Market Analysis and Insights

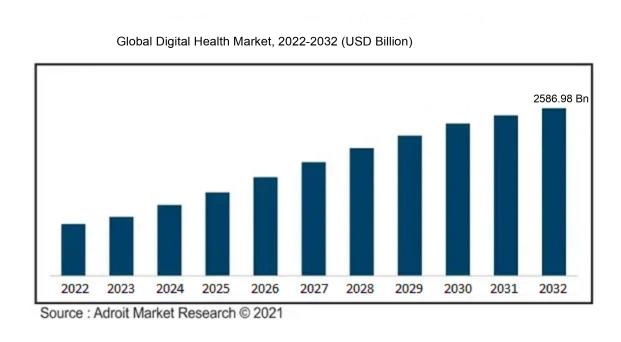

From 2022 to 2032, the digital health industry, which is anticipated to be valued USD 225.25 billion in 2022, is anticipated to rise at a CAGR of 27.10% from 2022 to 2032, reaching USD 2586.98 billion by 2032.

The use of digital health technology has been facilitated by the implementation of supporting policies in several nations. Healthcare providers have been pushed to incorporate digital solutions into their practices as a result of regulatory reforms, including enhanced payment rules for telemedicine and remote care.

Digital Health Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 2586.98 billion |

| Growth Rate | CAGR of 27.10% during 2022-2032 |

| Segment Covered | by Product & Service,Component ,End User ,by Region |

| Regions Covered | North America, Europe, Asia Pacific, South America Middle East and Africa |

| Key Players Profiled | Cerner Corporation, Allscripts Healthcare Solution, Inc., Cisco Systems, Koninklijke Philips N.V., eCLINICALWORKS, General Electric company, Honeywell International Inc., Siemans Healthcare AG, Mckesson Corporation, and Qualcomm Technologies, Inc. are major players in the global digital health market. |

Market Definition

Digital health is the application of information and communication technology (ICT), digital technologies, and electronic data to improve patient care, advance healthcare, and advance health and well-being.

It includes a wide range of applications, including wearables, health data analytics, electronic health records (EHRs), remote patient monitoring (RPM), telemedicine, mobile health (mHealth) apps, and other cutting-edge digital technologies. The objective of digital health is to use technology to improve patient experiences and health outcomes by making healthcare more convenient, effective, and personalized. In order to give treatment remotely, track patients' health status in real-time, make data-driven choices, and include patients in their own health management, numerous components of the healthcare ecosystem must be integrated with digital tools and data.

Digital health technologies have the capacity to change the way healthcare is provided, increase medical research, enhance medical diagnosis and treatment, give people more control over their health, and promote public health initiatives. Digital health also raises issues with big data security, interoperability, regulatory compliance, and ensuring that all populations have equal access to technology.

Key Market Segmentation

Insights on Product and Service

The e-Health Segment Valued for the Highest ShareThe eHealth segment dominated the market in 2021 and is likely to do so again throughout the projected period as a result of the growth in the prevalence of chronic diseases, the surge in demand for telehealth & telemedicine, and the rise in internet users. However, it is predicted that the mHealth segment would see considerable market growth over the course of the projection period due to increased demand for remote monitoring services, an increase in the incidence of hypertension, and a rise in smartphone usage.

Insights on Component

The Software Segment Valued for the Highest Share Because of developments in healthcare information technology, a surge in demand for reducing healthcare costs, and an increase in demand for organized data and workflow in the healthcare industry, the software segment dominated the market in terms of components in 2021 and is anticipated to maintain this trend over the forecast period. However, the hardware segment is anticipated to experience significant development over the course of the projected period due to an increase in expenditures in digital infrastructure and a rise in demand for software installation and upgrades.

Insights on Region

The North American Region Accounted for the Highest Share North America dominated the global digital health market in 2021 and is expected to do so again during the forecast period as a result of the rise in the prevalence of chronic diseases, the existence of significant players, the adoption of smartphone users, and advancements in healthcare information technology in the region. A higher prevalence of chronic illnesses, a growing senior population, a growth in the need for remote monitoring services, and an increase in internet users are predicted to cause Asia-Pacific to see the highest CAGR of 28.5% over the forecast period.

Key Company Profiles

Cerner Corporation, Allscripts Healthcare Solution, Inc., Cisco Systems, Koninklijke Philips N.V., eCLINICALWORKS, General Electric company, Honeywell International Inc., Siemans Healthcare AG, Mckesson Corporation, and Qualcomm Technologies, Inc. are major players in the global digital health market.

COVID-19 Impact and Market Status

The demand for telemedicine increased dramatically during the pandemic since it allowed people to consult with medical professionals remotely, lowering the danger of virus infection at healthcare institutions.

The use and uptake of telemedicine platforms and services increased dramatically, and many healthcare organizations made investments in telehealth infrastructure to keep up with the rising demand.

Remote patient monitoring systems gained popularity as a result of the necessity to treat chronic illnesses without in-person visits and monitor the health of COVID-19 patients online. RPM technologies, such as wearable medical equipment, and IoT-enabled medical equipment, let medical professionals remotely monitor patients' vital signs and health information.

Health and wellness applications that provided remote healthcare services, mental health support, fitness monitoring, and COVID-19 symptom tracking saw a spike in demand as a result of the epidemic. For those trying to monitor their health amid lockdowns and social seclusion measures, these applications become indispensable tools.

The epidemic caused delays in routine clinical trial procedures. As a result, there was a rapid transition towards virtual clinical trials, which used digital health technology to conduct research without having to physically visit the sites and gather data from trial participants remotely.

Latest Trends

1. Various digital health apps have progressively included AI and machine learning. These innovations improved patient outcomes and decreased medical mistakes by assisting in medication development, personalized treatment strategies, and predictive analytics.

2. Medical training, patient education, pain management, and even surgical planning have all benefited from the use of VR and AR technology. They provided engaging and immersive experiences that enhanced learning and patient involvement.

3. Software-based medical therapies, commonly referred to as digital therapeutics, have gained popularity. Specific medical diseases, such as mental health disorders, diabetes management, and smoking cessation, were addressed with these methods either in conjunction with conventional therapies or on their own.

4. Blockchain technology has the potential to improve patient privacy, interoperability, and the security of health data. It made it possible to store and exchange medical records in a secure, tamper-proof manner, enhancing authorized parties access to the data while protecting patient privacy.

5. The ecosystem of digital health benefited greatly from the Internet of Things (IoT). Smart wearables, home health monitoring systems, and connected medical gadgets made it possible to continuously collect data for more individualized and proactive healthcare.

6. The introduction of 5G networks enabled quicker and more dependable data transfer, which was helpful for data-intensive applications like medical imaging, remote operations, and real-time telemedicine consultations.

Significant Growth Factors

As a result of ongoing developments in digital technologies like AI, IoT, cloud computing, and data analytics, patient care, and outcomes have improved thanks to increasingly complex and effective digital health solutions.

Healthcare payers and providers are looking for creative and affordable solutions as a result of the growing cost of healthcare. With the ability to cut administrative costs, improve workflows, and deliver remote treatment, digital health technology has opened up new options.

The demand for healthcare services has increased as a result of the aging global population. Telemedicine and remote monitoring are two examples of digital health technologies that have the potential to better serve the demands of the senior population in terms of healthcare.

The use of health and wellness applications, wearable technology, and other digital health tools has increased as a result of rising smartphone usage and increased consumer awareness of digital health solutions.

Digital health technologies were more widely used as a result of the pandemic as individuals and healthcare professionals looked for alternatives to in-person care. During the epidemic, telemedicine, remote monitoring, and virtual health technologies expanded quickly.

Restraining Factors

The security and privacy of patient data present problems for the digital health business. Strong cybersecurity measures are needed for the gathering, storing, and sharing of sensitive health information in order to guard against data breaches and unauthorized access.

The healthcare sector is highly regulated, and regionally specific regulatory restrictions may apply to digital health solutions. A hurdle to entering and growing in a market might be navigating complicated and changing regulatory regimes.

The smooth transmission of information between healthcare providers can be hampered and the continuity of care jeopardized by the disparate digital health systems' inability to communicate with one another and use standardized data formats.

Digital health solutions may not be widely adopted in some locations due to restricted access to technology and poor internet connectivity, particularly in low-income communities and developing nations.

Recent Developments in the Global Digital Health Market: A Snapshot

• Converge, American Well's cutting-edge, next-generation telehealth platform, was introduced in April 2021. The most recent platform tackles the growing need for medical help while enhancing stakeholder connectedness in the healthcare industry.

Key Segments of Digital Health Market

by Product & Service

• mHealth

• eHealth

Component Overview

• Software

• Hardware

• Services

End User Overview

• Healthcare Providers

• Payers

• Healthcare Consumers

• Others

by Industry Vertical Overview

• Oil and Gas

• Food and Beverages

• Chemicals

• Pharmaceuticals,

• Metal and Mining,

• Automotive,

• Aerospace

• Others

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America