The size of the global market for flat glass was USD 140.30 billion in 2021, and it is anticipated to grow to USD 261.64 billion in 2030, at a CAGR of 7.5% over the forecast period.

.jpg

)

Global flat glass market accounted for a market revenue of USD 93.0 billion in the year 2018. Developing food & beverage, automotive, and construction sectors are the key factors driving the demand of the flat glass industry. Safety and occupational hazards related to glass production is hindering the market of flat glass from reaching its full potential. Furthermore, the logistic cost is another key factor restraining the growth of this industry.

The flat glass industry has seen a reduction in employment owing to technological advancement that has somehow reduced the need for manual labor. Nevertheless, growing demand from developing nations such as Brazil, China, and India has seen an increase in the flat glass industry in terms of demand for employment. Global flat glass demand surpassed 9.1 billion square meters in the year 2018 and is expected to grow considerably over the foreseeable future.

Need to reduce the carbon footprint coupled with initiatives from regulatory bodies is driving the demand for a range of various types of glass such as low emissivity windows and energy saving glass range. Likewise, end-use sectors such as electric vehicles and housing schemes from the government are anticipated to be key drift expanding the global flat glass industry.

Flat glass industry across the globe is fragmented in nature with nearly more than 110 companies producing flat glass at present. Trends like restructuring and consolidation are expected to shape the global flat glass industry for the new entrants as well as established players. However, organized players still dominate the global flat glass market and account for nearly more than 50% of the market share. For instance, Indian flat glass industry is dominated by established players such as MODIGUARD, LaOpala RG Limited, Piramal Glass, Borosil, Saint-Gobain, AGC Inc., and Hindusthan National Glass. These players hold nearly 70% of the market share followed by unorganized players with nearly 30% of the market share.

Flat Glass Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 261.64 billion |

| Growth Rate | CAGR of 7.5 % during 2020-2030 |

| Segment Covered | End-user Industry, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AGC Inc.; Cevital Group; Euroglas; Guardian Industries; Saint-Gobain; ÅžiÅŸecam Group; Vitro |

Key segments of the global flat glass market

Product Overview

- Tempered

- Laminated

- Basic float

- Insulating

- Others

Application Overview

- Automotive

- Construction

- Others

Region Overview

- North America

- U.S.

- Canada

- Europe

- Germany

- Asia Pacific

- China

- India

- Central & South America

- Brazil

- Middle East & Africa

Frequently Asked Questions (FAQ) :

At present, the float process is the most commonly used technique in the production of flat glass. This process is likely stable in comparison with Pittsburgh and Colburn process and accomplishes large-scale industrial production. Rising labor, energy and environmental cost, globalization is expected to be the unavoidable choice.

There lies a huge scope for the flat glass in the construction. Glass not only makes the structure look elegant but at the same time it improves the use of natural light. Furthermore, buildings account for nearly 50% of energy consumption. They are also considered to be the largest emitter of CO2 but they can also save most of the energy since construction holds more than 70% of the share in the global flat glass industry.

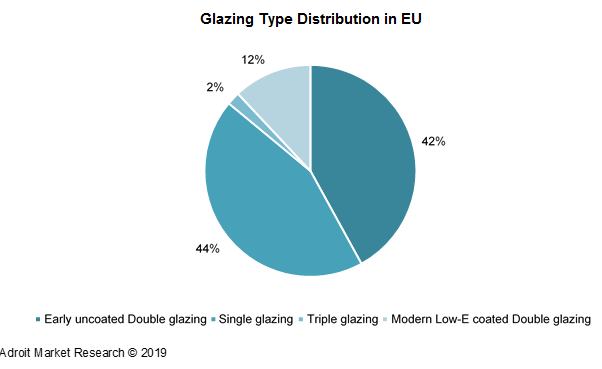

Large glazed designed flat glass in the construction industry is essential to turn the building as energy efficient. Architects that are specialized in the low energy building, utilize large glazed areas in their designs to increase productivity and comfort. For instance, In the European Union (EU) the single glazing accounts for 44% followed by early uncoated double glazing which holds 42% of the market share.

Glass products deliver many ways in reducing carbon emission but it is also important for this industry to take advantage of these benefits in order to realize the full potential of an economical low carbon economy. For instance, perfect performance is accomplished when a product saves more amount of carbon emission when in use than it generates during its production.

The main market of flat glass includes windows and facades for building, windscreen, backlights, sunroof, side glazing, and rear-side glazing for automotive. Additionally, flat glass is finding its way in solar thermal and photovoltaic panels in the solar-energy application. Domestic furniture, mirrors, and appliances are some of the other applications of flat glass.

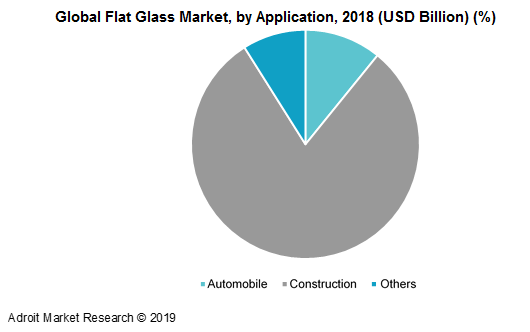

In terms of application, construction segment generated maximum market revenue in the year 2018 and accounted for over 80% market share in 2018. Growth in manufacturing real estate structure, commercial, and housing buildings such as hotels, workshops, shopping centers, warehouses, office buildings, etc. are thriving the global flat glass market.

The automotive industry is the fastest growing sector of the global flat glass market. Macro trends, such as driverless cars, and focus on CO2 emission are likely to aid the global flat glass market growth. Furthermore, utilization of flat glass in the windshield, body glass, backlights, sidelights, etc. and the ability of flat glass to be fabricated as per customer need is projected to drive the demand for the product in automotive OEM.

Product wise, tempered flat glass dominated the global flat glass market in the year 2018 and is anticipated to maintain its dominance over the forecast period. Automotive glass is designed to last for a lifetime to maintain quality and safety requirement hence, tempered and laminated glass type is widely used in the side windows of automotive to provide comfort and security against theft and impact. Tempered glass is light in weight that supports reduce the weight of the vehicle which eventually reduces the energy consumption of the vehicle. Laminated glass type is anticipated to exhibit the fastest growth of about 7.7% in the coming years.

In terms of region, North America, Europe, and the Asia Pacific together accounted for a market volume share of more than 85% in the year 2018. This share is further anticipated to increase over the forecast period owing to increasing demand from countries such as India, China, Germany, and Brazil. Value-added glass and mirrors & furniture sectors are one of the segments driving the demand of flat glass in countries like India other than construction and automotive.