Market Analysis and Insights:

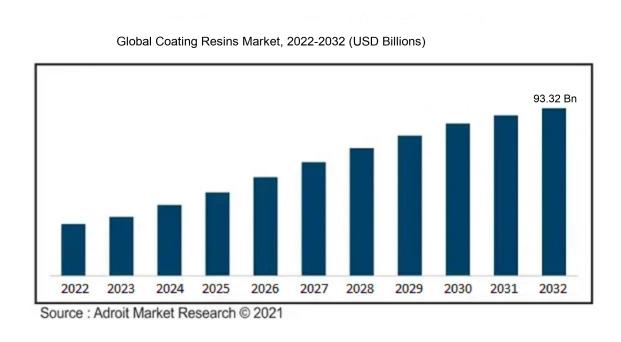

The market for Coating Resins was estimated to be worth USD 56.78 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 5.79%, with an expected value of USD 93.32 billion in 2032.

The coating resins industry experiences growth and high demand due to various contributing factors. A major driver is the rapid expansion of the global construction sector, spurred by a surge in infrastructure projects and urban development. This has created an increased need for protective coatings that boost the longevity of diverse surfaces including walls, floors, and roofs.

Moreover, there is a growing market for eco-friendly coatings driven by consumer awareness of sustainable products, leading to the emergence of bio-based and water-based coating resins that offer reduced VOC emissions and environmental impact. The automotive sector also plays a crucial role in fueling market demand, utilizing coatings for decorative and protective purposes in vehicles. Furthermore, the rising requirement for advanced and specialized coatings in industries such as aerospace, marine, and industrial applications contributes significantly to the expansion of the coating resins market. These factors, combined with continuous technological innovations and research efforts, are set to drive further growth in the sector in the foreseeable future.

Coating Resins Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 93.32 billion |

| Growth Rate | CAGR of 5.79% during 2024-2032 |

| Segment Covered | By Resin, By Technology, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF SE, The Dow Chemical Company, Arkema SA, Evonik Industries AG, Eastman Chemical Company, Allnex Belgium SA/NV, Momentive Specialty Chemicals Inc., PPG Industries Inc., Royal DSM NV, and Nuplex Industries Limited. |

Market Definition

Coating resins represent a class of substances utilized to furnish a shielding and aesthetically pleasing coating on a variety of surfaces, including metals, plastics, and wood. Renowned for their exceptional adhesion, resistance to chemicals, and robustness, they serve to prolong the lifespan and enhance the visual appeal of the treated item.

Coating resins are indispensable in a diverse array of industries, playing a critical role in numerous applications. These resins are essential for safeguarding surfaces, providing durability, and enhancing aesthetic appeal. By creating a protective barrier, they shield substrates from environmental threats like corrosion and UV radiation. Furthermore, coating resins contribute to the visual appeal of products by delivering a sleek and lustrous finish. They also promote adhesion and aid in pigment dispersion, resulting in vivid and enduring colors. The versatility and practicality of coating resins make them indispensable in sectors such as automotive, construction, packaging, and furniture, ensuring the resilience and excellence of coated surfaces.

Key Market Segmentation:

Insights On Key Resin

Polyurethane

Polyurethane is expected to dominate the global coating resins market. The demand for polyurethane-based coatings has been increasing due to their excellent properties such as high durability, abrasion resistance, flexibility, and resistance to chemicals and UV radiation. These coatings find extensive applications in industries such as automotive, construction, electronics, and furniture. Additionally, the growing need for sustainable and eco-friendly coatings has also driven the demand for water-based polyurethane coatings. With these factors fueling the market growth, polyurethane is anticipated to be the dominating part among the different types of coating resins.

Acrylic

Acrylic is another important resin type in the global coating resins market. Acrylic-based coatings are known for their fast drying time, good adhesion, excellent weatherability, and resistance to chemicals. These coatings are widely used in various industries including automotive, construction, marine, and aerospace. Additionally, the growing demand for low-VOC and eco-friendly coatings has further contributed to the increasing adoption of acrylic resins. Although acrylic resins have significant market share, they are expected to be overshadowed by the dominance of polyurethane in the global coating resins market.

Epoxy

Epoxy-based coatings have a strong presence in the global coating resins market, particularly in applications that require high chemical resistance and corrosion protection. Epoxy coatings are widely used in industries such as infrastructure, oil and gas, marine, and automotive. These coatings provide exceptional durability, adhesion, and protection against harsh environments. However, the dominance of polyurethane in terms of market demand is expected to limit the growth potential of epoxy-based coatings.

Vinyl

Vinyl-based coatings are commonly used for decorative and protective purposes. They offer good weatherability, durability, and resistance to chemicals. Vinyl coatings find applications in various sectors such as building and construction, automotive, and industrial. However, the market dominance of polyurethane is likely to restrict the growth of vinyl-based coatings in the global coating resins market.

Alkyd

Alkyd-based coatings are known for their excellent gloss retention, quick drying time, and good adhesion. These coatings are widely used in decorative applications and are popular in the furniture and appliance industries. However, the dominance of polyurethane is expected to limit the market growth potential for alkyd-based coatings.

Amino

Amino resins, unsaturated polyester resins, saturated polyester resins, and other parts within the coating resins market have a relatively smaller market share compared to the dominating polyurethane part. Amino resins find applications in wood coatings and are known for their excellent hardness and chemical resistance.

Unsaturated Polyester

Unsaturated polyester resins are commonly utilized in the production of fiberglass reinforced plastics and gel coats. These materials are chosen for their strong mechanical properties and resistance to environmental factors such as moisture and chemicals. In the construction industry, unsaturated polyester resins are widely used for manufacturing pipes, tanks, and panels. Their ability to form complex shapes and provide durable finishes makes them an essential component in boat hulls, automotive body parts, and various consumer goods.

Saturated Polyester

Saturated polyester resins are primarily used in high-performance coatings due to their excellent adhesion, durability, and chemical resistance. They are a key component in coil coatings, which are applied to metal sheets used in the construction of buildings and appliances. Automotive coatings benefit from the use of saturated polyester resins, as they provide a glossy, protective finish that withstands the harsh conditions faced by vehicles. Industrial coatings, another significant application, rely on these resins for their ability to protect machinery and equipment from corrosion and wear. The balance of flexibility and hardness in saturated polyesters makes them ideal for applications where a tough, long-lasting finish is required.

Others

The "Others" category in the global coating resins market includes a variety of niche products tailored for specific applications. These resins, while not as widely used as polyurethane, play crucial roles in specialized industries.

Insights On Key Technology

Water-based coatings

Water-based coatings are expected to dominate the Global Coating Resins Market. These coatings are gaining popularity due to their low volatile organic compound (VOC) content and environmental friendliness. Moreover, water-based coatings offer excellent durability, adhesion, and corrosion resistance. They also provide a wide range of color options, gloss levels, and finishes, making them suitable for various applications across industries such as automotive, construction, and furniture. The water-based technology is further boosted by growing regulations and awareness regarding sustainable and eco-friendly coatings. Therefore, water-based coatings are poised to dominate the Global Coating Resins Market.

Solvent-based coatings

Solvent-based coatings remain a significant player in the Global Coating Resins Market. These coatings are known for their excellent adhesion, durability, and resistance to extreme weather conditions. Despite concerns about VOC emissions, solvent-based coatings offer advantages such as fast drying time, high gloss, and excellent performance on different substrates. Industries like automotive, aerospace, and marine continue to rely on solvent-based coatings due to their superior properties. However, increasing environmental regulations and the shift towards more sustainable alternatives may limit the growth of solvent-based coatings in the long run.

UV-cured coatings

UV-cured coatings provide unique advantages such as rapid curing, low energy consumption, and enhanced performance characteristics. These coatings are widely used in various industries, including electronics, packaging, and automotive. UV-cured coatings offer excellent resistance to chemicals, abrasion, and scratches. However, the high cost of UV-curing equipment and limited applicability for certain substrates hinder their widespread adoption. Although UV-cured coatings are expected to experience steady growth, they are not anticipated to dominate the Global Coating Resins Market.

High solids coatings

High solids coatings are gaining traction in the Global Coating Resins Market due to their low VOC content and environmental benefits. These coatings provide excellent film thickness, robustness, and resistance to corrosion. High solids coatings offer higher solids content, reducing solvent emissions and increasing productivity. They are widely used in applications that require improved performance and durability, such as automotive, marine, and industrial equipment. Although high solids coatings show promising growth potential, they are not projected to dominate the Global Coating Resins Market.

Powder coatings

Powder coatings are another important technology in the Global Coating Resins Market. These coatings are applied as dry powders and cured using heat to form a hard and durable finish. Powder coatings offer excellent resistance to corrosion, chemicals, and impact. They are widely used in applications such as automotive, appliances, and architectural coatings. The advantages of powder coatings include high color retention, minimal waste generation, and absence of solvents. However, the need for specialized equipment and limited color options compared to liquid coatings may limit their dominating presence in the Global Coating Resins Market.

Insights On Key Application

Architectural Coatings

Architectural Coatings application is expected to dominate the Global Coating Resins Market. With the rapid growth in the construction industry, there has been a significant increase in demand for architectural coatings. These coatings are used for both decorative and protective purposes on various surfaces, including residential and commercial buildings. The rise in urbanization, changing consumer preferences towards aesthetically appealing designs, and the need for durability and protection against harsh weather conditions are driving the demand for architectural coatings. As a result, the Architectural Coatings part is expected to have the largest market share in the Global Coating Resins Market.

Marine & Protective Coatings

The Marine & Protective Coatings part is another significant application in the Global Coating Resins Market. This part caters to various applications such as shipbuilding, offshore structures, tanks, pipelines, bridges, and industrial equipment. The demand for marine and protective coatings is driven by the need for corrosion and chemical resistance, as well as protection from extreme weather conditions. The growth in marine transportation, oil and gas industry, and infrastructure development further contributes to the dominance of the Marine & Protective Coatings part in the Global Coating Resins Market.

General Industrial Coatings

The General Industrial Coatings part is an important application of the Global Coating Resins Market. It encompasses a wide range of industrial applications such as machinery, equipment, appliances, metal fabrication, and consumer goods. General industrial coatings provide protective and surface enhancement properties. The growing industrialization, manufacturing activities, and demand for high-performance coatings in various industries contribute to the dominance of the General Industrial Coatings part in the Global Coating Resins Market.

Automotive Coatings

Automotive Coatings part also holds a significant share in the Global Coating Resins Market. With the expansion of the automotive industry, the demand for coatings used in cars, trucks, motorcycles, and other vehicles has increased. Automotive coatings provide not only aesthetic appeal but also protection from corrosion, UV rays, and other environmental factors. The rising production and sales of vehicles, coupled with the trend of customization, drive the demand for automotive coatings. Hence, the Automotive Coatings part is a dominating part of the Global Coating Resins Market.

Wood Coatings

Wood Coatings plays a crucial role in the Global Coating Resins Market. This part includes coatings used for protecting and enhancing the appearance of wood surfaces in furniture, flooring, doors, and windows. The growth in the construction and furniture industries, along with the rising popularity of wooden aesthetics, drives the demand for wood coatings. Additionally, consumers' increasing focus on eco-friendly and sustainable products contributes to the dominance of the Wood Coatings part in the Global Coating Resins Market.

Packaging Coatings

Packaging Coatings also holds a significant share in the Global Coating Resins Market. These coatings are used for enhancing the appearance, protecting contents, and providing barrier properties to packaging materials such as metal cans, plastic bottles, and flexible packaging. The increasing demand for packaged goods, e-commerce growth, and the need for product differentiation drive the demand for packaging coatings. As a result, the Packaging Coatings part shows strong potential for dominating the Global Coating Resins Market.

Coil Coatings

Coil Coatings is an important part of the Global Coating Resins Market. These coatings are applied on metal coils used in various industries such as construction, automotive, and appliances. Coil coatings provide corrosion resistance, weatherability, and aesthetics to the coated metal sheets. The increasing demand for metal roofing, wall panels, and pre-painted appliances fuels the growth of the Coil Coatings part. Hence, it holds a significant market share in the Global Coating Resins Market.

Others

The Others applications represents a diverse range of applications in the Global Coating Resins Market. This category includes coatings used in various niche industries and applications that are not covered under the dominant parts. It is challenging to predict the exact dominance within this part without detailed market research. However, it is likely that the "Others" part includes smaller market shares for specific applications like electronics, aviation, textiles, and energy. Further analysis is required to determine which part is dominating within the "Others" category in the Global Coating Resins Market.

Insights on Regional Analysis:

North America

North America is expected to dominate the global coating resins market. This region has a well-established infrastructure and a thriving manufacturing industry, which drives the demand for coating resins. Additionally, North America has a high consumer preference for eco-friendly and sustainable products, leading to an increased demand for water-based and bio-based coating resins. The presence of key market players and technological advancements further strengthens the market position of North America in the coating resins industry.

Latin America

Latin America is a significant market for coating resins, but it is not expected to dominate the global market. The region experiences growth due to factors such as increasing investments in construction and infrastructure development. However, the market growth is hindered by economic uncertainties, political instability, and limited technological advancements in the coating resins industry.

Asia Pacific

Asia Pacific is a rapidly growing market for coating resins, with countries like China and India driving the demand. The booming construction and automotive industries in the region contribute to the high demand for coating resins. Additionally, the presence of several manufacturing hubs and a large consumer base further supports the market growth in Asia Pacific. Although the region shows immense potential, it is not expected to dominate the global market due to fierce competition and the presence of other dominant regions.

Europe

Europe is a mature market for coating resins and has a strong presence in the global industry. The region boasts advanced technological capabilities, stringent environmental regulations, and a focus on sustainable products. The market growth in Europe is driven by the automotive, construction, and industrial sectors. However, while Europe remains a significant player in the global market, it is not expected to dominate due to slower economic growth compared to other regions.

Middle East & Africa

Middle East & Africa is an emerging market for coating resins, experiencing steady growth due to infrastructure development and increased construction activities. The region is witnessing rising investments in the oil and gas, automotive, and building & construction sectors, contributing to the demand for coating resins. However, due to factors such as political instability, economic volatility, and limited technological advancements, Middle East & Africa is not expected to dominate the global coating resins market.

Company Profiles:

Prominent stakeholders within the worldwide Coating Resins industry are pivotal in spearheading the progression and evolution of cutting-edge coating methodologies to address the growing need for environmentally friendly, high-efficiency, and economical coating alternatives on a global scale.

Prominent players in the Coating Resins sector comprise BASF SE, The Dow Chemical Company, Arkema SA, Evonik Industries AG, Eastman Chemical Company, Allnex Belgium SA/NV, Momentive Specialty Chemicals Inc., PPG Industries Inc., Royal DSM NV, and Nuplex Industries Limited. These industry leaders are actively engaged in creating and delivering a diverse array of coating resins for applications across automotive, construction, and packaging industries. They are dedicated to pioneering sustainable and innovative coating solutions to cater to the evolving market needs. Leveraging their wide range of products, robust distribution channels, and global reach, these key stakeholders are pivotal in shaping the Coating Resins sector and propelling its advancement.

COVID-19 Impact and Market Status:

The Global Coating Resins market has experienced a decrease in demand as a result of the impact of Covid-19, caused by supply chain disruptions and diminished consumer expenditure.

The global market for coating resins has been significantly impacted by the COVID-19 pandemic. Stringent lockdown measures and disruptions in industrial activities across various countries have resulted in a decrease in the demand for coating resins in sectors including automotive, construction, and general manufacturing. The temporary closure of manufacturing facilities and reduced consumer spending due to economic uncertainties have also contributed to this decline. Additionally, challenges in raw material procurement and production activities have arisen due to the disrupted global supply chain and restrictions on international trade. Nevertheless, there are positive indications of market recovery as countries gradually ease lockdown measures and resume economic operations. The emphasis on hygiene and cleanliness, as well as the increased demand for antimicrobial coatings, is projected to boost the need for coating resins in applications such as healthcare facilities and public spaces. Despite the challenges faced initially, the coating resins market is expected to make a comeback in the post-pandemic era, driven by the revival of industries and ened investments in infrastructure projects.

Latest Trends and Innovation:

- In March 2021, Axalta Coating Systems announced the acquisition of U-POL, a UK-based manufacturer of coatings for the automotive aftermarket.

- In October 2020, PPG Industries completed the acquisition of Ennis-Flint, a global leader in pavement markings and traffic safety solutions.

- In September 2020, AkzoNobel introduced an innovative powder coating technology called ANITA, designed for heat-sensitive substrates like medium density fiberboard (MDF).

- In July 2020, Sherwin-Williams acquired R.J. Marshall Company, a leading supplier of coatings and additives for the industrial and infrastructure markets.

- In February 2020, BASF launched a new water-based polyurethane dispersion technology named Acronal® EDGE 4247, providing high-performance coatings with low volatile organic compound (VOC) content.

- In January 2020, Arkema announced the acquisition of Lambson, a UK-based company specializing in photoinitiators for curing coatings, inks, and adhesives.

- In November 2019, Axalta Coating Systems introduced a new high-temperature, corrosion-resistant internal pipe coating named Nap-Gard® 7-0017.

- In August 2019, PPG Industries announced the acquisition of Dexmet Corporation, a manufacturer of highly-engineered specialty materials for aerospace, automotive, and industrial applications.

- In May 2019, AkzoNobel launched a new digital tool called MIXIT™, enabling customers to digitally select, mix, and virtually apply coatings for various end-use applications.

- In March 2019, Sherwin-Williams introduced a new line of anti-graffiti coatings called Poly-Carb.

- In February 2019, BASF acquired the global surface modifier business of the Belgian company, Solvay.

Significant Growth Factors:

Factors driving the expansion of the Coating Resins Market comprise the escalation of infrastructure developments, surging interest in environmentally sustainable coatings, and the progression of the automotive sector.

The market for coating resins is poised for substantial growth in the foreseeable future, driven by various key factors. Notably, the surge in demand from pivotal end-use sectors like automotive, construction, and packaging is a paramount catalyst in this growth trajectory. These industries rely on coating resins for diverse applications, encompassing automotive finishes, architectural coatings, and safeguarding packaging materials. Furthermore, the escalating construction activities, primarily in emerging markets, are bolstering the need for coating resins owing to their pivotal role in fortifying structures and infrastructure against wear and tear. Additionally, the mounting environmental apprehensions and stringent protocols on volatile organic compound (VOC) emissions are steering the transition towards water-based and low VOC content coating resins, thereby elevating market demand.

Moreover, technological breakthroughs, including the introduction of innovative resin formulations and enhanced coating methodologies, are also bolstering market expansion. These advancements empower manufacturers to deliver top-notch, eco-friendly coating solutions, thereby attracting a broader consumer base. Lastly, the burgeoning middle-class populace and the uptick in disposable income in developing nations are propelling the demand for consumer goods, consequently stimulating the coating resins market. In essence, the confluence of escalating industrialization, environmental mandates, technological innovations, and evolving consumer inclinations are pivotal growth drivers for the coating resins market.

Restraining Factors:

Limited access to raw materials and price volatility are significant challenges for the Coating Resins Market.

The market for coating resins is facing various challenges that impede its progress and advancement. Stringent environmental regulations and growing concerns regarding VOC emissions present substantial obstacles for the industry. Manufacturers are required to decrease the VOC content in coating resins to comply with these regulations, resulting in increased production costs and constrained product performance. Fluctuations in raw material prices, such as petrochemicals and solvents, further impact the market's profitability and pricing strategies. In addition, there is fierce competition from alternative technologies like powder coatings and waterborne coatings, offering reduced VOC emissions and enhanced environmental benefits. Furthermore, the COVID-19 pandemic has negatively impacted the market by causing disruptions in the supply chain, decreased consumer expenditure, and delayed construction projects, leading to a decrease in demand for coating resins.

Despite these challenges, there are positive prospects to consider. The rising need for sustainable and environmentally friendly coating solutions presents opportunities for innovation and the development of low or zero VOC coating resins. Additionally, the increasing popularity of bio-based resins and advancements in technology have the potential to drive market growth.

Collaborations and partnerships among industry stakeholders can also facilitate the introduction of new products and help address the obstacles confronting the coating resins market. Unsaturated polyester resins are commonly utilized in the production of fiberglass reinforced plastics and gel coats. These materials are chosen for their strong mechanical properties and resistance to environmental factors such as moisture and chemicals. In the construction industry, unsaturated polyester resins are widely used for manufacturing pipes, tanks, and panels. Their ability to form complex shapes and provide durable finishes makes them an essential component in boat hulls, automotive body parts, and various consumer goods.

Key Segments of the Coating Resins Market

Resin Overview

• Acrylic

• Alkyd

• Vinyl

• Polyurethane

• Epoxy

• Amino

• Unsaturated Polyester

• Saturated Polyester

• Others

Technology Overview

• Water-based Coatings

• Solvent-based Coatings

• UV-cured Coatings

• High solids Coatings

• Powder Coatings

Application Overview

• Architectural Coatings

• Marine & Protective Coatings

• General Industrial Coatings

• Automotive Coatings

• Wood Coatings

• Packaging Coatings

• Coil Coatings

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America