Cyber Insurance Market Analysis and Insights:

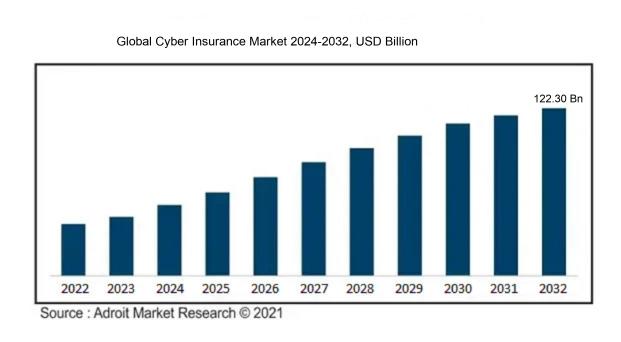

In 2023, the size of the worldwide cyber insurance industry was estimated at USD 56.98 billion. The market is anticipated to expand at a compound annual growth rate (CAGR) of 25.02%, from USD 21.08 billion in 2024 to USD 122.30 billion by 2032.

The Cyber Insurance Market is significantly influenced by the rising incidence and complexity of cyberattacks, which drives organizations to pursue financial safeguards against potential setbacks. Furthermore, regulatory demands and compliance standards, notably those established by frameworks such as GDPR and CCPA, encourage companies to adopt cyber insurance as part of their risk management strategies. The growing digital transformation across diverse industries ens their susceptibility to threats, reinforcing the necessity for comprehensive cybersecurity and insurance solutions. Moreover, there is a surge in awareness regarding cyber threats among essential stakeholders, including corporate boards and investors, resulting in an increased appetite for extensive coverage. Advancements in technology and the rise of interconnected devices add layers of complexity to network infrastructures, highlighting the need for specialized insurance products that address these evolving challenges. As organizations come to view cyber insurance as a critical element of their risk management approach, the market continues to experience significant growth.

Cyber Insurance Market Definition

Cyber insurance is a distinct form of coverage designed to safeguard companies from financial repercussions associated with cyberattacks, data breaches, and various digital threats. This insurance generally encompasses protection for expenses related to incident response, legal costs, and claims of liability.

Cyber insurance has become vital for organizations as it offers a financial safety net against the growing prevalence and intensity of cyber threats, which may result in considerable data compromises and interruptions to normal business functions. Companies are encountering escalating expenses related to ransomware attacks, data recovery efforts, and regulatory penalties, underscoring the necessity of insurance in alleviating potential financial impacts. Additionally, it provides access to specialized expertise, such as risk evaluation and emergency response teams, which bolsters an organization's overall cyber defense capabilities. As dependence on digital systems continues to increase, cyber insurance not only acts as a financial buffer but also serves as a strategic asset in managing risks and enhancing resilience in the face of advancing cyber challenges.

Cyber Insurance Market Segmental Analysis:

Insights On Insurance Type

Tailored

The tailored insurance type is expected to dominate the global cyber insurance market primarily due to its flexibility and customization capabilities. Businesses across various industries experience unique cyber risks that require specific coverage solutions, and tailored insurance policies can be designed to meet those particular needs. As cyber threats evolve, companies are seeking more comprehensive solutions that can address their unique risk profiles, making tailored policies more appealing. This trend is particularly prominent among medium to large enterprises, where the complexities of their operations necessitate specialized coverage that standalone policies fail to provide. Thus, tailored insurance is poised to lead the market as companies prioritize personalized risk management solutions.

Standalone

Standalone insurance offers a simpler, more straightforward approach to cyber risk coverage, making it appealing for smaller businesses or those new to cyber insurance. These policies are often more affordable and easier to understand compared to tailored options. As a result, standalone coverage attracts companies looking to fulfill basic regulatory requirements or needing essential protection against common cyber threats. However, while it provides a necessary baseline of coverage, standalone policies may lack the depth and specificity needed for businesses facing more complex cyber challenges. Consequently, while this option has its merits especially for smaller players, it is not expected to claim the leading position in the market.

Insights On Coverage Type

First-party Coverage

First-party coverage is expected to dominate the Global Cyber Insurance Market due to its direct focus on protecting the insured organization's assets and financial interests against cyber incidents. This type of coverage provides immediate relief by supporting businesses in managing losses from data breaches, business interruption, and theft of funds. As businesses increasingly recognize the potential financial repercussions of cyber threats, they are prioritizing coverage that safeguards their own resources. With the rising frequency of cyberattacks and regulatory pressures to secure sensitive data, organizations are likely to invest heavily in first-party coverage to mitigate risks, making it the leading choice in the cyber insurance landscape.

Liability Coverage

Liability coverage offers protection to organizations against claims resulting from data breaches and privacy violations impacting third parties. Although essential, it is seen as a reactive measure compared to first-party protection. This coverage typically addresses legal costs, settlements, and damages owed to clients or consumers affected by breaches. As organizations work to build their defenses against cyber threats, the priority often falls on direct protective measures, making this option less prominent in comparison. However, businesses still recognize the importance of this type of coverage, especially under growing regulatory scrutiny, ensuring it remains a vital tool in the cybersecurity arsenal.

Insights On Enterprise Size

Large Enterprise

Large Enterprises are expected to dominate the Global Cyber Insurance Market primarily due to their extensive digital footprints and the significant amount of sensitive data they handle. These organizations often face more complex cyber threats, which necessitate a robust insurance strategy to mitigate potential financial losses from cyber incidents. Furthermore, Large Enterprises usually have the financial resources to invest in comprehensive insurance policies and advanced cybersecurity measures. Their legal and regulatory requirements also demand a higher level of protection, prompting them to seek specialized coverage that fits their unique risk profiles. As cyberattacks grow in sophistication, Large Enterprises are increasingly viewing cyber insurance not just as an optional safeguard, but as an essential component of their risk management framework.

SMEs

Small and Medium Enterprises (SMEs) are gradually recognizing the importance of cyber insurance, although they currently play a lesser role in the market compared to Large Enterprises. Many SMEs often underestimate their exposure to cyber threats, leading to a slower adoption rate of insurance products. However, recent trends indicate a growing awareness of these risks, especially as attacks increasingly target smaller organizations. Limited financial resources and a perceived lack of threat have historically hindered their investment in cyber insurance. Yet, as they begin to realize the potential financial ruin from data breaches or cyber incidents, the demand for tailored cyber insurance solutions for SMEs could grow significantly in the future.

Insights On End-user

BFSI

The BFSI (Banking, Financial Services, and Insurance) sector is anticipated to dominate the Global Cyber Insurance Market due to its critical need for robust cybersecurity measures. This industry handles sensitive financial data and is a prime target for cybercriminals, resulting in significant losses in case of a breach. Financial regulations and compliance requirements are becoming increasingly stringent, pushing organizations within this sector to seek comprehensive insurance solutions to mitigate potential risks. The value of protecting client data and maintaining trust makes BFSI investment in cyber insurance not just essential but a priority.

Healthcare

The healthcare industry is increasingly recognizing the importance of securing patient data and systems against cyber threats. With the rising number of data breaches, hospitals, clinics, and insurance companies are under immense pressure to protect sensitive health information. Regulation such as HIPAA mandates stringent security measures, thereby driving the demand for cyber insurance policies tailored specifically for healthcare providers. As telemedicine and digital healthcare solutions proliferate, the necessity for robust coverage grows, making this sector a significant market player in the realm of cyber insurance.

Retail

The retail industry has seen a significant increase in cyberattacks, particularly with the shift towards e-commerce. Breaches not only compromise customer payment information but also tarnish brand reputation and trust. Retailers are keenly aware of the financial implications of data breaches and are thus investing in cyber insurance policies to shield themselves from potential losses and liability claims. Additionally, as customer data becomes more valuable, the need for sophisticated insurance solutions is projected to rise, making retail an important sector within the cyber insurance landscape.

IT & Telecom

The IT and Telecom sector is foundational to modern communications and data exchange, making it a key target for cyber threats. Companies in this space deal with vast quantities of sensitive information and proprietary technology, increasing their risk of breaches. As the threats evolve, organizations are increasingly turning to cyber insurance as part of their risk management strategy. The high incidence of cyberattacks in this sector, driven by the rapid digital transformation, fuels the growing importance of robust insurance solutions tailored to their unique vulnerabilities.

Manufacturing

The manufacturing sector has become a target for cybercriminals, particularly with the rise of IoT and smart manufacturing technologies. Disruptions to production lines due to cyber incidents can lead to severe financial losses. Companies are beginning to recognize the potential ramifications of cyberattacks on their operational efficiency and supply chain integrity. As a result, the demand for cyber insurance is starting to rise steadily, with firms looking to protect themselves against the multifaceted nature of risks associated with digital technologies in manufacturing processes.

Others

The 'Others' category encompasses a variety of industries that also face unique cyber risks but may not have as high a profile as the main sectors discussed. This could include government entities, educational institutions, and non-profit organizations, each of which holds sensitive data and faces different types of cyber threats. Although this may not currently dominate the market, the increasing digitization and reliance on technology in these sectors will likely drive demand for cyber insurance. As awareness grows regarding potential vulnerabilities and the necessity for protection, this category has the potential for significant growth in the cyber insurance market.

Global Cyber Insurance Market Regional Insights:

North America

North America is expected to dominate the Global Cyber Insurance market due to the high concentration of technology companies, increasing cyber threats, and advanced regulatory frameworks. The United States particularly leads in innovation related to cybersecurity, which boosts the demand for tailored cyber insurance products. Moreover, several industries like finance, healthcare, and retail heavily invest in cybersecurity measures, thus fostering the need for supporting insurance solutions. Furthermore, established players in the insurance sector are continuously developing new products to cater to these emerging risks, making North America a pivotal region in the global landscape of cyber insurance.

Latin America

Latin America is experiencing growth in the cyber insurance market, albeit at a slower pace compared to North America. The region has been increasingly recognizing the importance of cyber risk management due to rising digitalization and awareness of cybersecurity threats. However, the prevalence of traditional business practices often hampers the rapid adoption of cyber insurance. Legislative support and investments in digital infrastructure are beginning to build momentum, leading to a more favorable environment for cyber insurance products in the near future.

Asia Pacific

Asia Pacific is witnessing a notable rise in cyber insurance needs, driven by rapid digital transformation and increased cyber threats across various sectors. Countries like China and India are leading this change, with businesses recognizing the necessity of managing potential cyber risks. Moreover, government initiatives promoting cybersecurity further encourage organizations to invest in insurance policies. While the market's growth is promising, challenges such as varied regulatory frameworks and a lack of awareness can hinder immediate dominance in the sector.

Europe

Europe presents a diverse landscape for the cyber insurance market, as different countries have varying levels of regulation and cyber risk awareness. The implementation of the General Data Protection Regulation (GDPR) has ened awareness of data breaches and associated risks, creating a growing demand for cyber insurance. While markets like Germany and the UK are leading in terms of adoption, many smaller nations are still catching up. As businesses seek to comply with strict regulations, the interest in cyber insurance products is likely to grow, although at a diverse pace across the region.

Middle East & Africa

The cyber insurance market in the Middle East and Africa is still in a nascent stage, facing challenges such as limited industry understanding and regulatory barriers. However, increasing digital initiatives and ened awareness of cyber threats are beginning to drive interest in cyber insurance. Large-scale infrastructure projects and evolving technologies are creating a demand for protective measures against cyber risks. As businesses become more reliant on digital platforms, the growth of cyber insurance is expected to take off, albeit at a gradual pace, contingent on overcoming existing challenges in the region.

Cyber Insurance Competitive Landscape:

The major participants in the worldwide cyber insurance sector, comprising insurers, brokers, and technology firms, work together to evaluate risks, craft customized policies, and offer assistance during cyber-related incidents. Their specialized knowledge enables organizations to address weaknesses and recuperate from possible damages, thereby fostering the industry's expansion and strengthening its defenses against cyber threats.

Prominent entities within the Cyber Insurance Market encompass AIG, Chubb Limited, Allianz Global Corporate & Specialty, Marsh & McLennan Companies, Hartford Steam Boiler, Beazley, AXA XL, and the Zurich Insurance Group. Other influential players include Berkshire Hathaway, Munich Re, CNA Financial, Liberty Mutual, Hiscox, and Travelers. Additionally, firms such as Coalition, Corvus Insurance, Assurant, and Tokio Marine HCC contribute to the landscape, while AmTrust Financial, Markel Corporation, and Enstar Group are also significant contributors to this sector.

Global Cyber Insurance COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly expedited the expansion of the worldwide cyber insurance sector, as it ened awareness of cybersecurity threats among companies shifting to remote work environments.

The COVID-19 pandemic significantly propelled the expansion of the cyber insurance sector, primarily due to the swift transition to remote working, which exposed organizations to greater cyber risks. As threats to sensitive information became more pronounced, businesses increasingly acknowledged the need for protective measures, resulting in a notable rise in the demand for cyber insurance policies. In response, insurers took action by revising their coverage offerings and refining their underwriting practices to better accommodate the shifting landscape of risks related to ransomware, data breaches, and various cyber-related incidents. Additionally, the pandemic brought about ened regulatory oversight regarding data protection, leading companies to pursue insurance options that could alleviate potential liabilities. In light of these developments, the market experienced an increase in both policy limits and premiums, as insurers adjusted their strategies to correspond with the elevated threat environment shaped by rapid technological advancements. Ultimately, the pandemic has profoundly altered corporate perceptions of cybersecurity, underscoring the critical importance of comprehensive insurance coverage in an increasingly dynamic digital world.

Latest Trends and Innovation in The Global Cyber Insurance Market:

- In March 2023, Alliants, a cybersecurity and insurance specialist, launched a new cyber insurance policy that integrates real-time threat intelligence, aiming to provide businesses with tailored coverage based on their unique risk profiles.

- In February 2023, Coalition Inc. announced the acquisition of the cyber underwriting platform, At-Bay, expanding its capabilities in risk assessment and offering enhanced coverage options as part of a broader strategy to dominate the cyber insurance market.

- In April 2023, Aon plc revealed a partnership with IBM to leverage artificial intelligence and cloud technology for improving risk assessment and pricing models in their cyber insurance offerings, allowing for more accurate underwriting.

- In May 2023, Zurich Insurance Group introduced a new suite of cyber insurance products designed for small to medium-sized enterprises (SMEs), emphasizing risk mitigation strategies alongside insurance coverage to better protect businesses against increasing cyber threats.

- In July 2023, Travelers Companies, Inc. enhanced its cyber insurance policy by incorporating proactive incident response services, which provide clients with 24/7 access to cybersecurity professionals in the event of a breach.

- In August 2023, Chubb Limited expanded its range of cyber insurance products geared towards the healthcare sector, aiming to support providers in complying with regulatory requirements and protecting sensitive patient data.

- In September 2023, Hiscox launched a new cyber insurance policy tailored specifically for tech startups, recognizing the unique challenges and risks faced by emerging companies in the tech industry.

- In October 2023, Markel Corporation entered the cyber insurance market with a focus on manufacturing and construction sectors, offering bespoke policies that address specific risks inherent to those industries, reflecting a growing acknowledgment of the diverse landscape of cyber threats.

Cyber Insurance Market Growth Factors:

The expansion of the cyber insurance sector is propelled by the rise in cyber threats, the necessity for adherence to regulatory standards, and the growing consciousness of cybersecurity vulnerabilities among organizations.

The Cyber Insurance sector is witnessing notable expansion, influenced by several pivotal elements. Primarily, the escalating number and sophistication of cyberattacks have raised awareness among enterprises regarding the financial and operational dangers tied to data breaches. Organizations across diverse industries, such as healthcare, finance, and retail, are acknowledging the essential role of cyber insurance as a means to mitigate these risks. Furthermore, the increasing dependence on digital technologies and cloud services has broadened potential vulnerabilities, driving companies to pursue comprehensive coverage.

Regulatory demands, including the General Data Protection Regulation (GDPR) and the Cybersecurity Maturity Model Certification (CMMC) in the United States, mandate compliance, further propelling the need for insurance products. The rise of new threats, particularly ransomware attacks, alongside the demand for crisis management assistance, is also contributing to the market's growth. Insurers are responding by developing customized policies that address the unique requirements of various industries, promoting a more holistic approach to risk management. As understanding of these issues increases and the threat landscape shifts, businesses are placing greater importance on cyber insurance as a critical component of their broader risk management frameworks, thereby driving further market development.

Cyber Insurance Market Restaining Factors:

The cyber insurance market faces several significant challenges, including the absence of uniform policy frameworks and a limited comprehension of cyber threats among prospective customers.

The cyber insurance sector is confronted with various obstacles that may impede its advancement. One of the primary challenges stems from the swift progression of cyber threats, coupled with the intricate nature of assessing cyber risks. This complexity poses difficulties for insurers in accurately pricing their policies and forecasting potential losses. Moreover, numerous organizations, particularly small to medium-sized enterprises (SMEs), frequently overlook the criticality of cyber insurance or find themselves unable to allocate sufficient funds for extensive coverage, which restricts market growth.

Additionally, the lack of comprehensive historical data regarding cyber incidents complicates the reliability of risk modeling and loss evaluation. Regulatory ambiguities and the intricate compliance landscape can also discourage businesses from seeking cyber insurance, with inconsistent regulations across different regions contributing to further confusion. Misunderstandings related to the function of cyber insurance within a broader risk management framework can lead to inadequate coverage solutions.

Nevertheless, as awareness of cyber threats grows and companies increasingly appreciate the necessity of strong cybersecurity initiatives, the market is starting to transform. Insurers are responding by developing more customized products and promoting risk mitigation techniques, which is ultimately enhancing the resilience of the cyber insurance ecosystem.

Key Segments of the Cyber Insurance Market

By Insurance Type:

- Standalone

- Tailored

By Coverage Type:

- First-party

- Liability Coverage

By Enterprise Size:

- SMEs

- Large Enterprise

By End-user:

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America