Battery Management System Market Analysis and Insights:

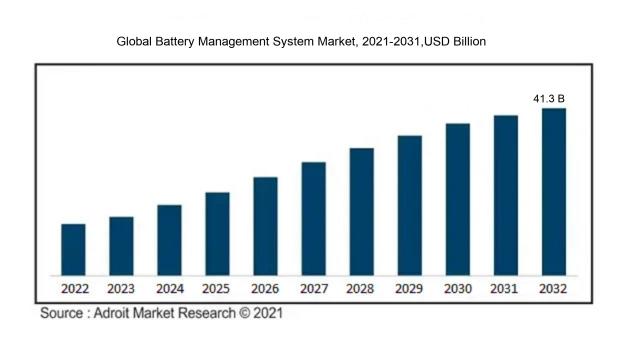

In 2023, the size of the worldwide Global Battery Management System market was US$ 8.7 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 19.2 % from 2024 to 2032, reaching US$ 41.3 billion.

The market for Battery Management Systems (BMS) is significantly influenced by the escalating need for energy storage across multiple industries, such as electric vehicles (EVs), renewable energy infrastructures, and consumer electronics. The swift expansion of the EV sector, driven by government initiatives aimed at supporting green energy and minimizing carbon emissions, calls for sophisticated BMS solutions that improve battery longevity, efficiency, and safety. Furthermore, the growing deployment of renewable energy sources, including solar and wind, underscores the importance of effectively managing battery systems to guarantee a consistent energy supply. Innovations in BMS technology, such as enhanced connectivity and intelligent features, promote wider adoption by allowing for real-time monitoring and assessment of battery conditions. Additionally, an increasing emphasis on sustainable energy practices and augmented investments in research and development are fueling market expansion. Collectively, these dynamics illustrate the essential function of BMS in maximizing battery performance and safety within a progressively electrified environment.

Battery Management System Market Definition

A Battery Management System (BMS) is an electronic framework designed to oversee and regulate the processes of charging and discharging batteries, thereby ensuring optimal safety, efficiency, and durability. It controls various parameters such as voltage, current, and temperature, while also facilitating communication with external devices.

The Battery Management System (BMS) plays a vital role in maintaining the safety, efficacy, and durability of devices powered by batteries, especially in electric vehicles and renewable energy applications. It keeps track of the voltage and temperature of individual cells, as well as the overall health of the battery, to prevent conditions such as overcharging or excessive discharge, which could result in permanent damage or serious risks such as thermal runaway. Furthermore, the BMS enhances performance by ensuring that the charge is evenly distributed among cells, thereby improving energy efficiency and prolonging the life of the battery. It also supplies essential information for diagnostics and performance assessment, making it an indispensable element for dependable and efficient battery operation across diverse uses.

Battery Management System Market Segmental Analysis:

-market.jpg )

Insights On Key Battery Type

Lithium-ion based

Lithium-ion batteries are expected to dominate the Global Battery Management System Market due to their superior energy density, lightweight design, and efficiency. As the demand for electric vehicles, renewable energy storage solutions, and portable electronics rises, the need for reliable and advanced battery management systems becomes crucial. The continuous advancements in lithium-ion technology—leading to longer life cycles and faster charging times—further enhance their appeal. Additionally, the decreasing costs of lithium-ion battery production coupled with the increasing emphasis on sustainable energy solutions position this type as the preferred choice among consumers and manufacturers, solidifying its leading status in the market.

Lead-acid based

Lead-acid batteries have a longstanding presence in the market, primarily known for their reliability and lower initial costs compared to lithium-ion alternatives. They are predominantly used in automotive applications, especially for starting, lighting, and ignition systems, as well as in backup power supply systems. However, lead-acid batteries are relatively heavy and have a lower energy density, which can limit their application in more advanced technologies like electric vehicles. Despite this, they continue to hold a significant market share due to their established infrastructure and widespread use in various industries, especially for stationary applications and data centers.

Nickel-based

Nickel-based batteries, such as Nickel-Metal Hydride (NiMH) and Nickel-Cadmium (NiCd), have been traditionally utilized in applications requiring high discharge rates, including hybrid vehicles and power tools. They offer decent energy density and cycle life but tend to be heavier and less energy-efficient than lithium-ion batteries. In recent years, their appeal has diminished with the rise of lithium-ion technology, which offers improved performance metrics. However, they still persist in certain niche markets where their unique characteristics, like higher performance in extreme temperatures, can be advantageous. Ongoing developments in nickel-based technologies may see them retain relevance in specific applications, particularly in hybrid systems.

Others

The "Others" category encompasses various types of batteries not classified under the main categories of lithium-ion, lead-acid, or nickel-based batteries. This may include technologies like solid-state batteries, sodium-ion batteries, and flow batteries, which are still emerging. These alternative batteries boast unique advantages, such as enhanced safety measures and potential for low-cost materials; however, they are often in the developmental stage and have yet to reach mass-market adoption. Due to technological challenges and the maturity of established battery types, the "Others" currently represents a small portion of the market, with potential growth contingent on future advancements and commercial viability of newer technologies.

Insights On Key Topology

Centralized

Centralized topology is expected to dominate as battery management systems offers simplicity and ease of implementation, which attracts certain sectors. This configuration centralizes the control of battery cells, leading to a more straightforward design and potentially lower costs. However, as the industry progresses, the limitations of scalability and responsiveness in centralized systems may hinder their growth. While this approach is beneficial for smaller applications or less complex systems, the push towards larger, more adaptable energy solutions may negatively impact its market share. Centralized systems may find more niche applications where their efficiency advantages can be fully utilized.

Distributed

The global Battery Management System market is expected to see rapid growth in the distributed topology. This is primarily due to the increasing demand for battery systems with high efficiency and flexibility, especially in applications like electric vehicles and renewable energy storage. In distributed configurations, control functions are spread across the battery modules, allowing for real-time data processing and improved fault tolerance. Additionally, this topology enhances scalability, making it easier to integrate with newer technologies and future growth, such as advancements in battery chemistry and energy management systems. As industries increasingly prioritize sustainability, the demand for distributed systems will continue to rise, given their adaptability and efficiency benefits.

Modular

Modular topology in the Battery Management System market is recognized for its versatility and ease of upgrading. This structure allows individual battery cells or packs to be independently managed, promoting efficient maintenance and replacement protocols. Modular systems can effectively cater to various applications, from consumer electronics to large-scale energy storage, making them appealing to manufacturers. However, the wider market trend is leaning towards distributed systems, which offer more robust data handling and scalability. Despite this, modular configurations may still thrive in specific applications where ease of modification and customization is prioritized, allowing them to carve out a substantial market share.

Insights On Key Application

Automotive

The automotive sector is anticipated to dominate the Global Battery Management System market due to the rising demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). Governments worldwide are promoting EV adoption through subsidies and environmental regulations which necessitate advanced battery management systems for optimal performance, safety, and longevity. The growing integration of smart technologies and IoT into vehicles is further driving the development and implementation of sophisticated battery management solutions. As automotive manufacturers invest heavily in research and development to enhance battery efficiency and vehicle range, this sector's growth will significantly outpace others, solidifying its leading position in the market.

Telecommunication

The telecommunication sector is increasingly adopting battery management systems, primarily due to the need for reliable energy storage solutions for network infrastructure and data centers. With the exponential growth in data consumption and the rollout of 5G technology, there is a pressing demand for uninterrupted power supply and efficient energy use. Battery management systems help in maintaining optimal battery health, extending lifespan, and ensuring operational efficiency, which are critical for sustaining high-performance networks. The growing emphasis on sustainability and reducing carbon footprints is also driving investment in advanced battery technologies within this sector.

Consumer Electronics

In the consumer electronics realm, battery management systems are essential for ensuring that devices like smartphones, laptops, and tablets operate efficiently. As manufacturers integrate more advanced features and higher-capacity batteries, the management systems become crucial for monitoring charge cycles, temperature, and battery health. The ongoing trend towards portable and smart devices amplifies the need for effective power management, as consumers demand longer battery life and faster charging capabilities. Consequently, this sector continues to witness significant growth, driven by technological innovations and a strong consumer preference for high-performance electronics.

Industrial

The industrial sector utilizes battery management systems largely to support equipment such as forklifts, automated guided vehicles (AGVs), and renewable energy storage systems. As industries move towards automation and energy efficiency, robust battery management becomes critical in managing the energy requirements of equipment and ensuring reliable operation. The rising focus on sustainability drives the demand for efficient energy storage solutions, leading to more investments in battery management technologies. However, the industrial market growth is generally slower than that of automotive, primarily due to its dependency on broader industrial adoption trends and investment cycles.

Others

The "Others" category encompasses various applications such as medical devices, aerospace, and military uses, where battery management systems play a pivotal role in ensuring device reliability and safety. While this category holds potential for growth, the specific s within it are often limited in scale compared to automotive or consumer electronics. Applications like medical devices require stringent regulatory compliance and reliability but represent a smaller share of the overall market. Therefore, while there are niche opportunities, their impact on the total battery management system market is less dominant compared to larger, more rapidly growing sectors.

Global Battery Management System Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Battery Management System (BMS) market due to several key factors. The surge in electric vehicle (EV) production, driven largely by countries like China, has fostered a robust demand for efficient battery management solutions. Furthermore, the presence of major battery manufacturers and a significant investment in battery technology by both private and government entities enhance the region's position. With rapid industrialization and urbanization, there’s also a growing need for energy storage systems across the region, supporting the proliferation of applications in renewable energy and electronics. Thus, the Asia Pacific market is set to take the lead in this burgeoning sector.

North America

North America, particularly the United States, holds a significant share of the Global Battery Management System market. This region is characterized by strong investments in research and development, particularly concerning electric and hybrid vehicles. With stringent regulations on emissions and government incentives to adopt cleaner technologies, the demand for advanced battery solutions is on the rise. Additionally, notable collaborations between technology firms and automakers further intensify the need for sophisticated battery management systems to support growing consumer expectations for performance and efficiency.

Europe

Europe is emerging as a crucial player in the Global Battery Management System market, mainly driven by stringent environmental laws and regulations promoting electric vehicles. The European Union’s commitment to reducing carbon emissions has resulted in increased investment in sustainable technologies, including BMS solutions. Furthermore, the presence of established automotive manufacturers in countries such as Germany and France is accelerating the development and demand for advanced battery management systems, aimed at optimizing performance and extending battery life in electric transportation solutions.

Latin America

Latin America exhibits a growing interest in Battery Management Systems, driven by the rising adoption of renewable energy projects and electric vehicles. Countries like Brazil and Argentina are starting to embrace clean energy solutions, yet the market is still developing compared to other regions. Challenges in infrastructure and higher costs for battery systems can slow down widespread adoption. However, the potential for solar energy integration and advancements in the electric vehicle sector could foster growth in BMS in the long term, attracting more investments into the region.

Middle East & Africa

In the Middle East & Africa, the Battery Management System market is in its early stages of growth. While there is increasing interest in renewable energy sources, especially solar power, the adoption of electric vehicles is still limited. Various factors, including low governmental incentives and a lack of infrastructure, challenge substantial market entry. However, there is potential for growth as economies industrialize and urbanize, and as more countries begin to recognize the necessity for energy solutions that integrate adequately with their power grids and transportation systems.

Battery Management System Market Competitive Landscape:

Key stakeholders in the global Battery Management System (BMS) sector propel innovation and technological enhancement, guaranteeing peak battery efficiency and safety across diverse applications. Their partnerships with manufacturers and research organizations foster progress in energy efficiency and sustainability throughout the industry.

Prominent companies in the Battery Management System sector encompass Texas Instruments, NXP Semiconductors, Analog Devices, Maxim Integrated, Renesas Electronics, STMicroelectronics, Panasonic Corporation, LG Chem, BYD Company, A123 Systems, Ioxus, Inc., BMS Battery, EverExceed Industrial Co., Ltd., Samsung SDI Co., Ltd., Nuvation Energy, and Infineon Technologies.

Global Battery Management System Market COVID-19 Impact and Market Status:

The Covid-19 crisis caused significant interruptions in supply chains and manufacturing capabilities, resulting in both delays and ened expenses within the Global Battery Management System sector. This situation also underscored the urgent requirement for energy storage solutions, particularly as the demand for electric vehicles surged.

The COVID-19 pandemic has had a profound impact on the Battery Management System (BMS) market, primarily due to disruptions in supply chains and variable demand across multiple industries. The implementation of lockdowns and various restrictions hindered manufacturing processes, affecting the production of electric vehicles (EVs) and renewable energy storage systems—both of which are crucial for driving BMS demand. However, the pandemic also acted as a catalyst for the increased adoption of clean energy technologies and electric vehicles as governments placed a stronger emphasis on sustainability efforts. This transition amplified the need for energy efficiency and advanced battery systems, sparking innovation within BMS technology. As economies began their recovery, the market experienced a resurgence, propelled by ened investments in electric mobility and renewable energy initiatives. In summary, despite the initial obstacles faced, the future outlook for the BMS market seems encouraging, underpinned by growth in the EV sector and progress in battery technology.

Latest Trends and Innovation in The Global Battery Management System Market:

- In September 2023, Panasonic announced the expansion of its battery management systems capabilities by integrating advanced AI algorithms into its BMS technology, enhancing battery performance and lifecycle management for electric vehicles.

- In August 2023, Texas Instruments launched a new line of battery management ICs designed specifically for electric vehicles, aimed at improving safety and efficiency in multi-cell battery systems.

- In July 2023, Siemens AG completed the acquisition of Avenium, a startup specializing in AI-driven battery management solutions, to strengthen its digital offerings in the energy sector.

- In June 2023, LG Chem unveiled its latest battery management system designed for commercial electric fleets, featuring real-time monitoring and predictive maintenance capabilities.

- In April 2023, Bosch acquired a significant stake in the start-up Volta Energy, which focuses on developing innovative battery management systems tailored for renewable energy storage applications.

- In February 2023, NXP Semiconductors announced a new series of automotive battery management products featuring enhanced communication protocols for more efficient power distribution in electric and hybrid vehicles.

- In January 2023, A123 Systems launched a next-generation battery management system that integrates cell balancing technology aimed at extending battery life for industrial applications.

- In December 2022, Samsung SDI entered a partnership with SK Telecom to develop smart battery management solutions using IoT technology, enabling intelligent monitoring and control of battery systems for various applications.

Battery Management System Market Growth Factors:

The Battery Management System sector is propelled by the growing popularity of electric vehicles, innovations in battery technologies, and the escalating need for solutions that store renewable energy.

The Battery Management System (BMS) sector is witnessing significant expansion, influenced by several crucial elements. The rising adoption of electric vehicles (EVs), spurred by stringent governmental policies aimed at reducing carbon footprints and a growing consumer focus on eco-friendly transportation, stands out as a major contributor. Moreover, the increased implementation of renewable energy sources like solar and wind requires effective energy storage systems, thereby boosting the demand for sophisticated battery management solutions.

Innovations in BMS technology, characterized by improved battery chemistries and advanced algorithms for monitoring battery health and optimizing performance, are driving further developments within the industry. The escalating need for energy storage in both residential and commercial settings, in addition to the growth of the Internet of Things (IoT) landscape, highlights the critical role of BMS in ensuring operational safety and efficiency.

Additionally, ened investments in research and development for electric and hybrid vehicles play a significant role in market growth. The growing recognition of the importance of battery recycling and life cycle management is also leading manufacturers to adopt more effective BMS strategies. Together, these dynamics are fostering a vigorous growth environment for the BMS market, establishing it as a vital component in the global shift towards cleaner energy solutions and improved mobility options.

Battery Management System Market Restaining Factors:

The main challenges impeding the growth of the Battery Management System sector are the elevated costs associated with integration and the intricate task of overseeing various battery chemistries.

The market for Battery Management Systems (BMS) encounters a variety of challenges that could hinder its expansion. A primary obstacle is the substantial expense associated with cutting-edge battery technologies, which may discourage uptake, particularly in industries where budget constraints are a factor. Additionally, the task of incorporating BMS into pre-existing infrastructures can be both complicated and expensive. This is especially true for older systems that demand extensive modernization. The swift evolution of technology requires manufacturers to implement regular updates to ensure compatibility and reliability, which can lead to reluctance in committing resources. Furthermore, rigorous government regulations and safety protocols concerning battery systems add to the complexities in the creation and rollout of BMS solutions. There is also a general lack of awareness and comprehension of the advantages of BMS among various industry stakeholders, which may impede the speed of market adoption. Lastly, fluctuations in the prices of essential raw materials, like lithium and cobalt, can influence production costs and alter the market landscape. Nevertheless, with a growing recognition of the significance of energy efficiency and sustainable practices, along with continuous technological progress, the BMS market is set to experience notable growth and innovation in the foreseeable future, presenting a favorable scenario for those involved in the industry.

Battery Management System Market Key Segments:

By Battery Type:

- Lithium-ion based

- Lead-acid based

- Nickel-based

- Others

By Topology:

- Centralized

- Distributed

- Modular

By Application:

- Automotive

- Telecommunication

- Consumer electronics

- Industrial

- Others

Regional Overview

- North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America