Market Analysis and Insights:

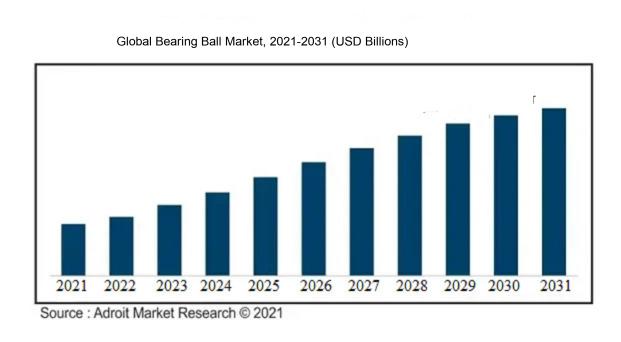

The market for Bearing Ball was estimated to be worth USD XX billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of XX%, with an expected value of USD XX billion in 2031.

The market for bearing balls is primarily steered by the escalating need for these components in diverse sectors including automotive, aerospace, and heavy machinery. Notably, the automotive industry plays a pivotal role in driving market growth owing to the extensive utilization of bearing balls in key areas like wheel bearings, transmission systems, and engine components. The global surge in vehicle production and sales is a key factor propelling the demand for bearing balls. Moreover, the aerospace industry's growing requirement for high-performance and long-lasting bearings is a significant driver for market expansion. The burgeoning industrial and manufacturing activities, particularly in developing nations, are also fueling the demand for bearing balls in heavy machinery and equipment. The industry's focus on energy efficiency and operational effectiveness is driving the adoption of bearing balls. Furthermore, the evolution of bearing ball technologies, including ceramic and hybrid bearings, is playing a pivotal role in expanding the market. However, challenges such as the high production costs of bearing balls and the presence of alternative bearing technologies may impede market growth.

Bearing Ball Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD XX billion |

| Growth Rate | CAGR of XX% during 2021-2031 |

| Segment Covered | By Product, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | SKF, NSK Ltd., Schaeffler AG, NTN Bearing Corporation, Timken Company, MinebeaMitsumi Inc., RHP Bearings Ltd., JTEKT Corporation, SKF Group, and Nachi-Fujikoshi Corp. |

Market Definition

A bearing ball is a geometric shape that is utilized within mechanical bearing systems to minimize friction and enable seamless rotational movement. Manufactured from materials like steel, ceramic, or plastic, it finds widespread applications across different industries for effective power transfer and mobility.

The ball bearing plays a critical role in diverse industries and applications by facilitating smooth rotation and minimizing friction. Its precise spherical shape and sturdy composition enable effective and dependable operation in machinery utilized in automotive, industrial, and aerospace sectors. This component efficiently supports substantial loads, ensuring stability and reducing energy wastage. By promoting the seamless movement of rotating components, the ball bearing enhances performance and durability of mechanical systems, thereby enhancing productivity and safety in various fields.

Key Market Segmentation:

Insights On Key Product

Steel Ball

Steel balls are expected to dominate the global bearing ball market. This is due to their wide range of applications in various industries, such as automotive, aerospace, and machinery. Steel balls offer exceptional strength, durability, and high load-bearing capacity, making them ideal for heavy-duty applications. Their high resistance to wear and corrosion further adds to their appeal. Moreover, steel balls are cost-effective compared to alternatives like ceramic balls. As a result, the demand for steel balls is anticipated to be the highest among the different parts in the global bearing ball market.

Ceramic Ball

Ceramic balls, although not expected to dominate the global bearing ball market, hold a significant share in the market. Ceramic balls offer advantages such as high heat resistance, low thermal expansion, and superior electrical insulation. These properties make them suitable for niche applications in industries like medical equipment, semiconductors, and precision machinery. However, the high manufacturing cost and the limited load-bearing capacity compared to steel balls restrict their dominance in the overall market.

Plastic Ball

Plastic balls have a relatively small share in the global bearing ball market. They find application in industries where corrosion resistance, non-magnetic properties, and lightweight materials are crucial, such as electrical appliances and chemical processing. Plastic balls are also used in non-aggressive environments where the load-bearing requirements are low. However, their limited load-bearing capacity and the availability of alternatives like steel balls and ceramic balls prevent plastic balls from becoming the dominant part in the market.

Others

The Others category, which includes specialty materials or unique types of bearing balls, is expected to have a minor share in the global bearing ball market. These specialty balls cater to specific applications where standard materials may not be suitable. Examples of such specialty balls include glass balls, tungsten carbide balls, and hybrid balls. Although they may find niche uses in specific industries, their overall demand is limited due to the availability and cost-effectiveness of the dominant parts like steel balls.

Insights On Key Application

Automobile Industry

The Automobile Industry is expected to dominate the Global Bearing Ball Market. This can be attributed to the high demand for bearing balls in various automotive applications such as engines, transmissions, wheels, and steering systems. The growing production and sale of automobiles across the globe, coupled with the increasing focus on vehicle electrification and lightweighting, are driving the demand for bearing balls in this industry. Furthermore, advancements in automotive technology, such as the development of electric and hybrid vehicles, are expected to further boost the demand for bearing balls in the automobile sector.

Industrial Equipment

With its diverse range of applications, the Industrial Equipment holds significant potential in the Global Bearing Ball Market. Industrial equipment, such as machinery, pumps, compressors, and conveyors, requires bearing balls to ensure smooth and efficient operation. The growth in industries such as manufacturing, mining, construction, and energy is fueling the demand for industrial equipment, thereby driving the demand for bearing balls in this .

Railway and Aerospace

The Railway and Aerospace is another vital application in the Global Bearing Ball Market. The railway industry heavily relies on bearings for smooth locomotion, while the aerospace industry requires bearings for various applications in aircraft engines, landing gear, and control systems. The increasing investments in railway infrastructure development and the growing demand for air travel are expected to drive the demand for bearing balls in these sectors.

Others

The Others category in the Application of the Global Bearing Ball Market encompasses various industries and applications not specifically mentioned in the previous parts. While the dominating parts mentioned above are expected to hold a major share in the market, the 'Others' also contributes to the overall demand for bearing balls. This includes applications in sectors such as agriculture, construction equipment, and medical equipment, where bearings play a crucial role. Although the demand may be relatively smaller compared to the dominant parts, it still contributes to the overall growth and development of the bearing ball market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific region is expected to dominate the Global Bearing Ball Market. The Asia Pacific region is home to some of the world's largest bearing ball manufacturers and suppliers, such as China and Japan. These countries have a strong industrial sector and are major consumers of bearing balls. Additionally, the growing automotive and manufacturing industries in countries like India, South Korea, and Taiwan are driving the demand for bearing balls in the region. With a large and expanding customer base, favorable government initiatives, and investments in technological advancements, the Asia Pacific region is poised to maintain its dominance in the Global Bearing Ball Market.

North America

North America is a significant market for bearing balls with a strong presence of major manufacturers and suppliers. The region has a well-established automotive and industrial sector, which drives the demand for bearing balls. The United States and Canada have robust manufacturing industries, automotive production, and a focus on technology-driven advancements. However, although North America is a substantial market, it is not expected to dominate the Global Bearing Ball Market due to intense competition and the relatively smaller customer base compared to the Asia Pacific region.

Latin America

Latin America represents a growing market for bearing balls, fueled by the region's expanding manufacturing and automotive sectors. Brazil, Mexico, and Argentina are key countries in the Latin American market. The increased infrastructure development and ongoing industrialization in these countries contribute to the demand for bearing balls. However, despite the growth potential, Latin America is not expected to dominate the Global Bearing Ball Market, mainly due to the smaller market size and the dominance of other regions.

Europe

Europe has a mature bearing ball market with a strong presence of manufacturers and suppliers. Countries like Germany, Italy, and France are known for their advanced manufacturing capabilities and automotive production. The region also has a well-established industrial sector, contributing to the demand for bearing balls. However, despite these factors, Europe is not likely to dominate the Global Bearing Ball Market. The slow economic growth in some European countries and the fierce competition from the Asia Pacific region restrict Europe's market dominance.

Middle East & Africa

The Middle East & Africa region showcases potential for the growth of the bearing ball market. The rising industrialization, infrastructure development, and increasing investments in sectors like manufacturing, mining, and oil and gas create opportunities for bearing ball manufacturers and suppliers in the region. However, due to the relatively smaller market size and less mature industrial sectors compared to other regions, Middle East & Africa is not expected to dominate the Global Bearing Ball Market. The region's dependency on imports and strong competition from Asia Pacific and Europe further limit its market dominance.

Company Profiles:

The primary participants in the international Bearing Ball industry perform a vital function in producing and delivering bearing balls. Their expertise and range of products significantly contribute to the market's development and competitiveness. Innovation and meeting customer needs are crucial factors that propel the market's advancement and sustain a robust market presence.

Prominent companies in the ball bearing market are known corporations such as SKF, NSK Ltd., Schaeffler AG, NTN Bearing Corporation, Timken Company, MinebeaMitsumi Inc., RHP Bearings Ltd., JTEKT Corporation, SKF Group, and Nachi-Fujikoshi Corp. Recognized for their proficiency in the production and distribution of top-tier bearing balls utilized across automotive, aerospace, industrial machinery, and power transmission sectors. These organizations boast diverse product ranges, a worldwide footprint, robust supply chains, and unwavering commitment to research and development, allowing them to effectively address the varied demands of a global clientele. Their competitive strategies revolve around introducing cutting-edge solutions, ensuring product dependability, and delivering exceptional customer experiences, thereby bolstering the advancement and competitiveness of the international ball bearing market.

COVID-19 Impact and Market Status:

The global bearing ball market has experienced substantial effects as a result of the Covid-19 pandemic, causing disruptions in supply chains, reduced production levels, and decreased demand owing to economic challenges.

The global bearing ball market has faced considerable repercussions due to the ongoing COVID-19 pandemic. The imposition of lockdown measures across various countries has led to a slowdown in industrial operations, thereby resulting in a noticeable decrease in the need for bearing balls. This decline in demand has particularly affected manufacturing sectors such as automotive, aerospace, and machinery, disrupting their production processes. Furthermore, restrictions on travel and a decrease in consumer spending have further aggravated the situation, impacting the demand for automobiles and machinery which, in turn, has impacted the bearing ball market. In addition to the aforementioned challenges, the breakdown in global supply chains and logistical hurdles have caused delays in the procurement of essential raw materials for bearing ball production. This has, in turn, led to supply shortages, impeding market growth. Despite these obstacles, the rapid expansion of e-commerce and online retail activities during the pandemic has opened up new avenues for the bearing ball market. The surge in demand for logistics and transportation services to support online shopping has partially mitigated the adverse effects on the market. Nevertheless, as economies gradually reopen and industrial operations return to normalcy over time, it is anticipated that the bearing ball market will witness a gradual recovery from the setbacks experienced during the pandemic.

Latest Trends and Innovation:

- On February 18, 2021, SKF, a leading Swedish bearing manufacturer, announced the acquisition of PEER Bearing Company, a U.S.-based bearing manufacturer, to expand their product portfolio.

- On March 30, 2020, Schaeffler AG, a German bearing manufacturer, announced a strategic partnership with IBM to make use of artificial intelligence (AI) in their manufacturing processes and enhance their product development.

- On August 12, 2021, NTN Corporation, a Japanese bearing manufacturer, announced the development of a new high-load capacity deep groove ball bearing that reduces rotational torque and enables downsizing of electric motors for automobiles.

- On June 3, 2020, Timken Company, an American bearing manufacturer, announced the acquisition of Diamond Chain Company, a producer of high-performance roller chains, to enhance their power transmission offerings.

- On November 2, 2021, NSK Ltd., a Japanese bearing manufacturer, announced the development of a ceramic ball bearing for high-speed electric motors, contributing to increased efficiency and extended service life.

- On September 14, 2020, JTEKT Corporation, a Japanese bearing manufacturer, announced the acquisition of Koyo Chile, a Chilean bearing manufacturer, to strengthen their presence in South America.

- On December 7, 2021, C&U Group, a Chinese bearing manufacturer, announced the development of a ceramic hybrid ball bearing for electric vehicle motors, aiming to address the demand for higher efficiency and longer lifespan.

- On July 22, 2020, RBC Bearings Incorporated, a U.S.-based bearing manufacturer, announced the acquisition of Swiss Tool Systems AG, a provider of precision tools and clamping devices, to expand their product offerings in the aircraft industry.

- On January 16, 2021, MENAFN, an online news agency, reported that the global bearing ball market is projected to grow at a CAGR of 3.9% from 2021 to 2026, indicating a positive outlook for the future of the industry.

Significant Growth Factors:

Driving the expansion of the Bearing Ball Market are the surging requirements from the automotive and industrial realms, ongoing technological progress, and the uptrend of automation in manufacturing operations.

The market for bearing balls is experiencing notable growth driven by various key factors. Primarily, the escalating requirement for bearing balls across industries including automotive, aerospace, and defense is propelling market growth. These sectors heavily rely on bearing balls in their machinery and equipment to ensure smooth and effective operations. Additionally, the thriving construction sector, particularly in developing nations, is spurring the need for bearing balls in construction machinery and equipment. Furthermore, the increasing industrial automation trends, emphasizing precision and reliability, are generating significant market demand for bearing balls. The rising popularity of electric vehicles (EVs) globally is also contributing to market growth due to the utilization of bearing balls in EV components such as motors and transmissions. Moreover, advancements in bearing ball technologies like ceramic and hybrid varieties are further stimulating market expansion. Lastly, the growing emphasis on renewable energy sources like wind power generation is driving demand for bearing balls in wind turbines. Collectively, these growth drivers are expected to sustain the expansion of the bearing ball market in the foreseeable future.

Restraining Factors:

Fluctuations in the prices of raw materials and strict government regulations impacting the manufacturing process serve as constraints on the bearing ball market.

The bearing ball industry is encountering various challenges that are influencing its progress and advancement. Primarily, the emergence of the COVID-19 pandemic resulted in significant disruptions to the global supply chain, causing a deceleration in manufacturing operations, thereby impacting the need for bearing balls. Moreover, the fluctuating prices of key raw materials like steel and ceramics present a hurdle to the market by directly influencing the production expenses of bearing balls. Additionally, stringent regulations and standards mandated by regulatory bodies in regions like Europe and North America can impede market expansion as manufacturers are required to conform to these guidelines, leading to increased costs and decreased profitability. Furthermore, the rising preference for alternative technologies such as roller bearings and magnetic bearings poses a threat to the growth of the bearing ball market. The sector also faces fierce competition from well-established competitors, resulting in pricing challenges.

Nevertheless, the bearing ball industry shows promise for advancement in the future. The market is anticipated to benefit from the growing demand for durable goods across various sectors including automotive, manufacturing, and aerospace. Furthermore, advancements in technology such as the introduction of hybrid bearings and self-lubricating bearing balls offer avenues for market extension. Additionally, the increasing focus on renewable energy sources like wind turbines may propel the demand for larger-sized bearing balls in the upcoming years.

Key Segmentation:

Product Overview

• Ceramic Ball

• Plastic Ball

• Steel Ball

• Others

Application Overview

• Industrial Equipment

• Automobile Industry

• Railway and Aerospace

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :

Table Of Content:

1. Introduction

1.1. Introduction

1.2. Units, Currency, Conversions, and Years Considered

1.3. Market Definition and Scope

1.4. Key Stakeholders

1.5. Key Questions Answered

2. Research Methodology

2.1. Introduction

2.2. Data Capture Sources

2.3. Market Size Estimation

2.4. Market Forecast

2.5. Data Triangulation

2.6. Assumptions and Limitations

3. Market Outlook

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Porter’s Five Forces Analysis

3.4. PEST Analysis

4. Bearing Ball Market by Product

4.1. Ceramic Ball

4.2. Plastic Ball

4.3. Steel Ball

4.4. Others

5. Bearing Ball Market by Application

5.1. Industrial Equipment

5.2. Automobile Industry

5.3. Railway and Aerospace

5.4. Others

6. Bearing Ball Market by Region

6.1. North America

6.1.1. US

6.1.2. Canada

6.1.3. Mexico

6.2. Europe

6.2.1. Germany

6.2.2. France

6.2.3. U.K

6.2.4. Rest of Europe

6.3. Asia Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia Pacific

6.4. Middle East & Africa

6.4.1. Saudi Arabia

6.4.2. UAE

6.4.3. Rest of Middle East and Africa

6.5. Latin America

6.5.1. Brazil

6.5.2. Argentina

6.5.3. Rest of Latin America

7. Competitive Landscape

7.1. SKF

7.2. NSK Ltd.

7.3. Schaeffler AG

7.4. NTN Bearing Corporation

7.5. Timken Company

7.6. MinebeaMitsumi Inc.

7.7. RHP Bearings Ltd.

7.8. JTEKT Corporation

7.9. SKF Group

7.10. Nachi-Fujikoshi Corp.

8. Appendix

8.1. Primary Research Approach

8.1.1. Primary Interview Participants

8.1.2. Primary Interview Summary

8.2. Questionnaire

8.3. Related Reports

8.3.1. Published

8.3.2. Upcoming