Market Analysis and Insights:

The market for Global Beverage Cans was estimated to be worth USD 29 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 4%, with an expected value of USD 40 billion in 2032.

.jpg)

The beverage can industry is largely influenced by a variety of interconnected factors. A significant driver is the growing consumer preference for packaging that offers convenience and portability, which facilitates consumption on the go. Additionally, a shift towards health-conscious choices has led to an increase in the use of lightweight and recyclable aluminum cans, appealing to both environmentally conscious consumers and producers. The expanding beverage sector, particularly in non-alcoholic categories like functional drinks and sparkling waters, further propels this market's growth. Innovations in can design and technology, including user-friendly features like easy-open tops and improved sealing systems, are meeting consumer demands for practicality. Moreover, stringent regulations aimed at reducing plastic waste are encouraging manufacturers to adopt more sustainable options, thereby increasing the appeal of aluminum cans. Economic advancements in emerging markets present further expansion opportunities, as rising disposable incomes correlate with higher consumption of packaged beverages. Collectively, these elements are driving significant growth in the beverage can market.

Global Beverage Cans Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 40 billion |

| Growth Rate | CAGR of 4% during 2024-2032 |

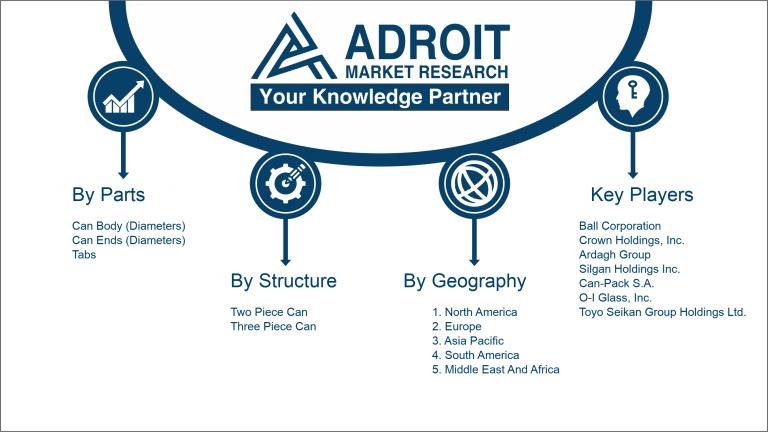

| Segment Covered | By Parts, By Material, By Structure, By Can Coating, By Volume, By Can Shape, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Ball Corporation, Crown Holdings, Inc., Ardagh Group, Silgan Holdings Inc., Can-Pack S.A., O-I Glass, Inc., Toyo Seikan Group Holdings Ltd., Novelis Inc., Nippon Steel Corporation, and Sidel Group |

Market Definition

Beverage cans are sturdy vessels commonly crafted from aluminum or steel, intended for the containment and preservation of liquid items like soft drinks, beer, and juices. These containers are lightweight and recyclable, frequently featuring a user-friendly pull tab for hassle-free opening.

Cans for beverages are integral to the beverage sector because of their lightweight nature, sturdiness, and recyclability. They are highly effective in maintaining the quality of drinks, safeguarding freshness and prolonging shelf life by shielding contents from light and oxygen. Furthermore, aluminum cans are exceptionally recyclable; the process utilizes considerably less energy compared to manufacturing new ones, rendering them a sustainable choice. Their portability and straightforward storage capabilities add to their attractiveness for consumers. In addition, the eye-catching artwork on cans functions as powerful marketing instruments, effectively drawing consumer interest and fostering brand loyalty amid a competitive landscape.

Key Market Segmentation:

Insights On Key Parts

Can Body (Diameters)

The Can Body, particularly the diameters, is expected to dominate the Global Beverage Cans Market due to the expanding consumer demand for light-weight packaging that maintains product integrity. The body of the can plays a crucial role in maximizing storage efficiency and minimizing material usage, thus catering to sustainability trends. Additionally, advancements in manufacturing processes allow for the production of thinner yet robust can bodies, which not only reduce costs but also enhance the overall eco-friendliness of beverage packaging. As ecological concerns rise, the preference leans towards materials and designs that offer a balance of strength and environmental impact, placing the Can Body at the forefront.

Can Ends (Diameters)

The Can Ends, specifically in terms of diameters, are important components of beverage cans, contributing to the overall seal and preservation of contents. While they do not dominate the market, they play a critical role in ensuring that beverages remain fresh and unaffected by external factors. The innovation in can ends that improve sealing technology is driving gradual growth in this area. However, the impacts of consumer preferences and evolving manufacturing efficiencies mean the focus will likely remain on other components, limiting the Can Ends' potential for market leadership.

Tabs

Tabs are the functional components of beverage cans that represent convenience and user experience. Though they contribute to the market, their importance is secondary compared to the overall can design and materials, like body and ends. The focus on ease of opening and safety has led to some innovations, but the growth rate remains constrained by competing technologies and varying consumer demands. As market dynamics shift, tabs remain essential but not the leading factor in overall market growth, with more attention directed towards the body design and material optimization.

Insights On Key Material

Aluminium

Aluminium is expected to dominate the Global Beverage Cans Market due to its lightweight, excellent corrosion resistance, and recyclability. The increasing awareness surrounding sustainability among consumers and manufacturers further propels aluminium’s use, as it can be recycled infinitely without degradation of properties. Additionally, the rapid expansion of the beverage industry, coupled with aluminium's ability to keep beverages fresh and maintain the integrity of taste, enhances its attractiveness for soft drinks and alcoholic beverages alike. These factors underscore the strong position aluminium holds in the market, making it the preferred material for manufacturers seeking both performance and environmental responsibility.

Steel

Steel, while less dominant in beverage can manufacturing, still plays a significant role, particularly in specific product categories. It is known for its robust strength and barrier properties, making it suitable for carbonated drinks. However, steel cans tend to be heavier than aluminium ones, which can increase shipping costs and reduce energy efficiency during transport. This material also has a lower recyclability rate compared to aluminium, which diminishes its appeal in an increasingly eco-conscious market. Despite these challenges, steel continues to be utilized in niche s where its properties offer advantages, such as in certain premium beverages.

Insights On Key Structure

Two Piece Can

The Two Piece Can is expected to dominate the Global Beverage Cans Market due to its advantageous manufacturing process. This design eliminates the need for a welded seam, leading to improved structural integrity and a lighter weight, which greatly reduces transportation costs. Furthermore, Two Piece Cans offer better product preservation, as they provide a tight seal that minimizes the risk of leakage and contamination. The trend towards eco-friendly packaging also favors Two Piece Cans, as they use less aluminum compared to Three Piece Cans. Thus, the combination of Manufacturing efficiency, cost-effectiveness, and sustainability gives this design an edge in capturing market demand.

Three Piece Can

The Three Piece Can, while less dominant, still has its uses in specific beverage applications, particularly for products requiring larger volumes or unique designs. This structure consists of a body and two ends, allowing for versatility in shape and size. However, the complexity of the manufacturing process results in a higher production cost, which could limit its competitiveness against the more efficient Two Piece Can. Moreover, concerns about potential leakage due to the seams could dissuade manufacturers from choosing this option for beverages that need enhanced preservation.

Insights On Key Can Coating

Epoxy

Epoxy coatings are expected to dominate the Global Beverage Cans Market due to their superior protective properties, which include excellent adhesion, corrosion resistance, and chemical resistance. These coatings provide a barrier against environmental factors that can compromise the integrity of the beverage inside the can. Additionally, epoxy coatings are well-suited for various beverages, including carbonated drinks, which further fuels their demand in the market. The increasing concern for food safety and the need to extend shelf life of products contribute to the preference for epoxy coatings. As manufacturers seek optimal performance in terms of production efficiency and sustainability, epoxy stands out as the most reliable option.

Polyester

Polyester coatings offer a strong performance in terms of durability and aesthetic appeal for beverage cans. Their application benefits from a lower environmental impact compared to traditional coatings, aligning with the growing sustainability trends in the beverage industry. Polyester can withstand various atmospheric conditions, making it suitable for outdoor storage and transport. However, despite their advantages, they often do not match the protective performance of epoxy coatings for specific beverages, which may affect their overall market share.

Vinyl

Vinyl coatings are primarily recognized for their cost-effectiveness and flexibility. They provide an appealing finish that can be beneficial in marketing beverage cans with vibrant designs. However, they lack the high-performance attributes of epoxy and polyester coatings regarding chemical resistance and durability under extreme conditions. Consequently, while they may be favored in niche markets for aesthetic reasons, their ability to compete in mainstream applications is limited.

Others

The Others category encompasses various alternative coatings, including natural and bio-based options, which are gaining traction due to rising environmental awareness among consumers and manufacturers alike. Though these coatings provide unique attributes, such as biodegradability and reduced toxicity, their market presence remains limited compared to epoxy, polyester, and vinyl. As the industry shifts toward greener solutions, traditional coatings still dominate due to their proven performance. Nonetheless, innovations in this category may gain traction in the future.

Insights On Key Volume

1 L

The 1 L volume is expected to dominate the Global Beverage Cans Market due to its versatility and convenience. This size is particularly favored by consumers for both individual and family use, as it provides a suitable quantity for various occasions. Additionally, the larger volume can be more cost-effective for consumers when comparing price per liter, making it an attractive option for those who seek value. Its widespread availability in a range of beverages including soft drinks, juices, and energy drinks further strengthens its position as the leading choice in the market. This preference aligns with the consumers' rising demand for larger packages, thereby solidifying its dominance.

100 mL

The 100 mL volume is often seen in specialty beverage markets, such as energy shots or premium mixers. These products cater to a niche audience that prefers smaller servings for concentrated flavors or specific dietary needs. The convenience of portability also appeals to busy consumers seeking quick refreshment on the go. However, despite its practicality in certain occasions, the 100 mL size does not enjoy the same popularity as larger formats.

150 mL

The 150 mL volume is typically associated with single-serve products like mocktails, flavored waters, or juices targeted at young consumers and health-conscious individuals. While it serves a specific need for immediate consumption and portion control, this size's limited versatility compared to larger containers restricts its overall market penetration. Consequently, it attracts specific demographic groups but lacks the broader appeal necessary to dominate the market.

200 mL

The 200 mL volume is popular among consumers looking for moderate serving options. This size is often found in children's beverages or product lines that emphasize controlled portions. As a result, it is used in health-focused marketing campaigns that promote moderation and balanced consumption. Despite its appeal, the market share of the 200 mL cans remains limited when compared to larger options capable of catering to more consumers in one package.

310 mL

The 310 mL volume is generally seen in niche categories such as craft beverages, offering a unique experience to consumers. This size can appeal to those seeking premium products; however, its limited availability and market presence in comparison to larger volumes restrict its growth. The 310 mL format also struggles to compete with single-serve and multi-serve options that provide higher value for consumers.

330 mL

The 330 mL volume is widely utilized in soft drink and beer packaging. While it is popular among consumers who prefer sharable, moderate servings, it faces stiff competition from the more dominant 1 L options. The 330 mL can offers a good balance between convenience and quantity for casual outings or home use; yet, its market performance may vary depending on regional preferences and consumer trends, ultimately influencing its potential for dominance.

500 mL

The 500 mL volume is popular for bottled water and energy drinks. It caters to active lifestyles, providing a sizable quantity to keep consumers hydrated. Although it is sought after for its practicality, the 1 L option eclipses it due to the broader appeal and better price-to-volume ratio. While 500 mL cans have a stable market presence, they are often overshadowed by larger capacities, limiting their domination capabilities.

Others

The Others category includes various unique packaging options and specialized sizes that target niche markets. This may encompass sizes that differ from standard offerings, aiming to cater to specific consumer preferences or trends. However, these alternative volumes struggle to achieve significant market share compared to the more popular sizes, limiting their overall impact on the Global Beverage Cans Market. Ultimately, while some innovative options can create excitement, they remain overshadowed by the dominant conventional sizes.

Insights On Key Can Shape

Slim

The Slim can is anticipated to dominate the Global Beverage Cans Market due to its growing popularity among health-conscious consumers and millennials who prefer lightweight, portable options. This trend is particularly strong in the beverage industry, where slim cans often appeal to consumers seeking low-calorie drinks and on-the-go formats. Key players are continuously innovating within this , also attributing to the market’s responsiveness to consumer demands for more aesthetically pleasing designs, which enhances brand image and sales. The growing trend of craft beverages has additionally reinforced the adoption of slim cans, augmenting their market presence.

Standard

The Standard can shape holds a significant position in the beverage landscape, primarily due to its extensive use across various types of beverages, including soft drinks, beers, and energy drinks. Its versatility makes it a preferred choice among manufacturers because it seamlessly accommodates large volumes, catering to diverse consumer needs. The established supply chain and production processes associated with Standard cans contribute to their cost-effectiveness, making them an enduring choice in the market. The familiarity of Standard cans among consumers also plays a role in maintaining steady sales and brand loyalty.

Sleek

Sleek cans are gaining traction in niche markets, particularly among premium beverage brands that aim to stand out on retail shelves. The modern design and elegant aesthetics of sleek cans appeal to younger and style-conscious consumers, which enhances brand visibility. Brands seeking to evoke a sense of luxury and sophistication often opt for this can shape, aligning with lifestyle and health trends. However, despite their appeal, sleek cans may face challenges related to production costs and direct competition from more established formats in the broader beverage market.

Others

The category labeled as Others encompasses various innovative can shapes that are gaining attention but do not yet dominate in terms of market share. This includes uniquely shaped cans designed for specialty beverages and limited edition releases which aim to capture consumer interest through novelty and innovation. While these alternatives may not have widespread application, they can create buzz and enhance brand differentiation. The market for these unique can designs remains primarily experimental, with producers continually testing consumer reactions to drive future trends in can design.

Insights On Key Fabrication

Printed

Printed cans are expected to dominate the Global Beverage Cans Market due to their ability to enhance brand visibility and consumer appeal. As manufacturers increasingly focus on aesthetics, the demand for printed designs has surged. This allows brands to create unique, eye-catching packaging that can differentiate their products in a saturated market. Furthermore, advancements in printing technology have enabled high-quality, vibrant graphics that attract consumers' attention on retail shelves. The rise of social media also plays a significant role in promoting visually appealing products, leading to a growing preference for printed beverage cans, making them the leader in this market.

Plain

Plain cans hold a notable position in the Global Beverage Cans Market, appealing to manufacturers aiming for cost-effectiveness and simplified production processes. They serve as a sturdy and efficient option for packaging, allowing brands to focus on scaling production without the additional costs associated with complex designs. Additionally, plain cans are often favored for products that emphasize a minimalist or classic image. However, as branding becomes more crucial in attracting consumers, plain cans may face growing competition from more visually engaging options.

Embossed

Embossed cans are a niche but interesting aspect of the Global Beverage Cans Market. While they have a unique tactile quality that can enhance brand perception and provide a premium feel, their production costs are generally higher than plain or printed options. Brands often use embossed designs to convey luxury or exclusivity, making them more suitable for specific high-end products. As authorities on consumer packaging continue to evolve, embossed cans may see limited growth compared to more economically viable options, but they remain a favorite in premium markets.

Others

The Others category within the Global Beverage Cans Market encompasses various unique fabrication methods that do not specifically fall under plain, embossed, or printed. This might include specialized coatings or finishes that can be tailored for certain products. However, this faces challenges in establishing a significant footprint compared to the dominant categories. The innovation potential exists, but market players may find it tough to compete effectively, as they need to justify the added value of these alternative methods to gain consumer acceptance and achieve substantial sales.

Insights On Key Application

Carbonated Soft Drinks (CSD)

Carbonated Soft Drinks (CSD) are expected to dominate the Global Beverage Cans Market due to their widespread popularity and consumption levels. This has shown consistent growth driven by the demand for convenience and on-the-go consumption patterns among consumers. The rising trend of flavor innovation and premium offerings within the CSD category also contributes to its dominance. Additionally, robust marketing strategies and competitive pricing have kept carbonated drinks in high consumer favor. The ease of packaging in cans aligns perfectly with the current consumer shift towards single-serving and recyclable options, further solidifying this 's leading position in the market.

Alcoholic Beverages

The Alcoholic Beverages category is experiencing steady growth, particularly with the rising trend of craft beers and premium spirits. Consumers are increasingly drawn to innovative flavors and the brand experience, pushing manufacturers to adopt eye-catching can designs. The convenience of cans, which are lightweight and portable, supports outdoor and on-the-go consumption, catering to the lifestyles of younger generations. Furthermore, sustainability initiatives in the alcoholic drinks sector aim to attract environmentally conscious consumers, further solidifying the potential for growth in this market .

Water

The packaged Water sector is increasingly focusing on premiumization, with brands offering enhanced and flavored waters that appeal to health-conscious consumers. The shift towards healthier choices is notable, as consumers are moving away from sugary drinks towards more hydration-focused options. Cans have become a preferred packaging format owing to their convenience, portability, and recyclability. The growing emphasis on sustainability is driving brands to adopt environmentally friendly packaging solutions, thus reinforcing the role of cans in the water .

Fruit and Vegetable Juices

Fruit and Vegetable Juices are gaining momentum due to the rising demand for healthy and natural beverages among consumers. The trend of cold-pressed and organic juices has revitalized this market , appealing to health-savvy individuals. Packaging in cans offers advantages such as shelf stability and convenience, making it easier for consumers to enjoy nutritious drinks without the worry of spoilage. As manufacturers focus on innovative flavors and blends, the consumption of juices in can format is expected to continue growing, thus enhancing its market significance.

Ready to Drink Tea and Coffee

Ready to Drink Tea and Coffee have witnessed an upswing in popularity, largely due to the convenience and variety they offer. The increasing inclination towards healthier beverage options, combined with the demand for caffeinated drinks on the go, has fueled growth in this area. Cans provide an ideal packaging option, promoting brand visibility and easy consumption. As consumers become more adventurous with flavors and preferences, this is also likely to benefit from innovative product launches, driving more attention to canned formats.

Sports/Energy Drinks

The Sports and Energy Drinks market has been expanding consistently, driven by an active lifestyle trend and a growing awareness of the benefits of hydration and performance. Consumers, especially younger demographics, are seeking energy-boosting options that come in convenient packaging. Cans play a significant role in this market by offering portability and quick access, which is essential for athletes and fitness enthusiasts. This trend toward on-the-go consumption is likely to support the sustained growth of Sports and Energy Drinks within the beverage can market.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Beverage Cans market in the coming years. This growth is largely driven by increasing urbanization, rising disposable incomes, and a shift towards convenient packaging solutions among consumers in countries such as China and India. The demand for beverages, particularly carbonated drinks and energy drinks, is also surging in this region, leading to greater consumption of beverage cans. Additionally, the expansion of the retail sector and innovative packaging technologies are further contributing to the growth of the beverage cans market. Environmental awareness has also prompted companies to adopt sustainable packaging practices, which favor the use of aluminum and steel cans over plastic options.

North America

North America is a significant player in the Global Beverage Cans market, driven by a strong preference for canned beverages among consumers. The region has a mature market characterized by high per capita consumption of beverages across various s, including alcohol, soft drinks, and energy drinks. Additionally, the rising awareness regarding sustainable packaging is pushing beverage companies to adopt cans over other materials, enhancing recyclability and eco-friendliness. However, the market may face challenges due to increasing competition and a saturation point within certain beverage s.

Europe

Europe is a robust market for beverage cans, with a strong focus on sustainability and recycling. Many European countries have implemented stringent regulations promoting the use of recyclable materials, contributing to a positive outlook for the beverage cans . The beverage consumption pattern in Europe reflects a growing trend towards premium and health-oriented products, prompting brands to utilize cans as a means of preserving quality and extending shelf-life. While the market is evolving, the economic recession might temper growth in some regions, especially in Southern Europe.

Latin America

Latin America presents a burgeoning beverage cans market, driven by a young population and increasing urbanization. The growing middle class is fostering higher demand for convenience, leading to a rise in the consumption of canned beverages. Popularity in sparkling and flavored water, alongside the need for portable beverage packaging, is propelling the growth of beverage cans in this region. While challenges such as infrastructure limitations exist, investments in manufacturing capabilities and supply chains could catalyze further growth in the coming years.

Middle East & Africa

The Middle East & Africa region is witnessing gradual growth in the beverage cans market, supported by shifting consumer preferences towards canned drinks, especially among younger demographics. Urbanization and improvements in the retail sector are further enhancing market opportunities. However, the market is somewhat constrained by economic factors and varying levels of development across countries. Despite this, the region shows potential due to an emerging middle class and increasing interest in international beverage brands, which could lead to a more significant demand for cans in the future.

Company Profiles:

The main contributors to the Global Beverage Cans market consist of producers who design and manufacture the cans, as well as distributors responsible for the effective distribution to retailers and end consumers. Their partnership plays a crucial role in stimulating market expansion by improving the accessibility of products and promoting sustainable practices.

Prominent participants in the market for beverage cans consist of Ball Corporation, Crown Holdings, Inc., Ardagh Group, Silgan Holdings Inc., Can-Pack S.A., O-I Glass, Inc., Toyo Seikan Group Holdings Ltd., Novelis Inc., Nippon Steel Corporation, and Sidel Group. Furthermore, other significant firms in this industry include Ball Metal Beverage Container LLC, Sonoco Products Company, Rexam PLC, CPMC Holdings Limited, Wiegand-Glas GmbH, and Hindalco Industries Limited.

COVID-19 Impact and Market Status:

The Covid-19 pandemic led to a notable rise in the demand for beverage cans, as individuals gravitated towards packaged goods and outdoor drinking experiences, which in turn affected supply chains and manufacturing capabilities.

The beverage cans market experienced substantial effects from the COVID-19 pandemic, largely influenced by shifting consumer habits and disruptions within supply chains. With widespread lockdowns, there was a notable increase in at-home consumption, resulting in ened demand for canned drinks, both non-alcoholic and alcoholic. However, manufacturers encountered significant obstacles, including workforce shortages and challenges in sourcing raw materials, which initially limited their production capabilities.

Moreover, the acceleration of e-commerce and direct-to-consumer sales necessitated rapid adaptation from companies, prompting enhancements in packaging solutions and sustainability efforts to align with evolving consumer expectations. The growing trend towards health consciousness also fueled an increase in the popularity of ready-to-drink canned beverages, as individuals sought convenient and hygienic options. As the industry gradually recovers, these adaptations are likely to have a persistent impact, with an emphasis on sustainability and innovation taking center stage, thus redefining future growth paths within the beverage cans market.

Latest Trends and Innovation:

- In June 2023, Ball Corporation announced the completion of its acquisition of the beverage can manufacturing facility in Phoenix, Arizona, enhancing its production capabilities in response to rising consumer demand for sustainable packaging solutions.

- In February 2023, Crown Holdings, Inc. launched a new line of eco-friendly aluminum beverage cans featuring a 30% reduced carbon footprint, signaling its commitment to sustainability and innovation in the beverage packaging industry.

- In August 2023, Ardagh Group expanded its beverage can production capacity in the U.S. by investing $30 million into its existing plant in Salisbury, North Carolina, aiming to meet increasing demand for cans in the craft brewing and non-alcoholic beverage sectors.

- In March 2023, Can-Pack S.A. announced a strategic partnership with a major beverage producer to develop a bespoke, fully recyclable can that utilizes recycled aluminum, supporting both companies' sustainability targets.

- In December 2022, Rexam PLC (now part of Ball Corporation) celebrated the successful implementation of new manufacturing technologies that improved production efficiency by 15%, highlighting the ongoing push for innovation in the beverage can market.

- In September 2023, Trivium Packaging introduced a new range of aluminum beverage cans designed specifically for the hard seltzer market, featuring enhanced resealability and premium printing capabilities to attract a growing consumer base.

- In April 2023, KHS Group unveiled a new filling line for beverage cans that is capable of handling both standard and specialized can formats, promoting flexibility for producers aiming to diversify their offerings in response to market demands.

- In July 2022, Novelis Inc. announced a partnership with multiple beverage companies to accelerate the use of recycled aluminum in can production, committing to recycling 10 billion cans by 2030, which reflects the industry's shift toward circular economy practices.

Significant Growth Factors:

The primary catalysts for growth in the beverage can sector encompass the escalating consumer preference for eco-friendly packaging solutions, a growing trend toward convenience-driven products, and the broadening presence of the beverage industry in developing regions.

The Beverage Cans Market is witnessing remarkable growth, fueled by a variety of influential factors. A primary driver is the rising consumer inclination towards lightweight and portable packaging, which complements the fast-paced, on-the-go lifestyle. This surge in demand favors aluminum and steel cans, celebrated for their practicality and recyclability. Additionally, the worldwide emphasis on sustainability further accelerates market growth, as beverage cans boast a superior recycling rate relative to plastic counterparts, making them attractive to both eco-conscious consumers and brands.

Moreover, the ongoing expansion of the beverage sector—including carbonated drinks, juices, and alcoholic beverages—boosts the need for effective packaging solutions. Innovations, such as uniquely shaped cans and advanced barrier technologies, aim to meet the diverse preferences of consumers, thereby widening the market appeal. The increasing disposable income seen in emerging markets also contributes to higher consumption levels of packaged beverages, enhancing market growth prospects

Finally, retail channels, particularly e-commerce, are increasingly favoring beverage cans due to their efficient use of space and ease of stock management, ultimately driving sales upward. Collectively, these elements are shaping a vigorous growth path for the Beverage Cans Market, reflecting changing consumer behaviors and sustainable initiatives within the global economic landscape.

Restraining Factors:

The beverage can industry faces significant hurdles, including escalating costs of raw materials and ened competition from eco-friendly packaging options.

The Beverage Cans Market encounters a variety of challenges that may hinder its expansion. One major issue is the escalating prices of essential raw materials like aluminum and tinplate, which can drive up production costs and, consequently, retail prices. Additionally, increasing environmental concerns are prompting consumers and regulatory entities to prioritize sustainable packaging, leading to a transition towards alternative materials, including biodegradable solutions. The industry also grapples with stringent regulations related to recycling and waste management, necessitating that manufacturers adhere to compliance standards that may inflate operational expenses. Furthermore, competition from other packaging types, such as glass and plastic, places additional pressure on beverage cans. Economic fluctuations contribute to variable demand, resulting in inconsistent sales trends. Nonetheless, amidst these obstacles, the Beverage Cans Market stands to gain from the growing emphasis on environmentally friendly practices and advancements in recycling technology. These developments have the potential to improve operational efficiency and minimize ecological footprints, thereby paving the way for new avenues of growth and sustainability within the industry.

Key Segments of the Beverage Cans Market

By Parts:

- Can Body (Diameters)

- Can Ends (Diameters)

- Tabs

By Material:

- Aluminium

- Steel

By Structure:

- Two Piece Can

- Three Piece Can

By Can Coating:

- Epoxy

- Polyester

- Vinyl

- Others

By Volume:

- 100 mL

- 150 mL

- 200 mL

- 310 mL

- 330 mL

- 500 mL

- 1 L

- Others

By Can Shape:

- Slim

- Standard

- Sleek

- Others

By Fabrication:

- Plain

- Embossed

- Printed

- Others

By Application:

- Alcoholic Beverages

- Carbonated Soft Drinks (CSD)

- Water

- Fruit and Vegetable Juices

- Ready to Drink Tea and Coffee

- Sports/Energy Drinks

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America