Fused Deposition Modeling 3D Printing Market Analysis and Insights:

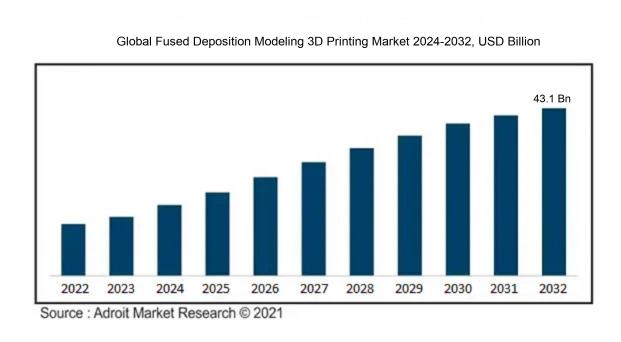

The fused deposition modeling 3D printing market was valued at 14.5 billion US dollars in 2022, and according to Adroit Market research report, it is projected to increase from 15.4 billion US dollars in 2023 to 43.1 billion US dollars by 2032. The compound annual growth rate (CAGR) of the fused deposition modeling 3D printing market is anticipated to be around 13.38% from 2024 to 2032.

The Fused Deposition Modeling (FDM) 3D printing sector is largely propelled by several pivotal elements. Primarily, the surging need for swift prototyping in diverse fields such as automotive, aerospace, and healthcare underscores FDM's practicality and economic advantages. Furthermore, the increasing consumer preference for tailored products and the movement towards additive manufacturing are vital, as FDM technology facilitates extensive customization while minimizing material waste. Progressive developments in printing materials and equipment are improving the quality and versatility of applications, leading to wider adoption. Additionally, the burgeoning interest in both educational environments and among hobbyists stimulates creativity and intensifies competition among providers, resulting in lower prices. The emphasis on sustainable practices and the use of biodegradable materials resonate with environmentally aware consumers. Collectively, these factors significantly drive the growth and transformation of the FDM 3D printing industry.

Fused Deposition Modeling 3D Printing Market Definition

Fused Deposition Modeling (FDM) is a 3D printing method that builds objects by sequentially extruding thermoplastic filament. This approach enables the accurate fabrication of intricate shapes through movements guided by computer software.

Fused Deposition Modeling (FDM) 3D printing holds a prominent place in the realm of additive manufacturing due to its user-friendliness, adaptability, and economical nature. This technology empowers users to swiftly produce intricate designs and prototypes, making it essential for design refinement across various sectors, including engineering and manufacturing. FDM utilizes thermoplastic materials, ensuring strength and applicability for a diverse range of uses, from functional components to creative art pieces. Additionally, its straightforward operation contributes to its popularity among DIY enthusiasts and educational organizations, encouraging creativity and knowledge acquisition. As the field of additive manufacturing advances, FDM remains a key technology that supports customized production and minimizes waste in fabrication methodologies.

Fused Deposition Modeling 3D Printing Market Segmental Analysis:

Insights On Material

Thermoplastics

Thermoplastics are expected to dominate the Global Fused Deposition Modeling 3D Printing Market due to their versatility, ease of processing, and cost-effectiveness. These materials are widely used in various applications, including prototypes, tooling, and end-use parts, owing to their excellent mechanical properties and recyclability. Popular thermoplastics like PLA, ABS, and PETG have become staples in the 3D printing community, making them readily available and well-understood among users. Furthermore, advancements in thermoplastic formulations and the increasing demand for lightweight components in industries such as automotive and aerospace are driving their adoption. Consequently, thermoplastics are poised to maintain their leading position in the market well into the future.

Photopolymers

Photopolymers are utilized primarily in resin-based 3D printing technologies, leveraging ultraviolet light to cure and solidify layers of resin. While they are less predominant in Fused Deposition Modeling, they still hold significance in niche applications requiring high precision and detailed surface finish. Industries like dental, jewelry, and intricate prototypes favor photopolymers due to their ability to create highly detailed models. This material offers the advantage of producing smoother surfaces and can be engineered for specific material properties, albeit at a higher cost and limited scalability compared to thermoplastics.

Metals

Metals are primarily associated with high-end applications concerning industrial and aerospace sectors. While Fused Deposition Modeling is not the predominant method for metal 3D printing, the emergence of metal filaments and advances in metal-polymer composites are gaining traction. They are valuable for producing functional prototypes and complex geometries, but the limited availability of compatible materials and higher costs relative to polymers restrict their widespread use. Nonetheless, the growth in demand for lightweight metal components is slowly driving attention toward potential applications in Fused Deposition Modeling.

Ceramics

Ceramics are known for their high-temperature resistance and robustness, catering to specialized applications in sectors such as healthcare and electronics. When integrated into Fused Deposition Modeling, ceramic materials can achieve specific properties like biocompatibility or thermal stability. However, the usage of ceramics presents challenges related to brittleness, processing difficulties, and a narrower range of applications compared to thermoplastics. As a result, while they have important applications, ceramics remain a minor player in the overall Fused Deposition Modeling ecosystem.

Composites

Composites, often engineered by combining thermoplastics with other materials, offer enhanced mechanical properties and a reduction in weight. These materials have found pathways into various industries looking to exploit their unique strengths, such as aerospace, automotive, and consumer products. However, the complexity involved in processing composites can hinder their growth compared to pure thermoplastics. The market for composites is expanding but still lags behind thermoplastics in terms of dominance due to the need for more specialized equipment and increased costs associated with these advanced materials.

Insights On Application

Manufacturing

Manufacturing is expected to dominate the Global Fused Deposition Modeling 3D Printing Market due to its significant capability to enhance production efficiency and reduce costs. The ability to create customized and complex parts with minimal waste makes FDM technology highly attractive for manufacturers across various industries. This application not only supports rapid prototyping but also enables full-scale production of components, catering to the growing demand for customized manufacturing solutions. Furthermore, advancements in materials and printer technologies have solidified FDM's role in manufacturing, making it a preferred choice for both small and large-scale production needs.

Prototyping

Prototyping plays a crucial role in the design process, allowing engineers and designers to quickly iterate and refine their concepts. With Fused Deposition Modeling, teams can produce functional prototypes more rapidly than traditional methods. The ability to test and validate designs early in the development cycle can save time and resources, making prototyping an essential application in various industries, particularly in automotive and aerospace sectors. The continuous demand for rapid prototyping solutions ensures its sustained relevance and growth within the FDM 3D printing market.

Medical

In the medical field, Fused Deposition Modeling offers innovative solutions for creating patient-specific models and surgical guides. Its ability to handle biocompatible materials and produce intricate designs facilitates the customization needed for implants and prosthetics. The increasing focus on personalized medicine and the need for advanced surgical training tools further boost the significance of this application. As the healthcare industry continues to innovate and evolve, the demand for FDM technology in medical applications is expected to rise steadily.

Art and Design

Art and Design applications of FDM technology enable artists and designers to explore new dimensions in creativity. The versatility of materials available for 3D printing allows for the creation of unique, intricate designs that were previously difficult to realize. Additionally, FDM technology aids in producing large-scale art installations and custom designs on a limited budget. As artists increasingly adopt technology for their creative processes, this sector is likely to continue expanding, though it may not match the growth seen in manufacturing and prototyping.

Education

In education, Fused Deposition Modeling is utilized to teach students about 3D design and manufacturing processes. It enables hands-on learning opportunities, allowing students to create their designs and understand the mechanics behind additive manufacturing. Schools and universities are increasingly incorporating FDM printers into their curricula to foster skills in engineering, design, and technology. This application supports future engineers and designers, but the overall market impact is comparatively lower than more industrial applications like manufacturing and prototyping.

Insights On Printer Type

Industrial

The Industrial category is expected to dominate the Global Fused Deposition Modeling (FDM) 3D Printing Market due to the increasing demand for high-performance, robust parts in manufacturing and aerospace industries. Businesses are harnessing advanced FDM technology for rapid prototyping, tooling, and production, benefiting from its scalability and efficiency. The industrial printers are capable of producing large-volume parts with high precision, driving cost-effectiveness and reducing wastage. Moreover, evolving trends towards automation and smart manufacturing underscore the need for high-end equipment, positioning Industrial FDM printers as essential tools for enterprise-level applications, thus ensuring their dominant market presence.

Desktop

The Desktop category appeals extensively to individual consumers, hobbyists, and small businesses that seek affordable and accessible 3D printing solutions. These models typically come with user-friendly interfaces, making them ideal for beginners and education-focused institutions. Despite their limited printing capacity and material range compared to industrial models, the Desktop printers are favored for prototyping small parts and customization projects. Their lower price point and the rise of the maker movement have fostered significant market interest, ensuring a steady demand for Desktop 3D printers, albeit falling short of the dominance of their industrial counterparts.

Professional

Professional printers occupy a particular niche, often utilized by design firms, engineering offices, and specialized manufacturers. These machines bridge the gap between Desktop and Industrial by offering enhanced precision and capabilities, targeting mid-range applications. As industries increasingly recognize the importance of prototyping and design validation, Professional printers are becoming a sought-after choice for businesses requiring high-quality outputs. Although they are gaining traction, their market share remains smaller compared to the Industrial due to higher price points and more focused applications, limiting widespread adoption.

Insights On End-User Industry

Healthcare

The healthcare industry is poised to dominate the Global Fused Deposition Modeling 3D Printing Market. The demand for customized solutions in medical applications such as prosthetics, dental implants, and tissue engineering is driving significant growth. Innovations in bioprinting are enabling the development of complex tissue structures, which are crucial for advancing medical therapies. Furthermore, the accelerating trend towards personalized medicine and the need for rapid prototyping of medical devices make the healthcare sector a major influencer in the market. Enhanced accuracy, reduced time-to-market for new medical devices, and improved patient outcomes are reinforcing the dominance of this industry.

Automotive

The automotive industry is rapidly adopting fused deposition modeling 3D printing technology for prototyping and producing customized components. Manufacturers use this technology to optimize designs, reduce weight, and enable faster production cycles. The benefits of rapid iteration in the design phase allow automotive engineers to create innovative solutions, improving overall vehicle performance and efficiency. Additionally, the push towards electric vehicles and autonomous driving technologies is further driving the requirements for advanced materials and manufacturing techniques, making automotive a critical player in the 3D printing landscape.

Aerospace

In the aerospace sector, fused deposition modeling 3D printing is gaining traction due to its ability to produce lightweight yet strong components. The industry's stringent regulations and the need for highly reliable parts are pushing manufacturers to explore additive manufacturing solutions that meet those standards. This technology allows for complex geometries that traditional manufacturing cannot achieve, thus promoting fuel efficiency and reducing operational costs. Continuous advancements in materials specifically designed for aerospace applications are also enhancing the viability of 3D printing, solidifying its role in this high-tech industry.

Consumer Electronics

The consumer electronics market is leveraging fused deposition modeling 3D printing for rapid prototyping and the customization of devices. Designers and engineers use this technology to iterate product designs quickly, allowing for swift market entry of innovative gadgets. From smartphone cases to complex circuit components, the flexibility in design capabilities offered by 3D printing resonates well within this fast-paced sector. The growing demand for personalized electronic devices is pushing companies to adopt this technology as it provides them with a competitive edge in product differentiation.

Education

In the education sector, fused deposition modeling 3D printing is making waves as a tool for hands-on learning and STEM education. Educational institutions are increasingly incorporating 3D printing into curricula to foster creativity and innovation among students. This technology enables students to conceptualize and create prototypes, thus enhancing their understanding of engineering and design principles. The accessibility of 3D printers in classrooms is fostering collaboration and project-based learning, aligning with modern educational methodologies that emphasize experiential learning and practical skill development.

Global Fused Deposition Modeling 3D Printing Market Regional Insights:

North America

North America is anticipated to dominate the Global Fused Deposition Modeling (FDM) 3D Printing market due to its robust technological advancements and high adoption rate of 3D printing technologies across various industrial sectors. The presence of well-established manufacturers, vast investments in research and development, and a strong ecosystem of startups focused on innovation contribute significantly to this dominance. Moreover, the region has a skilled workforce and extensive infrastructure that accelerates the application of fused deposition modeling in sectors such as aerospace, automotive, and healthcare. Additionally, increasing demand for customized and complex parts further drives the market growth in North America, establishing it as a frontrunner in the FDM 3D printing landscape.

Latin America

Latin America is gradually emerging in the Fused Deposition Modeling 3D Printing market, driven by an increasing awareness of 3D printing applications across various industries, including automotive and consumer goods. However, competition is still developing as the region faces challenges such as limited technological infrastructure and lower investment levels compared to more established markets. Government initiatives to promote innovation and partnerships between local manufacturers and international firms may enhance growth prospects over time, but for now, it remains a developing within the global context.

Asia Pacific

Asia Pacific is witnessing significant growth in the Fused Deposition Modeling 3D Printing market due to a surge in manufacturing, rising investments in research and development, and the increasing adoption of advanced technologies across sectors. Countries like China, Japan, and India are leading this transformation, leveraging their vast industrial base and cost advantages. Additionally, the growing trend of customization and the need for rapid prototyping in various industries are contributing to the region's market expansion. While Asia Pacific shows potential, it is still gaining traction compared to North America's established market dominance.

Europe

Europe holds a substantial position in the Global Fused Deposition Modeling 3D Printing market, primarily driven by a highly skilled workforce and innovation-driven industries such as aerospace, automotive, and medical technology. The European Union's emphasis on sustainability and eco-friendly manufacturing processes aligns well with the benefits offered by 3D printing technologies, fostering adoption in various sectors. Nonetheless, competition from North America holds the market back from achieving the same level of dominance, making Europe a significant but secondary player in the global landscape.

Middle East & Africa

The Middle East & Africa region is at a nascent stage in the Fused Deposition Modeling 3D Printing market. Interest in 3D printing technologies is growing, especially in sectors like construction and healthcare, but the region faces numerous challenges, including limited access to advanced technologies and lower levels of investment. However, increasing awareness and initiatives to promote technological advancements could spur future growth. Nonetheless, the current influence of this region in the global market remains minimal compared to other regions, notably North America.

Fused Deposition Modeling 3D Printing Competitive Landscape:

Major contributors in the worldwide Fused Deposition Modeling (FDM) 3D printing sector play a pivotal role by creating groundbreaking materials and sophisticated printer technologies, thus fueling market growth and improving application versatility across multiple industries. Their strategic partnerships and investments in research and development support the continuous advancement of FDM solutions tailored to a variety of manufacturing requirements.

The principal entities in the Fused Deposition Modeling (FDM) 3D printing sector encompass Stratasys Ltd., Ultimaker B.V., 3D Systems Corporation, Prusa Research, MakerBot Industries, Inc., Formlabs Inc., Raise3D, BCN3D Technologies, Snapmaker, and Tiertime Corporation. Furthermore, firms like Creality 3D, LulzBot (a division of Aleph Objects, Inc.), FlashForge Corporation, Anycubic, and Zortrax S.A. play a vital role in shaping market trends. Additionally, other prominent players such as Xometry, eSUN, Airwolf 3D, and PolyMaker introduce a variety of products and innovations within the FDM technology landscape.

Global Fused Deposition Modeling 3D Printing COVID-19 Impact and Market Status:

The Covid-19 pandemic dramatically hastened the integration of Fused Deposition Modeling (FDM) 3D printing technologies, as businesses turned to rapid prototyping and adaptable manufacturing options to navigate interruptions in their supply chains.

The COVID-19 pandemic had a profound effect on the market for Fused Deposition Modeling (FDM) 3D printing in various ways. At the outset, interruptions in supply chains and the cessation of factory operations resulted in setbacks in the production of 3D printers and their supplies, leading to a short-term decline in market growth. Nevertheless, industries quickly adjusted to the new challenges, resulting in ened demand for FDM technology, particularly in the healthcare sector, where the rapid prototyping of medical equipment and face shields became a priority. Additionally, the surge in remote work and innovation catalyzed research and development endeavors, promoting the expansion of educational and home-based FDM applications. By enabling on-demand manufacturing and diminishing dependence on international supply chains, FDM technology proved to be a crucial asset in a post-pandemic landscape, consequently fueling market recovery and growth. Therefore, despite the initial setbacks caused by the pandemic, the FDM 3D printing market has demonstrated remarkable resilience and adaptability.

Latest Trends and Innovation in The Global Fused Deposition Modeling 3D Printing Market:

- In October 2023, Stratasys announced the acquisition of Xaar 3D, a UK-based company specializing in advanced additive manufacturing technologies, aiming to enhance its multi-material 3D printing capabilities.

- In June 2023, Ultimaker and MakerBot merged under the banner of Stratasys to leverage their complementary strengths in the professional and educational sectors of 3D printing, significantly expanding their market presence.

- In December 2022, Prusa Research unveiled the Prusa XL, a new Fused Deposition Modeling printer featuring an advanced linear rail system for improved precision and reliability, showcasing innovations in design and performance.

- In August 2022, 3D Systems launched the Figulo CM, a ceramic 3D printing system based on FDM technology, targeting industries requiring high-performance ceramics, further diversifying their product offerings.

- In July 2022, Raise3D announced the release of its Pro3 series, equipped with advanced AI features for improved print monitoring and workflow efficiency, reflecting the company’s commitment to integrating smart technologies in 3D printing.

- In May 2022, BASF partnered with the German company, Ecolab, to develop new filaments that are both high-performance and environmentally friendly, focusing on sustainability in Fused Deposition Modeling techniques.

- In March 2022, Markforged introduced the Metal X 3D printer, which utilizes FDM principles to fabricate metal parts, marking a significant step towards expanding the FDM technology application beyond traditional materials.

- In January 2022, Formlabs expanded its FDM capabilities by launching the Form 3+ machine, which features improved print speeds and reliability, illustrating the company’s growth in the professional 3D printing market.

Fused Deposition Modeling 3D Printing Market Growth Factors:

The expansion of the Fused Deposition Modeling (FDM) 3D printing sector is propelled by innovations in materials, wider utilization in diverse industries, and a growing need for tailored manufacturing options.

The Fused Deposition Modeling (FDM) 3D printing industry is undergoing remarkable expansion, fueled by several pivotal elements. A significant driving force is the growing integration of additive manufacturing in diverse sectors, including aerospace, automotive, and healthcare, where efficient prototyping and tooling are essential. Additionally, breakthroughs in material science have produced enhanced thermoplastic materials that improve the functionality and range of FDM applications. The demand for customized products, especially in the medical sector with solutions like tailored prosthetics and dental devices, further propels growth.

Furthermore, the affordability and user-friendliness of FDM printers for small to medium-sized enterprises and educational establishments are encouraging widespread adoption. There is also an increasing emphasis on sustainable manufacturing, leading to a preference for biodegradable and recyclable materials within FDM processes. The incorporation of automation and advancements in software are optimizing production workflows, making FDM an appealing choice for manufacturers. Finally, the COVID-19 pandemic has intensified innovation and the application of 3D printing for rapid prototyping and bolstering supply chain resilience, significantly enhancing the market's dynamism. Collectively, these factors pave the way for substantial growth in the FDM 3D printing sector in the forthcoming years.

Fused Deposition Modeling 3D Printing Market Restaining Factors:

Primary limitations impacting the Fused Deposition Modeling (FDM) 3D printing industry encompass restrictions related to materials, reduced manufacturing velocities, and apprehensions regarding the quality of surface finishes.

The market for Fused Deposition Modeling (FDM) 3D printing encounters several obstacles that may hinder its expansion. One primary concern is the limitation of materials; while a range of thermoplastics is available, these may not fulfill the rigorous performance standards demanded by high-tech sectors such as aerospace and healthcare. Additionally, the operational speed and layer resolution of FDM printers might limit both their productivity and the overall quality of the output when juxtaposed with other additive manufacturing methods. The requirement for specialized technical knowledge to manage these devices and to refine the printed components can also dissuade potential adopters, especially within small to medium enterprises that may lack the necessary expertise. Furthermore, the substantial initial expenditure related to the operation and upkeep of sophisticated FDM systems can act as a significant barrier to market entry. The relentless emergence of competing additive manufacturing technologies adds to the challenges faced by FDM. Nevertheless, ongoing innovations in materials and technological advancements, along with the widening scope of applications across varied industries, are propelling growth and transformation within the field. As these challenges are navigated, the FDM sector is well-positioned for future growth and greater market acceptance, suggesting a promising trajectory ahead.

Key Segments of the Fused Deposition Modeling 3D Printing Market

By Material

• Thermoplastics

• Photopolymers

• Metals

• Ceramics

• Composites

By Application

• Prototyping

• Manufacturing

• Medical

• Art and Design

• Education

By Printer Type

• Desktop

• Industrial

• Professional

By End-User Industry

• Automotive

• Aerospace

• Healthcare

• Consumer Electronics

• Education

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America