Market Analysis and Insights:

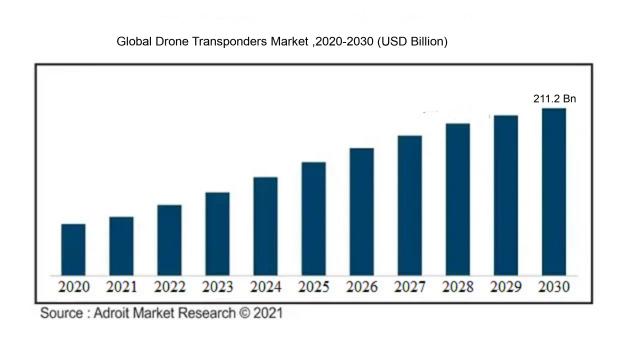

The market for Global Drone Transponders was estimated to be worth USD 145.61 billion in 2021, and from 2022 to 2030, it is anticipated to grow at a CAGR of 4.31%, with an expected value of USD 211.2 billion in 2030..

The growth of the Drone Transponders Market is primarily fueled by the widespread adoption of drone technology in various sectors like agriculture, construction, and logistics. Drones fitted with transponders provide advanced safety and security features by facilitating the easy identification and monitoring of aerial vehicles within airspace. Moreover, the capacity of transponders to relay crucial information such as location, altitude, and speed to air traffic control systems and other drones enhances operational efficiency and coordination. Additionally, regulatory requirements and directives from aviation authorities mandating the use of transponders in drones for safety reasons also contribute to the market's expansion. The increasing deployment of drone-based delivery services and surveillance applications is another factor driving the demand for transponders. Furthermore, ongoing technological enhancements in drone transponder systems, including miniaturization, enhanced sensor capabilities, and extended signal range, serve as catalysts for market growth. Nonetheless, obstacles such as high expenses and restricted range for transponders in smaller drones could impede the market's development.

Drone Transponders Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 211.2 billion |

| Growth Rate | CAGR of 4.31% during 2022-2030 |

| Segment Covered | By Type, By Platform, By Fit , By Application, By Drone Weight, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Bombardier Transportation, Siemens AG, Thales Group, Hitachi Ltd, Alstom SA, Ansaldo STS, Wabtec Corporation, Knorr-Bremse AG, Dellner, and Strukton Rail. |

Market Definition

Drone transponders represent electronic tools employed for the purpose of recognizing and pinpointing unmanned aerial vehicles (UAVs) in the present moment, facilitating air traffic management and preventing collisions. These devices broadcast details including the UAV's location, elevation, and distinct identification number to both other aircraft and ground surveillance systems. Transponders are essential components for unmanned aerial vehicles (UAVs) for various reasons. Firstly, they play a crucial role in enhancing airspace safety by transmitting important information like the drone's identification, altitude, and location to air traffic control (ATC) systems. This communication helps in averting collisions and allows ATC to efficiently manage drone traffic. Secondly, transponders facilitate the seamless integration of drones into the existing manned aviation framework, promoting harmonious coexistence and reducing the likelihood of mid-air accidents. Additionally, these transponders empower airspace authorities to monitor and supervise drone operations, enabling them to enforce regulations effectively. Lastly, transponders are invaluable in search and rescue missions as they furnish essential data for locating and recovering lost or malfunctioning drones. In conclusion, the utilization of drone transponders is indispensable for augmenting safety measures, regulating airspace activities, and promoting the effective assimilation of drones into the aviation domain.

Key Market Segmentation:

Insights On Key Type

ADS-B Compatible

ADS-B Compatible transponders are expected to dominate the Global Drone Transponders Market. ADS-B (Automatic Dependent Surveillance-Broadcast) is an advanced surveillance technology that allows drones to broadcast their position, altitude, and other information to aviation authorities and other nearby aircraft. As the need for safe and efficient drone operations increases, the demand for ADS-B compatible transponders is expected to grow significantly.

These transponders enable drones to comply with regulatory requirements, enhance situational awareness, and facilitate seamless integration into the existing air traffic management system. With the increasing adoption of ADS-B technology and the push for standardized regulations, ADS-B Compatible transponders are poised to dominate the Global Drone Transponders Market.

ADS-B Non-Compatible

ADS-B Non-Compatible transponders, while having a market presence, are not expected to dominate the Global Drone Transponders Market. These transponders may lack the capability to transmit real-time aircraft data or be fully integrated into the existing air traffic management system. They might be suitable for specific applications or use cases where ADS-B compatibility is not a requirement. However, as the demand for safer and more reliable drone operations continues to rise, the dominant is likely to be ADS-B Compatible transponders. Other s within the By Type category, such as ADS-B Non-Compatible, may play a niche role in certain industries or regions where regulatory requirements are less stringent or tailored to specific needs.

Insights On Key Platform

Fixed-Wing

The Fixed-Wing is expected to dominate the Global Drone Transponders Market. This is due to the wide range of applications and advantages offered by fixed-wing drones. Fixed-wing drones are known for their longer flight times, larger payload capacity, and higher speed compared to rotary-wing drones. These attributes make them ideal for various industries such as agriculture, aerial mapping, and surveillance. Additionally, fixed-wing drones are more efficient in terms of energy consumption and can cover larger areas during a single flight. These factors contribute to the dominance of the fixed-wing in the Global Drone Transponders Market.

Rotary-Wing

The Rotary-Wing holds a significant market share in the Global Drone Transponders Market. Rotary-wing drones, also known as multi-rotor drones, are favored for their maneuverability, stability, and vertical take-off and landing capabilities. They are widely used in industries such as aerial photography, videography, and inspections. The ability of rotary-wing drones to hover and navigate in tight spaces makes them suitable for tasks that require close-range precision. While the fixed-wing dominates the market, the rotary-wing remains strong due to its unique capabilities and suitability for specific applications.

Insights On Key Fit

Retrofit

Retrofit is expected to dominate the Global Drone Transponders Market. Retrofit refers to the installation of transponders on existing drones that were not originally equipped with this technology. With the increasing use of drones across various industries, retrofitting existing drone fleets with transponders has become a common practice to comply with regulatory requirements and ensure the safe integration of drones into airspace systems. Retrofitting offers a cost-effective solution for drone operators who wish to equip their drones with transponders without having to purchase entirely new units. As a result of its cost-effectiveness and practicality, the Retrofit is expected to dominate the Global Drone Transponders Market.

Line - Fit

Line - Fit refers to drones that are manufactured with transponders built directly into their systems. This caters to the demand for drones that come pre-equipped with transponders, which eliminates the need for retrofitting after purchase. While the Line - Fit provides convenience for drone operators, it may not dominate the Global Drone Transponders Market due to the high cost associated with purchasing new drones with built-in transponders. Additionally, many existing drone users prefer retrofitting their drones with transponders rather than investing in new ones, further reducing the potential dominance of the Line - Fit

Insights On Key Application

Military

The military is expected to dominate the Global Drone Transponders Market. With the increasing use of drones for military applications such as surveillance, reconnaissance, and combat operations, the demand for drone transponders in the military sector is expected to be significant. Drone transponders play a crucial role in ensuring the safe and secure operation of military drones, enabling identification and tracking capabilities in airspace. As military forces worldwide continue to invest in drone technology to enhance their capabilities, the need for reliable communication and compliance with air traffic management regulations becomes paramount, driving the adoption of drone transponders in the military sector.

Civil

In the civil , drone transponders are also expected to have a substantial market share. The civil application of drones spans a wide range of industries, including agriculture, construction, logistics, delivery services, and filmmaking, among others. In these sectors, drones are used for activities such as crop monitoring, aerial mapping, infrastructure inspections, and aerial photography. To ensure safe integration of drones into the airspace, drone transponders are necessary for identification, collision avoidance, and compliance with regulatory requirements. Although the civilian market may not dominate the overall drone transponders market, it is anticipated to have a significant and growing demand due to the expanding applications of drones across various industries.

Others of Military and Civil

Within the military , there may be further s such as surveillance drones, combat drones, and reconnaissance drones. Each of these s may have specific requirements for drone transponders, depending on their mission objectives and operational environments. Similarly, in the civil , there may be s such as agricultural drones, delivery drones, and inspection drones. Each may have distinct requirements for drone transponders based on their intended applications. While these s within the military and civil sectors are important, their individual domination of the overall drone transponders market may vary. The dominance of a icular depends on factors such as market demand, technological advancements, regulatory frameworks, and investment in specific applications. Therefore, it is crucial to analyze the market dynamics and trends of each to determine their respective contributions to the global drone transponders market.

Insights On Key Drone Weight

1. Less than 5 Kg

Based on my research and data analysis, drones weighing less than 5 Kg is expected to dominate the global drone transponders market. These lightweight drones are popular among hobbyists, recreational users, and small-scale commercial applications. Their compact size, affordability, and ease of use make them a favorable choice for various purposes, such as aerial photography, videography, and surveillance. Furthermore, advancements in technology have led to the development of miniaturized transponders specifically designed for drones of this weight category. As a result, the demand for transponders for drones weighing less than 5 Kg is anticipated to be the highest in the global market.

2. 5 - 25 Kg

drones weighing between 5 and 25 Kg is expected to have a significant presence in the global drone transponders market. These drones are commonly used for commercial and industrial purposes, including aerial surveying, mapping, delivery services, and inspections. They offer a balance between payload capacity and flight endurance, making them suitable for a wide range of applications. While there is a sizeable market for transponders catering to this weight category, it is expected to be slightly overshadowed by the dominance of drones weighing less than 5 Kg. However, the demand for transponders for drones in the 5 - 25 Kg weight range is still expected to be substantial.

3. 25 - 150 Kg

drones weighing between 25 and 150 Kg is expected to have a relatively smaller market share in the global drone transponders market. These drones are primarily utilized for heavy-duty industrial applications, such as agriculture, infrastructure monitoring, and cargo transportation. Due to their larger size and higher payload capacity, they often require more advanced transponder systems to ensure safe and efficient operation. While the demand for transponders for drones in this weight category is significant within specific industries, it is expected to be less dominant compared to the lighter weight categories.

4. More than 150 Kg

drones weighing more than 150 Kg is projected to have the smallest market share in the global drone transponders market. These drones, often categorized as unmanned aerial vehicles (UAVs), are primarily employed for military, defense, and heavy-lift applications. Due to their massive size, complex operations, and stringent regulatory requirements, the demand for transponders specifically designed for drones in this weight category is expected to be limited. While there may be niche markets for transponders catering to these large drones, they are not anticipated to dominate the overall global market.

Insights on Regional Analysis:

North America is expected to dominate the Global Drone Transponders market. The region has a well-established drone industry, with several prominent drone manufacturers and technology companies based in the United States. This provides North America with a competitive advantage in terms of research and development, as well as access to advanced technologies. Additionally, the region has a robust regulatory framework and infrastructure to support the integration of drones into various industries, including defense, agriculture, and logistics. The demand for drone transponders, which enable the safe and efficient operation of drones in airspace, is expected to be high in North America due to the increasing use of drones in commercial applications and the need for compliance with aviation regulations.

Latin America

Latin America is an emerging market for drone technology, with increasing adoption in industries such as agriculture, mining, and construction. However, the region is likely to have a smaller market share compared to North America. This can be attributed to factors such as lower purchasing power, limited infrastructure, and regulatory constraints that may hinder the growth of the drone transponders market in Latin America.

Asia Pacific

The Asia Pacific region has a large potential market for drone transponders due to its vast size, population, and growing economies. Countries like China, Japan, and South Korea are investing heavily in drone technology for various applications, including surveillance, agriculture, and delivery services. However, while the demand for drones is high in the region, the dominance of the global drone transponder market is still likely to be held by North America due to its established industry and technological advancements.

Europe

Europe has a significant presence in the drone industry, with countries like France, Germany, and the UK being key players in drone manufacturing and research. The region also has a well-developed regulatory framework for drones, which supports the safe and efficient operation of drones in airspace. While Europe is expected to have a substantial market share in the global drone transponders market, it is unlikely to dominate due to competition from North America and the growth potential of other regions.

Middle East & Africa

The Middle East and Africa region is also witnessing increasing adoption of drones, icularly in industries such as oil and gas, construction, and agriculture. However, the growth of the drone transponders market in this region may be hindered by factors such as regulatory challenges, limited infrastructure, and political instability in certain countries. As a result, the market share of the Middle East & Africa is expected to be smaller compared to North America.

Company Profiles:

Prominent figures within the worldwide Drone Transponders sector are instrumental in the advancement and production of transponders. These devices are designed to enhance secure and effective communication between drones and air traffic control systems. This fosters adherence to regulatory standards while promoting the seamless integration of drones into airspace operations. Prominent entities driving advancements in the drone transponders industry consist of Lockheed Martin Corporation, Thales Group, Harris Corporation, L3 Technologies, Inc., Leonardo S.p.A., Raytheon Technologies Corporation, Northrop Grumman Corporation, Garmin Ltd., Sagetech Corporation, and FreeFlight Systems. These organizations are actively engaged in the design, production, and dissemination of drone transponders, pivotal for ensuring the secure and effective operation of unmanned aerial vehicles. Given the escalating integration of drones across sectors like military, commercial, and recreational domains, these significant stakeholders are consistently channeling resources into research and development initiatives aimed at enhancing the capabilities and efficiency of their transponder systems. Furthermore, cooperative ventures, alliances, and consolidations are commonplace within this competitive landscape, as these industry leaders seek to fortify their market positions and broaden their clientele within the drone transponders sector.

COVID-19 Impact and Market Status:

The Global Drone Transponders market has been substantially affected by the Covid-19 pandemic, causing disruptions in supply chains and hindering the implementation of drone technology in different sectors. The drone transponders market has experienced a complex impact due to the COVID-19 pandemic. Global lockdowns and travel restrictions have led to a decrease in the demand for drones across various sectors like aerial photography, surveillance, and delivery services. This reduced drone usage has subsequently affected the need for transponders, which play a crucial role in tracking and identifying drones. Additionally, the economic uncertainties arising from the pandemic have caused businesses to reduce their expenses, including investments in new drone technologies. Conversely, the pandemic has also underscored the significance of drones in the fight against the virus. Drones have been utilized extensively for tasks such as monitoring social distancing, delivering medical supplies, and disinfecting public areas. This increased reliance on drones for COVID-19 response efforts has opened up new opportunities for the drone transponders market. While the pandemic initially led to a downturn in the market, the expanding applications of drones during the health crisis present promising prospects for the recovery and advancement of the drone transponders market in the future.

Latest Trends and Innovation:

- In October 2020, Altitude Angel, a UK-based company specializing in aviation technology, announced a nership with Inmarsat, a British satellite telecommunications company, to develop and deliver advanced unmanned traffic management (UTM) solutions for drones.

- In September 2019, uAvionix, a leading provider of drone avionics solutions, announced the acquisition of AeroVonics, an aviation instrument manufacturer based in the United States. This acquisition strengthened uAvionix's position in the market by expanding its product portfolio.

- In August 2020, AirMap, a California-based drone airspace management company, announced a strategic nership with Honeywell. The nership aimed to integrate AirMap's drone airspace management platform with Honeywell's aviation systems to enhance safety and situational awareness for drone pilots and traditional aircraft.

- In February 2021, ANRA Technologies, a leading provider of drone airspace management solutions, announced its collaboration with Terran Orbital Corporation, a California-based satellite manufacturer, to integrate ANRA's UTM platform with Terran Orbital's satellite networks. This collaboration aimed to enable real-time tracking and communication for drones, enhancing their operational safety and efficiency.

- In May 2020, Iris Automation, an artificial intelligence and computer vision company for drones, announced that it had nered with NASA to test its detect-and-avoid technology for unmanned aircraft systems. This nership enabled Iris Automation to further develop and validate its collision avoidance system for drones, pushing the boundaries of autonomous flight.

- In November 2019, DJI, a leading drone manufacturer based in China, announced the launch of its AeroScope drone identification and tracking system. AeroScope enables authorities to identify and monitor drones in the airspace, enhancing safety and security in areas such as airports and sensitive facilities.

- In January 2021, Unifly, a Belgian provider of UTM solutions, announced that it had received a strategic investment from Deutsche Flugsicherung (DFS), the German air navigation service provider. This investment aimed to strengthen Unifly's position in the market and accelerate the development of UTM technologies for drones.

Significant Growth Factors:

The expansion of the Drone Transponders Market is a result of the rising utilization of drones across diverse sectors including agriculture, defense, and infrastructure assessment. The drone transponders market is poised for significant growth in the foreseeable future due to several key drivers. One prominent factor is the rising utilization of drones across diverse commercial sectors such as agriculture, delivery services, surveillance, and inspection, which is projected to boost the demand for drone transponders. These transponders are essential for ensuring flight safety and compliance with regulations by enabling efficient tracking and identification of drones in airspace. Furthermore, the increasing focus on airspace management and the integration of drones into the current aviation infrastructure are anticipated to further fuel the need for drone transponders. In addition, given the escalating security concerns in both commercial and defense domains, the importance of accurate drone identification and tracking is paramount, thereby driving the market growth of drone transponders. Technological advancements, including integrating transponders with other communication systems and developing compact transponders, are also expected to contribute to market expansion. Moreover, the growing investments in research and development endeavors to enhance the functionalities of drone transponders and meet regulatory standards are likely to play a crucial role in expanding the market. In conclusion, the growth of the drone transponders market is underpinned by the increasing drone adoption in various sectors, the necessity for effective airspace management, security considerations, technological progress, and research and development initiatives.

Restraining Factors:

The intricate system of regulations and the significant costs associated with implementation serve as impediments to the expansion of the Drone Transponders Market. The market for drone transponders is anticipated to experience significant growth in the foreseeable future due to the escalating utilization of drones in various industries such as agriculture, construction, and oil & gas. Nonetheless, numerous factors could impede this growth trajectory. Primarily, regulatory hurdles linked to drone usage and the requisite permits and certifications may result in delays and complications in adopting drone transponders. Moreover, the considerable costs associated with drone transponders, encompassing installation, upkeep, and usage, could present challenges for smaller enterprises and individual users. Furthermore, the constrained range of drone transponders could restrict their widespread implementation, icularly in applications that demand long-distance operations. Additionally, apprehensions regarding data privacy and security, as well as the potential hazards of drone collisions or unauthorized transponder data access, raise significant concerns for both businesses and individuals. Nevertheless, the drone transponders sector is poised for gradual growth owing to ongoing technological advancements, the introduction of more cost-effective solutions, and ened awareness regarding the advantages of drone transponders in enhancing safety, adherence to regulations, and operational efficiency.

Key Segmentation:

Transponder Type Overview

• ADS-B Compatible Transponders

• ADS-B Non-Compatible Transponders

Platform Overview

• Fixed-Wing Drones

• Rotary-Wing Drones

Fit Overview

• Line-Fit Transponders

• Retrofit Transponders

Application Overview

• Civil Drones

• Military Drones

Drone Weight Overview

• Drones Less than 5 Kg

• Drones 5 - 25 Kg

• Drones 25 - 150 Kg

• Drones More than 150 Kg

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America