Market Analysis and Insights:

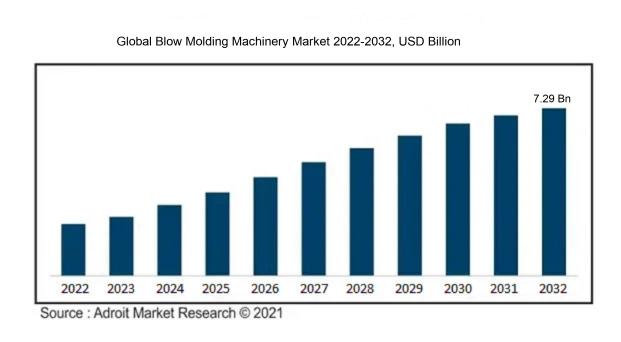

In 2022, the valuation of the blow molding machinery market stood at USD 5.01 billion. Over the decade from 2022 to 2032, this market is projected to expand at a compound annual growth rate (CAGR) of 3.81%, reaching an estimated USD 7.29 billion by the end of the period.

A multitude of interconnected factors are propelling the growth of the blow molding machinery market. The increasing need for packaging solutions across sectors such as food and beverages, pharmaceuticals, and consumer goods is a primary catalyst, driven by the necessity for cost-effective packaging that preserves product quality and enhances brand differentiation. Changing consumer lifestyles and rising purchasing power are leading to greater demand for aesthetically pleasing and innovative packaging. The industry is also moving toward more sustainable and eco-friendly practices, emphasizing recyclable and lightweight packaging to reduce carbon footprints. Further growth is spurred by technological innovations in blow molding machinery, including advanced control systems, energy-saving features, and automation, which boost productivity and lower production costs.

Blow Molding Machinery Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 7.29 billion |

| Growth Rate | CAGR of 3.81% during 2022-2032 |

| Segment Covered | By Type, By Application,By Raw Material,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Milacron Holdings Corp., Krones AG, Nissei ASB Machine Co., Ltd., Aoki Technical Laboratory, Inc., Kautex Maschinenbau GmbH, Bekum Maschinenfabriken GmbH, Sidel Group, Amsler Equipment Inc., Sacmi Imola S.C., and Parker Plastic Machinery Co. Ltd. |

Market Definition

The production of hollow plastic products utilizes blow molding machinery, a process in which a heated plastic tube, or parison, is expanded within a mold. This method is widely used for manufacturing various items including bottles, containers, and other plastic products.

Blow molding machinery is essential in various industries for the efficient large-scale production of plastic containers and products. This technology is crucial for cost-effective manufacturing of diverse items like bottles, drums, containers, and automotive parts. The blow molding process shapes hollow plastic objects by inflating molten plastic inside a mold, resulting in uniform and robust products. The equipment's versatility in producing products of different shapes and sizes offers manufacturers customization options and flexibility. Additionally, the use of recycled materials in blow molding supports sustainable practices, reducing the environmental impact of plastic production. The equipment's role is vital in high-volume production, customization, and sustainability, meeting the diverse needs of various industries.

Key Market Segmentation:

Insights On Key Type

Injection Stretch

The Injection Stretch is poised to lead the Global Blow Molding Machinery market. This machinery type is favored for its ability to enhance strength, clarity, and complexity in shapes. It is predominantly utilized in the packaging industry to manufacture bottles and containers, with growing demand for lightweight, durable, and visually appealing packaging solutions fueling its market growth.

Extrusion

Extrusion blow molding is another part of the Global Blow Molding Machinery market. This type of blow molding machinery is commonly used for high-volume production of hollow plastic products such as bottles, containers, and automotive parts. While it offers cost advantages and versatility in design, the Extrusion blow molding part is expected to face some challenges in terms of product strength and clarity compared to Injection Stretch blow molding.

Injection

The Injection blow molding part is also a part of the Global Blow Molding Machinery market. This type of blow molding machinery is commonly used for the production of small, complex plastic components such as medical devices, automotive parts, and toys. Injection blow molding offers precision, consistency, and high production efficiency. However, it may have limitations in terms of larger product sizes and volume production compared to Injection Stretch blow molding.

Insights On Key Application

Packaging

The packaging sector is anticipated to be a dominant force in the global blow molding machinery market. Blow molding machinery is integral to packaging applications across various industries including food and beverages, pharmaceuticals, and consumer goods. The sector's growth is driven by the need for lightweight, cost-efficient, and sustainable packaging solutions. As the focus on minimizing plastic waste and enhancing packaging efficiency intensifies, demand for blow molding machinery in the packaging industry is expected to surge.

Consumable

The consumable part is another significant part of the global blow molding machinery market. Consumables refer to products that are regularly used up or replaced, such as bottles, containers, and other disposables. This part encompasses applications in industries such as food and beverages, personal care, and household products. The demand for blow molding machinery to produce consumable items is driven by factors like changing consumer lifestyles, increasing disposable income, and a growing preference for convenience and on-the-go packaging solutions.

Automotive

The automotive part also holds a notable share in the global blow molding machinery market. Blow molding machinery is utilized to manufacture various automotive components such as fuel tanks, air ducts, and interior trims. The automotive industry's focus on light weighting, fuel efficiency, and reducing emissions has increased the demand for blow molded plastic parts. As a result, the usage of blow molding machinery in the automotive sector is expected to grow substantially in the coming years.

Electronics

The electronics part is another important part of the global blow molding machinery market. It involves the production of plastic housings, cases, and enclosures for electronic devices such as smartphones, tablets, and home appliances. With the continuous advancement of the electronics industry and the increasing adoption of electronic devices worldwide, the demand for blow molding machinery in the electronics sector is projected to witness significant growth.

Construction

The construction part has a significant presence in the global blow molding machinery market as well. Blow molding machinery is utilized to manufacture various construction-related products like pipes, tanks, and containers. The construction industry's increasing need for durable, corrosion-resistant, and cost-effective plastic products has driven the demand for blow molding machinery in this sector. Additionally, the expanding construction activities in developing economies and the rising adoption of plastic-based construction materials further contribute to the growth of this part.

Other

The other part encompasses applications of blow molding machinery that are not specifically categorized under packaging, consumable, automotive, electronics, or construction. This part may include unique and niche applications across various industries, such as healthcare, agriculture, and industrial packaging. While the exact dominating factor for this part cannot be determined without specific data, it represents diverse opportunities for blow molding machinery in different fields. The growth potential of this part depends on the specific needs and emerging trends within these industries.

Insights On Key Raw Material

Polyethylene (PE) : Polyethylene (PE) is projected to dominate the Global Blow Molding Machinery market due to its extensive use across industries such as packaging, automotive, and construction. PE's attributes like durability, flexibility, and affordability are increasing its demand for the production of bottles, containers, and packaging materials, thereby driving the growth of the blow molding machinery market.

Polyethylene Terephthalate (PET): PET is extensively used in the packaging industry, particularly for beverage bottles. The demand for PET bottles is growing due to the rising consumption of packaged beverages globally. However, the dominance of PE in other applications limits the growth potential of PET in the blow molding machinery market.

Polypropylene (PP): PP is another widely used material in various applications, including packaging, automotive parts, and consumer goods. However, the dominance of PE and its superior properties in terms of flexibility and cost-efficiency restricts the growth of PP in the blow molding machinery market.

Polybutylene Terephthalate (PBT): PBT is commonly used in electrical and electronic components due to its excellent electrical insulation properties. However, the limited application scope of PBT in blow molding compared to other materials hinders its dominance in this market.

Polyvinyl Chloride (PVC): PVC is mainly used in construction and automotive applications. Its rigid nature and chemical resistance make it suitable for pipes, fittings, and automotive components. However, the limited use of PVC in blow molding applications restricts its dominance in the market.

Polystyrene (PS): PS is commonly used in packaging and insulation applications. It offers good thermal resistance and insulation properties. However, the lower demand for PS in blow molding compared to other materials limits its dominance in this market.

Others: This category includes other raw materials, such as polycarbonate and acrylic, which have limited usage compared to the dominant materials mentioned above. The limited demand for these materials in blow molding applications restricts their dominance in the market.

Insights on Regional Analysis:

North America

North America is likely to maintain its lead in the global blow molding machinery market. This dominance can be attributed to the growing demand for blow-molded products in various industries, including packaging, automotive, and consumer goods. The region boasts a robust manufacturing base and continuous technological advancements, which bolster its market position. Additionally, strict regulations on product quality and safety in North America are promoting the adoption of advanced blow molding machinery.

Latin America

Latin America is witnessing significant growth in the blow molding machinery market. The region's expanding consumer goods and packaging industries are driving the demand for blow molded products, thereby fueling the need for blow molding machinery. Moreover, favorable government initiatives and increasing investment in manufacturing infrastructure are further propelling the market growth in Latin America.

Asia Pacific

Asia Pacific is a rapidly growing region in the blow molding machinery market. The increasing population, rising disposable income, and growing urbanization in countries like China and India are driving the demand for blow molded products in various industries such as packaging, automobile, and construction. Moreover, the region's cost-effective manufacturing capabilities and favorable investment policies make it an attractive market for blow molding machinery.

Europe

Europe is witnessing a steady growth in the blow molding machinery market. The region has a strong automotive sector, which drives the demand for blow molded products such as automotive components and fuel tanks. Additionally, the increasing demand for sustainable packaging solutions and strict regulations regarding product safety contribute to the market's growth in Europe.

Middle East & Africa

The blow molding machinery market in the Middle East & Africa region is experiencing moderate growth. The rapid industrialization and infrastructural development in countries like Saudi Arabia, UAE, and South Africa drive the demand for blow molded products in sectors such as packaging, construction, and automotive. However, factors like limited technological advancements and political instability in some parts of the region pose challenges to the market growth.

Company Profiles:

Key figures in the global Blow Molding Machinery sector play a pivotal role in driving innovation, technological advancements, and the production of high-quality blow molding machinery to meet the demands of various industries worldwide. Their efforts are amplified by strategic initiatives aimed at expanding market presence through partnerships and acquisitions.

Key players in the blow molding machinery sector include Milacron Holdings Corp., Krones AG, Nissei ASB Machine Co., Ltd., Aoki Technical Laboratory, Inc., Kautex Maschinenbau GmbH, Bekum Maschinenfabriken GmbH, Sidel Group, Amsler Equipment Inc., Sacmi Imola S.C., and Parker Plastic Machinery Co. Ltd. These companies are renowned for their expertise in manufacturing and providing a broad spectrum of products and services tailored to various sectors. Their efficient, high-quality machines significantly contribute to meeting the increasing demand for advanced equipment, thus driving the development and progress of the global blow molding machinery market.

COVID-19 Impact and Market Status:

The worldwide blow molding machinery industry has faced notable challenges as a result of the Covid-19 pandemic, causing supply chain disturbances and a decrease in the need for final products.

The blow molding machinery market has experienced significant transformations due to the effects of the COVID-19 pandemic. Initial disruptions in the global supply chain caused delays in the production and delivery of machinery components, and many manufacturing facilities were temporarily shut down or operated at reduced capacity due to strict lockdown measures. This led to a decline in machinery demand. Economic uncertainties caused by the pandemic also led to reduced industry investments in capital expenditures. However, as situations improved and economies reopened, the demand for packaging solutions, especially in healthcare and food & beverage sectors, began to rise, potentially aiding the market's recovery. Manufacturers are now focusing on developing innovative and automated machinery to adapt to evolving consumer needs and preferences. Although market growth post-pandemic is expected to be steady, it is projected to occur at a slower rate than in previous years.

Latest Trends and Innovation:

- In November 2020, Milacron Holdings Corp., a leading manufacturer of injection molding machines, announced its acquisition by Hillenbrand, Inc. to form a new company called Milacron Holdings Corp.

- In August 2020, Kautex Maschinenbau, a subsidiary of the German packaging manufacturer, Gerhard Schubert GmbH, introduced the world's first all-electric blow molding machine for the production of plastic packaging.

- In June 2019, Sidel Group, a leading provider of packaging solutions for the food, beverage, and home care industries, acquired PET Engineering, an Italian company specialized in the design and engineering of PET containers.

- In April 2019, Nissei ASB Company, a manufacturer of injection stretch blow molding machines, introduced the "1.5-step" technology, which enables the production of PET containers with significantly reduced energy consumption.

- In January 2018, Husky Injection Molding Systems, a global supplier of injection molding equipment and services, announced the acquisition of the closure mold maker, KTW Group, to strengthen its product portfolio and expand its presence in the beverage packaging market.

- In October 2017, Graham Engineering Corporation, a global leader in blow molding and extrusion blow molding systems, acquired American Kuhne, a manufacturer of extrusion systems for the medical, packaging, and automotive industries, to expand its product offerings.

- In September 2016, Sipa, an Italian company specializing in the design and manufacturing of PET and container manufacturing systems, introduced the Xform Gen4 XP platform, which features a higher productivity and improved energy efficiency for blow molding operations.

- In March 2015, Bekum America Corporation, a provider of blow molding machinery, launched the EBlow 367 DL, a dual-layer blow molding machine capable of producing containers with up to 5-gallon capacities.

- In December 2014, Jomar Corp., a manufacturer of injection blow molding machines, introduced the IntelliDrive Series, which utilizes a servo-driven hydraulic system to increase energy efficiency and improve machine control.

Significant Growth Factors:

The market for blow molding machinery is experiencing growth due to factors like the rising need for eco-friendly and lightweight packaging solutions across multiple sectors, continuous technological progress, and expanding financial ventures in the packaging sector.

The blow molding machinery sector is experiencing notable growth, driven by several key factors. The increasing demand for plastic products across various sectors such as packaging, automotive, and consumer goods is a major driver. The blow molding process offers cost-effective and efficient solutions for producing items like plastic bottles and containers, boosting machinery demand. The expanding food and beverage industry, especially in emerging markets, is significantly contributing to market growth. Additionally, increasing consumer awareness about environmental sustainability is encouraging the use of recyclable and eco-friendly packaging options. Technological advancements in blow molding, such as automation and robotics, are also enhancing manufacturing efficiency and productivity, further fostering market expansion.

Restraining Factors:

The significant upfront capital investment and the scarcity of proficient operators are identified as potential constraints for the blow molding machinery sector.

Several factors are impeding the growth and progress of the blow molding machinery market. The high initial capital investment required for setting up blow molding machinery facilities is a major deterrent for potential investors. The advanced technology and cost of the machinery itself present significant financial barriers. Additionally, a shortage of skilled labor is a challenge, as proficient operation and maintenance of blow molding machinery require specialized expertise. Stringent regulations and environmental concerns about plastic waste further complicate the market landscape, imposing additional costs and challenges for manufacturers.

Moreover, competition from alternative packaging materials like paper-based or biodegradable options is diverting attention from plastic, impacting demand for blow molding machinery. Despite these challenges, the market holds considerable potential for growth. Ongoing technological advancements are improving machinery efficiency and productivity, making it more attractive to investors. Moreover, the sustained demand for plastic packaging in sectors like food and beverages, healthcare, and cosmetics offers opportunities for market innovation and the development of sustainable solutions, opening new pathways for growth.

Key Segments of the Blow Molding Machinery Market

Type

- Extrusion

- Injection

- Injection

Application

- Packaging

- Consumable

- Automotive

- Electronics

- Construction

- Other

Raw Material

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinyl chloride (PVC)

- Polystyrene (PS)

- Other

Regional Overview

North America

- United States

- Canada

- Mexico

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America