Cocoa and Chocolate Market Analysis and Insights:

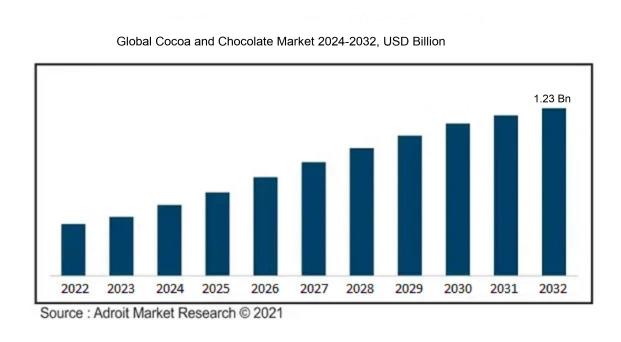

At a compound annual growth rate (CAGR) of 6.4%, the global cocoa and chocolate market, which was valued at USD 1.15 billion in 2024, is projected to reach USD 1.23 billion by 2032.

The cocoa and chocolate industry is propelled by a variety of crucial elements. One significant factor is the surge in consumer interest in high-quality, sustainable chocolate offerings. Additionally, there is a ened awareness of the health benefits associated with cacao, which is influencing purchasing decisions. The trend toward ethical sourcing is also gaining momentum among shoppers. Innovations in flavor profiles and product formulations—such as the rise of plant-based and organic chocolates—have contributed to the market's attractiveness. Economic variables, including shifts in cocoa prices and production hurdles stemming from climate change, play a vital role in determining market behavior. Moreover, the growing prevalence of e-commerce has made a diverse array of chocolate products more accessible, driving sales upward. Geographically, regions in Asia-Pacific and Latin America are experiencing notable growth driven by evolving consumer tastes and increased urbanization. In summary, the interaction of health consciousness, ethical sourcing practices, and the dynamics of emerging markets is continually influencing the landscape of the cocoa and chocolate sector.

Cocoa and Chocolate Market Definition

Cocoa is the processed product obtained from cocoa beans, encompassing both cocoa powder and cocoa butter, mainly utilized for flavor enhancement and baking purposes. In contrast, chocolate is a delicacy crafted by blending cocoa solids, cocoa butter, sugar, and typically milk, leading to a sweet indulgence available in multiple varieties.

Cocoa and chocolate are integral to worldwide culture and economics, cherished not just as delightful treats but also as vital agricultural products. Packed with flavonoids and antioxidants, cocoa is associated with numerous health advantages, such as better cardiovascular health and mood improvement. The chocolate sector sustains millions of growers, especially in emerging economies, promoting economic growth and trade. Additionally, it enriches culinary variety, playing a crucial role in many desserts and drinks. The emotional ties that people have with chocolate transform it into a representation of celebration and love, enhancing its significance in social customs around the globe.

Cocoa and Chocolate Market Segmental Analysis:

Insights On Ingredients

Cocoa Butter

Cocoa Butter is expected to dominate the Global Cocoa and Chocolate Market due to its essential role in the texture and mouthfeel of chocolate products. It serves as a primary fat in chocolate formulations, contributing to its quality and stability, which are critical factors for manufacturers and consumers alike. Additionally, with the rise of clean-label trends, cocoa butter is favored because it is a natural product with minimal processing. These attributes not only make it a preferred ingredient in high-end chocolates but also in artisan and premium foods, enhancing its demand across various consumer s. As a key component in chocolate production, along with its health benefits, cocoa butter's versatility solidifies its position in the market.

Cocoa Liquor

Cocoa Liquor plays a significant role in the chocolate-making process, as it contains both cocoa solids and cocoa butter. This combination is crucial for producing a wide range of chocolate products, from dark to milk chocolate. The growing trend of premium and gourmet chocolates, which often emphasize rich cocoa flavors, drives the demand for cocoa liquor. Manufacturers appreciate its ability to impart deep flavors and colors while maintaining quality in their products. As chocolate consumption rises globally, cocoa liquor is increasingly seen as an indispensable ingredient, appealing to both manufacturers and consumers looking for rich chocolate experiences.

Cocoa Powder

Cocoa Powder is a vital ingredient primarily used in baked goods, beverages, and confections. Its versatility makes it popular among various food and beverage manufacturers. The market for cocoa powder is bolstered by the increasing consumer preference for cocoa-based snacks and drinks, particularly in the health-conscious sector. Additionally, cocoa powder is often marketed for its antioxidant properties and is incorporated into products targeting health and wellness enthusiasts. As consumers demand more cocoa-flavored items and healthier alternatives, cocoa powder continues to gain traction in both retail and food service channels.

Insights On Application

Food and Beverages (Confectionery, Dairy, Bakery, Others)

The Food and Beverages sector, particularly Confectionery, is anticipated to dominate the Global Cocoa and Chocolate Market. This is due to the rising demand for chocolate-based confectionery products across various demographics, including children and young adults. The growing trend of indulgence and premiumization in chocolates is contributing to the 's expansion. Furthermore, awareness regarding the health benefits associated with cocoa compounds and the increasing trend of incorporating chocolate in various snacks and desserts are driving growth. Market players are also innovating with gourmet chocolate offerings and experiential products that cater to diverse consumer preferences, reinforcing the leading position of this application category.

Cosmetics and Pharmaceuticals

The Cosmetics and Pharmaceuticals category is gradually gaining traction as cocoa ingredients are increasingly recognized for their skin-nourishing properties. The rich antioxidant content in cocoa aligns well with the growing demand for natural and organic products in personal care. Brands in the cosmetics industry are formulating creams and lotions with cocoa extracts to leverage its hydrating and anti-aging benefits. Additionally, the pharmaceutical sector is exploring cocoa derivatives for potential health applications, contributing to a stable demand in this area.

Others

The 'Others' category, which includes non-traditional applications of cocoa and chocolate, is witnessing some growth but lacks the prominence seen in the Food and Beverages. This portion includes niche markets and specialty uses, such as in health supplements or artisan products. While it provides diversification and unique offerings, the overall demand in this remains relatively modest compared to the more established applications. Furthermore, market expansion in 'Others' is contingent on specific consumer trends and innovations, which can sometimes be less predictable than the broader food products.

Insights On Chocolate Type

Milk Chocolate

Milk chocolate is expected to dominate the Global Cocoa and Chocolate Market largely due to its widespread popularity and consumer preference. Its creamy texture and milder flavor appeal to a broad demographic, including children and adults alike. The versatile nature of milk chocolate allows it to be used in various products, from candy bars to baked goods and desserts, enhancing its market share. Additionally, the growing trend of indulgence and comfort food consumption drives demand for milk chocolates, making it a staple in retailers and grocery stores. With strong marketing and brand loyalty, milk chocolate consistently attracts consumers looking for satisfying and enjoyable options, thus positioning it as the leading type of chocolate in the global market.

Dark Chocolate

Dark chocolate presents itself as a strong competitor in the market, gaining traction largely due to health-conscious consumers. Known for its higher cocoa content and lower sugar levels, dark chocolate is often marketed for its potential health benefits, including improved cardiovascular health and antioxidants. The rise of gourmet and artisan chocolate brands has further propelled the popularity of dark chocolate, as consumers are increasingly seeking premium quality and ethical sourcing. While it may not have the mass appeal of milk chocolate, the niche market and growing awareness regarding health benefits position dark chocolate favorably among chocolate enthusiasts.

White Chocolate

White chocolate, while often debated due to its lack of cocoa solids, continues to maintain a niche presence in the market. Its sweet, creamy taste offers an alternative to traditional chocolates, appealing to consumers who prefer a sweeter flavor profile. White chocolate is frequently utilized in confectionery, desserts, and baking, making it a versatile ingredient that attracts both home bakers and professional chefs alike. Furthermore, seasonal products and novelty items featuring white chocolate contribute to its sustained interest among consumers. Although it does not dominate the market, its unique flavor and versatility ensure that it remains a viable option for many chocolate lovers.

Others

The "Others" category encompasses various niche and innovative chocolate products, including flavored chocolates, organic varieties, and specialty chocolates infused with unique ingredients such as spices and herbs. Although this might not have the same large consumer base as milk, dark, or white chocolate, it caters to specific consumer interests and trends, such as gourmet experiences and artisanal craft. The growing trend of customization and premium offerings in the chocolate market allows this category to thrive, attracting adventurous consumers looking to explore different flavors and combinations. As trends evolve, this category can provide opportunities for growth through innovation and differentiated offerings.

Global Cocoa and Chocolate Market Regional Insights:

Asia Pacific

The Asia Pacific region is anticipated to dominate the Global Cocoa and Chocolate market, significantly driven by the growing urban population, increasing disposable income, and changing consumer preferences towards premium and artisanal chocolate products. Countries like China and India are witnessing a surge in demand for chocolate, particularly among the youth and millennials who are becoming more inclined towards confectionery items. Moreover, the expansion of retail channels, including supermarkets and online platforms, is facilitating accessibility to diverse chocolate products. As the region continues to urbanize and consumers become more health-conscious, the interest in organic and dark chocolate varieties is also rising, further enhancing the market potential in Asia Pacific.

North America

North America remains a key player in the Global Cocoa and Chocolate market, primarily led by high chocolate consumption rates in the United States. The region is characterized by strong brand loyalty and a diverse range of product offerings, including premium and health-oriented chocolates. The market also benefits from innovative marketing strategies and packaging that appeal to consumers seeking convenience. Furthermore, increasing consumer awareness regarding sustainable sourcing practices, such as ethical sourcing of cocoa, is shaping purchasing decisions, making North America a competitive region despite challenges posed by health trends discouraging high sugar intake.

Europe

Europe is one of the largest markets for cocoa and chocolate, driven by a rich tradition of chocolate consumption and high per capita chocolate consumption rates. The European consumer base shows a notable preference for high-quality and artisan chocolate brands, with a growing trend toward fair-trade and organic options. Countries like Switzerland and Belgium are renowned for their chocolate heritage, supporting a robust market for premium products. However, competition is intense, and manufacturers must continually innovate to cater to evolving consumer tastes and dietary preferences, including the increasing demand for vegan and low-sugar alternatives.

Latin America

Latin America has a pivotal role in the cocoa and chocolate market as it is both a major producer of cocoa beans and an emerging consumer market. Countries such as Brazil and Mexico are experiencing a growth in chocolate consumption, driven by nostalgia for traditional flavors and the rise of gourmet chocolate products. The growing middle class and increasing popularity of cacao-based products are further boosting this market. Nonetheless, challenges in distribution and a focus on local products could limit the overall growth pace in comparison to the more developed markets in North America and Europe.

Middle East & Africa

The Middle East & Africa region presents a unique market for cocoa and chocolate, characterized by increasing demand and burgeoning urbanization trends. Countries like South Africa and the UAE are witnessing rising shifts in consumer behavior with an inclination toward luxury chocolate brands. However, the region still faces challenges like economic instability and variable cocoa production, which can affect supply chains. Efforts by local brands to innovate and create flavors that resonate with cultural preferences are transforming this region's market landscape, although the overall market remains relatively nascent compared to Asia Pacific and other established regions.

Cocoa and Chocolate Competitive Landscape:

Prominent entities within the worldwide cocoa and chocolate sector manage a range of supply chain phases, encompassing the growth and processing of cocoa beans to the production and delivery of chocolate items. Their cooperative efforts and innovative approaches influence market dynamics, foster product advancement, and promote sustainability initiatives throughout the industry.

Prominent entities in the Cocoa and Chocolate sector encompass Mars, Incorporated, Barry Callebaut AG, Mondelez International, Inc., Cargill, Incorporated, Ferrero Group, Lindt & Sprüngli AG, Hershey Company, Nestlé S.A., Olam Group, and Cocoa Processing Company. Other noteworthy participants include Ecom Agroindustrial Corp. Ltd., GUYANA Cocoa Corporation, ADM (Archer Daniels Midland Company), and Schokinag Holding GmbH. Additionally, firms such as Blommer Chocolate Company, Cassegrain, Natra S.A., and Puratos Group play significant roles in shaping the industry landscape.

Global Cocoa and Chocolate COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted supply chains and transformed consumer habits, resulting in a ened demand for chocolate as a source of comfort. However, this surge in interest was met with obstacles in cocoa production, primarily stemming from labor shortages and logistical challenges.

The COVID-19 pandemic had a profound effect on the cocoa and chocolate industry, resulting in significant disruptions in supply chains, alterations in consumer habits, and varying levels of demand. Lockdowns and regulations in critical cocoa-producing areas, especially in West Africa, led to labor shortages and logistical issues that complicated both the harvesting and distribution of cocoa beans. At the same time, consumers began to favor comfort foods, particularly chocolate, as they sought indulgent options during challenging periods. Despite this increased interest, the overall growth of the market was constrained by the pandemic's economic repercussions, which caused many consumers to limit their purchases of premium products due to reduced disposable income. Additionally, there was a notable rise in e-commerce, significantly boosting online sales of chocolate, as physical stores encountered various difficulties. As the industry has started to recover from the pandemic, there are promising developments, particularly with an increasing focus on sustainability and ethical sourcing practices in cocoa production, which are likely to redefine the chocolate market in the evolving landscape.

Latest Trends and Innovation in The Global Cocoa and Chocolate Market:

- In March 2021, Barry Callebaut announced the acquisition of a majority stake in Germany-based company, Diederichs, which specializes in producing handcrafted premium chocolates. This move aimed to strengthen Barry Callebaut's presence in the retail and artisanal chocolate s.

- In June 2021, Cargill introduced its new range of sustainable chocolate products, focusing on traceability and transparency in sourcing practices. This innovation is in line with their commitment to responsible agriculture and improving the livelihoods of cocoa farmers.

- In April 2022, Mondelez International acquired the Belgian chocolate manufacturer, Côte d'Or, enhancing their premium chocolate offerings and expanding their footprint in the European market.

- In September 2022, Nestlé launched its 'Cocoa Plan' update, which aims to ensure sustainable sourcing of cocoa while improving the living conditions for cocoa farmers. The plan includes investments in community programs and environmental initiatives.

- In November 2022, Ferrero announced a collaboration with Puratos Group to drive innovation in chocolate applications, focusing on clean label ingredients and sustainable sourcing, aimed at catering to health-conscious consumers.

- In January 2023, Olam Food Ingredients (OFI) completed the acquisition of the remaining shares of the African cocoa processor, Nigeria-based Olam Cocoa, strengthening its supply chain and production capabilities in the continent.

- In March 2023, Hershey's unveiled a new line of plant-based chocolate bars, marking a significant product innovation aimed at appealing to the growing vegan and health-conscious consumer base.

- In July 2023, Meiji Holdings announced a partnership with the Rainforest Alliance to advance sustainability practices across its cocoa supply chain, enhancing its commitment to environmental stewardship and social responsibility in sourcing.

- In September 2023, Lindt & Sprüngli introduced a new production technology that allows for a reduction in sugar content without compromising the taste and texture of their premium chocolates, showcasing their commitment to health-conscious offerings.

Cocoa and Chocolate Market Growth Factors:

The expansion of the cocoa and chocolate industry is propelled by a surge in consumer preference for high-quality and ethically produced items, ened awareness of health benefits, and a broader utilization of chocolate across different food and beverage categories.

The Cocoa and Chocolate Market is currently undergoing remarkable expansion, influenced by several key elements. A rising inclination for high-quality and artisanal chocolates, shaped by evolving consumer tastes aiming for distinctive flavors, has fostered the emergence of niche chocolate brands. Additionally, an increasing awareness of health and wellness among consumers is propelling market growth, as darker chocolates, known for their antioxidants due to elevated cocoa content, gain popularity.

The surge in interest regarding vegan and organic chocolate varieties is also meeting the demand for healthier choices among a broader demographic. Innovations such as chocolates enriched with superfoods and other functional ingredients are further appealing to health-conscious consumers. The growth of e-commerce has enhanced access to a wide array of chocolate products, making it easier for customers to purchase these delights and boosting overall sales.

Furthermore, rising disposable incomes in emerging markets are enabling consumers to spend more on luxury commodities, including premium chocolates. Though climate change poses significant risks to cocoa cultivation, the shift towards sustainable sourcing and direct trade practices is gaining traction, addressing these challenges and enhancing consumer preference for ethically sourced products. Together, these dynamics are steering the Cocoa and Chocolate Market towards impressive growth, marked by shifting preferences and a deeper awareness of the origins of products.

Cocoa and Chocolate Market Restaining Factors:

The cocoa and chocolate industry encounters various obstacles, including volatile prices for raw materials, rising issues related to environmental sustainability, and disruptions within the supply chain.

The cocoa and chocolate sector encounters various hindrances that may affect its expansion. A significant obstacle is the volatility in cocoa pricing, which is impacted by challenges in the supply chain, environmental changes, and geopolitical tensions in regions renowned for cocoa production, especially in West Africa. The industry is also facing ened scrutiny regarding sustainability, as irresponsible agricultural methods and deforestation associated with cocoa farming alarm eco-conscious consumers. Additionally, the growing awareness about health has led to a decrease in the demand for sugary chocolate products, compelling producers to reformulate their offerings, which can complicate manufacturing processes. The market is also experiencing ened competition from alternative sweeteners and plant-based products, presenting further challenges to conventional chocolate sales. Issues related to labor, such as child labor and inadequate wages in cocoa cultivation, tarnish the industry’s image and may dissuade ethically-minded consumers. Nevertheless, in spite of these obstacles, the market demonstrates adaptability through innovations such as healthier chocolate products, brands that prioritize sustainability, and enhanced commitments to fair trade practices. These encouraging developments indicate a potential for growth while simultaneously tackling the critical issues currently facing the cocoa and chocolate market.

Key Segments of the Cocoa and Chocolate Market

By Ingredients

• Cocoa Butter

• Cocoa Liquor

• Cocoa Powder

• Others

By Application

• Food and Beverages

• Confectionery

• Dairy

• Bakery

• Others

• Cosmetics and Pharmaceuticals

• Others

By Chocolate Type

• Dark

• Milk

• White

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America