Market Analysis and Insights:

The market for Bottled Water was estimated to be worth USD 255.2 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6.51%, with an expected value of USD 455.56 billion in 2032.

.jpg)

The market for bottled water is shaped by various factors that drive its growth. A primary catalyst is the escalating awareness of health among consumers. Given the growing apprehensions regarding the safety of tap water, individuals are opting for bottled water as a more secure and healthier option. Furthermore, the evolution of lifestyles and the element of convenience significantly contribute to the market's expansion. The busyness of modern schedules and the preference for on-the-go consumption have propelled bottled water into popularity as a convenient and easily accessible source of hydration. Additionally, the surge in the tourism and travel sector has ened the demand for bottled water, with travelers frequently relying on it due to uncertainties surrounding the availability and quality of tap water in different locales. Moreover, the market has seen a boost from product innovations like flavored and functional water, addressing changing consumer tastes and preferences for enhanced flavors and added health benefits. Finally, increased promotional efforts, expanded distribution channels, and upgraded packaging choices have further propelled the growth of the bottled water market.

Bottled Water Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 455.56 billion |

| Growth Rate | CAGR of 6.51% during 2024-2032 |

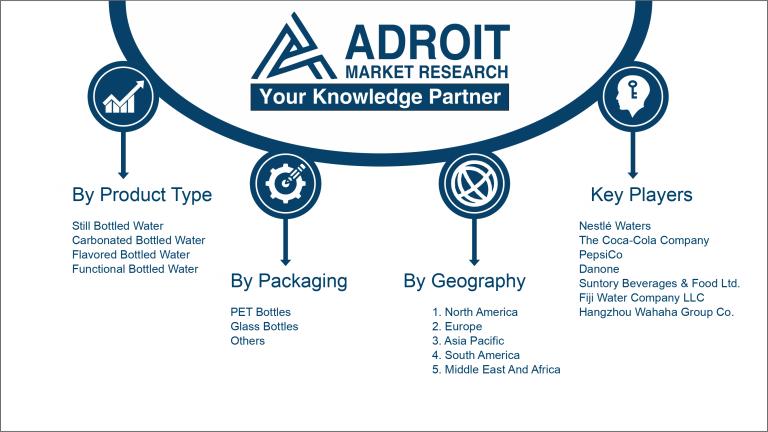

| Segment Covered | By Product Type, By Packaging,By Sales Channel ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nestlé Waters, The Coca-Cola Company, PepsiCo, Danone, Suntory Beverages & Food Ltd., Gerolsteiner Brunnen GmbH & Co. KG, Bisleri International Pvt. Ltd., Fiji Water Company LLC, Hangzhou Wahaha Group Co. Ltd., and Nongfu Spring Co. Ltd. |

Market Definition

Bottled water is defined as potable water that comes in plastic or glass receptacles, usually intended for purchase in retail settings. It serves as a practical and easily transportable choice for staying hydrated, often favored for its perceived cleanliness and flavor.

The significance of bottled water has been growing due to several factors. One key aspect is its provision of a convenient and portable supply of pure drinking water, particularly beneficial in regions with restricted access to safe potable water. This becomes critical in emergencies or places where tap water may be unsafe. Furthermore, bottled water serves as a reassurance to those worried about tap water quality, offering a dependable alternative. In addition, the ease of bottled water consumption enables individuals to maintain hydration levels on the move, whether at work, school, or during travels. Nonetheless, it is imperative to evaluate the environmental consequences of excessive plastic bottle use and to advocate for the adoption of reusable water bottles and eco-friendly packaging.

Key Market Segmentation:

Insights On Key Product Type

Flavored Bottled WaterFlavored Bottled Water is projected to dominate the Global Bottled Water market. Consumers are increasingly seeking more variety and flavor options in their beverages, and flavored bottled water offers a refreshing alternative to sugar-laden drinks. This is further driven by the growing health consciousness among consumers who prefer flavored water as a healthier choice compared to carbonated or sugary drinks. The availability of a wide range of flavors and the convenience of on-the-go consumption are expected to contribute to the dominance of flavored bottled water in the global market.

Still Bottled Water

Still bottled water remains a prominent part in the Global Bottled Water market. It appeals to consumers who prefer a more natural and non-carbonated option. Still bottled water is often perceived as a healthier choice due to its simplicity and lack of additives. The convenience of packaged still water for hydration purposes, especially in areas with poor water quality or limited access to clean drinking water, also drives the demand for this part.

Carbonated Bottled Water

Carbonated bottled water is another significant part within the Global Bottled Water market. It attracts consumers who enjoy the fizzy sensation and prefer a more refreshing and indulgent beverage option. The demand for carbonated bottled water is supported by the rise in health-consciousness, where consumers seek an alternative to sugary carbonated soft drinks. The increasing availability of flavored carbonated water with various fruit essences further fuels the popularity of this part.

Functional Bottled Water

Although not dominating the Global Bottled Water market, functional bottled water holds a niche market share. This part is characterized by water infused with additional ingredients such as vitamins, minerals, electrolytes, or antioxidants, designed to provide specific health benefits. Consumers who prioritize health and wellness and seek functional properties in their beverages often opt for functional bottled water. The increasing interest in nutritional supplementation and convenience contribute to the demand for this part.

Insights On Key Packaging

PET Bottles

PET Bottles are expected to dominate the global bottled water market. With their lightweight, reclosable, and shatterproof nature, PET bottles offer convenience and durability to consumers. The ease of transportation and lower production costs associated with PET bottles also contribute to their dominance in the market. Additionally, PET bottles are widely used by both small-scale and large-scale manufacturers, making them a preferred choice for packaging bottled water.

Glass Bottles

While PET bottles may dominate the market, glass bottles hold a significant share in the global bottled water market. Glass bottles are favored by consumers who prioritize sustainability and prefer a premium packaging experience. The perception of higher quality and the ability to preserve the natural taste of water are key factors driving the demand for glass bottles. However, glass bottles are heavier and more fragile compared to PET bottles, which leads to higher transportation costs and limits their market dominance.

Others

The Others category within the packaging of the global bottled water market includes alternative packaging materials and formats. This part encompasses various options such as aluminum cans, cartons, and pouches. While these packaging formats cater to niche consumer preferences, they have not gained significant traction to dominate the overall market. Factors such as limited availability, higher costs, and lesser brand recognition contribute to their lower market share compared to PET bottles and glass bottles. However, innovation and evolving consumer preferences may propel the growth of alternative packaging options in the future.

Insights On Key Sales Channel

Supermarkets/Hypermarkets

The Supermarkets/Hypermarkets part is projected to dominate the Global Bottled Water market. With their wide range of products and convenience for consumers, supermarkets and hypermarkets attract a large customer base. These retail outlets typically offer a dedicated section for bottled water, which further boosts the sales of this product. Moreover, the growing preference for one-stop shopping destinations and the increasing penetration of organized retail chains globally are expected to drive the dominance of the Supermarkets/Hypermarkets part in the Bottled Water market.

Convenience Stores/Drug Stores

The Convenience Stores/Drug Stores part is another significant part of the Global Bottled Water market. Convenience stores and drug stores are known for their easy accessibility and quick shopping experience. These outlets cater to consumers looking for convenience and immediate availability of everyday items, including bottled water. The ability of convenience stores and drug stores to cater to spontaneous buying behavior and their extended operating hours contribute to the substantial sales of bottled water in this part.

Grocery Stores/Club Stores

The Grocery Stores/Club Stores part holds a notable share in the Global Bottled Water market. Grocery stores and club stores offer a variety of products, including bottled water, to meet diverse consumer preferences. These stores typically attract customers looking for bulk purchases and discounted prices. Additionally, the convenience of finding bottled water along with other grocery items makes grocery stores and club stores an important sales channel for this product.

Foodservice

The Foodservice part represents a significant portion of the Global Bottled Water market. Restaurants, cafes, hotels, and other foodservice establishments serve bottled water as a primary beverage option to their customers. The demand for bottled water in foodservice outlets is driven by factors such as convenience, hygiene, and ready availability. As the foodservice industry continues to grow, the need for bottled water in this part is expected to remain substantial.

Others

The Others part comprises various sales channels that contribute to the Global Bottled Water market but do not fall into the previously mentioned categories. This part includes specialty stores, vending machines, online platforms, and other unconventional retail channels. While the individual contribution of each sales channel may be smaller compared to the dominant parts, the collective impact of these channels is significant in terms of overall market share. The increasing adoption of e-commerce and the rising popularity of specialty stores provide opportunities for bottled water sales in this part.

Insights on Regional Analysis:

North America

The North America region is expected to dominate the global bottled water market. The region has a high demand for bottled water, driven by factors such as increasing health consciousness among consumers and the convenience of on-the-go hydration. In addition, the presence of major bottled water companies with strong brand recognition and effective marketing strategies further contributes to the dominance of North America in the market. Moreover, the region has well-established distribution networks and a robust retail sector, ensuring wide availability of bottled water products.

Latin America

In Latin America, the bottled water market is witnessing significant growth. The region is driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for healthy beverage options. Moreover, changing lifestyles and a desire for on-the-go hydration are also contributing to the demand for bottled water. Additionally, the region's tropical climate, where access to clean drinking water can be a concern, further drives the consumption of bottled water in Latin America.

Asia Pacific

The Asia Pacific region is experiencing substantial growth in the bottled water market. Factors such as the rising population, urbanization, and a shift towards healthier lifestyles are driving the demand for bottled water in the region. Additionally, the increasing awareness about waterborne diseases and concerns regarding the quality of tap water further contribute to the growth of the market in Asia Pacific. Moreover, the region has several emerging economies, favorable demographics, and a strong presence of key players, which propel the growth of the bottled water market in this region.

Europe

Europe is another significant market for bottled water. The region's demand is driven by factors such as health consciousness, increasing consumer preference for convenient and on-the-go products, and the availability of a wide range of bottled water options. Additionally, concerns about the quality of tap water and an inclination towards more sustainable packaging solutions also contribute to the demand for bottled water in Europe. Furthermore, the region has strict regulations and standards for bottled water, ensuring product safety and quality, which further boost consumer confidence and drive market growth.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth in the bottled water market. Factors such as a hot climate, water scarcity, and inadequate access to safe drinking water contribute to the demand for bottled water in this region. The growing population, urbanization, and changing dietary patterns also drive the consumption of bottled water. Moreover, the rise in tourism and a growing middle-class population with increasing disposable incomes further augment the demand for bottled water in the Middle East & Africa region. Additionally, the availability of a wide variety of flavored and functional bottled water products also attracts consumers in this region.

Company Profiles:

Prominent entities such as Nestle Waters, Danone, and The Coca-Cola Company are influential figures in the worldwide bottled water sector. Their substantial distribution channels and established brand recognition propel market expansion by fostering product creativity and implementing robust marketing approaches.

Prominent contenders in the bottled water sector encompass Nestlé Waters, The Coca-Cola Company, PepsiCo, Danone, Suntory Beverages & Food Ltd., Gerolsteiner Brunnen GmbH & Co. KG, Bisleri International Pvt. Ltd., Fiji Water Company LLC, Hangzhou Wahaha Group Co. Ltd., and Nongfu Spring Co. Ltd. These renowned entities hold significant market positions, recognized for their superior quality and wide array of bottled water offerings. Nestlé Waters stands as a global giant in the bottled water industry, whereas The Coca-Cola Company and PepsiCo are key industry players with their distinct brands. Additionally, Danone, Suntory Beverages & Food Ltd., Gerolsteiner Brunnen GmbH & Co. KG, Bisleri International Pvt. Ltd., Fiji Water Company LLC, Hangzhou Wahaha Group Co. Ltd., and Nongfu Spring Co. Ltd. are also notable figures in the bottled water marketplace, meeting the needs of consumers on a global scale.

COVID-19 Impact and Market Status:

The global bottled water market has experienced a significant uptick as a result of the Covid-19 pandemic, attributed to ened consumer interest in secure and sanitary drinking choices.

The outbreak of the COVID-19 pandemic has brought about significant transformations in the bottled water sector. Concerns over health and hygiene have driven consumers to favor packaged water over tap water, resulting in a noticeable upsurge in sales and profits for companies in the bottled water industry. The implementation of lockdown measures and limitations on movement by governments have caused a reduction in the consumption of water from communal sources such as water coolers and fountains, bolstering the market for bottled water even further.

Nevertheless, challenges have emerged for the sector. Travel restrictions and the closure of dining establishments, cafes, and tourist attractions have led to a decline in the consumption of bottled water outside of the home. Moreover, the economic repercussions of the pandemic have impacted individual purchasing capabilities, potentially leading to a decrease in overall demand.

Latest Trends and Innovation:

• 2022 - Evian and Ball Corporation collaborate on a pilot program for refillable bottles made from sugarcane-based bioplastic.

• 2022 - Icelandic Glacial tests bottles made from algae-based materials.

• 2023 - Aquavitae develops personalized water droplets with customized flavors and health benefits.

• 2023 - Droplet utilizes microfluidics for precise water filtration and purification.

• 2024 - LARQ offers self-cleaning and temperature-controlled smart water bottles.

• 2024 - Hidrate integrates with fitness trackers and provides personalized hydration recommendations.

• 2021 - Culligan and Nestlé Waters offer water delivery subscriptions with refillable bottles and filtration systems.

• 2021 - Boxed Water expands its direct-to-consumer water delivery service.

• 2023 - Icelandic Glacial emphasizes its unique glacial water source and mineral profile.

• 2023 - Vermont Spring Water highlights its local sourcing and sustainable practices.

• 2022 - PepsiCo's LIFEWTR features added electrolytes and mood-boosting ingredients.

• 2022 - Bai Brands offers sparkling water infused with fruits and botanicals.

• 2023 - VeChain partners with Danone to track the source and sustainability of their bottled water.

• 2023 - OriginTrail implements blockchain solutions for transparency in water bottling supply chains.

• 2024 - Evian partners with SoulCycle to create a co-branded water bottle for fitness enthusiasts.

• 2024 - FIJI Water collaborates with yoga centers to launch a limited-edition bottle series.

Significant Growth Factors:

Factors driving the expansion of the bottled water industry encompass a rising awareness towards health, the convenience of its packaging, and a surging need for portable hydration options.

The bottled water industry has been witnessing substantial expansion for various reasons. Primarily, the surge in health awareness among individuals is amplifying the desire for bottled water, perceived as a healthier option compared to sugary beverages. Moreover, the escalating urban populace, especially in developing nations, is stimulating the craving for convenient and on-the-go drinks like bottled water. Furthermore, the growth in disposable incomes and shifting lifestyles is fostering the consumption of high-end bottled water variations. Concerns regarding the quality and safety of tap water in specific locations are also bolstering the growth of the bottled water sector. The wide array of flavors and innovative packaging techniques available are attracting consumers to opt for bottled water.

Additionally, the increasing instances of waterborne illnesses and the inadequacy of clean drinking water infrastructure in certain regions are driving the demand for bottled water. Finally, the flourishing tourism sector and the rise in outdoor activities are elevating the need for bottled water, given its convenience and portability as a hydration source. In essence, the bottled water industry is experiencing remarkable progress propelled by factors such as health consciousness, urbanization, rising incomes, water quality apprehensions, product advancements, and tourism trends.

Restraining Factors:

The growing awareness of environmental consequences and the trend towards adopting eco-friendly options present notable obstacles to the expansion of the bottled water industry.

The market for bottled water is experiencing growth due to increasing consumer desire for clean and convenient hydration options. However, it faces certain obstacles. One primary concern is the environmental impact of plastic bottle use, leading to a growing emphasis on sustainability. Consumers are becoming more environmentally conscious and are exploring alternatives like reusable bottles or filtered tap water. Another factor impeding growth is pricing, as bottled water tends to be more expensive than tap water, soda, or juice, which may discourage budget-conscious consumers.

The availability of public water sources and improving water quality in many areas also reduces the need for buying bottled water. Despite these challenges, the bottled water market is evolving. Strategies like utilizing sustainable packaging materials and emphasizing health benefits and convenience can help address environmental concerns and attract eco-minded consumers. By focusing on innovation and consumer engagement, the bottled water market can navigate these hurdles and remain successful in a changing landscape.

Key Segments of the Bottled Water Market

Market Overview

• Still Bottled Water

• Carbonated Bottled Water

• Flavored Bottled Water

• Functional Bottled Water

Packaging Overview

• PET Bottles

• Glass Bottles

• Others

Sales Channel Overview

• Supermarkets/Hypermarkets

• Convenience Stores/Drug Stores

• Grocery Stores/Club Stores

• Foodservice

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America