Market Analysis and Insights:

The global ethyl acetate market was valued at approximately USD 5.53 billion in 2022. Projections suggest a steady growth trajectory with a compound annual growth rate (CAGR) of 6.54% expected from 2023 to 2030. By the end of the forecast period in 2030, the market is anticipated to reach a value of around USD 9.34 billion.

.jpg

)

The ethyl acetate industry experiences the influence of multiple key factors. The increasing need for ethyl acetate across diverse sectors like paints, coatings, adhesives, and pharmaceuticals contributes significantly to market expansion. This surge is primarily due to the exceptional solvency characteristics of ethyl acetate, rendering it a preferred solvent in these sectors. Moreover, the market's momentum is fueled by the increasing use of ethyl acetate as an enhancer for flavors and fragrances within the food and beverage sector. This usage trend is further bolstered by the ened focus on adopting environmentally sustainable products, with ethyl acetate being derived from renewable sources and displaying low toxicity levels. Additionally, the expansion of the automotive sector, particularly in emerging markets, acts as a driving force for the ethyl acetate market, as it finds application in automotive repair and maintenance activities. Nevertheless, challenges such as volatile raw material costs and stringent regulatory frameworks concerning ethyl acetate production and usage could impede market progress. In essence, the ethyl acetate market is primarily steered by the escalating demand from various industries, its environmentally friendly attributes, and its versatile applications across multiple sectors.

Ethyl Acetate Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 9.34 billion |

| Growth Rate | CAGR of 6.54% during 2023-2030 |

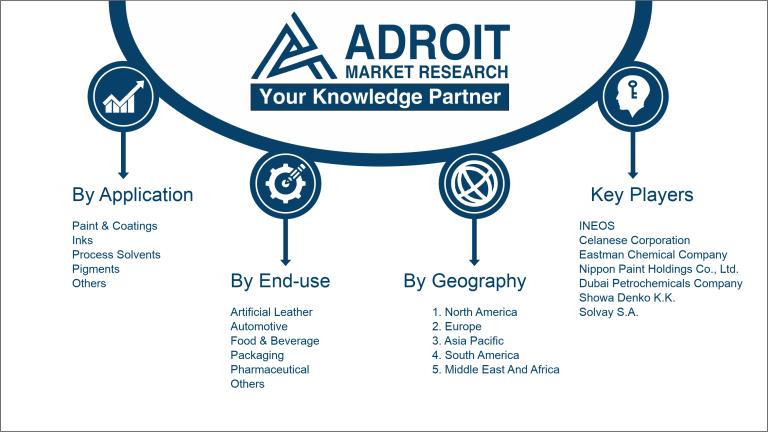

| Segment Covered | By Application,By End-use,By Distribution Channel ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | INEOS, Celanese Corporation, Eastman Chemical Company, Nippon Paint Holdings Co., Ltd., Dubai Petrochemicals Company, Showa Denko K.K., Solvay S.A., GNFC Ltd., Wacker Chemie AG, and Mitsubishi Chemical Corporation. |

Market Definition

Ethyl acetate, a transparent liquid compound, serves as a popular solvent in a range of industrial applications. This substance is produced from ethyl alcohol and acetic acid, boasting a distinct fruity aroma.

Ethyl acetate holds significant importance as a chemical compound with diverse utility across various sectors. Its prominent role as a solvent in pharmaceuticals, paints and coatings stems from its effective dissolving properties. Additionally, ethyl acetate holds a crucial position in the creation of nail polish removers, adhesives, and perfume, highlighting its versatility. Beyond these applications, it also acts as a flavor enhancer in the food and beverage industry and facilitates the extraction of essential oils and flavorings. Additionally, ethyl acetate finds relevance in the synthesis of multiple chemicals, such as pharmaceutical intermediates and pesticides. The versatility and wide-ranging applicability of ethyl acetate underscore its significance in numerous industrial contexts.

Key Market Segmentation:

Insights On Key Application

Paint & Coatings

The Paint & Coatings sector is forecasted to lead the global ethyl acetate market, largely driven by its extensive utilization as a solvent in the manufacturing of paints and coatings. Ethyl acetate provides excellent properties such as fast evaporation, low toxicity, and good solvency, making it a preferred choice for this application. The booming construction industry, increasing demand for automotive coatings, and growing urbanization are driving the demand for paints and coatings, consequently fueling the growth of the ethyl acetate market in this part.

Inks:

The Inks part is expected to witness significant growth in the global ethyl acetate market. Ethyl acetate is widely used as a solvent in the manufacturing of inks, particularly for flexographic and gravure printing. The rising demand for packaging materials, labels, and commercial printing outsourcing products is contributing to the growth of the inks part. Additionally, the shift toward eco-friendly and low-VOC (volatile organic compound) inks is further propelling the use of ethyl acetate in this application.

Process Solvents:

The Process Solvents part is another important in the global ethyl acetate market. Ethyl acetate functions as a versatile and highly effective processing solvent across diverse sectors, including pharmaceuticals, cosmetics, textiles, and the food and beverage industry. It is utilized for extraction, purification, and separation processes due to its excellent solvency power and compatibility with a wide range of chemicals. Rising industrial operations and ened demand for processed goods are propelling the need for ethyl acetate as a processing solvent.

Pigments:

The Pigments segment is anticipated to witness consistent growth within the global ethyl acetate market. Ethyl acetate serves as a dispersing agent for pigments across a range of applications including paints, inks, and coatings. It aids in the uniform dispersion of pigments, enhances color development, and improves the overall performance of the final product. The rising demand for vibrant and high-quality colors in the automotive, construction, and textile industries is driving the use of ethyl acetate in this part.

Insights On Key End-use

Automotive

Automotive sector is expected to dominate the Global Ethyl Acetate market. In the Automotive part, the demand for ethyl acetate is anticipated to be driven by its use as a solvent in automotive paints and coatings. Ethyl acetate provides good solvency for various resins and is widely used in automotive refinishing applications.

Food & Beverage

The surge in demand for ethyl acetate as both a flavoring agent and solvent within the food and beverage sector is a significant contributing factor to this trend. Ethyl acetate is used in the production of artificial flavors and fragrances, as well as in the extraction of flavors from various food ingredients. Its characteristics, including low toxicity and appealing scent, render it appropriate for incorporation into food and beverage products.

Artificial Leather

In terms of Artificial Leather, the section focusing on Ethyl Acetate is anticipated to see moderate growth. Ethyl acetate is employed in artificial leather production due to its solvent capabilities and volatility. It is utilized in the coating and finishing process of artificial leather, contributing to its texture and appearance.

Packaging

The Packaging industry is forecasted to undergo consistent growth. Ethyl acetate serves as a solvent in printing inks, adhesives, and lacquers utilized in packaging materials. With the rising demand for packaged goods and the expansion of e-commerce activities, the need for ethyl acetate in the packaging sector is expected to rise.

Pharmaceutical

The pharmaceutical sector's demand for ethyl acetate is anticipated to be fueled by its role as a solvent in pharmaceutical drug manufacturing. Ethyl acetate is employed in the extraction and purification of active pharmaceutical ingredients, as well as in pharmaceutical formulations as a solvent. However, the growth rate in this part might be relatively lower compared to others due to stringent regulations and high-quality standards in the pharmaceutical industry

Insights On Key Distribution Channel

Offline Distribution Channel

The offline distribution channel holds the maximum share in the Global Ethyl Acetate market. The offline distribution channel encompasses traditional brick-and-mortar outlets, specialty stores, and supermarkets. Certain consumers opt for physically inspecting and purchasing products to ensure they meet their quality and specification standards. Additionally, the offline distribution channel provides a platform for instant gratification and personalized assistance from sales representatives. Although online shopping is gaining popularity, the offline distribution channel remains significant, catering to a substantial consumer base and contributing to the overall market. Consequently, the online distribution channel is expected to be the dominating part of the Global Ethyl Acetate market.

Online Distribution Channel

Although the offline distribution channel is expected to dominate the market, the online distribution channel is projected to have the highest growth the Global Ethyl Acetate market. With the increasing penetration of the internet and the rising trend of e-commerce, consumers are increasingly preferring the convenience and ease of purchasing products online. Online platforms offer an extensive array of choices and expedited delivery services, drawing in a broader consumer demographic. Additionally, the COVID-19 pandemic has hastened the transition to online shopping, as individuals opt to steer clear of crowded retail establishments.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global ethyl acetate market. The region will witness significant growth owing to the rapid industrialization, increasing population, and rise in disposable income. Additionally, the expanding textile, automotive, and cosmetics industries are driving the demand for ethyl acetate in this region. The presence of major market players and the availability of raw materials at a relatively lower cost are further boosting the market growth in Asia Pacific.

North America

One of the most significant regions for the global ethyl acetate market is North America. The region's economy is booming because ethyl acetate is in high demand across several end-use sectors, including the pharmaceutical, food and beverage, and paint and coating industries. The industry is growing in part because of the stringent rules that these businesses must follow when using chemicals. Moreover, technological advancements and innovative applications of ethyl acetate in different sectors are expected to further propel the market in North America.

Europe

Europe is a well-established market for ethyl acetate due to the presence of various industries and a mature consumer base. On the other hand, strict controls on the use of specific chemicals and rising environmental concerns are likely to cause the market to expand moderately. Despite these challenges, the demand for ethyl acetate in the region remains steady, driven by the pharmaceutical, packaging, and automotive sectors. Continuous research and development activities to develop bio-based ethyl acetate formulations are also expected to contribute to market growth in Europe.

Latin America

There is a lot of room for expansion in the ethyl acetate market in Latin America. Ethyl acetate is in high demand due to its versatility and the region's fast urbanization and industrialization. The ethyl acetate market in Latin America is seeing expansion due to the increasing demand from the automotive, electronics, and construction sectors. Market expansion in this area is bolstered by supportive government programs and rising expenditures in infrastructure development.

Middle East & Africa

The ethyl acetate market is anticipated to experience consistent expansion in the Middle East and Africa region. The region's growth is mostly driven by the booming construction sector and increased expenditures in infrastructure projects. Additionally, the rising packaging and automotive sectors are contributing to the demand for ethyl acetate in this region. However, issues such as restricted availability of raw materials and problems connected to transportation and distribution may impede the market expansion in the Middle East & Africa.

Company Profiles:

Prominent entities within the worldwide ethyl acetate sector significantly impact the manufacturing and supply chain of this compound, fostering its consistent expansion and catering to diverse industry needs. Their astute initiatives to broaden market reach and improve production capacities drive the advancement and progression of the global ethyl acetate industry.

Leading companies in the global ethyl acetate industry comprise a distinguished lineup including INEOS, Celanese Corporation, Eastman Chemical Company, Nippon Paint Holdings Co., Ltd., Dubai Petrochemicals Company, Showa Denko K.K., Solvay S.A., GNFC Ltd., Wacker Chemie AG, and Mitsubishi Chemical Corporation. These industry titans actively engage in the manufacturing, delivery, and promotion of ethyl acetate, a widely utilized solvent across diverse sectors such as paints and coatings, printing inks, adhesives, pharmaceuticals, and food and beverages. The competition within this group is steered by elements like product excellence, inventive solutions, pricing strategies, operational efficiency, and client partnerships, as each company endeavors to secure a notable position within the ethyl acetate market.

COVID-19 Impact and Market Status:

The global ethyl acetate market has experienced an adverse effect due to the Covid-19 pandemic, causing a decrease in demand as a result of disruptions in multiple end-use sectors.

The global Ethyl Acetate market has been significantly impacted by the ongoing COVID-19 pandemic. The stringent lockdown measures and travel restrictions implemented by governments around the world have disrupted supply chains, resulting in a decrease in the production and trade of various goods, including Ethyl Acetate. Moreover, the decreased industrial activities and closure of key end-use industries like automotive, construction, and packaging have further reduced the demand for Ethyl Acetate, leading to a decline in market revenue and profitability. However, as the world progressively recovers from the epidemic and businesses reopen, the Ethyl Acetate industry is predicted to enjoy a steady rebound. The rising demand for Ethyl Acetate in varied areas such as paints & coatings, adhesives, and food and beverage is likely to fuel market expansion post-pandemic. Additionally, the introduction of various stimulus packages and governmental initiatives designed to jumpstart the economy is poised to offer opportunities for market participants to recover and reestablish their position in the industry.

Latest Trends and Innovation:

- In January 2020, BASF SE completed the acquisition of Solvay's integrated polyamide business.

- In February 2021, Eastman Chemical Company announced the expansion of its ethyl acetate production capacity at its facility in Kingsport, Tennessee.

- In May 2021, Celanese Corporation announced plans to acquire Mitsui's 32.5% equity interest in the Ibuprofen Joint Venture between the two companies.

- In July 2021, INEOS Oxide completed the acquisition of The Dow Chemical Company's ethyl acetate business.

- In September 2021, China National Petroleum Corporation (CNPC) announced the successful development of a new ethyl acetate production technology.

- In October 2021, The Dow Chemical Company announced the completion of its merger with DuPont, creating the new company DowDuPont Inc.

- In November 2021, Jubilant Life Sciences Limited announced the acquisition of a specialized chemical manufacturing plant in Manchester, UK to increase their ethyl acetate production capabilities.

Significant Growth Factors:

The ethyl acetate market is experiencing growth due to rising demands across diverse sectors including pharmaceuticals, paints and coatings, as well as food and beverages. This development is further encouraged by its ecologically favorable qualities and financial advantages.

The ethyl acetate market is seeing considerable expansion due to many important reasons. One of the key factors is the increased demand for ethyl acetate across varied sectors such as paints, textiles, medicines, and food & drinks. This chemical compound is widely utilized as a solvent in these sectors because of its favorable characteristics such as low toxicity, high volatility, and fast-drying attributes. Additionally, the rising usage of ethyl acetate as a flavor enhancer in the food and beverage sector is helping to the market development. The automobile industry's rise, particularly in emerging nations, is also pushing the need for paints and coatings, consequently raising the need for ethyl acetate. The global rise in construction activities is further boosting the consumption of paints and coatings, consequently raising the demand for ethyl acetate. Furthermore, the expanding pharmaceutical sector, fueled by surging disease rates and the demand for innovative medications, is stimulating the requirement for ethyl acetate as a solvent. These growth drivers, combined with the ready availability and cost-effectiveness of ethyl acetate, are anticipated to propel market growth in the coming years.

Restraining Factors:

The expansion of the ethyl acetate market is limited by the restricted availability of raw materials and the volatility of prices.

The market for ethyl acetate is confronting various constraining elements that could impede its advancement. Chief among these challenges is the erratic nature of raw material prices – namely ethyl alcohol and acetic acid – which are pivotal in the production of ethyl acetate. Price fluctuations have the potential to significantly impact profit margins and obstruct market expansion. Furthermore, the imposition of strict regulations and protocols by governmental bodies concerning the use of chemicals across diverse industries represents another obstacle to market growth. Complying with these directions involves extensive investment in research and development, as well as adherence to demanding manufacturing standards, consequently rising production costs. Availability of substitutes like methyl acetate or ethyl propionate for specific applications serves as an additional limiting factor that may reduce the demand for ethyl acetate. The repercussions of the COVID-19 pandemic on the global supply chain have also affected the production and distribution of ethyl acetate, resulting in supply shortages and price hikes.

Despite these hurdles, the ethyl acetate market is poised for rise in the near future owing to its numerous uses in industries such as paints, coatings, medicines, and food & beverages. The rising need for environmentally friendly and sustainable solvents, along with the introduction of innovative technologies and production methodologies, presents an avenue for market participants to overcome these impediments and foster the growth of the ethyl acetate sector in the long term.

Key Segments of the Ethyl Acetate Market

Ethyl Acetate Application Overview

- Paint & Coatings

- Inks

- Process Solvents

- Pigments

- Other Applications

Ethyl Acetate End-use Overview

- Artificial Leather

- Automotive

- Food & Beverage

- Packaging

- Pharmaceutical

- Other End-uses

Ethyl Acetate Distribution Channel Overview

- Offline

- Online

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K.

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America