Food Packaging Market Analysis and Insights:

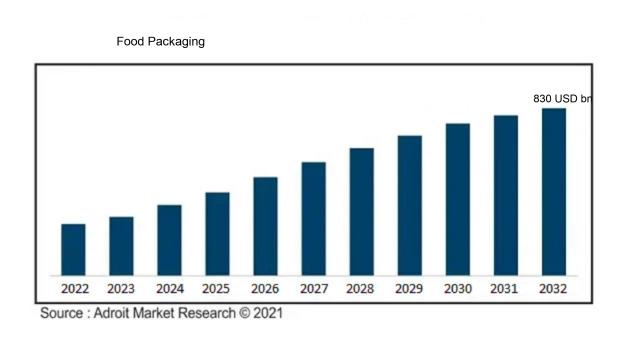

The market for Global Food Packaging was estimated to be worth USD 490 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6.2%, with an expected value of USD 830 billion in 2032.

The Food Packaging Market is fundamentally influenced by several pivotal factors. A primary driver is the increasing consumer preference for convenience and ready-to-eat meal options, which calls for efficient packaging solutions. Heightened health consciousness among consumers has led to a demand for packaging that ensures food safety and prolongs shelf life. Innovations in biodegradable and environmentally friendly materials are becoming more popular, reflecting the growing commitment to sustainability from both consumers and manufacturers. Additionally, regulatory initiatives aimed at minimizing plastic waste and enhancing the recyclability of packaging are steering the market towards more eco-friendly options. Technological progress in packaging methods, including smart packaging technologies, is also improving consumer interaction and safeguarding food quality, thereby fostering the continued advancement of the food packaging industry.

Food Packaging Market Definition

Food packaging encompasses the design and creation of containers intended to protect food products, maintaining their freshness and safety. Food packaging fulfills several essential roles that go beyond just looking appealing. It ensures food products remain fresh and safe by shielding them from contamination, oxidation, and deterioration. Well-designed packaging enhances consumer convenience with features like easy-open mechanisms, resealable options, and portion control. Moreover, it is crucial for brand awareness and marketing, aiding products in distinguishing themselves in a saturated market. Sustainable packaging choices can also boost corporate accountability and attract environmentally aware consumers, thereby enhancing a brand's reputation. In essence, food packaging is vital for preserving product quality, safeguarding safety, and enhancing brand identity in a competitive landscape.

Food Packaging Market Segmental Analysis:

Insights On Key Material

Plastics

Plastics are expected to dominate the Global Food Packaging Market due to their lightweight, durability, and versatility. They are extensively used in various food packaging formats and can be engineered to meet specific requirements such as barrier properties and moisture resistance. The growing demand for convenience in food consumption, especially in the fast-paced lifestyle of urban populations, further drives the adoption of plastic packaging. Additionally, innovations in biodegradable and recyclable plastics are addressing sustainability concerns, making this material increasingly preferred by manufacturers and consumers alike.

Glass

Glass, while not as dominant as plastics, plays a significant role in high-end food packaging, particularly for items such as sauces, beverages, and cured products. Its non-reactive nature and ability to provide an excellent barrier against external elements ensure the preservation of product quality. Furthermore, glass is fully recyclable, making it an attractive option for environmentally conscious consumers.

Metal

Metal packaging, especially aluminum and steel cans, remains popular for beverages and canned food items. The ability of metal to provide airtight seals ensures extended shelf life, making it desirable for products that require longevity. Moreover, metal containers are lightweight and can be easily transported, reducing shipping costs. However, concerns about the potential leaching of metals into food have led to increased scrutiny and the need for additional protective coatings.

Paper & Paperboard

Paper and paperboard are widely used in food packaging, particularly for dry goods and takeaway applications. Their biodegradable nature aligns with the growing emphasis on sustainability in packaging practices. Additionally, advancements in water-resistant and grease-resistant coatings have expanded their applicability for food items that require additional protection. However, their limited moisture barrier properties can pose challenges for packaging perishable products, which may restrict their use in certain s of the food industry.

Wood

Wood is primarily utilized in niche areas of food packaging, such as for luxury items like artisan cheeses and wines, often imparting a unique aesthetic. While it is renewable and has minimal environmental impact compared to synthetic alternatives, its use is limited due to durability concerns and potential contamination risks. Moreover, wood packaging can be costly and less practical for mass production, putting it at a disadvantage against more versatile materials like plastics and metals.

Insights On Key Product Type

Flexible

Flexible food packaging is expected to dominate the Global Food Packaging Market due to its versatility, lightweight nature, and ability to extend product shelf life. The increasing demand for convenience foods, ready-to-eat meals, and on-the-go solutions has augmented the popularity of flexible materials such as pouches and films. Moreover, advancements in packaging technologies, including barrier coatings and resealable features, have further enhanced flexible packaging's appeal. Additionally, its ability to be customized for various products and branding opportunities makes it an attractive choice for manufacturers and retailers, paving the way for its leadership in the market.

Rigid

Rigid food packaging maintains a strong presence in the market, primarily driven by its durability and protective qualities. Common forms include jars, bottles, and containers, which provide excellent support for various food products, particularly those that require protection from external influences. The convenience of portioning, as well as the ease of storing and stacking, contributes to the appeal of rigid packaging. Furthermore, the trend towards e-commerce and home delivery services necessitates robust packaging solutions, which reinforces the demand for rigid formats, ensuring they remain a significant player in the overall food packaging landscape.

Semi-rigid

Semi-rigid packaging serves as a unique solution within the food packaging market, offering characteristics derived from both rigid and flexible formats. This type includes trays, clamshells, and containers that provide decent structural integrity while allowing adaptability. Semi-rigid options are appealing for fresh produce and bakery items as they offer an optimal display while minimizing damage during handling and transportation. The growing consumer preference for visually appealing and functional packaging boosts the growth of this category, particularly in sectors such as deli and takeout services, making it an important in modern food packaging approaches.

Insights On Key Packaging Type

Bags & Pouches

Bags & pouches are expected to dominate the Global Food Packaging Market due to their versatility and cost-effectiveness. These packaging types are easy to transport, lightweight, and offer excellent barrier properties that help in prolonging the shelf life of food products. As consumers increasingly demand convenience and sustainability, bags and pouches align well with modern lifestyle trends. Furthermore, advances in packaging technology have improved the functionality of these products, allowing for resealable options that enhance their user-friendliness. The rising demand for packaged food, particularly in the snack, further supports the growth of bags and pouches in the market.

Films & Wraps

Films and wraps are gaining traction in the food packaging sector due to their ability to preserve freshness and extend shelf life. These flexible materials are particularly popular for wrapping perishable items and can be customized for strength and thickness depending on the requirements of the food product. Additionally, the lightweight nature of films and wraps makes them a preferred choice for manufacturers looking to reduce shipping costs. The focus on minimizing food waste has also led to an increased demand for high-performance films that provide enhanced barrier properties, catering to the evolving needs of consumers.

Stick Packs & Sachets

Stick packs and sachets are becoming more prevalent in single-serve packaging, driven by the demand for portion control and convenience among consumers. Ideal for snacks, beverages, and condiments, these formats allow for easy handling and reduced product waste. The compact size and lightweight nature of stick packs and sachets make them highly portable, aligning well with busy lifestyles. Moreover, innovations in packaging technology, such as easy-open designs and resealable options, further enhance their usability and appeal in the competitive food and beverage landscape.

Bottles & Jars

Bottles and jars remain a staple in the food and beverage packaging market, particularly for liquids and semi-solid items. They provide excellent protection from external contaminants and allow for easy pouring or dispensing. With an increasing focus on sustainability, there has been a notable shift towards recyclable glass and plastic options. Additionally, innovative designs and functionalities, such as wide-mouth openings or squeeze bottles, cater to enhanced user experiences. The demand for organic and artisanal products has also led to a rise in the use of glass jars, further solidifying their role in the packaging market.

Boxes & Cartons

Boxes and cartons are essential for the carton packaging, particularly in the realm of dry foods and cereals. They are highly effective in protecting products during transport and offer ample space for branding and nutritional information. Their lightweight and durable nature help in minimizing shipping costs, while many boxes and cartons are made from recyclable materials, aligning with the current push for eco-friendly packaging solutions. The versatility of these formats allows for stacking and efficient shelf display in retail environments, making them a preferred choice among manufacturers for various food products.

Cans

Cans are a traditional and reliable choice for packaging many food products such as fruits, vegetables, and prepared meals. The canning process offers a unique ability to preserve food for extended periods without the need for refrigeration, making it ideal for both domestic and international markets. Metal cans provide excellent protection against physical damage, light, and oxygen, which is crucial in maintaining food quality. Additionally, with advancements in can manufacturing, there is an increased focus on recyclable and eco-friendly materials, aligning with consumer preferences for sustainable packaging options.

Trays

Trays are prominently used for fresh food items such as fruits, vegetables, and meats, providing both protection and convenience for consumers. Their structural integrity allows multiple layers of food products to be displayed attractively in retail settings. Often made from recyclable plastic, trays can be designed to include specific divisions for different food items, ensuring safe transportation without cross-contamination.

Clamshells

Clamshells have emerged as a popular choice for packaging fresh produce and ready-to-eat meals. Their hinged design allows for easy access while ensuring that the food remains secure and protected. Clamshell packaging is particularly valued for its visibility, enabling consumers to see the product without having to open it. Furthermore, the adaptability of materials used in clam packaging systems allows manufacturers to cater to various product types. As sustainability becomes a priority, many clamshells are being designed with recyclable materials, appealing to conscious consumers in the modern market.

Insights On Key Application

Meat, Poultry & Seafood

The Meat, Poultry & Seafood is expected to dominate the Global Food Packaging Market due to growing consumer demand for protein-rich foods and the increasing focus on food safety and shelf life extension. The rise in meat consumption globally, particularly in developing nations, is driving the need for innovative packaging solutions that offer better preservation, convenience, and sustainability. Furthermore, the ened focus on traceability and transparency in food supply chains is pushing manufacturers to invest in advanced packaging technologies that not only meet regulatory requirements but also appeal to health-conscious consumers. Consequently, this sector is likely to lead the market due to its critical importance in maintaining food quality and safety.

Fruits & Vegetables

The Fruits & Vegetables category plays a critical role in the food packaging market. As consumers increasingly adopt healthier eating habits, the demand for fresh produce has surged. This sector is becoming more focused on sustainable packaging solutions, such as biodegradable materials, to cater to environmentally conscious consumers. Innovations in packaging that extend shelf life while preserving freshness, such as vacuum sealing and modified atmosphere packaging, are also driving growth. Additionally, the rise of e-commerce in grocery shopping necessitates durable and protective packaging to ensure that fruits and vegetables arrive in optimal condition, reinforcing their significance in the food packaging landscape.

Bakery & Confectionery

The Bakery & Confectionery sector is witnessing robust growth driven by the rising popularity of convenient snack options and indulgent treats. Packaging in this category focuses on enhancing product appeal and maintaining freshness, which is essential for baked goods that have a limited shelf life. Innovations such as tamper-evident and resealable packaging are particularly important for attracting consumers and ensuring food safety. The booming demand for artisan and organic bakery products is also leading to a push for eco-friendly packaging solutions. Consequently, this is carving a substantial niche within the overall food packaging market.

Dairy Products

The Dairy Products sector is notable for its need for efficient packaging solutions that preserve product integrity and extend shelf life. Innovations such as smart packaging technologies are becoming increasingly prevalent, enabling real-time tracking of freshness and quality. This category is responding to growing consumer demands for convenience and health-oriented products, leading to the introduction of single-serve packaging formats. Furthermore, sustainability efforts are pushing manufacturers to adopt environmentally friendly materials, which is becoming a significant differentiator in the competitive landscape. Therefore, the Dairy Products sector remains a vital component of the food packaging market.

Sauces, Dressings, and Condiments

The Sauces, Dressings, and Condiments sector is consistently expanding, driven by the growing inclination for flavorful and diverse culinary experiences among consumers. Innovative packaging solutions that offer portion control and ease of use are on the rise, enhancing consumer convenience. Moreover, the increased popularity of international cuisines is encouraging brands to introduce new flavors and varied offerings. This sector is also focusing on sustainable practices, with many brands moving towards eco-friendly packaging alternatives. As consumer preferences evolve, this category adapts quickly, maintaining its importance in the broader food packaging market while catering to dynamic market trends.

Others

The "Others" category encompasses a wide variety of food products and is characterized by specialized packaging solutions tailored to different food types. This category includes frozen foods, snacks, and prepared meals, all of which require unique packaging to meet quality and safety standards. The increasing demand for ready-to-eat meals and frozen foods, particularly among busy urban consumers, drives growth in this sector, making convenience a significant driver. Additionally, trends toward healthier snack options are prompting shifts in packaging designs to attract health-conscious buyers. The diversity within this group affirms its relevance in the overall food packaging market.

Insights On Key End User

Chain Restaurants

Chain restaurants are expected to dominate the Global Food Packaging Market due to their extensive reach, brand consistency, and high operational efficiency. These establishments have numerous outlets, often requiring standardized packaging solutions that facilitate branding and ensure quality across various locations. Moreover, as chains are increasingly focusing on sustainability and consumer preferences, they are more likely to invest in innovative packaging that caters to health-conscious consumers and environmentally friendly practices. Their substantial purchasing power allows them to negotiate better pricing and develop long-term relationships with packaging suppliers, further solidifying their leading position in the market.

Quick Service Restaurants

Quick service restaurants (QSRs) are characterized by their speed of service, affordable pricing, and high customer turnover. This significantly contributes to the food packaging market as it requires disposable packaging for takeout and delivery options. The surge in online food delivery services has led to a notable increase in demand for efficient and convenient packaging solutions tailored for QSRs. Innovations in packaging materials and designs aimed at improving the customer experience, such as tamper-proof and eco-friendly containers, further drive the growth and resilience of this sector.

Cafe & Kiosks

Cafés and kiosks are vital players in the food packaging market, especially in urban areas where they cater to on-the-go consumers seeking quick snacks or beverages. These establishments emphasize the aesthetic and functional aspects of packaging, often focusing on branding to enhance customer experience. The rise in consumer demand for artisan and specialty products has encouraged cafés and kiosks to adopt unique packaging solutions that attract attention and convey quality.

Full-Service Restaurants

Full-service restaurants offer a diverse range of cuisines and dining experiences, which has a direct impact on their packaging needs. Although typically associated with dine-in services, the trend toward takeaway meals has prompted these establishments to invest in high-quality packaging to preserve food integrity and enhance presentation. Moreover, full-service restaurants seek packaging that aligns with their brand identity, often choosing elegant and durable materials that reflect the quality of their offerings. As dining patterns evolve post-pandemic, this sector is expected to embrace innovative packaging solutions that cater to both takeout and delivery demands.

Others (FMCG, Hotels, Retailers)

The "Others" category, which includes FMCG companies, hotels, and retailers, plays a crucial role in the food packaging market by creating packaging solutions that prioritize convenience and shelf appeal. These industries often seek packaging that maintains freshness and extends shelf life while ensuring regulatory compliance. The growth of e-commerce and the trend towards pre-packaged meals have increased the demand for stylish and functional packaging, which can enhance the consumer's shopping experience. Furthermore, sustainability is becoming a focal point in this as businesses aim to reduce their environmental impact with recyclable and biodegradable packaging options.

Global Food Packaging Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Food Packaging market due to several dynamic factors. The region has seen rapid urbanization and an increase in disposable income, leading to ened consumer demand for convenient and packaged food products. Additionally, a robust food processing industry, especially in countries like China and India, is driving innovations and investments in food packaging technologies. The prevalence of a younger population that values convenience and sustainability further supports the growth of this. Moreover, the region's strong manufacturing capabilities and strategic investments in packaging technologies place it ahead of other regions in adopting advanced packaging solutions.

North America

North America remains a strong contender in the Global Food Packaging market, characterized by a well-established food industry and high consumer awareness regarding food safety and packaging standards. The demand for sustainable and environmentally friendly packaging solutions is significant, pushing companies to innovate and invest in eco-friendly materials, such as biodegradable plastics. The rapid adoption of smart packaging technologies and the growth of e-commerce also fuel the market in this region, as consumer preferences shift towards convenience and efficiency.

Europe

Europe’s food packaging market is driven by strict regulatory frameworks concerning food safety and environmental sustainability. Countries in this region are increasingly focusing on recyclable and reusable packaging solutions. Demands for high-quality, premium packaging also persist, supported by the rising trend of organic food consumption. Innovations in food preservation techniques are creating evolving opportunities within the market, ensuring that Europe remains a key player on the global stage despite challenges such as economic fluctuations and varying packaging regulations across countries.

Latin America

Latin America is witnessing steady growth in its food packaging market, fueled by a burgeoning middle class and a growing awareness of health and nutrition. The region is experiencing an increase in investments, particularly in advanced packaging technologies, which are essential for enhancing shelf life and reducing food waste. However, challenges such as economic instability and fragmented regulations can affect the market's progress. Despite these hurdles, the rising demand for convenience food products provides an optimistic outlook for future growth in food packaging.

Middle East & Africa

The Middle East and Africa are emerging markets for the Global Food Packaging industry, influenced by changing consumer lifestyles and urbanization. With a growing population and an increasing demand for processed and packaged foods, this region shows significant potential for market growth. Additionally, many countries are investing in infrastructure improvements and technology enhancements that will support packaging innovations. However, economic disparities and infrastructural challenges remain hurdles that could limit rapid growth in certain areas of this region.

Food Packaging Competitive Landscape:

Leading entities in the Global Food Packaging sector, encompassing manufacturers, suppliers, and retailers, are pivotal in fostering innovation and promoting sustainability. They are engaged in the creation of cutting-edge packaging solutions that improve the longevity of products and ensure consumer safety. Through their partnerships, they facilitate effective distribution and address the changing needs of consumers, thus influencing industry trends and setting standards.

Prominent participants in the food packaging industry encompass Amcor plc, Sealed Air Corporation, Ball Corporation, Mondi Group, Tetra Pak International S.A., WestRock Company, International Paper Company, Smurfit Kappa Group, Huhtamaki Oyj, Berry Global, Inc., Sonoco Products Company, Graphic Packaging Holding Company, Crown Holdings, Inc., DS Smith plc, and Ardagh Group S.A.

Global Food Packaging COVID-19 Impact and Market Status:

The Covid-19 pandemic markedly ened the need for eco-friendly and sanitary food packaging options, as individuals placed greater emphasis on health and safety, thereby fostering innovation within the sector.

The COVID-19 pandemic has profoundly impacted the food packaging industry, resulting in significant growth driven by increased consumer emphasis on hygiene and safety. With the global implementation of lockdowns and social distancing measures, there was a notable pivot to online grocery shopping, leading to a ened demand for packaging that is both robust and easily transportable. Furthermore, the rise in take-out and delivery services necessitated that food manufacturers and retailers focus on packaging that ensures product safety and prolongs shelf life. Concurrently, the growing environmental awareness among consumers propelled the popularity of sustainable packaging, prompting businesses to investigate eco-friendly alternatives. Nonetheless, initial disruptions in supply chains created challenges concerning material availability and costs. Overall, the pandemic has not only fast-tracked trends towards convenience and safety within food packaging but has also inspired the industry to innovate and adapt to evolving consumer demands and regulatory requirements.

Latest Trends and Innovation in The Global Food Packaging Market:

- In July 2023, Amcor announced its acquisition of Enflex, a leading producer of flexible packaging in North America, enhancing Amcor's capabilities in sustainable packaging solutions.

- In September 2023, Sealed Air Corporation introduced its new EcoPure packaging technology, designed to be biodegradable and compostable, addressing the growing consumer demand for environmentally friendly options.

- In March 2023, Tetra Pak unveiled its new fully recyclable carton package, aimed at improving the sustainability of food packaging by using responsibly sourced materials.

- In April 2023, Smurfit Kappa Group acquired the corrugated cardboard manufacturer Rigid Containers, boosting its presence in the UK packaging market and expanding its product offerings.

- In August 2023, Mondi Group launched a new line of functional paper bags that provide moisture protection for food products while maintaining a high level of sustainability.

- In June 2023, Berry Global acquired RPC Group Plc, a strategic merger that strengthened Berry's portfolio in rigid and flexible packaging solutions focusing on food products.

- In January 2023, Huhtamaki announced the development of a new compostable food service packaging line, aimed at reducing plastic waste in the food packaging sector.

- In October 2023, Crown Holdings launched a new lightweight aluminum beverage can, which reduces material usage and increases efficiency in recycling processes.

- In May 2023, WestRock partnered with the Sustainable Food Packaging Coalition to enhance sustainability standards in food packaging, committing to reducing greenhouse gas emissions across its supply chain.

- In February 2023, Constantia Flexibles introduced an innovative high-barrier film for packaging that extends the shelf life of perishable food products, increasing food safety and reducing waste.

Food Packaging Market Growth Factors:

The growth of the Food Packaging Market is propelled by a rising consumer preference for convenience, a focus on sustainability efforts, and advancements in packaging technology.

The Food Packaging Industry is witnessing remarkable growth driven by several crucial factors. Firstly, the rising consumer preference for convenience foods and ready-to-eat options is creating a demand for packaging solutions that not only extend shelf life but also ensure product freshness. Additionally, ened awareness concerning food safety and hygiene is encouraging manufacturers to adopt sophisticated packaging technologies that reduce contamination risks.

Sustainability plays a pivotal role as consumers increasingly opt for environmentally friendly packaging materials, prompting companies to explore biodegradable and recyclable alternatives. The growth of e-commerce and online grocery shopping further amplifies this demand, highlighting the necessity for protective packaging that safeguards products during shipping.

Moreover, innovations in packaging design, such as smart packaging featuring sensors to monitor product freshness and quality, are becoming increasingly popular. Regulatory pressures focused on minimizing plastic waste and advocating for eco-friendly practices are also nudging businesses to reevaluate their packaging approaches, presenting opportunities in sustainable materials and methods.

Together, these elements are transforming the food packaging sector, driving technological innovation and market growth.

Food Packaging Market Restaining Factors:

Significant challenges in the food packaging industry involve strict regulatory requirements and growing environmental issues related to plastic waste.

One of the primary concerns is the growing focus on environmental issues, particularly regarding plastic waste, which has prompted regulatory reforms favoring sustainable packaging options. These changes often lead to increased operational costs for manufacturers. Furthermore, fluctuations in the prices of raw materials, influenced by economic instability and disruptions in supply chains, create obstacles for sustaining profitability.

Health and safety regulations are becoming more rigorous, compelling companies to allocate resources toward compliance efforts. This can be particularly burdensome for smaller businesses. Additionally, a shift in consumer preferences towards fresh, minimally packaged goods is affecting the demand for traditional packaging forms.

The marketplace is also facing competition from alternative packaging methods, such as biodegradable and edible options, which further challenge the reliance on conventional plastic and non-recyclable materials. Nonetheless, the industry is experiencing a wave of innovation in sustainable packaging technologies, which creates avenues for growth. Adopting environmentally-friendly practices not only aligns with consumer preferences but also fosters brand loyalty and the potential for entry into new markets. This signifies a hopeful trajectory for the sector as it adapts to fulfill both ecological responsibilities and consumer expectations.

Key Segments of the Food Packaging Market

By Material

- Glass

- Metal

- Paper & Paperboard

- Plastics

- Wood

By Product Type

- Rigid

- Semi-rigid

- Flexible

By Packaging Type

- Bags & Pouches

- Films & Wraps

- Stick Packs & Sachets

- Bottles & Jars

- Boxes & Cartons

- Cans

- Trays

- Clamshells

- Others

By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy Products

- Meat, Poultry & Seafood

- Sauces, Dressings, and Condiments

- Others

By End User

- Quick Service Restaurants

- Café & Kiosks

- Full-Service Restaurants

- Chain Restaurants

- Others (FMCG, Hotels, Retailers)

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America