Credit Card Payments Market Analysis and Insights:

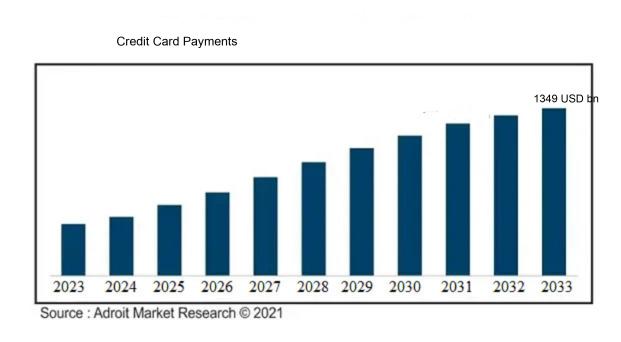

The market for Global Credit Card Payments was estimated to be worth USD 589 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 8.96%, with an expected value of USD 1349 billion in 2033.

The credit card payments sector is chiefly influenced by the growing preference for cashless transactions, as both individuals and enterprises prioritize convenience and efficiency in their financial dealings. The surge in e-commerce and mobile purchases has greatly enhanced the use of credit cards, as they provide superior security compared to alternative payment options. Furthermore, an increase in disposable income and consumer expenditure, particularly in emerging markets, has significantly bolstered the demand for credit cards. Technological advancements, including contactless payment methods and mobile wallet applications, have streamlined the transaction process, catering to the needs of tech-oriented consumers. Additionally, the current push for digital transformation across various sectors encourages businesses to adopt credit card payment systems, broadening acceptance avenues and enhancing consumer confidence. Regulatory initiatives that support secure payment mechanisms and the emergence of loyalty programs connected to credit card transactions are also pivotal in shaping the landscape of this market.

Credit Card Payments Market Definition

Credit card payments constitute a method of transaction in which individuals utilize a card provided by a financial entity to access borrowed funds for their purchases, with the requirement to repay the borrowed amount, typically along with interest fees. This system allows for prompt access to credit, enhancing and simplifying the process of acquiring goods and services.

Credit card transactions are essential in contemporary trade, offering a secure and convenient method for both consumers and businesses to engage in financial exchanges. They empower consumers by increasing their purchasing capacity, enabling them to make substantial acquisitions while managing their cash flow through flexible payment options. For businesses, the ability to accept credit cards can enhance sales opportunities by attracting a wider audience and expediting payment processes. Furthermore, credit cards frequently come with consumer safeguards, loyalty programs, and fraud prevention mechanisms, fostering confidence between users and providers. In summary, credit card transactions simplify financial dealings, encourage economic growth, and enhance the efficacy of international markets.

Credit Card Payments Market Segmental Analysis:

Insights On Key Card Type

General Purpose

General Purpose credit cards are anticipated to dominate the Global Credit Card Payments Market due to their widespread acceptance, flexibility, and extensive consumer appeal. These cards are designed for a variety of spending needs, which allows them to attract a broad user base. They typically offer features such as cash back, rewards points, and promotional financing options, catering to both everyday expenses and larger purchases. Additionally, the trend towards digital payment solutions and the increasing adoption of e-commerce have bolstered the popularity of general-purpose cards. Their versatility in serving various demographics and spending habits positions them strongly in the market.

Specialty

Specialty credit cards cater to specific needs or consumer interests, such as travel rewards, retail loyalty, or fuel savings. While they appeal to niche markets, their membership is generally limited to consumers who align closely with the associated brand or service. This targeted focus can lead to compelling rewards for active users, but the overall market share remains smaller compared to general-purpose options. Nonetheless, the unique benefits offered by specialty cards attract loyal customers willing to maximize their rewards or savings in a specific area, thereby maintaining a dedicated, if limited, in the market.

Others

The "Others" category includes any remaining credit card types that do not fall under general-purpose or specialty designations. This may encompass subcategories such as secured credit cards or those aimed at specific demographics, like students or seniors. While this plays a crucial role in providing options for individuals with varying credit histories or financial needs, it is often overshadowed by the broader appeal of general-purpose and specialized cards. Consumers in this category may seek different benefits, but the limited market presence makes it unlikely to rival the leading categories in overall transaction volumes and usage rates.

Insights On Key Application

Restaurants and Bars

Restaurants and bars are expected to dominate the Global Credit Card Payments Market due to the increasing trend of cashless transactions and the growing preference for convenience among consumers. The food service industry has been rapidly adopting digital payment methods, including credit card payments, to provide a seamless experience. With millennials and Gen Z increasingly opting for dining out experiences, the demand for quick and efficient payment solutions is paramount. Moreover, the integration of loyalty programs and mobile payments within this sector further incentivizes credit card usage, solidifying its leading position in the market.

Food and Groceries

The food and groceries sector is witnessing notable growth in credit card adoption as consumers increasingly prefer contactless payments for everyday purchases. Grocery stores, supermarkets, and delivery services are responding to this trend by offering various card payment options. The demand for convenience, especially during busy shopping hours, drives shoppers to utilize credit cards, enhancing the overall checkout experience. As e-commerce continues to expand in the food industry, this is expected to see sustained growth in the usage of credit card payments.

Health and Pharmacy

The health and pharmacy is experiencing growth in credit card payments, particularly due to the rising trend of online prescriptions and health-related e-commerce. Consumers are now more inclined to use plastic for pharmacy transactions to manage their healthcare expenses conveniently. Insurance reimbursements and loyalty rewards also play a significant role in encouraging customers to utilize their credit cards in this sector, catering to both convenience and cost management.

Consumer Electronics

The consumer electronics is steadily adopting credit card payments, driven by the tech-savvy population and the rise of online shopping. With high-value purchases often associated with electronic goods, customers prefer using credit cards for their ability to manage finances through installment plans and reward benefits. The convenience of fast transactions and the protection against fraud further promote the use of credit cards in this industry, leading to increased sales volumes.

Media and Entertainment

Credit card payments in the media and entertainment sector are becoming increasingly prevalent, particularly due to the rise of subscription-based services and digital content purchases. Consumers are inclined to use credit cards for their convenience and rewards, making it easier to manage monthly subscriptions for streaming services, gaming, and other digital platforms. Additionally, as more entertainment companies explore online distribution channels, credit card adoption is likely to rise, reflecting a shift towards digital transactions.

Travel and Tourism

In the travel and tourism sector, credit card payments are commonly utilized for booking flights, accommodations, and other travel-related expenses. Globally, travelers prefer using credit cards for the added benefits of rewards points, fraud protection, and ease of currency conversion during international trips. With the travel industry recovering and experiencing an upward trend, the use of credit cards is likely to continue growing, as it remains a preferred payment method among tourists.

Insights On Key Provider

Visa

Visa is anticipated to dominate the Global Credit Card Payments Market due to its extensive global acceptance and deep-rooted partnerships with financial institutions and merchants. With its innovative technology solutions, such as contactless payments and advanced security features like tokenization, Visa successfully addresses the evolving demands of consumers and merchants alike. Moreover, Visa's strong brand recognition and reputation for reliability instill confidence among consumers in adopting their payment solutions. This widespread acceptance allows Visa to maintain a significant market share and reinforces its position as a leader in the credit card payments landscape.

Mastercard

Mastercard, while not the leading player, has carved a substantial niche in the credit card payments market. Its strategic focus on technology-driven payment solutions, such as biometric authentication and AI-driven fraud detection, positions it competitively against other providers. Additionally, Mastercard's collaborative approach in forging partnerships with fintech companies enhances its offerings, allowing it to tap into new markets. The brand's commitment to innovation and customer satisfaction continues to attract a loyal customer base, ensuring sustained relevance in the ever-evolving payments landscape.

Others

The 'Others' category, encompassing various alternative payment providers, plays an important role in the Global Credit Card Payments Market. These companies include regional players and niche providers that cater to specific demographics or sectors. While they may not hold a dominant market share, their growth can be attributed to targeted marketing strategies and localized offerings that resonate with specific consumer needs. Additionally, the rise of digital wallets and emerging financial technologies continues to boost this category's presence, thus expanding the range of payment options available in the market.

Global Credit Card Payments Market Regional Insights:

North America

North America is expected to dominate the Global Credit Card Payments market due to its well-established financial infrastructure, high consumer spending capacity, and rapid technological advancements in payment solutions. The U.S. and Canada lead in credit card penetration and usage, fostering a culture of cashless transactions. The region has a strong presence of major credit card networks and is experiencing continuous innovation in digital payment technologies, including contactless payments and mobile wallets. The regulatory support and strategic partnerships among financial institutions also contribute to the growth of this market, making North America the clear frontrunner.

Latin America

Latin America is witnessing a significant transformation in the credit card payments landscape, driven by increasing smartphone penetration and a growing middle class. Financial inclusivity initiatives are enhancing access to banking services for the unbanked population. While the region still faces challenges regarding credit card penetration compared to North America, there's a rising trend towards digital payment methods, which is gradually boosting its market. Moreover, the adoption of e-commerce is accelerating, making credit cards a preferred payment option among consumers, thus placing Latin America in a burgeoning position for future growth.

Asia Pacific

Asia Pacific is emerging as a critical player in the Global Credit Card Payments market, characterized by its large population and rising disposable income levels. Countries like China and India are experiencing rapid urbanization and a shift towards digital payment systems. However, cash still remains prevalent in many parts, which can hinder growth. Despite this, the expansion of e-commerce platforms and government initiatives to promote cashless transactions are likely to drive credit card usage. The region's dynamic fintech landscape adds to its potential, making Asia Pacific a significant market, albeit not the one currently dominating.

Europe

Europe is a mature market for credit card payments, characterized by various regulations and a mix of traditional and digital payment methods. Countries like Germany and France show more robust credit card growth, but overall adoption varies widely across the region. The European Union's focus on PSD2 regulations aims to enhance payment services, potentially driving up credit card usage. However, the presence of a strong culture of alternative payment methods such as bank transfers and e-wallets could limit the dominance of credit cards. Despite its innovative landscape, Europe faces challenges in positioning itself as the market leader.

Middle East & Africa

The Middle East & Africa region is at an early stage in the credit card payments market, with significant disparities between urban and rural areas in terms of financial access. Economic growth and an increase in e-commerce are beginning to spur adoption, particularly in wealthier Gulf states. However, low credit card penetration due to historical reliance on cash transactions presents a considerable challenge. Initiatives aimed at increasing financial literacy and mobile banking adoption are helping fuel market growth. While the potential for credit card payments exists, it is still developing compared to more established regions.

Credit Card Payments Competitive Landscape:

Prominent participants in the worldwide credit card payment sector, including banks, payment facilitators, and technology firms, play a vital role in enabling transactions by prioritizing safety, effectiveness, and advancements in payment technologies. Their partnership fosters market expansion and improves user satisfaction through offerings such as fraud detection, digital wallet services, and seamless integration with online retail platforms.

Prominent entities within the Credit Card Payments sector encompass Visa Inc., Mastercard Incorporated, American Express Company, Discover Financial Services, UnionPay International, JCB Co., Ltd., PayPal Holdings, Inc., Stripe Inc., Square, Inc., and Worldpay, Inc. (a subsidiary of Vantiv). Notable contributors also include Fiserv, Inc., Adyen N.V., Global Payments Inc., Fifteen Group, and Wirecard AG. Furthermore, companies like TSYS (Total System Services, Inc.), Elavon Inc. (a branch of U.S. Bank), First Data Corporation (now integrated with Fiserv), and ACI Worldwide play significant roles in the industry. Additionally, fintech startups such as Klarna, Affirm, and Afterpay are increasingly influencing the payments arena, thereby affecting conventional credit card processes. Together, these players are instrumental in driving market dynamics and fostering advancements within the credit card payments landscape.

Global Credit Card Payments COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly expedited the transition to digital payment systems, resulting in a surge in credit card utilization as individuals pursued contactless transaction options in response to health safety apprehensions.

The COVID-19 pandemic had a profound impact on the landscape of credit card payments, hastening the transition to digital and contactless methods as consumers placed a greater emphasis on hygiene and convenience. As lockdowns and social distancing measures took effect, there was a notable decrease in traditional shopping, which led to a dramatic rise in online transactions and an increased dependence on credit cards for e-commerce activities. In response, financial institutions enhanced their digital banking offerings and introduced various promotional incentives to encourage consumer spending. Additionally, ened economic uncertainty prompted many individuals to reevaluate their financial behaviors, resulting in a greater demand for balance transfer options and tools for financial management. The rise of fintech innovations and mobile payment solutions further transformed consumer preferences, highlighting the importance of speed and security in financial transactions. Ultimately, the pandemic served as a powerful driver of change in the credit card payments industry, fostering new consumer habits that are expected to endure even as the global environment normalizes.

Latest Trends and Innovation in The Global Credit Card Payments Market:

- In October 2023, Visa announced its acquisition of Fintech startup, PayFlex, which specializes in providing flexible payment solutions for consumers and businesses, aiming to enhance its digital payment offerings.

- In September 2023, Mastercard revealed a partnership with the tech company, Plaid, to improve connectivity between banks and payment systems, streamlining the credit card payment process and expanding their reach to more consumers.

- In August 2023, American Express launched its “Send and Split” feature which allows cardholders to split charges with friends and family seamlessly, enhancing consumer experience for joint payments.

- In July 2023, Stripe acquired Bouncer, a fraud prevention technology company, to bolster its security measures and enhance the efficiency of credit card payments on its platform.

- In June 2023, Discover Financial Services announced a collaboration with PayPal to enable PayPal users to link their Discover credit cards directly, facilitating greater transaction flexibility.

- In May 2023, Capital One introduced a new feature in its mobile app that uses artificial intelligence to provide personalized spending insights for cardholders, aimed at improving customer engagement and satisfaction.

- In April 2023, Square (now known as Block, Inc.) launched a new program aimed at integrating credit card payments with cryptocurrency transactions, allowing businesses to accept both forms of payment easily.

- In March 2023, JPMorgan Chase reported the expansion of its card rewards program, allowing customers to earn points for using their credit card with select partner merchants, further incentivizing credit card usage.

- In February 2023, Wells Fargo announced the launch of a virtual credit card service, providing users with secure, temporary card numbers for online shopping to enhance security and privacy in digital transactions.

Credit Card Payments Market Growth Factors:

The expansion of the credit card payment industry is propelled by a surge in online shopping, innovations in payment technologies, and a growing consumer inclination towards cashless methods of transaction.

The Credit Card Payments Market is witnessing remarkable expansion due to a variety of influential factors. Primarily, the surge in the use of digital payment methods and e-commerce transactions is boosting the demand for credit cards, as consumers prioritize convenient and secure payment alternatives. Additionally, the emergence of mobile payment solutions and contactless technologies is enhancing user convenience, thereby increasing the frequency of credit card transactions.

The advent of reward programs and cashback incentives significantly contributes to this trend, encouraging consumers to opt for credit cards for their everyday expenditures. Financial institutions are also at the forefront of innovation, introducing features such as improved security protocols, virtual credit cards, and personalized credit offerings that cater to a wide range of consumer preferences.

Furthermore, the expansion of fintech firms and their solutions is streamlining transactions and broadening the availability of credit card services to previously underrepresented populations. Regulatory improvements aimed at boosting digital payments and promoting financial inclusion are also playing a vital role in this market's growth.

Finally, the ongoing economic recovery in various regions following the pandemic is leading to increased consumer spending, which further invigorates the credit card payments sector. Together, these factors indicate a promising growth path for the credit card payments market in the upcoming years.

Credit Card Payments Market Restaining Factors:

Significant barriers in the credit card payment industry revolve around increasing apprehensions regarding cybersecurity threats and the difficulties associated with adhering to regulatory standards, both of which could undermine consumer confidence and adoption rates.

The credit card payment sector encounters various challenges that may hinder its expansion. A prominent issue is the increasing prevalence of fraud and cybercrime, which raises security apprehensions for both consumers and merchants, resulting in a hesitance to engage in credit card transactions. Additionally, the substantial fees charged to merchants can discourage small enterprises from accepting credit cards, thereby limiting the potential customer demographic. Regulatory frameworks further complicate the scenario; stringent compliance demands can create obstacles for new entrants in the payment processing arena. Furthermore, the rising trend of alternative payment options, including mobile wallets and peer-to-peer payment platforms, has begun to divert consumer inclination from traditional credit cards. Economic fluctuations may also restrict consumer spending, consequently lowering credit card transaction volumes. Nonetheless, continuous technological advancements, such as enhanced security protocols and intuitive payment solutions, are improving the overall user experience, ensuring that the credit card payment sector remains resilient and adaptable. As the market evolves, it is expected to uncover creative strategies to overcome these challenges and promote sustained growth and consumer trust.

Key Segments of the Credit Card Payments Market

By Card Type

• General Purpose

• Specialty

• Others

By Application

• Food and Groceries

• Health and Pharmacy

• Restaurants and Bars

• Consumer Electronics

• Media and Entertainment

• Travel and Tourism

• Others

By Provider

• Visa

• Mastercard

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America