Electric Ranges Market Analysis and Insights:

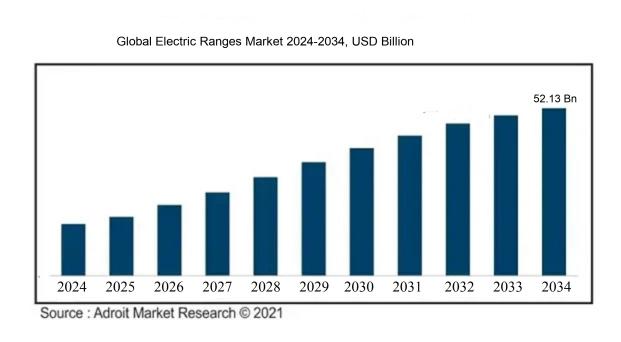

The Market for Electric Ranges was valued at USD 25.10 billion in 2024, increased to USD 27.15 billion in 2025, and is expected to reach over USD 52.13 billion by 2034, indicating a robust compound annual growth rate (CAGR) of 8.28% from 2024 to 2034.

The Electric Ranges Market is significantly influenced by a growing consumer focus on environmental sustainability and energy efficiency. As more households opt for energy-saving appliances, electric ranges are becoming increasingly favored due to their reduced carbon emissions in comparison with conventional gas counterparts. Advances in technology, such as smart cooking capabilities and improved temperature regulation, enhance user experience and attract more buyers. Furthermore, government initiatives and regulations that encourage energy-efficient appliances contribute positively to market expansion. In addition, the rise of urban living and the trend toward modern kitchen aesthetics motivate consumers to choose stylish electric ranges that blend functionality with visual appeal. The expansion of the real estate sector, especially in emerging markets, aligns with this trend, as newly constructed homes and renovations frequently feature electric cooking solutions. Increased disposable incomes enable consumers to invest in premium kitchen appliances, further driving the market's growth.

Electric Ranges Market Definition

Electric ranges are culinary devices that integrate a stovetop and an oven, utilizing electrical power for operation. They offer diverse heating options on the cooktop for stovetop cooking and provide a regulated environment for baking or roasting within the oven.

Electric ranges have become essential in modern kitchens, appreciated for their efficiency, adaptability, and user-friendly nature. They offer accurate temperature regulation, which ensures uniform cooking outcomes—important for both novice and expert chefs alike. As the demand for energy-efficient devices grows, electric ranges generally use less energy than gas alternatives, leading to decreased utility costs and a smaller ecological footprint. Additionally, contemporary electric ranges are designed with cutting-edge features, including induction cooking, integration of smart technologies, and enhanced safety protections, all of which improve usability and safety. In summary, electric ranges embody a combination of innovation and practicality, making them an indispensable element of today's culinary landscape.

Electric Ranges Market Segmental Analysis:

Insights On Types

24 Inch

The 24 Inch category is expected to dominate the Global Electric Ranges Market due to its perfect balance between cooking capability and space efficiency. It is highly favored in urban settings where kitchen space is limited, yet effective cooking performance is crucial. Consumers are increasingly seeking compact designs that provide versatility, making 24-inch electric ranges a preferred choice among homeowners and renters alike. This also typically offers advanced technological features that enhance cooking experiences, such as smart controls and energy efficiency, contributing to its growing popularity and sales volume. With increasing urbanization and the rise in population living in smaller residences, the demand for 24-inch ranges is projected to surge, pushing it to the forefront of this market.

20 Inch

The 20 Inch electric ranges are primarily targeted towards extremely compact living spaces and typically cater to budget-conscious consumers or those who require a secondary kitchen setup, like in a guest house or apartment. While they appeal to a niche market looking for space-saving options, their overall popularity is limited compared to larger ranges. The performance features offered are often basic, which may not satisfy the demands of customers seeking a more sophisticated cooking experience. Therefore, it is expected that the 20 Inch category will continue to lag in market share relative to larger, more versatile options.

27 Inch

The 27 Inch electric range holds appeal for families desiring additional cooking capacity without the bulk of larger models. However, it remains a less common choice compared to both the 24 Inch and 30 Inch s. While offering a good compromise between size and performance, the 27 Inch doesn't have a distinct target audience that prioritizes this specific measurement, which could lead to lower sales volume. Its features may lack some of the innovation seen in smaller or larger models, making it comparatively less attractive in a highly competitive market.

30 Inch

The 30 Inch electric ranges command significant consumer interest, particularly among those who entertain or cook larger meals frequently. This size is often regarded as a standard in larger family kitchens. However, despite popularity, the 30 Inch options may face challenges related to space constraints in smaller homes or apartments. Trends also indicate a preference for energy-efficient models and smart technology features, which some 30 Inch ranges may offer less effectively. Therefore, while they have a dedicated consumer base, their widespread adoption can be limited by evolving preferences in today's housing markets.

Others

The "Others" category encompasses a variety of electric ranges that do not fit neatly into the specified sizes. This may include specialized ranges designed for unique market requirements or niche consumers. However, it's a that primarily lacks the strong identification or branding that the distinct sizes provide, which can hinder recognition in the broader market. The performance and technological features in this category can vary widely, making it challenging to compete directly with the more popular and well-defined sizes like 24 Inch or 30 Inch. Consequently, it is anticipated to capture a minimal portion of the overall market.

Insights On Product

Freestanding Electric Ranges

Freestanding electric ranges are anticipated to dominate the Global Electric Ranges Market due to their versatility and ease of installation. These units can be placed anywhere in the kitchen, making them highly consumer-friendly, particularly for those who are renting or do not want to commit to built-in options. Their popularity lies in the diverse design choices and the functionality they offer, catering to various culinary needs. Additionally, freestanding models often come at a lower price point compared to the other types, attracting budget-conscious consumers. This accessibility, along with a wide range of features and sizes, solidifies their leading position within the market.

Slide-in Electric Ranges

Slide-in electric ranges present a more seamless and custom look, designed to fit flush with countertops for a built-in appearance. While they are less versatile than freestanding models, their aesthetic appeal attracts homeowners looking to enhance the style of their kitchen. These ranges often come with advanced features, such as smart technology integration and additional cooking options, appealing to a higher-end market. However, their installation can be more complicated, requiring professional assistance, which may deter some consumers.

Drop-in Electric Ranges

Drop-in electric ranges, known for their unique installation method, allow for a more tailored kitchen design. These units often blend seamlessly with cabinetry and provide a sleek, integrated look. Despite their elegant appearance, their market share is smaller due to their fixed installation requirements, which often limits flexibility for users. Additionally, drop-in models tend to have a higher price point, which may restrict their appeal primarily to affluent homeowners or those undertaking comprehensive kitchen renovations. Their niche status makes them appealing but less dominant in the broader market context.

Insights On Application

Residential

The residential sector is set to dominate the Global Electric Ranges Market due to the increasing trend of smart homes and the growing preference for energy-efficient appliances among consumers. Many households are opting for electric ranges because they offer precise temperature control, which is essential for modern cooking techniques. Additionally, the rise in urbanization and population growth are also driving demand in this. The convenience of electric ranges, especially for urban dwellers with limited space, enhances their appeal. The trend towards healthier cooking practices and the availability of advanced features like self-cleaning and touch controls further solidify the residential market's leading position in the electric range sector.

Commercial

The commercial of the electric ranges market caters primarily to restaurants, hotels, and catering services. While its growth is steady, it faces more competition from other types of cooking appliances like gas ranges and induction cooktops, which are often preferred for their faster cooking times and operational efficiency. However, as sustainability becomes a focal point in the foodservice industry, an increasing number of commercial kitchens are beginning to adopt electric ranges to meet energy efficiency standards. This gradual shift could provide a pathway for growth, although the competition remains a challenge for long-term market dominance.

Insights On Distribution Channel

Online/e-commerce

The Online/e-commerce channel is expected to dominate the Global Electric Ranges Market due to the increasing trend of online shopping and the convenience it offers to consumers. A growing number of people prefer to research and purchase appliances from the comfort of their homes, leading to a rise in online sales. E-commerce platforms provide users with the ability to easily compare prices, read reviews, and access a wider variety of products than might be available in traditional retail settings. Additionally, the COVID-19 pandemic accelerated this shift as more consumers turned to online shopping, and this trend is projected to continue as technology improves and logistics enhance the delivery experience.

Mass Retailers

Mass retailers play a significant role in the Global Electric Ranges Market due to their extensive physical presence and ability to offer competitive pricing. These stores often feature a wide selection of electric ranges from numerous brands, providing consumers with choices in one convenient location. Their established customer bases and effective marketing strategies contribute to steady sales. However, their importance may gradually decrease as more consumers choose the convenience and efficiency of online shopping, especially among younger demographics who are increasingly tech-savvy.

Electronic & Appliance Stores

Electronic and appliance stores have traditionally been a vital distribution channel for electric ranges, offering expert advice and curated options tailored to specific customer needs. These specialty retailers provide an opportunity for customers to physically examine the products, ensuring they make informed purchasing decisions. Although this channel maintains a loyal customer base, it faces competition from online platforms that offer an even broader range of products and easy return policies. As a result, while electronic and appliance stores will retain their relevance, their market share may diminish over time.

Others

The "Others" category encompasses various distribution channels such as direct-to-consumer sales, showrooms, and wholesale suppliers. While these avenues can effectively reach specific markets, they typically represent a smaller portion of the overall market for electric ranges. Showrooms may provide personalized service and a unique shopping experience, but they lack the extensive reach of online e-commerce and mass retailers. As the market continues to evolve, these alternative channels must adapt and innovate to attract a larger share of consumers who are primarily leaning toward more convenient options.

Global Electric Ranges Market Regional Insights:

Asia Pacific

Asia Pacific is poised to dominate the Global Electric Ranges market due to several compelling factors. The rapid urbanization and increasing disposable income in countries like China and India are driving demand for modern kitchen appliances, including electric ranges. Moreover, a growing focus on energy efficiency and environmental sustainability among consumers is boosting the adoption of electric ranges over traditional gas alternatives. The strong presence of major manufacturers and continuous technological advancements in the region further support its leadership position. The expanding residential sector, along with rising culinary trends, complements the surge in electric range sales, making Asia Pacific a cornerstone for this market expansion.

North America

North America exhibits significant growth potential in the Global Electric Ranges market. The region's established consumer base, coupled with a strong preference for energy-efficient appliances, supports the increasing adoption of electric ranges. The rise of smart home technology is also driving innovation in electric range features. However, market saturation and a mature housing market may pose challenges to explosive growth in this sector. Nevertheless, premium product offerings and a focus on sustainability will contribute to a steady market trajectory.

Europe

Europe is anticipated to maintain a competitive position in the Global Electric Ranges market, characterized by stringent energy regulations and a strong commitment to environmental sustainability. The well-developed retail infrastructure facilitates the distribution of advanced electric ranges, while consumers show growing interest in smart kitchen solutions. Although the region faces challenges from economic fluctuations, innovation in design and features continues to attract consumers seeking high-quality appliances. Luxury product s may offer additional growth opportunities.

Latin America

Latin America presents a diverse yet underdeveloped market for electric ranges. While growth potential exists, the region faces significant hurdles, including economic volatility and budget constraints that limit consumer spending. However, rising urbanization and a gradual shift toward modern appliances signal a future increase in electric range adoption. Importantly, increasing awareness of energy-efficient products may gradually enhance the market as consumers seek long-term savings and environmentally friendly solutions, paving the way for future growth in this.

Middle East & Africa

The Middle East & Africa region showcases a modest growth outlook for the Global Electric Ranges market due to varying consumer preferences and economic disparities. The demand is primarily concentrated in urban centers, where exposure to modern electrical appliances is higher. However, the overall market remains limited by infrastructural challenges and low penetration of electric ranges in rural areas. Efforts to enhance energy access and improve living standards could gradually shift consumer preferences toward electric solutions, potentially expanding the market in the long run.

Electric Ranges Competitive Landscape:

Key participants in the worldwide electric ranges sector, comprising producers, suppliers, and retailers, play a pivotal role in fostering innovation and enhancing competition, which in turn shapes product evolution and consumer choices. Their strategic collaborations and market strategies are essential for responding to emerging trends and effectively meeting customer needs.

The primary participants in the electric ranges industry comprise Whirlpool Corporation, GE Appliances (part of Haier), Samsung Electronics, LG Electronics, Frigidaire (which is owned by Electrolux), Bosch, Miele, Maytag (which operates under Whirlpool Corporation), KitchenAid (also a Whirlpool subsidiary), Viking Range Corporation, Electrolux, Amana (a brand under Whirlpool Corporation), Jenn-Air (another Whirlpool subsidiary), and Smeg.

Global Electric Ranges COVID-19 Impact and Market Status:

The Global Electric Ranges market has faced considerable disturbances due to the COVID-19 pandemic, which resulted in supply chain issues, changes in consumer preferences, and a short-term drop in sales during periods of lockdown.

The COVID-19 pandemic significantly influenced the electric ranges market, marked by varying demand levels, disruptions in supply chains, and changes in consumer habits. Initially, sales saw a sharp decline as lockdowns resulted in the closure of retail outlets and a drop in consumer spending. However, as more people began cooking at home, interest in electric ranges rose. This growing preference for home-cooked meals led to an increased demand for high-efficiency, quality appliances. At the same time, manufacturers encountered difficulties in acquiring raw materials and adhering to production timelines, which caused delays and escalated costs. As economic conditions started to improve, consumers became more focused on safety and cleanliness, resulting in advancements in appliance designs and the integration of smart technologies. Additionally, the pandemic hastened the shift toward online shopping, prompting retailers to modify their sales approaches. In summary, although the electric ranges market faced immediate challenges, it displayed resilience and opportunities for growth driven by innovation and evolving consumer lifestyles in the aftermath of the pandemic.

Latest Trends and Innovation in The Global Electric Ranges Market:

- In April 2023, Whirlpool Corporation announced the launch of its new line of smart electric ranges equipped with Wi-Fi connectivity and voice control features, enhancing user convenience and kitchen automation.

- In January 2022, GE Appliances unveiled a series of electric ranges with advanced induction technology promising faster cooking times and improved energy efficiency, catering to the growing consumer demand for eco-friendly kitchen appliances.

- In March 2023, Samsung introduced its new Bespoke line of electric ranges that offer customizable designs, allowing consumers to select colors and finishes that match their kitchen aesthetics.

- In October 2022, LG Electronics expanded its home appliance portfolio by acquiring a stake in a tech startup focused on developing AI-based cooking assistance for electric ranges, aiming to integrate smart cooking functionalities into their products.

- In February 2023, Electrolux announced a partnership with a leading energy management company to develop electric ranges that optimize energy usage based on grid conditions, targeting sustainability-focused consumers.

- In June 2023, Bosch launched a new series of electric ranges featuring advanced safety features such as motion sensors and automatic shut-off, addressing consumer concerns regarding kitchen safety.

- In July 2022, the Italian company Smeg expanded its distribution network in North America, focusing on electric ranges that blend vintage design with modern cooking technology to cater to a niche market.

- In September 2023, Frigidaire introduced a range of affordable electric ranges with air fry technology, targeting budget-conscious consumers looking for multifunctional cooking solutions.

Electric Ranges Market Growth Factors:

The Electric Ranges Market is propelled by a growing consumer demand for energy-efficient solutions, advancements in culinary technology, and the surging popularity of smart home devices.

The Electric Ranges Market is witnessing notable expansion, driven by several key influences. Heightened consumer consciousness surrounding energy efficiency has spurred a preference for electric ranges over conventional gas counterparts, primarily due to their lower energy consumption and reduced operational expenses. Moreover, innovations such as smart technology and touch-sensitive interfaces are revolutionizing culinary experiences, further appealing to tech-oriented buyers.

As urban areas grow and living spaces become more compact, the demand for space-saving and efficient appliances that electric ranges provide is on the rise. The transition toward sustainable lifestyles and efforts to minimize carbon footprints are also prompting consumers to choose electric cooking options, which can harness renewable energy.

The COVID-19 pandemic has catalyzed an increase in home cooking, resulting in greater investments in kitchen appliances, including electric ranges. Additionally, governmental measures that encourage the adoption of energy-efficient appliances through various incentives and rebates are positively affecting market dynamics. With ongoing innovations in design and functionality by manufacturers, alongside the emergence of online retail platforms, the appeal and accessibility of electric ranges are significantly enhanced, reinforcing their market presence. These combined elements are driving the Electric Ranges Market towards significant growth in the forthcoming years.

Electric Ranges Market Restaining Factors:

Significant challenges in the electric ranges industry involve substantial upfront expenses and intensifying rivalry from other cooking technologies.

The Electric Ranges Market encounters numerous challenges that may hinder its growth potential. One major obstacle is the relatively high upfront cost of electric ranges when compared to traditional gas options, which can dissuade budget-sensitive consumers. Moreover, variability in electricity costs may raise concerns about the long-term financial implications for potential buyers. In certain regions, where gas cooking is the norm and holds cultural significance, the perception that electric cooking is slower or less efficient can complicate its acceptance. Additionally, in rural areas with limited electric infrastructure, widespread adoption can be stymied. Compatibility with current kitchen designs and the necessity for electrical upgrades also present notable challenges. Environmental issues associated with the manufacturing and disposal of electric appliances add another layer of complexity, particularly as consumers increasingly prioritize sustainability. Nevertheless, technological advancements that improve energy efficiency and cooking capabilities, combined with ened consumer awareness of the advantages of electric cooking, are gradually altering these perceptions. The shift towards more sustainable practices, along with enhanced government initiatives advocating for the use of electric appliances, provides a promising future for the electric ranges market, fostering hope for growth and innovation in the industry.

Key Segments of the Electric Ranges Market

By Product

• Freestanding electric ranges

• Slide-in electric ranges

• Drop-in electric ranges

By Application

• Residential

• Commercial

By Distribution Channel

• Mass retailers

• Electronic & appliance stores

• Online/e-commerce

• Others

By Types

• 20 Inch

• 24 Inch

• 27 Inch

• 30 Inch

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America