Market Analysis and Insights:

In 2022, the valuation of the frozen food industry reached approximately USD 397.21 billion. Over the next decade, it is expected to achieve a compound annual growth rate (CAGR) of 4.39%, culminating in an estimated market size of USD 607.16 billion by 2032.

.jpg

)

Several factors are contributing to the expansion of the frozen food sector. Changing consumer lifestyles and the rise in working professionals have led to a higher demand for convenience in meal preparations, a niche that frozen foods fill effectively by offering quick meal solutions with little prep time required. Additionally, increasing disposable incomes and a growing middle class in emerging markets are enhancing purchasing power, further fueling the demand for frozen products. Technological improvements in freezing and packaging are also improving the quality and convenience of these products, boosting their market growth. Moreover, an emphasis on food safety and the desire for longer shelf life are increasing their attractiveness, as they help reduce food waste. The expansion of retail outlets, including online stores, and the availability of a varied assortment of frozen food options also significantly contribute to market growth.

Frozen Food Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 607.16 billion |

| Growth Rate | CAGR of 4.39% during 2023-2032 |

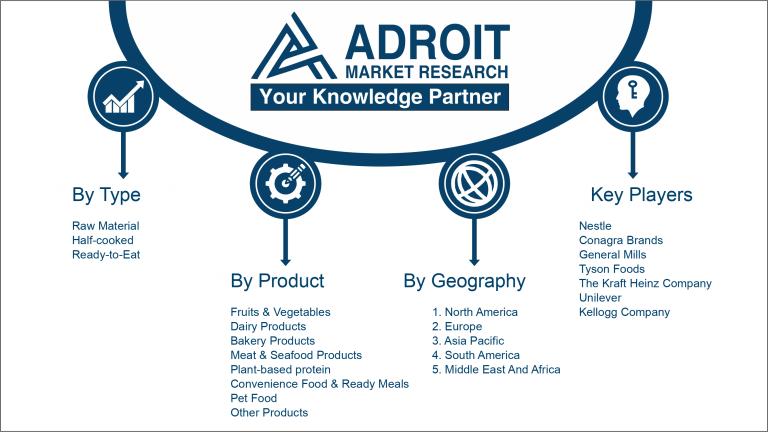

| Segment Covered | By Product ,By Consumption,By Type,By Distribution Channel,By Freezing Technique ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nestle, Conagra Brands, General Mills, Tyson Foods, The Kraft Heinz Company, Unilever, Kellogg Company, McCain Foods, Rich Products Corporation, and Ajinomoto Co., Inc. |

Market Definition

Frozen food includes perishables that are subjected to extremely low temperatures to preserve their quality and extend their shelf life, typically offered in convenient, pre-packaged forms for easy consumer use.

Frozen food is integral to modern life, serving several key roles. It offers ready-to-eat solutions that save time and reduce effort for individuals and families alike. By preserving food longer than fresh options, it aids in nutrient retention and minimizes waste, ensuring year-round access to nutritious foods. Economically, it enables bulk purchases and long-term storage, lowering grocery bills. Advances in freezing techniques have also improved the quality and flavor of these products, presenting a practical and reliable choice for consumers with a wide variety of preferences.

Key Market Segmentation:

Insights On Key Product

Convenience Food & Ready Meals

Convenience Food & Ready Meals is predicted to lead the global frozen food market. The demand for these products is growing particularly among the urban workforce, who favor meals that require minimal preparation time. Enhancements in freezing technology have also elevated the quality and taste of these meals, increasing their appeal.

Fruits & Vegetables

Fruits & Vegetables part is expected to witness significant growth in the global frozen food market. The rising awareness regarding the health benefits of consuming frozen fruits and vegetables, along with their extended shelf life, is driving the demand for this part. Frozen fruits and vegetables retain their nutritional value and freshness, making them a popular choice for individuals seeking convenient and healthy options.

Dairy Products

The dairy products part is anticipated to experience substantial growth in the global frozen food market. The increasing consumption of milk-based products and a growing preference for frozen desserts, such as ice creams and yogurts, are fueling the demand for this part. Frozen dairy products offer convenience and a wide range of flavors to cater to consumer preferences.

Bakery Products

Bakery products, such as frozen bread, cakes, pastries, and other baked goods, are expected to witness steady growth in the global frozen food market. The convenience factor, longer shelf life, and availability of a variety of bakery products in the frozen format are driving the demand for this part. It allows consumers to enjoy freshly baked goods anytime, without the need for preparation from scratch.

Meat & Seafood Products

The meat and seafood products part is expected to witness significant growth in the global frozen food market. Frozen meat and seafood offer convenience, extended shelf life, and the ability to retain their nutritional value and taste. The increasing preference for ready-to-cook and ready-to-eat frozen meat and seafood products is driving the growth of this part.

Plant-based Protein

The plant-based protein part is anticipated to grow steadily in the global frozen food market. As the demand for vegetarian and vegan food options rises, the availability of frozen plant-based protein products, such as burgers, sausages, and meat substitutes, is increasing. Consumers are opting for frozen plant-based protein products due to their convenience, health benefits, and environmentally friendly nature.

Pet Food

The pet food part is projected to experience moderate growth in the global frozen food market. Frozen pet food offers convenience, ensures the preservation of nutrients, and caters to specific dietary requirements of pets. The trend of pet parents seeking high-quality and convenient pet food options drives the demand for this part.

Other Products

The Other Products includes a variety of frozen food items that do not fall into the specific categories mentioned above. This part comprises niche products such as frozen soups, appetizers, and specialty frozen foods. The demand for these products is expected to be diverse and driven by specific consumer preferences, creating opportunities for unique offerings in the market.

Insights On Key Consumption

Food Service

The Food Service is expected to be a major player in the global frozen food market. This trend is driven by a growing demand for convenient, ready-to-eat meal options and the increasing prevalence of restaurants, cafes, and fast-food chains worldwide. Food service providers rely on frozen food products to meet consumer needs for quick and convenient meal solutions, solidifying this segment's market dominance.

Retail

The Retail part is also expected to play a significant role in the Global Frozen Food market. Consumers are increasingly opting for frozen food options for their everyday cooking needs, as these products offer convenience, longer shelf life, and a wide variety of choices. Retail stores, including supermarkets, hypermarkets, and convenience stores, offer a range of frozen food products, from vegetables and fruits to meat and seafood, catering to the diverse preferences of consumers. While the Food Service part is projected to dominate, the Retail part is likely to have a substantial market share as well.

Insights On Key Type

Ready-to-Eat

Ready-to-Eat frozen food is anticipated to take a leading position in the global frozen food market, driven by the rising demand for time-saving and convenient food options, particularly among the urban populace. These products offer the advantage of quick and easy meal preparations without sacrificing taste or quality. The popularity of Ready-to-Eat frozen foods is also supported by the wide range of choices available, including pizzas, burgers, pasta, and Asian dishes, catering to diverse tastes and dietary preferences.

Half-Cooked

The half-cooked part of the global frozen food market is expected to have a significant presence. Half-cooked frozen food products provide consumers with partially prepared meals that require minimal cooking time. These products offer convenience while still allowing consumers to customize the dish to their liking. The demand for half-cooked frozen food is primarily driven by consumers who prefer a fresher taste compared to fully cooked options.

Raw Material

Although the raw material part is an essential component of the global frozen food market, it is expected to have a relatively smaller market share compared to the dominating part. Raw material frozen food products include fruits, vegetables, meat, and seafood, among others. These products cater to consumers who prefer to buy ingredients in bulk and freeze them for later use. The demand for raw material frozen food is driven by factors such as convenience, longer shelf life, and the ability to retain nutritional value.

Insights On Key Distribution Channel

Online

The online distribution channel is projected to capture a significant share of the global frozen food market. The ease and convenience of purchasing frozen products online have greatly boosted consumer demand. Online platforms provide an extensive selection of frozen foods with convenient delivery options, enabling customers to enjoy frozen food without leaving their homes. The growing trend of online grocery shopping and the proliferation of e-commerce platforms further strengthen the position of online channels in the market.

Offline

Despite the growing prominence of online sales, offline distribution remains a vital component of the global frozen food market. Physical stores such as supermarkets, hypermarkets, convenience stores, and specialty frozen food shops are pivotal, providing easy access to a broad array of products. These venues attract customers with strategic placement, promotions, and displays, especially during routine shopping visits. Convenience stores meet the immediate needs of busy consumers, while specialty stores cater to gourmet tastes. The physical shopping experience, with its tactile advantages and personalized service, ensures that offline channels maintain their relevance in the distribution landscape.

Insights On Key Freezing Technique

Individual Quick Freezing (IQF)

The Individual Quick Freezing (IQF) method is poised to dominate the global frozen food market. This technique freezes individual items separately, which prevents ice crystals from forming and preserves the food's quality. IQF's ability to maintain the natural texture, flavor, and appearance of food has made it popular among consumers. It also offers the convenience of portion control and easy storage, enhancing its market demand.

Blast Freezing

Blast Freezing is another part of the Global Frozen Food market. It involves freezing the food products quickly in a blast freezer at extremely low temperatures. While Blast Freezing is widely used in commercial and industrial settings due to its rapid freezing capabilities, it does not preserve the texture, taste, and appearance of food as effectively as IQF. Consequently, its market share is expected to be lower than that of IQF.

Belt Freezing

Belt Freezing is a slower freezing method compared to IQF and Blast Freezing. In this technique, food items are placed on a conveyor belt and gradually frozen over time. While Belt Freezing is suitable for certain types of frozen food products, such as vegetables and seafood, its market share is likely to be lower compared to IQF and Blast Freezing. This is because consumers prefer frozen food products that retain their natural characteristics, which may not be fully preserved using Belt Freezing.

Insights on Regional Analysis:

North America

North America is forecasted to lead the global frozen food market, driven by a combination of busy lifestyles, the demand for convenience, and a preference for ready-to-eat meals. The region sees high consumption of frozen vegetables, fruits, and meats. Additionally, the presence of major industry players and increased consumer awareness of food safety and quality contribute to its leading position in the market.

Asia Pacific

Asia Pacific holds a significant potential for growth in the frozen food market due to the increasing urbanization, changing consumer preferences, and rising disposable incomes. The region's large population and growing adoption of western food habits contribute to the demand for frozen foods. Additionally, the rising popularity of frozen snacks, seafood, and frozen convenience meals are driving the market growth in the Asia Pacific region.

Europe

Europe is a mature market with a high consumption of frozen food products. The region's dominance in the frozen food market is driven by the presence of well-established manufacturers and consumers' preference for convenience and time-saving products. The demand for frozen bakery products, frozen desserts, and frozen ready meals remains strong in Europe. Furthermore, the increasing focus on sustainable and organic frozen food products is expected to drive market growth in the region.

Latin America

Latin America is witnessing significant growth in the frozen food market due to factors such as rising disposable incomes, changing consumer lifestyles, and urbanization. The region's love for convenience and time-saving food options, such as frozen pizzas, frozen snacks, and frozen vegetables, is driving the market expansion. Additionally, the increasing adoption of frozen food by foodservice establishments and the growing retail infrastructure contribute to the market's growth in Latin America.

Middle East & Africa

The Middle East & Africa region is experiencing steady growth in the frozen food market. Factors such as increasing urbanization, rising working population, and growing tourism industry have led to a rise in the demand for frozen food products. The region's high temperatures and long shelf life requirements make frozen food a practical choice. The consumption of frozen meat, poultry, and seafood products, as well as frozen desserts and ice creams, is driving the market growth in the Middle East & Africa region.

Company Profiles:

Key players in the global frozen food industry are vital to the sector's dynamics by offering a diverse array of products to meet consumer demands. Their efforts are focused on expanding market reach, launching new products, and forging strategic alliances to enhance their competitive edge.

Leading companies in the global frozen food sector include Nestle, Conagra Brands, General Mills, Tyson Foods, The Kraft Heinz Company, Unilever, Kellogg Company, McCain Foods, Rich Products Corporation, and Ajinomoto Co., Inc. These companies have distinguished themselves through extensive product variety and strong market presence. They compete through innovation in product development, strategic acquisitions, and broadening distribution networks. These industry leaders continually introduce new flavors, focus on health-conscious options, and offer convenient packaging to meet evolving consumer preferences and lifestyles, maintaining their significant market shares and driving the market's growth.

COVID-19 Impact and Market Status:

Significant growth in the global frozen food market has been spurred by a ened consumer focus on convenient, sustainable food options and the trend of stockpiling essential goods, largely influenced by the Covid-19 pandemic.

The COVID-19 pandemic instigated notable shifts in the frozen food market as lockdowns and social distancing measures led consumers to depend more on frozen food for its convenience and extended shelf life. This increased reliance boosted sales across various frozen food categories, including vegetables, fruits, meats, and seafood. The surge in home cooking and the demand for easy meal solutions during extended home stays enhanced the popularity of frozen ready-to-eat meals. However, the pandemic also disrupted supply chains and manufacturing processes, resulting in shortages of some frozen foods. The closures of restaurants and declines in the food service industry further affected sales through these channels. As the world gradually recovers and restrictions ease, the frozen food market is expected to stabilize and adapt to new consumer behaviors and opportunities for innovation and growth.

Latest Trends and Innovation:-

In January 2021, Nestlé announced its acquisition of Freshly, a US-based provider of fresh-prepared meal delivery services.

- In February 2021, Conagra Brands completed its acquisition of Sanckadium, a leading manufacturer of frozen snacks.

- In March 2021, Ajinomoto Co., Inc. launched a new plant-based line of frozen meals under its brand, Ajinomoto Eat Well.

- In April 2021, Swanson launched a range of frozen plant-based meals, catering to the growing demand for vegan options.

- In May 2021, McCain Foods partnered with NUGGS, a plant-based chicken nugget start-up, to develop and distribute innovative frozen plant-based products.

- In June 2021, Tyson Foods introduced its Raised & Rooted brand in the frozen food , offering plant-based protein alternatives.

- In July 2021, General Mills acquired Tyson Foods' frozen meals unit, including the brands Yoplait, Annie’s, and Hamburger Helper.

- In August 2021, Birds Eye launched a new range of frozen vegetable pasta, tapping into the trend of healthier and convenient meal options.

- In September 2021, Kraft Heinz announced the introduction of Planters Cornbread Crisps, a frozen snack innovation combining the flavors of cornbread and nuts.

- In October 2021, Unilever acquired Graze, a UK-based snack box delivery service, expanding its frozen snack portfolio.

Significant Growth Factors:

Factors driving the growth of the frozen food industry comprise the rising consumer inclination towards convenience, longer product shelf life, and the growing preference for ready-to-eat meals.

The frozen food industry has seen significant growth, propelled by key factors such as the escalating demand for convenient and time-saving meal solutions. In today's fast-paced environment, consumers increasingly opt for quick, hassle-free dining experiences that require minimal preparation. Frozen foods meet these needs effectively with their ready-to-eat or easy-to-cook options.

The growing focus on health and wellness has also boosted the popularity of frozen foods, with manufacturers incorporating nutritious ingredients to cater to health-conscious consumers. Moreover, advancements in freezing technologies ensure the preservation of nutritional value and quality, increasing the appeal of frozen foods. The broadening range of frozen food options, including ethnic and gourmet choices, further broadens consumer appeal and meets diverse dietary needs.

Restraining Factors:

The Frozen Food Market faces challenges from factors such as the preference of consumers for fresh and organic food choices, worries about the inclusion of preservatives in frozen food products, and the rising trend towards homemade meals.

Various challenges confront the frozen food industry, potentially hindering its growth and development. A significant barrier is the perception among many consumers that frozen food is less nutritious and of lower quality than fresh alternatives. This view leads to a preference for fresh over frozen, often based on beliefs about health and taste advantages. Limited consumer awareness about the high quality and variety of frozen foods available also restricts market growth. Additionally, the lack of adequate storage facilities in homes with limited space can be an obstacle, as can the need for specialized freezing equipment, which adds to the cost and limits broader access to frozen foods.

Environmental concerns and sustainability issues related to increased packaging waste also pose challenges. Despite these hurdles, positive trends are emerging as manufacturers improve the quality and variety of their frozen offerings and advancements in freezing technology maintain the nutritional integrity of frozen foods. Additionally, efforts to educate consumers about the benefits of frozen foods—such as convenience, longevity, and reduced food wastage—are helping to shift perceptions and open up growth opportunities in the industry.

Key Segments of the Frozen Food Market

Frozen Food Product Overview

- Fruits & Vegetables

- Dairy Products

- Bakery Products

- Meat & Seafood Products

- Plant-based protein

- Convenience Food & Ready Meals

- Pet Food

- Other Products

Frozen Food Consumption Overview

- Food Service

- Retail

Frozen Food Type Overview

- Raw Material

- Half-cooked

- Ready-to-Eat

Frozen Food Distribution Channel Overview

- Online

- Offline

Frozen Food Freezing Technique Overview

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America