Market Analysis and Insights:

The market for Bone Densitometers was estimated to be worth USD 350 million in 2024, and from 2024 to 2034, it is anticipated to grow at a CAGR of 2.5%, with an expected value of USD 439 million in 2034.

.jpg)

The market for bone densitometers is significantly influenced by the growing incidence of osteoporosis and various bone-related conditions, especially among older adults. With increasing life expectancy, there is a ened demand for early detection and preventive healthcare, which emphasizes the importance of precise bone density assessments. Furthermore, technological advancements, including the introduction of portable and more effective densitometers, have enhanced both accessibility and diagnostic ability, driving further market expansion. Increasing awareness regarding bone health, alongside proactive initiatives from healthcare organizations aimed at promoting preventive measures, is also contributing to a broader patient demographic. In addition, supportive government policies and reimbursement strategies for osteoporosis screening are vital to the market’s growth. Collectively, these elements foster a conducive environment for the expansion of the bone densitometer market, reflecting larger trends within healthcare that prioritize improved patient care and overall quality of life.

Bone Densitometers Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2034 |

| Study Period | 2023-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 439 million |

| Growth Rate | CAGR of 2.5% during 2024-2034 |

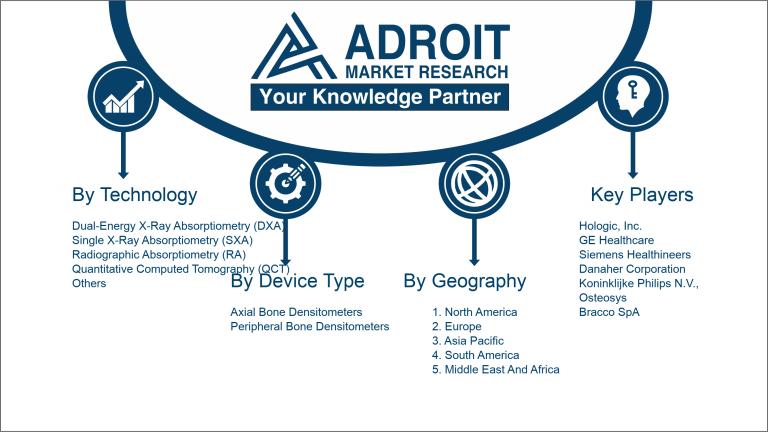

| Segment Covered | by Technology, by Device Type, by End-Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Hologic, Inc., GE Healthcare, Siemens Healthineers, Danaher Corporation, Koninklijke Philips N.V., Osteosys, Bracco SpA, Horizon Medical Products, Panasonic Healthcare Holdings Co., Ltd., FDEX, Inc., Medonica Co., Ltd., and Compumedics Limited. |

Market Definition

Bone densitometers are advanced medical instruments designed to evaluate bone mineral density, assisting in the determination of bone health and the likelihood of osteoporosis. These devices employ methods like dual-energy X-ray absorptiometry (DEXA) to deliver precise measurements of bone density.

Bone densitometers are essential instruments in the evaluation of skeletal health, specifically by quantifying bone mineral density (BMD), which is important for identifying disorders such as osteoporosis. These instruments employ dual-energy X-ray absorptiometry (DXA) technology to deliver precise assessments, aiding in the identification of individuals susceptible to fractures and various bone-related conditions. Early identification enables prompt intervention strategies, including changes in lifestyle and pharmaceutical treatments, that bolster bone integrity and mitigate fracture risks. With an aging population and a rise in bone disorders, the importance of bone densitometers escalates, making them vital resources for healthcare professionals in the enhancement of patient care concerning bone health.

Key Market Segmentation:

Insights On Key Technology

Dual-Energy X-Ray Absorptiometry (DXA)

The Dual-Energy X-Ray Absorptiometry (DXA) technology is expected to dominate the Global Bone Densitometers Market due to its high precision and reliability in measuring bone mineral density (BMD). DXA is considered the gold standard for osteoporosis diagnosis and monitoring, and it offers fast scanning times with low radiation exposure to patients. Its widespread adoption in clinical settings is further supported by its ability to evaluate body composition, making it favorable among healthcare professionals. The increasing prevalence of osteoporosis and related fractures worldwide drives the demand for DXA systems, solidifying its leading position in the market.

Single X-Ray Absorptiometry (SXA)

Single X-Ray Absorptiometry (SXA) is utilized primarily for peripheral bone density measurement, targeting areas like the wrist or heel. It is less commonly employed than DXA due to its specific applications and limitations in assessing total body bone density. While SXA can provide quick assessments and is portable, it lacks the comprehensive analysis that DXA offers. Consequently, its market presence remains modest compared to DXA.

Radiographic Absorptiometry (RA)

Radiographic Absorptiometry (RA) is another method that allows for the measurement of bone density using standard radiographs. RA leverages existing X-ray images to estimate bone mineral content, making it cost-effective and accessible. However, its accuracy is generally inferior to DXA, and it is not widely used for osteoporosis assessments. Therefore, while RA provides a convenient option in certain circumstances, its overall impact in the bone densitometry landscape is considerably limited when compared to more advanced technologies.

Quantitative Computed Tomography (QCT)

Quantitative Computed Tomography (QCT) is a specialized imaging technique that provides three-dimensional evaluations of bone density, particularly useful for assessing the trabecular bone. This method allows for detailed analysis and the detection of changes in bone structure but involves higher radiation exposure than DXA. Due to its complexity and reliance on advanced imaging systems, QCT is predominantly employed in research or specialized clinical settings, which restricts its broader market appeal compared to the more prevalent DXA technology.

Others

The Others category encapsulates various emerging technologies and methods used for bone density assessment, such as ultrasound and the usage of innovative imaging techniques. While these alternatives may offer unique advantages, such as lower radiation levels or cost-effective solutions, they currently hold a minor share in the market. The dominance of established methods like DXA greatly overshadows these newer technologies, limiting their competitive footprint within the bone densitometry market.

Insights On Key Device Type

Axial Bone Densitometers

Axial Bone Densitometers are expected to dominate the Global Bone Densitometers Market due to their superior accuracy and comprehensive analysis capabilities. These devices provide a higher precision in measuring bone mineral density (BMD) primarily in the spine, hip, and total body, which are critical areas for assessing osteoporosis risk. The increased prevalence of osteoporosis, particularly among aging populations, enhances the demand for such devices. Moreover, axial bone densitometers' advanced imaging technology and ability to identify fractures early contribute significantly to their market prominence. The alignment with healthcare providers' standards for effective patient management furthers their establishment as a preferred choice in clinical settings.

Peripheral Bone Densitometers

Peripheral Bone Densitometers serve a niche purpose in the bone health assessment market. These devices are primarily utilized for preliminary screening due to their portability and ease of use. While they do provide useful information about bone density, their ability to measure BMD is limited compared to axial devices, as they focus on extremities like the wrist or heel. This makes them less favorable for comprehensive osteoporosis management. Nevertheless, their affordability and convenience appeal to specific markets, particularly in outpatient settings, making them valuable in a particular patient demographic or in resource-limited environments.

Insights On Key Application

Osteoporosis and Osteopenia Diagnosis

The dominant area expected to lead the Global Bone Densitometers Market is the diagnosis of osteoporosis and osteopenia. This sector is propelled by the rising prevalence of osteoporosis worldwide, especially among the aging population. As awareness of bone health increases, more individuals are seeking early diagnosis and treatment options, which in turn drives demand for bone densitometers. Furthermore, advancements in technology have improved the accuracy and efficiency of bone density assessments, significantly increasing usage in clinical and home settings. The integration of preventive healthcare measures and growing government initiatives to combat osteoporosis will also contribute to the continuous growth of this.

Cystic Fibrosis Diagnosis

Cystic fibrosis diagnosis is a significant area, although it does not dominate the market. The need for accurate assessment of bone health is crucial in cystic fibrosis patients, as they are at increased risk for bone density loss. This area benefits from specialized diagnostic tools designed to monitor and manage the health of individuals with this genetic disorder. However, the volume of patients requiring routine DFS is relatively smaller than those diagnosed with osteoporosis, limiting its overall market share.

Body Composition Measurement

Body composition measurement is gaining traction as a crucial aspect of health assessment, especially with the growing focus on obesity and its related complications. Utilizing bone densitometry for evaluating body composition allows for comprehensive assessments of muscle mass, fat distribution, and bone density. While it constitutes an important , its appeal is still niche compared to more widespread diagnostic applications like osteoporosis. Thus, while experiencing growth, it remains secondary in comparison to the primary healthcare concerns.

Rheumatoid Arthritis Diagnosis

The area focused on rheumatoid arthritis diagnosis is essential but occupies a minor share of the market. Since patients with rheumatoid arthritis may face bone density loss due to inflammation and medication effects, the need for regular monitoring is crucial. However, the breadth of patients diagnosed with rheumatoid arthritis does not equate to that of osteoporosis, making it less dominant. As awareness around joint and bone health increases, this may see growth, but it currently remains overshadowed by the more prevalent osteoporosis diagnosis.

Others

The Others category represents a variety of less common applications in bone densitometry. These might include rare conditions impacting bone density or specific research applications. While this area does provide diversity in terms of product utilization, its overall impact on market growth is limited. As such, it is not a leading focus for most manufacturers or healthcare providers, making it significantly smaller compared to the aforementioned applications.

Insights On Key End-Use

Hospitals

The hospital is anticipated to dominate the Global Bone Densitometers Market due to the increasing prevalence of osteoporosis and other bone-related ailments that necessitate regular screening and diagnostic imaging. Hospitals typically have access to advanced technologies and offer comprehensive care, making them preferable for patients requiring multiple services in one location. Additionally, the rising demand for preventive healthcare solutions and the integration of bone densitometry into routine assessments within larger healthcare frameworks contribute to higher adoption rates in hospitals. As they represent the focal point for patient management and provide multidisciplinary approaches, hospitals are expected to remain the leading end user in this market.

Specialty Clinics

The specialty clinics is witnessing growth as they offer targeted care and specialized treatments for conditions like osteoporosis. These clinics provide tailored services which may enhance patient adherence and outcomes. Additionally, advancements in diagnostic technologies have made it easier for specialty clinics to implement bone densitometry services, allowing for rapid assessments. Moreover, as patients seek more focused attention and expertise, the popularity of specialty clinics continues to rise, although this will likely remain behind the hospital sector in terms of market share.

Diagnostics and Imaging Centers

Diagnostics and imaging centers play a crucial role in the bone densitometry market by offering state-of-the-art facilities for bone health assessments. These centers provide accessible, dedicated services for patients requiring bone density tests, supporting patients who prioritize convenience and quick results. However, despite their essential contributions to diagnostics, they generally do not provide comprehensive care like hospitals do, often referred patients for further evaluation. Thus, while they are growing in importance within the healthcare landscape, their market dominance is eclipsed by the more extensive capabilities of hospitals.

Others

The Others category, which includes diverse healthcare facilities such as research institutions and mobile unit services, is essential for niche market requirements and emerging trends in bone health assessments. These entities often invest in innovative technologies and may offer unique insights into patient management and epidemiological research. However, their limited scale and reach compared to hospitals and specialized centers often constrain their market presence. Consequently, while they can address specific needs within the bone densitometry market, they do not command a substantial share relative to more established care providers.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Bone Densitometers market primarily due to advanced healthcare infrastructure, higher disposable income, and a significant prevalence of osteoporosis and other bone-related disorders among its aging population. The presence of major manufacturers and ongoing technological advancements further bolster the region's market growth. Additionally, increased awareness regarding bone health and the importance of early diagnosis contributes to a rise in demand for bone densitometry devices. North America's focus on research and development, coupled with favorable reimbursement policies, positions it as the leader in this market.

Latin America

Latin America is experiencing a gradual expansion in the Bone Densitometers market, driven by increasing healthcare access and investment in medical technologies. The rising prevalence of osteoporosis and related diseases, particularly among the elderly, is encouraging governments and healthcare providers to prioritize bone health initiatives. Moreover, there is a growing trend toward adopting advanced medical imaging technologies and diagnostic devices. However, challenges such as economic disparities and infrastructure limitations may impede market growth in some regions.

Asia Pacific

The Asia Pacific region shows significant potential for growth in the Bone Densitometers market, primarily due to a rapidly aging population and rising healthcare expenditures. Countries like China and India are witnessing increasing awareness regarding bone health and the importance of early diagnosis of bone-related disorders. Furthermore, the region's improving healthcare infrastructure and increasing government initiatives to promote preventive healthcare are expected to drive demand for bone densitometry devices. However, regulatory challenges and variations in healthcare access among countries could impact growth rates.

Europe

Europe exhibits a stable but competitive market for Bone Densitometers, characterized by advanced medical technologies and a high emphasis on preventive healthcare. The increasing prevalence of chronic diseases, along with strong government regulations supporting health screening programs, is likely to drive market expansion in this region. Additionally, the presence of key manufacturers and ongoing investment in research and development further enhances the competitive landscape. Nonetheless, market growth may be moderated by economic fluctuations and differences in healthcare policies across European countries.

Middle East & Africa

The Bone Densitometers market in the Middle East & Africa is still in its nascent stages but has substantial growth potential. The rising awareness about osteoporosis and related bone diseases, alongside increasing disposable incomes and healthcare expenditure, is helping drive the adoption of bone densitometry technology. However, challenges such as limited healthcare infrastructure and varying levels of access to medical technologies across countries pose significant hurdles. Despite these limitations, strategic investments in healthcare systems and growing international partnerships could positively influence market advancements in the medium to long term.

Company Profiles:

Prominent entities in the worldwide Bone Densitometers sector play a crucial role in fostering technological progress and innovation, leading to improved diagnostic precision and quality of patient care. These players utilize strategic partnerships, invest in research, and maintain a varied range of products to uphold their competitive edge and address the increasing health needs.

Prominent participants in the Bone Densitometers sector consist of Hologic, Inc., GE Healthcare, Siemens Healthineers, Danaher Corporation, Koninklijke Philips N.V., Osteosys, Bracco SpA, Horizon Medical Products, Panasonic Healthcare Holdings Co., Ltd., FDEX, Inc., Medonica Co., Ltd., and Compumedics Limited.

COVID-19 Impact and Market Status:

The Covid-19 pandemic had a substantial impact on the Global Bone Densitometers market, causing postponements of non-essential procedures and regular screenings. This resulted in a lowered demand for diagnostic devices at times when healthcare resources were under considerable pressure.

The COVID-19 pandemic had a profound effect on the bone densitometer sector, largely due to interruptions in healthcare services and a reduction in elective medical procedures. As hospitals focused on treating COVID-19 patients, many non-urgent appointments were postponed, resulting in a significant decrease in the demand for bone density assessments. Furthermore, the temporary shutdown of diagnostic facilities and a drop in patient visits adversely impacted the sales and utilization of these devices. Conversely, the ened awareness of osteoporosis and its related fractures during the pandemic led numerous healthcare providers to investigate remote monitoring and telehealth strategies for managing patients, potentially transforming the market landscape. Additionally, the increasing focus on preventive healthcare in the aftermath of the pandemic may rekindle interest in monitoring bone health, indicating a slow but steady recovery and potential expansion in the bone densitometer market as healthcare systems evolve to meet new operational challenges and patient requirements.

Latest Trends and Innovation:

- In October 2023, Hologic announced the launch of their new Horizon DXA System, incorporating advanced imaging technology for enhanced precision in bone density measurements. This system aims to improve patient comfort while offering clinicians better data for osteoporosis management.

- In September 2023, GE Healthcare completed its acquisition of Princy Health, enhancing its bone health diagnostic tools. This merger is expected to leverage Princy Health’s data analytics capabilities to improve the bone densitometry market's service offerings.

- In August 2023, Siemens Healthineers unveiled its updated version of the Luminos Agile Series X-ray system, which includes integration with bone densitometry features. This development is aimed at providing a more streamlined diagnostic workflow in the radiology department.

- In July 2023, Swiss company Wolf Healthcare entered into a partnership with the University of Zurich to develop next-generation ultra-high-resolution bone densitometry technology, focused on increasing sensitivity to small changes in bone mineral density.

- In June 2023, DexaScan launched an innovative software platform that utilizes machine learning algorithms for better predictive analytics in bone health assessment, marking a significant technological advancement in data interpretation in the bone densitometer market.

- In May 2023, OsteoScan received FDA approval for their portable bone densitometer, aimed at expanding access to osteoporosis screening in remote and underserved regions. This approval is expected to drive market penetration in areas with limited healthcare resources.

- In April 2023, Fujifilm announced an investment in new research initiatives focusing on hybrid imaging technologies that incorporate both optical and densitometry capabilities, aiming to enhance diagnostic accuracy for osteoporosis and related conditions.

Significant Growth Factors:

The expansion of the Bone Densitometers Market is propelled by a rising incidence of osteoporosis, technological innovations, and an aging demographic that is increasingly prioritizing preventive health measures.

The Bone Densitometers Market is witnessing robust growth influenced by a multitude of factors. Notably, the rising incidence of osteoporosis and related skeletal issues, particularly in the elderly, has significantly increased the demand for precise diagnostic solutions. Technological advancements have paved the way for the creation of advanced, user-friendly densitometers, making them more attractive to healthcare professionals and patients alike. Moreover, a growing focus on preventive healthcare and the importance of early diagnosis is leading to more frequent bone density assessments.

Government-backed initiatives and healthcare policies aimed at promoting screening programs further augment the market's growth. The incorporation of artificial intelligence and machine learning in diagnostic processes is fostering innovation, delivering more accurate results and enhancing patient care. Additionally, the surge in specialty clinics and diagnostic centers that utilize cutting-edge imaging technologies is likely to improve access to bone densitometry services.

Collaborative efforts between manufacturers and healthcare institutions are optimizing product distribution and aiding in market expansion. Finally, increased disposable incomes and healthcare spending in developing regions are widening market prospects, facilitating the broader adoption of bone densitometers. Overall, these elements are anticipated to significantly bolster the growth of the Bone Densitometer Market in the forthcoming years.

Restraining Factors:

Significant challenges in the Bone Densitometers market encompass the elevated expense of devices, rigorous regulatory requirements, and restricted reimbursement options.

The Bone Densitometers Market encounters a variety of challenges that may impede its expansion. A primary obstacle is the substantial cost linked to sophisticated bone densitometry devices, which can restrict availability for smaller clinics and healthcare institutions, especially in less developed areas. Additionally, the intricate nature of certain technologies may necessitate targeted training for healthcare staff, thereby increasing operational expenses and the demand for ongoing education. Another issue is market awareness; both patients and healthcare providers might not recognize the critical role of bone density assessments in thwarting osteoporosis and other skeletal issues. Regulatory challenges also contribute to the problem, as strict guidelines can prolong the approval timeline for new devices, hindering their timely market introduction. Moreover, competition from alternative diagnostic approaches can shift focus away from bone densitometry. Nevertheless, the rising incidence of osteoporosis and similar conditions, alongside technological advancements, is fostering improved solutions that could enhance market acceptance. With increasing awareness regarding bone health, the market is set for future growth, fueled by innovation and the movement towards personalized healthcare solutions, ultimately benefiting both patients and healthcare professionals.

Key Segments of the Bone Densitometers Market

Segmentation by Technology

- Dual-Energy X-Ray Absorptiometry (DXA)

- Single X-Ray Absorptiometry (SXA)

- Radiographic Absorptiometry (RA)

- Quantitative Computed Tomography (QCT)

- Others

Segmentation by Device Type

- Axial Bone Densitometers

- Peripheral Bone Densitometers

- Segmentation by Application

- Osteoporosis and Osteopenia Diagnosis

- Cystic Fibrosis Diagnosis

- Body Composition Measurement

- Rheumatoid Arthritis Diagnosis

- Others

Segmentation by End-Use

- Hospital

- Specialty Clinics

- Diagnostics and Imaging Centers

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America