Market Analysis and Insights

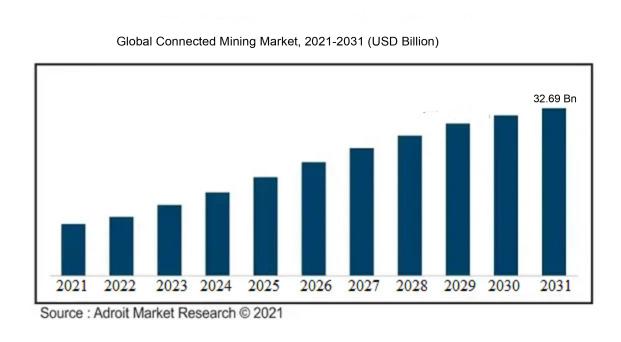

From 2022 to 2031, the market for connected mining is expected to grow at a CAGR of 13.9%, from a value of USD 9.49 billion in 2021 to USD 32.69 billion.

Companies are always seeking the newest and most cutting-edge analytics innovations to boost production and cut expenses. The use of equipment simulator systems is one of those cutting-edge technical expenditures. Around the world, more and more mine operators are becoming aware of the benefits that simulation may offer to their mining sites. To improve the performance of their key fundamentals, mining firms are investing in simulation systems.

Connected Mining Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 32.69 billion |

| Growth Rate | CAGR of 13.9% during 2021-2031 |

| Segment Covered | by Component ,by Mining Type,by Application ,by Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | SAP SE, Cisco Systems Inc., IBM Corporation, ABB Ltd., Siemens AG, Accenture, Schneider Electric, Trimble Inc., Rockwell Automation Inc., and Hexagon. |

Market Definition

The term "connected mining" describes the application of data-driven solutions and digital technology to improve and optimize many parts of the mining sector.

In order to build a connected ecosystem within mining operations, it entails the integration of sensors, automation, data analytics outsourcing, and communication technology. Improved operational effectiveness, safety, sustainability, and decision-making are the main objectives of connected mining. Numerous sensors and gadgets are used in mining operations to gather real-time data from machinery, equipment service, and the environment. These sensors keep an eye on variables like humidity, vibration, pressure, and more.

Advanced analytics techniques are used to analyze the obtained data in order to get insights into the operation of the mining machinery, processes, and safety situations. Predictive and prescriptive analytics aid in predicting maintenance requirements, improving output, and averting failures.

Automation of mining operations and equipment is a common component of connected mining. The ability to handle equipment remotely and autonomously lowers the need for on-site staff while increasing safety in potentially dangerous areas.

Data transmission between sensors, equipment, and control centers requires reliable communication networks, including wireless and the Internet of Things (IoT). This makes it possible to observe and make decisions in real-time.

Connected Mining Market Scope:

Key Market Segmentation

Insights on Deployment Mode

The On-Premise Segment is Valued for the Highest Share

The on-premise segment accounted for the greatest Connected Mining Market Share by deployment method in 2021, and it is anticipated that it will continue to hold a commanding position for the duration of the forecast period. This is explained by the many benefits of on-premise deployment, including the high degree of security and safety provided by the latter. Because they offer better data protection and have a lower risk of data breaches, industries prefer on-premise deployment methods over cloud-based ones. This preference for on-premise deployment models furthers industry demand for them.

Insights on Component

The Solution Segment Valued for the Highest Share

Depending on the component, the solution segment led the connected mining market in 2021 and is anticipated to do so again in the coming years. Linked mining can improve worker safety by tracking mine personnel, monitoring entries and exits, monitoring the progress of evacuations, and receiving alarms. This causes the market to expand.

Insights on Region

The North American Region Accounted for the Highest Share

In 2021, the market was led by North America, depending on the area. This is attributable to the quick development of technology, the digitalization of economies, and government measures that enhance the market expansion in this region. But over the projection period, Asia-Pacific is anticipated to develop at the fastest pace since this region is seeing a high rate of adoption of technologies like remote monitoring, operational analytics & data processing, and mine safety systems and solutions.

Key Company Profiles

The key players operating in the connected mining market include SAP SE, Cisco Systems Inc., IBM Corporation, ABB Ltd., Siemens AG, Accenture, Schneider Electric, Trimble Inc., Rockwell Automation Inc., and Hexagon.

COVID-19 Impact and Market Status

Due to lockdowns, travel restrictions, and staffing issues, several mining facilities had temporary shutdowns or decreased production. This might have slowed down or delayed the deployment of linked mining technology.

The emphasis on remote operations and automation has risen as a result of the requirement to keep workers on-site to a minimum and preserve physical distance. This could have hastened the uptake of connected mining systems that provide remote monitoring and management of machinery and operations. The pandemic's impact on supply chains may have impacted the supply of hardware, sensors, and other elements required to adopt connected mining systems. The epidemic made it clear how crucial digital transformation is to maintaining corporate continuity.

Companies in the mining industry that understood how linked technology may enhance productivity, safety, and decision-making may have accelerated their adoption plans. Due to the epidemic, mining corporations gave worker health and safety even more attention. Technologies for connected mining that provides remote monitoring, proactive maintenance, and hazard identification may have gained popularity as instruments for enhancing safety in the mining environment.

Latest Trends

1. Edge computing reduces latency and enables real-time decision-making by processing data closer to its source. Edge computing can improve on-site data processing and analysis in connected mining, enabling quicker reaction times and minimizing the need to send massive amounts of data to centralized servers.

2. In order to analyze the massive volumes of data gathered from sensors, equipment, and operations, AI and machine learning techniques are being used. By spotting trends and abnormalities, these technologies improve processes, enable predictive maintenance, and improve decision-making.

3. Utilizing digital twin technology, physical assets, and operations are replicated virtually. Digital twins are used in linked mining to model situations, test modifications, and optimize operations before putting them into practice in the real world, minimizing downtime and dangers.

4. High-speed, low-latency communication is made possible by the introduction of 5G networks, which is essential for connected mining's real-time data transfer. It makes it possible to deploy cutting-edge technology for maintenance and training, including augmented reality and remote operation of autonomous machinery.

5. For jobs like surveying, mapping, and inspections in mining operations, drones, and robotics are becoming more and more common. They can deliver reliable data, lower the likelihood of accidents, and boost productivity.

Significant Growth Factors

Real-time monitoring, data analytics, and automation are made possible by connected mining systems, which enhance operational effectiveness, optimize processes, and decrease downtime.

Improved safety in mining operations is a result of the capability to remotely monitor people and equipment, anticipate maintenance requirements, and identify potentially dangerous situations. Data-driven insights aid in resource utilization optimization, resulting in less waste, effective material transportation, and improved inventory control.

By analyzing equipment data, connected mining systems enable predictive maintenance, reducing unplanned downtime, extending equipment lifespan, and preventing malfunctions. By facilitating more effective energy use, waste reduction, and regulatory compliance, connected mining promotes environmental sustainability.

Mining businesses have adopted cutting-edge technology as a result of the push for digital transformation in sectors in order to remain competitive and resilient in a quickly changing market. The COVID-19 epidemic accelerated the adoption of connected mining systems by highlighting the value of remote operations and automation. Mining firms can react swiftly to changing situations thanks to real-time data analytics, which offers actionable insights that enhance decision-making.

Restraining Factors

Connected mining solutions involve a substantial initial investment in technology, infrastructure, training, and system integration.

For mining enterprises, particularly those with minimal IT skills, integrating several systems, handling vast amounts of data, and assuring interoperability may be difficult and complex tasks. Sensitive data, such as production statistics, financial data, and personnel records, are handled by mining operations. In linked contexts, ensuring data security and privacy is of utmost importance.

Integration is challenging since many mining operations still rely on antiquated systems that might not work with current linked technology. The adoption of new technology may be hampered by numerous restrictions that apply to the mining sector. Regulatory requirements can be time-consuming and expensive to navigate.

Data analytics, IoT, cybersecurity, and other pertinent fields need staff with competence in the implementation and management of linked mining solutions. Adoption may be hampered by a talent shortage. Connected mining requires a stable communications infrastructure, including network coverage and internet access.

Operations may encounter connection issues in remote or difficult geographic regions. The introduction of new technology could encounter resistance from traditional mining cultures and practices. For an implementation to be effective, change management and staff training are essential.

Recent Developments in the Global Connected Mining Market: A Snapshot

• In November 2021, Hexagon unveiled the Power of One, a centralized technology platform and partnership that links every aspect of the mine. Hexagon's suite of products, called The Power of One, links all mining operations from the pit to the plant. It takes place through a platform that connects all software and sensors to a sophisticated monitoring system that can be accessed from the field to the cloud.

• In October 2021, Proterra, a cutting-edge business researching electrification technologies for commercial vehicles, signed up with Komatsu. Through the partnership, it was hoped to use Proterra's battery technology to electrify the newest underground mining equipment.

Key Segments Connected Mining Market

by Component

• Solution

• Service

by Deployment Mode Overview

• On-Premise

• Cloud

by Mining Type Overview

• Surface

• Underground

by Application Overview

• Exploration

• Processing and Refining

• Transportation

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America