Cardiovascular Devices Market Analysis and Insights:

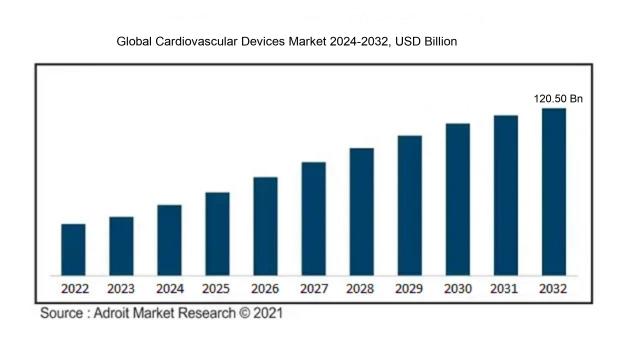

In 2023, the worldwide market for cardiovascular devices was valued at USD 60.56 billion. At a compound annual growth rate (CAGR) of 8.2%, the market is expected to reach USD 120.50 billion by 2032 from USD 66.51 billion in 2024.

The market for cardiovascular devices is significantly propelled by the escalating incidence of cardiovascular diseases (CVDs), which rank as a major contributor to global mortality rates. The aging population and shifts in lifestyle habits, including unhealthy diets and insufficient physical activity, are key factors exacerbating this issue. Innovations in medical technology, such as less invasive treatment options and advanced diagnostic instruments, improve the efficacy of cardiovascular interventions, driving market expansion. Furthermore, supportive government policies and an increase in healthcare spending enhance medical infrastructure, promoting wider access to cutting-edge cardiovascular devices. The rising focus on preventive healthcare and the proactive management of cardiac conditions also boost demand within this field. In addition, greater public awareness regarding CVDs and the vital role of early detection stimulate market growth, as both patients and healthcare professionals seek the latest solutions for cardiovascular treatment. Collectively, these elements cultivate a vigorous landscape for the cardiovascular devices market, encouraging ongoing development and progress.

Cardiovascular Devices Market Definition

Cardiovascular instruments are specialized medical devices intended for the diagnosis, monitoring, or treatment of heart-related disorders. This category includes elements such as stents, pacemakers, and heart valves. These instruments are essential in the management of cardiovascular diseases, significantly enhancing patient health results.

Cardiovascular devices are indispensable in contemporary medicine, serving vital functions in the diagnosis, surveillance, and treatment of diverse heart ailments. Instruments such as stents, pacemakers, and defibrillators significantly enhance patient health by reinstating normal cardiac function and averting critical emergencies. They empower healthcare providers to deliver prompt interventions and tailored therapeutic strategies, which ultimately improves the overall quality of life for patients. Given that cardiovascular diseases are among the primary causes of death worldwide, the ongoing innovation and availability of these technologies are crucial for effectively managing cardiac health, lowering healthcare expenditures, and, in turn, promoting longer and healthier lives for those impacted by heart-related conditions.

Cardiovascular Devices Market Segmental Analysis:

Insights On Key Device Type

Therapeutic and Surgical Devices

Therapeutic and Surgical Devices are expected to dominate the Global Cardiovascular Devices Market due to the increasing prevalence of cardiovascular diseases and the growing demand for effective treatment options. Devices such as Ventricular Assist Devices (VAD), Catheters, Stents, and Heart Valves are essential in managing severe heart conditions and performing critical interventions. The rise in an aging population, coupled with an increase in lifestyle-related disorders, prompts a higher adoption of these devices. Advances in technology are enhancing the efficacy and safety of these devices, further driving their demand, thereby solidifying their position as the leading category in the market.

Diagnostic and Monitoring Devices

Diagnostic and Monitoring Devices play a vital role in early detection and ongoing management of cardiovascular diseases. Tools such as Electrocardiograms (ECGs) provide essential real-time data about heart health, enabling physicians to make timely decisions. The integration of advanced wearable technology is enhancing patient monitoring capabilities, encouraging proactive healthcare management. As remote health solutions grow more prevalent, these devices are becoming increasingly important, catering to the need for continuous cardiac assessment and patient engagement.

Insights On Key Application

Coronary Artery Disease (CAD)

Coronary Artery Disease (CAD) is expected to dominate the Global Cardiovascular Devices Market due to its high prevalence and the significant demand for effective medical interventions. CAD is a leading cause of morbidity and mortality worldwide, driving extensive research and development efforts. The increase in risk factors such as aging populations, rising incidence of obesity, and sedentary lifestyles contribute to the growing number of patients requiring medical devices for diagnosis and treatment. Moreover, advancements in technology, including minimally invasive procedures and improved stent designs, enhance treatment outcomes and attract both healthcare providers and patients, further solidifying the position of CAD within the cardiovascular devices market.

Cardiac Arrhythmia

Cardiac Arrhythmia represents a substantial portion of the cardiovascular devices market due to the rising incidence of irregular heartbeats impacting millions globally. The growing need for diagnostic devices, such as electrocardiogram (ECG) monitors and implantable cardioverter-defibrillators (ICDs), reflects the seriousness of this condition. Increased awareness and diagnosis of arrhythmias have led to better patient management and treatment options. With continuous innovations in technology and a growing emphasis on wearable devices that monitor heart rhythms, the market continues to evolve, catering to the needs of this patient population.

Heart Failure

Heart Failure is an important in the Global Cardiovascular Devices Market, driven by its increasing prevalence, particularly among the aging population. With significant morbidity and healthcare costs associated with heart failure, there is a rising demand for advanced devices such as left ventricular assist devices (LVADs) and implantable monitors. There is ongoing innovation focused on improving the management of heart failure, which enhances patient outcomes and therapy adherence. Furthermore, as more individuals are diagnosed with heart failure, the market for devices catered to this condition is expected to expand significantly, reflecting the urgent need for better management solutions.

Others

The "Others" category in the cardiovascular devices space encompasses a variety of applications, including peripheral artery disease and congenital heart defects, which also contribute to the market dynamics. Although this is not as dominant as CAD, cardiac arrhythmia, or heart failure, it still reflects the diverse needs of patients and healthcare providers. As awareness about different heart conditions increases and the healthcare landscape continues to evolve, innovations in devices catering to these varied applications can drive growth. Research and development efforts aimed at addressing these lesser-known conditions will likely improve outcomes and expand treatment options for relevant patient populations.

Insights On Key End User

Hospitals

Hospitals are expected to dominate the Global Cardiovascular Devices Market primarily due to the high patient volume and the availability of advanced medical technology. They often have comprehensive cardiovascular departments and specialized facilities that can perform complex procedures such as surgeries and advanced imaging techniques. Furthermore, hospitals are generally equipped with the latest cardiovascular devices and have the ability to provide emergency care, which enhances their attractiveness to patients seeking cardiovascular treatments. The continuous growth in the incidence of cardiovascular diseases also leads to increased patient admissions in hospitals, necessitating the use of more cardiovascular devices. This alignment of resources, technology, and patient needs secures hospitals as the leading force in this market.

Specialty Clinics

Specialty clinics are rapidly gaining importance in the cardiovascular devices market, focusing on specific cardiovascular issues and providing tailored care. These facilities often emphasize outpatient procedures, enticing patients with their efficiency and specialized services. As healthcare shifts towards a more patient-centered approach, specialty clinics leverage advanced technology and expertise to attract their clientele, especially those seeking preventative care or management of chronic conditions. The rise of minimally invasive techniques allows these clinics to perform procedures that compete effectively with those in traditional hospital settings, making them a critical component of the overall cardiovascular care spectrum.

Others

The "Others" category generally includes a variety of healthcare settings like rehabilitation centers, diagnostic centers, and outpatient facilities that contribute to the cardiovascular devices market. Though this represents a smaller portion of the overall market, it plays a vital role in holistic cardiovascular care. These facilities often focus on patient recovery and follow-up services that are crucial for cardiovascular health. The growing emphasis on outpatient care and preventative measures encourages the deployment of cardiovascular devices across diverse healthcare settings in this classification, while still relying heavily on hospitals and specialty clinics for acute and invasive interventions.

Global Cardiovascular Devices Market Regional Insights:

North America

North America is expected to dominate the Global Cardiovascular Devices market due to several critical factors. The region boasts a highly advanced healthcare infrastructure, significant investments in research and development, and a substantial number of key market players. The prevalence of cardiovascular diseases is alarmingly high in the U.S., driving demand for effective medical technologies. Furthermore, the regulatory environment and stringent adherence to quality standards encourage rapid innovation and deployment of new devices. The combination of these elements not only fosters a competitive landscape but also appeals to stakeholders looking to invest in cardiovascular solutions.

Latin America

Latin America, while currently a smaller of the global market, is gradually gaining traction thanks to improving healthcare access and rising awareness of cardiovascular health issues. Countries like Brazil and Mexico are investing in healthcare reforms and infrastructure, paving the way for the adoption of advanced cardiovascular technologies. However, challenges such as affordability and inconsistent regulatory frameworks can hinder rapid growth. Nonetheless, increasing healthcare expenditures and public initiatives indicate a hopeful future for the cardiovascular devices market in this region.

Asia Pacific

Asia Pacific represents an emerging yet dynamic within the Global Cardiovascular Devices market. Key players are increasingly focusing on this region due to its large population, rising prevalence of lifestyle-related diseases, and growing middle-class income levels. Countries such as China and India are seeing increased healthcare spending, which contributes to demand for cardiovascular devices. However, disparities in healthcare access and regulatory challenges might slow the pace of market adoption compared to North America. With the right investments and initiatives, Asia Pacific has substantial growth potential over the coming years.

Europe

Europe has established itself as a significant player in the Global Cardiovascular Devices market, largely due to its sophisticated healthcare systems and a high prevalence of cardiovascular issues. Countries such as Germany, France, and the UK are at the forefront, driving advancements in medical device technology. However, the market is often characterized by stringent regulations and longer product approval timelines, which can pose challenges for companies looking to enter. Despite these issues, Europe's commitment to innovation in cardiovascular care and collaborative public-private partnerships provide a solid foundation for sustained growth.

Middle East & Africa

The Middle East & Africa region is currently one of the smaller markets in the Global Cardiovascular Devices landscape but has potential for growth. Increasing urbanization and the rise in lifestyle diseases are leading to higher demand for cardiovascular care solutions. However, the market faces considerable challenges due to limited healthcare infrastructure, political instability, and economic disparities within the countries. Nonetheless, initiatives to improve healthcare systems and global investments in health technology could transform this region's cardiovascular device market in the future.

Cardiovascular Devices Competitive Landscape:

Leading entities in the global cardiovascular devices sector propel innovation and competitive dynamics through the creation of sophisticated products like stents, pacemakers, and imaging technologies. They also pursue strategic alliances and mergers to expand their market presence and enhance patient care. A strong emphasis on research and development facilitates the ongoing advancement of solutions aimed at tackling cardiovascular illnesses.

Prominent entities in the cardiovascular device sector consist of Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences Corporation, Siemens Healthineers, Johnson & Johnson (DePuy Synthes), Philips Healthcare, Terumo Corporation, St. Jude Medical (currently integrated with Abbott), Stryker Corporation, Cardiovascular Systems, Inc., B. Braun Melsungen AG, Cook Medical, Kardiacare, and LivaNova PLC.

Global Cardiovascular Devices COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly affected the Global Cardiovascular Devices market, causing postponements in elective surgeries and disrupting supply chains. This resulted in a temporary drop in sales and an increased focus on technologies for remote patient monitoring.

The COVID-19 pandemic has had a profound influence on the cardiovascular devices sector, manifesting both adverse and beneficial effects. Initially, the imposition of lockdowns and the reorganization of healthcare priorities caused significant postponements in elective procedures, resulting in a downturn in cardiovascular device sales as medical facilities concentrated their resources on treating COVID-19 patients. Furthermore, disruptions in the supply chain led to shortages of critical components and hindered the introduction of new products.

On the flip side, the pandemic has elevated awareness regarding cardiovascular health, spurring greater interest in remote monitoring systems and technologies for home care. Advancements in telemedicine and digital health solutions gained traction, encouraging manufacturers to revise their approaches and develop more sophisticated cardiovascular monitoring instruments. In summary, while the short-term consequences of the pandemic have negatively affected certain areas of the market, the long-term prospects appear promising as there is a growing emphasis on improving cardiovascular care and enhancing patient management strategies.

Latest Trends and Innovation in The Global Cardiovascular Devices Market:

- In March 2023, Medtronic announced the acquisition of Mazor Robotics for $1.6 billion, a move aimed at enhancing its capabilities in minimally invasive surgery, particularly for cardiovascular interventions.

- In February 2023, Abbott received FDA approval for its Tendyne transcatheter mitral valve implantation system, which represents a significant advancement in the treatment of mitral valve diseases without the need for open-heart surgery.

- In January 2023, Boston Scientific initiated a strategic collaboration with Exonate, focusing on the development of novel therapies for retinal diseases, which could indirectly impact cardiovascular health by addressing systemic issues related to vascular health.

- In December 2022, Edwards Lifesciences launched its latest version of the SAPIEN 3 Ultra heart valve, boasting a new delivery system designed to enhance ease of use and improve patient outcomes in transcatheter aortic valve replacement (TAVR) procedures.

- In November 2022, Philips announced a partnership with Siemens Healthineers to develop advanced digital diagnostics that could improve decision-making in cardiovascular treatment pathways.

- In September 2022, JenaValve Technology, a developer of transcatheter aortic valve replacement devices, secured a substantial investment to support the clinical trials for its next-generation TAVR device, with an emphasis on safety and patient outcomes.

- In August 2022, Biotronik received FDA approval for its new Cobalt and Cobalt XR cardiac resynchronization therapy defibrillators, which include advanced diagnostic features aimed at improving the management of heart failure patients.

- In July 2022, Cook Medical launched a new line of vascular access products, aiming to improve patient safety and comfort during cardiovascular procedures, marking a significant innovation in the access device domain.

- In June 2022, Sientra and Aesthetics Biomedical announced a strategic partnership to broaden the market reach of their respective cardiac-related biotechnologies, aiming at enhancing patient care through innovative solutions.

- In April 2022, Nihon Kohden secured FDA clearance for its new ECG monitoring devices that incorporate AI capabilities, enabling more accurate cardiovascular event detection and monitoring in healthcare settings.

Cardiovascular Devices Market Growth Factors:

The expansion of the cardiovascular device industry is largely fueled by technological innovations, a rising incidence of heart-related conditions, and a growing elderly demographic.

The market for cardiovascular devices is witnessing robust expansion, influenced by multiple pivotal factors. Firstly, the global surge in cardiovascular diseases (CVD), driven by changing lifestyles, an aging demographic, and increasing obesity levels, is boosting the need for sophisticated medical technologies. Secondly, advancements in technology, highlighted by the rise of minimally invasive techniques and novel innovations like implantable cardioverter-defibrillators, are improving patient outcomes and safety, thereby propelling market growth. Moreover, increased healthcare spending, especially in developing regions, is enhancing access to advanced cardiac treatments and the adoption of state-of-the-art devices.

In addition, supportive governmental regulations and initiatives that aim to bolster healthcare infrastructure are playing a crucial role in market advancement. The growing focus on preventive healthcare and early detection of heart-related ailments is also significant, as both patients and healthcare practitioners place greater value on cardiac health. Furthermore, partnerships and mergers among leading industry players are driving innovation and expanding product offerings, intensifying market competition. Together, these elements are fostering a dynamic environment for the cardiovascular devices market, which is anticipated to continue its growth trajectory in the forthcoming years, addressing the escalating demand for effective cardiovascular interventions.

Cardiovascular Devices Market Restaining Factors:

The primary challenges facing the Cardiovascular Devices Market involve the elevated expenses linked to cutting-edge technologies and the rigorous requirements for regulatory approval.

The growth of the Cardiovascular Devices Market is hindered by a variety of factors. One significant obstacle is the high costs associated with sophisticated devices and surgical interventions, which can restrict access in developing areas where healthcare funding is limited. Additionally, the rigorous regulatory landscape for device approval can lengthen the time it takes for products to reach the market, which may deter manufacturers from investing in new technologies. The rising prevalence of product recalls due to safety issues further complicates the situation, adversely affecting both the reputation of manufacturers and the confidence of consumers. Furthermore, the availability of alternative treatments, such as pharmaceuticals, might lead patients to avoid device implantation, particularly in less severe cases. A shortage of qualified healthcare professionals trained to utilize advanced cardiovascular devices also limits their adoption in various regions. Economic downturns pose another challenge, potentially leading to decreased healthcare investments and negatively influencing market trends. Despite these hurdles, progress in technology—such as the development of minimally invasive techniques and improved device biocompatibility—is fostering innovation and supporting market expansion. With healthcare systems globally placing greater emphasis on cardiovascular well-being, the prospects for the market remain positive, anticipating enhanced device accessibility and efficacy, which will ultimately improve patient outcomes and satisfaction.

Key Segments of the Cardiovascular Devices Market

By Device Type

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring

- Others

- Therapeutic and Surgical Devices

- Ventricular Assist Devices (VAD)

- Cardiac Rhythm Management (CRM) Devices

- Catheter

- Stents

- Heart Valves

- Others

By Application

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

By End User

- Hospitals

- Specialty Clinics

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America