Market Analysis and Insights:

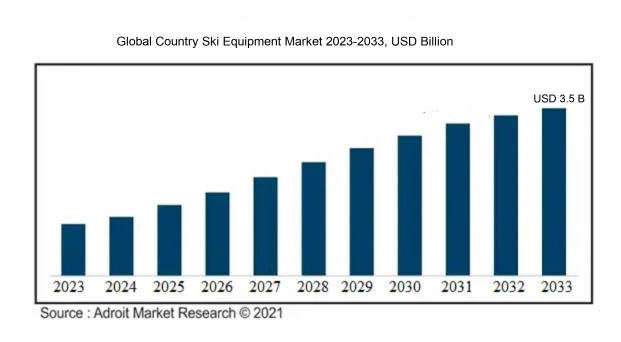

The market for Global Cross Country Ski Equipment was estimated to be worth USD 1.5 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 6%, with an expected value of USD 3.5 billion in 2033.

The market for ski equipment in the country is propelled by several pivotal factors. There has been a notable surge in interest for outdoor leisure activities and winter sports, especially in climate-appropriate areas, which has subsequently boosted the demand for skiing apparatus. The escalating trend of ski tourism—driven by both local and global travel—has prompted further investments into ski amenities and gear. Moreover, advancements in ski technology, including the use of lightweight materials and enhanced performance capabilities, appeal to both beginners and experienced skiers alike. The growing awareness of environmental issues is also influential; consumers are increasingly favoring sustainable and eco-friendly ski products. Additionally, the rise of personalized and high-performance equipment addresses the needs of various skill levels and individual preferences, thereby broadening the market reach. Lastly, the impact of social media and endorsements from high-profile personalities in promoting winter sports has led to greater consumer interaction and increased sales in the ski equipment industry. Collectively, these elements play a crucial role in driving the growth and transformation of the ski equipment market.

Cross Country Ski Equipment Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2033 |

| Study Period | 2022-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 3.5 billion |

| Growth Rate | CAGR of 6% during 2023-2033 |

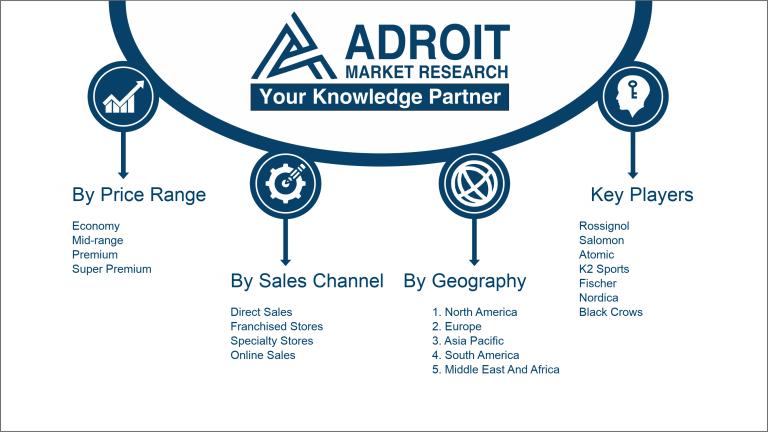

| Segment Covered | By Product, By Price Range, By End-User, By Sales Channel Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Rossignol, Salomon, Atomic, K2 Sports, Fischer, Nordica, Black Crows, Head Ski, Elan, Dynastar, Volkl, Dalbello, Burton Snowboards, Thule Group, and Scott Sports. |

Market Definition

Cross-Cross Country Skiing gear encompasses the specialized equipment tailored for traversing diverse landscapes, which includes skis, poles, and boots crafted to facilitate smooth and effective movement. This gear is essential for both leisure and competitive skiing, as it significantly improves performance and comfort on groomed paths and unmarked wilderness areas.

Cross Country Skiing gear plays a vital role for numerous reasons, chiefly in improving the skiing experience and ensuring the user's safety. This equipment includes specialized items such as skis, poles, boots, and bindings that are specifically crafted to enhance performance across diverse terrains. High-quality gear aids in maintaining stability and control, facilitating easier navigation through snow-covered areas and challenging landscapes. Furthermore, having the appropriate equipment is essential for injury prevention, as it offers necessary support and protection. Well-chosen gear can also boost enjoyment and build confidence, which encourages more people to take part in the sport. Ultimately, investing in high-quality Cross Country Skiing equipment not only fosters individual skill development but also promotes the enjoyment and growth of winter sports overall.

Key Market Segmentation:

Insights On Key Product

Touring Skis

Touring Skis are anticipated to dominate the Global Cross Country Ski Equipment Market primarily due to the growing trend of outdoor recreation and adventure tourism. They cater to a wide audience, including casual skiers and enthusiasts seeking versatility in different terrains. As fitness and leisure activities gain popularity, more individuals are inclined towards cross-Cross Country Skiing, which specifically benefits from the design and functionality of touring skis. Enhanced technology integrated into these skis also plays a crucial role in attracting consumers, leading to significant sales and market share in this product category.

Race and Performance Classic Skis

Race and Performance Classic Skis appeal significantly to competitive skiers and professionals focused on speed and efficiency. Their design prioritizes lightweight materials and advanced engineering for optimized performance, thereby attracting dedicated athletes who participate in events. This niche, while smaller, commands high-value sales, supported by a passionate community dedicated to racing. The continuing evolution in technology, material enhancement, and competitive spirit in the skiing world keeps this category active within the market.

Metal-edge Touring Skis

Metal-edge Touring Skis offer improved edge control and stability, making them an attractive choice for skiers venturing into varied snow conditions. Their unique design enhances maneuverability, which appeals to a growing of skiers seeking safer and more confident experiences in off-trail environments. As the recreational skiing market grows, these skis are increasingly recognized for their performance in diverse landscapes.

Touring Boots

Touring Boots are essential for skiers looking for a comfortable fit and compatibility with multiple skiing systems. The demand for a more versatile and performance-oriented boot has increased as skiing enthusiasts explore various terrains. This growing interest in backCross Country Skiing has led to innovations in boot design, enhancing comfort and control, which further strengthens their market presence.

Race and Performance Classic Boots

Race and Performance Classic Boots are specifically designed for competitive skiers seeking the best possible performance. Their lightweight construction and precise fit facilitate optimal energy transfer during racing, effectively making them indispensable for serious athletes. This strong focus on competition ensures a steady demand, although the customer base remains concentrated among professional and performance-oriented skiers.

Metal-edge Touring Boots

Metal-edge Touring Boots complement the skiing experience by providing enhanced support and stability on varied terrains. These boots are particularly favored by those who engage in backCross Country Skiing, as they enable skiers to traverse rugged landscapes with confidence. As outdoor activity enthusiasts grow in number, the demand for such specialized boots is expected to rise steadily.

New Nordic Norms (NNN) Bindings

New Nordic Norms (NNN) Bindings have gained popularity among skiers who prioritize improved stability and ease of use. These bindings enable skiers to easily transition between different types of skiing, attracting a versatile customer base. The compatibility with various boot designs supports their growth and relevance in the marketplace, influencing their acceptance in the broader skiing community.

Salomon Nordic system (SNS) Bindings

Salomon Nordic system (SNS) Bindings are well-regarded for their innovative attachment mechanisms that enhance performance and security. Targeting avid skiers, these bindings allow for an increased power transfer from foot to ski, catering to both recreational and competitive skiers. Their established brand reputation continues to maintain demand, contributing to sustained sales within this specific category.

Poles

Poles are an integral yet often overlooked component of cross-Cross Country Skiing gear, providing essential support and balance. Their continued relevance is guaranteed by advancements in materials and ergonomic designs, which enhance the skiing experience significantly. As a critical accessory in cross-Cross Country Skiing, they maintain steady sales as consumers seek complementary products to optimize their performance on the trails.

Insights On Key Price Range

Mid-range

The mid-range price category is anticipated to dominate the Global Cross Country Ski Equipment Market due to its perfect balance of quality and affordability. This is tailored to meet the needs of a wide demographic of skiers—ranging from beginners to intermediates—who seek reliable gear without breaking the bank. Mid-range products often feature enhanced durability and performance compared to economy options, making them attractive to recreational skiers looking for value. Additionally, the rise of ski tourism and increased participation in winter sports contribute to a growing consumer base that favors mid-range products, thereby solidifying its dominance in the market.

Economy

The economy price category caters to budget-conscious consumers and entry-level skiers who are reluctant to invest heavily in gear. While it has a significant share, its growth prospects are constrained, as many buyers who start with economy products tend to upgrade as their skills improve. This often struggles with quality perception, as products in this range may compromise performance and durability. However, it remains a critical choice for those exploring skiing for the first time or seeking gear for occasional use.

Premium

The premium appeals to serious skiers and enthusiasts who prioritize high-quality performance and advanced technology. These consumers are willing to invest significantly for cutting-edge gear, which often incorporates the latest innovations in ski equipment. However, the premium market is limited to a smaller, wealthier audience and faces price sensitivity challenges during economic downturns. Despite these limitations, the premium enjoys a loyal customer base who prioritize performance, making it a strong contender in niche markets.

Super Premium

The super premium category represents the ultra-luxury of the skiing market, targeting elite athletes and affluent consumers seeking the highest performance possible. Although this includes exceptional craftsmanship and exclusive features, its market share remains relatively small compared to mid-range and premium options due to its high price point. Super premium products attract a specific clientele who often invest in gear as a status symbol. While it has a devoted following, its sales volume is limited, indicating that it does not dominate the broader market landscape.

Insights On Key End-User

Individuals

Individuals are expected to dominate the Global Cross Country Ski Equipment Market. This sector thrives due to the increasing popularity of skiing as a recreational and fitness activity among outdoor enthusiasts. The rise of social media and adventure tourism has fueled the interest in skiing among a broader audience, leading to more individuals investing in quality ski equipment. Additionally, the accessibility of skiing facilities and local training programs has encouraged beginners to try skiing. As health consciousness grows, people are drawn to skiing not only for leisure but also as part of an active lifestyle, further driving the demand in this.

Institutional

The institutional category involves organizations such as schools, universities, and ski clubs that provide skiing experiences and training. Although this sector has a reliable demand for equipment, it generally lags behind the individual market in terms of growth. Most institutions purchase ski gear in bulk, leading to more predictable and less volatile purchasing patterns. However, the focus on educational programs and organized events holds potential for gradual growth, but it still pales in comparison to the robust individual-focused market.

Professional

The professional sector caters to competitive skiers and athletes requiring specialized equipment to enhance their performance. While this category is critical and represents a niche in the skiing market, it occupies a smaller share compared to the mass of recreational users. Athletes generally invest in high-performance, customized gear, driven by sponsorships and competition requirements. Thus, while the professional market is significant for innovation and product development, its overall dominance is limited compared to the individual skiing community.

Beginners

Beginners represent a growing as more people explore skiing as an introductory winter sport. Comprehensive instructional programs and beginner-friendly equipment options have made it easier for newcomers to join the sport. Experiences such as rental equipment and ski lessons contribute to this 's upward trajectory; however, it is still considered part of the overall individual market rather than a dominant category of its own. As interest solidifies into regular participation, this group may begin to evolve into intermediate or advanced skiers.

Intermediates

The intermediates category, consisting of skiers who have moved beyond beginner stages but are not yet experts, plays a vital role in the market. These consumers typically seek improved gear to enhance their skills and experience. This group is motivated by a desire for better performance and comfort, leading to significant investment in upgraded equipment. Despite its importance, the intermediate does not exhibit the same breadth of market share or growth potential observed in the individuals.

Advanced

The advanced skier sector includes those with extensive experience and specialized needs. While it features highly invested individuals looking for top-tier equipment, its overall market share remains smaller as compared to the broader population of casual skiers. Advanced users often require bespoke gear, which can contribute to innovation in the industry. However, the narrower focus of this group limits its growth capability. As a result, while advanced skiers are crucial for high-performance product lines, they do not significantly impact overall market dynamics.

Insights On Key Sales Channel

Online Sales

Online sales are projected to dominate the Global Cross Country Ski Equipment Market due to the increasing trend of e-commerce and the growing preference for online shopping among consumers. The convenience of purchasing equipment from the comfort of home, along with access to a broader range of products and competitive pricing, significantly influences consumer choices. Additionally, factors such as enhanced product information availability, online reviews, and the ability to easily compare prices are key drivers for this channel. The COVID-19 pandemic has accelerated this trend further, leading retailers to enhance their online presence, thus solidifying online sales as a leading channel in the ski equipment market.

Direct Sales

Direct sales in the Cross Country Ski Equipment Market offer consumers personalized service and guidance, fostering a strong connection between brands and customers. This approach allows manufacturers to engage closely with their audience, providing tailored product recommendations and after-sales support. The relationship between the consumer and seller can create loyalty and trust, especially in niche markets where specific equipment expertise is required. As a result, direct sales can capture a dedicated customer base willing to invest in high-quality products and services, but they may not compete with the expansive reach that online sales provide.

Franchised Stores

Franchised stores combine brand recognition and a local presence, offering a unique blend of community engagement and reliable product availability. These outlets can tap into local markets effectively, providing a more personalized shopping experience that some consumers value. However, franchised stores may struggle to compete efficiently with online sales channels, primarily due to limited stocks and higher overhead costs. Despite these challenges, they can attract customers through promotions and events, creating a loyal local consumer base that appreciates the in-person experience.

Specialty Stores

Specialty stores in the Cross Country Ski Equipment Market cater to enthusiasts and serious skiers, providing an extensive range of specialized products and expert knowledge. This channel focuses on quality and specialized items, attracting customers looking for specific gear suited to their particular skiing needs. Though they may not have the extensive reach of online platforms, their knowledgeable staff and tailored selection can create a loyal clientele. These stores often host events or workshops, fostering a community of ski lovers that can lead to repeat business, although their growth potential remains constrained compared to the rapidly expanding online sales channel.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Cross Country Ski Equipment market, primarily due to its strong skiing culture and extensive infrastructure. The region, particularly the United States and Canada, possesses some of the world's most renowned ski resorts and a well-established market for ski equipment. Consumer enthusiasm for skiing is bolstered by a plethora of outdoor sports and winter activities, driving the demand for specialized ski gear. Additionally, the region has a high disposable income, promoting higher spending on premium and innovative products. Moreover, the influence of major brands and advancements in technology continue to elevate the market's standards and expectations.

Latin America

Latin America exhibits a smaller yet emerging market for Cross Country Ski equipment, primarily driven by a growing interest in sports tourism and winter sports. While countries like Chile and Argentina have ski resorts, the overall adoption of skiing and related gear remains limited compared to North America. However, the scenic landscapes and increasing international tourism could foster gradual growth as more individuals are introduced to skiing conditions, paving the way for future expansion in the sector.

Asia Pacific

The Asia Pacific region shows a diverse potential for the Cross Country Ski equipment market, driven mainly by increasing middle-class populations and rising disposable incomes. Countries like Japan and South Korea have established ski resorts attracting domestic tourism. The propensity for adventure sports in emerging markets, such as China and India, hints at a growing awareness and interest in skiing. This trend could see a gradual increase in demand for ski equipment, although it still lags behind the established markets like North America.

Europe

Europe is a significant player in the global Cross Country Ski equipment market, characterized by abundant skiing destinations and established traditions in winter sports. Countries such as France, Switzerland, and Austria have long been synonymous with skiing, and the presence of both established and emerging brands contributes to a healthy market. The rising focus on sustainable and eco-friendly skiing practices can carve new niches, facilitating opportunities for innovations in equipment. Despite this, the region faces stiff competition from North America, which limits its market dominance.

Middle East & Africa

The Middle East and Africa represent the least developed in the Cross Country Ski equipment market, where skiing is not a dominant sport due to predominantly warm climates. While there are a few indoor ski facilities, the overall awareness and participation in skiing are significantly lower than in other regions. However, as global tourism becomes more integrated and people seek winter sports activities, select markets, particularly in Morocco and South Africa, may experience slow growth potential in the future.

Company Profiles:

The primary contributors to the global Cross Country Ski equipment market—including producers, retailers, and distributors—play a crucial role in fostering innovation and competition. By improving product quality and broadening distribution channels, they stimulate market growth. Furthermore, their joint efforts in marketing initiatives and connecting with consumers notably impact market trends and overall growth patterns.

Prominent companies in the domestic ski equipment sector encompass Rossignol, Salomon, Atomic, K2 Sports, Fischer, Nordica, Black Crows, Head Ski, Elan, Dynastar, Volkl, Dalbello, Burton Snowboards, Thule Group, and Scott Sports.

COVID-19 Impact and Market Status:

The Covid-19 outbreak profoundly impacted the worldwide ski gear industry, causing a temporary halt in retail operations and a decrease in consumer expenditure. This situation ultimately led to a downturn in both sales and rental transactions.

The COVID-19 pandemic had a profound effect on the ski equipment market in the country, largely driven by shifts in consumer behavior, restrictions on travel, and ened health awareness. The initial phase saw a downturn in the market as ski resorts shuttered, resulting in a sharp decline in both equipment sales and rentals. However, with the gradual lifting of these restrictions, there was a significant revival in the interest for outdoor activities, particularly skiing. This led to a notable rise in demand for ski gear, especially among families and novices looking for safe recreational options. Retail outlets experienced a surge in sales, particularly in essential items such as skis, snowboards, and safety equipment. Additionally, online shopping gained popularity, transforming the retail landscape. Despite these positives, the industry grappled with supply chain issues and material shortages, which hindered production and affected product availability. In summary, although the market faced numerous obstacles, the pandemic sparked a renewed enthusiasm for winter sports, hinting at potential long-term expansion within the ski equipment sector as participants return to the slopes.

Latest Trends and Innovation:

In March 2023, Rossignol Group announced its acquisition of ski boot manufacturer Lange, enhancing its product offerings and consolidating its position in the ski equipment market.

In February 2023, ski apparel and equipment brand North Face launched a new line of eco-friendly ski gear, utilizing recycled materials and sustainable manufacturing processes to meet increasing consumer demand for environmentally responsible products.

In December 2022, Völkl, a subsidiary of Tecnica Group, unveiled a new line of high-performance skis utilizing innovative carbon technology designed to improve stability and reduce weight, catering to both professional athletes and recreational skiers.

In October 2022, Head announced a merger with a prominent ski apparel brand, allowing Head to increase its presence in the lifestyle while providing complementary products to their existing ski equipment lines.

In May 2022, Salomon introduced its “Ski with Ease” technology in ski bindings to enhance safety and performance, effectively increasing skier confidence, which contributed to positive reception and sales growth during the 2022-2023 winter season.

In January 2022, Fischer Sports launched a new line of all-mountain skis with a focus on versatility and user-friendly features, aiming at beginners and intermediates, which significantly improved their market share in the entry-level ski.

In November 2021, Black Diamond Equipment expanded its ski touring category by acquiring a small start-up focused on innovative avalanche safety equipment, demonstrating a commitment to skier safety and technological advancement.

Significant Growth Factors:

The expansion of the Cross Country Ski Equipment Market is fueled by a greater involvement in winter sports, an upsurge in disposable income, and innovations in ski technology.

The Cross Country Ski Equipment Market is witnessing notable expansion driven by various influential factors. A primary catalyst is the rising interest in winter sports, fueled by an increased focus on health and wellness, encouraging more individuals to participate in skiing. Initiatives that advocate for outdoor recreational activities, along with a growing number of ski resorts and the enhancement of related infrastructure across different areas, further support this trend.

Technological advancements have also significantly improved the quality of ski equipment, which boosts both safety and performance, thereby attracting both beginners and experienced skiers alike. Furthermore, the shift toward eco-friendly products is becoming increasingly significant, with manufacturers showcasing sustainable and environmentally conscientious ski gear to cater to eco-aware customers.

In addition, the impact of social media and digital marketing has ened awareness and enthusiasm for skiing, subsequently increasing demand. Seasonal discounts and collaborative efforts between equipment manufacturers and ski resorts create further incentives for potential buyers. The thriving ski tourism market, especially in emerging regions, is contributing positively to equipment sales as well.

Finally, favorable economic conditions and a rise in disposable income are encouraging consumers to invest in premium ski gear, broadening accessibility to a diverse range of customers. Collectively, these elements are integral to the growth trajectory of the Cross Country Ski Equipment Market.

Restraining Factors:

The Cross Country Ski Equipment Market faces significant challenges, primarily due to elevated production expenses and rivalry from other winter sports activities.

The Cross Country Ski Equipment Market encounters numerous obstacles that could impede its growth trajectory. A primary issue is the substantial expense linked to high-quality ski gear, which may discourage novice skiers and restrict market development. Additionally, the inherent seasonality of skiing influences demand; during non-winter months, sales tend to drop, resulting in variable revenue for both retailers and manufacturers. The presence of alternative winter sports gear, such as snowboarding equipment, can further redirect consumer interest and expenditures. Environmental factors also contribute significantly, as climate change alters snowfall patterns, thereby affecting participation rates in skiing activities. Furthermore, inadequate infrastructure in specific areas can restrict access to ski resorts, adversely affecting the market. Finally, targeting niche demographics, coupled with a lack of awareness among potential participants, may limit the market's reach.

Nonetheless, amidst these challenges, the rising enthusiasm for outdoor recreational pursuits and an increasing focus on health and wellness offer promising opportunities for innovation and brand distinction within the market. This shift, along with advancements in technology and material science, could pave the way for the creation of more cost-effective, high-quality equipment, fostering a more welcoming atmosphere for skiing aficionados and drawing in new customers.

Key Segments of the Cross Country Ski Equipment Market

By Product

- Touring Skis

- Race and Performance Classic Skis

- Metal-edge Touring Skis

- Touring Boots

- Race and Performance Classic Boots

- Metal-edge Touring Boots

- New Nordic Norms (NNN) Bindings

- Salomon Nordic System (SNS) Bindings

- Poles

By Price Range

- Economy

- Mid-range

- Premium

- Super Premium

By End-User

- Individuals

- Institutional

- Professional

- Beginners

- Intermediates

- Advanced

By Sales Channel

- Direct Sales

- Franchised Stores

- Specialty Stores

- Online Sales

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America