Debt Collection Software Market Analysis and Insights:

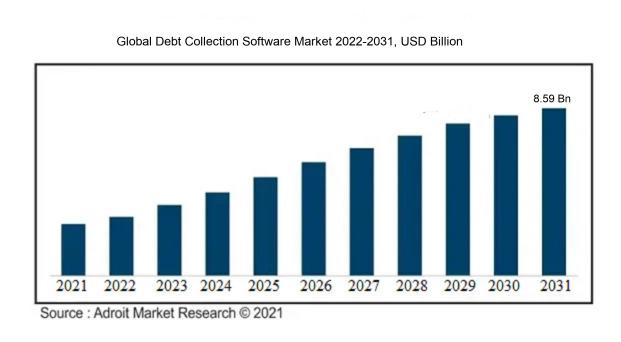

The global debt collection software market was valued at USD 3.05 billion in 2022 and is projected to increase at a compound annual growth rate (CAGR) of 10.29% from 2023 to 2031, reaching an estimated USD 8.59 billion in 2031.

The growth of the Debt Collection Software Market is being fueled by the increasing instances of outstanding bills and liabilities observed in diverse sectors, prompting a ened demand for effective and streamlined collection procedures. Progress in technology, particularly the integration of artificial intelligence and machine learning, has significantly bolstered the functionalities of debt collection software by empowering it to analyze data intricately, forecast debtor conduct, and optimize collection tactics. In addition, the strict regulatory standards and conformity prerequisites stipulated by governments and financial entities have obligated businesses to procure specialized software solutions to ensure conformance with legal frameworks. Furthermore, the surging popularity of cloud-based debt collection software provides organizations of varying sizes with advantages such as scalability and cost efficiency, thus further driving market expansion. In essence, the growth of the market is shaped by the amalgamation of sector-specific challenges, technological advancements, and regulatory factors delineating the debt collection landscape.

Debt Collection Software Market Definition

Debt collection software represents a form of technological solution that aids businesses in optimizing and mechanizing the endeavor of retrieving overdue payments from clients. This software offers functionalities for monitoring outstanding debts, facilitating communication with debtors, and structuring payment agreements efficiently.

Debt recovery software plays a vital role in optimizing the process of recovering debts by automating various tasks including communication with debtors, tracking payments, and prioritizing accounts. Through its sophisticated analytics features, this software empowers businesses to effectively handle outstanding accounts, lower delinquency rates, and enhance the overall efficiency of debt collection operations. Furthermore, debt recovery software aids organizations in adhering to regulatory standards, minimizing errors, and fostering better customer relationships by offering a clear and well-organized framework for debt recovery endeavors. In essence, the integration of debt recovery software is indispensable for enterprises seeking to boost operational efficiency, elevate collection activities, and sustain a healthy financial position.

Debt Collection Software Market Segmental Analysis:

Insights On Component

Software

It is anticipated that the software component would rule the global debt collection software market. The main cause of this is the growing use of digitization and automation in the debt collecting procedure. Businesses aiming to optimize their collections operations use debt collection software because it provides scalability, accuracy, and efficiency. Additionally, features such as predictive analytics, workflow automation, and customer ation further enhance the capabilities of debt collection software, driving its demand in the market.

Services

Services in the Global Debt Collection Software Market play a crucial role in complementing the functionality of debt collection software. Services are important since they offer consultation, installation, training, and support services to guarantee the efficient deployment and use of debt collection software solutions, even if the software component is anticipated to predominate. Service providers offer customization options, integration services, and expertise in compliance and regulatory requirements, making Services an essential component for businesses seeking comprehensive debt collection solutions.

Insights On Deployment

Cloud

The global debt collection software market is anticipated to be dominated by the cloud deployment industry. In contrast to conventional on-premise systems, cloud-based solutions provide scalability, flexibility, and cost-effectiveness. With increasing adoption of cloud technology across industries, debt collection software hosted on the cloud is projected to experience higher growth rates. Companies are attracted to cloud solutions due to lower upfront costs, easier implementation, and seamless updates, making Cloud the dominating part in the Debt Collection Software Market.

On-premise

The On-premise deployment sector, while still relevant for organizations with specific security or compliance needs that require in-house hosting of software, is expected to have slower growth compared to Cloud. On-premise solutions generally involve higher initial investments in infrastructure and maintenance, making them less attractive for businesses looking for cost-effective and agile debt collection software solutions. As more companies shift towards cloud-based deployments for their flexibility and scalability, the on-premise part is likely to see a decline in market share over time.

Insights On Organization

Large Enterprises

Large Enterprises are expected to dominate the Global Debt Collection Software market due to their higher financial capacity and need for advanced debt collection solutions to handle larger and more complex debt portfolios efficiently. These enterprises often deal with a significant volume of debts owed to them, making robust debt collection software crucial for streamlining operations and maximizing recovery rates. With their resources and focus on scalability, large enterprises are likely to invest in comprehensive debt collection software systems that can be tailored to their specific requirements and integrated with existing enterprise-level systems.

Small and Medium Enterprises

Small and Medium Enterprises (SMEs) play a crucial role in the Debt Collection Software market by contributing to its growth through their increasing adoption of automated collections solutions. Although not expected to dominate the market, SMEs are gradually recognizing the benefits of utilizing debt collection software to enhance their debt recovery processes and improve operational efficiency. As SMEs face challenges like limited resources and manpower, they are turning to cost-effective and user-friendly debt collection software tailored to their scale of operations to stay competitive and compliant in the evolving debt collection landscape.

Global Debt Collection Software Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Debt Collection Software market. The region is experiencing rapid economic growth, leading to an increase in the number of businesses and subsequently debt collections. To increase productivity and streamline operations, nations in the Asia Pacific area are implementing debt collecting software. Additionally, the need for debt collection software in this area is being driven by the growing emphasis on digital transformation and technical breakthroughs in nations like China, India, and Japan.

North America

In the global market for debt collection software, North America is a major participant. The debt collection sector in the region is well-established, and technology solutions are widely adopted. With the presence of key market players, advanced infrastructure, and stringent regulations, North America continues to be a dominant force in the debt collection software market. Businesses in the region are increasingly leveraging software solutions to manage their debt collection processes effectively.

Europe

Europe is a key region in the Global Debt Collection Software market, known for its well-established financial services sector and adoption of advanced technologies. Countries like the UK, Germany, and France have a strong presence of debt collection agencies and financial institutions that are driving the demand for debt collection software. The use of software solutions for debt collection is also being fueled by the region's emphasis on data security and regulatory compliance.

Latin America

Latin America is an emerging player in the Global Debt Collection Software market. The region is experiencing economic growth and an expansion of financial services, leading to an increased need for debt collection solutions. Countries like Brazil, Mexico, and Argentina are witnessing a rise in debt collection activities, driving the demand for software tools that can improve collection efficiency. The adoption of digital platforms and services in the financial sector is further driving the growth of debt collection software in Latin America.

Middle East & Africa

Middle East & Africa is a developing region in the Global Debt Collection Software market. The region's financial services sector is evolving, and businesses are increasingly looking for efficient debt collection solutions. Countries in the Middle East & Africa region are gradually embracing technology to streamline their debt collection processes and improve overall operational efficiency. In the upcoming years, there will likely be a greater need for debt collection software due to the increased focus on digital transformation and financial inclusion.

Global Debt Collection Software Market Competitive Landscape:

Prominent entities in the worldwide Debt Collection Software industry mainly comprise software firms specializing in debt collection solutions, like Experian, FICO, and TransUnion. These organizations are dedicated to creating and supplying cutting-edge software solutions and technologies aimed at enhancing efficiency in debt collection procedures for global businesses and financial entities.

Prominent companies within the Debt Collection Software Market comprise FICO (Fair Isaac Corporation), CGI Inc., Pegasystems Inc., Nucleus Software, Experian Information Solutions Inc., Temenos AG, Nortridge Software LLC, Chetu Inc., Intellect Design Arena Limited, and DAKCS Software Systems.

Global Debt Collection Software Market COVID-19 Impact and Market Status:

The presence of Covid-19 in the global market for debt collection software has resulted in a rise in the need for digital tools and automated systems to enhance the efficiency of debt collection operations.

The outbreak of the COVID-19 pandemic has had a profound impact on the debt collection software industry, with businesses grappling with financial hardships resulting in a global increase in outstanding debts. The economic downturn stemming from the pandemic has led to a rise in overdue accounts and missed payments, fueling a ened demand for debt collection services and software solutions. Nonetheless, the sector has also encountered impediments such as delays in debt retrieval procedures, legal constraints on debt recovery activities, and the requisite for more sophisticated technologies to facilitate remote work. In response to the evolving landscape and the imperative to streamline operations, organizations are increasingly prioritizing the integration of AI-powered analytics and automation functionalities into debt collection software to optimize productivity and achieve superior outcomes during the recovery phase post-pandemic.

Recent Trends & Innovations in the Debt Collection Software Market:

- In October 2020, Ontario Systems announced the acquisition of SwervePay, a leading payment facilitation provider, to enhance its debt collection software capabilities.

- In September 2021, InterProse acquired La Jolla-based debt collection software provider MicroBilt to expand its market presence and range of services.

- Temenos, a prominent banking software provider, introduced Workload Management technology in March 2022 within its debt collection software suite to improve operational efficiency.

- in1touch, a software solutions company, partnered with InterProse in February 2021 to integrate its membership management platform with InterProse's debt collection software, offering a comprehensive solution for associations and creditors.

- FICO unveiled its FICO Collection Suite 9 in July 2021, introducing advanced machine learning capabilities to enhance debt collection strategies and efficiency.

Debt Collection Software Market Growth Factors:

The emphasis on optimizing operations and enhancing effectiveness within the financial services sector is a key factor driving growth in the debt collection software market.

The Debt Collection Software Market is poised for substantial expansion driven by various key factors. The increasing demand for automation and enhanced efficiency in debt collection processes is propelling organizations in diverse sectors to adopt these software solutions. Furthermore, the escalation in financial frauds and non-performing assets has amplified the necessity for robust debt collection tools that can assist companies in optimizing their collection activities and recovering outstanding debts efficiently. The incorporation of cutting-edge technologies like artificial intelligence, machine learning, and analytics into debt collection software is augmenting the functionalities of these solutions, empowering them to better identify and communicate with debtors. Additionally, the rising focus on regulatory compliance and data security is boosting the adoption of debt collection software equipped with advanced security features and designed to ensure adherence to legal mandates. Collectively, these factors are anticipated to drive the growth of the Debt Collection Software Market in the foreseeable future.

Debt Collection Software Market Restraining Factors:

The expansion of the debt collection software market might encounter obstacles due to regulatory hurdles and a rise in competitive dynamics.

Numerous obstacles impede the growth of the Debt Collection Software Market, such as escalating concerns related to data security and privacy protocols, posing difficulties for businesses in managing sensitive consumer data. Furthermore, the substantial initial investment needed to deploy advanced debt collection software solutions may serve as a deterrent for small and medium enterprises. Moreover, the intricacies associated with integrating these software platforms with existing legacy systems and the resistance toward altering traditional debt collection procedures can impede the market's adoption and expansion. Nevertheless, with the escalating emphasis on digital transformation, automation, and the ened demand for streamlined debt collection workflows, the market is poised to gradually surmount these constraints, fostering innovation and enhancing operational efficiency within debt collection processes.

Key Segments of the Debt Collection Software Market

Component Overview

• Software

• Services

Deployment Overview

• On-premise

• Cloud

Organization Overview

• Small and Medium Enterprises

• Large Enterprises

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America