Boron Fertilizers Market Analysis and Insights:

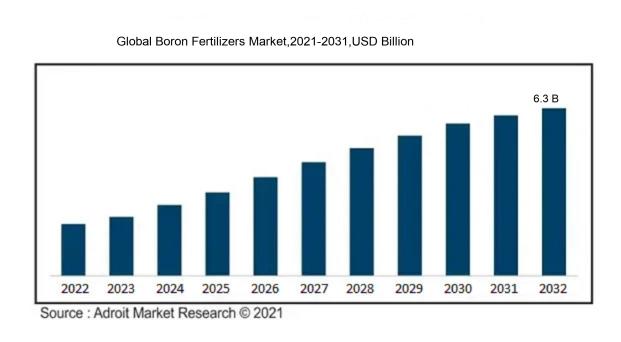

In 2023, the size of the worldwide Boron Fertilizers market was US$ 3.1 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 7.81 % from 2024 to 2032, reaching US$ 6.3 billion.

The Boron Fertilizers Market is significantly influenced by the rising demand for improved agricultural productivity and higher crop yields, especially in areas where boron is lacking in the soil. As the global population expands, the need for food increases, making the use of specialized fertilizers like boron critical for achieving sustainable agricultural practices. Additionally, ened awareness regarding micronutrient deficits in crops has led farmers to use boron fertilizers to promote optimal growth and health in their plants. Innovations in product formulation and application techniques have also played a vital role in market expansion, enhancing the accessibility and effectiveness of these fertilizers. Furthermore, government initiatives aimed at improving agricultural efficiency and promoting sustainable practices have strengthened the demand for boron fertilizers. The growth of the agribusiness sector in developing nations, coupled with rising investments in research and development, is poised to positively influence market trends, providing a solid foundation for the progress of boron-based fertilization methods in the future.

Boron Fertilizers Market Definition

Boron fertilizers serve as crucial nutrient enhancers that deliver boron, a micronutrient necessary for the growth and advancement of plants. These fertilizers improve both the yield and quality of crops by supporting essential functions like pollination and the absorption of nutrients.

Boron fertilizers are vital for agricultural practices because they significantly promote plant growth and overall development. As a micronutrient, boron is involved in several critical physiological functions, such as the formation of cell walls, the movement of sugars within the plant, and the regulation of hormones. This nutrient is especially advantageous for plants that flower and bear fruit, assisting in processes like pollination and seed formation. Insufficient boron levels can result in diminished growth, inferior fruit quality, and lower crop yields. Its application is essential in soils lacking boron, playing a role in sustainable farming techniques. Additionally, effective management of boron can enhance the efficiency of nutrient use, thereby reinforcing food security and boosting agricultural productivity across various ecosystems.

Boron Fertilizers Market Segmental Analysis:

Insights On Source

Boric Acid

Boric acid is expected to dominate the Global Boron Fertilizers Market due to its significant advantages in enhancing agricultural productivity and soil health. As a highly soluble source of boron, it allows for efficient nutrient uptake by plants. The increasing emphasis on sustainable farming practices and the need for optimized crop yield in various regions contribute to the growing preference for boric acid among farmers. In addition, boric acid has a stronger reputation for delivering immediate results in acid soils and is recognized for its role in reducing plant stress, making it a favorite among agronomists and crop producers.

Borax

Borax, though not as dominant as boric acid, still holds a vital position in the Global Boron Fertilizers Market. This naturally occurring mineral is popular for its slow-release properties, providing an extended boron supply to crops over time. Farmers often prefer borax for its lower cost and ease of handling, especially in large-scale operations. Its usage is particularly prominent in grain and fruit production, where sustained nutrient release is crucial for improving crop quality and yield. However, it may require careful management due to the risk of boron toxicity in some soils when overapplied.

Others

The "Others" category in the Global Boron Fertilizers Market encompasses various lesser-known sources of boron, such as extruded or processed boron compounds. While this currently holds a smaller market share, it plays a role for specialized applications within niche agricultural practices. Products falling under this category may include synthetic formulations or proprietary blends targeted at specific crops or soil conditions. Although not widely adopted, their unique features can attract particular markets focusing on precision agriculture and tailored nutrient solutions, creating potential growth opportunities in the future.

Insights On Application

Fruits and Vegetables

The fruits and vegetables market is expected to dominate the Global Boron Fertilizers market. This is primarily due to the increasing demand for high-quality produce globally, influenced by the rising health consciousness among consumers. Boron is crucial for the proper growth and development of fruits and vegetables as it helps in cell wall formation, flowering, and mobile nutrient uptake. Additionally, with the trend of organic farming and sustainable agriculture practices, farmers are increasingly leveraging boron fertilizers to enhance soil fertility and crop yield. Thus, the fruits and vegetables category is anticipated to hold the leading position in terms of boron fertilizer application.

Cereals and Grains

The cereals and grains category is significant in the agricultural sector, although it may not lead in boron fertilizer consumption. These crops require essential nutrients for optimal growth, and boron contributes to seed formation and development. However, the market's growth in this is tempered by the preference for nitrogen and phosphorus fertilizers, which are more commonly associated with cereals. Nonetheless, as the global food demand rises, attention to micronutrients like boron will grow, driving gradual adoption in cereals and grains.

Oilseeds and Pulses

Oilseeds and pulses play a vital role in agriculture and food supply, but they typically do not represent the largest application for boron fertilizers. While these crops benefit from boron, especially in terms of seed quality and oil production, the predominant focus on macro-nutrients sometimes overshadows the significance of micronutrients. As awareness grows around micronutrient deficiencies in soils, there may be an increase in boron application in oilseeds and pulses, but it will remain a secondary focus compared to fruits and vegetables.

Others

The 'Others' category, incorporating various non-specified crops, is relatively small in the context of the boron fertilizers market. While certain niche crops like nuts or specialty vegetables may demand boron for optimal growth, the volume of these crops pales in comparison to fruits, vegetables, cereals, and oilseeds. As agricultural practices evolve, the use of boron in lesser-known or less common crops could see some growth. However, it is unlikely to rival the more prominent categories that dominate the market today.

Global Boron Fertilizers Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Boron Fertilizers market due to the region's extensive agricultural activities supported by a large agricultural workforce and growing investment in modern farming practices. Rapidly increasing crop production demand driven by a rising population is propelling farmers to utilize micronutrients like boron to enhance yield efficiency. Additionally, countries like China and India are focusing on improving their soil health, further driving the application of boron fertilizers. The government's supportive policies and agricultural subsidies in these nations, coupled with significant technological advancements in fertilizer production, contribute to the growing market presence in this region.

North America

North America, particularly the United States and Canada, is experiencing a steady growth in the use of boron fertilizers due to advanced farming techniques and technological innovations in agriculture. Farmers in this region are increasingly aware of the importance of micronutrients in improving crop quality and increasing yields. The region's focus on sustainable farming practices, along with stringent environmental regulations, encourages the use of specialized fertilizers like boron to optimize crop growth while minimizing ecological impact. Furthermore, research advancements and regional agricultural programs support the incorporation of boron fertilizers in their agronomy practices.

Europe

Europe showcases a growing interest in boron fertilizers, driven by the increasing demand for sustainable agriculture and organic farming. European countries are implementing strict regulations on fertilizer usage that encourage the adoption of micronutrients to improve crop resilience and soil quality. There's a strong emphasis on integrating boron into nutrient management programs, especially in countries like Germany and France. Additionally, the rising awareness about soil health and its impact on food quality is propelling the growth of boron fertilizer applications, setting forth a positive trend in the European market.

Latin America

Latin America is emerging as a significant player in the global boron fertilizers market, mainly due to the increasing agricultural production in Brazil and Argentina. These countries are investing heavily in crop innovations and practices that require specialized fertilizers, including boron varieties. The need to boost crop yields in a region characterized by extensive agriculture underlines the relevance of boron fertilizers. Furthermore, the shift towards sustainable farming and awareness about micronutrient deficiencies in soils is encouraging farmers in Latin America to utilize boron fertilizers to enhance their crop outputs and ensure long-term soil viability.

Middle East & Africa

The Middle East & Africa region, while not the leading market for boron fertilizers, is gradually experiencing a surge in demand due to the increasing importance of agricultural production in water-scarce areas. Countries are beginning to understand the role of micronutrients like boron in improving crop resilience against climatic stressors, leading to a slow but steady adoption of such fertilizers. Efforts to increase agricultural productivity amidst rising population pressures and food security concerns are becoming more pronounced. However, challenges such as limited access to agricultural technology and education could hinder rapid growth in this region, making it lesser in terms of dominance compared to others.

Boron Fertilizers Market Competitive Landscape:

Leading participants in the worldwide boron fertilizers sector play a crucial role in fostering innovation, manufacturing, and the distribution of boron-infused products. They focus on improving agricultural productivity and soil vitality. Their strategic partnerships and commitments to research and development are essential to satisfy the increasing agricultural demands.

The boron fertilizers sector is primarily dominated by players such as Axiom Chemicals, Borax Argentina S.A., G. C. B. (Gadepan), Eti Maden, and U.S. Borax Inc., which operates as a subsidiary under Rio Tinto. Other prominent companies in this field include American Borate Company and Yara International ASA. Additionally, significant contributors such as Solvay S.A., Haifa Group, and the Mosaic Company also play a vital role. Firms like Gujarat Boron Derivatives Limited and BoroMax, a subdivision of BoroMax Agronomics, further enhance the landscape of this industry. Collectively, these entities are crucial to the production and distribution of boron fertilizers around the world, catering to agricultural demands in diverse regions.

Global Boron Fertilizers Market COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted the worldwide boron fertilizer industry by causing disruptions in supply chains and altering agricultural methods, resulting in variable demand and shifts in pricing structures.

The COVID-19 pandemic had a profound effect on the boron fertilizers industry, primarily due to interruptions in supply chains, workforce shortages, and variable demand within agricultural sectors. The implementation of initial lockdowns resulted in a slowdown of agricultural operations and hindered both production and distribution processes, which temporarily decreased sales of boron fertilizers. Nonetheless, as the agricultural sector began to recover—propelled by a ened need for food—the market showed signs of revival. Additionally, government stimulus initiatives and a renewed focus on food security contributed to an uptick in fertilizer usage. The pandemic also accelerated the transition towards sustainable agricultural practices, spurring greater interest in specialized fertilizers that include boron. Consequently, while the immediate effects posed challenges to market stability, the long-term prospects appear promising, driven by an increasing recognition of the importance of soil health and crop yield, which is expected to bolster the demand for boron fertilizers in an improving agricultural environment.

Latest Trends and Innovation in The Global Boron Fertilizers Market:

- In July 2023, Imerys announced the acquisition of Boron and the Industrial Minerals business of the Brazilian company, Minerações Leão, expanding their presence in the boron fertilizers market in South America.

- In June 2023, Nutrien launched a new line of boron-enriched fertilizer products aimed at improving plant health and yield, utilizing innovative delivery methods designed for precision agriculture.

- In March 2023, Rio Tinto completed the expansion of their borate mine in California, increasing production capacity to meet the growing demand for boron fertilizers globally.

- In February 2023, Borax, a subsidiary of Rio Tinto, introduced a new product called "Borate Plus", a blended fertilizer that combines boron with essential micronutrients for enhanced crop performance.

- In January 2023, American Vanguard Corporation announced a strategic partnership with Yara International to develop new formulations of boron fertilizers tailored for various crop types, leveraging both companies' R&D capabilities.

- In November 2022, Eti Maden, a Turkish state-owned enterprise, signed a distribution agreement with U.S.-based supplier AgroLiquid to distribute their boron-based fertilizers across North America, increasing accessibility for farmers.

- In October 2022, the agricultural technology company, Nutrient Technologies, developed an advanced boron application method using drone technology to optimize the distribution of boron fertilizers in hard-to-reach areas, unveiling this innovation at the International Conference on Agronomy.

Boron Fertilizers Market Growth Factors:

The expansion of the Boron fertilizers market is primarily fueled by the rising demand for enhanced agricultural yields, the necessity for soils enriched with micronutrients, and a growing recognition of sustainable agricultural methods.

The boron fertilizers market is experiencing notable growth due to several influential factors. Foremost among these is the surging global requirement for food, driven by population increases, which demands enhanced agricultural techniques. Boron plays a vital role in crop nutrition and development, significantly impacting seed germination, flowering, and fruit quality—making it indispensable for achieving high agricultural yields. Furthermore, the rising incidence of micronutrient deficiencies in soils underscores the critical need for boron to maintain soil vitality and ensure superior crop productivity.

The proliferation of organic farming methods, which typically benefit from the application of micronutrient fertilizers, also supports the market expansion. Additionally, government initiatives that advocate for sustainable agricultural practices, alongside the integration of precision farming technologies, propel the adoption of boron fertilizers. Ongoing research and development aimed at creating more efficient boron formulations further improves their absorption and efficacy across various crops. Increasing recognition of boron's potential to alleviate plant stresses such as drought and disease further promotes its utilization in diverse agricultural settings. Collectively, these elements, coupled with ened investment in agricultural advancements, position the boron fertilizers market for significant growth in the forthcoming years.

Boron Fertilizers Market Restaining Factors:

Crucial limiting elements in the boron fertilizer sector encompass rigorous regulatory requirements and a scarcity of appropriate arable land.

The Boron Fertilizers Market encounters multiple challenges that could impede its expansion. A primary issue is the insufficient understanding among agricultural producers about the advantages of boron fertilizers, especially in areas where boron deficiencies are not widely acknowledged. Additionally, the volatility in the prices of raw materials can cause instability in production expenses, which may result in elevated prices for the final products. Environmental regulations regarding the use of chemical fertilizers can further limit the application of boron fertilizers in specific regions, given that excessive levels of boron can adversely affect plant health and soil condition. Furthermore, the presence of competing fertilizers and alternative farming practices adds to the difficulties, as growers might prefer more familiar or cost-effective solutions. The restricted availability of boron resources in various locations can also influence supply chains and access to these fertilizers. Nonetheless, the growing emphasis on sustainable farming practices and the increasing demand for improved crop yields offer substantial prospects for innovation and development within the boron fertilizers sector, indicating a bright outlook as awareness and advancements in technology progress.

Segments of the Boron Fertilizers Market

By Source

• Borax

• Boric acid

• Others

By Application

• Fruits and vegetables

• Cereals and grains

• Oilseeds and pulses

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America