Food Service Market Analysis and Insights:

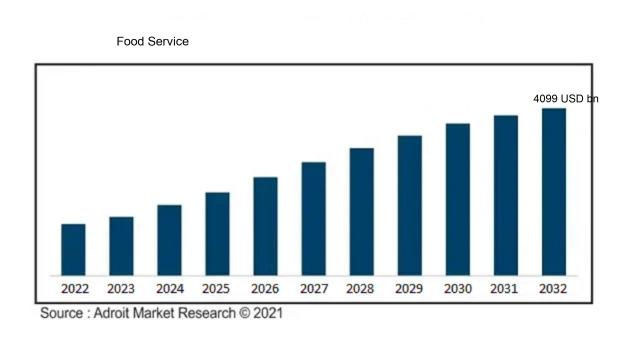

The market for Global Food Service was estimated to be worth USD 3015 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 3.44%, with an expected value of USD 4099 billion in 2032.

The Food Service Industry is shaped by several pivotal elements that contribute to its growth and transformation. Increasing disposable incomes alongside urban growth have led to a rise in consumer expenditures on dining, resulting in a ened demand for a variety of food choices. The trend towards convenience is fostering the growth of online food delivery platforms and fast-casual dining options, catering to the needs of busy consumers. Moreover, a rising consciousness regarding health and nutrition among the public is encouraging food service providers to incorporate healthier menu items, such as organic and locally-sourced produce. The impact of social media and emerging food cultures has also raised consumer expectations for distinctive culinary experiences and aesthetically pleasing dishes. Lastly, technological advancements, particularly in mobile applications for ordering and payments, are improving customer interaction and operational productivity within the industry. Collectively, these dynamics foster a vibrant atmosphere for the food service sector, promoting innovation and improved accessibility.

Food Service Market Definition

The food service industry encompasses the preparation, presentation, and distribution of meals and drinks to customers, including establishments such as restaurants, catering companies, and cafeterias. This sector focuses on overseeing food production, maintaining service excellence, and enhancing the customer experience to achieve satisfaction and operational efficiency.

The food service industry holds a vital position in contemporary society by delivering necessary nutrition, enhancing community interactions, and boosting economic development. This sector includes restaurants, catering, institutional meal provision, and food delivery services, accommodating a wide range of culinary preferences and dietary requirements. It plays a significant part in local and national economies by generating employment opportunities. Additionally, food service facilitates cultural exchange through diverse cuisines, enriching social connections. As the demand for convenience rises, the industry embraces technological advancements and prioritizes health and sustainability, thereby evolving in response to consumer preferences while contributing to the well-being of communities.

Food Service Market Segmental Analysis:

Insights On Sector

Commercial

The commercial sector is expected to dominate the Global Food Service Market due to its expansive growth and continuous innovation. Factors contributing to this sector's growth include an increasing number of dining establishments such as restaurants, cafes, and food delivery services that cater to changing consumer preferences. Enhanced customer experience and the introduction of experiential dining concepts have propelled the demand for commercial food services. Additionally, the rise in disposable income among consumers, coupled with a trend toward dining out instead of home-cooked meals, further boosts the commercial market's prominence. As a result, this sector is anticipated to capture a significant share of the overall market.

Non-Commercial

The non-commercial sector comprises institutions such as schools, hospitals, and corporate cafeterias, playing a notable role in the food service industry. Although it is not expected to outperform the commercial sector, it still holds significant potential, particularly in areas focusing on health and wellness. The growing emphasis on nutrition in educational institutions and workplace wellness programs can drive the demand for healthy food offerings. Additionally, as work culture shifts towards offering more amenities to employees, corporate cafeterias are responding with diverse and nutritious food options.

Insights On Systems

Ready Prepared Foodservice System

The Ready Prepared Foodservice System is expected to dominate the Global Food Service Market due to its increasing efficiency and convenience. As the demand for quick and easy meal preparation grows, this system excels by allowing food to be prepared in advance and stored for later use. The rise of fast-casual dining and meal delivery services is supporting its market dominance, as establishments and consumers alike prefer options that save time without sacrificing quality. Additionally, this system's ability to cater to diverse dietary needs aligns with current consumer preferences, making it a more appealing choice among foodservice providers.

Conventional Foodservice System

The Conventional Foodservice System relies on traditional methods of food preparation and service, which appeals to certain demographics seeking authentic dining experiences. However, its labor-intensive nature and time commitments can deter high-volume operations. While it remains popular in regions that favor home-cooked meals and fresh ingredients, its growth potential is limited compared to more efficient systems. The emphasis on convenience is steering many establishments away from conventional practices, though it may still thrive in niche markets that prioritize traditional values and culinary authenticity.

Centralized Foodservice System

The Centralized Foodservice System involves the centralized preparation of meals in bulk and distributing them to various locations. This method provides consistency in food quality and reduces costs due to economies of scale. While it serves well for institutions like schools and hospitals, its reliance on logistics poses challenges in terms of freshness and menu variety. The growing demand for personalized dining experiences and quick service options, along with the rise of competition from other systems, may affect its dominance in the long run. However, its efficiency still makes it attractive for larger organizations seeking to streamline operations.

Assembly-Serve Foodservice System

The Assembly-Serve Foodservice System focuses on assembling pre-prepared components to create meals, offering speed and reduced labor costs. This approach is particularly favored in fast-casual and take-out dining s due to its efficiency. However, it can be perceived as lacking in freshness compared to other methods, which may turn off consumers looking for homemade flavors. As consumers increasingly demand transparency regarding food preparation and sourcing, the Assembly-Serve system's reliance on pre-cooked or frozen items face scrutiny. This approach may thus struggle to compete with more personalized and fresh alternatives in the evolving market landscape.

Insights On Restaurant Type

Fast Food

Based on current data and consumer trends, the Fast Food category is expected to dominate the Global Food Service Market. The increasing consumer demand for convenience, speed, and affordable meal options drives the growth of this. Fast food establishments adapt rapidly to changing dietary preferences and offer a wide variety of items, including healthier choices. Additionally, innovations in delivery services and mobile ordering have significantly contributed to the popularity of fast food. As busy lifestyles propel consumers towards quick dining solutions, the Fast Food market is likely to maintain its lead over other types of food service.

Full-Service

The Full-Service category encompasses a broad range of dining experiences, focusing on providing customers with sit-down meals where service is integral. This often features higher-end culinary offerings and an emphasis on ambiance, making it appealing for special occasions. Although growing steadily, Full-Service establishments face competition from quicker dining alternatives, which can offer a more casual yet satisfying experience. Many Full-Service restaurants are adapting by incorporating elements of convenience, such as online reservations and takeout, to attract more customers and remain relevant in the evolving food industry landscape.

Limited Service

The Limited Service category is characterized by restaurants that provide a more streamlined experience than Full-Service options but offer a more upscale alternative to Fast Food outlets. This includes cafes and counter-service eateries that balance quality and convenience without the higher costs associated with full-service dining. Limited Service establishments often focus on specialty offerings such as freshly brewed coffee, pastries, and grab-and-go items. While the experiences steady growth due to evolving consumer preferences for quick yet quality meals, it does not hold the same market sway as Fast Food venues, which fulfill the convenience factor more effectively.

Special Food Service

The Special Food Service covers a diverse range of unique dining options, including food trucks, catering services, and specialized diet-focused establishments. These businesses appeal to specific niches, such as vegan, gluten-free, or ethnic cuisine, attracting customers looking for unique culinary experiences. While this category is gaining traction due to an increasing focus on dietary preferences and health consciousness, it remains smaller compared to more generalist categories like Fast Food or Full-Service dining. The Special Food Service market shows promise but is primarily limited by its specific focus and relatively narrower consumer base.

Global Food Service Market Regional Insights:

Asia Pacific

The Asia Pacific region is anticipated to dominate the Global Food Service market due to several key factors. Rapid urbanization, combined with a growing middle-class population, has driven significant changes in consumer preferences towards dining out and food delivery services. Furthermore, a cultural shift emphasizing convenience and quality in food options has led to increased investments in food service infrastructure, including restaurants, cafes, and quick-service outlets. Innovations in technology, including mobile ordering and food delivery apps, continue to evolve the market landscape, making dining experiences more accessible. Countries like China and India, with their vast populations and changing lifestyles, further exemplify the growth potential, making Asia Pacific a critical hub for future food service activities.

North America

In North America, the food service market remains robust, bolstered by a high consumer spending power and diverse culinary preferences. The region is home to several leading global chains and a strong culture of dining out. However, increasing labor costs and a focus on health-conscious eating can limit some growth aspects. The adoption of technology, such as online ordering and delivery platforms, also plays a significant role and helps sustain market dynamics. Nevertheless, while still a key player, North America's overall growth rate is likely to be outpaced by the burgeoning markets in the Asia Pacific.

Europe

Europe's food service market showcases rich cultural diversity and innovation in food offerings. The post-pandemic recovery has driven growth in both traditional dining establishments and fast-casual concepts. Sustainability and health-focused dining experiences are particularly significant trends, as consumers increasingly seek out locally sourced and organic options. However, stringent regulations related to food safety and labor laws can impact operational flexibility, which might hinder aggressive expansion compared to more dynamic regions like Asia Pacific. Overall, Europe remains a vital yet saturated market with complex challenges.

Latin America

The food service market in Latin America is characterized by vibrant culinary traditions and an increasing inclination towards quick-service restaurants. Economic fluctuations can impact discretionary spending but rising urban populations are fostering growth. Nonetheless, issues related to infrastructure and supply chain inefficiencies can challenge operational stability for food service businesses. Despite these obstacles, a youthful demographic and evolving consumer habits present opportunities, particularly in urban centers. The region's potential is evident, but it is not currently positioned to surpass the development observed in Asia Pacific.

Middle East & Africa

In the Middle East and Africa, the food service market is on a growth trajectory driven by a burgeoning population and increasing urbanization. A shift in consumer eating habits towards fast food and casual dining has opened new avenues for investment. However, socio-economic challenges and varying regulations across countries can create an unstable business environment. While several markets in this region show promise, particularly in terms of untapped potential for expansion, they still lag behind the rapid growth and consumer dynamics seen in the Asia Pacific region, limiting their immediate competitive capabilities.

Food Service Competitive Landscape:

Influential entities within the worldwide food service sector, comprising prominent restaurant brands, catering companies, and food delivery services, propel innovation and foster customer interaction by providing varied menu selections and improved dining experiences. Their collaborations and technological investments significantly influence market dynamics and enhance operational effectiveness.

In the food service industry, prominent entities include Aramark Corporation, Compass Group PLC, Sysco Corporation, US Foods Holding Corp, and Sodexo S.A. Notable restaurant chains such as Darden Restaurants, Yum! Brands, McDonald's, Restaurant Brands International, and Starbucks also play a significant role. Additional key contributors include Panera Bread, Chick-fil-A, Domino's Pizza, Chipotle Mexican Grill, and Brinker International. Furthermore, other important companies are Cracker Barrel Old Country Store, The Wendy's Company, Bloomin' Brands, Pret a Manger—which falls under JAB Holding Company—and Jollibee Foods Corporation.

Global Food Service COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the global food service industry, hastening the transition to online delivery and takeaway options while resulting in temporary shutdowns and operational limitations for numerous restaurants.

The COVID-19 pandemic brought about significant upheaval in the food service industry, introducing both formidable challenges and transformative shifts. With the implementation of lockdowns and social distancing protocols, in-house dining experienced a drastic downturn, leading to numerous business closures and a marked shift towards takeout, delivery, and al fresco dining. Many food service operators integrated contactless payment solutions and intensified hygiene measures to instill confidence in their patrons. This period also catalyzed an increased reliance on technology, with online ordering and food delivery platforms witnessing considerable expansion. While various sectors, particularly fast-casual and quick-service eateries, navigated these changes more adeptly than traditional dining venues, the pandemic also influenced consumer choices towards healthier, comforting, and locally sourced food options, as individuals prioritized safety and familiarity. Moving forward, the path to recovery for the food service sector will depend on its ability to adapt to evolving consumer behaviors and the potential for new regulatory frameworks in a post-pandemic world.

Latest Trends and Innovation in The Global Food Service Market:

- In January 2023, Chipotle Mexican Grill announced the acquisition of the tech-driven restaurateur, ‘Naked Taco,’ to enhance its digital innovation and drive customer engagement.

- In February 2023, Yum! Brands, the parent company of KFC and Taco Bell, reported a strategic investment in virtual restaurant model 'Nextbite' to expand its delivery and takeout options, aiming to reach a broader audience.

- In March 2023, Starbucks unveiled its new innovative "cashless" store model in Seattle, incorporating advanced technology for a seamless customer experience and aiming to streamline operations.

- In April 2023, Domino’s Pizza successfully integrated AI technology into its ordering process, introducing an enhanced voice ordering system that allows customers to place orders hands-free.

- In May 2023, McDonald's announced a significant merger with artificial intelligence firm ‘Apprente’ to improve its drive-thru ordering experience and speed up service through voice recognition.

- In June 2023, Sysco Corporation, a leading food service distributor, acquired ‘Paper Products Company,’ greatly expanding its reach in the food service packaging sector.

- In August 2023, DoorDash launched a partnership with local grocers across the U.S. to broaden its market presence beyond restaurants, signaling a shift towards comprehensive food service solutions.

- In September 2023, Denny’s Corporation introduced a new line of AI-driven menu creation tools to capture customer preferences and trends, aiming to align its offerings with evolving consumer tastes.

- In October 2023, Nestlé Professional expanded its plant-based product line and introduced an innovative vegan frozen dessert, responding to growing consumer demand for plant-based options in food service.

Food Service Market Growth Factors:

The primary drivers of growth in the food service industry encompass a ened consumer preference for convenience, an uptick in eating out trends, and the burgeoning popularity of online food delivery platforms.

The Food Service Market is undergoing remarkable expansion due to several pivotal factors. Primarily, the combination of rising urbanization and increasingly hectic lifestyles has spurred a ened need for accessible dining alternatives, particularly in the form of fast-casual eateries and food delivery services. Furthermore, the growing consumer inclination towards a variety of cuisines and healthier food options has prompted food service providers to diversify their menus and incorporate organic and locally sourced ingredients.

Technological innovations are also instrumental in this growth, as the implementation of online ordering systems and mobile applications has significantly improved both customer convenience and operational workflows. The ened demand for food delivery and the use of third-party services have broadened market accessibility, further aligning with consumer preferences for convenience. Additionally, the resurgence of dining out following the pandemic has reinvigorated market growth, as patrons increasingly seek social interactions and upscale dining experiences.

Strategic investments and collaborations within the food service sector are also driving expansion and enhancing service delivery. Together, these elements are transforming the Food Service Market, creating new growth opportunities and enhancing consumer interaction across diverse s.

Food Service Market Restaining Factors:

The food service industry faces significant challenges stemming from escalating operational expenses and ened competition, both of which impede profitability and long-term viability.

The food service sector encounters various limiting factors that could impede its expansion and progress. Economic variations, including periods of recession or inflation, can drastically alter consumer spending patterns, resulting in a decline in dining out. Additionally, the health and safety issues that gained prominence during the COVID-19 pandemic have led to stringent regulations and operational hurdles for food service businesses. Labor shortages and escalating labor expenses further complicate the situation, hindering the ability to maintain service quality and operational efficiency.

Moreover, a shift in consumer preferences towards healthier and more sustainable dietary options places additional demands on traditional food service frameworks to adapt rapidly. Competition from delivery and takeout platforms is also reshaping the industry landscape, compelling traditional establishments to reevaluate their business strategies. Ongoing supply chain disruptions, particularly concerning fresh produce, create challenges in ensuring menu consistency and availability.

Despite these obstacles, the industry has demonstrated resilience and adaptability. Numerous food service operators are embracing technology, amplifying their online presence, and revamping their menus to entice discerning consumers, thereby paving the path for recovery and growth. The evolution of consumer preferences offers a distinctive chance for food service providers to reinvent themselves and flourish within an ever-changing market environment.

Key Segments of the Food Service Market

By Sector

• Commercial

• Non-Commercial

By Systems

• Conventional Foodservice System

• Centralized Foodservice System

• Ready Prepared Foodservice System

• Assembly-Serve Foodservice System

By Restaurant Type

• Fast Food

• Full-Service

• Limited Service

• Special Food Service

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America