Market Analysis and Insights:

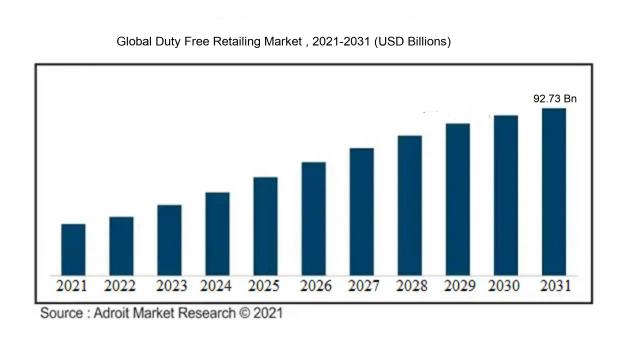

The market for duty-free retailing was estimated to be worth USD 30.17 billion in 2021, and from 2022 to 2031, it is anticipated to grow at a CAGR of 10.49%, with an expected value of USD 92.73 billion in 2031.

The duty-free retail market is influenced by various factors that drive its growth. Firstly, the surge in international travel and tourism industry has a significant impact as more individuals are exploring new destinations and traveling globally, resulting in an increased demand for duty-free goods at airports and other travel centers. Secondly, the rise in disposable income levels among different demographics has played a role in the market's expansion. Increased disposable income enables people to indulge in luxury products and shop for exclusive items offered at duty-free stores. Furthermore, changing consumer preferences and lifestyles are shaping the demand for duty-free products, as consumers are increasingly seeking high-quality items and are willing to purchase premium brands from duty-free outlets. The emergence of e-commerce and online duty-free shopping has also contributed to market growth by providing consumers with convenience and a wider selection of products. Lastly, the continuous development of airport infrastructure and the expansion of duty-free retail spaces in major airports globally have had a positive impact on market growth. These driving factors work together to drive the growth and profitability of the duty-free retailing market.

Duty Free Retailing Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 92.73 billion |

| Growth Rate | CAGR of 10.49% during 2022-2031 |

| Segment Covered | By Product, By Sales Channel, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Dufry AG, Lotte Duty Free, The Shilla Duty Free, DFS Group, JR/Duty Free, Heinemann, King Power International Group, China Duty Free Group, Lagardère Travel Retail, and Gebr. Heinemann. |

Market Definition

Duty-free retailing encompasses the retail of merchandise within specified zones where consumers are not required to pay specific taxes and duties that are usually levied on imported items. These duty-exempt establishments are commonly situated in global airports, border checkpoints, and harbors, providing a diverse assortment of goods including but not limited to alcoholic beverages, tobacco products, beauty products, high-end items, and various other commodities.

Duty-free retailing holds considerable significance for multiple reasons. Firstly, it offers travelers the chance to make purchases at reduced prices since they are not subjected to the usual taxes and duties. This can enhance customer satisfaction and incentivize more global travel. Secondly, it fosters economic development by creating employment opportunities within airports and generating income for both retailers and governmental bodies. Moreover, duty-free stores act as a platform for showcasing local merchandise, thereby promoting tourism and domestic industries. Lastly, duty-free retailing enriches the overall shopping experience of travelers by presenting a diverse range of products and brands in a convenient and easily accessible manner. In conclusion, duty-free retailing plays a vital role in elevating the travel experience, boosting local economies, and delivering added value to consumers.

Key Market Segmentation:

Insights On Key Product

Luxury Goods

Luxury Goods is expected to dominate the Global Duty Free Retailing market. The demand for branded and high-end luxury goods such as watches, jewelry, designer apparel, and accessories has been consistently rising among global consumers. Duty-free shopping provides an opportunity for travelers to indulge in luxury purchases without paying additional taxes, making it an attractive proposition. The luxury goods part is projected to dominate the market due to the increasing disposable income and changing consumer preferences towards luxury and premium products.

Perfume & Cosmetics

Perfume & Cosmetics, although not the dominating player, holds a significant share in the Global Duty Free Retailing market. Travelers, especially from emerging economies, tend to spend a considerable amount on perfumes, cosmetics, and beauty products at duty-free stores. The part benefits from the rising trend of grooming, personal care, and the desire to own luxury beauty brands. However, it faces competition from luxury goods as consumers may have a higher tendency to prioritize luxury goods over cosmetics.

Electronics

Electronics is also a notable component in the Global Duty Free Retailing market, but it may not dominate due to various factors. Technological advancements, new product launches, and the growing popularity of gadgets create a substantial demand among travelers. However, the relatively higher cost of electronics and the availability of competitive prices in the local markets limit the dominance of this part in duty-free retailing.

Wine & Spirits

Wine & Spirits is another component that contributes significantly to the Global Duty Free Retailing market. Travelers often seize the opportunity to purchase alcoholic beverages at duty-free stores due to the cost advantage and a wide range of options available. The rising global demand for premium wines and spirits further strengthens this part's position in the market.

Food, Confectionery & Catering

Food, Confectionery & Catering also holds a reasonable share in the Global Duty Free Retailing market. Travelers often purchase specialty food items, chocolates, and confectioneries as souvenirs or gifts for their loved ones. The unique and exclusive food offerings enhance the shopping experience at duty-free stores. However, compared to other parts, it may have limited dominance due to the perishable nature of some products and the availability of local food options.

Tobacco

Tobacco is a component that has faced challenges due to increasing health awareness and stringent regulations on tobacco products in many countries. Although there is still a demand for duty-free tobacco products, it may not dominate the global market due to the declining trend of tobacco consumption and restrictions on advertising and promotion.

Others

The Others component in the Global Duty Free Retailing market includes various product categories that do not fall under the major parts. This category may include items like books, accessories, souvenirs, and travel essentials. While these products may attract certain customers, they are unlikely to dominate the market due to their niche and diverse nature, as well as the strong competition from the dominating parts.

Insights On Key Sales Channel

Airports

The Airports is expected to dominate the Global Duty Free Retailing Market. Airports have become major hubs for travel, catering to a large and diverse customer base. Duty-free shops in airports offer a wide range of products and brands, attracting both domestic and international travelers. As airports continue to expand and passenger traffic grows, the demand for duty-free retail products is expected to increase. Furthermore, airports often provide a convenient shopping experience with extended operating hours and a wide selection of products, making it a favorable location for duty-free shopping.

Cruise Liners

Cruise Liners form another important sector in the Global Duty Free Retailing Market. With the rising popularity of cruise holidays, these liners present a unique shopping opportunity for travelers. Duty-free shops on cruise liners offer an exclusive and intimate shopping experience, targeting a captive audience during their journey. The limited retail space on cruise ships may restrict the variety of products available but can also create a sense of exclusivity and urgency for shoppers. Although cruise liners may not dominate the market like airports, they play a significant role in catering to the shopping needs of travelers on board.

Railway Stations

Railway Stations also have a notable presence in the Global Duty Free Retailing Market. Many major railway stations are located in bustling city centers and popular tourist destinations, attracting both local commuters and travelers. Duty-free shops in railway stations provide convenience and accessibility to a wide range of customers. Unlike airports or cruise liners, railway stations offer a quick shopping option for passengers while they wait for their train. Although the product offerings may be more limited compared to airports, the high footfall and proximity to busy urban areas make railway stations a significant part in the duty-free retail market.

Border

The Borders component is a distinct and important player in the Global Duty Free Retailing Market. Duty-free shops located at border crossings between countries capitalize on the international travelers passing through. These border stores often focus on offering products that may be subject to higher taxes or duties in neighboring countries. They provide a shopping opportunity for travelers looking to make cost savings or purchase goods not readily available in their home country. While border duty-free shops may be limited in terms of size and variety, they serve a unique purpose and hold significance in the overall duty-free retail market.

Down-Town & Hotel Shop

Down-Town & Hotel Shops are a smaller but still holds significant share in the Global Duty Free Retailing Market. These shops cater to both local residents and tourists in city centers or within hotels. Down-town duty-free shops often offer convenience to shoppers who may not have access to airports or other travel hubs. Hotel shops, on the other hand, target hotel guests looking for convenience and a unique shopping experience. While these parts may not dominate the market like airports or even railway stations, they provide a valuable option for duty-free shopping in urban areas and hospitality establishments.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global duty free retailing market. This region has witnessed significant growth in recent years, driven by the rising disposable income of consumers and the booming tourism industry. Countries like China, Japan, and South Korea have emerged as major players in the duty free retailing market, attracting a large number of international travelers. Additionally, the expansion of airport infrastructure, especially in emerging economies, has further contributed to the growth of duty free retailing in the Asia Pacific region. With a vast consumer base and increasing demand for luxury and premium products, Asia Pacific is poised to continue dominating the global duty free retailing market.

North America

North America is expected to be a significant player in the global duty free retailing market. The region is home to a large number of international airports, attracting a substantial number of travelers. Countries like the United States and Canada have a well-established duty free retailing sector, offering a wide range of products to shoppers. Moreover, the increasing popularity of online duty free shopping platforms has further contributed to the growth of the market in North America. However, compared to the Asia Pacific region, North America's growth potential in duty free retailing may be slightly limited due to a smaller population and less dependence on international tourism.

Europe

Europe is another important region in the global duty free retailing market. The region has a rich history of duty free retailing, with countries like the United Kingdom, France, and Germany being major players. The presence of major transportation hubs, such as London Heathrow and Paris Charles de Gaulle airports, has facilitated the growth of the duty free sector in Europe. Additionally, the region's strong luxury goods market and high disposable income levels contribute to the demand for duty free shopping. However, Europe's dominance in the global duty free retailing market may be challenged by the rapid growth of the Asia Pacific region.

Latin America

Latin America is a growing player in the global duty free retailing market but is not expected to dominate the market. The region's vibrant tourism industry, particularly in countries like Mexico, Brazil, and Argentina, attracts a significant number of international travelers. Duty free retailing in Latin America is mainly concentrated in airports and border crossings. However, challenges such as political instability, economic fluctuations, and infrastructural limitations can hinder the growth of the duty free market in this region.

Middle East & Africa

The Middle East & Africa region is also a growing player in the global duty free retailing market, but it is not expected to dominate. The region's strategic location as a transit hub between Europe, Asia, and Africa has contributed to its duty free retailing growth. Countries such as the United Arab Emirates, Qatar, and Saudi Arabia have established themselves as major duty free retail destinations. The region's booming aviation sector, driven by the presence of major airlines like Emirates and Qatar Airways, further supports the growth of duty free shopping. However, compared to the Asia Pacific region, the Middle East & Africa has a smaller consumer base and limited potential for growth in duty free retailing.

Company Profiles:

Prominent participants in the international duty-free retail sector comprise Dufry AG, Lagardère Group, and China International Travel Service Corporation Ltd. These entities exhibit notable influence within the sector, focusing on enhancing their product portfolio and market presence to address the escalating requirement for duty-free goods.

Prominent companies in the Duty Free Retailing sector comprise Dufry AG, Lotte Duty Free, The Shilla Duty Free, DFS Group, JR/Duty Free, Heinemann, King Power International Group, China Duty Free Group, Lagardère Travel Retail, and Gebr. Heinemann.

COVID-19 Impact and Market Status:

The global duty-free retailing sector has experienced notable effects from the Covid-19 pandemic, characterized by diminished international travel and decreased consumer expenditures, consequently contributing to a downturn in sales and overall revenue.

The duty-free retailing market has been significantly impacted by the global COVID-19 pandemic. With the implementation of lockdowns and travel restrictions by governments worldwide to contain the spread of the virus, international travel ground to a halt. This had a profound effect on duty-free shops, which heavily depend on passenger traffic for their revenue. The closure of airports and the suspension of flights led to a sharp decline in sales and revenue for duty-free retailers due to reduced footfall and travel demand.

Additionally, the adoption of remote work policies and social distancing measures further dampened the travel and tourism industry, resulting in decreased consumer spending. Some duty-free retailers tried to adapt their business models by offering online shopping and home delivery services, but these efforts could not offset the substantial losses incurred from the absence of physical travelers. As countries slowly reopen their borders and resume international travel, duty-free retailers are optimistic about a gradual recovery.

However, the full rebound of the market remains uncertain, as the course of the pandemic and shifting consumer behaviors continue to unfold.

Latest Trends and Innovation:

- In June 2020, Dufry Group, a leading global travel retailer, announced the acquisition of its long-term joint venture in Russia with RegStaer Group, becoming the controlling shareholder and strengthening its presence in the Russian duty-free market.

- In September 2021, Lotte Duty Free entered into an agreement to acquire a 44% stake in the operator of duty-free stores at Singapore's main airport, The Shilla Duty Free (Singapore) Pte. Ltd., expanding its presence in the Southeast Asian market.

- In February 2022, DFS (Takashimaya) Singapore announced its partnership with digital payments company Alipay, enabling Chinese tourists to use Alipay for purchases at DFS shops, aiming to enhance customer experience and attract more Chinese tourists.

- In March 2022, Lagardère Travel Retail finalized the acquisition of the remaining 50% stake in CARISA, a leading retailer in the Caribbean region, expanding its footprint in the Caribbean duty-free market.

- In April 2022, Heinemann Duty Free, a key player in the global duty-free market, introduced an innovative digital shopping concept called "anwbXpress" at Amsterdam Airport Schiphol, aiming to provide an enhanced shopping experience for travelers.

- In July 2022, Dufry Group announced the replenishment of its capital, totalling CHF 1.4 billion, via equity and convertible bonds, strengthening its financial position to facilitate strategic growth and investment opportunities in the duty-free retailing sector.

Significant Growth Factors:

Factors contributing to the expansion of the duty-free retailing market encompass the growth in global travel, the development of airport facilities, and the escalation of consumer disposable income.

The duty-free retail industry has experienced notable growth in recent times due to various pivotal reasons. Primarily, the upsurge in global travel has been a significant driver behind the market's expansion. The escalating number of individuals embarking on international trips for various purposes such as leisure and business has led to a ened demand for duty-free goods at airports and other travel-centric venues. Moreover, the burgeoning middle-class demographic worldwide has played a role in the market's prosperity, enabling more people to partake in overseas travel and engage in duty-free shopping activities. Furthermore, the robust growth of the tourism sector in different nations, alongside the establishment of new airports and travel centers, has presented duty-free retailers with abundant opportunities to broaden their reach and cater to a broader clientele base. The integration of cutting-edge technologies, including e-commerce platforms and mobile shopping apps, has also transformed the duty-free shopping experience, enhancing convenience and accessibility for travelers. In addition, the diversification of duty-free retail beyond airport premises, with the introduction of city center duty-free stores and border outlets, has further stimulated market growth. Lastly, the increasing appeal of luxury brands, coupled with the perception of duty-free shopping offering superior prices and exclusive bargains, has further bolstered the market's upward trajectory. Overall, the duty-free retail industry is poised to sustain its growth pattern in the foreseeable future, driven by these influential factors.

Restraining Factors:

Factors inhibiting the growth of the Duty Free Retailing Market encompass fierce competition, rigorous regulations, and decreased global tourism resulting from geopolitical conflicts.

The global duty-free retail market is experiencing significant growth due to the increasing trend of international travel and the rising disposable incomes of consumers. However, there are various factors that could impede this market's growth. Stringent regulations and compliance requirements in different countries can present obstacles for duty-free retailers. Customs procedures complexity, trade restrictions, and demanding documentation processes can hinder the expansion of duty-free outlets. Fluctuating exchange rates and unstable economic conditions can influence the spending power of travelers, impacting their willingness to purchase duty-free goods. Moreover, the proliferation of e-commerce and online shopping platforms has provided consumers with extensive options, potentially diverting their attention away from traditional duty-free stores. The COVID-19 pandemic has had a severe impact on the travel industry, leading to airport closures and reduced passenger traffic, negatively affecting duty-free retail. Nevertheless, the duty-free retail market has tremendous potential, with governments investing in infrastructure development, airports expanding, and international travel gradually recovering post-pandemic. To navigate these challenges and capitalize on growth prospects, easing regulations, adopting innovative marketing approaches, enhancing customer experiences, and leveraging digital solutions will be crucial for the future success of the duty-free retail industry.

Key Segments of the Duty Free Retailing Market

Product Overview

• Perfume & Cosmetics

• Electronics

• Wine & Spirits

• Food

• Confectionery & Catering

• Tobacco

• Luxury Goods

• Others

Sales Channel Overview

• Airports

• Cruise Liners

• Railway Stations

• Border

• Down-Town & Hotel Shop

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America