Digital Payment Market Analysis and Insights:

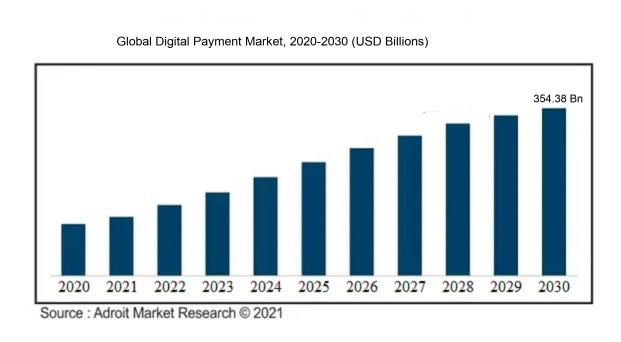

The global digital payment industry is forecast to develop at a compound annual growth rate (CAGR) of 20.79% from 2024 to 2030, reaching an estimated USD 354.38 billion in 2030 from its 2023 valuation of USD 90.48 billion.

There are several important reasons behind the digital payment industry's explosive growth. Firstly, the widespread availability of smartphones and internet connectivity has played a crucial role in the increased uptake of digital payment solutions, enabling users to conduct transactions with ease and flexibility. Secondly, the rising preference for cashless transactions, driven by factors such as convenience, security, and speedier processing, has reshaped consumer habits towards digital payment methods. The need for digital payment services has been further boosted by the growth of e-commerce platforms and the increasing acceptance of online buying. Additionally, government efforts to promote a cashless economy, coupled with the introduction of innovative payment technologies like contactless payments, mobile wallets, and cryptocurrencies, have bolstered the expansion of the digital payment sector. Lastly, the ongoing impact of the COVID-19 pandemic has expedited the adoption of digital payment options as both consumers and businesses prioritize contactless transactions to ensure safety and efficiency. These pivotal factors collectively contribute to the continual growth and diversification of the digital payment landscape.

Digital Payment Market Definition

Digital payment involves the electronic movement of money and conducting transactions using diverse digital channels, thus obviating the necessity for physical currency exchanges. It includes avenues like mobile wallets, internet banking, QR codes, and digital currencies.

The significance of digital payment in contemporary society cannot be overstated, owing to its manifold benefits. Firstly, it ensures convenience and expediency by enabling instantaneous transactions, negating the necessity for physical cash and diminishing wait times. Secondly, digital payment fortifies financial security by mitigating the risks of theft and misplacement associated with tangible currency. Furthermore, it enhances transparency and accountability via digital documentation, streamlining financial monitoring and oversight. In addition, it fosters financial inclusivity by granting access to financial services for individuals without banking access, thereby narrowing economic disparity. Lastly, digital payment serves as a catalyst for economic advancement by facilitating e-commerce and empowering enterprises to venture into global markets. Ultimately, the significance of digital payment emanates from its transformative capabilities in simplifying transactions, fortifying security, advancing financial inclusivity, and propelling economic progress.

Digital Payment Market Segmental Analysis:

Insights On Solution

Payment Gateway

Payment gateways are anticipated to be the industry leader in the global digital payment market. Between an online retailer and the bank handling the payment, a payment gateway serves as a safe middleman. In the digital payment ecosystem, a payment gateway plays a critical role in authorizing transactions, encrypting sensitive data, and ensuring a seamless payment experience for customers. With the increasing adoption of e-commerce and the proliferation of mobile payment solutions, the demand for secure and reliable payment gateways is on the rise. The convenience, efficiency, and enhanced security offered by payment gateways make them a crucial component of the digital payment infrastructure, which is why they are expected to dominate the market.

Payment Processing

Payment processing is another significant player within the Solution category. It involves the handling and verification of payment transactions, including capturing the customer's payment information, sending it to the appropriate issuing bank for authorization, and settling the transaction. Payment processors are responsible for ensuring secure and efficient payment processing across different channels, including online, in-store, and mobile. While payment processing is an essential part of the digital payment ecosystem, it is likely to have a more supporting role rather than dominating the market. This is because payment processing relies on other parts, such as payment gateways, to facilitate the actual transaction.

Payment Security & Fraud Management

Payment security and fraud management are critical sectors in the Global Digital Payment market. As the number of digital transactions has increased, so has the potential of fraud and security breaches. The goals of fraud management and payment security systems are to identify fraudulent activity, stop illegal access, and safeguard private client information. These systems include machine learning algorithms, encryption strategies, and sophisticated authentication procedures to detect and reduce any dangers. While payment security and fraud management are crucial components of the digital payment ecosystem, they are more focused on risk mitigation rather than dominating the market independently.

Transaction Risk Management

Transaction risk management is another sector within the Solution category. It involves the assessment and management of risks associated with payment transactions. Transaction risk management solutions help identify and prevent potential fraud, chargebacks, and other financial risks. These solutions typically include fraud detection tools, real-time monitoring, and risk assessment algorithms. While transaction risk management is an important aspect of ensuring secure digital payments, it is likely to have a supporting role rather than dominating the market. This part works in conjunction with other parts, such as payment processing and security & fraud management, to provide a comprehensive risk management framework.

Others

The Others category includes various parts within the Solution category that do not fall into the aforementioned categories. These might include emerging solutions or niche services that are not as widely adopted or recognized as the dominating parts. It is difficult to determine the specific parts included in the "Others" category, as it may vary depending on the market dynamics and evolving industry trends. However, it is unlikely that any of the parts within the "Others" category would individually dominate the Global Digital Payment Market.

Insights On Deployment

Cloud

The Cloud deployment is expected to dominate the Global Digital Payment Market. Cloud-based digital payment solutions offer several advantages over traditional on-premise solutions, such as scalability, cost-effectiveness, and ease of integration. With the increasing demand for flexibility and convenience in payment processes, businesses are adopting cloud-based digital payment services to simplify transactions and streamline operations. Cloud deployment is a great option for both small and large businesses since it allows for secure payment processing and real-time data access. The convenience, scalability, and cost-effectiveness of cloud-based solutions make it the dominating part in the Global Digital Payment Market.

On-premise

As compared to the dominating component Cloud, the deployment On-premise is expected to have a limited market share in the Global Digital Payment Market. While there are still businesses that prefer on-premise digital payment solutions due to security concerns or regulatory requirements, the adoption of cloud-based solutions has been on the rise. On-premise solutions may not offer the flexibility and scalability that cloud-based solutions could, in addition to necessitating significant infrastructure investments and continuous maintenance costs. As a result, the market share of the on-premise part is expected to be relatively smaller in comparison to the cloud part in the Global Digital Payment Market.

Insights On End-use

Retail & E-commerce

With the increasing popularity of online shopping and the shift towards digital transactions, the Retail & E-commerce deployment is expected to dominate the Global Digital Payment Market. The convenience and ease of digital payments have made it the preferred choice for consumers when purchasing products or services online. The adoption of digital payments in the retail industry has also been hastened by the expansion of e-commerce platforms and the incorporation of digital payment systems within these platforms. As a result, the Retail & E-commerce part is set to lead the Global Digital Payment Market.

BFSI

The Global Digital Payment Market is anticipated to be significantly influenced by the BFSI (Banking, Financial Services, and Insurance) end-use. As financial institutions continuously strive to modernize their services and provide seamless online banking experiences, the adoption of digital payment solutions becomes crucial. With the increasing number of individuals using online banking and mobile applications to manage their finances, digital payments are becoming an integral part of the BFSI sector. Therefore, the BFSI part is expected to be a dominant player in the Global Digital Payment Market.

Healthcare

In the Healthcare end-use, while there is potential for the adoption of digital payment solutions, it is not expected to be the dominating part in the Global Digital Payment Market. Although there is a rise in telehealth services and online consultations, the majority of healthcare payments still occur through traditional methods such as insurance claims and direct payments. Additionally, the sensitive nature of healthcare data and the need for secure transactions pose challenges for the widespread adoption of digital payments in the healthcare sector. Hence, the Healthcare part is not projected to dominate the Global Digital Payment Market.

IT & Telecom

The IT & Telecom end-use is expected to contribute significantly to the Global Digital Payment Market. With the growth of the digital economy and the increasing number of companies providing online services, digital payment solutions are essential for this part. The IT & Telecom industry relies heavily on digital transactions for subscriptions, software purchases, and online services. Moreover, the integration of digital payment gateways in mobile applications and telecommunications platforms further supports the dominant role of the IT & Telecom part in the Global Digital Payment Market.

Media & Entertainment

While the Media & Entertainment end-use has the potential to utilize digital payment systems, it is not anticipated to dominate the Global Digital Payment Market. Although there has been an increase in online content streaming and digital subscriptions, the revenue generation from digital payments in this part is not as significant as in other industries. Traditional payment methods, such as advertising revenue and sponsorships, continue to be prominent in the Media & Entertainment sector. Therefore, the Media & Entertainment part is not expected to be the leading player in the Global Digital Payment Market.

Transportation

The Transportation end-use is also unlikely to dominate the Global Digital Payment Market. While there has been a rise in digital payment options for transportation services, such as ride-hailing and ticketing systems, cash payments and traditional ticketing methods still prevail in many regions. Moreover, the adoption of digital payment systems in public transportation is relatively slower due to infrastructure limitations and regulatory frameworks. Although the demand for digital payment solutions in the transportation sector is increasing, it is not projected to be the dominating part in the Global Digital Payment Market.

Others

Several industries not specifically included in the categories given are included in the Others category. As a result, identifying a particular dominating component within this group is difficult. Depending on these industries' particular needs and traits, the importance of digital payments may differ. Without further information on the specific industries encompassed within the Others category, it is not feasible to identify a dominating player in the Global Digital Payment Market.

Insights On Enterprise size

Small & Medium Enterprises

The Small & Medium Enterprises (SMEs) size is expected to dominate the Global Digital Payment Market. SMEs are a significant driver of economic growth and represent a vast number of businesses worldwide. With the increasing digitization of financial transactions and the adoption of digital payment solutions, SMEs are actively embracing these technologies to streamline their payment processes and reduce costs. The affordability and accessibility of digital payment solutions make them an ideal choice for SMEs, enabling them to expand their customer base, improve operational efficiency, and enhance customer experience. Therefore, it is anticipated that SMEs will dominate the Global Digital Payment Market.

Large Enterprises

Large Enterprises, although not expected to dominate the Global Digital Payment Market, still play a crucial role in its growth and development. These businesses have greater financial resources and are often early adopters of innovative technologies, including digital payment solutions. Large Enterprises typically have complex payment processes and operate on a global scale, which can benefit from the implementation of digital payment systems to streamline operations and improve transparency. However, due to their distinct characteristics, such as legacy systems, regulatory requirements, and established banking relationships, the adoption of digital payment solutions in large enterprises may present certain challenges and take longer to fully integrate.

Insights On Mode of Payment

Digital Wallets

Digital Wallets are expected to dominate the Global Digital Payment Market. This part has witnessed significant growth in recent years due to its convenience, security, and ease of use. Digital wallets allow users to make quick and seamless transactions using their mobile phones, eliminating the need to carry physical cash or cards. With the increasing penetration of smartphones and internet connectivity, more and more consumers are opting for digital wallets as their preferred mode of payment. Additionally, the integration of digital wallets with various services such as e-commerce platforms and ride-hailing apps has further boosted their popularity. As a result, digital wallets are anticipated to dominate the Global Digital Payment Market in the coming years.

Bank Cards

Bank cards, including both debit and credit cards, continue to be a widely used mode of payment around the world. Although digital wallets have gained prominence, bank cards still hold a significant market share. Bank cards offer convenience and acceptance at a wide range of merchants globally. They are widely accepted and familiar to consumers, making them a popular choice for in-store purchases. Moreover, advancements in technology have led to the emergence of contactless payment options, further enhancing the ease and speed of using bank cards. While digital wallets are growing rapidly, bank cards are expected to maintain a strong position in the Global Digital Payment Market.

Net Banking

Net banking, also known as online banking or internet banking, is another significant sector of the Global Digital Payment Market. It allows consumers to conduct financial transactions directly through online banking platforms provided by their respective banks. Net banking offers convenience, security, and flexibility to users, enabling them to access and manage their accounts from anywhere with an internet connection. This part is particularly popular for online shopping and bill payments. However, compared to digital wallets and bank cards, net banking may have certain limitations in terms of user experience and wider acceptance, which may prevent it from dominating the Global Digital Payment Market.

Point of Sales

Point of Sales (POS) systems are widely used in physical retail stores and restaurants for accepting card payments. While POS systems enable the acceptance of various payment methods, including bank cards and digital wallets, they themselves do not dominate the Global Digital Payment Market. POS systems play a crucial role in facilitating transactions, but they are not the primary mode of payment chosen by consumers. Instead, the dominance lies with the parts such as digital wallets and bank cards, which serve as the payment source for the transactions processed through POS systems.

Digital Currencies

Digital currencies, such as cryptocurrencies (e.g., Bitcoin) and stablecoins, have gained attention in recent years. However, they do not currently dominate the Global Digital Payment Market. Digital currencies are known for their decentralized and secure nature, making them an attractive option for certain niche use cases. Nevertheless, their adoption has been limited due to factors like complexity, price volatility, regulatory uncertainties, and a lack of widespread acceptance among merchants. While digital currencies have the potential for future growth and disruption in the digital payment landscape, they are not expected to dominate the market at present.

Others

The Others category includes various alternative modes of payment that do not fall under the other parts mentioned (bank cards, digital currencies, digital wallets, net banking, and point of sales). These alternative modes could include methods like prepaid cards, mobile payments, or even emerging technologies like biometric payments or voice-enabled payments. Although some of these alternative modes may have their niche markets, they do not have the dominant market share to dominate the Global Digital Payment Market as a whole. Their usage and acceptance may vary depending on specific regions and target markets.

Global Digital Payment Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Digital Payment market. With the largest population in the world and a rapidly growing middle class, the region has a tremendous potential for digital payment adoption. Countries like China and India have been leading the way in digital payments, with the rise of mobile payment services such as Alipay and WeChat Pay in China, and the government-supported initiatives like Unified Payments Interface (UPI) in India. Additionally, advancements in technology and infrastructure, such as widespread mobile internet access and smartphone penetration, further fuel the growth of digital payments in the Asia Pacific region. As a result, it is projected to be the dominant market for digital payments in the foreseeable future.

North America

In North America, digital payment adoption is also robust. With a highly developed and technologically advanced financial infrastructure, the region has seen a significant shift towards digital payments in recent years. The popularity of mobile payment services like Apple Pay, Google Pay, and Venmo has been on the rise, providing consumers with convenient and secure ways to make payments. Furthermore, the increasing adoption of contactless payment technologies and the growing e-commerce industry contribute to the dominance of digital payments in North America.

Europe

In Europe, digital payment solutions have gained widespread acceptance and usage. The region is characterized by a strong banking system, technological advancements, and a high level of digital connectivity. This has led to the adoption of various digital payment methods, including mobile payments, contactless cards, and online banking transfers. Additionally, the regulatory framework, such as the Revised Payment Services Directive (PSD2) in the European Union, has further facilitated the growth of digital payments. Consequently, Europe remains a significant player in the global digital payment market.

Latin America

Latin America is experiencing a significant growth in digital payments, driven by factors such as increasing internet penetration, smartphone adoption, and the rise of e-commerce. Countries like Brazil, Mexico, and Argentina are witnessing an upsurge in mobile payment usage, with services like Mercado Pago, PagSeguro, and Mercado Libre gaining traction. Additionally, innovative fintech companies are playing a crucial role in promoting digital payments in the region. While Latin America may not dominate the global digital payment market, its steady growth and potential make it an important player in the industry.

Middle East & Africa

The Middle East & Africa region is witnessing a steady growth in digital payments. Factors such as increasing smartphone penetration, rising e-commerce activity, and government initiatives to promote cashless transactions are driving the adoption of digital payment solutions. Countries like the United Arab Emirates, South Africa, and Kenya have seen significant advancements in mobile payment technologies, with services like M-Pesa and Paytabs gaining popularity. However, while the region shows promise in terms of digital payment adoption, it is not expected to dominate the global digital payment market as compared to the aforementioned regions.

Global Digital Payment Market Competitive Landscape:

The primary contributors in the worldwide digital payment sector are entrusted with the task of creating and delivering secure and user-friendly channels for conducting online monetary transactions. Moreover, these stakeholders play a crucial role in advancing innovative digital payment systems on a global scale.

Prominent companies in the digital payment industry include PayPal Holdings Inc., Visa Inc., Mastercard Incorporated, American Express Company, Alipay.com Co. Ltd., Apple Inc., Samsung Electronics Co. Ltd., Google LLC (Google Pay), Square Inc., Paytm Mobile Solutions Pvt Ltd., Amazon.com Inc., Tencent Holdings Limited (WeChat Pay), Stripe Inc., Ant Group Co. Ltd., Fiserv Inc., Worldpay from FIS, JP Morgan Chase & Co., Bank of America Corporation, and Citigroup Inc., among others. These industry leaders play a significant role in advancing digital payment technologies and providing diverse payment solutions and platforms to ensure secure and seamless online transactions.

Global Digital Payment Market COVID-19 Impact and Market Status:

The global acceptance of digital payment systems has experienced rapid advancement due to the Covid-19 pandemic, leading to increased expansion and creativity within the industry.

The global outbreak of COVID-19 has brought about significant changes in the digital payment sector. The implementation of lockdowns and social distancing measures has propelled a swift transition towards digital transactions, as individuals increasingly opt for non-physical interactions and cashless payments. Consequently, there has been a notable uptick in the adoption of digital payment platforms and services, including mobile payment solutions, digital wallets, and contactless payment methods. This surge is driven by the desire for convenient, secure, and hygienic payment options amid the current circumstances. Furthermore, the closure of traditional brick-and-mortar establishments has necessitated businesses to pivot swiftly towards online transactions, further boosting the demand for digital payment solutions. Despite these advancements, the economic repercussions of the pandemic have been substantial, resulting in job losses and diminished purchasing power. This has instigated a more cautious approach towards spending, influencing consumer behavior regarding payments. Consequently, the digital payment landscape has witnessed a disparate impact, with certain s experiencing growth while others encounter obstacles. In essence, the COVID-19 crisis has expedited the transition towards digital payments, generating fresh prospects within the market. Nonetheless, it has underscored the necessity for resilient and inclusive solutions to navigate the economic uncertainties stemming from the current situation.

Recent Trends & Innovations in the Digital Payment Market:

- On January 13, 2021, Visa announced the acquisition of Plaid, a financial technology company that provides the infrastructure for digital payments, for $5.3 billion.

- On March 8, 2021, Mastercard announced a strategic partnership with Paytm, an Indian e-commerce payment system, to enable contactless payments for customers in India.

- On April 19, 2021, PayPal announced the launch of "Checkout with Crypto" feature, allowing U.S. customers to use their cryptocurrencies for online payments at millions of merchants.

- On May 17, 2021, Square, Inc., a financial services and mobile payment company, announced the acquisition of Afterpay, an Australian buy-now-pay-later company, for $29 billion.

- On June 10, 2021, Google Pay integrated with Western Union and Wise to allow users in the United States to send money internationally.

- On July 15, 2021, Apple Pay announced the introduction of the ability to buy Bitcoin and other cryptocurrencies within the Apple Wallet app.

- On August 23, 2021, Samsung Pay partnered with Curve, a fintech company, to offer Samsung Pay users in the United Kingdom the ability to manage multiple debit and credit cards from a single app.

- On September 29, 2021, Amazon Pay unveiled its "Amazon Pay Later" feature in India, offering customers the option to make purchases and pay later in installments.

- On October 18, 2021, Alipay, a digital payment platform run by Ant Group, launched a blockchain-powered cross-border remittance service between Pakistan and Malaysia.

- On November 11, 2021, JPMorgan Chase announced the launch of QuickAccept, an all-in-one card reader allowing businesses to accept digital payments through a mobile app.

Digital Payment Market Growth Factors:

The expansion drivers of the Digital Payment Market encompass ened levels of smartphone ubiquity, growing acceptance of electronic commerce, and the demand for convenient and secure payment solutions.

The digital payment sector has undergone substantial expansion in recent times, owing to several contributing factors. Primarily, the proliferation of smartphone users and internet accessibility on a global scale has encouraged the widespread adoption of digital payment methods. The ease and availability provided by smartphones have led consumers to increasingly utilize digital payment platforms for a variety of transactions, ranging from online purchases to utility bill settlements and peer-to-peer transfers. Furthermore, the burgeoning popularity of e-commerce has been instrumental in propelling the digital payment market forward. As consumer preferences shift towards online shopping, businesses have adjusted by incorporating digital payment solutions to ensure a seamless and secure payment process. Additionally, governmental efforts to promote cashless transactions, along with initiatives like demonetization in various countries, have created a conducive environment for the expansion of digital payments. The user-friendly interface, efficiency, and security features offered by digital payment platforms have significantly contributed to the market's growth. Furthermore, the emergence of cutting-edge technologies such as Near Field Communication (NFC), QR codes, and mobile wallets has further accelerated the adoption of digital payment services. These innovations deliver a swift and hassle-free payment experience, attracting a larger user base towards digital payment solutions. In essence, the surge in smartphone usage, the growing preference for online shopping, government-led campaigns, and advancements in payment technology collectively serve as the driving forces behind the remarkable progression of the digital payment landscape.

Digital Payment Market Restraining Factors:

Security challenges and the absence of adequate digital infrastructure in specific areas serve as impediments to the expansion of the digital payment sector.

The digital payment sector has experienced notable advancement in recent times, yet faces various impediments that thwart its complete growth potential. Firstly, security apprehensions present a prominent hurdle to the widespread acceptance of digital payments. Concerns related to unauthorized access, data breaches, and identity theft instill reluctance in many individuals towards trusting digital payment platforms. Secondly, the presence of limited internet accessibility in some regions inhibits the progress of digital payments. Numerous developing nations encounter obstacles in terms of internet reach and connectivity, which restricts the uptake of digital payment services. Thirdly, the scarcity of digital proficiency among older demographics acts as a barrier to adoption. The absence of a comprehensive understanding of digital payment system functionality leads individuals to prefer conventional payment methods. Additionally, certain individuals retain a preference for the physicality and concrete nature of cash, making it challenging for digital payment solutions to wholly supplant traditional avenues. Nevertheless, despite these challenges, the digital payment industry harbors vast growth prospects. With ongoing technological advancements, security protocols are enhancing, and endeavors are underway to enlighten individuals about the advantages and safety of digital payments. Furthermore, the COVID-19 pandemic has propelled the transition towards cashless transactions, further stimulating the acceptance of digital payment solutions. With continual improvements in security measures, expanding internet accessibility, and increasing digital literacy, the digital payment market is poised for extensive expansion in the forthcoming years.

Key Segments of the Digital Payment Market

Solution Overview

• Application Program Interface

• Payment Gateway

• Payment Processing

• Payment Security & Fraud Management

• Transaction Risk Management

• Others

Deployment Overview

• Cloud

• On-premise

End-Use Overview

• BFSI

• Healthcare

• IT & Telecom

• Media & Entertainment

• Retail & E-commerce

• Transportation

• Others

Enterprise Size Overview

• Large Enterprises

• Small & Medium Enterprises

Mode of Payment Overview

• Bank Cards

• Digital Currencies

• Digital Wallets

• Net Banking

• Point of Sales

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America