Market Analysis and Insights:

The market for Detonators was estimated to be worth USD 9.8 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 3.5%, with an expected value of USD 13.5 billion in 2032.

.jpg)

The Detonator Market experiences significant momentum due to several key influences, such as the growing requirements for explosives in sectors like mining, construction, and demolition, along with the global growth of these industries. Innovations in detonator technology, particularly the development of electronic detonators that enhance safety and accuracy, significantly contribute to market advancement. In addition, regulatory frameworks advocating for safer blasting methods and the shift towards environmentally sustainable explosives further elevate the demand for sophisticated detonators. Factors such as geopolitical dynamics and increased investments in infrastructure projects further stimulate market growth. Additionally, the emphasis on improved safety protocols in the handling and application of explosives compels manufacturers to pursue innovation and meet stricter regulatory standards. As urban development accelerates and the pursuit of resources intensifies, these elements collectively foster a favorable landscape for the Detonator Market to thrive, addressing the changing requirements of various sectors dependent on explosives for operational effectiveness.

Detonator Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 13.5 billion |

| Growth Rate | CAGR of 3.5% during 2024-2032 |

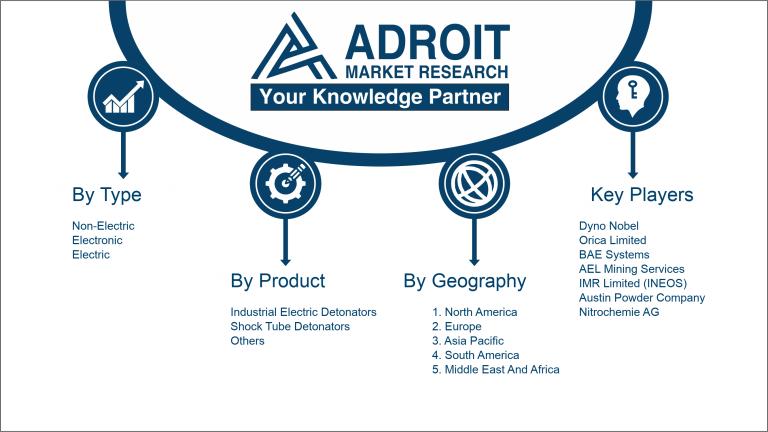

| Segment Covered | By Type, By Product, By Assembly Type, By Application, By Sales Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Dyno Nobel, Orica Limited, BAE Systems, AEL Mining Services, IMR Limited (INEOS), Austin Powder Company, Nitrochemie AG, Nobel Fireworks, Explosives Engineering, and Henan Archipelago. Other noteworthy firms encompass African Explosives Limited (AEL), Axxis Digital Detonators (Rheinmetall), E.I. du Pont de Nemours and Company, Maxam Corp, Detonator Technology Limited, Trolleys & Accessories Inc., and Solar Group |

Market Definition

A detonator is an instrument designed to initiate an explosive reaction by activating a detonation charge. This device plays a crucial role in various fields such as construction, mining, and defense, allowing for precise timing of explosive events.

The Detonator serves an essential function across multiple sectors, especially in mining and construction, by facilitating the accurate and regulated triggering of explosives. Its significance is underscored by its contribution to safety protocols, as it reduces the likelihood of unintended detonations, ensuring a methodical and efficient use of explosives. This apparatus allows for the coordination of explosions, enhancing excavation and demolition tasks while lessening unintended harm and minimizing ecological consequences. With ongoing technological progress, dependable detonators enhance both productivity and performance, rendering them vital instruments for experts striving to optimize output while adhering to rigorous safety regulations.

Key Market Segmentation:

Insights On Key Type

Electronic

The electronic type is expected to dominate the Global Detonator Market due to its enhanced precision and reliability. Electronic detonators offer significant advantages over non-electric and electric variants, including programmable timing, reduced misfire rates, and improved safety features. The increasing demand for safer and more efficient blasting operations in sectors like mining, construction, and demolition significantly drives the preference for electronic detonators. Moreover, the technological advancements that lead to better integration with automated systems in controlled blasting processes further bolster electronic detonators' market share. This trend, fueled by awareness of the efficiency and safety benefits, positions the electronic category at the forefront of this market.

Non-Electric

Non-electric detonators have historically been used due to their reliability and simplicity in various blasting operations. These detonators do not require any electrical components, which minimizes the risk of accidental detonation caused by stray currents or electrical faults. Their operational reliability and ease of use in remote areas where electrical sources may not be available contribute to persistent demand. However, the growth of the electronic is overshadowing this type as industries seek more advanced solutions that enhance safety and control during blasting.

Electric

Electric detonators typically face competition from both electronic and non-electric alternatives. They offer benefits such as ease of use and predictable detonation times, which have made them a popular choice in the past. However, limitations related to safety, including risks of premature detonation due to electrical interference, have hindered their market growth. As industries increasingly prioritize safety and efficiency in their blasting operations, the demand for electric detonators continues to decline compared to the strengths of electronic detonators, which provide superior features that align with modern operational requirements.

Insights On Key Product

Industrial Electric Detonators

Industrial electric detonators are expected to dominate the global detonator market. This is primarily due to their precise timing and control, which are essential in industrial applications such as mining, construction, and demolition. The demand for enhanced safety and efficiency in blasting operations significantly favors electric detonators over other types. Additionally, advancements in technology have led to improved features, reliability, and reduction in failure rates, making them more appealing to users. As industries increasingly focus on automation and process optimization, the growing preference for electric detonators will solidify their position as the leading product in the market.

Shock Tube Detonators

Shock tube detonators play a vital role in the detonator market, serving specific applications particularly in mining and quarrying. Due to their simplicity, reliability, and cost-effectiveness, they are often favored for smaller-scale operations. Shock tube systems do not require electrical power, which makes them more versatile in challenging environments. Nevertheless, while they continue to have a significant market, their preference lies in certain niches and does not encompass the broader industrial requirements that electric detonators address.

Others

The category of "Others" includes various alternative detonator products that do not fall under the major classifications of electric or shock tube detonators. This can include non-electric systems, programmable detonators, and other technological innovations that cater to specific industries or unique applications. While there is a presence of these products in the market, their demand is generally lower compared to the established categories. The growth within this sector often hinges on niche applications or industries looking for specialized solutions, but they remain a smaller fraction of the overall market landscape.

Insights On Key Assembly Type

Wireless Detonator

The wireless detonator is poised to dominate the global detonator market due to its increasing adoption in various industries, such as mining, construction, and military operations. This type of detonator offers significant advantages, including enhanced safety, ease of use, and improved operational efficiency. With advancements in communication technology, wireless detonators provide a robust solution for remote detonation, reducing the risks associated with manual handling of explosives. The growing focus on safety regulations and the need for precise control further drive the preference for wireless detonators over their wired counterparts. Thus, their convenience and safety features position them as the leading choice in the market.

Wired Detonator

Wired detonators are still prevalent in many industries despite the rise of their wireless counterparts. These devices are often viewed as more reliable in terms of signal delivery, as they do not rely on battery power or communication signals that might fail under certain conditions. In regions where wireless technology faces connectivity issues, wired detonators continue to serve as the preferred choice. Moreover, they are generally more cost-effective, making them attractive for budget-conscious operations. However, their limitations in terms of installation complexity and safety risks associated with the wires may hinder their growth prospects in the long term.

Insights On Key Application

Coal Mines

Coal mines are expected to dominate the Global Detonator Market due to the continued high demand for coal as a primary energy source in various regions of the world. The extraction and processing of coal require advanced blasting techniques to ensure efficiency, thereby increasing the use of detonators. Ongoing investments in mining infrastructure, especially in emerging economies like India and China, where coal remains a critical energy resource, further drive the need for effective detonation solutions. Environmental considerations, such as the shift towards cleaner energy resources, may eventually tilt the market, but, in the near future, coal mines will continue to steer demand.

Metal Mines

Metal mines utilize detonators extensively, particularly in the extraction of valuable ores such as gold, copper, and iron. The growth in the global demand for metals for industrial applications and technological advancements promotes increased exploration and mining activities. However, while significant, the metal mining sector does not presently lead the detonator market as coal remains the more dominant application due to its widespread use and economic viability in various regions.

Non-metal Mines

Non-metal mines, which include the extraction of resources like potash and gypsum, rely on detonators for effective blasting methods. The market for non-metallic minerals is expanding with the increasing demand for construction materials and industrial minerals. Although important, their share of the detonator market is limited compared to coal and metal mines. The subsequent focus of non-metal mines on sustainability may also influence their reliance on detonators.

Railway/Road

The railway and road construction sectors account for a significant share of detonator usage, particularly for tunneling and excavation projects. With global infrastructure investments on the rise, these applications are expected to grow steadily. However, the demand does not match the scale and volume present in coal mining applications, positioning this sector as a key player but not the market leader.

Hydraulic and Hydropower

In the hydraulic and hydropower sectors, detonators play an essential role in constructing dams and waterway projects. The global shift towards renewable energy creates opportunities for expansion in this sector. Although its growth is promising, it faces stiff competition from the demands presented by coal mining, which currently maintains a more substantial market presence over detonators.

Insights On Key Sales Channel

Distribution Channel

The Distribution Channel is expected to dominate the Global Detonator Market due to its wider reach and the preferred purchasing method among various industries. The fragmentation of this market means that many players, including regional distributors and specialized retailers, provide targeted solutions catering to diverse customer requirements. By leveraging existing networks, distribution channels reduce barriers to entry for smaller companies and enable large manufacturers to achieve economies of scale. This channel also facilitates better inventory management and logistical support, making it attractive for customers who prioritize reliability and timely delivery. Furthermore, with increasing regulatory frameworks, buyers favor established distributors who can assure compliance with required safety standards.

Direct Channel

The Direct Channel serves as a vital alternative in the Global Detonator Market, appealing to specific customer requirements that necessitate personalized service. Manufacturers who opt for direct sales can forge closer relationships with clients, ensuring that they fully understand the unique needs and compliance requirements within various industries. However, the emphasis on the direct approach often limits market penetration primarily to larger companies capable of handling logistics and customer relationships effectively. While this channel can command better profit margins, its reliance on a single sales point may hinder broader scalability and flexibility.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Detonator market due to rapid industrialization, increased mining activities, and a booming construction sector. Countries like China and India have seen substantial infrastructural growth, leading to a higher demand for detonators in excavation and demolition processes. Moreover, technological advancements and the rising adoption of state-of-the-art blasting practices are enhancing the productivity and safety of detonation operations. The presence of major manufacturers and a growing focus on mining for precious resources further solidify Asia Pacific's leading position in the market.

North America

North America has a robust detonator market, primarily driven by the United States, which is a leading consumer of explosives for mining and construction industries. The region benefits from strong regulatory frameworks that ensure safety in explosive use and a demand for innovative, high-performance detonators. Furthermore, technological advancements in the sector, alongside the revival of the oil and gas industry, fuel market growth. However, it lags behind Asia Pacific due to slower growth rates in related sectors.

Europe

Europe's detonator market showcases moderate growth, sustained by strict regulatory standards and an emphasis on safety in explosive handling. The region has a well-established mining and construction sector, particularly in countries like Germany and Sweden. The transition towards more environmentally friendly explosives is gaining traction, driven by the European Union's stringent environmental policies. However, the slower pace of large-scale infrastructure projects and economic barriers may hinder its competitiveness against the booming Asia Pacific market.

Latin America

Latin America presents unique opportunities for the detonator market, significantly influenced by mining activities, particularly in countries like Brazil and Chile, which are rich in mineral resources. The region is experiencing an increased focus on mining sector investments and enhancements in safety standards for explosives usage. However, it often faces challenges related to political stability and regulatory regulations that slow down market advancements compared to Asia Pacific, making its potential impact less pronounced on a global scale.

Middle East & Africa

Middle East & Africa offers a burgeoning market for detonators, propelled mainly by construction growth and resource extraction activities, particularly in countries such as South Africa and the UAE. The region is experiencing increased urbanization, which drives demand for explosives in infrastructure development. However, the sector's expansion is stunted due to varying economic conditions and investment levels across different countries, leading to a more fragmented market and ultimately less global dominance than seen in Asia Pacific.

Company Profiles:

Major contributors in the worldwide detonator industry, including producers and vendors, spearhead advancements and guarantee product accessibility while complying with safety standards. Their tactical partnerships and endeavors to expand into new markets play a crucial role in shaping industry trends and influencing growth patterns.

The detonator market features several prominent players, including Dyno Nobel, Orica Limited, BAE Systems, AEL Mining Services, IMR Limited (INEOS), Austin Powder Company, Nitrochemie AG, Nobel Fireworks, Explosives Engineering, and Henan Archipelago. Other noteworthy firms encompass African Explosives Limited (AEL), Axxis Digital Detonators (Rheinmetall), E.I. du Pont de Nemours and Company, Maxam Corp, Detonator Technology Limited, Trolleys & Accessories Inc., and Solar Group. Additionally, entities such as Gmoscape Corporation, NITROGÉNIO Indústria e Comercio Ltda, and RST Instruments also hold significant positions within this industry.

COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly affected the global detonator market, leading to supply chain disruptions and a drop in demand across sectors like mining and construction, primarily due to project postponements and lockdown measures.

The COVID-19 pandemic exerted a profound influence on the detonator market, resulting in significant disruptions to supply chains, production timelines, and demand patterns. At the onset, many manufacturing facilities were compelled to shut down, facing labor shortages that curtailed output and led to delays in product delivery. Additionally, industries like construction and mining, which are primary users of detonators, encountered project slowdowns and reduced operations due to health mandates and safety apprehensions, further suppressing demand.

On the flip side, the emphasis on infrastructure development and increased mining activities as part of economic recovery strategies has started to foster a slow resurgence within the market. Moreover, the industry's evolution has been marked by significant innovations in safety protocols and the introduction of advanced digital detonator technologies, driving a transformation toward enhanced operational efficiency and safety enhancements.

In summary, while the detonator market grappled with substantial difficulties amid the pandemic, the forecast for recovery appears promising, largely fueled by a resurgence of investments in infrastructure and modernization initiatives across the sector.

Latest Trends and Innovation:

- In October 2022, E. I. du Pont de Nemours and Company announced its acquisition of the explosives manufacturer ENAEX USA, enhancing its product offerings in the detonator and expanding its market presence in the North American region.

- In June 2023, Orica Limited launched its new digital detonator technology, called BlastIQ, which integrates advanced data analytics and connectivity features aimed at improving blasting efficiency and safety in mining operations.

- In January 2023, AECI Mining Chemicals unveiled its latest innovation in electronic detonators, claiming increased precision and control over blast patterns, which they showcased at the Mining Indaba conference in Cape Town.

- In March 2023, MAXAM announced a strategic partnership with a leading technology firm to develop next-generation digital detonation systems, focusing on automation and real-time data delivery in blast management, aiming to reduce operational costs and enhance safety protocols.

- In September 2023, BME (Bulk Mining Explosives) reported successful trials of its new shock-resistant detonator technology, which improves safety in adverse environmental conditions, crucial for mining operations in remote areas.

- In August 2023, Dyno Nobel revealed plans for expanding its manufacturing facilities in North America to ramp up production of its advanced electronic detonators, responding to increased demand from the mining and construction sectors.

- In February 2023, DetNet UK launched a groundbreaking hybrid detonator aimed at reducing the risk of misfires and enhancing overall productivity in explosive operations, setting a new standard in the industry.

- In July 2023, Nitrochemie AG announced its merger with a European competitor, significantly broadening its portfolio of detonants and establishing a stronger presence in the European market for explosives and blasting solutions.

Significant Growth Factors:

The expansion of the Detonator Market is largely propelled by a rising need for explosive substances in industries such as mining, construction, and demolition, as well as improvements in safety standards and technological innovations.

The Detonator Market is witnessing remarkable expansion, influenced by multiple factors. A key driver is the rising need for explosives across various sectors, including mining, construction, and oil and gas, which are all experiencing global growth. Technological advancements have resulted in the creation of more advanced detonator systems that improve safety, reliability, and efficiency, thereby attracting additional investments. Furthermore, the increasing demand for precise blasting techniques in infrastructure initiatives is boosting the use of electronic detonators, recognized for their accuracy and lower chances of misfires. The enforcement of strict safety and environmental regulations also compels the implementation of innovative detonator technologies, further stimulating market growth. Additionally, the urbanization and infrastructure projects in developing regions are significantly increasing the need for explosives. Enhanced military budgets and progress in defense technologies are shaping market dynamics, as specialized detonators are often necessary for military purposes. Moreover, the rising emphasis on renewable energy initiatives, including geothermal and biomass projects, is generating fresh avenues for detonator usage. Collectively, these elements are fostering a strong upward trend for the Detonator Market.

Restraining Factors:

The Detonator Market faces significant challenges due to strict regulatory standards and safety issues associated with the management and utilization of explosive substances.

The detonator industry is confronted with various challenges that could impede its progress. One significant issue is the regulatory landscape, where stringent safety and environmental protocols can complicate production workflows and elevate compliance expenses for manufacturers. Moreover, disparities in regulations across different regions can pose obstacles for businesses aiming to penetrate new markets. Fluctuating prices of raw materials further complicate matters, affecting production expenditures and profit margins, which may lead to unpredictable financial performance.

The growing emphasis on sustainability and environmentally friendly approaches presents additional hurdles for conventional detonator technologies, driving a shift in research and development efforts. The emergence of alternative technologies, particularly electric detonation systems, could further reduce the reliance on traditional detonators. To add to the complexity, geopolitical tensions and variations in defense budgets can induce market volatility, influencing both investment patterns and innovation trajectories.

Notwithstanding these obstacles, the detonator market exhibits resilience, propelled by technological advancements and expanding applications across various domains, including mining and construction. Companies that navigate these challenges through innovation and a commitment to sustainable practices are well-positioned to seize new opportunities, ensuring ongoing growth and progress within the sector.

Key Segments of the Detonator Market

By Type

• Non-Electric

• Electronic

• Electric

By Product

• Industrial Electric Detonators

• Shock Tube Detonators

• Others

By Assembly Type

• Wired Detonator

• Wireless Detonator

By Application

• Coal Mines

• Metal Mines

• Non-metal Mines

• Railway/Road

• Hydraulic and Hydropower

• Others

By Sales Channel

• Direct Channel

• Distribution Channel

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America