Electric Truck Market Analysis and Insights:

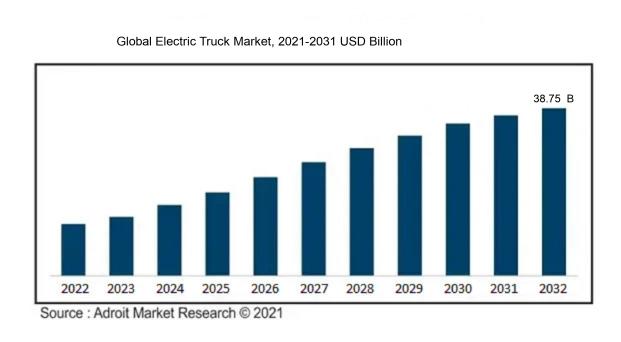

In 2023, the size of the worldwide Electric Truck market was US$ 11.97 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 13.91% from 2024 to 2032, reaching US$ 38.75 billion.

The market for electric trucks is significantly influenced by various essential elements, notably the global emphasis on sustainability. Stricter environmental regulations designed to curb carbon emissions, along with a ened awareness of climate issues, are encouraging companies to transition to more eco-friendly transportation solutions. Advances in battery technology and electric powertrains have not only improved efficiency and performance but also reduced costs, rendering electric trucks increasingly practical for commercial applications. Moreover, the rising expense of conventional fuels, combined with available government incentives and subsidies aimed at promoting electric vehicle usage, is further driving market expansion. Concerns about air quality and urban pollution are leading local governments to prefer electric trucks for logistics and public transit purposes. Additionally, the continuous enhancement of charging infrastructure plays a crucial role in ensuring the operational practicality of electric trucks, making them more appealing to fleet operators who wish to move away from traditional diesel vehicles. Collectively, these elements create an invigorating landscape for the growth of the electric truck sector.

Electric Truck Market Definition

The market for electric trucks includes the manufacturing, distribution, and operation of vehicles powered by electricity, most commonly utilizing batteries or fuel cells. This sector is propelled by an increasing appetite for eco-friendly transportation alternatives and ongoing innovations in electric vehicle technology.

The electric truck sector plays a vital role in mitigating greenhouse gas emissions and diminishing dependence on fossil fuels, thereby facilitating a shift towards sustainable transportation. As global regulatory frameworks concerning emissions become increasingly stringent, electric trucks present an environmentally friendly solution for the logistics and freight sectors, enhancing energy efficiency. Furthermore, innovations in battery technology and the expansion of charging infrastructure bolster the practicality of electric trucks. Their integration can result in considerable financial benefits for companies through reduced fuel and maintenance expenditures, in addition to improving air quality in urban settings. In summary, this market represents a transformative step towards sustainable practices within the heavy-duty transportation industry.

Electric Truck Market Segmental Analysis:

Insights On Key By Propulsion Type

Battery Electric Vehicle (BEV)

Battery Electric Vehicles (BEVs) are expected to dominate the Global Electric Truck Market due to their advantages in energy efficiency and lower operating costs. The increasing push for sustainable transportation, along with tightening regulations around emissions, favors BEVs over other propulsion types. Advancements in lithium-ion battery technology are leading to greater range and reduced costs, making these vehicles more appealing for logistics and transportation companies. Furthermore, the growing infrastructure for charging stations boosts consumer confidence and adoption rates. The focus on zero-emission fleets aligns well with government incentives and corporate sustainability goals, solidifying BEVs' leading position in the market.

Plug-in Hybrid Electric Vehicle (PHEV)

Plug-in Hybrid Electric Vehicles (PHEVs) serve as a transitional option for fleets looking to reduce emissions without fully committing to all-electric systems. Their dual propulsion allows for the convenience of conventional fuel options while also offering electric driving capability for shorter urban routes. This flexibility makes PHEVs appealing for businesses hesitant about fully shifting to BEVs. However, the more complex nature of PHEVs may cause some fleet operators to prefer the simplicity of all-electric models, which could limit their growth in the long term. As battery technology advances, many operators may gradually shift towards full electrification.

Fuel Cell Electric Vehicle (FCEV)

Fuel Cell Electric Vehicles (FCEVs) exhibit potential in specific applications, particularly in long-haul transportation and heavy-duty sectors where battery weight and charging times are limiting factors. The fast refueling capabilities of FCEVs make them suitable for logistics operations that require quick turnaround times. Although still emerging, advancements in hydrogen production and delivery infrastructure are enhancing their viability. However, the current high cost of fuel cell systems and the lack of widespread hydrogen refueling stations pose significant challenges for broader adoption. These hurdles make it a less immediate solution compared to BEVs for most fleets, impacting market share.

Insights On Key By Type

Light-duty Trucks

Light-duty trucks are expected to dominate the Global Electric Truck Market due to their versatility and widespread use in urban applications. With the growing emphasis on reducing carbon footprints and increasing urbanization, many companies and municipalities are opting for electric light-duty trucks for deliveries and services. The lower purchase and operational costs associated with electric vehicles, coupled with governmental incentives promoting zero-emission transportation, are driving growth in this. Additionally, advancements in battery technology and charging infrastructure are improving the viability of electric options in the light-duty category, making them attractive for both consumers and businesses alike.

Medium-duty Trucks

Medium-duty trucks serve a crucial role in the logistics and distribution sectors, often being used for regional deliveries and urban freight. While they are essential for businesses that require a balance between load capacity and efficiency, they face stiff competition from light-duty vehicles that are becoming increasingly viable due to electric technology. Many companies are transitioning to electric models, especially for last-mile delivery solutions, but overall adoption has yet to reach the saturation levels seen in the light-duty. Market growth for medium-duty trucks will likely be substantial as manufacturers continue to innovate and improve fuel efficiency and battery performance.

Heavy-duty Trucks

Heavy-duty trucks are essential for long-distance transportation and play a vital role in industries like freight and construction. Despite their importance, the Global Electric Truck Market for heavy-duty trucks is currently lagging behind light-duty models. This is primarily due to the greater challenges posed by weight, range, and charging times. The technology for electric heavy-duty trucks is developing, but it is not yet as mature as for lighter trucks, resulting in slower adoption rates. As businesses begin to prioritize sustainability, heavy-duty manufacturers will face pressure to innovate and provide electric solutions, which may drive future growth in this category.

Insights On Key By End User

Last Mile Delivery

Last Mile Delivery is expected to dominate the Global Electric Truck Market. This 's growth can be attributed to the increasing demand for urban logistics, where efficient and sustainable solutions are required to meet consumer expectations for quick deliveries. The rise of e-commerce has propelled the need for electric vehicles that can maneuver through city traffic without contributing to pollution. Additionally, governmental incentives and regulations aimed at reducing emissions in urban areas are further encouraging the adoption of electric trucks for last mile delivery. Their ability to operate quietly and efficiently in residential areas makes them particularly appealing for logistics companies aiming to enhance their services while adhering to environmental standards.

Long Haul Transportation

Long Haul Transportation presents a robust opportunity for electric trucks, particularly due to the ongoing changes in regulations concerning emissions and fuel efficiency. As corporations seek to decrease their carbon footprint and adhere to stricter environmental policies, the adoption of electric vehicles for long-distance routes becomes increasingly viable. However, challenges such as charging infrastructure and battery capacity mean that growth in this area may proceed at a slower pace compared to other sectors.

Refuse Services

The Refuse Services sector is gradually integrating electric trucks to enhance operational efficiency and sustainability. The demand for cleaner waste management solutions is driving municipalities to consider electric alternatives, aiming to reduce noise and air pollution in urban environments. Although this market is progressing, the upfront costs and operational adjustments can limit rapid adoption compared to more nimble sectors like last mile delivery.

Field Services

Electric trucks in Field Services are seeing growing interest, especially in industries that require transportation to remote or hard-to-reach locations. While the potential benefits of reduced operating costs and compliance with eco-friendly regulations are evident, the limitations of range and payload capacity are still hurdles. The adoption rate is slower compared to others, mainly due to dependency on versatile vehicle designs and reliable charging access at job sites.

Distribution Services

Distribution Services are experiencing a gradual shift towards electric trucks as companies prioritize sustainability in their logistics strategies. The reduced operating costs and improved environmental impact appeal to businesses looking to enhance their reputations with customers. However, challenges remain regarding the initial investment and the need to upgrade existing distribution networks to accommodate electric vehicles, thus slowing widespread adoption in this particular area relative to last mile delivery.

Insights On Key By Range

Above 200 miles

The expected to dominate the Global Electric Truck Market is "Above 200 miles." This range is primarily gaining traction due to the increasing demand for electric trucks that can operate efficiently over longer distances, especially in logistics and freight delivery sectors. The ability to travel further without frequent recharging makes these trucks highly appealing for commercial use, especially for companies aiming to reduce operational costs and improve delivery times. Additionally, advancements in battery technology continue to enhance the range and efficiency of electric trucks, leading fleets to favor vehicles capable of covering greater distances, thereby solidifying this range's dominance.

Upto 200 miles

The "Upto 200 miles" range is primarily focused on regional and urban transportation. Vehicles within this range tend to serve short-haul applications, making them suitable for last-mile deliveries and localized logistics. Although this area has growth potential, it faces stiff competition from the "Above 200 miles" category, which is more adaptable to broader market demands. The main appeal of trucks in this range stems from lower costs and operational flexibility, yet the limitations in range can constrain their attractiveness for larger logistics companies seeking comprehensive, long-haul solutions.

Insights On Key By Battery capacity

50-250 kWh

The 50-250 kWh category is anticipated to dominate the Global Electric Truck Market. This range of battery capacity is particularly versatile, striking a balance between weight, cost, and energy needs, making it ideal for medium- to heavy-duty electric trucks that require reasonable range while remaining cost-effective. As logistics and delivery services expand their electric fleets, trucks equipped with 50-250 kWh batteries can efficiently handle a variety of routes, particularly urban or regional transportation, without sacrificing performance. Additionally, ongoing advancements in battery technology further enhance the appeal of this capacity range, making it a practical choice for fleet managers focused on sustainability and operational efficiency.

<50 kWh

The under 50 kWh capacity is generally more suited for light-duty electric vehicles rather than larger trucks, as this range typically offers limited range and carrying capacity. While it can serve niche markets, such as last-mile delivery vehicles in urban areas, the overall applicability to the electric truck sector remains limited. As a result, it is less likely to capture significant market share compared to its higher-capacity counterparts. Its use is primarily seen in smaller applications where short distances and lower load capacities are predominant.

Above 250 kWh

The above 250 kWh capacity is focused on heavy-duty electric trucks which require substantial energy supplies to operate efficiently over longer distances. While this range has impressive capabilities, particularly for long-haul applications, it is often burdened by high costs and issues related to weight. Additionally, the infrastructure required to support such large batteries is still in development, which limits widespread adoption. Nonetheless, this is critical for future advancements in electric freight solutions, targeting industries that prioritize sustainable logistics and are willing to invest heavily for reduced emissions in long-distance transport.

Insights On Key By GVWR

10001 - 26000 lbs

The of electric trucks within the range of 10,001 to 26,000 pounds GVWR is expected to dominate the global market. This is primarily attributed to the growing demand for medium-duty trucks, which are extensively used in logistics and delivery services. Retailers and e-commerce companies are increasingly turning to electric options to reduce their carbon footprint while also benefiting from lower operational costs. Additionally, advancements in battery technology and increasing government incentives are making these vehicles more accessible and attractive to fleet operators. As urban areas implement stricter emissions regulations, the medium-duty electric truck is likely to experience substantial growth, leading to its dominance in the overall market.

Upto 10000lbs

The category of electric trucks up to 10,000 pounds GVWR is anticipated to have steady growth; however, it is likely to remain overshadowed by larger vehicles. The primary usage in areas such as last-mile delivery and urban transportation makes this category appealing, especially for small businesses. Government incentives and growing environmental awareness are encouraging small delivery services and urban logistics companies to adopt these lighter electric trucks. However, the limited payload capacity compared to medium and heavy-duty trucks restricts its growth potential, ultimately placing it in a less dominant position in the broader electric truck market.

Above 26001 lbs

Electric trucks with a GVWR that exceeds 26,001 pounds are experiencing a gradual increase in interest, mainly due to advancements in heavy-duty electric vehicle technologies. However, this faces challenges, including higher manufacturing costs and limited infrastructure for charging heavy-duty vehicles. Despite the push for more sustainable transportation solutions, the large capital investment needed for heavier electric trucks may deter fleet operators from immediate adoption. Consequently, while this portion has potential for growth with developments in logistics and construction sectors, it is not expected to lead the market in comparison to medium-duty electric trucks.

Insights On Key By Level of Automation

Autonomous Trucks

The autonomous trucks is anticipated to dominate the global electric truck market due to rapid advancements in technology and increasing investments in automation by major players. These fully automated vehicles are designed to reduce human intervention, increasing efficiency and safety, which appeals to fleet operators looking to optimize logistics and reduce costs. As manufacturers embrace innovations like machine learning and artificial intelligence, autonomous trucks are expected to deliver improved route planning and fuel efficiency. The growing demand for sustainable transportation solutions, alongside regulatory support for autonomous vehicles, reinforces the expectation that this will lead the market in the coming years.

Semi-Autonomous Trucks

The semi-autonomous trucks plays a crucial role in the transition toward fully autonomous transport solutions. These vehicles support drivers with advanced features such as adaptive cruise control and lane-keeping assistance, enhancing safety while still requiring operator involvement. The advantage of semi-autonomous technology lies in its gradual implementation; fleet operators can integrate these systems into their existing operations without a complete overhaul. As such, many organizations may prefer semi-autonomous models as a cost-effective initial step toward automation, allowing them to test technology and adapt their workforce accordingly.

Fully Autonomous Trucks

Fully autonomous trucks, while still emerging, present a unique opportunity for the transportation industry. Their potential to dramatically improve operational efficiency lies in the elimination of human errors and the ability to operate continuously without the requirement for breaks. However, regulatory hurdles and technological readiness remain barriers to widespread adoption. Currently, trials and pilot programs are taking place, showcasing the advancements and challenges inherent in implementing these technologies on a large scale. As infrastructure evolves and acceptance grows, fully autonomous trucks may become more commonplace, but they presently trail behind the demand for safer, hybrid solutions.

Insights On Key By Battery Type

Lithium-iron-phosphate

Lithium-iron-phosphate (LiFePO4) batteries are expected to dominate the Global Electric Truck Market due to their strong performance characteristics, cost-effectiveness, and enhanced safety features. These batteries have a longer lifecycle and excellent thermal stability, which makes them suitable for heavy-duty applications like electric trucks. Furthermore, the increasing emphasis on safety and sustainability in the commercial transport sector is driving manufacturers to favor LiFePO4 chemistry. Unlike other battery types, lithium-iron-phosphate batteries offer a balance between performance, reliability, and lower environmental impact, which aligns with the growing regulatory demands and consumer preferences for cleaner and safer transport solutions.

Lithium-nickel-manganese-cobalt oxide

Lithium-nickel-manganese-cobalt oxide (NMC) batteries have been gaining traction for use in electric trucks due to their high energy density and versatility across various applications. They allow for longer driving ranges and quick charging capabilities, making them suitable for logistics and transport companies that prioritize efficiency and performance. However, the cost of production and dependence on cobalt, which raises ethical and supply chain concerns, may limit their widespread adoption in the electric truck sector. Despite these challenges, NMC batteries are still a viable option for applications requiring high-performance features.

Others

The "Others" category encompasses various battery types, such as solid-state batteries, sodium-ion batteries, and flow batteries, which are still in experimental or early commercial stages. While these alternatives promise advancements like enhanced safety, potentially lower costs, and greater sustainability, they currently face challenges regarding energy density, charging speed, and commercial readiness. Research and development are ongoing, but as of now, they do not offer the immediate advantages seen in lithium-ion options like lithium-iron-phosphate or lithium-nickel-manganese-cobalt oxide batteries. As the technology matures, they could play a more significant role in the future markets.

Global Electric Truck Market Regional Insights:

North America

North America is expected to dominate the Global Electric Truck Market due to a combination of stringent government regulations focused on reducing carbon emissions, increasing investments in electric vehicle infrastructure, and the growing presence of key manufacturers such as Tesla and Rivian. The region has witnessed significant technological advancements in battery technology, which enhances the range and efficiency of electric trucks. Additionally, public-private partnerships have fostered innovation in the electric vehicle sector. Enhanced consumer awareness regarding sustainability has led to rising demand for electric trucks for logistics and freight transportation. Consequently, North America is poised for substantial growth in this market.

Latin America

Latin America exhibits a growing interest in electric trucks, particularly driven by the need to innovate transportation methods amid urbanization and logistical challenges. Government initiatives are increasingly focusing on green transportation, with some countries implementing incentives for electric vehicle purchases. However, infrastructural deficits and the relatively high cost of electric trucks may restrain rapid adoption. The potential remains significant, especially if investments in charging infrastructure increase.

Asia Pacific

The Asia Pacific region shows considerable promise in the electric truck market, primarily due to its manufacturing capabilities and rapidly evolving technology ecosystems. Countries like China are leading the charge, having made significant strides in electric vehicle production, supported by favorable government policies and large-scale investments. With many urban centers pushing for lower emissions, the demand for electric trucks is projected to climb in this region.

Europe

Europe is also a vital player in the electric truck market, supported by comprehensive environmental regulations mandating a reduction in vehicle emissions. European manufacturers are heavily investing in electric truck development, with a focus on sustainability in logistics and transportation. However, varying governmental policies among member states could impact market uniformity. Still, consumer interest in green technologies is a driving force in expanding this.

Middle East & Africa

The Middle East & Africa region is currently lagging in the electric truck market due to limited infrastructure and high upfront costs associated with electric vehicles. While there is increasing awareness of the benefits of electric transportation, the regional reliance on fossil fuels poses a significant challenge. Nonetheless, there is potential for growth, particularly if governments begin to introduce supportive measures and frameworks to boost electric vehicle adoption in the future.

Electric Truck Market Competitive Landscape:

Major contributors in the worldwide electric truck sector propel innovation by creating cutting-edge technologies and forming strategic alliances. They prioritize increasing production capabilities and improving supply chains to address the rising demand. These joint initiatives support the shift towards sustainable transport, influencing the evolution of logistics and delivery systems.

Prominent participants in the electric truck industry encompass companies such as Tesla, Nikola Corporation, Rivian Automotive, BYD Company Limited, Workhorse Group, Lordstown Motors, Freightliner (a division of Daimler AG), Volvo Group, Hino Motors, Proterra Inc., CNH Industrial, Cummins Inc., Green Power Motor Company, and Arrival.

Global Electric Truck Market COVID-19 Impact and Market Status:

The Covid-19 pandemic catalyzed a rapid shift towards electric trucks, driven by increasing environmental awareness, government support, and interruptions in supply chains that compelled the logistics industry to emphasize eco-friendly alternatives.

The COVID-19 pandemic had a profound impact on the market for electric trucks, presenting both obstacles and new avenues for growth. Initially, the sector faced significant challenges due to disruptions in supply chains, workforce shortages, and varying consumer demand, which led to setbacks in production and the timely delivery of vehicles. Nevertheless, the pandemic highlighted the urgency of sustainability and prompted a transition towards more eco-friendly transportation options, resulting in an uptick in investments in electric vehicle technology. In response, many governments implemented policies and incentives aimed at promoting electric trucks, coinciding with efforts for environmental enhancement and economic recovery. Additionally, the rapid expansion of the e-commerce industry intensified the demand for electric delivery vehicles, resonating with businesses aiming to lower their carbon emissions. In summary, although the COVID-19 crisis posed several challenges, it also catalyzed a significant shift towards electrification in commercial transport, suggesting a promising future for the electric truck market in the aftermath of the pandemic.

Latest Trends and Innovation in The Global Electric Truck Market:

- In June 2022, Tesla unveiled the production version of the Tesla Semi, with initial deliveries slated for December 2022, showcasing significant advancements in battery technology and autonomous driving features.

- In August 2022, Rivian announced its partnership with Amazon to deliver 100,000 electric delivery vans by 2030, marking a significant step toward sustainable delivery solutions.

- In September 2022, Ford announced plans to increase its production of the all-electric F-150 Lightning, aiming to produce 150,000 units annually by 2023 amid high demand.

- In October 2022, Daimler Trucks initiated its joint venture with Volvo Group to develop and produce hydrogen fuel cell systems, enhancing their capabilities in the zero-emission truck.

- In March 2023, Nikola Corporation announced its acquisition of Proterra’s battery systems business, aiming to bolster its capabilities in electric truck manufacturing with advanced battery technology.

- In May 2023, BYD launched the all-electric 8TT model in the North American market, focusing on zero-emission solutions for the logistics and transportation sectors.

- In July 2023, Amazon placed an additional order for 100,000 electric vans from Rivian, further solidifying its commitment to an all-electric delivery fleet by 2030.

- In August 2023, Shell acquired a 100% stake in Volta Charging to expand its electric vehicle charging networks, with plans to integrate charging solutions for electric trucks.

- In September 2023, Nikola Corporation showcased its Tre BEV at the IAA Transportation trade fair, demonstrating advancements in electric drivetrain technology and range capabilities.

- In October 2023, Freightliner announced its production expansion plans for the electric eCascadia and eM2 trucks, responding to growing demand and sustainability goals from the logistics industry.

Electric Truck Market Growth Factors:

The market for electric trucks is expanding as a result of stricter environmental regulations, innovations in battery technology, and a growing need for eco-friendly transportation options.

The market for electric trucks is witnessing remarkable expansion fueled by several influential factors. Firstly, stricter environmental regulations and an increased emphasis on sustainability are prompting both logistics firms and manufacturers to transition to electric vehicles, aiming to curb greenhouse gas emissions. Secondly, improvements in battery technology have resulted in greater energy efficiency and extended driving ranges for electric trucks, resolving earlier performance issues. Additionally, the declining prices of components, especially batteries, have made electric trucks a more feasible choice for businesses economically.

Moreover, the growth of e-commerce and the rising need for effective last-mile delivery solutions have opened up new opportunities for electric trucks, which are particularly well-suited for urban and suburban areas. Government incentives and subsidies are also instrumental in facilitating this transition by mitigating initial investment expenses. Furthermore, an increasing consumer demand for sustainable options is motivating companies to upgrade their fleets with electric vehicles. Finally, substantial investments in charging infrastructure are easing concerns about range limitations and improving the practicality of electric trucks, thereby further propelling market growth. Together, these elements signify a strong trajectory towards the electrification of the trucking sector, setting the stage for significant development in the years ahead.

Electric Truck Market Restaining Factors:

The electric truck market faces several significant obstacles, including inadequate charging facilities, substantial initial investment requirements, and apprehensions related to battery range and overall performance.

The electric truck sector encounters several obstacles that may hinder its development. One major issue is the substantial initial investment required for electric trucks, which might discourage companies from switching from traditional diesel vehicles. Furthermore, the scarcity of charging stations, particularly in rural and less developed regions, significantly limits widespread use. Concerns regarding battery longevity and the operational range of electric trucks may also sway fleet managers' decisions, as they often prefer vehicles that can operate for long durations without needing to recharge. Additionally, the trucking industry faces stringent environmental and safety regulations, complicating the adoption of innovative technologies. The slower charging process compared to the quick refueling of conventional trucks can lead to operational delays. Moreover, competition from well-established internal combustion engine (ICE) truck manufacturers may pose challenges for new entrants in the electric truck market. Despite these hurdles, continuous improvements in battery technology and growing investments in charging networks are laying the groundwork for a more feasible electric truck landscape. As awareness around environmental concerns rises and government support expands, the electric truck market appears ready for significant growth in the years ahead, contributing to a more sustainable logistics and transportation ecosystem.

Key Segments of the Electric Truck Market

By Propulsion Type

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

By Type

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

By End User

- Last Mile Delivery

- Long Haul Transportation

- Refuse Services

- Field Services

- Distribution Services

By Range

- Up to 200 miles

- Above 200 miles

By Battery Capacity

- Less than 50 kWh

- 50-250 kWh

- Above 250 kWh

By Gross Vehicle Weight Rating (GVWR)

- Up to 10,000 lbs

- 10,001 26,000 lbs

- Above 26,001 lbs

By Level of Automation

- Semi-Autonomous Trucks

- Autonomous Trucks

By Battery Type

- Lithium-nickel-manganese-cobalt oxide

- Lithium-iron-phosphate

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America