Automotive Plastics sector is predicted to undergo substantial expansion driven by the upsurge in lightweight material demand, the proliferation of electric vehicles, stringent regulatory standards, and advancements in manufacturing techniques.

Restraining Factors:

Challenges confronting the Automotive Plastics Market encompass the escalating focus on environmental sustainability and the recycling of plastic materials.

The automotive plastics industry has shown remarkable growth in recent times, notwithstanding certain factors that could impede its continued expansion. Primarily, the considerable cost of manufacturing automotive plastics stands out as a key inhibiting factor. The production of these plastics necessitates sophisticated technology and processes, which can be costly and involve substantial investments. Additionally, the fluctuation in prices of raw materials like crude oil and natural gas significantly impacts the production costs of automotive plastics, potentially leading to inflated prices for components and rendering them less accessible to consumers and manufacturers alike. Secondly, challenges related to the recycling and disposal of automotive plastics present another barrier to growth. Inadequate management of automotive plastic waste can result in environmental contamination. Moreover, the recycling process is complex due to the variety of polymers and additives present, rendering it less efficient and more expensive. The lack of proper recycling infrastructure and regulatory frameworks further obstruct the development of effective and sustainable recycling practices. Finally, the sluggish uptake of electric vehicles (EVs) could also restrain the automotive plastics market. EVs require fewer plastic components compared to traditional internal combustion engine vehicles, potentially limiting the demand for automotive plastics. Nevertheless, despite these challenges, the automotive plastics market is projected to experience substantial growth in the foreseeable future. Factors such as the increasing need for lightweight and fuel-efficient vehicles, stringent environmental mandates, and advancements in plastic manufacturing technologies offer opportunities for market expansion. Embracing sustainable methodologies, investing in innovative recycling technologies, and exploring novel applications for automotive plastics can help surmount these obstacles and drive further growth in the industry.

Key Segments of the Automotive Plastics Market

Product Overview

• Acrylonitrile butadiene styrene (ABS)

• Polypropylene (PP)

• Polyurethane (PU)

• Polyvinyl Chloride (PVC)

• Polyethylene (PE)

• Polybutylene Terephthalate (PBT)

• Polycarbonate (PC)

• Polymethyl methacrylate (PMMA)

• Polyamide (Nylon 6, Nylon 66)

• Others

Process Overview

• Injection Molding

• Blow Molding

• Thermoforming

• Others

Application Overview

• Interior

• Exterior

• Under the hood

• Powertrain

• Drivetrain

• Instruments Panel

• Electronics

• Others

Vehicle Type Overview

• Passenger Cars

• Light Commercial Vehicles

• Medium & Heavy Commercial Vehicles

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America