Data Center Colocation Market Analysis and Insights:

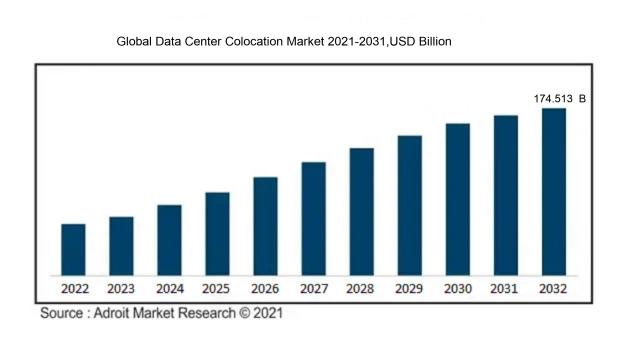

In 2023, the size of the worldwide Data Center Colocation market was US$ 67.34 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 12.39% from 2024 to 2032, reaching US$ 174.513 billion.

The colocation market for data centers is primarily fueled by the rising demand for scalable IT frameworks and ened data security needs. Many organizations are choosing colocation services to cut down on the capital costs tied to constructing and running their own data centers, thus enhancing their cost-effectiveness. The advent of cloud computing and the Internet of Things (IoT) has dramatically increased data generation, which, in turn, requires reliable and adaptable storage alternatives. Furthermore, businesses are facing regulatory demands concerning data privacy and compliance, prompting them to utilize colocation services that offer enhanced security features. The move towards hybrid IT architectures grants organizations increased flexibility in managing their resources, contributing further to market expansion. Additionally, improvements in energy efficiency and cooling technologies make colocation facilities more appealing, as companies aim to reduce their environmental impact while enhancing operational efficiency. Collectively, these elements are driving significant growth in the colocation sector.

Data Center Colocation Market Definition

Data center colocation involves leasing space within a third-party facility, allowing various organizations to house their servers and networking equipment in a secure environment. This setup offers superior infrastructure, reliable power sources, efficient cooling systems, and enhanced connectivity alternatives.

Data center colocation plays a significant role for enterprises by enabling them to house their servers and networking devices within a professionally operated environment. This arrangement enhances security measures, boosts operational uptime, and offers greater redundancy, all essential for ensuring uninterrupted business operations. By utilizing shared space and infrastructure, organizations can lower operating expenses related to energy consumption, cooling systems, and physical security measures. Moreover, colocation grants firms access to high-speed internet and advanced infrastructure, which would be challenging and costly to set up on their own. This flexibility allows businesses to expand their capabilities effectively while concentrating on their primary objectives.

Data Center Colocation Market Segmental Analysis:

Insights On Key Type

Retail Colocation

3D Printers

Retail colocation is expected to dominate as it caters to businesses that require smaller space allocations and more tailored solutions. This option is preferred by startups and SMEs that need flexibility without the commitment of large-scale resources. Retail operators provide a more personalized service level, enabling clients to manage their infrastructure needs on a more granular basis. As digital transformation initiatives are rapidly adopted by smaller companies, retail colocation is poised to sustain its existing importance in the market, offering agile solutions for those seeking to enter the market without extensive capital investment.

Wholesale Colocation

Wholesale colocation provides organizations with considerable opportunities for growth and scalability. This model is particularly favored by larger enterprises and cloud service providers needing extensive power and space. The rise of data-hungry applications and edge computing requirements leads companies to choose this model for its cost-effectiveness and robust infrastructure. Furthermore, many of these facilities provide sophisticated capabilities, which are necessary for industries experiencing rapid growth like AI, big data analytics, and IoT. Large firms can deploy their resources without the burden of full management, reinforcing the appeal of wholesale solutions in the evolving digital landscape.

Insights On Key Deployment

On Cloud

The "On Cloud" is expected to dominate the Global Data Center Colocation Market due to an increasing demand for scalable and flexible storage solutions. Companies are rapidly adopting cloud services to reduce costs and improve efficiency, allowing businesses to expand without the need for significant upfront infrastructure investments. The trends indicate that enterprises prefer cloud-based solutions to facilitate remote work and seamless data access, driving the growth of this. Furthermore, cloud adoption is expected to rise with the enhancement of technological features like advanced security measures, which reassures companies regarding data safety and performance levels, further solidifying its prominent position in the colocation landscape.

Premises

The "Premises" category, which encompasses traditional data center setups, remains relevant but is experiencing slower growth compared to the cloud. Organizations heavily invested in their infrastructure often prefer keeping critical data on-site due to compliance, security, and performance concerns. This choice allows for greater control over physical assets and directly monitoring operations. However, the high costs associated with maintaining on-premises equipment, including power and cooling requirements, have led many to consider alternatives, making it a stagnant yet necessary option for firms with specific regulatory demands.

Insights On Key End User

IT and Telecom

The IT and Telecom sector is poised to dominate the Global Data Center Colocation market, primarily due to the rapid growth in data consumption and the increasing need for cloud services. As businesses transition to digital operations, they require robust infrastructure to ensure seamless connectivity and data management. This sector is also characterized by ened demand for scalability and flexibility in data handling, which colocation facilities can provide efficiently. Moreover, the rise in Internet of Things (IoT) and 5G technologies further drives the need for larger, more efficient data centers. Hence, the amalgamation of these factors positions the IT and Telecom sector as the leading user of colocation services globally.

BFSI

The Banking, Financial Services, and Insurance (BFSI) sector represents a substantial portion of the Global Data Center Colocation market. This industry places a premium on security, compliance, and data integrity, driving significant investments in colocation services. The demand for reliable disaster recovery solutions and the need to manage vast amounts of sensitive customer information push BFSI companies to adopt colocation strategies. Additionally, with the ongoing digital transformation initiatives within financial institutions, colocation facilities offer essential infrastructure support to meet regulatory demands and enhance operational efficiency.

Government and Defense

The Government and Defense sector is vital in shaping the Global Data Center Colocation market. This sector requires stringent security protocols and compliance with various governmental regulations, making colocation an attractive solution. Data centers provide secure environments for sensitive information while allowing the government to leverage advanced technology without the heavy burden of maintaining physical facilities. Increased focus on cybersecurity and the necessity for reliable data management during national emergencies further drive the adoption of colocation services within this domain.

Healthcare

The Healthcare sector is increasingly turning to colocation as it grapples with vast amounts of data generated from electronic health records (EHRs) and telemedicine solutions. This prioritizes data security and compliance with healthcare regulations such as HIPAA, necessitating a robust infrastructure that colocation providers offer. Furthermore, the push for interoperability and data sharing among healthcare systems enhances the need for reliable facilities that can handle the large volumes of sensitive data while ensuring patient privacy. As the sector continues to evolve, colocation will likely play a crucial role in supporting healthcare networks.

Global Data Center Colocation Market Regional Insights:

North America

North America is anticipated to dominate the Global Data Center Colocation market due to several compelling factors. The region hosts a significant concentration of key players, including established colocation providers, cloud service providers, and telecom entities, resulting in competitive pricing and innovative service offerings. The rapid growth of big data, IoT, and AI technologies in North America ensures consistent demand for colocation services, driven by increased data generation and the need for robust data storage solutions. Additionally, favorable regulatory frameworks and infrastructural advancements further enhance the region's attractiveness for investment in colocation facilities, solidifying its leading position in the global market.

Latin America

Latin America is emerging as a promising region for the Data Center Colocation market, predominantly due to increasing internet penetration and the growing digital transformation among local businesses. A rising number of enterprises are recognizing the need for external data management solutions, spurring investments in colocation facilities. However, challenges such as political instability, varying regulations, and less developed infrastructure compared to more mature markets like North America hinder its rapid growth. Nevertheless, specific countries like Brazil and Mexico show substantial potential, driven by urbanization and the expansion of tech startups.

Asia Pacific

Asia Pacific is poised for significant growth in the Data Center Colocation market, primarily fueled by rapid urbanization, increased adoption of cloud services, and a burgeoning digital economy. The region is home to a vast population and growing technology-centric economies such as China, India, and Japan, increasing the demand for data storage and management. Furthermore, governments are proactively promoting data localization policies, which often encourages the establishment and expansion of data centers. While there is intense competition and room for growth, challenges related to power supply, environmental considerations, and regulatory compliance may hinder its complete dominance.

Europe

Europe is a strategic region for the Data Center Colocation market, especially with its advanced technological infrastructure and robust regulatory environment. The region is witnessing a steady demand for colocation services driven by the increasing emphasis on data privacy and stringent regulations such as GDPR. European enterprises are increasingly focusing on hybrid and multi-cloud strategies, stimulating ongoing investments in colocation facilities. While Western Europe, particularly nations like Germany and the UK, leads in adoption, Eastern Europe shows potential for growth, although it lags in terms of availability and pricing competitiveness.

Middle East & Africa

The Middle East & Africa region represents a developing landscape for the Data Center Colocation market, driven by rapid urbanization and a surge in technology adoption. Countries in the Gulf Cooperation Council (GCC) are heavily investing in digital infrastructure and smart city initiatives, presenting opportunities for colocation providers. However, challenges such as political instability, fluctuating energy prices, and varying levels of technological readiness across the continent may hinder extensive market growth. Despite these hurdles, the increasing push for digital transformation and data localization in certain countries could yield growth in the longer term.

Data Center Colocation Market Competitive Landscape:

The leading entities in the Global Data Center Colocation sector, including service providers and technology firms, are pivotal in fostering innovation and advancing infrastructure. They prioritize scalability and dependability for enterprises. Through strategic collaborations and investments, these players enhance their service portfolios, addressing the varied requirements of customers within a competitive environment.

Prominent participants in the Data Center Colocation sector encompass Equinix, Digital Realty Trust, NTT Communications, CyrusOne, CoreSite Realty Corporation, QTS Realty Trust, Interxion, Rackspace Technology, Alibaba Cloud, China Telecom Global, Verizon Communications, Iron Mountain, Flexential, BSO Network Solutions, and StackPath.

Global Data Center Colocation Market COVID-19 Impact and Market Status:

The COVID-19 pandemic significantly propelled the expansion of the global data center colocation sector, as it led to a surge in the necessity for remote services and digital frameworks, prompting companies to transition to online business models.

The COVID-19 pandemic profoundly influenced the colocation market for data centers, catalyzing a surge in the demand for remote work arrangements and digital services. As organizations transitioned to online platforms, there was a ened requirement for robust IT infrastructures, prompting greater investment in colocation services. Many companies aimed to delegate their data management responsibilities to external providers that could ensure scalability and dependability during these unpredictable times. Additionally, the rise in data traffic fueled by e-commerce, streaming, and cloud services intensified the emphasis on efficient data center operations to accommodate these growing demands. Although the industry initially faced supply chain and construction challenges, the long-term perspective has improved as companies adapted to health and safety protocols. The colocation market is anticipated to thrive due to ongoing digital transformation efforts and a growing dependency on hybrid cloud solutions, positioning it favorably for expansion in the post-pandemic era as organizations continue to prioritize adaptable and resilient IT frameworks.

Latest Trends and Innovation in The Global Data Center Colocation Market:

- In July 2023, Digital Realty and Stream Data Centers announced a partnership to provide a new data center facility in Dallas, Texas, enhancing their capabilities in the colocation market and expanding the range of services offered to clients seeking edge solutions.

- In August 2023, Equinix completed the acquisition of ADNOC's data center portfolio for approximately $500 million, which includes sites across the United Arab Emirates, significantly strengthening Equinix's presence in the Middle East.

- In September 2023, Vantage Data Centers launched a new data center in Frankfurt, Germany, expanding their footprint in Europe and offering additional capacity to meet the increasing demand for colocation services in the region.

- In October 2023, QTS Realty Trust announced the opening of a new data center in Richmond, Virginia, which is equipped with advanced infrastructure and sustainability features, positioning the company to cater to the growing demand for green data center solutions.

- In November 2023, CyrusOne completed the acquisition of a competing colocation provider in Canada, consolidating its market presence and increasing its scale to enhance service offerings for its North American clients.

- In December 2023, CoreSite Realty Corporation announced the expansion of its Los Angeles data center with an additional 40,000 square feet of colocation space, reflecting the growing needs of cloud providers and enterprises for data center capacity in California.

- In January 2024, Iron Mountain Incorporated launched its latest data center in Singapore, focused on hybrid cloud infrastructure, utilizing its specialties in security and compliance to cater to sectors such as finance and healthcare.

Data Center Colocation Market Growth Factors:

The Data Center Colocation Market is experiencing growth due to several key drivers, including a ened need for economical IT infrastructure, a surge in data traffic, and an increasing emphasis on robust security measures and disaster recovery strategies.

The Data Center Colocation Market is undergoing significant expansion, attributable to several pivotal factors. To begin with, the surging popularity of cloud computing has compelled businesses to search for adaptable infrastructures, thus increasing the demand for colocation centers that excel in both flexibility and operational effectiveness. Furthermore, the rise of big data analytics and IoT applications necessitates secure and efficient storage and processing solutions, making colocation services even more vital.

Additionally, organizations are prioritizing the reduction of operational costs and capital investments, thereby making outsourced data center options increasingly appealing. The escalation of cyber threats, along with the need for stringent data protection protocols, has led enterprises to pursue colocation services, particularly those equipped with advanced security capabilities and compliance with industry regulations.

Moreover, the swift advancement of 5G technology amplifies connectivity and speeds, further stimulating the demand for data centers that offer robust colocation services. Regionally, areas characterized by burgeoning technological ecosystems and high internet traffic, especially in the Asia-Pacific and North America, are seeing increased investments in colocation infrastructures. Lastly, the growing emphasis on sustainable data management practices is generating interest in eco-friendly colocation solutions, ensuring that these facilities comply with contemporary environmental standards while providing exceptional service to their clients. Taken together, these elements position the Data Center Colocation Market for continuous and significant growth.

Data Center Colocation Market Restaining Factors:

The Data Center Colocation Market faces several significant constraints, such as substantial capital investments, challenges associated with scalability, and the complexities of adhering to regulatory requirements.

The Data Center Colocation Sector is hindered by various factors that could impede its growth. One significant obstacle is the escalating demand for energy efficiency alongside the increasing expenses related to energy use, which is raising the operational costs for colocation service providers. Moreover, the necessity for compliance with stringent government regulations concerning data security and environmental sustainability requires substantial investments from data center operators, potentially straining their financial capabilities.

Additionally, the fast pace of technological innovation presents a challenge, as colocation facilities may need ongoing upgrades to meet the shifting demands of infrastructure, risking obsolescence. The intensifying competition from cloud service providers that deliver integrated, scalable solutions can also discourage prospects from opting for traditional colocation services. Concerns regarding data security and the risk of service interruptions lead businesses to be cautious about entrusting sensitive workloads to third-party solutions.

Nonetheless, amid these hurdles, the continuous digital transformation and increasing dependence on cloud services offer significant growth opportunities for the colocation industry. Providers that can swiftly adapt to market trends, improve their service offerings, and focus on customer satisfaction are likely to succeed in this evolving environment, promoting both resilience and innovation in the future.

Key Segments of the Data Center Colocation Market

By Type

• Retail Colocation

• Wholesale Colocation

By Deployment

• On Cloud

• Premises

By End User

• BFSI (Banking, Financial Services, and Insurance)

• IT and Telecom

• Government and Defense

• Healthcare

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America