Market Analysis and Insights:

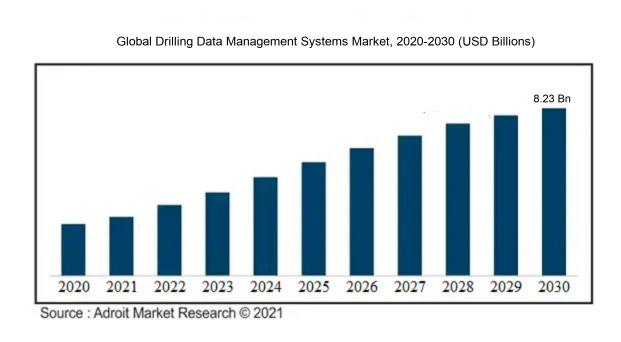

The market for Global Drilling Data Management Systems was estimated to be worth USD 2.79 billion in 2021, and from 2022 to 2030, it is anticipated to grow at a CAGR of 16.21%, with an expected value of USD 8.23 billion in 2030.

The market for drilling data management systems is influenced by several factors. A key driver is the rising demand for efficient and precise data management within the drilling sector. As drilling operations become more intricate and the importance of real-time data analysis grows, companies are turning to advanced data management systems to enhance their operations and decision-making processes. Additionally, the increasing emphasis on cost efficiency and operational effectiveness is fueling market expansion. These systems allow companies to consolidate all drilling-related data, reducing costs related to manual data handling. Furthermore, the escalating necessity for data security and adherence to regulatory standards is pushing market growth. These systems offer robust security features to safeguard sensitive information and assure compliance with regulations. Moreover, advancements in data analytics, cloud computing, and artificial intelligence are also contributing to market development by enabling improved data processing capabilities and predictive analytics. In conclusion, the drilling data management systems market is poised for substantial growth in the foreseeable future, driven by these factors.

Driling Data Management Systems Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 8.23 billion |

| Growth Rate | CAGR of 16.21% during 2022-2030 |

| Segment Covered | By Type, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Schlumberger Limited, Halliburton Energy Services, Baker Hughes, National Oilwell Varco, Weatherford International Ltd., DrillEdge, Petroleum Experts, TDE Group, Kongsberg Gruppen, and Accuview Software Inc. |

Market Definition

Drilling Data Management Systems (DDMS) encompass software solutions crafted to aggregate, assess, and oversee drilling-related information, facilitating proactive surveillance and effective strategizing during drilling endeavors. By facilitating streamlined data structuring, protected data retention, and effective stakeholder communication, these platforms enhance drilling efficiency, reduce risks, and elevate operational outcomes.

Drilling data management systems are essential tools in the oil and gas sector, serving as crucial components for optimizing operations, ensuring precision, and enhancing efficiency. These systems facilitate the efficient collection, categorization, analysis, and storage of crucial drilling data, encompassing details on wellbore stability, drilling efficiency, equipment status, and safety parameters. Through the adoption of such systems, organizations can make well-informed decisions in real-time, streamline drilling procedures, and minimize operational disruptions. The incorporation of these systems also fosters improved teamwork and communication among diverse teams and stakeholders involved in drilling activities. Additionally, drilling data management systems provide valuable insights into performance metrics, allowing companies to pinpoint areas of enhancement and elevate overall productivity levels. Ultimately, leveraging these systems results in cost savings, ened safety standards, and ened prosperity in drilling endeavors.

Key Market Segmentation:

Insights On Key Type

Software

Software is expected to dominate the Global Drilling Data Management Systems market. With the increasing focus on data-driven decision making and efficient management of drilling operations, software solutions that aid in data analysis, visualization, and real-time monitoring are in high demand. These software systems offer advanced features such as predictive analytics, data integration, and reporting capabilities, enabling companies to optimize drilling processes, reduce costs, and improve overall productivity. As drilling activities continue to grow globally, the demand for software solutions that can effectively handle and analyze large volumes of drilling data is expected to surge.

Services

Services play a crucial role in the Global Drilling Data Management Systems market but are not expected to dominate. These services include consulting, implementation, maintenance, and support provided by vendors or third-party service providers. While software drives the market, services complement software offerings by ensuring smooth implementation, training, and ongoing support for the end-users. These services help companies in integrating drilling data management systems into their existing workflows, providing necessary customization, and troubleshooting any issues that may arise. Although services are an essential part of the market, they are expected to be secondary to the dominance of software in terms of market share.

Hardware

Hardware is not anticipated to dominate the Global Drilling Data Management Systems market. While hardware components such as servers, storage devices, and network equipment are vital for supporting the infrastructure necessary for data management systems, they do not hold the same level of influence as software and services. The primary focus of the market is on the software solutions that enable efficient data processing and analysis, while the hardware serves as the underlying support system. As software continues to evolve and improve, the hardware requirements may change, but the overall dominance is expected to remain with software in the Global Drilling Data Management Systems market.

Insights On Key Application

Gas Industry

The Gas Industry application is expected to dominate the Global Drilling Data Management Systems market. This is due to the increasing demand for natural gas and the growth of gas exploration and production activities worldwide. Drilling data management systems play a crucial role in the efficient and safe extraction of gas reserves, ensuring accurate data collection, analysis, and decision-making. Additionally, the adoption of digital technologies and automation in the gas industry has led to the need for robust data management systems, further driving the dominance of this part.

Oil Industry

In the Global Drilling Data Management Systems market, the Oil Industry application holds significant importance but is not expected to dominate. Despite being a well-established market, the demand for drilling data management systems in the oil industry is relatively saturated, with most companies already having implemented efficient data management systems. However, ongoing advancements in technology and the need for efficient data analysis and integration may drive further adoption in this part.

Others

The Others category includes industries beyond gas and oil, such as geothermal and mining. While these industries have their own drilling activities, they do not hold a dominant position in the Global Drilling Data Management Systems market. The demand for drilling data management systems in these industries is generally lower compared to the gas and oil sectors due to factors such as the scale of operations and the specific requirements of each industry. However, there may still be niche opportunities for drilling data management systems in these other industries.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Drilling Data Management Systems market. This region has a strong presence of major oil and gas companies, technological advancements, and a well-established infrastructure. The drilling activities in countries like Norway, the United Kingdom, and Russia contribute significantly to the market growth. Furthermore, the increasing demand for energy resources and the exploration of unconventional reserves are driving the adoption of drilling data management systems. The European region also emphasizes environmental regulations, which further necessitates the need for efficient data management systems in the drilling industry. Overall, Europe's robust industry landscape and favorable government policies position it as the dominating region in the Global Drilling Data Management Systems market.

North America

North America is one of the key contributors in the Global Drilling Data Management Systems market. The region has a strong presence of shale gas and oil reserves, especially in the United States and Canada. The advent of advanced drilling technologies, such as hydraulic fracturing, has revolutionized the drilling industry in North America. Additionally, the increase in drilling activities in the Gulf of Mexico and the development of offshore drilling projects in the region further contribute to the market growth. The need for effective data management systems to optimize drilling operations and improve decision-making processes is driving the adoption of drilling data management systems in North America.

Asia Pacific

Asia Pacific is experiencing significant growth in the Global Drilling Data Management Systems market. The region is witnessing a surge in drilling activities due to the increasing demand for energy resources, rapid industrialization, and urbanization. Countries like China, India, and Indonesia are the major contributors to the market growth in this region. The exploration of offshore reserves and the development of unconventional resources are driving the adoption of drilling data management systems in Asia Pacific. The region's focus on technological advancements, coupled with government initiatives to promote domestic drilling activities, is expected to propel the market growth in Asia Pacific.

Latin America

Latin America is emerging as a promising market for Drilling Data Management Systems. The region has significant oil and gas reserves, particularly in countries like Brazil, Mexico, and Venezuela. The continuous exploration and production activities in the pre-salt reserves in Brazil and deep-water fields in Mexico are driving the adoption of drilling data management systems in this region. Moreover, the implementation of stringent regulations and safety standards for drilling operations further fuels the demand for efficient data management systems. Latin America's potential for offshore drilling and increasing investments in the oil and gas industry position it as a growing market for drilling data management systems.

Middle East & Africa

Middle East & Africa is witnessing steady growth in the Drilling Data Management Systems market. The region is known for its abundant oil and gas reserves, particularly in countries like Saudi Arabia, Iraq, and the United Arab Emirates. The development of new oil fields and the exploration of unconventional resources in this region drive the demand for efficient data management systems in drilling operations. Additionally, the emphasis on enhancing efficiency, reducing operational costs, and improving decision-making processes in the oil and gas industry further contributes to the adoption of drilling data management systems in the Middle East & Africa. Overall, the region showcases promising growth prospects in the Drilling Data Management Systems market.

Company Profiles:

Prominent stakeholders within the worldwide Drilling Data Management Systems sector play a pivotal role by delivering extensive software solutions that streamline drilling activities and boost productivity. Their primary emphasis lies in the progression of cutting-edge technologies and delivery of immediate analytics for improved decision-making across the oil and gas domain.

Schlumberger Limited, Halliburton Energy Services, Baker Hughes, National Oilwell Varco, Weatherford International Ltd., DrillEdge, Petroleum Experts, TDE Group, Kongsberg Gruppen, and Accuview Software Inc. are prominent companies in the field of drilling data management systems. Specializing in cutting-edge solutions, they cater to the oil and gas industry by enhancing drilling operations, cost-efficiency, and overall productivity. Through their innovative technologies and substantial sector expertise, these key players are instrumental in shaping and executing drilling data management systems. This empowers organizations to make well-informed decisions based on real-time data analysis. By providing holistic solutions and support services, these companies significantly drive the progression and innovation within the drilling data management systems domain.

COVID-19 Impact and Market Status:

The outbreak of the Covid-19 pandemic has significantly impacted the Global Drilling Data Management Systems industry, resulting in disruptions to drilling schedules and impeding investment choices, consequently hindering the pace of market expansion.

The global drilling data management systems market has been significantly affected by the COVID-19 pandemic. The imposition of stringent lockdown measures and travel restrictions on a global scale has resulted in a decrease in drilling activities within the industry. Many drilling projects have been either postponed or cancelled, leading to a reduced demand for drilling data management systems. This downturn in drilling activities has also caused a decline in investments in the oil and gas sector, further impacting the market. Furthermore, the economic instability brought about by the pandemic has compelled companies to prioritize cost-cutting strategies, including reducing expenditures on drilling data management systems. However, despite the immediate challenges, a gradual recovery of the market is anticipated as global economies reopen and the demand for oil and gas increases. The ongoing adoption of digitalization and automation technologies in the drilling sector is expected to fuel the demand for drilling data management systems in the long term, as companies strive to enhance operational efficiencies and optimize processes in a post-pandemic landscape.

Latest Trends and Innovation:

- In January 2020, Halliburton announced the acquisition of Cytobuoy, a Netherlands-based company specializing in real-time water quality monitoring solutions.

- In June 2020, Schlumberger introduced DrillPlan Precise, an advanced well construction planning solution that combines digital technologies and domain expertise to optimize drilling operations.

- In August 2020, Baker Hughes announced a collaboration with Microsoft to accelerate the digital transformation of the oil and gas industry by leveraging artificial intelligence and cloud computing.

- In September 2020, Weatherford International launched ForeSite Edge, an edge computing platform that uses advanced physics-based models to optimize production and reservoir management in real time.

- In November 2020, National Oilwell Varco (NOV) partnered with IBM to develop RigSense, a predictive maintenance solution for offshore drilling rigs that utilizes artificial intelligence and IoT technologies.

- In February 2021, Schlumberger introduced P1X, an advanced drilling motor that delivers superior performance and durability in challenging drilling conditions.

- In March 2021, Halliburton announced the acquisition of Innovatum, a leading provider of wellbore clean-up and displacement products, to enhance its drilling fluid offerings.

- In May 2021, Weatherford International collaborated with Intel to develop a next-generation automated drilling platform powered by artificial intelligence and machine learning algorithms.

- In July 2021, Baker Hughes introduced Nexus, a unified drilling solution that integrates data analytics and real-time monitoring to improve drilling efficiency and decision-making.

- In October 2021, National Oilwell Varco (NOV) acquired DrillingInfo, a leading provider of data analytic solutions for the oil and gas industry, to enhance its drilling data management capabilities.

Significant Growth Factors:

Factors propelling growth in the market for drilling data management systems comprise a ened need for real-time data analysis, escalating exploration and production operations within the oil and gas sector, and an increasing emphasis on streamlined data management and decision-making procedures.

The market for drilling data management systems is poised for substantial growth in the upcoming years, propelled by various key drivers. Firstly, the escalating global demand for energy resources, particularly in the oil and gas sector, is fueling the necessity for more efficient and productive drilling operations. With the continual growth of the world population, the need for energy is on the rise, resulting in an increased requirement for drilling activities to cater to this demand. Secondly, technological advancements have paved the way for the development of advanced drilling data management systems that offer enhanced efficiency, precision, and real-time monitoring capabilities, crucial for optimizing drilling processes. The incorporation of big data analytics in the drilling sector has also led to improved decision-making and operational efficacy, further spurring the adoption of drilling data management systems.

Additionally, stringent regulatory mandates and mounting environmental concerns are playing a significant role in the market's expansion. Governments and environmental groups are placing greater emphasis on minimizing the environmental impact of drilling operations, leading to the enforcement of more rigorous regulations. The integration of drilling data management systems aids in tracking and overseeing drilling activities to ensure compliance with these regulations and to minimize the environmental footprint. Lastly, the increasing trend of digital transformation across various industries is propelling the uptake of drilling data management systems. These systems enable the collection and analysis of vast volumes of data, empowering companies to streamline their operations, boost productivity, and cut down costs. Overall, the synergy of rising energy demand, technological progress, regulatory prerequisites, and digitalization is steering the growth of the drilling data management systems market.

Restraining Factors:

The growth of the drilling data management systems market is hindered by the constrained financial resources and insufficient awareness within small and medium-sized enterprises.

The market for drilling data management systems encounters various obstacles that hinder its progress and advancement. Firstly, the significant initial investment required for the implementation of these systems serves as a deterrent for numerous small and medium-sized drilling enterprises, constraining their capacity to embrace such technologies. Moreover, the intricate and technical nature of these systems necessitates specialized skills and expertise, which might not be easily accessible or affordable for all businesses. Additionally, the absence of standardization in data formats and protocols impedes interoperability and compatibility among different systems, resulting in inefficiencies and challenges in data integration. Concerns surrounding data security and confidentiality also present notable obstacles, given the substantial amounts of sensitive and proprietary information generated by drilling activities. Resistance to change within the industry further complicates the adoption of new technologies, including drilling data management systems. Furthermore, the repercussions of the COVID-19 pandemic on the oil and gas sector have led to diminished investments and operational complexities, further impeding market growth.

Key Segments of the Drilling Data Management Systems Market

Type Overview

• Services

• Software

• Hardware

Application Overview

• Gas Industry

• Oil Industry

• Other

Regional Overview

North America

• United States

• Canada

• Mexico

Europe

• Germany

• France

• United Kingdom

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America