CRO services Market Analysis and Insights:

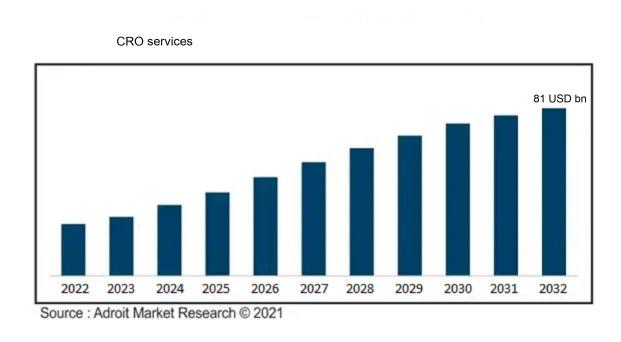

The market for Global CRO services was estimated to be worth USD 49 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 7.2%, with an expected value of USD 81 billion in 2032.

The market for Contract Research Organization (CRO) services is largely propelled by the rising need for streamlined and economical drug development methods. This trend is particularly evident as pharmaceutical firms aim to reduce their research and development costs. The increasing intricacies of clinical trials, alongside stringent regulatory mandates concerning safety and effectiveness, encourage companies to seek specialized service providers. Furthermore, the surge in funding directed towards biopharmaceuticals—especially in areas such as biologics and personalized medicine—intensifies the requirement for CROs capable of effectively managing these complex environments. Advances in technology, especially innovative data analytics and digital platforms for remote patient monitoring, significantly improve the efficiency of clinical trials, making collaborations with CROs increasingly appealing. Moreover, the move toward adaptive clinical trial designs and the growth of emerging market investments are expanding the range of CRO services offered. Collaborative global efforts and strategic alliances within the healthcare industry are also playing a vital role in enhancing market growth by promoting innovation and diversifying service capabilities.

CRO services Market Definition

CRO, or Conversion Rate Optimization, encompasses a range of strategic approaches designed to improve a website or landing page's performance in turning visitors into customers. This entails a thorough examination of user interactions, experimentation with different components, and the application of modifications to boost overall conversion rates.

Conversion Rate Optimization (CRO) services play a vital role for companies aiming to improve their digital performance by optimizing the impact of their website visits. Utilizing an array of techniques, including A/B testing, user experience enhancements, and comprehensive data analysis, CRO uncovers visitor behaviors and preferences. This insight enables businesses to customize their offerings to enhance user engagement. The result is a higher conversion rate of visitors into paying customers, along with a rise in overall revenue—achieved without the need for increased traffic. Ultimately, well-executed CRO services foster a deeper understanding of consumer needs, which is key to boosting customer satisfaction and loyalty, essential components for sustained business growth.

CRO services Market Segmental Analysis:

Insights On Type

Clinical Research Services

Clinical Research Services is expected to dominate the Global CRO services market due to the increasing demand for efficient clinical trials and regulatory approvals in the pharmaceutical and biotechnology sectors. With the rise in chronic diseases and the necessity for innovative treatments, pharmaceutical companies rely heavily on these services to design, manage, and execute critical clinical studies. Furthermore, the complexity involved in modern trials necessitates collaboration with expert organizations that can offer insights, operational efficiencies, and technology solutions. Therefore, this is strategically positioned to capture substantial market growth, driven by the dynamic nature of drug development and the emphasis on accurate and timely clinical data.

Early-Phase Development Services

Early-Phase Development Services focus on initial phases of drug development, including preclinical and phase I studies. With the growing emphasis on expedited approvals and the competitive nature of drug development timelines, companies are increasingly outsourcing these services to specialized organizations. This enables them to streamline operations and reduce time-to-market, thus enhancing their ability to compete in the evolving pharmaceutical landscape.

Discovery Studies

Discovery Studies play a pivotal role in identifying potential drug candidates and understanding the underlying biological mechanisms of diseases. This phase involves extensive research, including high-throughput screening and biomarker identification, which is crucial for innovative drug development. As biopharmaceutical companies push for novel therapeutics, the demand for discovery studies is expected to grow.

Chemistry, Manufacturing, & Control (CMC)

Chemistry, Manufacturing, & Control (CMC) is essential for ensuring that pharmaceutical products are manufactured consistently and meet regulatory standards. This encompasses a range of activities, including formulation development, stability testing, and process validation. As regulatory bodies set higher standards, the reliance on specialized CMC services will likely continue to expand as pharmaceutical companies seek to ensure the safety and efficacy of their products.

Preclinical Services

Preclinical Services involve testing new substances in laboratory and animal studies to assess their safety and biological activity before moving to human trials. This area is experiencing growth due to the need for comprehensive data to support regulatory submissions. The surge in biopharmaceutical innovations demands robust preclinical studies to minimize risks associated with early-phase human trials. Researchers are increasingly turning to CROs for expertise in this area to accelerate their drug development timelines while ensuring compliance with stringent regulatory requirements.

Laboratory Services

Laboratory Services encompass a variety of analytical and diagnostic tests essential for the support of clinical trials and drug development processes. This aids in generating data critical for understanding a drug's profile and effects throughout the testing phases. As clinical trials become more complex and involve diverse patient populations, the demand for precise and reliable laboratory services is increasing. Moreover, technological advancements in laboratory diagnostics contribute to faster results, pushing more sponsors to engage with CROs that offer comprehensive laboratory capabilities.

Bioanalytical Testing Services

Bioanalytical Testing Services specialize in the analysis of biological samples to measure the concentration of drugs, metabolites, and biomarkers. This area is crucial for determining drug pharmacokinetics and pharmacodynamics. With the growth of biologics and biosimilars, there is a thrust toward bioanalytical testing services to ensure effective monitoring of drug levels in clinical studies and thereafter. As regulatory agencies continue to refine their requirements for bioanalytical data, this aspect remains vital for developing effective therapeutic solutions.

Analytical Testing Services

Analytical Testing Services provide critical assessments of the quality, safety, and efficacy of new drug products. With a growing focus on data integrity and compliance due to stringent regulatory environments, analytical testing services will see ened demand. As a result, companies increasingly leverage CROs for their analytical expertise and capability to maintain rigorous quality standards throughout the development process.

Consulting Services

Consulting Services in the CRO sector involve strategic guidance for organizations navigating the complex regulatory landscape of drug development. This includes providing insights on trial design, regulatory submissions, and market access strategies. As organizations seek to optimize their clinical development pathways and reduce costs, the reliance on specialized consulting services is set to rise. The growing complexity of drug development paradigms and regulatory frameworks will enhance the significance of consulting offerings, ensuring that companies maximize their chances of successful product launches.

Insights On Therapeutic Area

Oncology

The oncology therapeutic area is expected to dominate the Global CRO services market due to the increasing prevalence of cancer globally, driving the demand for specialized clinical trials and innovative treatments. Furthermore, advancements in technologies such as genomics and biomarkers have prompted numerous pharmaceutical and biotechnology companies to invest heavily in oncology research. This focus not only enhances the complexity and duration of trials but also increases the need for CRO services that can provide expertise in oncology. Given these factors, oncology is set to lead the market.

CNS

The central nervous system (CNS) area has been gaining attention due to the rising incidence of neurological disorders such as Alzheimer’s, Parkinson’s, and depression. Despite being a smaller portion in comparison to oncology, the complexity of drug development in the CNS realm can provide lucrative opportunities for CROs. As the understanding of neurological diseases improves, the search for innovative therapies is likely to increase, which could foster growth for the CRO sector servicing this area.

Cardiovascular

The cardiovascular market has traditionally held significant importance in pharmaceutical research due to cardiovascular diseases being among the leading causes of death worldwide. Although the growth in this area is steady, it is overshadowed by the explosive advancements and investments seen in oncology. The increasing prevalence of risk factors like obesity and aging populations continues to push the necessity for research in cardiovascular diseases. However, the relatively mature state of this market can restrain the explosive growth witnessed in more innovative areas like oncology, leading to a more moderate demand for CRO services in this compared to others.

Insights On End User

Biopharmaceutical

The biopharmaceutical sector is poised to dominate the Global CRO services market primarily due to the increasing complexity of drug development processes and the rise in investment toward biologics and biosimilars. With advancements in technology and biotechnological techniques, biopharmaceutical companies require extensive research and development services to navigate regulatory challenges, conduct clinical trials, and ensure efficient market entry. The growing need for tailored treatments, particularly in oncology and rare diseases, further fuels demand for specialized CRO services. Increased collaboration between biopharmaceutical firms and CROs fosters innovation, enhances operational efficiency, and drives the uptake of these outsourced services.

Pharmaceutical

The pharmaceutical industry represents a significant player within the Global CRO services market, driven by the ongoing need for traditional drug development, testing, and regulatory compliance. Pharmaceutical companies often engage CROs to manage large-scale clinical trials across various therapeutic areas, tapping into the expertise offered by these firms to streamline processes and reduce costs. As patent expirations lead to the launch of generic drugs, the demand for CRO services in conducting post-marketing studies and ensuring quality control is likely to persist. However, the focus on innovation and biologics may gradually shift some resources towards competing sectors.

Medical Device Companies

Medical device companies are an essential of the Global CRO services market, though they currently hold a smaller share compared to the other industries. The growing complexity of medical devices, alongside regulatory requirements, necessitates specialized clinical testing and validation services provided by CROs. These firms play a crucial role in assisting medical device companies to comply with stringent regulations and to conduct clinical procedures effectively. Additionally, the increasing focus on advanced technologies such as wearable devices and telemedicine presents new opportunities for collaboration between CROs and medical device manufacturers, promoting innovation in the sector.

Global CRO services Market Regional Insights:

North America

North America is set to dominate the Global Contract Research Organization (CRO) services market due to several key factors. North America's robust regulatory framework ensures quality compliance, which is essential for successful clinical trials. The region also benefits from advanced technological infrastructure and a highly skilled workforce, making it a preferred hub for innovative drug research and development initiatives. Furthermore, increased investments in healthcare spending and a growing focus on personalized medicine create a favorable environment for CROs to thrive, thereby solidifying North America's leading position in the market.

Latin America

Latin America is experiencing growth in the CRO services market, driven by a rise in clinical trial activities. The region offers various advantages, including diverse patient populations and favorable regulatory environments in countries like Brazil and Mexico. As pharmaceutical companies look to diversify their trial locations due to cost constraints and quicker patient recruitment, Latin America increasingly becomes an appealing choice. Additionally, government initiatives aimed at promoting clinical research contribute to further market expansion.

Asia Pacific

The Asia Pacific region is witnessing a surge in CRO services owing to its rapid economic growth and an expanding healthcare ecosystem. Countries such as China and India are becoming focal points for clinical trials due to their large patient base and lower operational costs, which makes them attractive for multinational pharmaceutical firms. The increasing incidence of chronic diseases and a growing emphasis on advanced research methodologies further support the growth of CROs in this region.

Europe

Europe continues to be a significant player in the CRO services market, fueled by a well-established healthcare system and an extensive network of academic institutions. The region hosts numerous regulatory trials, thanks to its stringent regulatory standards aimed at ensuring patient safety. Countries like the UK, Germany, and France lead in conducting clinical research due to their advanced healthcare infrastructure and skilled workforce. Furthermore, collaborations among biopharmaceutical companies and CROs promote innovation, thus reiterating Europe’s importance within this competitive landscape.

Middle East & Africa

The Middle East and Africa region represents a nascent yet promising of the CRO services market. While historically less active than other regions, increasing investment in healthcare infrastructure and a rising number of clinical trials are changing the landscape. As the region strives to enhance its clinical capabilities, it is expected to attract more global CROs for collaborative research endeavors, signaling future growth potential.

CRO services Competitive Landscape:

Prominent entities within the global Contract Research Organization (CRO) services sector are instrumental in streamlining clinical trials and regulatory procedures, allowing pharmaceutical and biotechnology firms to expedite the market introduction of their products. These organizations offer vital skills and resources, encompassing data administration, patient enrollment, and adherence support, which significantly improve the operational efficiency of drug development processes.

Key participants in the market for Contract Research Organization (CRO) services comprise IQVIA, Covance, Syneos Health, PPD, Parexel International Corporation, Charles River Laboratories, Medpace, PRA Health Sciences, ICON plc, WuXi AppTec, KCR, Worldwide Clinical Trials, Linical Accelovance, and Ergomed. Additionally, noteworthy firms include BioClinica, InVentiv Health, Sygnature Discovery, Aptiv Solutions, and TFS International. These organizations are acknowledged for their vital roles in advancing clinical research and development, providing a diverse range of services tailored to pharmaceutical, biotechnology, and medical device sectors.

Global CRO services COVID-19 Impact and Market Status:

The Covid-19 pandemic markedly expedited the expansion of the worldwide Contract Research Organization (CRO) services sector, driven by a ened need for clinical research and development as pharmaceutical firms pursued swift strategies for the creation of vaccines and treatments.

The COVID-19 pandemic had a profound effect on the market for Contract Research Organization (CRO) services, introducing a mix of challenges and new opportunities. At the outset, the imposition of lockdowns and various restrictions led to significant disruptions in clinical trial processes, which in turn delayed the timelines for drug development. Conversely, the urgent need for vaccines and treatments catalyzed swift advancements in and integration of digital technologies, such as telehealth and remote patient monitoring, which improved operational effectiveness.

A notable trend that surfaced was the increasing emphasis on decentralized clinical trials, promoting more flexible and patient-focused methodologies. Additionally, the pandemic underscored the critical importance of strong supply chains and effective regulatory systems, resulting in ened investments in CRO services. Consequently, despite the early hurdles posed by the pandemic, the CRO market has demonstrated remarkable resilience and is expected to experience growth in the post-COVID era, fueled by a growing demand for clinical research services and an ongoing pursuit of innovative health solutions.

Latest Trends and Innovation in The Global CRO services Market:

- In July 2023, ICON plc announced the acquisition of the Medpace Integrated Drug Development Services (IDD) business, enhancing its existing capabilities in drug development and clinical trial management.

- In August 2023, Syneos Health launched Syneos Health Communications, a new division that aims to improve communication strategies within clinical research and facilitate better patient engagement.

- In September 2023, PPD, part of Thermo Fisher Scientific, introduced a new data science platform designed to streamline clinical trial operations through enhanced data analytics and AI-driven insights.

- In October 2023, Covance, a Labcorp Drug Development company, completed the acquisition of KCR, a full-service clinical contract research organization, expanding its footprint in Europe and bolstering its Phase I-III clinical trial capabilities.

- In June 2023, Parexel announced a strategic partnership with HealthBeacon to integrate novel adherence technology into its clinical trial services, aimed at improving patient compliance and data accuracy.

- In March 2023, WuXi AppTec launched new biopharma capabilities focused on cell and gene therapy, significantly expanding its CRO offerings to meet the growing demand in this innovative field.

- In May 2023, Charles River Laboratories announced its acquisition of HemaCare, a provider of human blood products and services for the clinical research market, to enhance its custom solutions in cell therapy and immuno-oncology.

CRO services Market Growth Factors:

Major elements contributing to the expansion of the CRO services market encompass a ened demand for outsourced clinical research, technological innovations, and a growing emphasis on personalized medicine.

Primarily, the escalating pressure on pharmaceutical and biotechnology firms to optimize their research and development efforts is elevating the role of CROs in clinical trials and adherence to regulatory standards. Furthermore, the increasing intricacy of clinical trial designs and the ened focus on personalized medicine are compelling organizations to engage with the specialized knowledge provided by CROs. The global rise in clinical trial participation, especially within emerging economies, also plays a crucial role in this growth, as drug companies seek to minimize expenses and accelerate market entry. The proliferation of chronic illnesses and the aging demographic further intensify the demand for innovative drug development approaches, which in turn propels the CRO sector. Lastly, the increasing tendency to outsource research activities allows companies to concentrate on their primary strengths, resulting in greater investment in CRO services. Altogether, these factors foster a vibrant landscape that supports the continued expansion of the CRO services market.

CRO services Market Restaining Factors:

Significant obstacles in the CRO services sector stem from rigorous regulatory mandates and diverse international compliance norms, which can hinder the execution of clinical trials.

The market for Contract Research Organization (CRO) services encounters a number of inhibiting factors, including intricate regulatory frameworks, budget limitations, and increasing competition from emerging markets. Regulatory complexities can notably extend the duration of clinical trials, as varying requirements across different regions can lead to delays and ened costs. Moreover, clients often contend with stringent budgetary constraints, complicating CROs' ability to secure the necessary investments for cutting-edge technologies and enhancing service quality. The entrance of biotech startups and smaller enterprises has escalated competition, initiating price wars that pressure profit margins and potentially jeopardize service standards. The rapid advancement of technologies, such as data analytics and artificial intelligence, also requires continual investment and expertise, which may be a challenge for some CROs to maintain. Furthermore, the acquisition and retention of talented professionals remain a hurdle, as a proficient workforce is crucial for delivering superior research services. Nevertheless, in spite of these obstacles, the CRO market shows remarkable resilience, spurred by an increasing demand for drug development outsourcing and the expanding global pharmaceutical sector. As organizations strive for enhanced efficiency and innovation, CROs are poised to adapt and flourish, ultimately contributing to better patient outcomes and faster market introduction of new therapies.

Key Segments of the CRO Services Market

By Type

- Clinical Research Services

- Early-Phase Development Services

- Discovery Studies

- Chemistry, Manufacturing, & Control (CMC)

- Preclinical Services

- Laboratory Services

- Bioanalytical Testing Services

- Analytical Testing Services

- Consulting Services

By Therapeutic Area

- Oncology

- CNS

- Cardiovascular

By End User

- Pharmaceutical

- Biopharmaceutical

- Medical Device Companies

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America