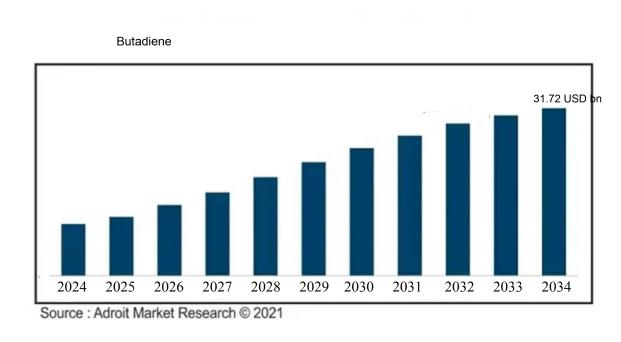

Butadiene Market Analysis and Insights:

The market for Butadiene was estimated to be worth USD 13.86 billion in 2024, and from 2025 to 2034, it is anticipated to grow at a CAGR of 9.9%, with an expected value of USD 31.72 billion in 2034.

The butadiene market is predominantly influenced by the rising demand for synthetic rubber, a crucial component in the automotive and tire manufacturing sectors. The expansion of the automotive industry, especially in developing nations, drives this demand as producers seek resilient and high-performance materials. Furthermore, the diverse applications of butadiene in the creation of plastics, resins, and fibers also play a significant role in propelling market growth. Innovations in extraction and processing technologies have improved production efficiency and lowered costs, enhancing the accessibility of butadiene. Additionally, government policies and initiatives that encourage the use of sustainable materials could pave the way for bio-based alternatives, thereby affecting the market dynamics. It's also important to note that variations in crude oil prices heavily influence butadiene manufacturing, given its derivation from petroleum. In summary, the interaction of industrial expansion, technological advancements, and price fluctuations is crucial in determining the future direction of the butadiene market.

Butadiene Market Definition

Butadiene is an odorless, combustible gas that serves mainly as a monomer in the synthesis of synthetic rubbers and plastics. It plays a crucial role in the creation of diverse materials, such as automotive tires and latex-based items.

Butadiene serves as a vital precursor in the rubber and plastics sectors, mainly for the development of synthetic rubber varieties, including styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR). These compounds are crucial for the fabrication of tires, automotive parts, and a range of consumer products due to their outstanding durability and flexibility. Additionally, butadiene plays a role in creating plastics such as acrylonitrile-butadiene-styrene (ABS), which are commonly found in household goods and electronic enclosures. Its adaptability further enhances its importance as a primary material in the chemical industry, where it contributes to the production of solvents, resins, and various intermediates, highlighting its pivotal role in worldwide manufacturing processes.

Butadiene Market Segmental Analysis:

Insights On Product Type

Styrene Butadiene Rubber

Styrene Butadiene Rubber (SBR) is anticipated to dominate the Global Butadiene Market due to its extensive usage in tire manufacturing, which continues to experience robust demand attributed to rising automotive production and increasing vehicle ownership worldwide. Furthermore, SBR's favorable properties such as durability, heat resistance, and excellent mechanical strength make it a preferred choice for various industrial applications. Additionally, the growth in infrastructure and construction activities, coupled with advancements in manufacturing technologies, further propel the market growth for SBR. Its versatility in applications across different industries confirms its position as the most compelling product type within the butadiene domain.

Butadiene Rubber

Butadiene Rubber is known for its exceptional resilience and aging stability, which makes it suitable for a variety of applications. However, its market share is consistently challenged by other synthetic rubbers that deliver comparable or superior performance characteristics. The use of Butadiene Rubber is often restricted in consumer-focused products compared to other synthetic options, somewhat limiting its growth. Nonetheless, it serves specific niche s where traditional rubber substitutes may fall short, keeping its relevance alive in the competitive landscape.

Acrylonitrile Butadiene Rubber

Acrylonitrile Butadiene Rubber (NBR) is primarily valued for its oil resistance and durability, making it a popular material in automotive and industrial applications. Although it maintains a stable market presence, its growth is relatively slower compared to other alternatives due to its higher cost and specific application requirements. As industries seek more cost-effective solutions, the uptake of NBR may be constrained. However, for specialized applications such as fuel handling and high-performance seals, NBR remains a critical product.

Nitrile Butadiene Rubber

Nitrile Butadiene Rubber is extensively used in various industrial applications, particularly for products requiring robust oil and fuel resistance. Despite its advantages, the growth potential is limited as manufacturers increasingly focus on alternative synthetic rubber types that demonstrate similar properties with added benefits such as lower costs or eco-friendliness. Consequently, Nitrile Butadiene Rubber's presence in the market is maintained primarily in less price-sensitive applications, where its unique characteristics can be capitalized upon.

Styrene Butadiene Latex

Styrene Butadiene Latex finds its application predominantly in coatings, adhesives, and textiles due to its excellent binding properties and versatility. However, the growth prospect for Styrene Butadiene Latex is comparatively moderate, hindered by strong competition from other polymer emulsions that provide similar benefits. Despite its essential role in several industries, shifting preferences towards more sustainable and environmentally friendly materials could negatively impact its market share, limiting expansive growth.

Hexamethylenediamine

Hexamethylenediamine, while an important industrial chemical, operates in a more marginal position within the broader butadiene landscape. Its applications are largely confined to specialized fields, such as the production of polyamides and as a curing agent in epoxy resins. As a consequence, the demand for Hexamethylenediamine is subject to fluctuations based on niche market trends rather than dominating industry trajectories. The limited scope of its applications might restrict its overall growth potential in comparison to other types derived from butadiene.

Insights On Production Process

C4 Hydrocarbon Extraction

C4 hydrocarbon extraction is expected to dominate the Global Butadiene Market due to its established efficiency and cost-effectiveness in the extraction process. This method utilizes a well-developed infrastructure that ensures a steady supply of hydrocarbons primarily sourced from natural gas and crude oil processing. With the increasing demand for butadiene in the manufacture of synthetic rubber and plastics, the C4 process sits strategically at the center of supply chains. Furthermore, advancements in extraction technologies lead to higher yields and lower environmental impact, reinforcing its competitive edge over other methods. The compatibility with existing petrochemical processes also makes C4 hydrocarbon extraction an appealing choice for manufacturers.

n-Butane Dehydrogenation

n-butane dehydrogenation offers a viable alternative for butadiene production, particularly with advancements in catalyst development improving process efficiency. However, its reliance on a consistent supply of n-butane can be a limiting factor. The process involves a chemical reaction where n-butane is converted to butylenes, which can then be further processed to yield butadiene. This method is advantageous for regions where n-butane is readily available. Nevertheless, the energy-intensive nature of dehydrogenation means that it may not compete effectively in pricing and output efficiency against more established methods like C4 hydrocarbon extraction.

From Ethanol

The production of butadiene from ethanol presents a sustainable and eco-friendly alternative, tapping into renewable resources. This method is gaining traction due to the increasing global focus on sustainability and reducing carbon footprints. Ethanol-derived processes utilize biomass and can lead to lower greenhouse gas emissions compared to traditional fossil fuel-derived methods. However, the ethanol production supply chain can be subject to fluctuations based on agricultural variables, which could impact consistency in butadiene production volumes. As the bio-based economy expands, this method may see increased interest, but its overall market share currently lags behind more conventional options.

From Butenes

Production from butenes involves the conversion of existing butenes into butadiene through various chemical reactions. While this method can be integrated into facilities already processing butenes, it faces challenges in sourcing sufficient feedstock. The efficiency of converting butenes into butadiene can vary significantly based on the manufacturing process, and market dynamics might lead to competition for butene supplies. Despite its potential benefits of utilizing existing chemicals, the market for butenes is not as robust as that for C4 hydrocarbon extraction, limiting the expansion prospects for this approach in the Global Butadiene Market.

Insights On End User

Chemical

The Chemical sector is expected to dominate the Global Butadiene Market due to its extensive applications in producing synthetic rubber, plastics, and resins. This end user plays a crucial role in various industries, including automotive, textiles, and consumer goods. The growing demand for high-performance materials, particularly in tire manufacturing and specialty chemicals, bolsters the need for butadiene. Additionally, as environmental regulations push for more sustainable practices, innovations in chemical processing that utilize butadiene are becoming commonplace. This trend positions the Chemical industry at the forefront of butadiene consumption and ensures a significant market share.

Automobile

The Automobile industry represents a vital part of the butadiene market, utilizing it primarily in the production of synthetic rubber for tires and various automotive components. The growing trends in electric vehicles and sustainable transportation solutions require more advanced materials, driving the demand for high-quality synthetic rubber. Additionally, with the continuous increase in global vehicle production, the automobile sector plays a significant role in butadiene consumption. As manufacturers push for better performance and longevity in tires, the demand for butadiene within this industry is expected to remain strong.

Plastics and Polymers

The Plastics and Polymers industry is another key player in the usage of butadiene, primarily responsible for the production of high-impact polystyrene and acrylonitrile butadiene styrene (ABS). As consumer demand shifts towards lightweight, durable materials, the need for innovative polymer solutions has risen significantly. This benefits from the ongoing trend of urbanization and increased construction activities around the world. The versatility of polymers makes them indispensable in numerous applications, leading to sustained growth in the consumption of butadiene in this sector.

Building & Construction

In the Building & Construction market, butadiene is utilized as a crucial component in various construction materials and coatings. The continual growth in infrastructure projects and residential developments worldwide drives the demand for products such as sealants, adhesives, and insulation materials that often incorporate butadiene. With increasing urbanization and a rising global population, the need for advanced construction materials will persist, thereby supporting the butadiene market. Sustainable building trends further enhance the prospects for the use of butadiene in eco-friendly construction solutions.

Consumer Products

The Consumer Products sector employs butadiene in the production of various everyday items, including household goods, packaging, and personal care products. This market has seen steady growth owing to an increasing consumer preference for innovative and sustainable products. Items manufactured using materials derived from butadiene offer enhanced durability and functionality. As the demand for convenience-oriented and eco-friendly consumer goods grows, the role of butadiene in this industry is likely to expand, contributing to market development.

Healthcare

Within the Healthcare industry, butadiene is essential for the production of medical devices, packaging materials, and personal protective equipment. The importance of high-quality medical supplies, particularly in response to global health challenges, underscores the necessity for reliable materials made from butadiene. The ongoing development of advanced healthcare technologies will likely increase the demand for butadiene-based products. Moreover, an emphasis on safety and compliance in healthcare packaging will further drive its application, enhancing the 's overall market value.

Others

The "Others" category encompasses various niche markets that utilize butadiene, including specialty chemicals and industrial applications. This group, while less prominent than the primary industries mentioned, plays an essential role in driving butadiene consumption. The growth of specialized sectors seeking unique formulations or high-performance materials ensures that butadiene will remain relevant across diverse applications. Emerging markets and innovations in different fields contribute to the sustained demand for this versatile chemical, making this significant in its own right.

Global Butadiene Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Butadiene market, primarily driven by rapid industrialization and growing demand from key end-user industries such as automotive, plastics, and synthetic rubber manufacturing. Countries like China and India have significant investments in the petrochemical sector, leading to increased production capabilities and consumption of Butadiene for various applications. The region benefits from the availability of raw materials, a growing middle class, and rising automotive production, which further fuels the demand for butadiene-based products. Additionally, the increasing adoption of sustainable practices in manufacturing is leading to innovations that bolster the Butadiene market, positioning Asia Pacific as the global leader.

North America

North America holds a substantial position in the Global Butadiene market, primarily due to its established chemical industry and technological advancements in the production processes. The region benefits from a well-integrated supply chain and a strong demand for synthetic rubber, particularly in the automotive and tire sectors. However, the market is facing challenges such as fluctuating prices and potential regulatory hurdles related to environmental concerns. Despite these challenges, North America’s market is characterized by high-quality production standards and significant investment in R&D, which may help sustain its competitive edge in certain parts.

Latin America

In Latin America, the Butadiene market is largely driven by the petrochemical industry as well, although it experiences relatively slower growth compared to other regions. Brazil and Mexico are the key players in this market, driven by their burgeoning automotive industries and increasing economic development. The region, however, faces challenges such as political instability and insufficient infrastructure that can hinder the growth and expansion of butadiene production facilities. Despite these challenges, efforts are being made to enhance production capabilities and to tap into regional demand, positioning Latin America as a potential contributor to the global market.

Europe

Europe has a well-established market for Butadiene, supported by strong demand from the automotive and plastics sectors. The region is focused on sustainability and innovation, which has led to advances in recycling technologies and bio-based products. However, Europe's market is also facing constraints due to stringent regulations aiming at reducing carbon emissions, which may impact traditional butadiene production methods. While the region may not dominate the market, its commitment to sustainability and innovation could create niche opportunities in specific parts and keep it competitive on the global stage.

Middle East & Africa

The Middle East & Africa region has significant potential in the Butadiene market, thanks to abundant oil and gas reserves that facilitate the production of petrochemicals. However, the development of this market is uneven, with countries like Saudi Arabia leading in production capability while others lag due to limited infrastructure. Projects are underway to bolster petrochemical production in regions like the Gulf Cooperation Council (GCC), which could lead to increased output and demand for Butadiene. However, geopolitical challenges and economic disparities may hinder swift growth, making this region a gradually emerging player in the global market.

Butadiene Competitive Landscape:

The global butadiene market is significantly influenced by key industry players, comprising leading chemical producers and refiners. They propel production and foster innovation by leveraging cutting-edge technologies and engaging in strategic partnerships. These stakeholders are essential in optimizing supply chain operations, maintaining price stability, and addressing the increasing demand from sectors like automotive, plastics, and rubber.

Prominent entities in the butadiene industry encompass BASF SE, LyondellBasell Industries N.V., Royal Dutch Shell plc, ExxonMobil Chemical Company, INEOS Group Holdings S.A., TPC Group Inc., Mitsubishi Chemical Corporation, Repsol S.A., Sinopec Limited, and Sumitomo Chemical Co., Ltd. Additionally, noteworthy contributors include LG Chem Ltd., Braskem S.A., Evonik Industries AG, Kraton Corporation, and CNPC (China National Petroleum Corporation). These organizations are instrumental in the manufacturing, distribution, and innovation of butadiene and its derivatives for diverse applications in the worldwide market.

Global Butadiene COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the global butadiene market, resulting in variations in demand and complications within supply chains. This upheaval led to instability in prices and a reduction in production capabilities.

The butadiene market experienced substantial effects due to the COVID-19 pandemic, primarily caused by disturbances in global supply chains, diminished industrial production, and varying demand from crucial industries like automotive and rubber manufacturing. In the early stages, lockdown restrictions resulted in a downturn in manufacturing activities and a short-lived reduction in butadiene usage, especially in the tire and automotive sectors, as vehicle sales saw a significant drop. Nevertheless, as economies gradually reopened and the demand for personal protective equipment surged, the market started to bounce back. Additionally, the transition toward sustainable and electric vehicles is altering the demand landscape, leading to changes in production methodologies. As manufacturers adjust to the new post-pandemic environment—characterized by enhanced sustainability and robust supply chain resilience—the butadiene market is projected to experience a steady recovery, alongside potential long-term transformations driven by these changing trends.

Latest Trends and Innovation in The Global Butadiene Market:

- In March 2023, INEOS announced the acquisition of the Butadiene production assets of the Dutch company, Braskem, located in Dutch Harbor, marking a strategic expansion in the European Butadiene market.

- In January 2023, Shell Chemical launched a new advanced catalytic process for Butadiene extraction that promises to increase yield by 20%, significantly reducing production costs and environmental impact.

- In July 2022, LyondellBasell announced a merger with the German chemical company, Covestro, aimed at enhancing the production of Butadiene derivatives, expanding their market reach in Europe.

- In December 2021, ExxonMobil made a significant investment in its Butadiene production facilities in Baton Rouge, Louisiana, upgrading existing technology to improve efficiency and reduce emissions.

- In February 2022, Reliance Industries Limited completed its Butadiene plant expansion project in Jamnagar, India, which added an additional 120,000 metric tons per year of production capacity.

- In October 2021, TPC Group announced a strategic partnership with LG Chem to develop sustainable Butadiene production methods, focusing on bio-based feedstock sources to reduce carbon footprint.

- In August 2023, BASF launched a new line of Butadiene-based polymers that are designed for enhanced performance in automotive applications, focusing on sustainability and recycling capabilities.

Butadiene Market Growth Factors:

Primary drivers of growth in the Butadiene sector encompass a ened need for synthetic rubber within the automotive industry, along with a surge in the manufacturing of lightweight materials for diverse applications.

The butadiene industry is experiencing substantial growth, primarily driven by rising demand in the automotive and rubber production sectors. As the automotive market flourishes, especially in Asia-Pacific regions, the requirement for synthetic rubber in tire manufacturing has intensified, thereby increasing the need for butadiene. The pursuit of fuel-efficient and environmentally friendly vehicles has also spurred advancements in butadiene-derived products. Additionally, the expansion of the petrochemical industry, where butadiene plays a vital role as a raw material for creating polymers and resins, supports this market's upward trajectory. The shift towards sustainable production methods, particularly the exploration of bio-based butadiene, is opening up additional paths for growth. Further, regulatory measures aimed at curbing emissions and promoting environmental sustainability are encouraging the use of synthetic materials derived from butadiene. Innovations in extraction and processing technologies are also enhancing efficiency and cost-effectiveness, boosting product accessibility. In conclusion, the convergence of automotive growth, technological progress, and sustainability efforts is propelling the butadiene market towards significant future expansion.

Butadiene Market Restaining Factors:

The Butadiene market faces significant challenges due to variable costs of raw materials and stringent environmental regulations that affect manufacturing methods.

The butadiene market faces several challenges that could hinder its growth potential. A primary issue is the volatility in the prices of essential raw materials, notably petroleum and natural gas, which can result in ened production expenses. Furthermore, stringent environmental regulations concerning emissions and waste management present substantial compliance hurdles for manufacturers, which may restrict production capabilities and increase operating costs. The fluctuations in the global economy can also diminish demand from critical sectors such as automotive and rubber, thereby affecting market dynamics adversely.

Moreover, competition from alternative materials, including bio-based feedstocks and synthetic rubber, introduces another layer of difficulty, especially as these alternatives may attract more environmentally aware consumers and industries. Additionally, geopolitical tensions and disruptions in supply chains can lead to instability and uncertainty in material availability, influencing both pricing and market access.

Nevertheless, the rising demand for high-performance materials, particularly within the automotive and construction industries, offers considerable opportunities for growth. Advances in production technology and sustainability efforts are expected to propel the market forward, fostering a more robust and adaptable butadiene sector in the future.

Key Segments of the Butadiene Market

By Product Type

- Butadiene Rubber

- Styrene Butadiene Rubber

- Acrylonitrile Butadiene Rubber

- Nitrile Butadiene Rubber

- Styrene Butadiene Latex

- Hexamethylenediamine

By Production Process

- C4 hydrocarbon extraction

- n-butane dehydrogenation

- From ethanol

- From butenes

By End User

- Automobile

- Chemical

- Plastics and Polymers

- Building & Construction

- Consumer Products

- Healthcare

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America