Biofuels Market Analysis and Insights:

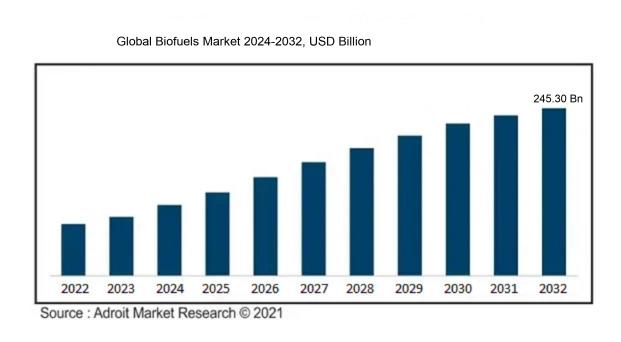

In 2023, the size of the global biofuels market was estimated at USD 125.99 billion. It is projected to grow at a compound annual growth rate (CAGR) of 8.05% from USD 132.67 billion in 2024 to USD 245.30 billion by 2032.

The biofuels industry is propelled by a confluence of factors, prominently featuring ened environmental awareness, supportive regulatory frameworks, and the imperative for energy independence. As concerns regarding climate change intensify, there is a strong push for a transition from traditional fossil fuels to renewable energy options. Government initiatives, including mandates and financial incentives for biofuel production, significantly contribute to the expansion of this market. Moreover, technological advancements are improving production efficiency, rendering biofuels more economically feasible. The unpredictability of fossil fuel prices further motivates industry participants to seek alternative energy solutions, with biofuels emerging as a viable and sustainable option. Additionally, the growing demand for cleaner energy in the transportation sector, combined with innovations in feedstock processing and enhancements in biofuel yields, plays a pivotal role in accelerating global adoption of renewable energy sources.

Biofuels Market Definition

Biofuels represent renewable energy alternatives sourced from organic matter, including plants and discarded materials, and can generate heat, power, or fuel for transportation. These energy sources seek to minimize greenhouse gas emissions and decrease dependence on fossil fuels by employing sustainable methods.

Biofuels play an essential role for multiple reasons. They serve as a renewable energy alternative, which can drastically decrease reliance on fossil fuels, leading to a reduction in greenhouse gas emissions and aiding in the fight against climate change. By harnessing biomass, including plant materials and agricultural by-products, biofuels enhance energy security and promote diversification in energy sources. Furthermore, they bolster rural economies by generating employment opportunities in both agricultural and processing sectors. Biofuels also contribute to energy sustainability by offering domestically produced alternatives, which reduce dependence on international oil market volatility and promote a more robust energy framework.

Biofuels Market Segmental Analysis:

Insights On Key Product

Ethanol

Ethanol is expected to dominate the Global Biofuels Market due to its extensive application in the transportation sector and growing demand for cleaner fuel alternatives. As countries intensify their focus on reducing greenhouse gas emissions and achieving energy independence, ethanol derived from corn, sugarcane, and cellulosic sources has gained substantial momentum. The adaptability of ethanol blends in traditional combustion engines and its established regulatory support, including mandates for renewable fuels, amplifies its market presence. Additionally, advancements in production technologies and a rise in consumer acceptance of sustainable practices further solidify ethanol’s leading position within the biofuels landscape.

Biodiesel

Biodiesel remains a significant player in the Global Biofuels Market, primarily due to its renewable nature and potential to reduce harmful emissions when used in diesel engines. Made from vegetable oils, animal fats, or recycled cooking oil, biodiesel meets stringent government regulations, making it a viable alternative for industries looking to achieve sustainability goals. Its compatibility with existing diesel engines without modifications ensures a smoother transition for consumers, contributing to its strong market appeal. Furthermore, the rise in initiatives promoting the use of biodiesel in public transportation is expected to bolster its growth trajectory.

Wood Pellets

Wood pellets, as a renewable energy source, have witnessed increasing adoption in both residential and commercial heating applications. Their combustion results in lower emissions compared to fossil fuels, aligning with the global push for carbon neutrality. The practicality of wood pellets, which can be sourced from sustainable forestry practices, adds to their attractiveness as a biofuel. Additionally, European markets have shown significant demand for wood pellets as a biomass energy solution, with large-scale power plants incorporating them as a substitute for coal, thus driving investments in this.

Others

The "Others" category encompasses various biofuels such as biogas, bioethanol from advanced feedstocks, and algae-based fuels. While these alternatives demonstrate promising potential for future applications and innovations, their current market presence does not compete with leading products like ethanol and biodiesel. Factors such as high production costs, regulatory challenges, and the need for specialized technologies have limited their widespread adoption. Nonetheless, continuous research and development efforts may unveil new opportunities for growth, potentially enhancing their market share in the coming years.

Insights On Key Form

Liquid Biofuel

Liquid biofuels are poised to dominate the global biofuels market due to their versatility and established infrastructure for production and distribution. Bioethanol and biodiesel, the two main types of liquid biofuels, are already widely adopted in transportation and can be blended with traditional fuels. Their ability to integrate seamlessly into existing fuel supply chains and engine technologies enhances their market penetration. Moreover, the rising demand for renewable energy and stringent environmental regulations aimed at reducing greenhouse gas emissions are further propelling the growth of liquid biofuels. Governments worldwide are implementing policies that favor the production and use of liquid biofuels, making them a preferred choice in the market.

Solid Biofuel

Solid biofuels, such as wood pellets and agricultural residues, have a significant presence in the energy sector, particularly in industrial heating and power generation applications. They are generally considered carbon-neutral and are an established source of renewable energy, especially in regions with abundant biomass resources. However, while solid biofuels are increasingly used for heat and electricity, their market may be limited by logistical challenges and storage requirements compared to other forms of biofuels. Nonetheless, they remain popular in rural areas and developing countries where traditional energy access is limited, offering an important alternative fuel source.

Gaseous Biofuel

Gaseous biofuels, primarily biogas and biomethane, show potential for growth in the global market, particularly in sectors where natural gas is used. These fuels are produced from organic materials via anaerobic digestion processes and offer a sustainable solution for waste management while generating renewable energy. The rise of combined heat and power (CHP) systems that utilize biogas indicates a positive trend for its adoption. However, the limited infrastructure for production, transportation, and storage in comparison to liquid fuels hampers quicker market expansion. Despite these challenges, gaseous biofuels are gaining attention due to their ability to reduce dependency on fossil fuels and help lower carbon emissions.

Insights On Key Feedstock

Corn

Corn is expected to dominate the Global Biofuels Market due to its widespread availability and established infrastructure for production, especially in countries like the United States. The efficient conversion rates of corn into ethanol have been continuously optimized, making it a preferred choice for biofuel manufacturers. Moreover, government policies and subsidies in many regions support corn-based biofuel production, further solidifying its position in the market. As a crop, corn is economically scalable and fits well within existing agricultural practices, allowing for significant production potential. Its versatility in biofuel applications and cost-effectiveness makes it the leading feedstock in the global biofuels landscape.

Sugarcane

Sugarcane is another critical player in the biofuels industry, particularly for ethanol production. It is mainly cultivated in tropical and subtropical regions, allowing it to thrive where other feedstocks may not be as effective. Sugarcane offers high sugar content and efficient fermentable yield, which enables the production of ethanol with a lower carbon footprint compared to fossil fuels. Countries like Brazil are leveraging sugarcane as a primary feedstock for biofuels, supported by government initiatives and a strong market for flex-fuel vehicles. Its renewable nature and ability to contribute to energy security make it a compelling alternative to corn.

Vegetable Oils

Vegetable oils represent a significant portion of the biofuels market, primarily used for biodiesel production. This feedstock includes oils from various sources, such as palm, soybean, and rapeseed. The primary advantage of using vegetable oils is their compatibility with diesel engines, providing a direct avenue for replacement of fossil fuels. However, supply chain issues, land-use competition, and higher costs compared to other feedstocks can pose challenges. As sustainability becomes increasingly important, the focus on biofuels derived from waste cooking oil and non-food crops is expected to gain traction, making vegetable oils a noteworthy category despite certain limitations.

Others

The "Others" category in biofuel feedstocks encompasses a diverse range of materials, including waste products, agricultural residues, and biomass from various sources. This is gradually gaining attention due to the increasing push towards circular economy practices and sustainability. By utilizing waste materials, this category minimizes environmental impact and offers an innovative solution to the biofuels industry. The growth of technology that enables efficient conversion of these materials into biofuel is critical. However, the volume and regional variations in availability can create market inconsistency compared to more established feedstocks like corn and sugarcane. Nonetheless, the potential for reduced emissions and sustainable practices gives promise to this category.

Insights On Key Application

Transportation

Transportation is poised to dominate the Global Biofuels Market due to an increasing global emphasis on reducing greenhouse gas emissions and dependency on fossil fuels. The transportation sector, which includes automobiles, trucks, buses, and shipping vessels, is the largest consumer of energy worldwide and considerably impacts climate change. As regulatory frameworks become more stringent regarding emissions and sustainable fuel use, biofuels are increasingly seen as a viable alternative to traditional fossil fuels. The growing adoption of flexible-fuel vehicles and initiatives promoting biofuel blends in various fuel commodities continue to drive this market forward. Given these driving factors, the transportation market will likely see substantial growth in the coming years.

Aviation

Aviation is another vital area within the biofuels market, though it ranks behind transportation. The sector is slowly embracing sustainable aviation fuels (SAF) as awareness of climate change intensifies. Strong government support and industry partnerships are emerging to boost the adoption of biofuels in aviation. Airlines are beginning to integrate SAF into their fuel mix, facilitating a reduction in carbon emissions while maintaining performance standards. While the growth rate is promising, the aviation market remains constrained by the high costs associated with biofuel production compared to conventional fuels. Nevertheless, the consistent push for greener travel is paving the way for future advancements in aviation biofuels.

Energy Generation

The energy generation is gradually gaining traction in the global biofuels market, primarily driven by renewable energy policies and the need for cleaner energy options. Biofuels, specifically solid biomass and biogas, can be effectively utilized for electricity production and heating. As countries transition away from fossil fuel sources to meet their renewable energy targets, biofuel applications for energy generation will see increased investment. However, the is competitive with other renewable sources like solar and wind energy, which may hinder its growth. Nonetheless, the potential for biomass to contribute to energy independence remains a solid proposition in moving toward sustainable energy sources.

Heating

The heating shows moderate growth within the biofuels market, mainly through the use of biodiesel and heating oils as substitutes for traditional fossil fuels. Increased focus on residential and industrial heating has propelled the demand for biofuels, especially in regions aware of climate requirements. Nonetheless, the faces challenges primarily due to the high efficiency and low cost of conventional heating sources, limiting broader adoption. Also, significant competition from natural gas remains, reducing the urgency to switch to biofuels in heating applications. While there is scope for expansion, particularly in regions with strong governmental incentives to adopt greener solutions, the 's growth potential is relatively capped.

Others

The 'Others' category encompasses various niche applications of biofuels, such as feedstock for chemical production and the generation of bioplastics. While these applications do exist, they are relatively small compared to the more prominent s like transportation and aviation. The growth potential is hindered by lack of widespread awareness and common usage patterns among consumers and industries. However, innovations and technological advancements aimed at diversifying biofuels' applications may create new opportunities in the future. As sustainability trends continue to gain traction, there may be an upward shift in interest for biofuels within these lesser-known applications, though it remains a smaller market overall.

Global Biofuels Market Regional Insights:

North America

North America is expected to dominate the Global Biofuels Market, primarily due to its advanced technological infrastructure, robust research and development initiatives, and supportive government policies aimed at promoting renewable energy. The United States, in particular, has a significant bioethanol and biodiesel production capability driven by its vast agricultural resources. The implementation of the Renewable Fuel Standard (RFS) has further incentivized the production and consumption of biofuels in the region, ensuring a steady growth trajectory. Additionally, increased consumer awareness and corporate sustainability goals are propelling investments in biofuel technologies, making North America a frontrunner in this sector.

Latin America

Latin America is poised to be a prominent player in the Global Biofuels Market, largely driven by its abundant natural resources and favorable climatic conditions for raw material cultivation. Countries like Brazil have established themselves as leaders in bioethanol production, particularly from sugarcane, and are benefiting from a strong domestic market and export opportunities. Government initiatives have further supported biofuel adoption, making it a crucial component of energy strategy in several Latin American countries. However, facing challenges such as infrastructure limitations and variability in agricultural output can affect sustained growth in this region.

Asia Pacific

The Asia Pacific region is rapidly emerging in the Global Biofuels Market, with nations like China and India investing heavily in biofuel production to decrease reliance on fossil fuels. Rising energy demands and increasing pollution levels have prompted governments to focus on renewable energy sources, particularly bioethanol and biodiesel. However, competition for agricultural land and food security concerns may pose hurdles. Despite this, supportive policies and an expanding biofuels infrastructure are shaping a positive outlook for the market in the coming years.

Europe

Europe has shown consistent growth in the Global Biofuels Market, driven by stringent regulations and commitments to reduce carbon emissions. The European Union has implemented various directives promoting the use of biofuels in transportation, significantly increasing market demand. Countries like Germany and France are leading in biodiesel production, utilizing rapeseed and other sustainable feedstocks. However, Europe faces challenges regarding feedstock availability and public acceptance, which could affect future growth, despite the strong policy support that underpins the sector.

Middle East & Africa

The Middle East & Africa region is currently the smallest contributor to the Global Biofuels Market but shows potential for growth. Several countries are exploring biofuels to diversify their energy sources amid fluctuating oil prices, while African nations are increasingly looking to biofuel as a solution to energy shortages. However, regulatory frameworks and technology adoption remain nascent, posing significant challenges. Investment in research and development, alongside supportive policies from local governments, can enhance the biofuel market in this region, but overall growth might still be limited compared to other regions.

Biofuels Competitive Landscape:

Central figures in the worldwide biofuels sector, encompassing manufacturers, tech innovators, and policy regulators, stimulate advancements, improve production efficacy, and shape regulatory environments to promote sustainability and address increasing energy requirements. Their cooperative efforts are vital for the progression of biofuel technologies and the broadening of market opportunities.

The major contributors to the biofuels sector comprise Archer Daniels Midland Company, POET LLC, Neste Corporation, Renewable Energy Group, Inc., Cargill, Incorporated, DuPont de Nemours, Inc., Bayer AG, Valero Energy Corporation, Gevo, Inc., and Abengoa Bioenergy. Furthermore, other prominent firms in this domain include Infinita Renovables, Inc., BioAmber Inc., Sweetwater Energy, Inc., Clariant AG, and Solazyme, Inc. Additionally, entities such as Biofuel Energy Corp., Pacific Ethanol, Inc., RSB Group, and Nova Labs play a vital role in shaping the market landscape.

Global Biofuels COVID-19 Impact and Market Status:

The Covid-19 pandemic drastically affected the global biofuels sector by leading to a drop in demand, largely due to mobility limitations and decreased transportation activities. This scenario resulted in lowered production levels and a decline in investments directed towards renewable energy initiatives.

The COVID-19 pandemic has profoundly influenced the biofuels industry, primarily due to supply chain disruptions and a significant drop in demand for transportation fuels. The lockdown measures led to a notable decline in mobility, which correspondingly reduced fuel consumption and affected biofuel production, resulting in decreased market prices. Additionally, many biofuel facilities were temporarily shuttered or reduced their operational capacities, creating an oversupply of raw materials such as corn and sugarcane and thereby impacting agricultural markets adversely. On the other hand, the crisis has reignited interest in sustainability and cleaner energy solutions, which could enhance the long-term prospects for biofuels as nations pursue recovery strategies centered around greener initiatives. The implementation of government policies and incentives aimed at promoting renewable energy has gained prominence, indicating a potential recovery in the biofuels sector as countries emphasize the transition toward more sustainable energy practices. In summary, while the pandemic presented immediate challenges to the biofuel market, it could also catalyze a shift towards sustainable energy solutions in the future.

Latest Trends and Innovation in The Global Biofuels Market:

- In July 2023, Renewable Energy Group, Inc. announced its acquisition by Chevron Corporation for $3.15 billion, aiming to enhance Chevron's biofuel production capabilities and bolster its sustainable energy portfolio.

- In January 2023, TotalEnergies launched its first biojet fuel production facility in France, with an annual capacity of 200,000 tons, positioning itself as a leader in the aviation biofuels market.

- In October 2022, Neste announced the commencement of a major expansion at its renewable diesel plant in Singapore, which is expected to add 1.3 million tons of production capacity by early 2024.

- In August 2022, biogas company, Bioenergy Infrastructure Group (BIG), acquired a stake in a new biogas facility in Scotland as part of its strategy to increase renewable natural gas production and meet carbon neutrality goals.

- In September 2021, DSM and Pannonia Bio agreed to cooperate on the development of a biorefinery project that aims to produce biofuels and animal feed, promoting circular economy targets within Europe.

- In November 2021, Vivergo Fuels began operating a new advanced biofuel production plant in the UK designed to convert low-grade feedstocks into high-quality bioethanol and animal feed.

- In March 2021, Los Angeles-based Renewable Energy Group, Inc. unveiled plans to build a new biodiesel production facility in Louisiana, expected to be commissioned by mid-2022, enhancing regional biofuel output.

- In January 2020, Archer Daniels Midland Company (ADM) announced the acquisition of Soybean Processing assets from a competitor, strengthening its position to produce biodiesel from soy oil and expand its biofuels market footprint.

Biofuels Market Growth Factors:

The expansion of the biofuels sector is driven by several key elements, such as a ened awareness of environmental issues, regulatory frameworks from governments that encourage renewable energy sources, and innovations in the technologies used for biofuel production.

The biofuels sector is witnessing robust expansion, fueled by several pivotal influences. Primarily, there is a ened global focus on renewable energy as a strategy to combat climate change, which is increasing the demand for biofuels as more sustainable options compared to traditional fossil fuels. Supporting this trend are governmental policies and incentives aimed at cutting down greenhouse gas emissions, with numerous countries enforcing regulations that mandate the inclusion of biofuels in petrol and diesel. Furthermore, innovations in biomass sourcing and processing techniques have enhanced the efficiency and cost-effectiveness of biofuel production, spurring further development and capital investment in the industry.

The growing consciousness surrounding energy security, alongside volatile oil prices, is also promoting a transition to home-grown biofuels, which offers both economic advantages and a reduction in reliance on foreign oil supplies. Additionally, the automotive sector’s commitment to improving fuel efficiency and the increasing prevalence of flexible-fuel vehicles are driving up biofuel usage. Finally, escalating investments in the research and development of advanced biofuels—particularly second and third generations—are paving the way for more sustainable production practices, thereby enhancing the market's potential. Altogether, these elements are contributing to a vibrant and evolving biofuels market, marked by rapid advancements and growth.

Biofuels Market Restaining Factors:

The biofuels market faces significant challenges, including elevated production expenses, restricted access to feedstock resources, and competitive pressures from traditional fossil fuels.

The biofuels sector encounters numerous challenges that impede its expansion, notably the competitive pressure from fossil fuels, which typically offer lower prices and benefit from established infrastructure. Variations in commodity prices can render biofuel manufacturing less economically feasible, particularly for sources such as corn and sugarcane. Moreover, discussions regarding land utilization raise issues related to food security and ecological consequences, as the cultivation of biofuels may contribute to deforestation and a decline in biodiversity. Regulatory impediments also significantly impact the sector, with fluctuating government policies and subsidies disrupting market consistency and deterring investments. Furthermore, technological challenges, including the requirement for sophisticated processing techniques, can elevate production expenses and hinder efficiency. Nevertheless, technological progress and an increasing focus on environmental sustainability present avenues for growth within the biofuels market. As sustainable methodologies become more prevalent, the industry is likely to adjust, seek alternative feedstock sources, and refine production processes, paving the way for a biofuels future that supports global energy transition objectives.

Key Segments of the Biofuels Market

By Product:

- Biodiesel

- Ethanol

- Wood Pellets

- Others

By Form:

- Solid Biofuel

- Liquid Biofuel

- Gaseous Biofuel

By Feedstock:

- Corn

- Sugarcane

- Vegetable Oils

- Others

By Application:

- Transportation

- Aviation

- Energy Generation

- Heating

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America