Electric Vehicles Battery Market Analysis and Insights:

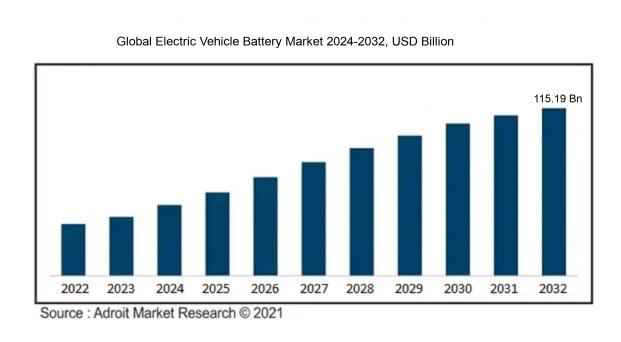

The size of the worldwide Electric Vehicles (EV) battery market was estimated at USD 60.05 billion in 2023 and is expected to increase at a compound annual growth rate (CAGR) of 5.06% from USD 70.70 billion in 2024 to USD 115.19 billion by 2032.

The expansion of the Electric Vehicles (EV) battery sector is fueled by multiple critical factors. Primarily, the ened global focus on mitigating carbon emissions and facilitating sustainable transportation is driving up the demand for EVs, leading to increased battery manufacturing. Innovations in battery technology, including advancements in lithium-ion and solid-state batteries, are improving energy capacity, performance, and durability, which makes EVs more attractive to consumers. Moreover, governmental incentives and policies that encourage EV usage, such as financial rebates and the development of charging infrastructure, significantly contribute to the sector's growth. The escalating prices of conventional fossil fuels, combined with a global pivot toward renewable energy sources, have rendered Electric Vehicless a more cost-effective option. In addition, growing public consciousness regarding environmental concerns and the potential for long-term financial savings from owning an EV are also enhancing market growth, thereby nurturing a more dynamic environment for the production and innovation of EV batteries.

Electric Vehicles Battery Market Definition

A battery in an Electric Vehicles functions as a rechargeable energy reservoir that supplies power to the vehicle's electric motor. This system is usually comprised of numerous individual cells, engineered to deliver a high energy density and optimize performance during both operation and energy recuperation.

The battery of an Electric Vehicles (EV) plays a vital role, as it significantly affects the vehicle's efficiency, travel distance, and overall expenses. Acting as the main energy reservoir, it dictates the distance an EV can cover on a single charge, which in turn influences consumer trust and willingness to adopt electric transportation. Additionally, breakthroughs in battery technology—such as improvements in energy capacity and rapid charging capabilities—are essential for optimizing the user experience. The eco-friendliness of EV batteries is equally critical, involving factors related to material sourcing, recycling initiatives, and reducing ecological footprints, thereby contributing substantially to the broader shift towards sustainable mobility.

Electric Vehicles Battery Market Segmental Analysis:

Insights On Key Battery Type

Lithium-Ion

Lithium-Ion batteries are expected to dominate the Global Electric Vehicles Battery Market due to their high energy density, longer lifespan, and decreasing costs. As the demand for Electric Vehicless rises, manufacturers favor Lithium-Ion technology because it offers longer mileage and quicker charging capabilities compared to alternative battery types. The advancements in battery technology, including improved charging speeds and safety measures, have further cemented Lithium-Ion as the preferred choice for automakers and consumers alike. Additionally, significant investments in the supply chain for Lithium-Ion battery production and recycling initiatives contribute to its expected dominance in the market.

Lead-Acid

Lead-Acid batteries, while historically significant in automotive applications, are increasingly overshadowed by more advanced technologies like Lithium-Ion. However, they are still utilized in specific s of Electric Vehicless, particularly in low-speed Electric Vehicless and certain types of hybrid vehicles. Their lower initial cost makes them attractive for budget-conscious consumers, even though they present limitations in energy density and overall vehicle range. Moreover, the recycling process for Lead-Acid batteries is well-established, contributing to their sustained use in specific applications despite the overall market shift toward newer technologies.

Nickel-Metal-Hydride

Nickel-Metal-Hydride batteries have established a niche in the hybrid vehicle market, particularly for models like the Toyota Prius. They offer benefits such as good thermal stability and lower cost compared to Lithium-Ion batteries in certain applications. Although they are less energy-dense and have a shorter cycle life, they remain relevant due to their reliability and the existing infrastructure supporting their use. As automakers transition to more eco-friendly technologies, Nickel-Metal-Hydride batteries may continue to serve as a bridge for consumers seeking a balance between cost and performance in hybrid systems.

Others

The "Others" category includes various alternative battery technologies such as solid-state batteries and flow batteries. While these technologies are still in developmental phases or are niche players in the market, they show potential for future growth. Solid-state batteries, for instance, promise higher energy densities and improved safety features but face challenges in commercial viability and production scale. Innovations in this category may eventually disrupt the market, but as of now, they represent a small portion of the overall Electric Vehicles battery market compared to Lithium-Ion, Lead-Acid, and Nickel-Metal-Hydride options.

Insights On Key Vehicle Type

Passenger Car

The Passenger Car category is expected to dominate the Global Electric Vehicles Battery Market due to a combination of increasing consumer demand for eco-friendly transportation and advancements in battery technology. As more individuals prioritize sustainability and seek alternatives to traditional combustion engine vehicles, the shift towards electric passenger cars is becoming more pronounced. Key factors such as government incentives, improved charging infrastructure, and a wider range of EV models are further promoting the adoption of electric passenger vehicles. Consequently, the scale of production and investment in battery technology specifically catering to passenger cars is significantly higher than in other vehicle categories, leading to a demand surge within this sector.

Commercial Vehicle

The Commercial Vehicle market is noteworthy for its increasing focus on reducing operational costs and emissions. Fleets are looking to optimize their logistics through Electric Vehicless, which can significantly lower fuel expenses and maintenance costs over time. Additionally, regulatory pressure to meet stricter emission standards has propelled the transition of heavy-duty electric trucks and vans from traditional fuels. Although this is growing, it doesn't represent the volume or massive consumer base found in passenger cars.

Two Wheeler

The Two Wheeler is expanding due to rising urbanization and the need for efficient, affordable transportation options. Electric scooters and motorcycles are gaining traction in densely populated areas where traffic congestion and pollution are significant concerns. However, while the market for electric two-wheelers is dynamic and increasing, it still does not achieve the same market share as passenger cars, which often face greater consumer attention and investment in battery technologies.

Insights On Key Propulsion Type

Battery Electric Vehicles (BEV)

Battery Electric Vehicless (BEVs) are expected to dominate the Global Electric Vehicles Battery Market due to their zero-emission nature and increasing consumer acceptance. The global shift toward sustainability and stricter emissions regulations are bolstering the market for BEVs. Additionally, advancements in battery technology have contributed to the enhancement of battery range and performance, making BEVs increasingly viable. Major automobile manufacturers are heavily investing in electric technologies, encouraging a growing number of consumers to transition to a fully electric driving experience. This trend is likely to intensify as infrastructure for charging networks expands, further boosting BEV adoption over other propulsion types.

Plug-in Hybrid Electric Vehicles (PHEV)

Plug-in Hybrid Electric Vehicless (PHEVs) represent a flexible option for consumers, combining both electric and traditional automotive technology. While their demand is growing, PHEVs have not gained the same traction as BEVs because they still rely on fossil fuels for operation. Regulatory policies and rising fuel prices provide an incentive for consumers, but many potential buyers are leaning towards fully electric solutions to minimize their carbon footprint. The existence of two separate powertrains may deter some individuals who seek simpler and more efficient models, limiting the overall market potential of PHEVs in comparison to BEVs.

Hybrid Electric Vehicles (HEV)

Hybrid Electric Vehicless (HEVs) have established a significant presence in the automotive market, primarily due to their fuel efficiency and capability of using both a gasoline engine and an electric motor. However, the increasing shift towards fully Electric Vehicless is limiting the growth prospects of HEVs. Their systems can be more complex and less efficient than those of BEVs, as they still depend on conventional fuels. Additionally, as public awareness of environmental issues grows, consumers are increasingly motivated to adopt vehicles that offer fully electric solutions rather than hybrid alternatives, further hindering the expansion of the HEV.

Global Electric Vehicles Battery Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Electric Vehicles Battery market due to several compelling factors. The region is home to major players in battery manufacturing, including China, which has a significant market share and strong government support for Electric Vehicles (EV) adoption. Furthermore, the growing consumer demand for EVs, enhanced by increasing environmental awareness and regulatory frameworks, but also substantial investments in renewable energy and battery technology, create a conducive environment for growth. With rapid advancements in battery technologies and economies of scale being achieved, Asia Pacific’s leadership is solidified, making it a center for innovation and production in the Electric Vehicles battery industry.

North America

North America is emerging as a strong contender in the Global Electric Vehicles Battery market, primarily driven by increasing consumer interest in EVs and a supportive regulatory environment aimed at reducing carbon emissions. Government incentives for Electric Vehicles purchases and investments in battery technology have contributed to a growing infrastructure. Additionally, key manufacturers are ramping up their production capacities, aligning with local demand, which further positions North America as a viable market for Electric Vehicles batteries. The collaboration between automotive firms and battery manufacturers also reflects the region's commitment to electric mobility.

Europe

Europe is witnessing a significant shift towards electric mobility, fueled by stringent regulations and ambitious goals for carbon neutrality. The region's commitment to reducing greenhouse gas emissions has resulted in substantial investments in Electric Vehicles technologies and battery production. European manufacturers are accelerating the development of battery technologies to ensure competitive advantages. Cooperative efforts among governments, automotive companies, and technology firms underline Europe’s focus on localizing production, which enhances its strategic importance in the Electric Vehicles battery supply chain. The growing adoption of Electric Vehicless in this region drives demand for efficient and sustainable battery solutions.

Latin America

Latin America shows potential in the Global Electric Vehicles Battery market but is currently lagging behind leading regions. The increasing awareness of environmental issues and a growing middle class are slowly driving interest in Electric Vehicless. However, the region faces challenges such as underdeveloped infrastructure and limited investment in EV technology compared to Asia Pacific and Europe. Countries like Brazil and Chile are taking initial steps toward adopting electric mobility, but the overall market growth remains constrained by economic factors and the existing reliance on traditional fuel sources. Yet, the potential for future growth should not be overlooked as demand ultimately increases.

Middle East & Africa

The Middle East & Africa is at the nascent stage of Electric Vehicles battery adoption, with several challenges impacting the market. There is a keen interest in developing clean energy solutions, especially in oil-rich countries considering diversification. However, infrastructural limitations, high costs associated with Electric Vehicless, and a lack of widespread charging facilities hinder widespread adoption. The market is gradually evolving, particularly in South Africa and some Gulf states, where innovative projects and investments in sustainable energy are gaining traction. Nevertheless, the region requires significant advancements in technology and infrastructure to become a key player in the Global Electric Vehicles Battery market.

Electric Vehicles Battery Competitive Landscape:

The main contributors to the Global Electric Vehicles Battery sector, including manufacturers, suppliers, and research organizations, propel the advancement, production, and distribution of cutting-edge battery technologies, thus promoting efficiency and sustainability. Their collective efforts significantly impact market dynamics, facilitating the shift towards electric transportation through strategic alliances and investments.

Prominent participants in the Electric Vehicles Battery sector encompass Tesla, Panasonic, CATL (Contemporary Amperex Technology Co., Limited), LG Energy Solution, Samsung SDI, BYD, A123 Systems, Northvolt, SK Innovation, and Siemens. Furthermore, firms such as Toshiba, Hitachi Chemical, Johnson Controls, Romeo Power, Micromem Technologies, and Farasis Energy also hold important positions in this arena. The market's competitive environment highlights a blend of well-established automotive and tech companies, in addition to dedicated battery producers, all playing vital roles in advancing and developing Electric Vehicles battery technologies.

Global Electric Vehicles Battery COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly intensified the need for batteries used in Electric Vehicless, propelled by a rising consumer enthusiasm for eco-friendly transportation and enhanced governmental backing for renewable energy projects.

The COVID-19 pandemic profoundly affected the Electric Vehicles (EV) battery industry, causing disruptions in both supply chains and production processes, while also influencing demand variations. The onset of lockdowns resulted in a notable decrease in vehicle manufacturing and sales, thereby leading to a contraction in battery orders. Conversely, the crisis sparked a ened interest in eco-friendly technologies and sustainable transport solutions, prompting governments to introduce stimulus initiatives aimed at boosting post-pandemic EV adoption. Growing public awareness surrounding air quality and environmental concerns further fueled the demand for Electric Vehicless, resulting in substantial growth within the battery market. In response to these challenges, manufacturers began to diversify their suppliers and invest in local production capabilities to reduce future risks. Concurrently, advancements in battery technology and recycling initiatives have gained traction, as companies strive to improve efficiencies and lower costs. As recovery continues, the EV battery market is well-positioned for significant growth, bolstered by an evolving regulatory environment and a continued consumer shift toward sustainable mobility options.

Latest Trends and Innovation in The Global Electric Vehicles Battery Market:

- In February 2023, Panasonic announced a joint venture with Tesla to build a new lithium-ion battery factory in Kansas, aiming to enhance production capabilities for Electric Vehicles batteries to support Tesla's growing demand.

- In June 2023, Samsung SDI revealed plans for a $1.3 billion investment in a new battery manufacturing facility in the United States to produce batteries for Electric Vehicless, which is expected to begin operations by 2025.

- In September 2023, General Motors entered into a partnership with LG Energy Solution to expand their Ultium battery production capacity, with an additional $275 million investment to enhance their Ohio-based plant for EV battery cell manufacturing.

- In October 2023, Northvolt secured an additional funding round of $1.1 billion to accelerate its battery cell production in Europe, focusing on sustainable battery materials to minimize environmental impact.

- In August 2023, Rivian announced a significant technological breakthrough in battery chemistry, resulting in a 20% increase in energy density for its R1T electric truck, expected to improve overall vehicle range and performance.

- In July 2023, Ford Motor Company revealed its plans to build a state-of-the-art battery recycling facility in Michigan, with a focus on recovering valuable materials from used batteries to support its Electric Vehicles production.

- In March 2023, SK Innovation completed its merger with SK On, creating a stronger player in the EV battery market with combined resources dedicated to expanding production in North America and Europe.

- In May 2023, BYD unveiled its new Blade Battery technology, which emphasizes safety and efficiency, while simultaneously announcing a significant increase in their production capacity for the upcoming year to meet rising global demand.

- In November 2023, Aulton announced its collaboration with the Chinese government to develop and produce sodium-ion battery technology, marking a shift towards alternative battery solutions for Electric Vehicless.

- In January 2023, Tesla acquired Maxwell Technologies, focusing on integrating ultracapacitor technology into its battery solutions, which is expected to enhance energy storage capabilities and vehicle performance.

Electric Vehicles Battery Market Growth Factors:

The expansion of the Electric Vehicles Battery Market is fueled by innovations in battery technology, stricter environmental regulations, and a growing consumer interest in eco-friendly transportation options.

The Electric Vehicles (EV) battery sector is experiencing notable expansion, influenced by several significant elements. Firstly, the ened awareness of environmental issues, along with rigorous governmental mandates aimed at curtailing carbon emissions, is driving the surge in EV demand, subsequently increasing the requirement for advanced battery solutions. Innovations in technology, including enhancements in lithium-ion battery formulations and the inception of solid-state batteries, are improving energy efficiency, lifespan, and charging capabilities, making Electric Vehicless more attractive to buyers. Moreover, the reduction in battery manufacturing costs, facilitated by scaling efficiencies and advancements in production techniques, is rendering EVs more economically viable, thus widening their market reach. The growth of charging networks is another essential aspect that mitigates concerns about travel range, encouraging a larger of consumers to explore Electric Vehicles options. Furthermore, escalating investments from both governmental and private entities in the research and development of battery technologies are nurturing technological advancements. The transition toward renewable energy systems, coupled with the implementation of energy storage options, is also integral in driving the demand for advanced battery solutions. Together, these dynamics are cultivating a thriving ecosystem essential for the ongoing sustainable development of the Electric Vehicles battery market.

Electric Vehicles Battery Market Restaining Factors:

Critical challenges facing the Electric Vehicles battery sector encompass a scarcity of raw materials, elevated manufacturing expenses, and apprehensions related to battery recycling and environmental sustainability.

The market for Electric Vehicles (EV) batteries is currently facing numerous obstacles that could impede its expansion. A primary concern is the substantial cost associated with battery production, primarily due to the high prices of essential raw materials such as lithium, cobalt, and nickel. This financial burden not only impacts the market prices of Electric Vehicless but also restricts their availability to a broader audience. Furthermore, there are significant environmental concerns related to the extraction of these materials, coupled with the limited recycling methods in place for discharged batteries, raising sustainability flags.

Additionally, the supply chain is experiencing a bottleneck, with the demand for EV batteries frequently exceeding the production capacity of manufacturers. The infrastructure necessary for charging stations and the electricity grid is often insufficient to facilitate the widespread adoption of Electric Vehicless, which can lead to apprehension about travel range among prospective drivers. Technological hurdles remain as well, specifically regarding the enhancement of battery longevity and the reduction of charging times, which are vital areas of focus for ongoing research and innovation.

Nevertheless, despite these challenges, the future of the Electric Vehicles battery market appears promising. Continuous improvements in battery technology, a surge in investments toward sustainable initiatives, and government policies that encourage EV adoption are all contributing to the potential for more environmentally friendly transportation solutions and enhanced energy efficiency.

Key Segments of the Electric Vehicles Battery Market

By Battery Type:

- Lithium-Ion

- Lead-Acid

- Nickel-Metal-Hydride

- Others

By Vehicle Type:

- Passenger Car

- Commercial Vehicle

- Two Wheeler

By Propulsion Type:

- Battery Electric Vehicles (BEV)

- Plug in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America