Market Analysis and Insights:

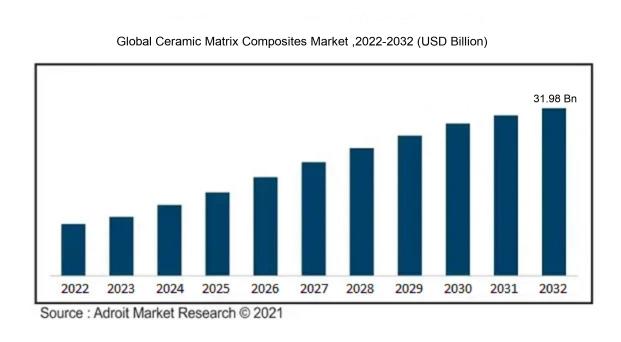

The market for Global Ceramic Matrix Composites was estimated to be worth USD 11.91 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 10.42%, with an expected value of USD 31.98 billion in 2032.

The driving forces behind the growth of the Ceramic Matrix Composites (CMC) market stem from various critical factors.Initially, the surge in demand for lightweight and high-performance materials across industries such as aerospace, automotive, and defense is fueling the expansion of the CMC market. CMCs possess exceptional mechanical properties, including high strength, stiffness, and heat resistance, while offering a significantly reduced weight compared to traditional materials like metals.

Moreover, the increasing emphasis on fuel efficiency and ecological sustainability is driving the adoption of CMCs in the automotive sector, where lightweight materials are essential for mitigating carbon emissions.

Another significant driver is the escalating investment in research and development endeavors aimed at enhancing manufacturing techniques and streamlining production processes for CMCs. These innovations lead to enhanced product quality, lowered manufacturing costs, and enhanced commercial viability, ultimately fostering market growth. Additionally, the growing utilization of CMCs in the energy industry, icularly in gas turbines for power generation, is contributing to the market's expansion.

Ceramic Matrix Composites Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 31.98 billion |

| Growth Rate | CAGR of 10.42% during 2023-2032 |

| Segment Covered | By Matrix Material, By Fiber Type, By End-Use, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | General Electric Company, Rolls-Royce Holdings PLC, COI Ceramics Inc., Ube Industries Ltd., Kyocera Corporation, SGL Carbon SE, 3M Company, Applied Thin Films Inc., CeramTec GmbH, CoorsTek Inc., Lancer Systems LP, Starfire Systems Inc., Ultramet Inc., and United Technologies Corporation. |

Market Definition

Ceramic matrix composites (CMCs) represent a unique class of composite materials comprising a ceramic matrix that is strengthened by fibers or icles. These materials are renowned for their superior strength at high temperatures and remarkable thermal endurance. CMCs find widespread application in the aerospace, automotive, and energy sectors thanks to their outstanding mechanical characteristics and resilience in challenging environments. Ceramic Matrix Composites (CMCs) play a vital role in various industries due to their unique blend of characteristics.

These include exceptional mechanical properties like high tensile strength, hardness, and stiffness, coupled with outstanding resistance to corrosion, wear, and thermal shock. Their lightweight nature makes them well-suited for applications in industries where weight is a crucial factor, such as aerospace and automotive. Moreover, CMCs excel in high-temperature environments, offering a reliable alternative where traditional materials fall short. With their superior performance, CMCs contribute to enhanced efficiency, durability, and reliability across different sectors, driving technological advancements and elevating overall performance standards.

Key Market Segmentation:

Insights On Key Matrix Material

Oxide-based

CMCs Oxide-based CMCs are expected to dominate the Global Ceramic Matrix Composites Market. This is due to their superior properties such as high temperature resistance, thermal stability, and excellent mechanical strength. Oxide-based CMCs, which include materials like alumina, zirconia, and spinel, possess excellent thermal insulation and corrosion resistance, making them ideal for various applications in aerospace, automotive, and energy sectors. The increasing demand for lightweight and high-performance materials is driving the growth of oxide-based CMCs in the market. Additionally, advancements in manufacturing processes and developments in oxide-based CMC formulations have further fueled their dominance in the global ceramic matrix composites market.

Non-oxide-based CMCs

Non-oxide-based CMCs, including materials like silicon carbide (SiC) and carbon fiber-reinforced carbon (C/C), are also gaining traction in the Global Ceramic Matrix Composites Market. Although they may not dominate the market as oxide-based CMCs do, they hold significant potential in specific industries. Non-oxide-based CMCs exhibit exceptional mechanical strength, excellent thermal shock resistance, and high hardness. These properties make them suitable for applications in the aerospace, defense, and industrial sectors. The demand for lightweight, high-strength materials is driving the adoption of non-oxide-based CMCs, icularly in industries where extreme conditions and harsh environments are prevalent.

Insights On Key Fiber Type

Continuous Fiber

Continuous Fiber is expected to dominate the Global Ceramic Matrix Composites Market. Continuous fiber refers to a type of fiber reinforcement in which the fibers are arranged in a continuous manner throughout the composite material. This results in a higher strength and stiffness compared to discontinuous fiber composites. Continuous fiber composites are widely used in applications that require high performance and structural integrity, such as aerospace, defense, and automotive industries. The ability of continuous fiber composites to provide excellent mechanical properties, enhanced heat resistance, and improved fatigue resistance makes them the preferred choice in various end-use sectors. With the increasing demand for lightweight and high-performance materials, continuous fiber composites are expected to dominate the global ceramic matrix composites market.

Discontinuous/SiC Whisker

Discontinuous/SiC Whisker is one more noticeable within the By Fiber Type category of the Global Ceramic Matrix Composites Market. Discontinuous fiber composites consist of short fibers that are embedded in a matrix material. These composites offer improved impact resistance and toughness compared to continuous fiber composites. The use of discontinuous fibers, such as SiC whiskers, provides additional strength and stiffness to the composite material. Discontinuous/SiC Whisker composites are commonly used in applications that require good wear resistance and thermal stability, such as cutting tools, engine components, and electrical insulators. Although not dominating the market, discontinuous/SiC whisker composites hold a significant share due to their unique properties and suitability for specific applications within the ceramic matrix composites market.

Insights On Key End-Use

Aerospace & Defense

Among the By End-Use s, the Aerospace & Defense is expected to dominate the Global Ceramic Matrix Composites Market. The aerospace and defense industry has a significant demand for high-performance materials that can withstand extreme conditions. Ceramic matrix composites offer excellent strength, high-temperature resistance, and lightweight properties, making them ideal for applications in aircraft and military equipment. With ongoing advancements and investments in aerospace and defense technologies, the demand for ceramic matrix composites is projected to grow steadily in this .

Automotive

In the Global Ceramic Matrix Composites Market, the Automotive is anticipated to hold a significant share, albeit not as dominant as the Aerospace & Defense . Ceramic matrix composites have the potential to enhance the performance and efficiency of automobiles due to their lightweight and high strength characteristics. They can be used in components such as engine s, brake systems, and exhaust systems, contributing to fuel economy and reducing emissions. The automotive industry's increasing focus on sustainability and efficiency is likely to drive the demand for ceramic matrix composites in this .

Energy & Power

The Energy & Power is another important market for ceramic matrix composites. These materials offer excellent thermal stability, corrosion resistance, and high-temperature capabilities, making them suitable for applications in the energy and power sector. Ceramic matrix composites can be utilized in gas turbines, nuclear reactors, solar thermal systems, and other power generation equipment. With the increasing demand for cleaner and more efficient energy sources, the use of ceramic matrix composites is expected to grow in the Energy & Power .

Industrial

The Industrial is also expected to contribute to the Global Ceramic Matrix Composites Market. Ceramic matrix composites find applications in various industrial sectors such as chemical processing, metal casting, and semiconductor manufacturing. They offer excellent resistance to wear, corrosion, and thermal cycling, making them valuable in harsh industrial environments. Industries looking for high-performance materials to enhance process efficiency, reduce maintenance costs, and improve product quality are likely to drive the demand for ceramic matrix composites in the Industrial .

Others

The "Others" within the By End-Use category represents diverse industries and applications that are not individually specified. While the dominance of the Global Ceramic Matrix Composites Market lies in the Aerospace & Defense , and there are significant contributions from the Automotive, Energy & Power, and Industrial s, it is challenging to determine the dominating factor within the "Others" category. This could include niche markets, specialty applications, or smaller industries where ceramic matrix composites find specific applications. Detailed research and analysis of the specific industries within this would be required to identify the dominating factor.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Ceramic Matrix Composites market. This is primarily due to the rapid industrialization and expanding aerospace and defense sectors in countries like China and Japan. The region has a strong manufacturing base and is home to several key players in the composites industry. Additionally, the increasing investments in research and development activities to enhance the properties and performance of ceramic matrix composites by regional governments and organizations further contribute to the region's dominance.

North America

North America is a significant player in the Global Ceramic Matrix Composites market. The region has a well-established aerospace and defense industry, which demands lightweight and high-performance materials like ceramic matrix composites. The presence of major manufacturers and research institutes in countries like the United States and Canada gives North America a competitive edge. Moreover, the region's focus on innovation and technological advancements drives the development and adoption of ceramic matrix composites in various applications.

Europe

Europe has a strong presence in the Global Ceramic Matrix Composites market. The region is known for its advanced manufacturing capabilities and expertise in aerospace and automotive industries. The European Union's stringent regulations on carbon emissions also drive the demand for lightweight and energy-efficient materials, making ceramic matrix composites an attractive option. Furthermore, collaborations between industry and academia for research and development activities further boost the growth of the market in Europe.

Middle East & Africa

The Middle East & Africa region holds potential for the Global Ceramic Matrix Composites market, although it is not expected to dominate. The region has been witnessing growth in sectors like defense, oil and gas, and construction. The increasing infrastructure investments and the need for advanced materials to withstand extreme conditions create opportunities for ceramic matrix composites. However, the market in this region is still developing and faces challenges like limited manufacturing infrastructure and technological expertise.

Latin America

Latin America is also a growing player in the Global Ceramic Matrix Composites market. The region's automotive and aerospace industries are driving the demand for lightweight and high-performance materials. Moreover, governments' initiatives to attract foreign investments and promote industrial growth further contribute to the market's development. However, the market in Latin America is relatively smaller compared to other regions, and it faces challenges like limited awareness and availability of ceramic matrix composites.

Company Profiles:

Prominent entities within the global Ceramic Matrix Composites industry are charged with producing and distributing ceramic matrix composites across diverse sectors. Their significant contributions revolve around driving innovation and utilization of these materials, alongside dedicating resources towards research and development to enhance their range of products. Prominent participants in the Ceramic Matrix Composites (CMC) industry include General Electric Company, Rolls-Royce Holdings PLC, COI Ceramics Inc., Ube Industries Ltd., Kyocera Corporation, SGL Carbon SE, 3M Company, Applied Thin Films Inc., CeramTec GmbH, CoorsTek Inc., Lancer Systems LP, Starfire Systems Inc., Ultramet Inc., and United Technologies Corporation. These organizations play a vital role in the research, production, and dissemination of ceramic matrix composites, which see applications across industries like aerospace, defense, automotive, and energy. Through a commitment to innovation and diversification of their offerings, these key industry players solidify their global market presence, catalyzing advancements in ceramic matrix composites.

COVID-19 Impact and Market Status:

The global market for Ceramic Matrix Composites has experienced notable effects due to the Covid-19 pandemic, resulting in reduced demand and disturbances in supply chains. The global ceramic matrix composites (CMC) market has faced notable repercussions as a result of the COVID-19 pandemic.

This sector saw a slowdown in growth due to disruptions in supply chains and decreased industrial operations during the lockdown phase. Key industries that heavily rely on CMCs, such as aerospace, automotive, and energy, experienced a downturn in their activities, leading to reduced demand for these materials. Factors like travel constraints and social distancing guidelines further affected the manufacturing and distribution of CMCs. Despite these challenges, there have been positive developments in the market. The increasing emphasis on lightweight and high-performance materials across various sectors is anticipated to stimulate demand for CMCs as the post-pandemic recovery unfolds.

Moreover, technological advancements like additive manufacturing present fresh prospects for the CMC market. Companies are actively engaging in R&D endeavors to create more efficient and affordable CMC products, thereby fostering market expansion. In essence, while the COVID-19 crisis presented obstacles to the ceramic matrix composites market, it has also ushered in opportunities for innovation and long-term growth.

Latest Trends and Innovation:

- In June 2021, GE Aviation announced its plans to develop a new facility in Huntsville, Alabama, focused on manufacturing ceramic matrix composite s for large commercial engines.

- In May 2020, 3M completed its acquisition of Advanced Ceramics Business from Ceradyne, a subsidiary of Saint-Gobain.

- In November 2019, Toray Industries, Inc. announced the establishment of a new facility in Gumi, South Korea, for the production of carbon fiber composite materials, including ceramic matrix composites.

- In September 2019, Rolls-Royce and the University of Cambridge nered to open the Rolls-Royce University Technology Center for Advanced Materials in Oxfordshire, United Kingdom, with a focus on advanced materials research, including ceramic matrix composites.

- In July 2018, CoorsTek acquired Philips Ceramics, a division of Royal Philips, expanding its portfolio of ceramic matrix composite products.

- In January 2017, General Electric (GE) announced the acquisition of LM Wind Power, a manufacturer of wind turbine blades that incorporate ceramic matrix composites.

Significant Growth Factors:

The expansion drivers of the Ceramic Matrix Composites industry comprise rising utilization in the aerospace and defense sectors, technological progress in manufacturing methods, and the requirement for materials that are both lightweight and high-performing.

Ceramic matrix composites (CMCs) have risen as a notable material across various industries, displaying substantial growth in recent times. The expansion of the CMC sector can be credited to several significant drivers. Primarily, the increasing need for lightweight and high-performing materials in aerospace and defense sectors has prominently influenced the market. CMCs boast extraordinary characteristics like superior strength, thermal durability, and exceptional resilience to extreme environments, making them a favored option for components in aircraft engines, missiles, and satellite systems. Furthermore, the rising demand for energy-efficient solutions in sectors such as power generation and automotive industries has further boosted the necessity for CMCs. Their capacity to endure high temperatures and offer top-notch thermal insulation has led to an increased utilization of CMCs in gas turbines, heat exchangers, and exhaust systems to boost energy efficiency and minimize emissions. Additionally, the expanding medical field has also played a role in the advancement of the CMC market, as these composites find applications in prosthetics, dental implants, and bone scaffolds due to their biocompatibility and resistance to corrosion.

Moreover, continuous research and development endeavors aimed at refining the production procedures of CMCs and lowering their manufacturing expenses are anticipated to steer the market's progress in the upcoming years. In essence, the major growth stimulants of the CMC market comprise the demand for lightweight and high-performing materials in aerospace and defense, the quest for energy-efficient solutions in power generation and automotive sectors, the flourishing medical industry, and the persistent R&D actions focused on enhancing production methods.

Restraining Factors:

A significant challenge facing the Ceramic Matrix Composites industry is the elevated production expenses linked to the manufacturing procedures. The Ceramic Matrix Composites (CMC) industry has experienced significant growth recently, but faces various impediments to further expansion. One major challenge is the high cost associated with producing CMCs, stemming from the complexity of manufacturing processes and the expense of raw materials, ultimately resulting in competitively priced end products. Additionally, the lack of familiarity and comprehension of CMC benefits among end-users acts as a hindrance to wider adoption. Industries are often unaware of the advantages offered by CMCs, such as enhanced performance, greater temperature tolerance, and decreased weight, leading to hesitancy in investing in these materials and slowing market growth.

Technical difficulties in CMC production, such as developing reliable fabrication methods and ensuring consistent material quality, can result in production setbacks and quality concerns. Furthermore, stringent regulations prevalent in industries like aerospace and defense can restrict the broad acceptance of CMCs. Despite these challenges, the CMC sector holds significant promise. Ongoing advancements in manufacturing technologies, increased awareness, and investments are expected to effectively address these obstacles. Through continuous research and development efforts, CMCs are poised to surmount these challenges and emerge as a transformative material in various sectors, driving future growth and innovation.

Key Segments of the Ceramic Matrix Composites Market

Matrix Material Overview

• Oxide-based CMCs

• Non-oxide-based CMCs

Fiber Type Overview

• Continuous Fiber

• Discontinuous/SiC Whisker

End-Use Overview

• Aerospace & Defense

• Automotive

• Energy & Power

• Industrial

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :