Cloud Meetings and Team Collaboration Services Market Analysis and Insights:

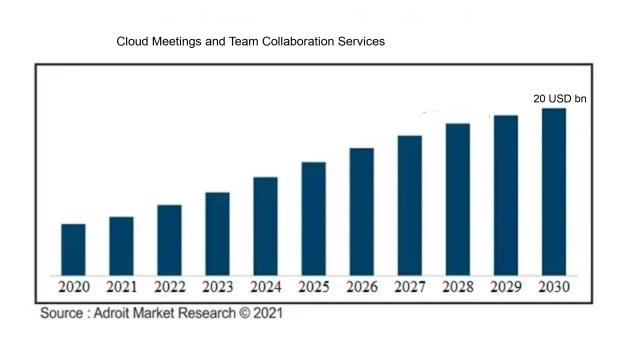

The Global Cloud Meetings and Team Collaboration Services Market is expected to grow from USD 9.4 billion in 2018 to USD 20 billion by 2030, at a CAGR of 9.6% from 2019 to 2030.

The market for Cloud Meetings and Team Collaboration Services is largely propelled by a ened need for remote work solutions, a trend that has escalated alongside the global pivot toward flexible work arrangements. Businesses are increasingly turning to cloud-based platforms to improve communication and teamwork among teams that are spread across various locations. Additionally, the proliferation of mobile technology and widespread access to high-speed internet empowers more companies to efficiently adopt these services, thereby enhancing their overall effectiveness and productivity. Concerns about security and the necessity for strong data management systems also drive organizations to pursue dependable cloud collaboration options. Moreover, continuous advancements in artificial intelligence and machine learning are enriching the capabilities of these services, making them particularly attractive to enterprises in search of cohesive team collaboration solutions.

Cloud Meetings and Team Collaboration Services Market Definition

Cloud-based meeting and collaboration tools are sophisticated digital platforms that promote immediate interaction and teamwork among members by leveraging cloud technology. They offer functionalities such as audio and video conferencing, file exchange, and project management capabilities, thereby boosting productivity and ensuring seamless connectivity, no matter where participants are located.

Cloud-based meeting and collaboration solutions play a pivotal role in promoting effective communication among remote teams, thereby enhancing both productivity and operational efficiency. Their inherent flexibility allows employees the freedom to work from various locations, a necessity that has grown significantly in today’s digital environment. Additionally, many of these services include built-in project management tools that help to optimize workflows and enhance project oversight. By improving collaborative efforts, businesses can accelerate innovation, adapt rapidly to market dynamics, and ultimately boost their overall effectiveness.

Cloud Meetings and Team Collaboration Services Market Segmental Analysis:

Insights On Type

Software

The software is anticipated to dominate the Global Cloud Meetings and Team Collaboration Services Market, primarily due to the growing demand for integrated communication solutions that enhance productivity and collaboration. With rapid technological advancements, businesses are consistently seeking efficient tools that can streamline their operations and facilitate seamless communication among remote teams. Furthermore, advancements in artificial intelligence and machine learning within software applications improve user experience and enable more effective collaboration, thus solidifying the software 's position as the market leader.

Services

The services plays a crucial role in the Global Cloud Meetings and Team Collaboration Services Market, as it encompasses a wide range of offerings, including consultation, implementation, and customer support. Organizations often prefer managed services that ensure seamless integration of cloud collaboration solutions into their existing systems. As businesses navigate complex tech landscapes, professional services become essential, providing the expertise needed for customization and ongoing support. Additionally, increasing demand for training and onboarding services as part of a comprehensive solution makes this essential in enhancing overall productivity.

Others

The others in the Global Cloud Meetings and Team Collaboration Services Market refers to miscellaneous offerings that do not fall into the primary categories of software and services. This could include hardware solutions, such as collaboration devices and peripherals, which complement software applications. While this category represents a smaller portion of the market, it is gradually gaining traction, especially with the rise of hybrid work environments. Companies are investing in high-quality audio-visual equipment to improve meeting experiences and support collaboration strategies. However, it remains overshadowed by the robust growth of both the software and services categories in the market.

Insights On Application

IT and Telecom

The IT and Telecom sector is expected to dominate the Global Cloud Meetings and Team Collaboration Services Market. This is largely due to the increasing demand for enhanced communication solutions driven by remote work trends and the ongoing digital transformation across organizations. Companies in this sector rely heavily on cloud-based collaboration platforms to facilitate seamless internal communication and customer interactions, thus ensuring operational efficiency. The rapid advancements in technology and the growing need for agile teamwork are further propelling this industry towards adopting innovative cloud collaboration tools. As a result, IT and Telecom's significant investments and focus on integrating sophisticated communication solutions make it the leading in this market.

BFSI

The Banking, Financial Services, and Insurance (BFSI) sector is increasingly leveraging cloud meetings and collaboration services to enhance operational efficiency and customer service. With the rapid digital transformation in this industry, financial institutions are adopting secure and scalable solutions to streamline internal processes and improve client interactions. The ability of cloud services to ensure compliance and data security is vital for BFSI firms, making them popular choices in enhancing their collaboration efforts. However, while it is a critical, compared to IT and Telecom’s lead, its growth is more focused on risk management and compliance than solely on collaboration enhancement.

Healthcare

The Healthcare industry recognizes the essential role that cloud meetings and collaboration services play in improving communication among healthcare professionals, especially with the rise of telemedicine. These platforms facilitate remote consultations, case discussions, and collaborative efforts among healthcare teams, ultimately enhancing patient care. While this sector has seen growth in utilizing cloud communication tools for improved healthcare delivery, it faces challenges such as regulatory compliance and data security that can limit the pace of adoption compared to the top-performing.

Retail

In the Retail sector, cloud meetings and collaboration services are being utilized primarily to enhance logistics, team communication, and customer service. The retail industry has increasingly adopted these technologies to facilitate better coordination among teams across different locations and to respond swiftly to market demands. However, this sector tends to prioritize customer-facing solutions, such as e-commerce platforms, over internal collaboration tools, making its overall impact less dominant compared to IT and Telecom.

Government

The Government sector also utilizes cloud meetings and collaboration services, particularly for improving inter-agency communication and public service delivery. By adopting these tools, government entities can increase efficiency and responsiveness in various departments, but the adoption rate tends to be slower due to bureaucratic processes and budget constraints. While effective, the growth of cloud collaboration in this sector remains limited compared to the rapid advancements seen in the IT and Telecom industry.

Media & Entertainment

The Media & Entertainment sector increasingly relies on cloud meetings and collaboration services to enhance content creation, production, and distribution processes. This industry benefits from the ability to collaborate in real-time, facilitating creative brainstorming and project management across geographically dispersed teams. However, the pace of growth in this is also comparable to the increased demand for streaming services and content delivery networks, making it less predominant than the IT and Telecom field which holds a robust infrastructure for such services.

Others

The "Others" category encompasses various industries that utilize cloud meetings and collaboration services but do not specifically fall under the primary categories listed. This includes sectors like education, non-profit organizations, and various small to medium enterprises that adopt cloud-based tools for enhanced communication and collaboration. While there is some growth in this category, it remains overshadowed by the more dominant sectors such as IT and Telecom, which leverage their technology more extensively for meeting and collaboration functionalities.

Global Cloud Meetings and Team Collaboration Services Market Regional Insights:

North America

North America is expected to dominate the Global Cloud Meetings and Team Collaboration Services market. This region benefits from a strong technological infrastructure, a high adoption rate of cloud solutions, and a large presence of key players such as Microsoft, Zoom, and Cisco. According to recent studies, North America accounts for a significant share of the market due to its robust service offerings and investment in continuous innovation, appealing to businesses that prioritize efficiency and collaboration in their operations.

Latin America

Latin America is witnessing a gradual growth in the adoption of Cloud Meetings and Team Collaboration Services, driven by increased internet penetration and a rising trend of remote work. However, the region faces challenges such as infrastructure limitations and varying levels of digital literacy among the population. While there are budding opportunities, particularly in countries like Brazil and Mexico, the overall market is still developing and cannot yet rival the growth rate witnessed in North America or Asia Pacific.

Asia Pacific

Asia Pacific is on a path to significant growth in the Cloud Meetings and Team Collaboration Services market. The rising number of start-ups and a tech-savvy population are driving the demand for innovative collaboration tools. However, despite its potential, challenges such as regulatory hurdles and data privacy concerns can impact the pace of adoption, keeping it behind North America for the time being.

Europe

Europe's Cloud Meetings and Team Collaboration Services market is expanding, largely due to the increasing trend of remote work and digital collaboration tools. The region's strong emphasis on data privacy and regulatory compliance, driven by frameworks like GDPR, fosters a cautious yet steady approach towards the adoption of cloud services. While specific countries like Germany and the UK are growing fast, Europe’s overall market remains somewhat fragmented compared to the unified approaches seen in North America.

Middle East & Africa

The Middle East & Africa region is in the early stages of embracing Cloud Meetings and Team Collaboration Services. Emerging market dynamics are driving some interest, particularly in urbanized areas with better infrastructure. However, there are significant challenges such as economic variability, inconsistent internet access, and lower levels of technology adoption in many African countries. These factors restrict extensive rapid growth in this, resulting in a focus on basic collaboration tools rather than advanced cloud services that dominate other regions.

Cloud Meetings and Team Collaboration Services Competitive Landscape:

Major contributors in the global Cloud Meetings and Team Collaboration services sector foster innovation and gain a competitive edge by providing adaptable solutions that improve remote communication and teamwork.

The principal entities operating within the Cloud Meetings and Team Collaboration Services sector comprise Microsoft Corporation, Zoom Video Communications, Cisco Systems, Inc., Google LLC, Slack Technologies, Inc. (a subsidiary of Salesforce), Atlassian Corporation Plc, RingCentral, Inc., Oracle Corporation, and LogMeIn, Inc. (now integrated with Francisco Partners). Other notable players include TeamViewer AG, Webex (a Cisco brand), Discord Inc., BlueJeans Network, Workplace from Facebook, and Fuze, Inc. Furthermore, organizations such as Lifesize, Zoho Corporation, Highfive, Jitsi, Wrike, and Miro also hold substantial positions in this industry.

Global Cloud Meetings and Team Collaboration Services COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly expedited the utilization of cloud-based meeting and team collaboration platforms, as organizations around the globe were compelled to shift to remote work, resulting in an increased need for digital communication solutions.

The onset of the COVID-19 pandemic significantly propelled the widespread use of cloud-based meeting and collaboration platforms, as businesses transitioned to remote work to maintain operational continuity. This shift necessitated robust communication tools, allowing companies to uphold productivity levels within a virtual setting. Consequently, applications like Zoom, Microsoft Teams, and Google Meet saw substantial increases in user engagement, which in turn spurred greater investment in technological infrastructure and improvements in service features. The pressing need for seamless collaboration catalyzed advancements in video conferencing, document sharing, and project management tools. This evolving landscape fostered ened competition, encouraging both established players and newer companies to innovate and broaden their service offerings. While the market is beginning to stabilize as organizations embrace hybrid work models, the fundamental changes in collaborative practices are expected to endure, ensuring an ongoing demand for cloud-based solutions. Thus, the sector is anticipated to continue its evolution, prioritizing security, integration options, and enhancements to user experience.

Latest Trends and Innovation in The Global Cloud Meetings and Team Collaboration Services Market:

- In March 2023, Cisco announced the acquisition of Perspica, a machine learning-based startup that enhances data analytics capabilities for their Webex platform, enabling improved performance insights for cloud meetings.

- In January 2023, Zoom launched Zoom Team Chat enhancements, allowing better integration of chat and video features, including advanced thread management and enhanced search functionalities to streamline team collaboration.

- In September 2023, Microsoft integrated AI capabilities into Teams through a series of updates, including features like enhanced meeting transcripts and real-time translation, which significantly improved accessibility and user experience.

- In April 2023, Slack, a subsidiary of Salesforce, introduced automated workflows within their platform to facilitate project management and streamline communication, further improving team collaboration efficiency.

- In June 2023, Google Workspace unveiled new features for Google Meet, including improved video quality and noise cancellation technologies, aimed at enhancing user experience during virtual meetings.

- In August 2023, Mattermost announced the launch of Mattermost 8.0, featuring new collaborative tools that integrate chat, video, and document sharing, designed for distributed teams aiming for seamless communication.

- In February 2023, Asana expanded its integration with video conferencing tools, partnering with Zoom and Microsoft Teams to allow users to manage projects and collaborate directly from their preferred meeting platforms.

- In July 2023, RingCentral announced a strategic partnership with Cisco to integrate RingCentral's cloud phone system with Cisco's Webex platform, enhancing communication options for businesses.

Cloud Meetings and Team Collaboration Services Market Growth Factors:

The Cloud Meetings and Team Collaboration Services Market is experiencing growth driven by several key factors, including a rising need for remote work tools, technological advancements in cloud infrastructure, and an increase in worldwide connectivity.

The shift towards remote work, significantly accelerated by the COVID-19 pandemic, has prompted organizations to seek out dependable and efficient collaborative tools. Improvements in internet connectivity and the widespread availability of mobile devices enhance the accessibility of these services, allowing for uninterrupted communication across different locations. Moreover, businesses are placing greater emphasis on affordable solutions that minimize the necessity for in-person meetings, leading them to adopt cloud-based services known for their flexibility and scalability.

The surge in digital transformation efforts across various sectors requires the deployment of sophisticated collaboration platforms capable of supporting real-time document sharing, video conferencing, and project management tasks. Additionally, rising concerns regarding data protection and regulatory compliance are pushing service providers to enhance their offerings with strong security measures, which in turn boosts user confidence. The trend toward globalization and the formation of cross-functional teams create a demand for tools that can support varied workflows and communication methods.

Technological innovations, including artificial intelligence and machine learning, are increasingly being integrated into these collaboration platforms to improve user experiences by offering smart assistance. Collectively, these drivers highlight the growing dependence on cloud-based solutions for seamless team collaboration and communication.

Cloud Meetings and Team Collaboration Services Market Restaining Factors:

The primary obstacles affecting the market for cloud-based meeting and team collaboration services comprise worries about data protection, possible technical challenges, and differing levels of user adaptability among organizations.

Foremost among these are issues related to data security and privacy, as organizations grow increasingly cautious about the risks of data breaches and unauthorized access to delicate information within cloud systems. Furthermore, disparities in digital literacy and the hesitation of some companies to move away from conventional meeting methods to cloud-based alternatives can restrict the adoption of these services. Moreover, the proliferation of providers contributes to market saturation, making it more difficult for organizations to identify the most suitable solutions for their collaborative needs. Nonetheless, the rising demand for remote working solutions, along with ongoing technological advancements such as AI-enhanced functionalities and seamless integration options, are fostering significant innovation and promising sustained growth in the realm of Cloud Meetings and Team Collaboration services.

Segments of the Cloud Meetings and Team Collaboration Services Market

By Type

- Software

- Services

- Others

By Application

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Retail

- IT and Telecom

- Government

- Media & Entertainment

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America