Electric Scooters Market Analysis and Insights:

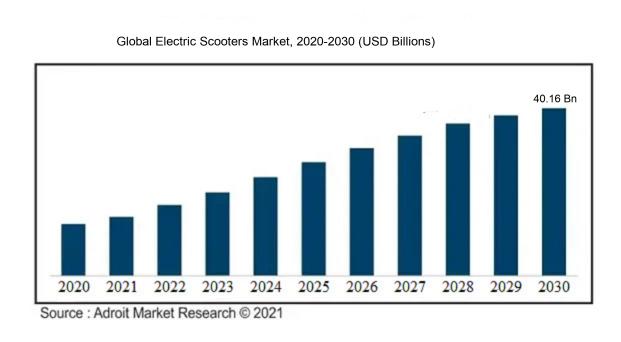

The market for electric scooters was estimated to be worth USD 26.79 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 6.84%, with an expected value of USD 40.16 billion in 2030.

The electric scooters industry is witnessing a substantial uptick driven by various factors. Primarily, the growing consciousness around environmental sustainability and the imperative to lessen carbon footprints are propelling the demand for electric scooters owing to their reputation as a more eco-friendly mode of transportation. Moreover, the escalating fuel costs and the cost-effectiveness of electric scooters compared to traditional fuel-driven vehicles are drawing consumers towards this innovative form of transport. Additionally, the convenience and user-friendliness of electric scooters, including their compact design and ease of navigation in busy urban settings, are further augmenting their popularity. Governmental programs and regulations advocating for the uptake of electric vehicles, alongside incentives and subsidies, are fostering market expansion. Furthermore, advancements in battery technology are enhancing battery lifespan and charging efficiency, thereby bolstering the electric scooters market. In essence, these factors are fuelling the robust growth of the electric scooters sector, with expectations of continued expansion in the foreseeable future.

Electric Scooters Market Definition

Electric scooters represent a contemporary means of transportation that rely on electric power for propulsion, catering to individuals seeking convenient and eco-friendly travel options over short to moderate distances. These vehicles incorporate an electric motor and rechargeable battery system, contributing to their emission-free nature and providing a resource-efficient mode of personal locomotion.

Electric scooters have gained significance for a variety of reasons. Primarily, they serve as a convenient and environmentally friendly mode of transportation for short distances, contributing to the reduction of carbon emissions and lessening the reliance on traditional fuels. Moreover, electric scooters offer a cost-efficient solution, with decreased maintenance and operational expenses in comparison to conventional vehicles. They also present a more effective means of commuting in urban areas plagued by traffic congestion. Additionally, electric scooters encourage individuals to embrace active modes of transport, fostering a healthier lifestyle. The surge in the popularity of electric scooters has spurred the development of diverse ride-sharing platforms, making them more accessible and affordable. In essence, electric scooters play a vital role in addressing environmental issues, enhancing urban mobility, and advocating for healthier living choices.

Electric Scooters Market Segmental Analysis:

Insights On Type

Li-Ion

Li-Ion batteries are expected to dominate the Global Electric Scooters Market. Li-Ion batteries offer higher energy density, longer lifespan, and faster charging capabilities compared to other types of batteries. These advantages make Li-Ion batteries a preferred choice for electric scooters. Additionally, Li-Ion batteries are lighter and more compact, allowing for sleeker and more portable scooter designs. As the demand for electric scooters continues to rise, manufacturers are increasingly choosing Li-Ion batteries to meet the growing consumer expectations for performance, efficiency, and convenience.

Sealed Lead Acid

Sealed Lead Acid batteries are another prominent player in the Type category. Despite their lower energy density and slower charging time compared to Li-Ion batteries, Sealed Lead Acid batteries are still commonly used in electric scooters, especially in developing markets. Sealed Lead Acid batteries are known for their affordability, durability, and ability to withstand extreme weather conditions. These factors make them a suitable choice for budget-conscious consumers and those who prioritize longevity and reliability over high-performance features.

Ni-MH

Ni-MH batteries, although not as widely used as Li-Ion or Sealed Lead Acid batteries, still have a significant presence in the Global Electric Scooters Market. Ni-MH batteries offer a balance between cost, capacity, and safety. They have a longer lifespan and better energy density compared to Sealed Lead Acid batteries but fall short of the performance offered by Li-Ion batteries. Ni-MH batteries are often found in mid-range electric scooters that cater to consumers who seek a balance between price and performance.

Insights On Technology

Battery Operated

Battery Operated is the sector that is expected to dominate the Global Electric Scooters Market. The growing concern for environmental sustainability and the rising demand for clean and energy-efficient modes of transportation have fueled the adoption of battery-operated electric scooters. Battery-operated scooters offer several advantages including zero emissions, low maintenance costs, and quieter operation. Additionally, advancements in battery technology have led to improved performance, longer battery life, and faster charging capabilities, making battery-operated scooters a popular choice among consumers. As governments worldwide offer incentives and subsidies to promote electric mobility, the demand for battery-operated electric scooters is expected to surge in the coming years.

Plug-In

Plug-In, while not the dominating sector, still holds a significant share in the Global Electric Scooters Market. Plug-In electric scooters require a direct power source for charging and are often used for longer commutes or in areas with limited charging infrastructure. Although they may not offer the same level of convenience as battery-operated scooters, plug-in models are favored by users who require a longer range and are unable to charge frequently. As charging infrastructure improves and the range anxiety associated with plug-in electric scooters diminishes, this part is expected to see growth in the future.

Insights On Voltage

48V

The 48V category is expected to dominate the Global Electric Scooters Market. This is primarily due to its balanced combination of power and efficiency. Electric scooters with a 48V battery system provide a higher voltage compared to the lower voltage categories, which allows for improved performance, especially in terms of acceleration and top speed. Additionally, a 48V battery system can offer a longer range, enabling riders to travel greater distances on a single charge. The 48V part is likely to be favored by consumers who prioritize both power and range in their electric scooters.

36V

While the 48V category dominates the market, the 36V category still holds significance in the Global Electric Scooters Market. Electric scooters equipped with a 36V battery system offer a balance between power and affordability. These scooters are suitable for urban environments and short commutes, where lower acceleration and top speed are acceptable. The 36V part may appeal to price-conscious consumers who prioritize cost-effectiveness and are not necessarily looking for higher performance or longer range.

24V

Although the 24V category may not dominate the market, it still caters to a specific target audience in the Global Electric Scooters Market. Scooters with a 24V battery system are typically entry-level or budget options. They are suitable for casual users, children, and light-duty applications. The lower voltage of 24V limits the performance capabilities of these scooters, resulting in lower accelerations, slower top speeds, and shorter ranges. However, the affordability of 24V electric scooters makes them attractive to cost-conscious consumers who prioritize price over performance.

More than 48V

The More than 48V category is not expected to dominate the Global Electric Scooters Market. Electric scooters with a voltage higher than 48V are less common and typically fall into niche or specialized categories. These scooters are designed for specific applications that require higher power output, such as off-road or high-performance use. The higher voltage allows for increased acceleration, top speed, and range. However, due to their specialized nature, electric scooters with a voltage exceeding 48V are likely to have a limited market share and appeal to a smaller of enthusiasts or professionals seeking exceptional performance.

Global Electric Scooters Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the global electric scooters market. The region has a rapidly growing population and rising urbanization, leading to increased demand for convenient and eco-friendly modes of transportation. Moreover, government initiatives to reduce air pollution and promote electric vehicles have further boosted the adoption of electric scooters in countries like China, India, and Japan. The presence of major electric scooter manufacturers and technological advancements in battery technology and charging infrastructure have also contributed to the region's dominance in the market. Overall, Asia Pacific offers a large market potential for electric scooters, making it the dominating region in the global market.

North America

In North America, the electric scooters market is witnessing significant growth. Factors such as increasing awareness about environmental sustainability, changing consumer preferences towards alternative modes of transportation, and supportive government initiatives are driving the demand for electric scooters in the region. Additionally, the presence of leading players in the market and the availability of advanced charging infrastructure contribute to the growth of the electric scooters market in North America. However, despite these positive factors, the market is likely to be dominated by other regions such as Asia Pacific due to the larger consumer base and higher adoption rates.

Europe

Europe is also witnessing substantial growth in the electric scooters market. Factors such as stringent government regulations to reduce emissions, increasing fuel prices, and the growing preference for electric vehicles are driving the demand for electric scooters in the region. Additionally, the presence of well-established charging infrastructure and favorable government policies supporting the adoption of electric vehicles contribute to the growth of the market in Europe. However, despite these favorable conditions, the dominating region is expected to be Asia Pacific due to its larger market size and higher growth potential.

Latin America

Latin America is experiencing a gradual increase in the adoption of electric scooters. Factors such as rising concerns about air pollution, improving charging infrastructure, and increasing urbanization contribute to the market growth in the region. However, the electric scooters market in Latin America is still in its early stages compared to other regions. The lack of widespread awareness and affordability issues may hinder the rapid expansion of the market. Consequently, Latin America is not expected to dominate the global electric scooters market.

Middle East & Africa

The Middle East & Africa region is witnessing a steady growth in the electric scooters market. Improving urban infrastructure, increasing environmental awareness, and government initiatives to reduce carbon emissions have led to the adoption of electric scooters in some countries within the region. However, the market for electric scooters in the Middle East & Africa is relatively small compared to other regions. Factors such as limited charging infrastructure, low purchasing power of consumers, and the prevalence of traditional transportation systems hinder the market's growth. Hence, the region is not expected to dominate the global electric scooters market.

Global Electric Scooters Market Competitive Landscape:

Major contributors in the worldwide electric scooters industry are pivotal in fostering creativity, producing top-tier goods, and broadening their reach to address the rising interest in sustainable and convenient modes of transportation. Their objective is to provide cutting-edge electric scooters with improved functionalities and capabilities to attract more customers and build a reputable brand image.

Prominent companies in the electric scooters sector encompass Xiaomi, Bird, Lime, Voi Technology, LimeBike, Skip, Scoot Networks, Spin, Razor, and Yadea. Noteworthy for its advanced features and exceptional performance, Xiaomi, a leading Chinese technology corporation, has garnered acclaim for its electric scooters. Bird and Lime are well-established providers of electric scooter rentals that operate in various cities worldwide. Voi Technology, a European firm, specializes in offering sustainable and environmentally friendly micro-mobility solutions. LimeBike, Skip, Scoot Networks, and Spin are also significant contributors to the electric scooter rental domain. Razor, a distinguished manufacturer of electric rides and scooters, has successfully ventured into the electric scooter market. Yadea, a Chinese electric vehicle producer, has solidified its global footprint through its array of electric scooters.

Global Electric Scooters Market COVID-19 Impact and Market Status:

The global market for electric scooters has been greatly affected by the Covid-19 pandemic, resulting in a decrease in both consumer demand and sales as a result of supply chain interruptions and decreased consumer expenditure.

The electric scooters market has been significantly affected by the COVID-19 pandemic. There has been a noticeable decrease in demand due to a combination of factors. As a result of lockdowns and travel restrictions implemented to curb the spread of the virus, people's mobility has been limited, leading to a decrease in the use and desire for electric scooters. Furthermore, the economic downturn stemming from the pandemic has resulted in reduced consumer purchasing power, making it challenging for individuals to invest in non-essential goods like electric scooters. Despite these challenges, the pandemic has also created some opportunities for the electric scooters market. With a growing focus on health and safety, there has been an increased interest in environmentally friendly and personal transportation choices that facilitate social distancing. This trend could potentially boost the demand for electric scooters as a feasible substitute for public transportation. Nevertheless, the overall impact of COVID-19 on the electric scooters market has been largely negative, with a decrease in demand outweighing any potential benefits. Consequently, the industry has had to pivot its strategies towards cost reduction and digital marketing initiatives to maintain growth.

Recent Trends & Innovations of the Electric Scooters Market:

- In January 2021, Lime announced the acquisition of Boosted, a prominent electric skateboard manufacturer.

- In March 2021, Bird acquired Circ, a leading electric scooter operator, to expand its presence in the European market.

- In April 2021, Voi Technology partnered with Triumph Motorcycles to launch a new range of electric scooters with enhanced performance and design.

- In June 2021, Segway-Ninebot unveiled the KickScooter Air T15, an innovative electric scooter featuring a lightweight, foldable design for enhanced portability.

- In July 2021, Uber announced a strategic partnership with Gogoro, a Taiwanese electric scooter manufacturer, to offer Uber Green e-bikes and e-scooters in select cities.

- In August 2021, Xiaomi, a major global player in the electric scooter market, launched the MIJIA electric scooter pro 2 Mercedes-AMG Petronas F1 Team Edition, showcasing their collaboration with the racing team.

- In September 2021, Niu Technologies, a leading Chinese electric scooter manufacturer, announced the launch of three new models, including the upgraded NQi GTS Limited Edition.

- In November 2021, Bird expanded its offerings by introducing the Bird Three, a new e-scooter equipped with advanced safety features and improved battery life.

- In December 2021, Lime partnered with Taiwan-based Kymco Motor, combining their expertise to develop and manufacture electric scooters for shared mobility services in Asia.

Electric Scooters Market Growth Factors:

The expansion of the electric scooter industry is predominantly fueled by the rising trend towards urban living, escalating environmental consciousness, and the increasing need for alternative transportation options.

The market for electric scooters is witnessing remarkable expansion for various reasons. Firstly, the surge in awareness about environmental sustainability and the imperative to curb carbon emissions has instigated a global shift towards eco-friendly modes of transportation. Electric scooters present a clean and energy-efficient option compared to traditional gasoline-powered vehicles, attracting a growing number of environmentally conscious consumers. Moreover, the expanding urban populace and escalating traffic congestion have bolstered the demand for compact and agile transport solutions. Electric scooters emerge as a practical choice for short-distance travel, offering enhanced maneuverability to navigate busy city streets effortlessly. Advancements in battery technology have notably enhanced the performance and range of electric scooters, effectively addressing concerns about limited battery life and rendering them suitable for longer commutes as well. Additionally, the increase in disposable income and evolving consumer preferences favoring ownership models have significantly contributed to the market's upsurge. Shared mobility initiatives like electric scooter rentals have gained traction for providing a cost-effective and hassle-free transportation alternative. In sum, the growth of the electric scooters market is propelled by mounting environmental anxieties, urbanization trends, technological progress, and shifting consumer inclinations.

Electric Scooters Market Restraining Factors:

The constrained range and short battery life of electric scooters may act as a barrier to their extensive acceptance in the market.

The market for electric scooters has experienced notable growth in recent times, driven by escalating environmental concerns and the demand for more efficient modes of transportation. Nevertheless, there exist various factors that impede the advancement of this market. Primary among these is the restricted capacity of batteries, which poses a significant challenge impacting the endurance and scope of electric scooters. Despite advancements in battery technology, the expenses and weight associated with high-capacity batteries continue to dissuade progress. Another obstacle is the absence of a standardized charging infrastructure, which inhibits the widespread acceptance of electric scooters. The lack of easily accessible charging stations at regular intervals creates obstacles for both consumers and service providers. Moreover, safety issues concerning the design and usage of electric scooters present a constraint. Users frequently lack adequate training and knowledge, resulting in accidents and injuries. Additionally, the higher initial cost of electric scooters compared to conventional models serves as a deterrent for price-conscious consumers. Nonetheless, despite these challenges, the electric scooters market holds significant growth potential. Ongoing investments in battery technology and infrastructure enhancements, coupled with an increasing awareness among consumers about the environmental advantages, are anticipated to propel market expansion. Furthermore, collaborations between industry stakeholders and governmental initiatives aimed at promoting electric mobility are fostering a conducive environment for the electric scooters market to flourish and overcome its current limitations.

Key Segments of the Electric Scooters Market

Type Overview

• Sealed Lead Acid

• Li-Ion

• Ni-MH

Technology Overview

• Plug-In

• Battery Operated

Voltage Overview

• 36V

• 24V

• 48V

• More than 48V

Regional Overview

North America

• United States

• Canada

• Mexico

Europe

• Germany

• France

• United Kingdom

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America