Dental Service Organization Market Analysis and Insights:

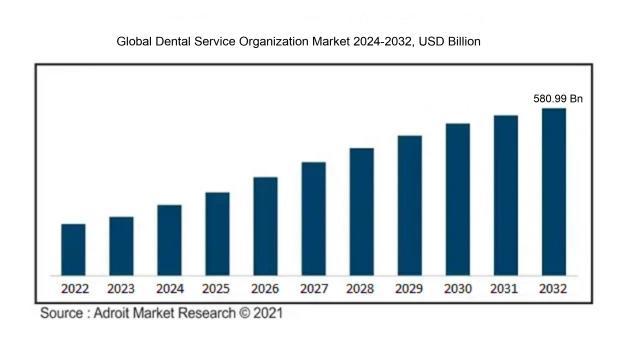

In 2023, the size of the worldwide dental services organization market was estimated to be USD 138.55 billion. The market is anticipated to increase at a compound annual growth rate (CAGR) of 18.5% between 2024 and 2032, from USD 160.98 billion in 2024 to USD 580.99 billion in 2032.

The market for Dental Service Organizations (DSOs) is significantly influenced by a variety of vital elements. A notable uptick in the demand for dental care, along with a growing incidence of oral health challenges, is pushing this market forward. Additionally, an increasingly older demographic necessitating more in-depth dental services further drives the demand. The movement toward preventive healthcare, alongside a preference for all-encompassing treatment alternatives, is also a contributing factor to market expansion. Financial challenges faced by dental professionals, combined with an emphasis on enhancing operational efficiency, prompt many dental practices to partner with DSOs for improved resource allocation and clinical assistance. Furthermore, innovations in dental technologies and the rising integration of digital tools are refining service delivery, appealing to both dental providers and patients. Changes in regulations and the broader availability of dental service insurance are facilitating this market's growth by ensuring increased access to dental care. Together, these dynamics foster a vibrant and progressively developing DSO sector, making it an appealing area for investment and growth within the healthcare landscape.

Dental Service Organization Market Definition

A Dental Service Organization (DSO) operates as a business framework delivering various non-clinical support functions to dental practices, enabling dentists to concentrate on delivering patient care. The range of services offered may encompass administrative duties, marketing strategies, human resources management, and financial oversight.

Dental Service Organizations (DSOs) are vital to contemporary dentistry, offering significant assistance to dental offices so that they can prioritize patient care. By managing administrative responsibilities like billing, marketing, and human resources, DSOs enable dentists to concentrate more fully on clinical work. They promote operational efficiency via centralized procurement, incorporation of advanced technologies, and workforce training. Furthermore, DSOs increase accessibility to dental care by supporting the expansion of practices and providing business management insights. This partnership approach not only drives advancement within the dental field but also enhances service delivery for both practitioners and their patients.

Dental Service Organization Market Segmental Analysis:

Insights On Service

Marketing & Branding

Marketing & Branding is expected to dominate the Global Dental Service Organization Market due to the increasingly competitive landscape of dental practices. As dental organizations strive to attract and retain patients, a strong marketing strategy that includes digital marketing, social media presence, and brand positioning becomes essential. The ability to effectively communicate value propositions and differentiate services contributes significantly to patient acquisition and retention rates. Additionally, this service not only enhances visibility but also builds trust among patients, making it a priority for dental organizations aiming for sustainable growth. With more practices seeking innovative ways to market their services, Marketing & Branding is anticipated to lead the market.

Human Resources

Human Resources is an essential component for dental service organizations, focusing on hiring, training, and employee retention. This area is crucial for enhancing workforce efficiency, which directly impacts service delivery in dental practices. By fostering a skilled and motivated workforce, organizations can improve patient experiences and operational effectiveness. Investing in HR practices such as employee development programs, performance evaluations, and workplace culture directly contributes to the overall success of dental practices. As organizations grow, the complexity of managing human resources effectively also increases, ensuring that this area remains a significant consideration.

Accounting

Accounting plays a vital role in the operation of dental service organizations by managing financial health and ensuring compliance with regulations. Accurate financial tracking and reporting are paramount for decision-making, budgeting, and cash flow management. Dental practices must manage expenses effectively and understand revenue streams, particularly as they seek to grow and invest in new technologies or services. As organizations scale, sophisticated accounting practices become necessary to maintain financial integrity and support sustainable growth strategies. Thus, the demand for accounting services remains significant, supporting the underlying financial infrastructure of dental practices.

Medical Supplies Procurement

Medical Supplies Procurement is a critical area within dental service organizations, focusing on the acquisition of essential tools and materials required for operations. The timely and cost-effective procurement of supplies ensures that dental practices can provide high-quality care without interruption. As practices aim for operational efficiency and effectiveness, strategically sourcing and negotiating with suppliers becomes increasingly important. This element necessitates strong supplier relationships and effective inventory management practices, ensuring that the organization is always prepared for patient needs. Consequently, the importance of Medical Supplies Procurement is continuously rising, driving demand within the sector.

Others

The "Others" category encompasses several ancillary services that dental service organizations may utilize to support operations. While not the primary focus, these services can include IT support, patient management systems, and administrative services that enhance operational efficiency. Organizations are recognizing the value of integrating advanced technology and automation into their processes to streamline workflows and improve patient interactions. Although not a leading force compared to Marketing & Branding, these complementary services play a significant role in strengthening the overall functionality of dental practices, thus contributing positively to the market.

Insights On End-Use

General Dentists

General Dentists are poised to dominate the Global Dental Service Organization Market due to their widespread prevalence and the broad range of services they provide. These professionals typically serve as the first point of contact for patients seeking dental care, resulting in higher patient volumes. Their comprehensive practice encompasses preventive, restorative, and cosmetic treatments, catering to a diverse patient demographic. Additionally, advancements in technology and increased public awareness regarding oral health are driving more individuals to seek regular dental care, further elevating the role of General Dentists in the market. The combination of their foundational role in patient care and the rising demand for dental services positions them as the primary influencers in the industry.

Dental Surgeons

Dental Surgeons play a crucial role in the dental services landscape, particularly in specialized procedures and complex surgical cases. Their expertise in oral surgery, including wisdom tooth extraction and jaw realignment, addresses specific patient needs, which can be critical for those requiring advanced interventions. Although they represent a smaller of the overall dental care market, the increasing prevalence of dental surgeries and technological advancements in surgical techniques are likely to further enhance their importance and growth. However, their market share may remain limited relative to General Dentists, mainly due to the more specialized nature of their practices.

Endodontists

Endodontists focus specifically on root canal treatments and other procedures related to the inner tissues of the teeth. Their specialized training allows them to handle complex cases involving tooth pain and infection, catering to a particular patient demographic that requires these services. With the rising incidence of dental diseases and an increasing emphasis on tooth preservation, the demand for Endodontist services is expected to grow. However, their market presence remains niche compared to more general practices, limiting their overall impact on the broader dental service organization landscape when juxtaposed with General Dentists.

Others

The 'Others' category in the dental service market comprises various dental professionals, including oral pathologists, pediatric dentists, and orthodontists. This is characterized by a diverse range of services tailored to specific patient needs, such as orthodontic treatments or specialized care for children. Although the variety of care offered is beneficial, the fragmented nature of this group means that no single specialty dominates the market. While demand for specialized dental services is on the rise, the broad audience addressed by General Dentists positions them more favorably in terms of market share and growth potential within the global landscape.

Global Dental Service Organization Market Regional Insights:

North America

The North American region is expected to dominate the Global Dental Service Organization (DSO) market due to several key factors, including a well-established healthcare infrastructure, high disposable income, and increasing demand for accessible dental care services. The presence of numerous leading DSO providers fosters a competitive environment, enhancing service quality and innovation. Moreover, the rising prevalence of dental disorders coupled with growing awareness about oral health is driving the demand for comprehensive dental services. The integration of advanced technologies within dental practices further propels market growth in this region, ultimately positioning North America as a significant player in the global DSO landscape.

Latin America

Latin America represents a growing market for dental service organizations, driven by the rising urban population and increasing dental awareness among consumers. Enhanced access to dental care, especially in urban areas, contributes to market expansion. Additionally, the prevalence of dental issues and a push for affordable healthcare solutions motivate investments in DSO. However, the region still faces challenges like economic fluctuations and disparities in healthcare access, which may inhibit rapid growth compared to more developed regions.

Asia Pacific

The Asia Pacific region shows significant potential for the dental service organization market, with rapid urbanization and population growth driving demand. Countries like India and China are witnessing an increase in disposable income and urbanization, leading to higher access to dental care services. The growing trend of medical tourism for dental procedures also contributes to market growth. Nonetheless, the region grapples with varying regulations and standards for dental services that could affect the overall growth trajectory.

Europe

Europe presents a mature market for dental service organizations with established healthcare frameworks and high standards of service. The growing elderly population creates a surge in dental care demand, while increasing awareness regarding oral health is driving more individuals to seek treatment. However, competition among existing DSOs can lead to market saturation and price pressures. As companies focus on innovation and enhanced patient experiences, the market is likely to experience moderate growth moving forward.

Middle East & Africa

The Middle East and Africa region are characterized by a developing dental service organization market, showing promise due to rising investments and improving healthcare infrastructure. Increased urbanization and population growth are leading to higher demand for dental services. International players are slowly entering the market, driven by the potential of a burgeoning middle class. However, economic discrepancies and a lack of universal healthcare solutions hinder rapid growth, making this region a developing within the global DSO landscape.

Dental Service Organization Competitive Landscape:

The primary contributors to the Global Dental Service Organization sector encompass dental service providers that optimize operational efficiency and elevate patient care, alongside technology companies that offer cutting-edge solutions to enhance service delivery and foster patient engagement. Collectively, these participants propel market expansion and revolutionize dental practices through improved operational workflows and sophisticated technological advancements.

Prominent entities within the Dental Service Organization sector comprise Aspen Dental Management, Inc., Heartland Dental, Pacific Dental Services, Dental One Partners, Inc., Smile Brands Inc., North American Dental Group, Benevis, Great Expressions Dental Centers, West Coast Dental Services, Inc., and InterDent Service Corporation. These organizations are vital to the industry, each facilitating dental care delivery through diverse operational and organizational frameworks.

Global Dental Service Organization COVID-19 Impact and Market Status:

The Covid-19 pandemic notably expedited the integration of tele-dentistry and improved infection control protocols across the Global Dental Service Organization sector, fundamentally transforming both the delivery of services and the way patients engage with dental care.

The COVID-19 pandemic had a profound effect on the Dental Service Organization (DSO) sector, presenting both obstacles and new avenues for growth. At the onset, numerous dental practices temporarily shut down and experienced a significant drop in patient attendance due to concerns over health and compliance with regulations, which consequently led to a revenue downturn for DSOs. Nevertheless, as practices started to adapt by adopting more rigorous safety measures and incorporating telehealth services, signs of recovery emerged in the market. Following the lockdown, there was a noticeable increase in the demand for dental services, which, along with the trend of consolidation within the dental field, has propelled the advancement of DSOs. These entities have effectively offered vital resources, operational support, and efficiencies that assist independent practices in maneuvering through the challenges of the post-pandemic period. Moreover, the ened emphasis on preventive care and greater patient awareness regarding oral health have stimulated further demand for DSOs, setting the stage for sustained growth amidst the transforming healthcare landscape.

Latest Trends and Innovation in The Global Dental Service Organization Market:

- In March 2023, Heartland Dental announced the acquisition of a multi-office dental group based in Texas, expanding its network and reach in the state's growing market.

- In January 2023, DentalOne Partners rebranded itself as ‘The Greatest Dental Company’ and launched a new marketing initiative aimed at enhancing patient engagement through digital platforms.

- In February 2023, Pacific Dental Services partnered with Smile Generation to integrate cutting-edge technology within their offices, focusing on telehealth solutions and advanced imaging technology for improved patient care.

- In April 2022, Aspen Dental acquired an additional 50 practice locations, with a focus on increasing access to quality dental care in underserved communities across the Midwest and East Coast.

- In June 2022, Smile Brands announced a merger with a dental practice management firm that solidified their strategy to enhance operational efficiencies and patient experience through innovation in service delivery.

- In September 2022, Bright Now! Dental implemented a new appointment management system powered by artificial intelligence, optimizing scheduling processes and reducing patient wait times by up to 30%.

- In July 2022, Kool Smiles expanded its operations by acquiring several dental practices in the Southeast, aligning their mission to improve access to dental care for children and families.

- In October 2022, Dental Whale launched a comprehensive training program for its affiliated practices focusing on digital dentistry and practice management systems, aiming to elevate the standard of care provided by their dental professionals.

Dental Service Organization Market Growth Factors:

The primary drivers of growth in the Dental Service Organization sector encompass ened awareness of dental health, an uptick in dental treatments being performed, and a growing elderly demographic in need of oral healthcare services.

The market for Dental Service Organizations (DSOs) is witnessing remarkable expansion, influenced by several pivotal elements. An increase in dental health issues, coupled with a rising elderly demographic, has ened the demand for dental care, underscoring the necessity for efficient organizational frameworks to oversee operations. Moreover, the ongoing consolidation trend within the dental sector is fueling the rise of DSOs, as dental practitioners increasingly seek administrative assistance to optimize operations, lower operational costs, and improve patient care outcomes.

Technological innovations, including tele dentistry and digital imaging, are enhancing the appeal of DSOs by streamlining service delivery and fostering greater patient interaction. Furthermore, the evolution of patient expectations, particularly in relation to accessibility and convenience, is driving dental practices to adopt DSO models that offer comprehensive care solutions. Financial considerations are also significant; DSOs typically provide better access to funding, empowering practices to invest in advanced technologies and broaden their range of services.

Lastly, the growing emphasis on value-based care prompts DSOs to prioritize patient outcomes and satisfaction, reinforcing their role in the dental care sector. Collectively, these dynamics are fostering substantial growth in the DSO market, transforming the delivery of dental services in alignment with shifting consumer demands.

Dental Service Organization Market Restaining Factors:

Critical limitations in the Dental Service Organization sector comprise regulatory hurdles, elevated operational expenses, and a deficit of qualified personnel.

The Dental Service Organization (DSO) sector is confronted with various challenges that could hinder its expansion. A primary obstacle is the intricate regulatory environment, which differs across regions and can impose stringent compliance demands on organizations. Such complexities often result in elevated operational expenses and create hurdles for new entrants in the field. Furthermore, the intense rivalry among current DSOs, paired with a shortage of qualified dental practitioners, places additional strain on resources and can restrict the ability to expand services. Financial limitations affecting smaller dental practices may also influence their readiness to collaborate with DSOs, presenting further difficulties. Moreover, shifting patient expectations along with rapid advancements in dental technology require continual adjustments, a challenge not all organizations can meet. Nonetheless, the DSO landscape is witnessing a transition toward value-based care, prioritizing patient experience and outcomes, thus opening new avenues for growth. As dental practices evolve and collaboration between DSOs and independent dentists increases, the market is positioned for innovative strategies that improve patient care and operational effectiveness, heralding a promising future.

Key Segments of the Dental Service Organization Market

By Service

• Human Resources

• Marketing & Branding

• Accounting

• Medical Supplies Procurement

• Others

By End-Use

• Dental Surgeons

• Endodontists

• General Dentists

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America