Market Analysis and Insights:

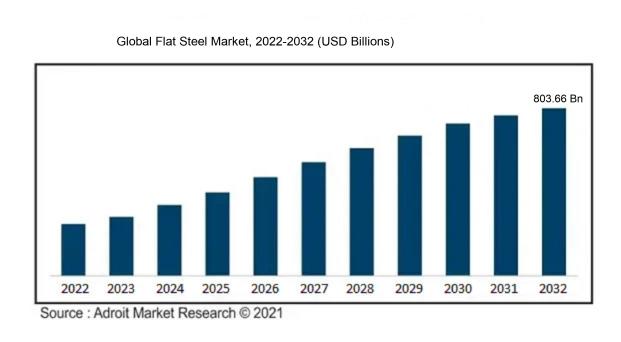

The market for Flat Steel was estimated to be worth USD 433.79 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 4.56%, with an expected value of USD 803.66 billion in 2032.

Several factors drive the demand for flat steel in the market. The construction industry serves as a key influencer, utilizing flat steel extensively in infrastructure projects, residential and commercial constructions, and in the production of various building materials. The automotive sector also significantly contributes to the demand for flat steel, employing it for its robustness and longevity in manufacturing vehicles and components. Energy industries such as oil and gas further boost the need for flat steel in constructing pipelines and storage facilities. Additionally, the market benefits from the increasing demand for renewable energy sources like wind turbines and solar panels. The rise of urbanization, industrialization, and infrastructure projects in developing nations is projected to increase the demand for flat steel. Technological developments in production methods and the introduction of advanced alloys are expected to further propel market growth. Lastly, government support for sustainable construction practices and investments in various sectors are set to have a positive impact on the flat steel market.

Flat Steel Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 803.66 billion |

| Growth Rate | CAGR of 4.56% during 2024-2032 |

| Segment Covered | By Product Type ,By End-use, By Process, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ArcelorMittal, POSCO, Nippon Steel Corporation, JFE Steel Corporation, Hesteel Group, Ansteel Group, Tata Steel, ThyssenKrupp AG, United States Steel Corporation, Nucor Corporation, Baosteel Group, Wuhan Iron and Steel Corporation, Shougang Group, Hyundai Steel Company, Essar Steel, China Steel Corporation, JSW Steel Limited, Gerdau SA, Steel Authority of India Limited, and Severstal. |

Market Definition

Flat steel, a steel product crafted into a flat form with a rectangular cross-section and consistent thickness along its length, finds widespread application across industries such as construction, automotive, and packaging.

Flat steel is highly valued across industries because of its versatile properties. It is renowned for its strength and longevity, making it ideal for use in construction for creating beams, columns, and other structural elements. Its flat profile facilitates easy cutting and shaping, making it a preferred material for producing automotive components, appliances, and machinery.

Additionally, its even surface aids in precise welding, enhancing its utility in construction and manufacturing processes. The malleability of flat steel allows for effortless transformation into various shapes and styles, making it a sought-after material for architectural and interior design projects. Overall, flat steel is crucial due to its robustness, adaptability, and flexibility, playing a significant role in numerous industries.

Key Market Segmentation:

Insights On Key Product Type

Sheets & Strips

The Sheets & Strips product type is expected to dominate. Sheets and strips are widely used in various industries such as automotive, construction, and packaging, due to their versatility and ease of use. The demand for sheets and strips is driven by the growing construction activities, increasing automotive production, and rising consumer goods packaging. Moreover, advancements in technology and manufacturing processes have led to the production of high-quality sheets and strips, further boosting their demand in the market. The Sheets & Strips part is likely to maintain its dominance in the global flat steel market due to its wide range of applications and consistent demand.

Hot-Rolled Coil

Hot-Rolled Coil is another significant product type in the global flat steel market. Hot-rolled coils are produced through a hot rolling process, which results in a smooth and flat surface finish. These coils are widely used in automotive manufacturing, construction, and infrastructure development. The increasing demand for lightweight and fuel-efficient vehicles has led to a rise in the production of hot-rolled coil for automotive applications. Additionally, the growth in infrastructure projects, especially in emerging economies, has also contributed to the demand for hot-rolled coil for construction purposes. Although the Sheets & Strips part is expected to dominate, hot-rolled coil remains a vital part in the global flat steel market.

Cold-Rolled Coil

Cold-Rolled Coil is a product type that holds a significant market share in the global flat steel market. Cold-rolled coils are processed at low temperatures, resulting in improved surface finish, uniform thickness, and enhanced mechanical properties. These coils are mainly used in industries such as automotive, construction, and appliances. The increasing demand for high-quality steel products with superior mechanical properties has propelled the demand for cold-rolled coil. Moreover, the growing emphasis on energy-efficient buildings and appliances has further boosted the market for cold-rolled coil in the construction and appliances sectors. Although it may not dominate the market, the Cold-Rolled Coil part remains an important player in the global flat steel market.

Slabs

Slabs are an integral product type of the global flat steel market. Slabs are the initial form of semi-finished steel products and serve as raw materials for various downstream processes. They are primarily used in the production of hot-rolled coils and other flat steel products. The demand for slabs is closely related to the overall demand for flat steel products in different industries, particularly in the construction and automotive sectors. As the starting point of the production chain, the slab part plays a crucial role in the global flat steel market. However, it is not expected to dominate the market due to its positioning as a raw material rather than a finished product.

Tinplate

Tinplate is a specialized product type in the global flat steel market, primarily used in the packaging industry. Tinplate refers to steel coated with a thin layer of tin, providing excellent corrosion resistance and aesthetic appeal. The growing demand for canned food and beverages, particularly in emerging economies, has significantly contributed to the demand for tinplate. The durability and sustainability offered by tinplate packaging have made it a popular choice among manufacturers and consumers. Although its market share may not be dominant compared to other parts, the tinplate part holds a crucial position in the flat steel market due to its specific applications in the packaging industry.

Coated Steel

Coated steel is another product type in the global flat steel market, characterized by a protective coating applied to the steel surface. This coating enhances its corrosion resistance, aesthetics, and durability. Coated steel finds applications in various sectors such as automotive, construction, appliances, and packaging. The demand for coated steel is driven by factors such as increased construction activities, growing automotive production, and the need for high-quality packaging materials. Although it may not dominate the market, the coated steel part plays a significant role in the global flat steel market by offering enhanced properties and fulfilling specific requirements of different industries.

Insights On Key End-use

Building & Construction

Building & Construction is expected to dominate the Global Flat Steel Market. Flat steel is widely used in the construction industry for various applications such as roofing, flooring, walling, and structural components. The demand for flat steel in the building and construction sector is driven by the growth in infrastructure development projects and the increasing trend towards sustainable and energy-efficient construction. Moreover, the rising population and urbanization have led to a surge in residential and commercial construction activities, further augmenting the demand for flat steel in this part.

Automotive & Transportation

The Automotive & Transportation end-use is another significant consumer of flat steel. Flat steel is extensively used in the manufacturing of vehicle bodies, chassis, and other structural components due to its high strength, durability, and excellent formability. The automotive industry is witnessing steady growth globally, driven by increasing disposable income, urbanization, and the demand for fuel-efficient vehicles. As a result, the demand for flat steel in the automotive and transportation sector is expected to rise, though it may not dominate the market compared to the Building & Construction part.

Machinery

In the Machinery end-use, flat steel plays a crucial role in the manufacturing of various machinery components. Flat steel is utilized in the fabrication of frames, panels, gears, and shafts, among others. The growth of the machinery industry, driven by industrialization and the increasing demand for automated manufacturing processes, fuels the demand for flat steel. However, this part is not expected to dominate the Global Flat Steel Market, as the demand from building & construction and automotive & transportation sectors is typically higher.

Electronics

The Electronics end-use, although requiring minimal flat steel consumption, utilizes it for specific applications. Flat steel is used in the manufacturing of electronic enclosures, cabinets, and equipment racks due to its excellent electromagnetic shielding properties and corrosion resistance. However, the demand for flat steel in the electronics sector is relatively limited compared to other parts, and it is unlikely to dominate the Global Flat Steel Market.

Consumer Goods & Appliances

Flat steel is also utilized in the manufacturing of consumer goods and appliances such as refrigerators, washing machines, and stoves. However, the demand from this part is relatively low compared to the building & construction and automotive & transportation sectors. As consumer goods and appliances have a lower demand for flat steel compared to other industries, it is not expected to dominate the Global Flat Steel Market.

Oil & Gas

The Oil & Gas part utilizes flat steel for various applications in pipelines, storage tanks, and offshore structures. However, the demand for flat steel in this part is relatively niche in comparison to other sectors. The volatility in oil and gas prices and the complex regulatory environment in the industry can also impact the demand for flat steel. Therefore, the Oil & Gas part is not likely to dominate the Global Flat Steel Market.

Energy

The Energy end-use includes renewable energy projects such as solar and wind energy, which may utilize flat steel for specific applications. However, the prominence of flat steel in this part is limited compared to other industries. The demand for flat steel in the energy sector depends on the investments and policies favoring renewable energy sources. While the demand may grow in the future, the Energy part is not expected to dominate the Global Flat Steel Market.

Insights On Key Process

Electric Arc Furnace

The Electric Arc Furnace process is expected to dominate the Global Flat Steel Market. This is due to several factors including its cost-effectiveness, versatility, and environmental sustainability. Electric Arc Furnace (EAF) technology allows for the production of flat steel using scrap metal as the primary raw material. It offers better energy efficiency compared to the Basic Oxygen Furnace (BOF) process, leading to lower production costs. Additionally, EAF has the advantage of quick start-up, higher steel quality control, and flexibility in producing various types of steel grades. These advantages make the Electric Arc Furnace part the dominant force in the Global Flat Steel Market.

Basic Oxygen Furnace (BOF)

The Basic Oxygen Furnace (BOF) process, while not expected to dominate the Global Flat Steel Market, still holds a significant share in the industry. BOF technology involves the use of pure oxygen to remove impurities from iron, resulting in high-quality steel production. It is commonly used in large-scale steel plants due to its ability to handle high production volumes. However, the BOF process has certain drawbacks, such as higher energy consumption and limited flexibility in steel grades. These limitations make it a less favorable choice compared to the Electric Arc Furnace part. Nonetheless, due to existing infrastructure and cost considerations, the BOF part continues to maintain a substantial presence in the Global Flat Steel Market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global flat steel market. The region has witnessed a significant increase in infrastructure development and construction activities, particularly in emerging economies such as China and India. These countries have shown a robust demand for flat steel products due to the rapid urbanization, industrialization, and growth in the automotive sector. Additionally, the region is home to several major steel producers who have been investing in expanding their production capacities, further boosting the dominance of Asia Pacific in the global flat steel market. The increasing demand for flat steel in various end-use industries, coupled with the favorable government policies promoting infrastructure development, makes Asia Pacific the leading region in the global flat steel market.

North America

Despite the dominance of Asia Pacific, North America holds a significant share in the global flat steel market. The region is home to advanced industries including automotive, construction, and manufacturing, which are major consumers of flat steel products. The recovery in the construction sector, along with the growing demand for lightweight and high-strength steel in the automotive industry, drives the demand for flat steel in North America. Additionally, the region has well-established steel manufacturers and a technologically advanced steel production infrastructure. However, the growing competition from low-cost steel imports and fluctuating raw material prices pose challenges to the growth of the flat steel market in North America.

Europe

Europe is another prominent market for flat steel products, driven by the presence of well-established steel manufacturers and the region's strong automotive and construction industries. The demand for flat steel in Europe is driven by factors such as increasing investments in infrastructure projects, renovation activities, and the shift towards lightweight and sustainable materials. While the market in Europe is mature, it continues to witness innovations in steel production techniques and advancements in product quality to meet the changing market demands. However, factors such as the uncertainty surrounding Brexit and the impact of the COVID-19 pandemic on the region's economy might have short-term implications on the flat steel market in Europe.

Latin America

Latin America represents a significant market for flat steel, primarily driven by countries such as Brazil, Argentina, and Mexico. The region's construction and automotive industries are key consumers of flat steel products. Construction activities, especially in the residential and commercial sectors, supported by government initiatives and investments, drive the demand for flat steel in the region. The automotive industry, too, contributes to the demand, with rising production and increasing focus on lightweight and fuel-efficient vehicles. However, factors like political and economic instability, along with the current COVID-19 pandemic, pose challenges to the growth of the flat steel market in Latin America.

Middle East & Africa

The Middle East & Africa region holds a moderate share in the global flat steel market. The market in this region is driven by infrastructure development projects, particularly in countries like the United Arab Emirates and Saudi Arabia. The region's growing construction sector, along with the demand for flat steel in the oil and gas industry, contributes to the market growth. However, the volatility in oil prices, geopolitical conflicts, and economic instability in some countries may affect the growth of the flat steel market in the Middle East & Africa region. Additionally, the COVID-19 pandemic has added uncertainties and challenges to the market dynamics in the region.

Company Profiles:

Prominent entities within the Global Flat Steel industry play a vital role in influencing market trends, fostering creativity, and satisfying customer needs across the globe. These entities oversee the production, dissemination, and promotion of flat steel items on a global scale, serving diverse sectors including construction, automotive, and packaging.

Prominent companies in the Flat Steel Market encompass ArcelorMittal, POSCO, Nippon Steel Corporation, JFE Steel Corporation, Hesteel Group, Ansteel Group, Tata Steel, ThyssenKrupp AG, United States Steel Corporation, Nucor Corporation, Baosteel Group, Wuhan Iron and Steel Corporation, Shougang Group, Hyundai Steel Company, Essar Steel, China Steel Corporation, JSW Steel Limited, Gerdau SA, Steel Authority of India Limited, and Severstal.

COVID-19 Impact and Market Status:

The worldwide flat steel sector has faced adverse effects as a consequence of the Covid-19 pandemic, leading to a reduction in demand and disturbances in supply networks.

The global flat steel market has been significantly affected by the ongoing COVID-19 pandemic. The implementation of lockdown measures worldwide resulted in a notable downturn in economic activities, leading to a diminished demand for flat steel products. This had a direct impact on various industries, with the construction sector, a significant consumer of flat steel, facing delays and disruptions in projects due to labor shortages and supply chain interruptions. Similarly, the automotive industry, another major end-user of flat steel products, witnessed a sharp decrease in sales as consumer confidence wavered amidst financial insecurities.

Despite the initial challenges, the flat steel market has begun showing signs of recovery as lockdown restrictions have been gradually lifted and economic operations are resuming. Governments worldwide have initiated stimulus packages and invested in infrastructure projects to kickstart their economies, thereby driving up demand for flat steel products in construction and manufacturing sectors. Furthermore, the surge in demand for renewable energy infrastructure and electrical equipment has played a role in bolstering the market's recovery.

As countries continue to navigate the impact of COVID-19 and economic activities return to normal levels, the flat steel market is projected to gradually regain its growth momentum observed prior to the pandemic.

Latest Trends and Innovation:

- In February 2020, ArcelorMittal, a leading steel and mining company, announced the completion of the acquisition of Essar Steel, one of India's largest flat steel producers. This acquisition further expanded ArcelorMittal's presence in the flat steel market.

- In September 2019, Nippon Steel Corporation, headquartered in Japan, successfully launched a new high-strength cold rolled steel sheet. This technology innovation aimed to meet the growing demand for lightweight and high-performance materials in industries such as automotive and construction.

- In July 2019, Tata Steel, one of the world's top steel producers, entered into a joint venture agreement with Thyssenkrupp AG, a German multinational conglomerate. The joint venture, named Thyssenkrupp Tata Steel B.V., was established to create a leading European flat steel producer, reducing overcapacity and increasing competitiveness.

- In November 2018, US Steel Corporation, an American integrated steel producer, acquired a 49.9% ownership stake in Big River Steel, an Arkansas-based steel manufacturing company. This acquisition allowed US Steel to increase its production capabilities and expand its product offerings in the flat steel market.

- In October 2018, POSCO, a South Korean multinational steel-making company, launched a new ultrahigh-strength steel sheet for automobiles. This breakthrough technology offered enhanced crash safety and lightweight design options for automotive manufacturers.

- In September 2018, Baosteel, a Chinese state-owned steel company, announced its intentions to merge with Wuhan Iron and Steel Group Corporation. The merger aimed to consolidate resources, increase efficiency, and create a stronger competitor in the global flat steel market.

Significant Growth Factors:

Factors contributing to the expansion of the Flat Steel Market encompass the surge in urbanization, escalating infrastructural advancements, and the burgeoning needs of the automotive and construction sectors.

The substantial expansion of the flat steel market can be credited to a multitude of influential factors. Primarily, the swift industrialization and urban development in emerging markets have led to an upsurge in construction activities, consequently bolstering the demand for flat steel products within the construction sector. Moreover, the burgeoning automotive industry, particularly in developing nations, has resulted in an increased need for flat steel items utilized in manufacturing automobile components. Furthermore, the escalating investments in infrastructure ventures, such as roads, bridges, and railways, are propelling the demand for flat steel products. In addition, the surging populace and rising disposable incomes have created a ened demand for consumer goods, including household appliances and furniture, both of which heavily rely on flat steel material. The growing recognition of the significance of renewable energy sources is also advancing the demand for flat steel products in the solar power . Additionally, the favorable governmental actions and policies aimed at amplifying domestic production capacities and curbing imports of flat steel items are anticipated to further stimulate market growth. In essence, the pivotal growth drivers of the flat steel market are intrinsically linked to the expansion of the construction industry, the ongoing progression of the automotive sector, infrastructure development endeavors, increasing consumer appetites for goods, the burgeoning renewable energy sector, and the supportive measures implemented by governments to fortify local production capabilities and diminish reliance on imported flat steel products.

Restraining Factors:

Challenges in the Flat Steel Market are driven by the competitive environment and the volatility of raw material costs.

The flat steel industry is encountering various factors that are impeding its progress. The global economic slowdown has led to a reduction in construction activities, a major consumer of flat steel. Fluctuations in raw material prices, like iron ore and coal, have also affected the profitability of flat steel producers. Additionally, strict government regulations on carbon emissions and environmental issues necessitate investments in new technologies and equipment, raising operational expenses. Furthermore, competition from alternative materials such as aluminum and composites has shifted consumer preferences. Trade disputes and tariffs imposed by different countries erect trade barriers and affect global flat steel demand. Despite these challenges, there are positive prospects in the market. The burgeoning population and urbanization in emerging markets offer opportunities for infrastructure development, boosting flat steel demand. Technological progress and process innovations can mitigate the impact of raw material price fluctuations and enhance efficiency. Moreover, the emphasis on sustainability and eco-friendly initiatives presents a chance for flat steel manufacturers to cater to the growing demand for environmentally conscious materials. By implementing appropriate strategies and adapting to evolving market conditions, the flat steel sector can surmount obstacles and achieve growth in the future.

Key Segments of the Flat Steel Market

Product Type Overview

• Slabs

• Hot-Rolled Coil

• Cold-Rolled Coil

• Sheets & Strips

• Tinplate

• Coated Steel

End-use Overview

• Building & Construction

• Automotive & Transportation

• Machinery

• Electronics

• Consumer Goods & Appliances

• Oil & Gas

• Energy

Process Overview

• Basic Oxygen Furnace

• Electric Arc Furnace

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America